With over 125 years of providing insurance to Northwestern states, Oregon Mutual puts its members first with above-average customer service and affordable policy options.

Table of contents

- Who Benefits Most and Least from Oregon Mutual Insurance?

- Oregon Mutual: Insuring the Pacific Northwest for more than 125 years

- Oregon Mutual Car Insurance Quotes and Discounts

- States Where Oregon Mutual Car Insurance is Offered

- Oregon Mutual Auto Insurance Coverages

- Other Special Auto Coverages Offered by Oregon Mutual Insurance

- Other Insurance Products Offered by Oregon Mutual Insurance

- How Can I Buy Auto Insurance from Oregon Mutual?

- How Can I Pay for My Oregon Mutual Car Insurance Policy?

- How Often Will Oregon Mutual Increase My Premiums?

- How Does Oregon Mutual’s Claims Process Work?

- How Can I Cancel My Oregon Mutual Car Insurance Policy?

- How Much Does Uber/Lyft Coverage Cost with Oregon Mutual?

- Insurance Companies Similar to Oregon Mutual

- Oregon Mutual Customer Satisfaction and Policyholder Reviews

- Oregon Mutual Mobile App Review

- Frequently Asked Questions: Oregon Mutual Car Insurance

- Is Oregon Mutual the cheapest car insurance in your area?

- Oregon Mutual Auto Insurance Overview

- Oregon Mutual Contact Information

Who Benefits Most and Least from Oregon Mutual Insurance?

Best For…

-

Safe drivers who can take advantage of the diminishing deductible program

-

Those who want to support a regional business with a long history of serving its community

-

Drivers who also want to insure a farm that they own or would like to manage their policies in one place

Not the Best For…

-

Anyone outside of California, Idaho, Oregon, or Washington, the only states where Oregon Mutual offers auto insurance policies

-

Those who would prefer to report and manage claims through an online portal

-

Families with teen drivers who like to be rewarded with good student discounts

Oregon Mutual: Insuring the Pacific Northwest for more than 125 years

Oregon Mutual is one of the oldest independent mutual insurance companies in the country. Founded in 1894 in McMinnville, OR, it boasts a “members first” philosophy made possible without obligations to outside investors. Although claims are handled centrally and reported via a toll-free number, policies are sold and managed through independent agents, so you can rely on a local expert for all of your insurance needs. In addition to wide-ranging auto insurance policy options, members can insure their homes, businesses, farms, and wineries all in one place.

Compare Car Insurance Quotes Instantly

Enter your ZIP codeGet my quotesOregon Mutual Car Insurance Quotes and Discounts

Auto insurance quotes are unique to each individual or family and can depend on many factors like where you live, the coverage you need, and your driving history. Without comparing quotes among companies, you may not get the best coverage for your needs or your budget.

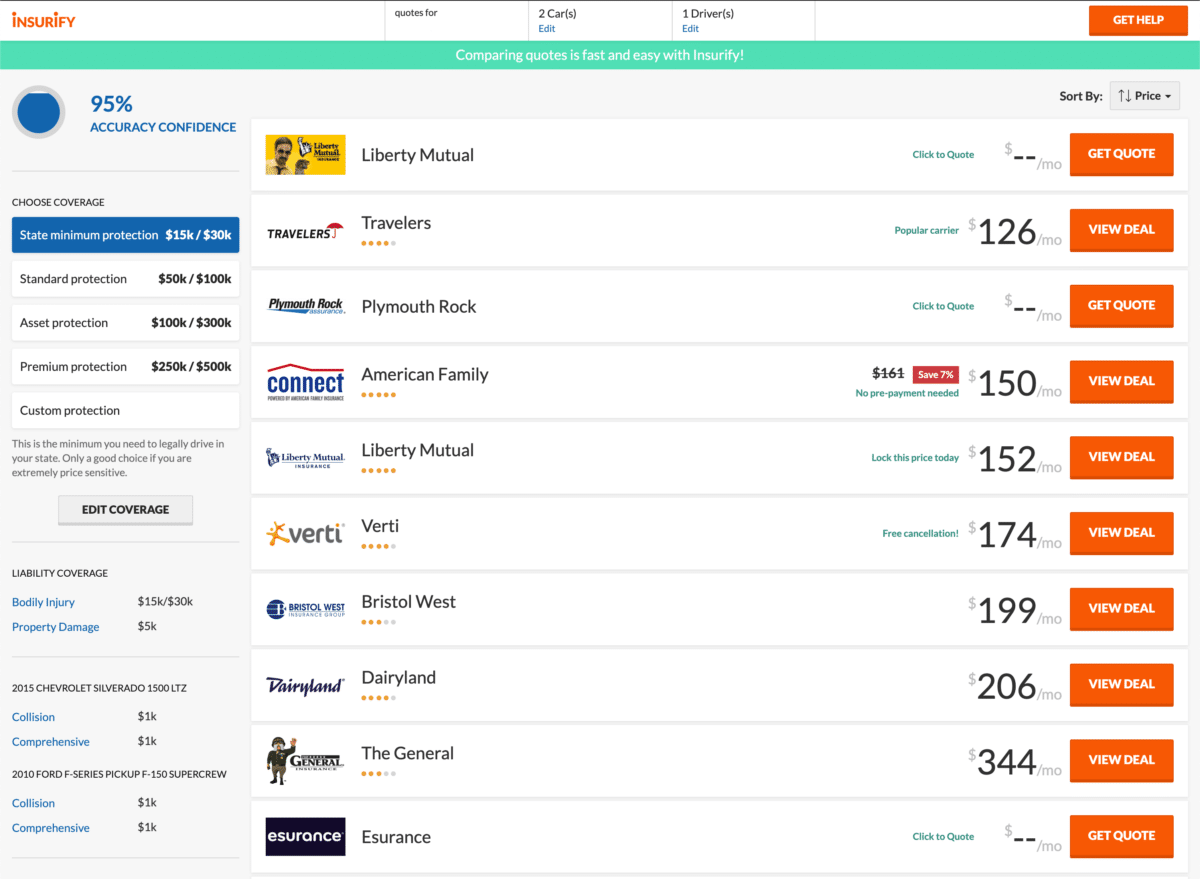

To compare auto insurance quotes based on your specific situation, use a site like Insurify to get real time information to help you make the best decision for your household.

Auto Insurance Quotes Comparison: Oregon Mutual vs. Competitors

To see how Oregon Mutual’s rates stacked up to those from its competition, Insurify’s data team gathered rates from Oregon Mutual, Progressive, and GEICO.

Below are the average car insurance rates for drivers under 40 in Oregon, from Oregon Mutual, Progressive, and GEICO:

| Insurance company | Quotes |

|---|---|

| Oregon Mutual | $50/month |

| Progressive | $63/month |

| GEICO | $57/month |

And here are the average car insurance rates for Oregon drivers with a speeding ticket, from Oregon Mutual, Progressive, and GEICO: **

**

| Insurance company | Quotes |

|---|---|

| Oregon Mutual | $84/month |

| Progressive | $86/month |

| GEICO | $74/month |

Finally, these are the average car insurance rates for Oregon drivers with an accident on their record, from Oregon Mutual, Progressive, and GEICO: **

**

| Insurance company | Quotes |

|---|---|

| Oregon Mutual | $107/month |

| Progressive | $102/month |

| GEICO | $92/month |

Oregon Mutual’s rates are quite comparable to those from Progressive and GEICO, although GEICO’s rates tend to be a couple of dollars cheaper. But this doesn’t necessarily mean GEICO will have the lowest rates for you and your driver profile. That’s why you should always compare quotes before buying car insurance. This can be time-consuming, so you should consider using Insurify, which lets you compare up to 20 different car insurance companies within minutes!

Drivers Can SAVE with these Discounts from Oregon Mutual

Oregon Mutual values loyal customers. With legacy and family discounts, policyholders can save by continuing a family trend of insurance policies with Oregon Mutual, while loyalty discounts reward longstanding customers.

Safety is also a top priority for Oregon Mutual, as discounts are available to those who complete a defensive driver course, and those who have an anti-theft device installed in their vehicle.

All of the following discount rates vary:

-

Defensive driver

-

Anti-theft device

-

Advanced quote

-

Family

-

Loyalty

-

Low mileage

-

Military deployment

-

Legacy

States Where Oregon Mutual Car Insurance is Offered

Founded in its namesake state of Oregon, Oregon Mutual Insurance Company offers auto insurance policies in Oregon, Washington, California, and Idaho.

Click here to find the cheapest car insurance quotes in your state.

Oregon Mutual Auto Insurance Coverages

-

Liability (BI/PD): If you’re at fault in an accident, you could be responsible for the cost of injuries and property damage sustained by the other vehicle. Liability coverage, which is required in most states, helps pay for those costs.

-

Comprehensive and collision: When you’re at fault in an accident, or when responsibility cannot be assigned to another driver (like in a hit and run or natural event), you are usually responsible for the cost of repairs to your vehicle. However, comprehensive and collision coverage helps protect you when no one else can pay for the damage. Comprehensive covers vehicle damage where another person is not involved, like a falling tree or storm damage. Collision helps pay for damages resulting from another vehicle hitting yours.

-

Personal Injury Protection: Also called “PIP,” this coverage helps pay for medical bills following an accident, as well as related costs like lost wages and childcare.

-

Uninsured and Underinsured Motorist: Applies if you’re hit by someone without insurance or sufficient insurance to cover the damage caused to you or your vehicle, Uninsured and Underinsured Motorist coverage helps pay for what another driver would typically cover.

Other Special Auto Coverages Offered by Oregon Mutual Insurance

When it comes to auto coverage, Oregon Mutual offers policy options beyond the usual, helping its members stay safe and save money along the way.

Vehicle upgrade: A vehicle can be deemed a “total loss” following an accident if the cost of repairs would exceed the actual value of the car. While many companies will cover the value of the totaled vehicle, Oregon Mutual will help you upgrade to a new car.

Diminishing deductible: A deductible is the amount you must pay out of pocket before insurance will help cover costs. For every year without a claim on your policy, your deductible will be reduced by a certain amount. This means that if you do end up needing to file a claim, you’ll save money down the road from your years of safe driving.

Accident forgiveness: Some companies raise rates any time you file a claim. Oregon Mutual’s accident forgiveness program means that you won’t see your premiums go up after an accident – even if you were at fault.

Roadside assistance: For 24/7 peace of mind, members can access towing and other emergency services with just a phone call.

Auto glass coverage: Even small chips in your windshield can lead to big problems. Auto glass coverage helps cover the cost to repair and replace the glass in your vehicle.

Child safety seat replacement: Whether you’re in an accident big or small, child safety seats need to be replaced following a collision to ensure they continue to protect your little ones. Oregon Mutual will replace the existing safety seat in your car following an accident.

Pet Injury – This coverage helps cover the costs of veterinary care if your furry friend is injured in a car accident.

Other Insurance Products Offered by Oregon Mutual Insurance

In addition to auto insurance policies, Oregon Mutual offers other insurance products tailored to its geography, insuring your home, business, farm, and even winery.

-

Homeowners Insurance: Whether you rent or own, live in a single-family house or condo unit, you can get dwelling and liability insurance to help protect your property and any accidents that might happen on-site. Additional coverage is available to protect valuables like jewelry, lapses in mortgage payments, and water or sewer backup damage.

-

Business Insurance: In addition to standard commercial insurance products like property damage, commercial auto, and liability, Oregon Mutual’s business insurance can also help protect your business against cyber-crime and data loss.

-

Farm, Ranch, and Agri-Business Insurance: Whether farming is your primary business or just a hobby, you can protect the value of your natural assets from destructive events like storms and droughts. Farm insurance policies cover many different assets, like row crops, grain and field crops, berry farms, and orchards.

-

Winery and Vineyard Insurance: Covering some of the country’s best wine regions, there are three tiers of protection for vineyards and wineries called Bronze, Silver, and Gold protection.

How Can I Buy Auto Insurance from Oregon Mutual?

Although you can get a quote online, Oregon Mutual Auto Insurance operates through a series of independent agents, so you can connect with someone face to face in your community to determine your policy needs.

Before committing to a new insurance company, be sure to compare quotes so you can get the best coverage and value for your situation. Insurify gives you real-time quotes from companies based on your unique needs.

How Can I Pay for My Oregon Mutual Car Insurance Policy?

Oregon Mutual Insurance Company accepts payment by phone, online account, and electronic funds transfer (EFT).

To make a payment by phone, call 1 (800) 409-3814. You’ll need your bank information and policy number handy.

Online payments can be made by credit or debit card and can be quickly processed through the company website at www.ormutual.com. You’ll need your policy or account number to start the online payment process.

If you’d rather not think about paying your bill month after month, you can enroll for Electronic Funds Transfer (EFT), and authorize an automatic monthly payment on the day of your choosing from your checking or savings account. Simply visit the “Make a Payment” tab on the company website and fill out the linked form.

How Often Will Oregon Mutual Increase My Premiums?

Oregon Mutual has an accident forgiveness program, so after your first accident, you won’t see your premium rates increase like many other auto insurance companies.

However, rates can still increase over time as a result of other changes, like a recent move or an event that caused you to lose a discount. If you’re worried about a specific event affecting your premiums, it’s best to discuss the issue with your local independent agent.

How Does Oregon Mutual’s Claims Process Work?

Oregon Mutual’s claims processing is done by phone. You can report a claim 24/7, 365 days a year, by calling 1 (800) 934-3809.

You should report an accident as soon as possible, but you’ll need to have some information handy first. Before calling, gather your own policy details, information about the other involved parties in the accident, as well as police report details for the initial phone intake.

Although you can use any body shop you’d like, Oregon Mutual has done the research for you. It maintains a list of recommended repair shops through the Customer Automobile Appraisal and Repair Service (CAARS).

How Can I Cancel My Oregon Mutual Car Insurance Policy?

If you’ve decided to cancel your insurance policy with Oregon Mutual, you can call the main customer service line at 1 (800) 888-2141, or contact your local agent.

Before you cancel, it’s essential to line up another insurance policy. Not only could you save on a future policy by planning ahead, but going without insurance leaves you financially vulnerable in case of an accident between policies. To find the best match for you, try comparing quotes with a site like Insurify, which uses your unique information to compare apples-to-apples policy quotes.

How Much Does Uber/Lyft Coverage Cost with Oregon Mutual?

Oregon Mutual does not currently offer rideshare coverage options. If you drive for Uber or Lyft, you should make sure you have adequate coverage in case you’re in an accident on the job—personal auto policies may not cover accidents that happen while you’re on the app.

Insurance Companies Similar to Oregon Mutual

Mutual insurance companies are technically owned by members. This often leads to more affordable rates since companies don’t need to worry about making a profit for outside investors. For those looking for auto insurance similar to Oregon Mutual, other member-owned companies include PEMCO and American Family.

According to Insurify’s internal database of over 2 million car insurance applications and analysis of external sources, people who previously held Oregon Mutual auto insurance policies most often switched to Progressive.

Oregon Mutual Customer Satisfaction and Policyholder Reviews

Oregon Mutual members rate this company highly in reviews and seem to echo that the company values customer service and transparency.

Common positive reviews mention competitive rates and fair claims decisions:

However, negative reviews cite unprofessional, and even unethical, behavior:

Oregon Mutual Mobile App Review

There is not currently a mobile app for Oregon Mutual.

Frequently Asked Questions: Oregon Mutual Car Insurance

-

What is Oregon Mututal’s phone number?

There are several contact numbers for Oregon Mutual depending on what you’re trying to accomplish. For the main customer service line, call 1 (800) 888-2141. For claims processing or roadside assistance, call 1 (800) 934-3809. For billing, call 1 (800) 409-3814.

-

How can I make a payment to Oregon Mutual?

Oregon Mutual accepts payments by phone, online, or by recurring electronic funds transfer. To make a payment by phone, call the billing line at 1 (800) 409-3814. For online or EFT payments, visit the Oregon Mutual website at ormutual.com and select “Make a Payment.” You’ll need your policy or account number, as well as the details of your debit card, credit card, or bank account to get started.

-

Does Oregon Mutual have good reviews?

Overall, Oregon Mutual has positive reviews on various websites. Drivers note good customer service, easy claims processing, and affordable rates as top reasons they’re happy with this company. When choosing a new insurance carrier, there’s more to consider than just reviews. Be sure to compare quotes based on your driving history and living situation with a site like Insurify to make sure you get the best value and coverage for you.

Is Oregon Mutual the cheapest car insurance in your area?

While Oregon Mutual may be an affordable option for many drivers, premiums depend on more than just the insurer. Your driving history, coverage options, location, and qualifying discounts can all affect your auto insurance premium, and even this can change over time as your life evolves.

To get the cheapest car insurance for the coverage you need, you should compare quotes from multiple companies.

Insurify is a site that can compare quotes using your unique information, helping you find the lowest car insurance rates for you.

Oregon Mutual Auto Insurance Overview

Oregon Mutual was founded in 1894 in McMinnville, Oregon, and is one of the oldest mutual insurance companies in the nation. Policies are currently only available in California, Idaho, Oregon, and Washington, and options include auto, home, business, farm, and vineyard insurance. Prioritizing customer service and local relationships, Oregon Mutual has an A+ rating by the Better Business Bureau and operates through a network of independent agents.

Customers are overall pleased with the quality of service provided by Oregon Mutual, and the company strives to provide quick claims processing. It is financially secure, with an A- (Excellent) rating from both A.M. Best and Kroll Bond Rating Agency.

After more than 125 years in the business, Oregon Mutual Insurance Company provides quality insurance products to its customers and puts safety and service first.

Oregon Mutual Contact Information

| Customer service phone number | 1 (800) 888-2141 |

| Customer service email address | contact@ormutual.com |

| Headquarters address | 400 NE Baker St McMinnville, OR 97128 |

| Claims service phone number | 1 (800) 934-3809 |

| Billing phone number | 1 (800) 409-3814 |

| Website URL | www.ormutual.com |

Compare Car Insurance Quotes Instantly

Enter your ZIP codeGet my quotesMethodology

Data scientists at Insurify analyzed more than 40 million real-time auto insurance rates from our partner providers across the United States to compile the car insurance quotes, statistics, and data visualizations displayed on this page. The car insurance data includes coverage analysis and details on drivers' vehicles, driving records, and demographic information. Quotes for Allstate, Farmers, GEICO, State Farm, and USAA are estimates based on Quadrant Information Service's database of auto insurance rates. With these insights, Insurify is able to offer drivers insight into how companies price their car insurance premiums.