Because you deserve better than a random guess, here’s a crash course in deciding the best deductible for your car insurance policy.

Compare Car Insurance Quotes Instantly

Enter your ZIP codeGet my quotesTable of contents

- How do car insurance deductibles work?

- Top considerations for choosing a deductible

How do car insurance deductibles work?

Putting it plainly: an insurance deductible is the amount of money that must be paid by the insured person before an insurance company pays a claim. In the event of a claim costing $800, if your deductible is $500, you only pay $500 for the claim and your insurance company pays $300.

The cost of your deductible has an inverse relationship to the cost of your car insurance premium. This means that if you have a lower deductible, you’ll pay a higher premium. And a higher deductible means you’ll pay a lower premium.

If you have policy riders that require a deductible, you will need to decide which amount is right for you. These and the amount of your deductible(s) should be listed on the declaration page of your car insurance policy. Be sure to note if there are specific limits or qualifications.

When do you pay a deductible?

The general rule of them for when you pay a deductible is: when they pay for your car, you pay for your car. Generally speaking, you’re on the hook for payment if you’re at-fault or when there is no fault determined for the claim—either because both drivers were found to be of equal fault or due to an “act of God.”

When do you not pay a deductible?

When another driver is the reason your car needs repairs, you do not have to pay… unless they’re an uninsured motorist or it’s an insurance claim related to a hit and run.

You can also choose not to repair your vehicle. In that case, your insurance company may pay the cost of the repair minus the deductible, meaning you’d keep the rest. Please note: if your car is financed, your lender may require repairs.

However, there may be some situations when this is a better deal depending on the cost and extent of the damage. For example, your car may sustain just under enough damage to be declared totaled. If you own your vehicle outright, you might take the cost of repair and put it toward buying a different car.

What types of insurance coverage require a deductible?

Understanding the costs and benefits of coverage that requires a deductible begins with knowing the coverage types and options associated with them. Depending on your needs and the requirements of your states, you may or may not purchase the following riders.

Comprehensive

Comprehensive coverage covers damages caused to your vehicle due to what are called “acts of God.” This includes hail, fire, extreme winds, and vandalism. Though refer to your insurance agent or policy documents for a complete list of covered damages.

What’s not covered is damage to your vehicle done by another car (for example, a hit and run when you’re parked in a parking lot).

For more information, check out our complete guide to comprehensive coverage and our guide to understanding comprehensive versus collision.

Collision

Collision coverage pays for damages caused by a collision above your collision deductible. It doesn’t matter who is at fault, though if you’re not at fault, you will pay a lot less for the claim. This is also the type of coverage that helps you during a hit-and-run accident.

For more information, check out our complete guide to collision insurance and our guide to understanding comprehensive versus collision .

Personal Injury Protection (PIP)

Personal Injury Protection or PIP covers bodily injury of you and any of your immediate family members while occupying a car. It is required in only 16 states and optional in seven. If a deductible is not available on your policy, bear in mind you will be on the hook for 20 percent of at-fault damages.

For more information, check out our in-depth article on Personal Injury Protection (PIP).

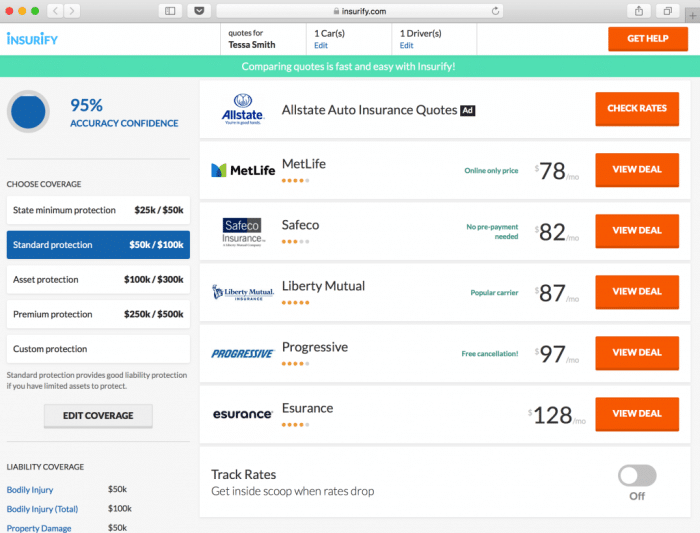

Different car insurance companies will have different costs for coverage. You can always test out these and other options using a car insurance quotes comparison site like Insurify.

With Insurify, you can compare auto insurance rates with different coverage options and deductible amounts within minutes. Simply use the dropdown menus on your quotes page and hit “update quotes” to get even more options.

A note on Vanishing Deductibles

The policy rider known as a Vanishing Deductible offers the benefit of lowering your deductible on an annual basis. However, the cost of this type of program is not free. If it costs $5 per month, as it does with Nationwide, that means you spend $60 a year for the rider.

That means that if—and only if—you get into an accident, you’ve saved yourself a total of $40 out of pocket. This may pay off for you, but if you run a low risk of being in an accident, it’s likely a losing gamble.

Top considerations for choosing a deductible

Start where it matters most: Do you even need insurance beyond liability coverage ? Knowing the answer to this question involves knowing the value of your vehicle, which you can look up on sites like Kelley Blue Book.

If the value of your vehicle is low and you can cover the cost of replacing it if it is totaled, then consider forgoing comprehensive or collision coverages. Having great liability insurance can be enough for drivers of older vehicles.

If, however, your vehicle is financed or worth more than you can afford to replace, collision and comprehensive may not only be a great option but a required option. If so, ask yourself these three questions:

1. How much do you want to pay for repair costs vs paying for insurance?

As was said before: a low deductible means a higher monthly premium. If you would rather pay less upfront, but more out of pocket expenses in the event of a claim, simply raise your deductible.

2. How likely are you to make a claim?

No crystal ball will tell definitively whether or not you’ll be in a car accident. But, seeing as you only pay your deductible in the event of a claim, you should understand the likelihood you’ll make one.

For example, you may live in a place with a high rate of traffic accidents. If so, you’re more likely to be involved in an accident. If not, you may be inclined to pay less upfront.

A pair of 2019 Insurify studies found that at-fault accidents more commonly occur in some states and cities more than others:

On the other hand, you may live somewhere with inclement weather, such as blizzards, hail storms, or other natural events, that make it more likely for you to have to make a comprehensive claim.

Other elements of your driving habits and your location can influence the likelihood of a claim, including:

-

Driving history

-

Annual mileage

-

Road conditions

-

Crime rates

3. How much can you afford out of pocket?

Just switching to a high deductible and calling it a day is not a good idea The most important question you can ask yourself right now is: What does my emergency fund look like? Simply put, if you can’t afford the loss, you’ll need to pay for a safety net. The basic law of deciding how much insurance you need is knowing what dollar amount worth of damage you can withstand.

Consider the following when trying to decide on a deductible cost:

By answering these questions honestly, you’ll know how to budget costs properly.

Be sure to test out your options with Insurify to compare quotes from top insurance companies and save big on insurance costs.

Compare Car Insurance Quotes Instantly

Enter your ZIP codeGet my quotesMethodology

Data scientists at Insurify analyzed more than 40 million real-time auto insurance rates from our partner providers across the United States to compile the car insurance quotes, statistics, and data visualizations displayed on this page. The car insurance data includes coverage analysis and details on drivers' vehicles, driving records, and demographic information. Quotes for Allstate, Farmers, GEICO, State Farm, and USAA are estimates based on Quadrant Information Service's database of auto insurance rates. With these insights, Insurify is able to offer drivers insight into how companies price their car insurance premiums.