The whole reason people buy homeowners insurance coverage is to protect themselves from the loss of their dwelling or personal property. In other words, so that when things go wrong, they can submit a claim and be made whole.

But the frequency and severity of home insurance claims greatly affects homeowners insurance companies and the greater property and casualty market. Those effects trickle down to homeowners across the country, mainly in the form of higher home insurance rates.

Below are the most important and interesting statistics and facts related to home insurance claims.

Table of contents

- Preparedness Statistics and Trends

- Claims Prevalence Statistics

- Insurance Statistics by Types of Claims

- Home Insurance Cost and Trends

- Property Loss Trends and Statistics

- Insurance Literacy

- Methodology & Sources

Preparedness Statistics and Trends

Taking action before an inclement weather event can save homeowners both in the cost for premiums and the cost of a claim. Many insurers offer discounts to homeowners who take preventative measures.

-

In recent years, homeowners have taken bigger steps to protect their homes from floods, hurricanes, and other natural disasters. (III)

-

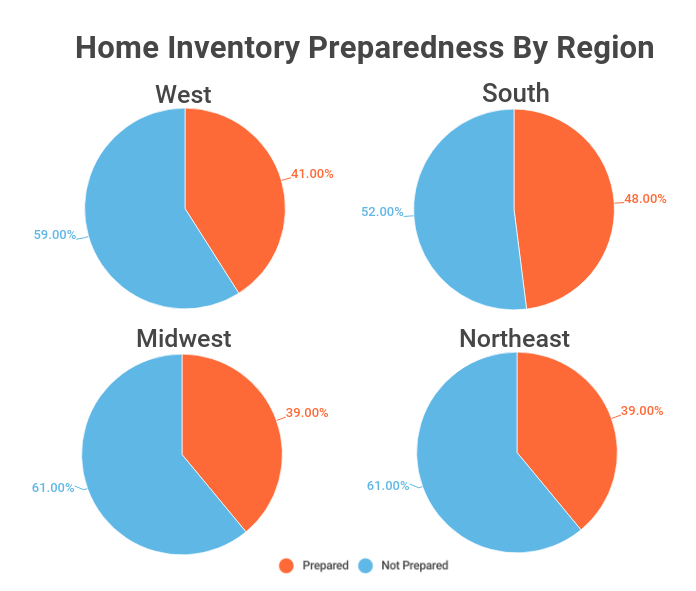

Close to half— 43% — of all homeowners have prepared an inventory of personal possessions to refer to in the event of a claim. (III)

-

The homeowners most likely to have an inventory reside in the South ( 48% ) and the West ( 41% ), closely followed by homeowners in the Midwest ( 39% ) and Northeast ( 39% ). (III)

Claims Prevalence Statistics

The cost for property claims is expensive and on the rise. This has created the need for a lot of change in the insurance market overall with both premiums and non-renewals on the rise.

-

Insurance companies payout billions every year to cover insurance claims. (III)

-

Each year, about 5% of insured homeowners submit a property claim on average. (Insurance Information Institute, III)

-

Each year on average, about 2.5% of insured homeowners submit a property damage claim resulting from wind or hail. (III)

-

On average, about 2% of insured homeowners submit a property damage claim resulting from water damage or freezing. (III)

-

About 0.29% of insured homeowners submit a property damage claim resulting from fire and lightning each year on average. (III)

-

About 0.25% of insured homeowners submit a property damage claim resulting from theft each year on average. (III)

-

On average, about 0.11% of insured homeowners submit a property damage claim resulting from bodily injury lawsuits or property damage caused by the policyholder or their family. (III)

-

5.7% of homeowners with insurance filed a claim in 2018. (III)

-

More than 98% of claims in 2018 were from property damage (theft included), not liability claims. (III)

-

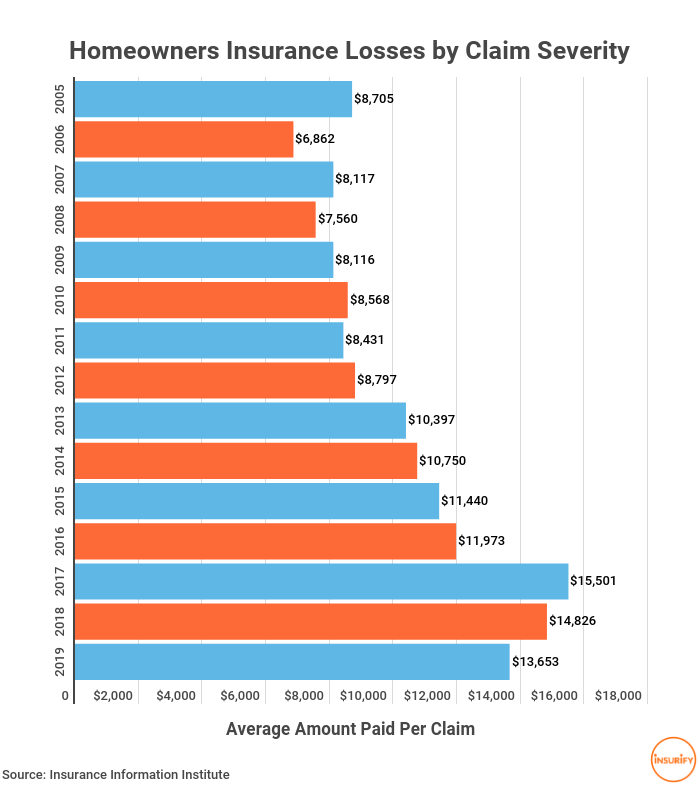

Over the last 20 years, claim frequency has decreased. However, claim severity (average amount paid per claim) has increased significantly over that same period of time. (Insurance Research Council)

Compare Home Insurance Quotes Instantly

Enter your ZIP codeGet my quotesInsurance Statistics by Types of Claims

The payout and ramifications of insurance claims varies greatly due to the type of claim. Understanding how different types of claims can affect your insurer can help you better understand how these claims affect your bottom line.

-

25 million Americans required aid from a medical professional for an unintentional injury suffered in the home in 2018. (III)

-

Wind and hail account for the most frequent home insurance claims at 34% of all claims. (BankRate)

-

Fire and lightning cause the second most frequent home insurance claims with 32% of all claims. (BankRate)

-

Hail and wind cause the most frequent home insurance claims while fire and lightning are the costliest claims. (III)

-

Property damage accounts for 98.1% of all home insurance losses. (Insurance Services Office, ISO)

-

About 1 in 50 homes have a home insurance claim related to water and freezing damage every year. (III)

-

Over the last few decades there has been a long-term decreasing trend in regards to theft crimes. (III)

-

In 2019, fire and lightning property loss decreased 37% compared to 2018. (III)

-

As a percentage of total insured losses, here are the top home insurance claims:

-

Wind and hail 34%

-

Fire and lightning 32.7%

-

Water damage and freezing 23.8%

-

Other property damage (vandalism, etc) 6.2%

-

Liability for injury and property damage to others 1.8%

-

Theft 1%

-

Medical payments 0.1%

-

Credit card or other >0.1% (ISO)

Home Insurance Claims Statistics: Sinkholes

-

States with the most damage from sinkholes are Florida, Texas, Alabama, Missouri, Kentucky, Tennessee, and Pennsylvania. (United States Geological Survey)

-

In Tennessee, home insurance companies are required to offer sinkhole insurance. Elsewhere, coverage is typically excluded. and homeowners must purchase a separate policy. (III)

-

In Florida, home insurance companies are required to cover “catastrophic ground cover collapse,” though sinkhole coverage is optional. (III)

-

In Tampa, Florida an entire house fell into a large sinkhole in March, 2013. Though large sinkholes are rare, small sinkholes appear in the U.S. at a rate of thousands per year. (III)

Home Insurance Claims Statistics: Injury

-

The most common place for personal injuries requiring medical attention is at home. In fact, more injuries occur at home than in public places, the workplace, and automobile crashes combined. (National Safety Council, NSC)

-

Since 1999, rates for unintentional home injury have risen 150%, especially due to an increase in poisonings and falls. Drug overdoses and older adult falls have accounted for most of this increase. (NSC)

-

In 2018, unintentional home injuries resulting in death decreased by 1.4% compared to 2017. (NSC)

-

Unintentional deaths at home have remained steady for more than 100 years. In 1912, there were 28 unintentional deaths per 100,000 people. In 2018, there were 27.3 unintentional deaths per 100,000 people. (NSC)

Home Insurance Claims Statistics: Fire and Lightning

-

About $826 million was paid out for insurance claims related to lightning losses in 2016. (Statista)

-

76,860 insurance claims were filed in 2019 related to lightning losses. (Statista)

-

The average payout for a fire and lightning claim is $80,000. (III)

-

Although fire is one of the least common events to result in a home insurance claim, fire claims account for 25% of all claims costs. (ValuePenguin)

Home Insurance Claims Statistics: Wind and Hail

-

34.4% of home property losses result from wind and hail damage. (ISO)

-

Wind and hail claims may be related to tropical storms and hurricanes. (Policygenius)

-

Approximately, 1 in 40 homes have a home insurance claim related to wind and hail damage every year. (III)

Home Insurance Claims Statistics: Theft

-

About 1% of home property losses are the result of theft. (Enservio)

-

Jewelry is the most common item listed on a home insurance claim due to theft. (Enservio)

-

Electronics and apparel are also common items listed on a home insurance claim due to theft. (Enservio)

Home Insurance Claims Statistics: Dog Bites

-

In 2003, the average dog bite claim cost $19,162. (Policygenius)

-

In 2019, the average dog bite claim cost $44,760. (Policygenius)

-

Dog bite claim costs have risen steadily year over year, possibly due to the increased cost in medical care. (Policygenius)

-

Dog breeds considered high-risk are excluded from coverage with certain home insurance companies. Dogs considered high-risk may include Akitas, Rottweilers, German shepherds, and pitbulls. (Policygenius)

Data Viz: Homeowners Insurance Losses By Cause (in Infogram)

Home Insurance Cost and Trends

For the most part, insurance costs are going up in the United States. This is due to a number of factors. While the costs related to insurance claims fluctuate every year, especially depending on the occurrence of severe weather events, the overall trend is increasing.

Home Insurance Trends by Location

Where you live has a lot to do with the perils you face. Some regions see much higher home insurance premiums due to the increased risk. And in many areas the number of claims has been on the rise for the last several years.

-

Parts of the country that have frequent violent storms and tornadoes tend to also have some of the most expensive home insurance premiums. This area is often referred to as “Tornado Alley” and is located in eastern Colorado, northern and western Texas, Oklahoma, Kansas, Nebraska, and South Dakota. The average home insurance premium is $1,312 annually. (BankRate)

-

States with a small number of severe weather events tend to have lower home insurance premiums. However, other factors can influence costs. (BankRate)

-

Crime rates can play a large role in assessing the cost of home insurance premiums. Crime rates are calculated by ZIP code. (BankRate)

-

The state with the lowest annual premiums for homeowners insurance is Hawaii at $376 a year. This is because Hawaii law requires that homeowners purchase a separate policy to cover hurricanes, which occur at a lower rate than in the Gulf states. (BankRate)

-

Cost increases from hurricane risk can vary significantly by location. For example, homes in coastal South Carolina come with much higher premiums than homes only a few miles inland. (BankRate)

-

California experiences more home insurance losses than any other state due in large part to recent trends regarding wildfires. $12 billion in 2017 and $13 billion in 2018. (Policygenius)

-

From 2015 to 2019, California saw insured losses totaling on average $10.7 billion a year. That’s 40% higher than the next state, Florida, and larger than the combined losses of the 29 states with the least amount of insured losses for residential property. (Policygenius)

-

Florida counted 6,821 lightning claims that resulted in $93.2 million in insured losses, making it the state with the most lightning claims in 2019. (Policygenius)

-

More than 2 million homes are in designated high-risk areas for wildfire in California alone. This is the highest residential exposure in the country. (Policygenius)

-

Texas has the highest number of hail damage claims with 637,977 claims between 2017 and 2019. (Policygenius)

Home Insurance Policy Statistics

-

Around 85% of homes in the U.S. have a home insurance policy covering them. (ValuePenguin)

-

79.09% of home insurance policies are for HO-3 policies also known as Broad Form policies. (National Association of Insurance Commissioners, NAIC)

-

The national average for a home insurance policy is $1,445 annually. (ValuePenguin)

-

The national average for a home insurance policy for a dwelling worth $250,000 is $1,312 annually. (BankRate)

-

Nearly half— 47% — of homeowners do not know what their insurance covers. (ValuePenguin)

-

60% of homeowners undervalue the replacement value of their homes. The average under-evaluation is 17%. (Marshall & Swift/Boeckh)

-

The amount of net premiums written in 2019 was about $93 trillion. (Statista)

-

65% of homeowners save on their home insurance policy through bundling discounts— bundling home insurance with auto, RV, or other policies. (J.D. Power)

-

Home insurance premiums are likely to increase after you experience theft. However, if theft rates are on the rise in your ZIP code, you are likely to see a rise in your home insurance premium even if you have not personally experienced theft loss. (BankRate)

Policy Non-Renewal Facts and Statistics

Policy non-renewals have been on the rise in the last two decades. Increased exposure to weather-related risks has been the main driver behind this rise. Legislation and government programs have ameliorated some of the worst effects of non-renewal.

-

Many programs exist across the U.S. to give homeowners in high-risk areas access to home insurance. These homeowners would otherwise be shut out of purchasing home insurance in the standard market. (III)

-

The Fair Access to Insurance Requirements (FAIR) plans provide property insurance to people in high-risk areas. This includes beach and windstorm plans and the state-run insurance companies— Florida’s Citizens Property Insurance Corp. and Louisiana’s Citizens Property Insurance Corp. (III)

-

FAIR and beach and windstorm plans have seen huge growth since 1980, both in terms of number of properties insured and in exposure value. (III)

-

Luckily, the number of FAIR plans peaked in 2011. Between 2011 and 2019, the number of policies written has decreased by 48.5% and the exposure value decreased by 51%. (III)

Cost of Homeowners Insurance: Trends and Statistics

The cost for home insurance has been rising significantly in the last 30 years. It has outpaced inflation consistently.

-

Homeowners insurance premiums are going up. Premiums rose 1.6% in 2017, then another 3.1% in 2018. (NAIC)

-

Between 2005 and 2018, the average cost of an annual home insurance premium rose from $764 per year to $1,249 per year. (Statista)

-

Between 2013 and 2018, the average home insurance premium cost rose by 15%. (ValuePenguin)

-

Renters insurance premiums are going down. Costs declined by 2.7% in 2017 and then by 0.6% in 2018. (III)

-

Houses valued at $750,000 cost $2,695 annually on average to insure in 2018. (Statista)

-

Houses built with brick or masonry framing cost $1,216 to insure annually on average in 2018. (Statista)

-

The average cost for homeowners insurance from Liberty Mutual in 2018 was $1,216 per year. (Statista)

Home Insurance Industry Statistics

-

In the first half of 2020, the property and casualty insurance industry (home, auto, boat, etc.) made a net profit of $27 billion. Though this may seem like a lot, it’s actually a significant decrease from past years— 23% less than the profit in 2019. (NAIC)

-

The early 2020 decline in profitability is attributed to stock market fluctuations during the beginning of the pandemic. (NAIC)

-

For multi-peril homeowners insurance policies in 2019, $103,995,754,245 total direct premiums were written. (NAIC)

-

6 insurance companies comprise 50% of the total property and casualty U.S. insurance market in 2019— a market that includes U.S. territories and Canada. (NAIC)

-

The top 5 largest insurers comprised 45% of the market in 2019. (ValuePenguin)

-

Though the group of top insurers have changed over the last seven years, with any given year, the five largest insurers comprise between 45% and 50% of the market. (ValuePenguin)

-

In 2019, State Farm was the largest insurer both for its market share and number of premiums written. (NAIC)

-

State Farm is the largest insurer, comprising 17% of the market share of the industry in 2017. Other top insurers include Allstate, Liberty Mutual, and USAA. (Statista)

-

An insurer’s loss ratio is a great indicator of the company’s financial viability. A ratio greater than 100 indicates that the insurer is paying more in claims than it is taking in with premiums, which is a recipe for poor financial performance. A ratio lower than 60 is a sign of financial strength. (Corporate Finance Institute)

-

State Farm’s gross direct loss to earned premium ratio was 58.75 in 2019. (BankRate)

-

In 2019, all of the 6 largest insurers gross direct loss to earned premium ratio was below 60. Farmers Insurance had the most favorable rating at 38.72. (BankRate)

-

In the first half of 2020, many states saw growth for direct premiums written for homeowners insurance compared to the same period in 2019. (NAIC)

-

By direct premiums written, State Farm saw the largest increase in 2019 writing about $18.68 billion in premiums. (Statista)

-

In 2019, Allstate wrote about $8.7 billion in direct premiums for home insurance and accounted for 8.4% of the market share. (Statista)

-

Liberty Mutual accounted for 6.5% of the market share in 2019. (Statista)

-

The states with the biggest increase in direct premiums written in the first half of 2020 were: Idaho, Arkansas, Iowa, and Florida. (NAIC)

-

Several states saw a decline in direct premiums written in the first half of 2020, including New York, Illinois, New Jersey, Hawaii, North Dakota, Delaware, Vermont, and West Virginia. (NAIC)

-

The net of homeowners reinsurance— insurance that an insurance company purchases from another insurance company to mitigate risk— fell from $56.5 billion in 2017 to $56.2 billion in 2018. (S&P Global Market Intelligence)

Property Loss Trends and Statistics

While the number of home insurance claims fluctuate every year, the overall trend for claims is going up both in frequency and severity. Many sources attribute this rise to increased risk exposure due to population spread and increased frequency in severe weather events.

-

The average payout for a home insurance claim is $8,787. (Insurance Research Council)

-

In 2019, the cost for all peril loss decreased by 13% compared to 2018. (LexisNexis)

-

Losses in 2019 from wildfire, hurricanes, hailstorms, and flooding, while severe, were lower in both severity and frequency compared to 2017 and 2018. (LexisNexis)

-

Catastrophic losses (think natural disaster) occurring from storms— wind, fire, and lightning— dropped by 32% in 2019. (LexisNexis).

-

In 2019, 90% of all catastrophic losses were caused by wind and hail, an increase from the previous year. (BankRate)

-

In 2019, the severity of weather-related water events increased. (BankRate)

-

Population growth is the main driver of increasing property loss due to human development in storm-prone regions. (III)

-

Between 2013 and 2019, the states with the highest costs for property loss were Colorado and Nebraska. (LexisNexis)

-

Excluding property loss from hurricanes and severe storms, the average claim size is $8,772 and the frequency is 1 in 29 homes per year. (ValuePenguin)

-

Home insurance losses were about $56.23 billion in 2018. (Statista)

Insurance Literacy

Understanding the basics of homeowners insurance is the foundation to getting the right coverage at the lowest cost to you.

-

HO-1 and HO-2 policies are called “named peril” policies because they only cover damage resulting from perils named in the policy. (ValuePenguin)

-

HO-3 and HO-5 policies are called “open peril” policies because they exclude coverage only for perils named in the policy. (ValuePenguin)

-

HO-8 policies are designed for homes that are older and of higher value. (ValuePenguin)

-

Named peril policies typically include some or all of the following:

-

Fire and lightning

-

Smoke damage

-

Theft

-

Windstorm or hail

-

Freezing pipes

-

Damage from the weight of ice, sleet or snow

-

Falling objects

-

Explosions

-

Volcanic eruption

-

Riots

-

Vandalism

-

Damage from aircraft

-

Damage due to vehicles

-

Electrical current damage

-

Water damage from plumbing, heating or A/C overflow

-

Damage from a water heater cracking, tearing and burning (Insurify)

-

Open peril policies typically exclude some or all of the following:

-

Earthquakes

-

Earth movement

-

Sinkholes

-

Floods

-

Acts of war

-

Nuclear accidents (Insurify)

-

To cover exclusions, homeowners should purchase either a rider or seperate policy covering that peril. For example, many homeowners purchase a separate flood insurance policy. (Insurify)

Methodology & Sources

Statistics from the following institutions were incorporated onto this page: Insurify, Insurance Information Institute, Insurance Research Council, BankRate, Insurance Services Office, ValuePenguin, United States Geological Survey, National Safety Council, Policygenius, Statista, Enservio, National Association of Insurance Commissioners, Marshall & Swift/Boeckh, J.D. Power, Corporate Finance Institute, S&P Global Market Intelligence, and LexisNexis.

Data Attribution: The information, statistics, and data visualizations on this page are free to use; we simply ask that you attribute any full or partial use to Insurify through a link to this page.