With the pandemic receding, the prospects for the car rental sector are picking up again. One of the biggest players in this area is Hertz, who fight it out with Avis Budget Group to lead the world in car rental. Maybe you are figuring out the process of buying Hertz stock wanting to profit from the revival of the car rental sector.

Below we show you the process of investing in Hertz stock safely with zero commission charged. We explore the ins and outs of Hertz as an investment, and compare it against its biggest rival Avis Budget Group. We also compare two regulated brokers: eToro and Webull.

Buying Hertz Stock – An Overview

Let’s kick off by outlining how simple it is to get started with online stock investment:

- ✅Step 1: Open an account with a Regulated Broker– Head to the website of a regulated broker. To open a new trading account, begin the registration process. Enter your email, and set up a log-in ID and password.

- 🔑Step 2: Verification – Because regulated brokers must comply with the latest KYC standards set up by international regulators, you will need to supply proof of ID and address.

- 💳 Step 3: Deposit – Depositing funds is simple. You can use debit/credit cards, bank wire, ACH and certain e-wallets. There is no charge for US investors.

- 🔎 Step 4: Search for Hertz Stock – Buying Hertz stock is a breeze: just type ‘HTZ’ in the toolbar to find it.

- 🛒 Step 5: Buy – You can buy Hertz stock with as little as $20 by clicking on the ‘Trade’ button.

Step 1: Choose a Stock Broker

Temporarily bankrupted in 2020 as result of global lockdown measures, Hertz bounced back into the market in 2021 with new investors. This firm is a decent investment prospect.

Out of the stock trading platforms available in the US, we focus on two: eToro and Webull. Both charge zero commission on stock purchases, and both are comprehensively regulated in the US.

1: eToro

Regulated broker eToro is place to buy Hertz stoc if you want to get hold of Hertz shares at zero commission with a spread fee of just 0.26%. With eToro, you can buy as little as $20 of Hertz stock in one go. 637,000 eToro investors follow the performance of Hertz stock.

Regulated broker eToro is place to buy Hertz stoc if you want to get hold of Hertz shares at zero commission with a spread fee of just 0.26%. With eToro, you can buy as little as $20 of Hertz stock in one go. 637,000 eToro investors follow the performance of Hertz stock.

In all, eToro boasts a really impressive choice of over 3,000 stocks. Diversity is the watchword here: you can invest in the dividend stocks as well as the penny stocks, for example. By comparison, Webull offers very few international stocks, and these can only be traded as ADRs (American Depositary Receipts).

In addition to stocks, eToro offers a range of indices, forex, commodities, crypto coins and an excellent selection of 264 Exchange Traded Funds (ETFs). Newcomers to investing should look into trading ETFs. That’s because they offer a way to spread risk by investing in many companies at once.

Another way of investing in many stocks at once with eToro is by investing in one of its 70 Smart Portfolios. Smart Portfolios are a key part of eToro’s pioneering Social Trading — which centres on helping beginners to learn the ropes.

CopyTrader is the second key part of eToro’s Social Trading. CopyTrader allows you copy other traders with no extra charge (but you do pay normal spread fees and any other trading fees).

Social Trading aside, eToro is counted has a stock apps. In the US, the SEC and FinCEN regulates eToro, which is also registered with FINRA. eToro also boasts regulation across Europe and in Australia.

| Number of Stocks: | 3000+ |

|---|---|

| Pricing System: | No commission. Spread fee only |

| Cost of Buying Hertz: | Spread fee of just 0.26% |

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

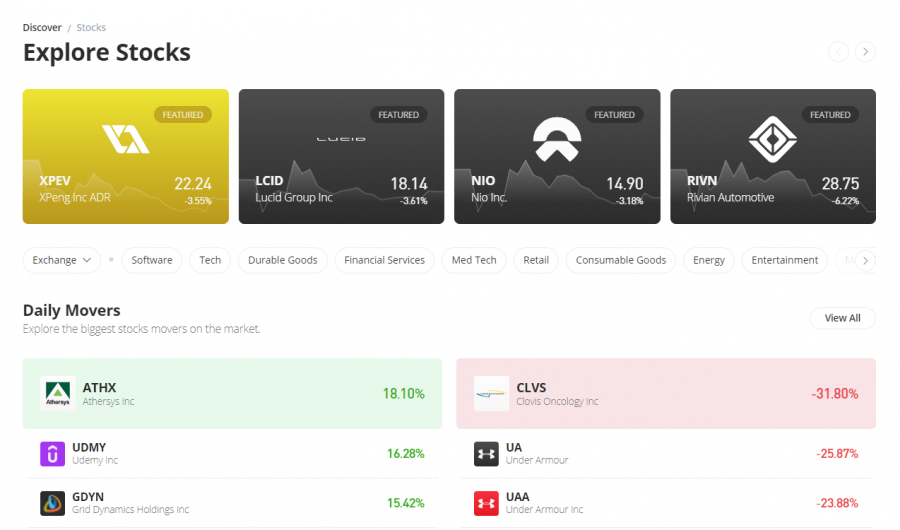

2: Webull

With 7m account holders, New York-based broker Webull has less than a third of eToro’s 25m users. Launched in 2017, Webull has been in business for a decade less than eToro.

With 7m account holders, New York-based broker Webull has less than a third of eToro’s 25m users. Launched in 2017, Webull has been in business for a decade less than eToro.

Otherwise the two stock providers are similar. Both offer proper regulation in the US and zero commission on Hertz and other shares. Offering an excellent user-experience is also a priority for both brokers.

Although Webull offers more stocks — with a selection of 5,000 — the vast majority are US-only. eToro offers 900+ international stocks from over 15 exchanges outside the US.

Webull does not offer the credit/debit card options of eToro. And, whereas bank wire deposits are free with eToro, there is a $8 charge with Webull. Withdrawal via bank wire costs a hefty $25 a pop with Webull, compared to eToro’s flat fee of $5 for all types of withdrawals.

Figuring out buying Hertz stock with Webull is as simple as it is with eToro. But, given eToro’s ongoing commitment to supporting the newbie trader with powerhouse functions like Smart Portfolios and CopyTrader, we suspect that beginners will find eToro a more simple ramp into investing in general. (eToro vs. Webull: more details here)

| Number of Stocks: | 5000+ (US only) |

|---|---|

| Pricing System: | Spread fee, no commission |

| Cost of Buying Hertz: | Spread fee: not available |

Your capital is at risk.

Step 2: Research Hertz Stock

What is Hertz

Hertz is one of the largest car rental firms in the world. Founded in 1918 in Chicago, Illinois, Hertz is headquartered in Esteros, Florida.

The firm operates from 12,000+ corporate and franchisee outlets in 160+ countries. Hertz is represented by 3 brands: Hertz, Thrifty and Dollar.

The firm has strategic partnerships with Tesla, Uber, Carvana, AWS, Polestar, Lyft and AmexGBT.

In the driving seat at Hertz is new CEO Stephen Scherr. Scherr took the number one spot in February 2022, having been Chief Financial Officer at investment bank Goldman Sachs.

In announcing Hertz’s Q1 2022 financial results, Scherr said, ‘Hertz produced a very strong first quarter. Our team delivered on behalf of customers amidst strong demand, reflecting a sharp rebound in travel.’

Hertz vs. Avis Budget Group

When in search of undervalued stocks, understanding a company’s balance sheet is important. But it is also key for investors to have an idea of where a company sits in its sector.

The main competitor for Hertz is the ABG (Avis Budget Group: buy it with eToro under the ticker ‘CAR’). These are the two biggest publicly-traded businesses in the global car rental market. They are similarly-sized. Hertz has 23,000 employees. ABG has 21,000. Both companies offer a mix of corporate and private use rental.

The Coronavirus Pandemic ravaged the car rental sector globally. Because of lock-downs, people rented cars far less often. A key question here is:

2020: Why did Hertz Have to File for Chapter 11 Bankruptcy Protection in 2020, and ABG Did Not

In the car rental sector, it is normal for companies to be in debt as a result of funding their vehicle fleets.

- In 2019, before the pandemic, Hertz had a fleet of 715k vehicles.

- ABG’s fleet was slightly smaller, at 660k vehicles.

- In 2019, Hertz was in more debt than ABG, facing greater depreciation costs on the value of the fleet and running with higher operating expenses.

Also, although in 2019 Hertz was renting out its fleet more efficiently in terms of volume — with a fleet utilization ratio of 79% vs. ABG’s 71% — it was making 25% less on average per vehicle.

Hertz’s cashflow dropped to -0.5% of revenue, compared to ABG’s figure of 3%. As a result Hertz could not afford a $400m loan payment and filed for bankruptcy in May 2020. (Figures courtesy of UK investment analysts Motley Fool)

2021: Hertz Emerged from Bankruptcy

Hertz emerged from bankruptcy protection on June 30, 2021. It shed $5bn of debt. A group of investors led by Knighthead Capital Management and Certares Management fronted $5.9 billion in capital. And HTZ stock was listed on the NASDAQ.

This has turned the tables on rival ABG to some extent.

Commenting in November 2021, stock analysts SeekingAlpha concluded that the two stocks are still comparable, with different strengths and weaknesses: ‘so Avis has over $5 billion more debt, and the equity trades for another $2.4 billion compared to Hertz. In exchange, you get more vehicles and about 10% more earnings last quarter.’

Let’s review a few key metrics from Hertz’ balance sheet and see where it stands today.

Hertz Stock Price History

Having figured out buying Hertz stock for zero commission with brokers eToro and Webull, the challenge is to figure out how much the stock is actually worth.

HTZ stock is priced today at just over $19 dollars ($19.07).

You can see from the chart below that the price went through some dark days over the course of 2020 and early 2021 as bankruptcy measures were in place. But having found institutional investors and listed on the NASDAQ in July 2021, Hertz’s fortunes changed for the better. The stock peaked at over $35 in early November 2021 and has since fallen to bounce off a support level around $16.

Hertz: Key Metrics

| Metric | Definition | Shows |

|---|---|---|

| EPS (Earnings Per Share) | Profit divided by number of shares outstanding | How much profit a company is making compared to the number of shares outstanding |

| P/E Ratio (Price/Earnings per Share Ratio) | Price of a share divided by EPS | How much the company is valued at by the markets |

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Hertz EPS (Earnings Per Share): $0.87

From Hertz’s Q1 2022 figures, we can see that its adjusted EPS is $0.87. This compares unfavourably to ABG’s EPS figure of $9.99.

This means that Hertz’s rival ABG is delivering far more profit per share. According to broker eToro, its gross profit margin is 42%, which is 3.5% better than ABG’s figure of 38.5%.

Hertz P/E Ratio: 3.39

Hertz’s P/E ratio is just 3.39 vs. ABG’s P/E ratio of 6.33.

ABG is trading at roughly twice the price as Hertz if earnings per share are equalised. This means in simple terms that the market currently rates ABG as being twice the value of Hertz.

Recent price movements suggest that Hertz might well be undervalued (see below).

Hertz Stock Dividends

‘Dividends’ are payments which companies sometimes make to shareholders. These payments are not compulsory, and can come and go.

Because the car rental sector was so badly hit by the pandemic, it is not the place to find dividend stocks. Neither Hertz nor its rival ABG have said that they will pay dividends this year.

Factors Affecting Hertz Stock

Before you settle on HTZ stock in a way that suits your budget and experience, you need to confirm that you want to buy it at all.

On the chart are two lines:

- Red line: 200-day Moving Average

This shows the average price over the last 200 days - Green Line: 50-day Moving Average

This shows the average price over the last 50 days

‘Golden Cross’ and ‘Death Cross’: Opportunity Knocks

You can see that at the beginning of 2022, the green line (50-day MA) rose to cross the red line (200-day MA). In technical charting, this is called a ‘Golden Cross’. This means, in simple terms, that the share price is doing a lot better than it has been for a while.

Then at the beginning of April 2022, the red line (200-day MA) rose to cross the green line (50-day MA). This is called — rather dramatically — a ‘Death Cross’. It means that the price is doing worse than it has been for a while.

For our purposes as investors looking to invest in stocks, this ‘Death Cross’ is potentially a benefit. It might mean that the stock price is underpriced: cheap at the price, in other words.

It is certainly true that, when a stock price shows a Death Cross, its performance shortly afterwards often improves as buyers rush in to pick up a bargain. This happens particularly if the business offers strong business fundamentals.

2: Robust Hertz — Still a Contender

Hertz generated revenues of $1.81bn in Q1 2022. That’s 3/4 of rival ABG’s revenues for the same period. But, although it briefly went broke under the pressures of the pandemic in 2020, Hertz is by no means broken. It still operates a sizeable fleet. It has less debt than rival ABG. And it is expanding under the leadership of new CEO Stephen Scherr, who brings the financial expertise he gained as CFO of investment bank Goldman Sachs.

One key area of focus is the booming EV (Electric Vehicle) sector.

3: Tapping into the EV Phenomenon

Globally, there could be as many as 230m electric vehicles on the road by 2030 (according to the International Energy Agency).

Investors looking to buy into the EV sector have many choices. Some go for the market leader and buy Tesla stock. Others pick a start-up, like Amazon-backed Rivian stock. To take a position in many EV stocks at once, and thereby reduce risk, there are also eToro BatteryTech and Driverless Smart Portfolios to consider.

Just like everyday investors, Hertz is looking to invest in the future of EVs:

- In 2021, Hertz announced a deal with Tesla to buy 100,000 Model 3 EVs.

- In 2022, Hertz announced a deal with EV producer Polestar to buy 65,000 vehicles.

- Across 80 markets globally, Hertz has 1,000 Level 2 electric chargers in place already.

- Hertz already too offers Tesla for rental in 20 of its international markets. A key partner here is taxi firm Uber; Hertz rents EVs to Uber drivers. Hertz, says CEO Scherr, ‘continues to experience strong driver demand, supported by the increasing earnings these [Uber] drivers can generate by renting from Hertz rather than outright ownership.’

4: Clear Management Focus

CEO Scherr has said that EVs work particularly well for corporate rental clients too. That’s because, ‘they need to rent cars to their employees, but they’re equally, through EV, satisfying their own ESG and carbon footprint objectives.’ CEO Scherr says he wants at least 30% of the Hertz fleet to be electric by 2024.

In other technological developments, Hertz is committed to equipping its entire North American fleet with telematics by the end of 2022.

CEO Scherr explains that, ‘our objective is to provide customers with a seamless digital experience every step of the way – in short, to take the hassle out of renting a car.’ Hertz has already teamed up with Amazon Web Services to roll this innovation out.

Step 3: Open an Account and Buy Hertz Stock

When it comes to buying Hertz stock, using a regulated broker is the answer.

Sign up

Navigate to a broker’s homepage, then fill out the box with some personal details. Tick the boxes to accept the terms and conditions. Or short-cut this step by signing up with your Facebook or Google account.

Verify

Regulated brokers must by law ensure that new investors are not fraudsters. So everybody must go through some simple KYC (Know Your Customer) steps. With automated software getting better all the time, this step need not be a hassle. Just make sure that you have ready:

- Proof of ID: ID card or passport.

- Proof of address: Utility bills, rent statements etc.

Deposit

Once verified, you are permitted to deposit funds. Log in to your account. Press the blue ‘Deposit Funds’ button on the left of your interface. Deposit with bank wire, ACH, credit/debit card and e-wallets are all available to US investors with no deposit fee charged.

Search

Find Hertz stock instantly by entering its ticker label ‘htz’ in the toolbar.

Click the Hertz logo to go to Hertz’s homepage. Here you can drill down through Hertz’ balance sheet, review analyst opinions, access your chatfeed and use powerful charting options.

Or, if you want to buy Hertz stock, simply press the blue ‘Trade’ button.

(Note that the ‘HTZWW’ stock below ‘HTZ’, which also bears the Hertz logo, relates to Hertz warrants issued in 2021. We advice that you stick to conventional HTZ stock traded on the NASDAQ.)

Buy Hertz Stock

Having pressed the blue ‘Trade’ button, there are a few things to decide:

- Enter how much USD you want to spend.

- You can set levels for Stop Loss as well as Take Profit, or come back to these later.

- Press ‘Open Trade’ when you are happy to execute your trade.

Sell Hertz Stock

To sell your HTZ stock, head to your portfolio. Click on the row that relates to your HTZ stocks. Then click on the red cross that appears at the far right. This opens your selling options, which are convenient because you can sell only a fraction of your HTZ holding if it suits you, rather than the whole lot at once. The proceeds of the sale will be credited to your USD balance immediately.

Hertz Strengths

When deciding whether Hertz stock has any strength, there are a few key things to consider.

BUY: ‘Moderate Buy’ Say Analysts

One of the advantages of using well-established brokers is that each stock is presented with plenty of useful stats.

Illustrated below is a snapshot from Hertz’s homepage on eToro.

Of 6 professional analysts who have recently commented on Hertz stock, the consensus is a ‘moderate buy’. 4 said ‘buy’ and 2 said ‘hold’. The average price target for May 2023 is $28.83, which is over 50% what HTZ stock is priced at currently.

BUY: Hertz Insiders Buy HTZ Stock in 2022

Another useful feature of broker eToro is that you can see the trading activity in HTZ shares amongst management.

We can see that in 2022, three significant buys have been made:

- BUY: 01.04.22: Director Evelina Vougessis Machas

- BUY: 31:03.22: President & COO Paul Stone

- BUY: 31.03.22: International President Angela Brav

No significant SELL trades have been executed by management since July 2021. This is a positive indicator for the future prospects of the HTZ share price.

BUY: Momentum Trade

It is worth re-iterating that, in mid-May 2022, the key technical indicator of the ‘Death Cross’ shows that the Hertz share price has dipped below its long-term average. This does not, as the dramatic ‘Death Cross’ name suggests, necessarily indicate that the share price is doomed. Rather, it shows that the shares are going cheaper than they have done for a while.

It is up to the individual investor to decide whether cheap shares mean that they are undervalued, or that they are in fact valued correctly at a low price because of some business problem facing Hertz.

As we have gleaned above, the general consensus among expert analysts is that Hertz is a ‘moderate buy’.

SELL: Hertz in the Press for the Wrong Reasons

Hertz has been under fire in the American press in 2022. Customers have complained that, whilst negotiating payment wrangles, Hertz has wrongfully accused them of stealing a Hertz vehicle and reported them to the police.

Hertz revealed in court in February 2022 that it reports over 3,000 customers to the US police every year, but that this figure represents only 0.014% of their 25m annual transactions in the US.

This is a serious reputational issue for Hertz. Nobody wants to hire a car if the rental company will report you to the police if there’s a dispute over payment.

Given the gravity of the situation, it is testament to the resilience of Hertz stock that the price has not collapsed. But it has not.

Conclusion

Above we have explored the strengths and weaknesses of car rental giant Hertz as investment prospect. We have explored buying Hertz stock with zero commission, and reviewed two regulated brokers.

#stocks #stockmarket #trading #forex #trader #wallstreet #daytrader #forextrader #finance #options #pips #forexsignals #forexlife #investing #forextrading #nyse #invest #investment #forexmarket #profit #daytrading #stocktrading #wealth #nasdaq #technicalanalysis #currency #foreignexchange #billions #investments #investor