Anchor protocol was a popular platform where investors could earn 20% interest on stablecoin TerraUSD (UST). Then UST lost its 1:1 peg to the dollar and crashed alongside Terra (LUNA) in mid May 2022.

In this guide we’ll review how to earn interest on stablecoins at some Anchor Protocol alternatives that are safer and easy to use for beginner crypto investors.

Where to Earn Interest on Stablecoins – Best Platforms

- Aqru – earn 12% stablecoin interest daily

- Crypto.com – earn up to 10% APY on stablecoins, open to USA

- BlockFi – earn 8% interest on stablecoins up to the first $20,000

- Nexo – earn up to 12% on DAI, USDC, USDP, USDT or TUSD

These are our picks for the best Anchor Protocol alternatives to earn interest on stablecoins. Each have their advantages and disadvantages, depending on your crypto interest goals for 2022 and your risk tolerance.

Best Stablecoin Interest Rates Compared

| Interest Account | Interest Rate | Terms & Conditions for Best Interest Rates |

| Aqru | 12% | None |

| Crypto.com | 10% | Three month lockup, and staking $40k in CRO |

| BlockFi | 8% | Up to $20k tier limit then 5.5 – 7% above |

| Nexo | 12% | Holding NEXO tokens, receiving interest in NEXO |

Who pays the most interest on stablecoins depends on how much you’re willing to invest, and risk tolerance.

Top Platforms to Earn Interest on Stablecoins – Reviews

Below we’ll take a closer look at the best places to earn interest on stables:

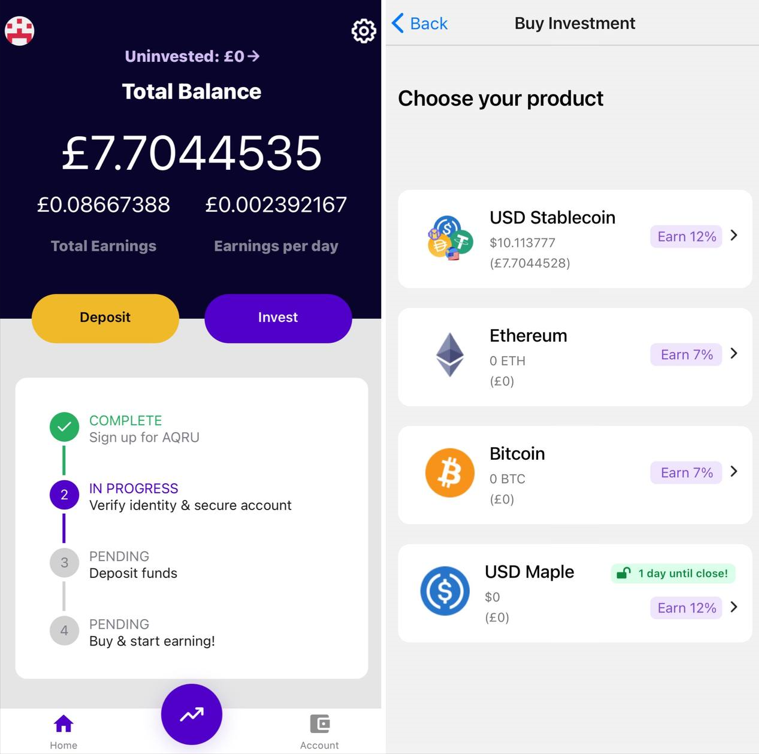

Aqru – Best Platform to Make Money with Crypto

Update – the yield rate on Aqru lowered temporarily as a result of the recent crypto market correction.

Aqru.io is one of the best crypto staking platforms to make money with cryptocurrency, supports USDT, USDC and DAI for daily interest payments of 12%, as well as also recently partering with Maple Finance to offer USD Maple at 12%.

As soon as you open an account you’re credited a free $10 in USDT to test out the platform.

Stablecoin interest platform Aqru

Your Aqru account accrues stablecoin interest continually with no input from you. Interest payments are sent to your balance daily so you earn compound interest on your growing capital.

The minimum deposit is $100 or equivalent in GBP or EUR. There are no minimum lock-up periods – you can uninvest and withdraw at any time.

An example investment of $10,000 held in stablecoins would earn $3.29 a day.

Unfortunately Aqru is also not currently available in the United States, however Crypto.com and BlockFi are – see our reviews of those platforms below.

- 12% compound interest rate, paid daily

- No lock-up period or tier limits

- Low minimum deposit ($100)

- Free fiat cash withdrawals

Cons

- Relatively new to the industry

- $20 fee on crypto withdrawals

- Not yet available in U.S.

- Small Reddit presence

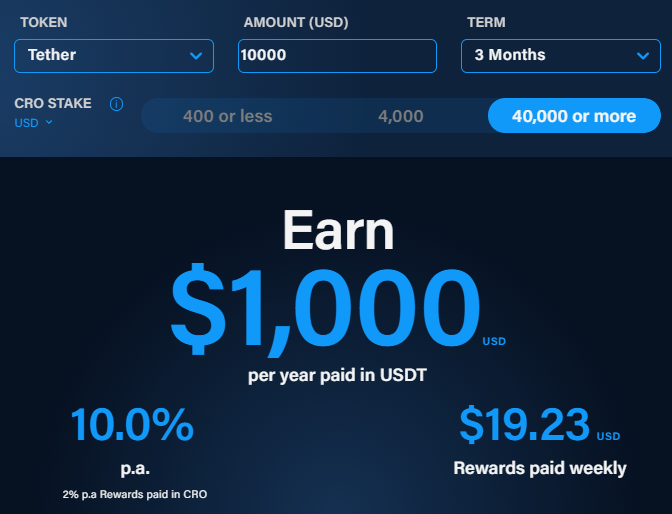

Crypto.com

American users are currently accepted on the Crypto Earn program and can use the app but not the exchange platform. Send crypto you already bought elsewhere on a platform like eToro to yourself on this platform to start earning crypto interest.

The Crypto.com stablecoin interest rate is up to 10% although it does require lockup periods of three months at a time and staking $40k in Cronos (CRO), the native token of the platform.

CRO has been in an long term bullish uptrend however so that bet might pay off – and has dipped in mid 2022 since the exchange cut rewards for its debit card users. The exchange listened to feedback though and rolled back some of the changes, so CRO could be in a ‘buy the dip’ spot now.

Crypto Earn program

The Crypto.com ‘Crypto Earn’ program supports earning interest on stablecoins including USDT, USDC, TUSD, DAI and 50 crypto assets in total alongside stablecoins – such as Bitcoin, Dogecoin, and more. The highest yield is on Polkadot and Polygon.

You can also take out crypto loans on Crypto.com using your crypto as collateral. You can be lent up to 50% of the total value of your crypto holdings.

An investment of $10,000 held in stablecoins on Crypto.com would earn $2.74 a day.

- 10% is a competitive stablecoin interest rate

- Also a crypto exchange, and offers a prepaid metal VISA card

- Borrow up to 50% of your crypto collateral

Cons

- Risk of CRO losing value during staking

- Risk of market crashes during a lockup period

- 25 USDT withdrawal fee

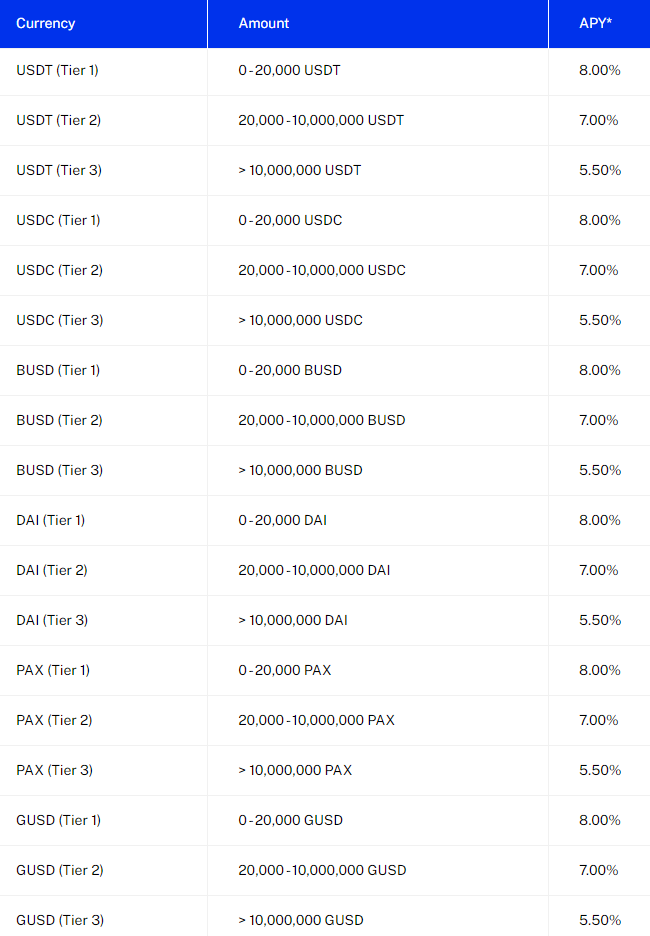

BlockFi

BlockFi came under SEC attention in the US – common for cryptocurrency platforms and projects – and was allowed to continue operating, which bodes well for the increasingly popular industry of earning interest on stablecoins and cryptos.

In operation since 2017, it’s established a good reputation as a crypto interest account. One disadvantage is the yields are subject to tiers, for example any stablecoins in value over $20,000 have a lower yield of 7%. Up to the first $20k the APY is 8%.

BlockFi stablecoin interest rates

Like Crypto.com, BlockFi is also a crypto lending platform on which you can take out crypto loans. Its LTV ratio is also 50%. The APR can be as low as 4.5%.

Investing $10,000 in stablecoins on BlockFi would generate a yield of $2.19 a day.

- Still operating after SEC crackdown

- Credit card and crypto loans

- No minimum deposit

- One free crypto withdrawal per month

Cons

- Stablecoin APY drops after first $20k

- Not available in NY state

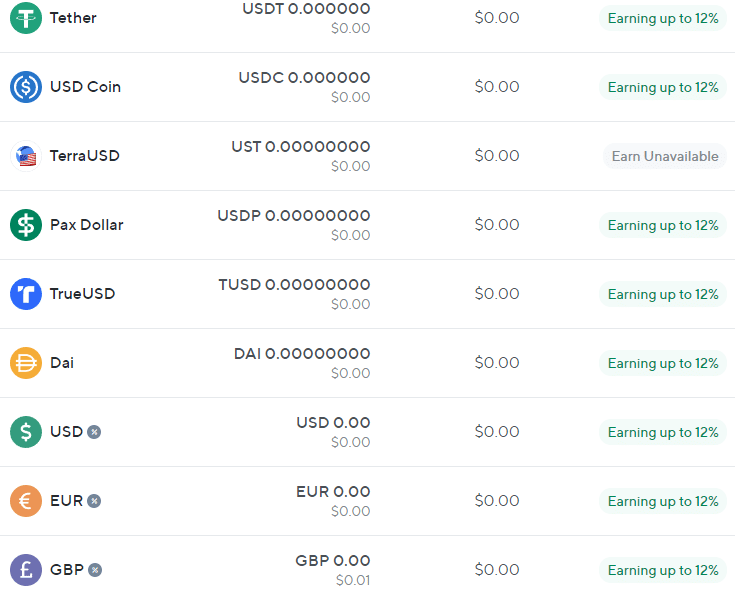

Nexo

Nexo is another popular option to earn interest on stablecoins which may not have the brand recognition of Crypto.com or BlockFi, but tends to offer the highest APY, both on stables and other crypto assets.

TerraUSD is no longer available but you can earn up to 12% on Tether, USD Coin, Pax Dollar, TrueUSD, Dai, and also on fiat currencies themselves.

Nexo stablecoin interest rates

The catch is holding at least 10% of your portfolio in NEXO token, the platform’s native currency – although that pumped when it was listed on Binance in 2022, and is in a long term uptrend.

You also need to opt into receiving your interest payments in NEXO – although you could instantly convert those into the crypto or stable asset of your choice, either on Nexo’s own exchange, or by transferring them to another crypto exchange – you’ll have five free withdrawals per month if you’re earning the highest yield as a Platinum user.

- Wide range of stables and cryptos supported – ApeCoin, Axie Infinity, and more

- Advertises military grade security

- Was unaffected by the UST collapse

- Five three crypto withdrawals a month for Platinum VIPs

Cons

- Requirement to hold 10% of portfolio in NEXO token for highest yield

- Also required to receive interest in NEXO for highest yield

How to Earn Interest on Stablecoins on Bybit

Update – UST is no longer available at Bybit, although you can stake stablecoins USDT and USDC on there.

Visit the official Bybit website and click ‘Sign Up’

Visit the official Bybit website and click ‘Sign Up’- To create an account enter your email, a password, and set up Google Authenticator (2FA) for security

- Buy USDT on the platform or transfer crypto to your wallet from another exchange such as eToro

- Use the spot trading platform to buy UST on the UST / USDT pair

- Click ‘Earn’ and ‘Flexible Savings’ in the menu, find UST and select ‘Stake Now’

- Choose an amount of UST to stake. Your daily yield will be estimated and displayed

- Your yield is distributed back to your balance after a one-day period

- Repeat the process to earn interest on UST again. USDT interest is also supported

For a step by step guide on how to sign up at Aqru, see our crypto interest acccounts page.

What are Stablecoins?

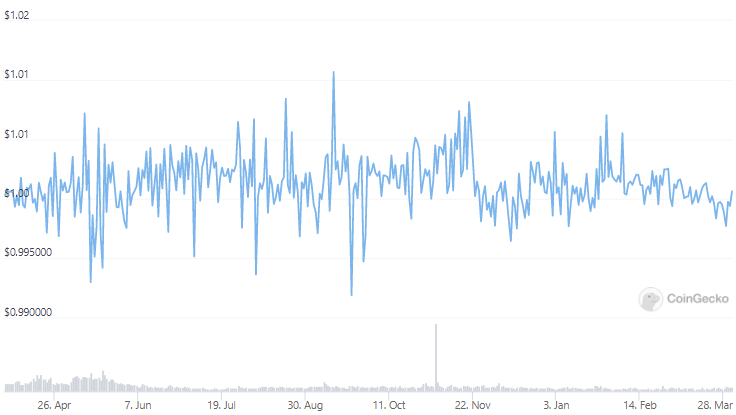

You may have come across Tether (USDT) if you’ve ever made a trade on a crypto exchange – the first ‘stable coin’ in crypto history, pegged to the value of the US dollar. So 1 USDT = 1 USD, approximately, without volatile fluctuations like other crypto coins.

When people sell cryptocurrency on an exchange for USDT, it works like moving their crypto into cash, only faster than sending it to a bank and then back onto the exchange the next time they want to buy crypto.

Technically you are swapping your crypto for another crypto, but a stable one so you are still realising your gains or losses and locking in the current valuation of your crypto holdings at the market rate.

Tether price chart over the last year

Tether is owned by the same owners of Bitfinex exchange, so you may have come across it on there where many of the best altcoins can be traded on USDT pairs. Some other exchanges only have USD pairs and other currency pairs, i.e. trading against fiat money.

USDT is commonly used to trade on Binance, the highest volume trading exchange. Alongside Binance USD (BUSD) the platform’s own stablecoin.

Many crypto platforms also now offer crypto lending services to stablecoin holders, allowing people to earn passive income in the form of stablecoin interest rather than just holding it with no benefit. Some focus on being crypto interest accounts, and others are also major crypto exchanges.

Crypto.com is popular for earning interest on stable coins and many other cryptos. Bybit is lesser known but has a good reputation.

Top Stablecoin Tokens

Tether has the largest market capitalization of $81.9 billion. After USDT the other top stablecoins include:

- USDC (USD Coin) – $51.6 billion

- BUSD (Binance USD) – $17.4 billion

- Dai (DAI) – $9.6 billion

- TrueUSD (TUSD) – $1.3 billion

- Pax Dollar (USDP) – $940 million

- TerraUSD (UST) – previously $16 billion, now $600 million after the UST crash

These are the most commonly used stablecoins. Coingecko also ranks Magic Internet Money (MIM) and Frax (FRAX) highly.

Coinmarketcap.com lists 75 stablecoins. By some counts there are over 200 active stablecoin projects. Together they process more volume than some payments platforms in traditional finance, such as Venmo.

Stablecoin price chart (USDT)

Some are pegged to the price of Gold per ounce for example Tether Gold (XAUT), which traders can trade Gold perpetual futures against on FTX exchange.

The Verdict

There are many crypto savings accounts that support earning interest on stablecoins. We reviewed four popular Anchor Protocol alternatives in this guide, and there are many others including Nexo, Celsius, Hodlnaut and YouHodler. Binance also supports Tether interest.

Compared to earning around 0.05% interest in a savings account with a high street bank and losing money to inflation, stablecoin platforms are very appealing to investors, and the high yield makes up for what most consider a low risk of the major stablecoin projects somehow going bankrupt or imploding if its turns out they don’t have cash reserves.

The lowest risk platform is debatably Coinbase as it is a trusted exchange globally, however we didn’t include it in this guide as the Coinbase stablecoin interest rate is only 0.15%, on either DAI or USDC. It does offer 5% APY on Cosmos (ATOM) however if you want to hold cryptocurrencies as part of your portfolio.

FCA regulated crypto platform eToro currently doesn’t support stablecoin interest but does offer Ethereum staking, alongside Cardano staking and Tron staking rewards.

Many investors open several accounts on different crypto exchanges and crypto lending platforms to split up their funds rather than keep all their eggs in one basket and take advantage of the various promos and bonuses. Aqru for example offers a free USDT to test out the platform.

Bybit is another viable alternative to Anchor protocol, still paying yield on USDT and USDC now that TerraUSD isn’t available. It alo supports DeFi mining and Dual Asset mining. If you’re in the US, Crypto.com could be the best place to earn interest on stablecoins as it accepts American investors.

For those outside the United States, Aqru is one of the simplest to get started on.

#cryptocurrencycommunity #cryptocurrencys #cryptocurrencyinvestments

#cryptocurrencyinviestments #cryptocurrencyeducation #cryptocurrencyrevolution

#allsortofcryptocurrency #cryptocurrencytop10 #cryptocurrency_news #instacryptocurrency

#cryptocurrencymemes #investincryptocurrency #cryptocurrencyinvestment

#cryptocurrencyisthefuture #cryptocurrencyinvesting #newcryptocurrency

#cryptocurrencylife #cryptocurrencytrade #cryptocurrencylifeinvest