Rivian is a US producer of Electronic Vehicles (EVs). The company — which is backed by Ford and Amazon — attracted massive interest when it came to market in 2021. The Rivian IPO was the biggest in the US since 2014. Since then, Rivian stock has been on the slide.

Below we delve into the Rivian world. We assess this stock’s strengths and weaknesses as an investment, and scope out some of the competition. We deliver two possible solutions to the question of buying Rivian stock, with our reviews of two online brokers where you can invest in this exciting company with zero commission. Let’s get started.

Buying Rivian Stock – An Overview

- ✅Step 1: Open an account with a Regulated Broker– Visit the official website of a regulated broker and complete the sign-up process to open a new trading account. Enter your details and login credentials.

- 🔑Step 2: Verification – Make sure you have ID and proof of address to hand as regulated brokers comply with the latest KYC standards as set by financial authorities.

- 💳 Step 3: Deposit – Deposit funds into your new account via debit cards, credit cards, e-wallets, and even bank transfers.

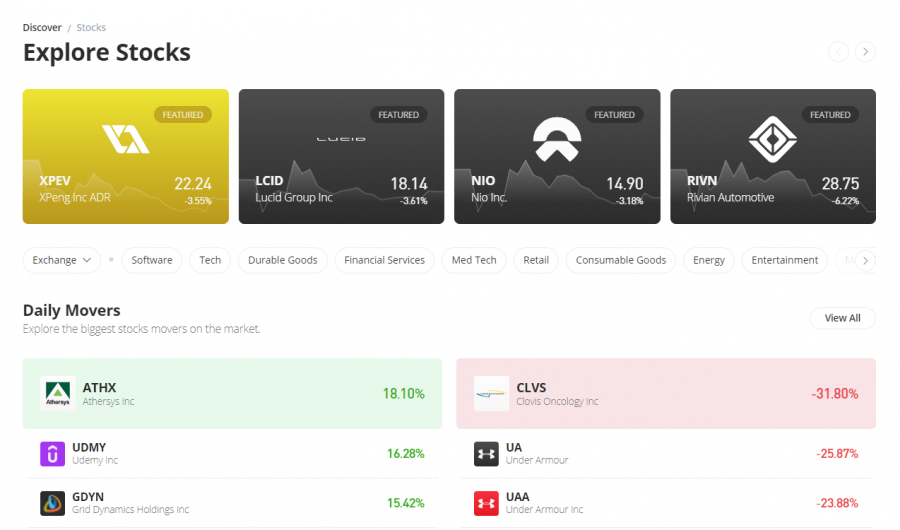

- 🔎 Step 4: Search for Rivian Stock – Pinpoint Rivian instantly by typing ‘Rivian’ in the toolbar or via the ‘Discover’ tab in the navigation menu.

- 🛒 Step 5: Buy – You can invest in Rivian stock with as little as $10 by clicking on the ‘Trade’ button located at the right-hand side of the screen.

Step 1: Choose a Stock Broker

We have picked out two of stock trading platforms available in the US. Both eToro and Webull allow you to buy Rivian shares at zero commission. Both are properly regulated in the US.

Compared to eToro, Webull offers a wider selection of US shares, as well as the chance to buy into financial options. But, unlike Webull, eToro offers powerful social trading tools.

Read on to decide for yourself which broker is right for you.

1: eToro

Broker eToro gives you the ready-made answer to the question of where to buy Rivian stock. You can deposit as little as $10 with eToro and get hold of Rivian shares with zero commission. A spread fee of just 0.24% applies.

Broker eToro gives you the ready-made answer to the question of where to buy Rivian stock. You can deposit as little as $10 with eToro and get hold of Rivian shares with zero commission. A spread fee of just 0.24% applies.

In all, eToro boasts a selection of over 3,000 stocks to trade. Over 900 are international stocks traded on exchanges like the London FTSE, the Euronext Paris and the Hong Kong Stock Exchange. Furthermore, eToro gives users access to biotech stocks, the oil stocks, and the most undervalued stocks just to name a few.

There’s also a selection of commodities, indices, forex, 67+ crypto coins and 264 Exchange Traded Funds (ETFs). ETFs are of particular interest to beginner investors, because they allow you to invest in many stocks at once. ETFs offer a low-cost way of spreading investment risk, so they are worth checking out.

eToro stands out amongst the stock apps on account of its regulation. In the US, eToro is regulated by FinCEN and registered with FINRA. The broker is also regulated across Europe and in Australia.

For beginners, eToro has pioneered two ways of social trading. Social trading means that investing newbies can benefit from the experience of others.

With eToro’s CopyTrader, you can select from thousands of traders and the software will automatically copy the trades of your chosen trader for free.

With one of eToro’s 70 Smart Portfolios, you can enter into a strategic position on a market in one go. For example, Rivian shares make up 3% of the BatteryTech Smart Portfolio. This holding allows you to invest in 30 electric vehicle sector companies at once, including Rivian rivals, Nio, Tesla and Li Auto. A minimum investment of $500 applies.

| Number of Stocks: | 3000+ (international) |

|---|---|

| Pricing System: | No commission. Spread fee only |

| Cost of Buying Rivian: | Spread fee of just 0.24% |

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

2: Webull

Launched in 2017, broker Webull has been in business for a whole decade less than eToro. With 7m account holders, Webull has a third of the user-base of eToro.

Launched in 2017, broker Webull has been in business for a whole decade less than eToro. With 7m account holders, Webull has a third of the user-base of eToro.

But, on the face of it, these two providers are similar.

Both offer comprehensive regulation in the US, a slick user interface, and — most importantly — the chance to buy Rivian shares at zero commission. Both platforms also offer powerful charting tools to support technical and momentum trading.

Webull’s 5,000 stocks are overwhelmingly US-only, compared to eToro’s selection of almost 3,000 stocks with almost 1,000 being international. Webull offers some forex as well as IRAs and stock options, but cannot match eToro when it comes to its range of crypto, commodities and indices.

Webull offers USD deposit with ACH and bank wire, but not credit/debit card like eToro. Bank wire deposits cost $8 a go with Webull, whereas they are free with eToro. Withdrawal to bank wire costs an eye-watering $25 a pop with Webull, compared to eToro’s withdrawal fee of $5 for all withdrawal methods.

With eToro constantly developing its social trading tools, we worry slightly that Webull may in comparison be a little intimidating for the out-and-out beginner to investing. But Webull’s excellent learning section, stuffed with simple-to-read blog pieces, makes up for that a little.

| Number of Stocks: | 5000+ (US only) |

|---|---|

| Pricing System: | Spread fee, no commission |

| Cost of Buying Rivian: | Spread fee: not available |

Your capital is at risk.

Step 2: Research Rivian Stock

Whether you are on the hunt for cheap stocks or have a specific stock target in mind, research is your ally.

Before you buy Rivian stock, make sure you know what the company does exactly. Assess it too on the basis of a few key financial metrics. And check out the competition:

- Why choose Rivian over rival newbies Lucid and Fisker

- What about the key quartet of 4 Chinese EV producers: Nio, Xpeng, Li Auto and Warren Buffet’s favourite, BYD

- Why not simply trust in the market leader and buy Tesla stock instead

These are the questions you need to be able to answer before you even decide about buying Rivian stock.

What is Rivian

Rivian is a manufacturer of electronic vehicles based in Irvine, California, US. The company was founded in 2009 by current CEO RJ Scaringe.

Unlike well-known EV producer Tesla, Rivian does not produce family saloons but concentrates on the niche SUV and truck sector. Rivian offers two models on public sale:

- R1T. This is a pickup truck with two rows of seats designed for 5 passengers. Retail prices start at $67,500.

- R1S. This is an SUV with three rows of seats designed for 7 passengers. Retail prices start at $72,500.

Rivian has also developed the EDV delivery van as part of a deal to supply 100,000 vehicles to 19% shareholder Amazon.

Rivian Stock Price – How Much is Rivian Stock Worth

Since its 2021 IPO, the Rivian stock price has fallen by over 60%, from $78 to today’s price of $28.75.

Rivian’s Stellar IPO

Rivian came to market in November 2021 with a hugely-successful Initial Public Offering (IPO). 153m shares were sold at a price of $78 each, valuing the company at over $66bn. This made this event the US’s biggest IPO since 2014.

By the end of the first day’s trading, each Rivian stock was worth $100, giving the company a market capitalisation of $86bn, larger than that of automotive legend Ford Motor Company, which is one of its key backers alongside retail behemoth Amazon.

Rivian is currently the third-biggest EV manufacturer in the world by market capitalisation, with its shares totalling almost £26bn in value. Like Lucid and Fisker, it has achieved a premium valuation based on future promise rather than any meaningful revenues generated.

Rivian: Three Stats to Judge this Stock By

Below we look at 3 key financial metrics for Rivian:

| Metric | Definition | Shows |

|---|---|---|

| EPS (Earnings Per Share) | Profit divided by number of shares outstanding | How much profit a company is making compared to outstanding shares |

| P/E Ratio (Price/Earnings per Share Ratio) | Price of a share divided by EPS | How much the company is valued at by the markets |

| Debt-to-Equity Ratio | Long-term debt divided by shareholder equity | How much debt the company is in as a proportion of shareholder equity |

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Rivian EPS (Earnings Per Share): NA

Rivian has no earnings per share. That’s because it is at the beginning of its commercial journey. Since its 2021 IPO, the company has been focused on developing its products and is only recently fielding them on the market. Only in the 4th quarter of 2021 did Rivian start to generate revenue ($1m) and Q1 2022 ($54m to be confirmed).

Generally, the higher the EPS figure for a stock, the better. With its staggering $53bn revenues in 2021, competitor Tesla has a formidable EPS figure of 7.3.

Rivian P/E Ratio: NA

Similar to Rivian’s EPS situation, Rivian does not have a P/E ratio yet because it has yet to generate any earnings. Tesla, on the other hand, has a P/E ratio of 117. This shows that Tesla shares are prized. Competitor NIO, by contrast, has a 2021 P/E ratio of -15.5.

Debt-to-Equity Ratio: 7.64%

One of the perks of using broker eToro is access to simplified financial data. Pictured below is a simple balance sheet for Rivian.

From it, we can see a very positive factor in this stock’s favour. This is Rivian’s high proportion of assets compared to liabilities. On balance sheets, this is shown by both the Quick Ratio and the Debt-to-Equity Ratio. This means Rivian is not massively burdened with debt.

- The Quick Ratio divides assets that could be liquidated in 90 days by total liabilities; the higher this figure, the better.

- The Debt-to-Equity Ratio shows the proportion of debts to the sum remaining should the firm pay off all its debts; the lower this figure the better.

At 7.64%, Rivian’s debt-to-equity ratio is very low compared to its rivals:

- Tesla debt-to-equity ratio: 20.61%.

- Lucid debt-to-equity ratio: 57.46%.

- Nio debt-to-equity ratio: 58.08%.

Rivian Stock Dividends

Dividends are free payments that companies sometimes pay out to shareholders. Companies are under no obligation to pay dividends, and few do. Coca-Cola is an example of a dividend stock.

With very little revenue as yet, start-up Rivian is in no position to pay dividends. Until it gets very successful, it is unlikely to do so. Even then, paying dividends is not that common in the EV sector. Market-leading Tesla, for example, has never paid dividends.

Important Factors for Rivian

There are 3 standout reasons why Rivian (RIVN) stock might be considered a buy:

1: Get in on the Booming Electronic Vehicle Market

Although just a start-up, the market has valued Rivian as the third-most valuable EV producer with a market capitalisation approaching $26bn.

By 2027, the global EV market is set to be worth around $800bn (according to Allied Market Research). By 2030, there could be as many as 230m electric vehicles on the road (according to the International Energy Agency).

Currently, it is big firms like Warren-Buffet backed BYD and Tesla which are making big sales:

- BYD, based in Shenzen, China, announced recently that it sold 286,329 EVs in Q1, 2022.

- Tesla sold in the region of 300,000 during the same period.

- Rivian, by stark contrast, only produced 2,553, and is planning to produce 25,000 EVs over the course of 2022.

Rivian as a stock is all about potential. Its stellar market valuation reflects this, rather than its capacity to match the market leaders for volume sales.

However, the Rivian sales outlook is far from terrible. In December 2021, CEO Scaringe announced that “with the growing backlog of 71,000 pre-orders and our 100,000 unit order from Amazon, we are excited to begin to satisfy the tremendous demand for our products and services.” Rivian’s original factory is equipped to produce 150,000 vehicles a year, with a second factory planned for construction this year in Georgia, US.

2: Time the NASDAQ Dip

Rivian shares are one of over 3,600 securities listed on the tech-heavy NASDAQ Exchange of the US.

Thanks to a combination of interest rate rises in the US and investor uncertainty over the Ukraine crisis, the NASDAQ Composite Index fell for a fifth consecutive week on Friday May 6th to 12,144.

This is the longest time the NASDAQ has spent falling since 2012.

At its all-time-high on November 19th, 2021, the NASDAQ hit 16,057. It has fallen 24% since then.

Fellow US index the S&P 500 also fell by more than 13% since January and April 2022. This was the worst start to a year that the S&P has experienced since 1939.

So, these are fierce times for the American stock markets, and particularly the tech sector of which Rivian is a part.

Former New York Federal Reserve President Bill Dudley says that stock market slashes are part of the authorities’ plan to tackle inflation. The idea is to slow down stock markets without crashing them and thus dissuade prices in general from going up too fast.

But there will likely be a recovery at some point. And, with its exciting growth potential, Rivian is a decent share to have in a portfolio to benefit from that return to growth. The difficult question, of course, is when will the NASDAQ bounce-back happen?

3: Trust in Rivian’s Balance Sheet Reserves

Despite generating negligible revenues so far, Rivian has an excellent debt-to-equity ratio of under 8% (as outlined above). That means that it may not have much sales activity, but it certainly has a lot of money in the bank to invest as well as deal with future challenges.

Rivian also has the backing of giants Ford Motor Company (which owns a 12% stake) and online retail platform Amazon (which owns a 19% stake). (Note, though, that these companies might reduce their stake when the 180-day lock-up period on their IPO purchases ends shortly.)

What’s more, Rivian recently secured $1.5bn in funding from Georgia State, US as part of a deal to build a factory there and create 7,500 jobs.

Step 3: Open an Account and Buy Rivian Stock

Signing up with the stock trading platforms is getting faster as the automated verification technology gets simpler to use.

When it comes to purchasing Rivian stock without spending hours setting up a trading account, a regulated broker has the answer.

Sign up

Navigate to a broker’s homepage. First, supply a few personal details and tick the relevant boxes showing you have read the legal info.

Verify

All regulated brokers must ensure that new investors follow KYC (Know Your Customer) procedures. This keeps everybody safe from fraud.

To comply with KYC, you will need to have handy:

- Proof of ID: passport or ID card.

- Proof of address: utility bills and other paperwork accepted.

Follow the instructions. Once verified, you will be notified by email.

Deposit

Once you get verified, you can deposit funds. You can deposit USD with credit/debit card, ACH and bank wire.

Search

Although most large brokers support thousands of stocks, finding Rivian is simple.

- Just enter its ticker label ‘RIVN’ or its name ‘Rivian’ into the toolbar.

- If you press the Rivian logo, you will go to the Rivian homepage.

- Or press the blue ‘TRADE’ button to head straight to your buying options.

Buy Rivian Stock

Before you buy, you can check out all sorts of data and research on Rivian on the Rivian homepage. You can also read your chatfeed, where any recent news or comments about Rivian will be listed. Here too you can access powerful charting options, to apply your technical charting knowledge and make a Rivian prediction of your own.

When you are ready to trade, press the ‘Trade’ button.

Here you can simply enter how much USD you want to spend. You can also set leverage on your purchase, but this can get complex (not to say risky), so this is not advised for beginners.

Set Stop Loss

Here you can set a stop loss for your trade, which can stop you losing too much money if the price falls dramatically. The software will terminate the trade automatically at a certain price.

Set Take Profit

You can also set a ‘take profit’ price level to benefit from any spike in price. Again, the software will terminate the trade automatically at this level.

Open your Rivian Position

You can set your stop loss and take profit levels later, or ignore them altogether. When you are happy with the details of your trade, press the blue ‘Open Trade’ button. (If the NASDAQ has yet to open, you can ‘Set Order’ instead which will activate your trading instruction as soon as the market opens).

Your trade will very likely be executed instantly. You will receive onscreen notification. You can review your trade in your portfolio.

Factors Affecting Rivian

With online platforms eToro and Webull offering Rivian shares at zero commission, the question of buying Rivian stock is answered.

Buy

‘Moderate Buy’: Trust in Positive Analyst Consensus

Let’s ask the experts. We need only check out Rivian’s homepage on eToro to find a useful overview of what sell-side analysts think about Rivian stock.

Here we can see that the consensus of 15 qualified experts is that Rivian is a ‘Moderate Buy’:

- 60% say Buy.

- 33% say Hold.

- Just 7% say Sell.

Note that the mean price target for Rivian stock is $70.77. ‘Price target’ means the price that an analyst thinks Rivian will be at in 12 months time. With Rivian currently priced at under $30, that means that analysts expect the price of Rivian to rise 145% over the next year.

Spread Your Risk: Use an eToro Smart Portfolio

If you invest in an eToro Smart Portfolio, you can gain instant exposure to many stocks in the EV market at once, including Rivian.

This is a much safer way to invest than to buy a single stock, as it spreads risk across multiple assets.

Rivian features as 3% of the BatteryTech Smart Portfolio, as well as 2% of the Driverless Smart Portfolio. With the 6-week losing streak of the NASDAQ, these portfolios have not performed well recently. But their strength lies in the diversity of EV assets they hold.

Driverless, for example, gives you exposure to 34 stocks related to the EV sector including:

- Out-and-out EV manufacturers like Tesla, Nio, Xpeng and Fisker.

- Big automotive companies moving into EV production like General Motors and Honda.

- Related tech companies like Qualcomm and Chargepoint.

Hold Tight With the Big Guns

Hedge funds with holdings in Rivian include:

- Coatue Management with a holding of $3.6bn.

- Soros Fund Management with a holding $2.1bn.

- Tiger Global Management with a holding of $77.87m.

These funds have not had the opportunity to sell any RIVN shares because of Rivian’s 180 day share lock-in (see below). But they saw fit to invest in the first place. If you are holding Rivian shares, so did you.

Sell

Rivian IPO Lock-in Period Ends May 9th 2022

This week, almost 800m Rivian shares are unlocked as the IPO 180-day share lock-in period ends. This means that Ford, for example — which has lost over $5bn on its 12% stake in Rivian — could sell 100m shares, and fellow investor Amazon could sell 160m.

Sales of this volume would send the Rivian price into freefall. But it is unlikely that buyers could be found for this quantity of shares, and fears about it happening are probably priced in already (ie. reflected in the Rivian stock price).

US news agency CNBC reports that Ford is planning to sell 8m of its shares (8% of its holding) via investment bank Goldman Sachs.

Rivian To Underperform in 2022 Production

Rivian says it is on course to produce 25,000 vehicles this year. This is half of what it said it would produce at its 2021 IPO. Industry sources say the firm is, though, just about managing to deal with supply-chain issues.

To be fair, if an investor puts money into a start-up, they cannot be too disappointed if it does not immediately deliver on its promises.

Conclusion

Above we have considered buying Rivian stock by looking at the respective strengths of brokers eToro vs. Webull.

With both brokers offering zero commission on stock trades as well as decent regulation in the US, both are solid. With that said, it’s always worth conducting your own research when selecting a broker to ensure its right for you.

#stocks #stockmarket #investing #trading #money #forex #investment #finance #invest #bitcoin #business #investor #entrepreneur #cryptocurrency #trader #financialfreedom #crypto #wallstreet #wealth #daytrader #motivation #forextrader #success #daytrading #nifty #forextrading #sharemarket #stock #millionaire