Porsche is one of the most well-known automobile manufacturers in the world, having a stellar reputation for designing and producing high-performance cars. Although Volkswagen has traditionally owned the company, upper management recently decided to take the Porsche brand public – a move that many investors have viewed favorably.

This guide explores how to buy Porsche stock by discussing several popular platforms where investors can acquire shares quickly and cost-effectively. We’ll also examine the fundamentals of Porsche’s stock before highlighting some of its key strengths.

How to Buy Porsche Stock – Quick Guide

As those who invest in stocks regularly will know, it’s essential to have a deep understanding of the investment process before entering the market. With that in mind, detailed below are the four steps investors must take to buy Porsche stock:

- ✅ Step 1 – Open an Account with a Regulated Broker: The first thing to do is find a regulated broker that offers access to the Frankfurt Stock Exchange – the exchange where Porsche shares will be listed. A popular example is eToro, a leading online broker offering both real shares and share CFDs.

- 🛂 Step 2 – Upload ID: Using eToro as an example, investors must verify their trading account by uploading proof of ID (e.g. passport) and proof of address (e.g. bank statement).

- 💳 Step 3 – Deposit Funds: Opt to deposit at least $10 into the trading account via credit/debit card, bank transfer, or e-wallet.

- 🔎 Step 4 – Buy Porsche Stock Responsibly: After researching the company thoroughly and ensuring proper risk management is employed, type ‘Porsche AG’ into the search bar and click ‘Trade’. In the order box, enter the desired position size (minimum $10) and click ‘Open Trade’.

78% of retail investor accounts lose money when trading CFDs with this provider.

Step 1: Choose a Regulated Stock Broker

The first step for those wondering how to invest in Porsche stock is to choose a suitable broker to partner with. It’s important to note that Porsche’s shares will be listed on the Frankfurt Stock Exchange rather than the NASDAQ or NYSE. Due to this, the chosen broker must offer access to the Frankfurt exchange so these shares can be accessed.

Fortunately, many stock trading platforms offer this functionality, so finding one to partner with should be straightforward. To help streamline this process even further, detailed below are three popular platforms that investors can use to buy Porsche shares.

1. eToro

One widely-used platform that offers access to the Frankfurt Stock Exchange is eToro. eToro is one of the world’s largest online brokers, serving more than 28 million clients across 140 countries. This broker is regulated by leading entities like FinCEN, FINRA, ASIC, CySEC, and the FCA, ensuring a high degree of investor protection.

One widely-used platform that offers access to the Frankfurt Stock Exchange is eToro. eToro is one of the world’s largest online brokers, serving more than 28 million clients across 140 countries. This broker is regulated by leading entities like FinCEN, FINRA, ASIC, CySEC, and the FCA, ensuring a high degree of investor protection.

Those looking to buy stocks can do so with eToro, as the platform offers both real stocks and stock CFDs. There are thousands of stocks available to trade with eToro since clients have access to 17 different stock exchanges. These include the NYSE, NASDAQ, LSE, and the Frankfurt Stock Exchange.

One of the reasons eToro has become so popular is that no commissions are charged when a trade is placed. eToro incorporates its fees into the bid/ask spread and requires a minimum investment of only $10. Moreover, those who opt to trade CFDs can employ up to 5:1 leverage when equity trading – although this is prohibited in some areas of the world.

Account funding is simple with eToro, as the minimum deposit is also only $10. All major credit/debit cards are accepted, along with bank transfers and various e-wallets. Notably, eToro has full support for PayPal, Skrill, Neteller, and Payoneer – with USD-denominated deposits free to make.

Finally, eToro also acts as a copy trading platform through its innovative ‘Copy Trader’ feature. This feature allows users to automatically copy the trades placed by other high-performing users with no additional fees. The minimum investment amount in this feature is just $200, making it accessible to beginners and experienced traders alike.

| Approx. Number of Stocks | 3,000 |

| Minimum Deposit | $10 |

| Cost to Buy Porsche Stock | 0% commission + market spread |

78% of retail investor accounts lose money when trading CFDs with this provider.

2. Capital.com

Another popular platform for those wondering how to buy Porsche stock is Capital.com. Capital.com is a highly-respected CFD broker that offers access to a vast range of tradable assets. It’s important to note that Capital.com is currently unavailable to US-based traders, yet is still used by more than 450,000 traders worldwide.

Another popular platform for those wondering how to buy Porsche stock is Capital.com. Capital.com is a highly-respected CFD broker that offers access to a vast range of tradable assets. It’s important to note that Capital.com is currently unavailable to US-based traders, yet is still used by more than 450,000 traders worldwide.

Much like eToro, Capital.com offers access to a range of international exchanges, including the Frankfurt Stock Exchange. This means users can buy Porsche stock with no commissions and from as little as $1 per position, thanks to Capital.com’s handy fractional investing feature.

Since Capital.com is a CFD broker, users can employ leverage of up to 5:1 on their equity trades. In terms of account funding, Capital.com allows deposits from as little as $20 and supports five base currencies. There are no deposit fees to contend with, and Capital.com supports credit/debit cards, bank transfers, and e-wallet deposits.

During our research for this Capital.com review, we also noted that withdrawals are free to make and can take as little as one business day via credit/debit card. Users can open positions through the browser-based platform or dedicated mobile app. Both feature real-time price charts and various order types.

Finally, Capital.com also has an extensive educational library, offering tutorial videos, webinars, articles, and online courses. There’s even a free demo account feature that allows traders to practice with $10,000 in virtual money.

| Approx. Number of Stocks | 5,400+ |

| Minimum Deposit | $20 ($250 for bank transfers) |

| Cost to Buy Porsche Stock | 0% commission + market spread |

80.61% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

3. Webull

Investors looking for a popular place to buy Porsche stock may also wish to consider Webull. Webull is a US-based trading platform launched in 2017 yet has grown exponentially due to its low-fee approach. The platform is regulated in the US by the SEC and FINRA, providing the highest level of investor protection.

Investors looking for a popular place to buy Porsche stock may also wish to consider Webull. Webull is a US-based trading platform launched in 2017 yet has grown exponentially due to its low-fee approach. The platform is regulated in the US by the SEC and FINRA, providing the highest level of investor protection.

It’s important to note that US-based clients can only trade stocks listed on US exchanges, such as the NYSE, NASDAQ, and AMEX. This means those looking to buy Porsche stock will have to wait until it appears on one of these exchanges as an American Depositary Receipt (ADR), which will then make it tradable.

However, those looking to invest in other stocks in the meantime can do so without paying any commissions. Webull also allows clients to open positions from as little as $5, with clients receiving up to 12 free stocks when they open and fund a new trading account.

Webull’s web-based app and mobile app both highly customizable. Users can read market news, employ an array of technical indicators, and even use various order types. Both the web-based app and mobile app also offer a handy price alerts function.

Those looking to buy stocks with credit card cannot do so with Webull since only ACH and wire transfer deposits are accepted. ACH deposits are free to make, and clients can also withdraw via ACH transfer with no fees. Finally, Webull also offers a free demo account to all users featuring unlimited virtual cash and real-time market data.

| Approx. Number of Stocks | 2,000+ |

| Minimum Deposit | N/A |

| Cost to Buy Porsche Stock | Unavailable at present; may be available via ADR in the future |

Your capital is at risk.

Step 2: Research Porsche Stock

Now that we’ve discussed where to buy Porsche stock, let’s discuss the stock’s fundamentals and the strengths/weaknesses that investors must consider. Although Porsche has been thought of as one of the best upcoming IPOs, investors must still complete independent research before making any investment decision.

With that in mind, let’s dive in and explore what Porsche is and how the share price could perform in the coming months.

What is Porsche?

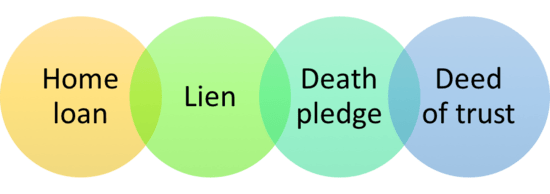

First thing’s first – what is Porsche? Put simply, Porsche is a well-known German automobile manufacturer that has built up a solid reputation for producing high-end vehicles. These vehicles include sports cars, SUVs, and sedans, with some of the most popular models being the Porsche 911, Porsche Taycan, and Porsche Cayenne.

According to Porsche’s website, the idea for the company stems all the way back to 1930, when the first order book was created. Traditionally headquartered in Stuttgart, Porsche began making cars for the German government and came up with the idea for the world-famous Volkswagen Beetle.

This is where Porsche and Volkswagen became intertwined, with the company’s founder, Ferdinand Porsche, helping the German army during World War II by producing a military version of the Beetle. Over the years, Volkswagen began moving into mass-market vehicles, with Porsche focusing more on sports cars. Following this approach, the first plans for the Porsche 356 were developed in the late 1940s.

Over the coming decades, Porsche continued to innovate in the luxury car market and developed several models that have become household names. Porsche’s unique style has made the brand appealing to high-net-worth individuals, with this becoming even more apparent in the classic car market.

An important point to note concerns Porsche’s close relationship with Volkswagen. Although both companies went their separate ways after the war, they continued collaborating in the following decades. This relationship grew so strong that the decision was made in 2011 to merge the two companies together.

This decision saw Volkswagen AG take ownership of Porsche AG in 2011, which essentially made Porsche a division of Volkswagen, along with other major brands like Audi, Bentley, and Lamborghini. At the time, Volkswagen was considered one of the most undervalued stocks in Germany, yet this soon changed as the share price nearly doubled in the four years that followed.

Porsche Share Price – How Much is Porsche Stock Worth?

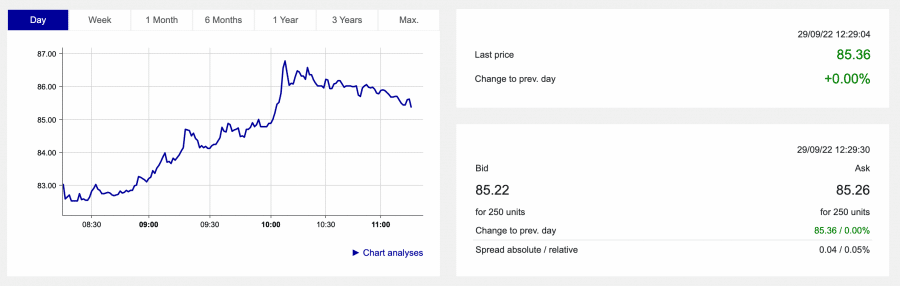

Discussing the Porsche stock price is relatively challenging since, at the time of writing, Porsche has just been listed on the Frankfurt Stock Exchange. As such, there is little share price information to go off of, which makes technical analysis difficult.

Having said that, we can still discuss the intricacies of Porsche’s IPO to gain insight into how the market values the company now that it has spun off from Volkswagen. Although many people opt not to invest during inflation, the listing of Porsche’s shares has presented a viable opportunity for those bored of sitting on the sidelines.

A brief from the Porsche Newsroom presented the prospectus for this IPO in mid-September 2022, setting the price range between €76.50 and €82.50 per share. Interestingly, a total of 911 million Porsche shares will be made available – a number chosen based on the brand’s flagship car.

Through this share offering, the brand’s owner, Volkswagen, hopes to net €9.4bn in funding. The money raised will be used to pay a special dividend to shareholders and also fund Volkswagen’s move into battery technology.

After going live at 8 am local time on September 29th, Porsche’s share price saw the company hit a valuation of €75bn. According to the Financial Times, this means the Porsche IPO is one of the largest ever seen in Europe.

Automobile manufacturer IPOs like Porsche’s are relatively rare in today’s market, with Ferrari’s 2015 IPO being the last to really make headlines. Yet Porsche’s IPO appears to have renewed enthusiasm in the sector, as the share price debuted at the upper end of the spectrum noted on the prospectus. Immediately after going live, shares surged to €84, highlighting the pent-up demand from investors.

Porsche Stock Dividends

Investors interested in the best dividend stocks may be curious whether Porsche does (or intends to) pay a dividend. However, Porsche shares do not pay dividends at the time of writing, which is the norm for IPO companies. This is because an IPO is facilitated to raise capital for expansion, so using that capital to pay dividends wouldn’t make sense.

However, a press release from Volkswagen in September noted that the company will hold a general meeting in December 2022, where a proposal to distribute a special dividend will be floated. This special dividend will be made up of 49% of the gross proceeds from selling Porsche’s IPO shares.

Thus, although Porsche shareholders will not initially get a dividend, Volkswagen shareholders may receive a special dividend as a result of the IPO. However, as is the case with all non-dividend paying companies, things could change in the future once Porsche’s financials become clearer.

Porsche Stock: Fundamental Research

Given the information presented up until now, is Porsche stock a buy or sell opportunity? Since there is limited information on the Porsche stock price, it’s vital to explore fundamental factors that may provide insight into the company’s prospects. Let’s take a look at some of these factors below:

Porsche’s Unrivalled Brand Appeal

When investors opt to buy Tesla stock, they are not just investing due to the company’s products, but also because of the brand. This is no different with Porsche stock, as the company’s brand appeal is one of its major strengths. Interestingly, Porsche has a distinct ‘high-end’ impression that makes the company’s vehicles appealing to the rich and famous.

Thanks to this, there’s a growing feeling that Porsche may be viewed more as a ‘luxury’ brand than an automobile manufacturer. If so, this could be excellent news for the share price, since luxury brands tend to experience consistent demand due to their exclusivity. In today’s high-inflation environment, this could benefit Porsche’s revenue significantly.

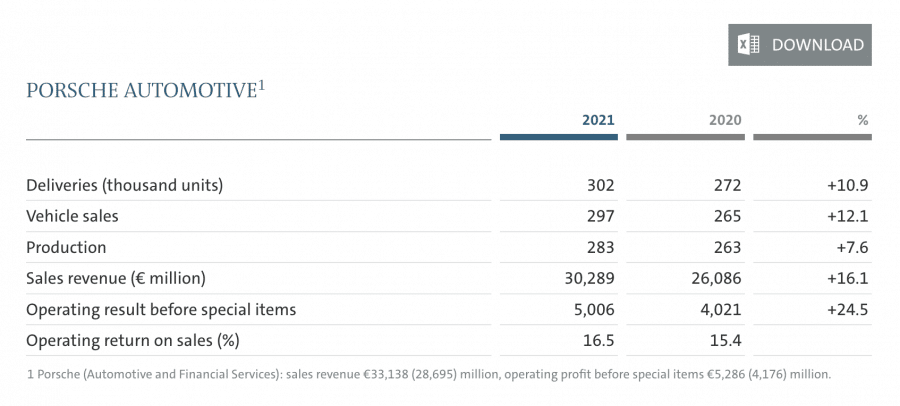

Moreover, Porsche’s high-end feel has enabled the company to develop industry-leading margins. Porsche’s operating margin for 2021 was 16.5% – much higher than parent company Volkswagen’s 3.3%. In addition, Porsche’s operating margin actually increased by 1.1% between 2020 and 2021, highlighting the efficiency of the company’s business model.

Transition into the Electric Vehicle Market

Another critical factor to bear in mind is Porsche’s venture into the electric vehicle (EV) market. Many of the best new stocks to emerge over the past few years, such as Rivian and Lucid Motors, have made waves in this market. However, established auto manufacturers like Ford and BMW have also pivoted into electric vehicles.

Given that more people than ever are interested in sustainable investing, the EV market is seen as a massive opportunity for car brands. Porsche’s management understands this, as the company now offers all-electric and plug-in hybrid cars. The most popular of these is the Porsche Taycan, which features a range of up to 300 miles in certain models.

This move into electric vehicles could prove fruitful for Porsche, as the company’s cars occupy an appealing niche in the market, combining energy efficiency with premium performance. Furthermore, given parent company Volkswagen’s plans regarding EVs, there’s likely to still be a crossover in terms of technological innovations, which will benefit Porsche.

Strong Financials are a Foundation for Growth

Finally, although Porsche has been under Volkswagen’s umbrella since 2011, the brand has still developed a solid financial reputation on its own merit. According to Statista, Porsche generated €30.29bn in revenue during the fiscal year 2021. This was over €4bn more than in the fiscal year 2020.

In addition, Porsche generated €5.0bn in profit during FY 2021 – a 24.5% increase from FY 2020. This profit increase was attributed to positive sales volume, which more than offset unfavourable exchange rates and increased commodity prices.

The company produced nearly 20,000 more cars in 2021 than it did in 2020, with the Taycan and Panamera models being the two that received the most attention. Porsche also delivered 30,000 more vehicles in 2021, a 10.9% increase from the previous year.

All of these metrics serve to highlight that Porsche is a growing company, which is made even more remarkable considering the challenging business environment in the US and America. Given Porsche’s stellar performance, many analysts believe the company’s IPO could help boost these financials even further – especially now that Porsche has begun tackling the EV market.

Step 3: Open a Trading Account & Buy Porsche Stock

Before rounding off this guide on how to buy Porsche stock, let’s revisit the investment process. Regardless of whether a trader is looking to invest $1,000 or invest $20,000, it’s essential to take the necessary steps to insulate themselves from fraud or scams.

With that in mind, presented below are the four steps investors must take to safely buy Porsche stock in 2022 – with the whole process able to be completed in under ten minutes.

Step 1 – Open an Account with a Regulated Broker

The first step is to decide where to buy Porsche stock. We reviewed several leading brokers earlier in this guide, although investors can opt for any trading platform they wish, provided it is regulated and offers access to the Frankfurt Stock Exchange.

Once investors have found their preferred place to buy Porsche stock for their individual needs, it’s simply a case of heading over to the platform’s website and opting to sign-up. The platform will usually ask for a valid email address and a username/password for the account.

Step 2 – Complete Account Verification

Most (if not all) of the best trading platforms will ask new users to verify themselves before trading. This is to comply with anti-money laundering guidelines. New users are usually asked to upload the following documents:

- Proof of ID (e.g. passport, driver’s license)

- Proof of Address (e.g. bank statement, utility bill)

The platform will then double-check these documents and send an email once they have been verified.

Step 3 – Make a Deposit

After becoming verified, investors will then be able to fund their accounts. Each broker will have its own minimum deposit threshold – for example, eToro’s is $10, whilst Capital.com’s is $20. In addition, it’s essential to deposit in the broker’s base currency to avoid any conversion fees.

Regarding deposit methods, most brokers accept credit/debit cards and bank transfers. However, some brokers allow users to buy stocks with PayPal, Skrill, Neteller, or other major e-wallets.

Step 4 – Buy Porsche Stock

Finally, investors must search for ‘Porsche AG’ shares using the search bar – it’s important to avoid the ‘Porsche Automobile Holding SE’ shares, as these are related to an entirely different company.

Finally, investors must search for ‘Porsche AG’ shares using the search bar – it’s important to avoid the ‘Porsche Automobile Holding SE’ shares, as these are related to an entirely different company.

Once the shares have been found, enter the desired investment amount in the order box, check that everything is correct, and open the position. Investors can then track the stock’s performance through the ‘Portfolio’ section of their account.

Buy Porsche Stock – Conclusion

To conclude, this guide has explored how to buy Porsche stock in detail, covering all of the essential elements that investors must consider before entering the market.

Porsche’s IPO has undoubtedly made waves in the investment community, mainly due to the strange timing. However, given Porsche’s exceptional brand appeal, the demand for shares will likely be sky high – meaning that many analysts have a rosy view of the company’s price potential.

#stocks #stockmarket #investing #trading #money #forex #investment #finance #invest #bitcoin #business #investor #entrepreneur #cryptocurrency #trader #financialfreedom #crypto #wallstreet #wealth #daytrader #motivation #forextrader #success #daytrading #nifty #forextrading #sharemarket #stock #millionaire