Yield farming is one of many ways to earn interest on idle cryptocurrency holdings. The main concept is that by lending your digital assets to a liquidity pool, you will be paid an attractive APY on your funds.

In this guide, we review the best yield farming crypto platforms for 2022 in terms of interest rates, security, lock-up terms, supported tokens, and more.

The Best Yield Farming Crypto Platforms for 2022 List

In the yield farming crypto list below, you will find an overview of the best platforms in the market right now to make money with cryptocurrency.

- OKX – Overall Best Yield Farming Crypto Platform for 2022

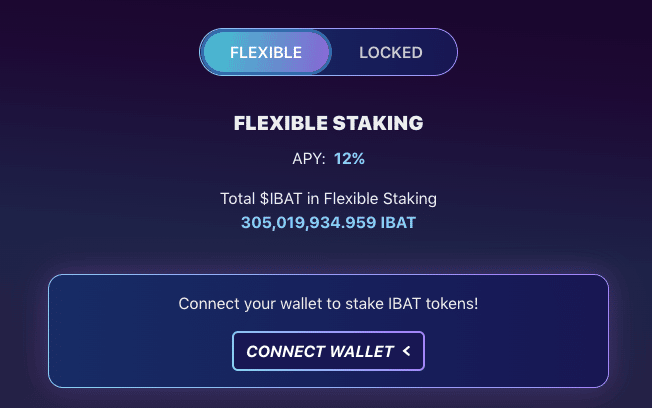

- Battle Infinity – Earn 12% APY with IBAT Battle Stake

- Quint – Recieve Luxury Prices by Entering Super-Staking Pools

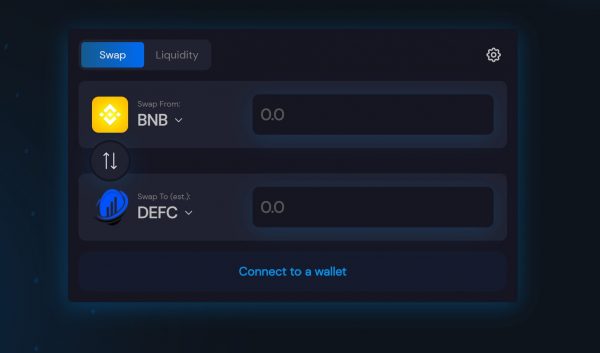

- DeFi Swap – Earn Up to 75% APY on DeFi Coin

- YouHodler – Worldwide Exchange with Yield Farming

- eToro – Regulated Platform Offering Crypto Interest Tools

- Crypto.com – Great Platform for Earning a High APY on Stablecoins

- BlockFi – Popular Platform for Bitcoin Yields

- Coinbase – Top-Rated Yield-Generating Platform for Beginners

Reviews of the providers from the above high yield farming crypto list can be found below.

Top Yield Farming Crypto Platforms Reviewed

We researched the best yield farming crypto platforms for 2022 and found that the top providers in the market offer a good balance between safety, attractive yields, and reasonable lock-up terms.

We also considered factors surrounding user-friendliness, customer service, and supported tokens.

1. OKX – Overall Best Yield Farming Crypto Platform for 2022

For investors looking to earn passive income from their cryptocurrency holdings, OKX exchange’s multiple income-earning opportunities make it the overall best yield farming platform for 2022. Available in 100 + countries, OKX exchange is accessed by over 20 million global users.

For investors looking to earn passive income from their cryptocurrency holdings, OKX exchange’s multiple income-earning opportunities make it the overall best yield farming platform for 2022. Available in 100 + countries, OKX exchange is accessed by over 20 million global users.

With OKX, investors can buy, trade, swap, stake and earn interest on their cryptocurrencies. Investors can access ‘OKX Earn’ – a one-stop-shop for multiple centralized earning options such as dual investment, P2P lending and staking. Built on the OKExChain, the Earn programme offers several DeFi (decentralized finance) products as well – including lending DApps (decentralized applications) and access to decentralized exchanges.

With the OKx Pool, investors can maximize their yields by accessing multiple mining services. Proof-of-Work (PoW) mining is supported on 9 major cryptocurrencies, such as Bitcoin. The top mining features on the OKx Pool include daily settlements, no minimum payouts and stable income flow.

Moreover, Tamadoge (TAMA), the popular new cryptocurrency, is providing its initial exchange offering with OKX. After raising $19 million to complete one of the best crypto presales in 2022, Tamadoge will be listed on the OKX exchange. The token will be available on this platform’s centralized and decentralized exchange – making it accessible to investors, regardless of any geographical limitations.

After completing a quick KYC (Know Your Customer) process within 10 minutes, investors can begin trading cryptocurrencies at the low cost of 0.10% per transaction.

What We Like About OKX:

- Available in 100+ countries

- Multiple Yield Farming Opportunities with ‘OKX Earn’

- Offers Access DeFi Products

- Listed Popular Tokens such as Tamadoge (TAMA)

- 0.10% Trading Fee on Cryptos

2. Battle Infinity – Earn 12% APY with IBAT Battle Stake

Battle Infinity (IBAT) is a play-to-earn (P2E) ecosystem incentivizing players to participate in gaming activities in return for various rewards. The platform settles transactions and offers various P2E elements by leveraging IBAT – the native cryptocurrency.

Battle Infinity (IBAT) is a play-to-earn (P2E) ecosystem incentivizing players to participate in gaming activities in return for various rewards. The platform settles transactions and offers various P2E elements by leveraging IBAT – the native cryptocurrency.

After accessing IBAT tokens from Battle Infinity’s decentralized exchange, investors can earn passive income through the staking platform – IBAT Battle Stake. On 24th September 2022, Battle Infinity’s official Twitter handle announced that the IBAT Battle Stake is now live.

Within two days of the announcement, the platform has collected over $3 million in total locked value. With a maximum supply of 10 billion tokens, nearly 10% of IBAT has been locked on the staking protocol. The instant success of the staking platform stems from the high APYs (Annual Percentage Yields) that investors can benefit from.

For example, the flexible staking protocol offers investors a staggering 12% APY on IBAT. The returns are even higher for investors looking to lock up their IBAT. For a 90-day lock-up period, investors can earn 14% APY. The APY increases to 17% for 90 days, 20% for 180 days and 25% for a 360-day lock-up period.

IBAT can also be staked to access other P2E elements such as the IBAT Battle Games – a multiplayer game store offering several P2E NFT games.

Apart from earning interest on IBAT staking, investors can pair up any other token with IBAT and receive interest on the pairing as well. A multi-use platform, players can access P2E features such as the Battle Arena – a virtual ecosystem where all items and characters will be minted as NFTs using ERC 721 smart contracts.

IBAT is currently trading at $0.0035 per token.

What We Like About Battle Infinity:

- 12% APY on Flexible Staking

- Up to 25% Returns on Locked-Up Assets

- 10% of all Tokens Locked-Up

- P2E NFT Games

3. Quint – Recieve Luxury Prizes By Entering Super-Staking Pools

Combining crypto interest with real-world rewards, Quint is one of the top yield farming platforms to watch in 2022.

Combining crypto interest with real-world rewards, Quint is one of the top yield farming platforms to watch in 2022.

On Quint’s platform, there are 2 types of what it calls super-staking pools. The first type is Luxury Raffle Pools. When users stake to these pools, they receive crypto interest and are entered into a drawing for luxury prizes like expensive watches, travel packages, and more.

The second type of super-staking pool on Quint is the Quintessential Pools. These pools offer guaranteed rewards like discounted stays at luxury hotels, discounted airline tickets, supercar experiences in cities around the world, and more. While the rewards rotate, users who stake to these pools are guaranteed to receive them along with crypto interest.

Quint also offers a more traditional staking pool where users can earn elevated interest rates on staked QUINT tokens. Staking QUINT alone can earn users up to 16.18% APY, while staking a combination of BNB and QUINT can earn users up to 39.08% APY. Crypto interest from the Quint platform can be harvested manually at any time and reinvested. There are no lock-in periods and its easy to move between the conventional and super-staking pools.

What We Like About Quint:

- Attractive interest rates of more than 39% for QUINT/BNB combination

- Super-staking pools offer luxury rewards

- No lock-up period

- Audited by Techrate and Certik

4. DeFi Swap – Earn Up to 75% APY on DeFi Coin

DeFi Swap is a crypto exchange and yield farming platform that offers crypto investors returns of up to 75% APY. The key to DeFi Swap’s high rates is its native DeFi Coin token (DEFC), which is the only crypto available for staking on the platform. You must lock in your coins for at least 30 days and up to 1 year. A 30 day lock-in period offers a 30% APY rate, while a 1 year lock-in offers a 75% APY rate.

DeFi Swap is a crypto exchange and yield farming platform that offers crypto investors returns of up to 75% APY. The key to DeFi Swap’s high rates is its native DeFi Coin token (DEFC), which is the only crypto available for staking on the platform. You must lock in your coins for at least 30 days and up to 1 year. A 30 day lock-in period offers a 30% APY rate, while a 1 year lock-in offers a 75% APY rate.

DeFi Swap is relatively new, but it’s quickly gained attention as one of the top new yield platforms of 2022. First, this is a fully decentralized exchange and DeFi service. You can swap into DeFi Coin using virtually any major cryptocurrency, including most stablecoins. Notably, DeFi Swap has made no secret of the fact that it wants to become the place for decentralized finance, so early investors could see higher rates or more yield farming options in the future.

For now, DeFi swap is available online or as a decentralized app. You must connect your wallet to see available staking options and interest rates.

What We Like About eToro:

- Earn interest rates up to 75% APY

- Staking periods of 30, 90, 180, or 365 days

- Convert to DeFi Coin from most cryptocurrencies

- Fully decentralized platform

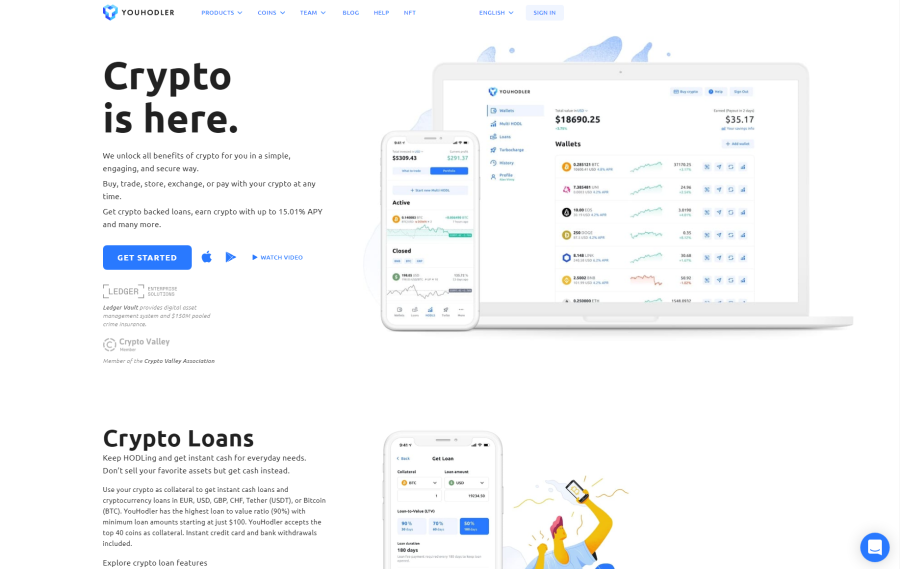

5. YouHodler – Worldwide Exchange with Yield Farming

Swiss-based YouHodler has been gaining traction recently as a result of its attractive lending options, slick interface, and transparent nature. Since it was founded in 2017, YouHodler accumulated more than 150,000 users within the 200+ countries it operates in.

Security on YouHodler is excellent. Funds are secured in a mixture of hot & cold wallets and Ledger Vault technology has been implemented to provide users with more custodial options. Additionally, users with over $10k in their accounts can use ‘3-factor authentication’ to suspend withdrawals.

YouHodler is famous for its excellent yield farming options. The top 50 cryptocurrencies are accepted and interest can be as high as 15%. Rewards for holding stablecoins can be up to 12.3% (excluding compounding) and Bitcoin can yield up to 6.8%. Returns do vary from asset to asset so it’s worth double checking rates before registering.

For investors looking for a yield farming platform, YouHodler is a great choice. It’s available almost everywhere except US territories, Germany, and a few Middle-eastern countries. With a wide array of accepted assets, transparent fee structure, and easy-to-understand terms, YouHodler is a sure contender for the best yield farming platform.

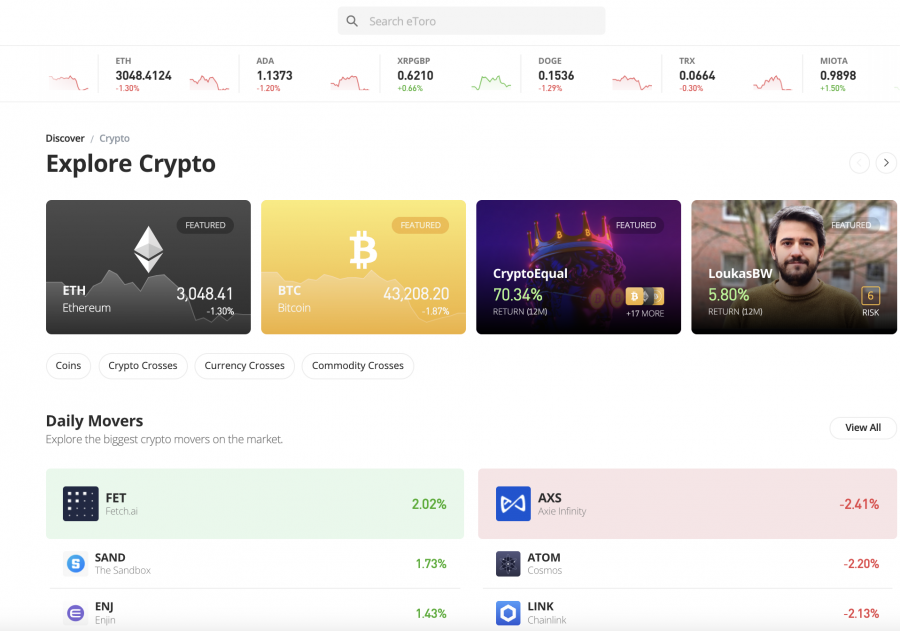

6. eToro – Regulated Platform Offering Crypto Interest Tools

If your main priority when searching for the best yield farming crypto sites is safety, look no further than eToro. Although this platform – which is regulated by the SEC, ASIC, FCA, and CySEC, doesn’t offer conventional yield farming services per se, eToro does allow you to earn passive interest. This is offered via an automated staking tool that generates income for as long as the tokens are held in your eToro account.

As of writing, eToro offers crypto staking services on Cardano, Ethereum, and Tron. There is no requirement to lock your tokens up for a minimum number of days, as all eToro interest-bearing tools are offered on a flexible basis. This will suit those that might require access to their crypto assets at short notice. In addition to a strong regulatory status and institutional-grade security tools, we also like eToro for its low-cost brokerage and exchange services.

For instance, eToro allows you to buy cryptocurrency on a spread-only basis, from just $10. Moreover, there are no fees to deposit funds in US dollars, nor will you be charged anything to store your tokens in the eToro crypto wallet.

eToro is also a popular option for mobile users, as the provider’s crypto wallet app allows you to exchange tokens across 500+ pairs. And finally, eToro offers a copy trading service that allows you to trade cryptocurrencies in a 100% passive manner.

What We Like About eToro:

- Regulated by the SEC, ASIC, FCA, and CySEC

- Automatically earn interest on supported tokens

- Withdraw your tokens at any time

- Also supports spread-only crypto purchases and copy trading tools

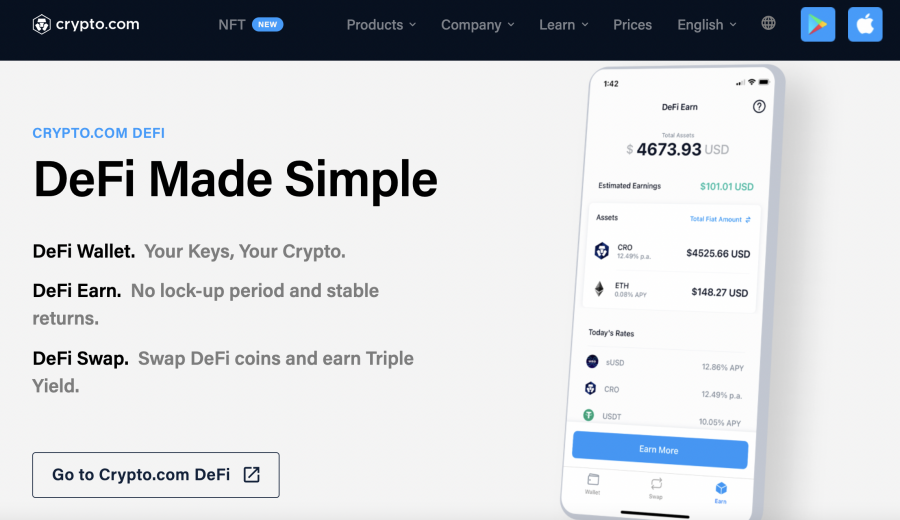

7. Crypto.com – Great Platform for Earning a High APY on Stablecoins

If you’re looking to earn the highest rate of interest possible on cryptocurrencies – without worrying about volatile pricing spikes, perhaps consider Crypto.com. This top-rated provider allows you to earn an APY of up to 14% when depositing stablecoins such as Tether and USDC into your account. There are, however, certain variables that will determine the exact APY that you are paid.

For instance, in order to earn the full 14% APR on Tether, you need to lock your tokens up for three months. You will also be required to stake no less than 40,000 CRO tokens. On the other hand, if you were to deposit Tether without staking any CRO tokens and on a flexible withdrawal basis, then the APY drops to 6%. As such, Crypto.com offers various APYs to suit different requirements.

With that said, Crypto.com offers more than 250+ digital currencies that yield interest – most of which fall outside of the stablecoin arena. This includes everything from Bitcoin, Ethereum, and Litecoin to Solana, Shiba Inu, and Decentraland. Once again, the APY that you can earn will depend on the lock-up period and whether you wish to stake CRO tokens. Nevertheless, Crypto.com also offers a popular mobile app that allows you to access your account no matter where you are located.

What We Like About Crypto.com:

- Supports more than 250+ coins

- Attractive rates on interest

- Increase APYs by staking CRO tokens

- Trusted platform

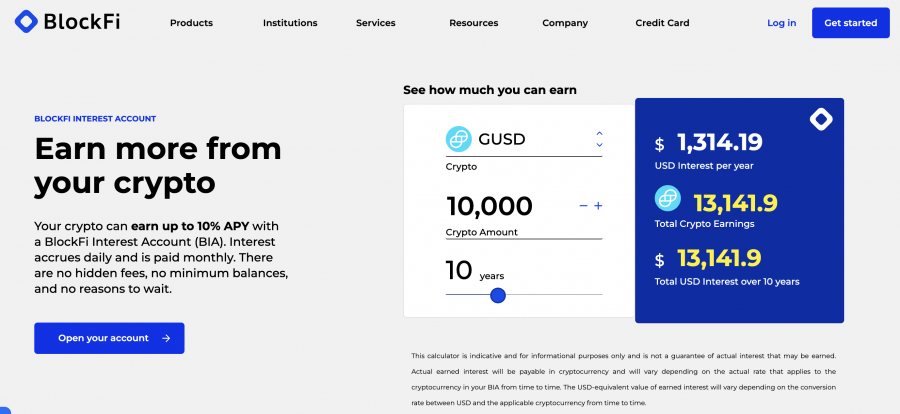

8. BlockFi – Popular Platform for Bitcoin Yields

BlockFi, one of the best crypto exchanges, offers a variety of services associated with cryptocurrency investments. In terms of earning interest, the platform offers reasonable APYs on both stablecoins and traditional digital assets. Regarding the former, you can earn an APY of up to 9.25% when you deposit Tether into your BlockFi account. And, this rate is paid up to the first 20,000 USDT deposited and without a lock-up period.

If you’re looking to generate a yield on your Bitcoin investments, the highest rate on offer is 4.5%. This rate is paid up to the first 0.10 BTC deposited. After that, the rate drops to 1%. Ethereum is slightly more competitive at 5%, albeit, this is only paid up to the first 1.5% ETH. In terms of safety, BlockFi keeps the vast bulk of client digital funds in cold storage. Moreover, digital tokens are kept with leading third-party exchanges – such as Gemini.

BlockFi also has an insurance policy in place to cover the potential threat of a remote hack. In addition to crypto yield services, BlockFi also offers traditional trading accounts. This allows you to buy and sell digital currencies at competitive fees. And as such, once you have purchased a crypto asset on the BlockFi platform, you can start generating yields straightaway. BlockFi is also known for its top-rated customer service, which includes phone support.

What We Like About BlockFi:

- Specialist crypto-interest earning site

- A large number of supported tokens

- No lock-up periods

- Top rates on stablecoins

9. Coinbase – Top-Rated Yield-Generating Platform for Beginners

Coinbase is one of the world’s largest cryptocurrency exchanges in terms of user accounts – with the platform now supporting tens of millions of traders. You can easily buy digital currencies here with a debit or credit card, and the Coinbase trading platform itself is perfect for beginners. Once you have crypto in your Coinbase account, you have the opportunity to start earning interest.

This is offered via its automated staking tool – which comes with no lock-up period. As Coinbase has only recently entered the crypto yield space, the platform supports just six tokens as of writing. This includes Cosmos (5%), Tezos (4.63%), Ethereum (4.5%), and Algorand (4%). Stablecoins include Dai (2%) and USDC (0.15%). Although Coinbase is ideal for newbies, the APYs on offer are a lot less competitive when compared to other platforms.

On the other hand, Coinbase does offer some of the best security protocols in this space, which includes cold storage, two-factor authentication, and IP address/device whitelisting. Moreover, Coinbase is not only a regulated entity in the US, but the company now trades on the NASDAQ exchange. Coinbase is also a good option if you want to create a diversified portfolio of cryptocurrencies, as the platform supports more than 50+ digital tokens.

What We Like About Coinbase:

- Regulated entity in the US

- No penalities on withdrawals

- Deposit funds in crypto or US dollars

- Perfect for beginners

What is Crypto Yield Farming?

Crypto yield farming occurs when you stake or lend your crypto holdings to generate passive returns and earn rewards. Decentralized finance, or DeFi for short, has gained traction lately as a result of new features such as liquidity mining.

How Does Yield Farming Crypto Work?

In its most basic form, when you use a yield farming crypto site, you will be doing so for the purpose of earning interest on your digital assets.

In many ways, this is similar to depositing money into a traditional savings account that offers an annual percentage yield (APY) on your funds.

However, make no mistake about it – not only is the concept of yield farming crypto sites a lot more complex than a conventional savings account – but the risks are much higher too. To learn more, read our guide to the best crypto savings accounts.

And as such, we’ll explain the fundamentals of how crypto yield farming works in the sections below so that you have a firm understanding of how this niche sector operates.

Crypto Yield Farming Explained – The Basics

At the start of your crypto yield farming journey, you will be required to deposit funds into your chosen platform. In turn, the digital tokens will then be deposited into a liquidity pool provider, via a smart contract.

And as such, crypto yield farming does not require an intermediary for the purpose of generating interest, as the smart contract operates on a decentralized basis.

So, the liquidity pool that your crypto funds are deposited into allows people to borrow capital. This might be for the purpose of speculation or in many cases – as a means to access liquidity.

After all, newly launched digital tokens will often require additional levels of liquidity so that buyers and sellers of the respective project have access to smooth market conditions.

APYs

In terms of how much you can make when you engage with a crypto yield farming platform – this will depend on a variety of factors. At the forefront of this is the respective digital token that your funds are providing liquidity for.

- For instance, if the smart contract provides liquidity for a newly launched cryptocurrency that carries a small market capitalization, then highly attractive APYs are likely to be offered.

- In fact, it is not unusual for such tokens to offer triple-digit yields.

- On the other hand, if you are depositing funds into a crypto yield farming pool that provides liquidity for an established, large-cap project – then expect the APYs to be much lower.

This is a classic example of risk and reward, insofar that the higher the APY, the more pricing volatility you should expect. More on this later.

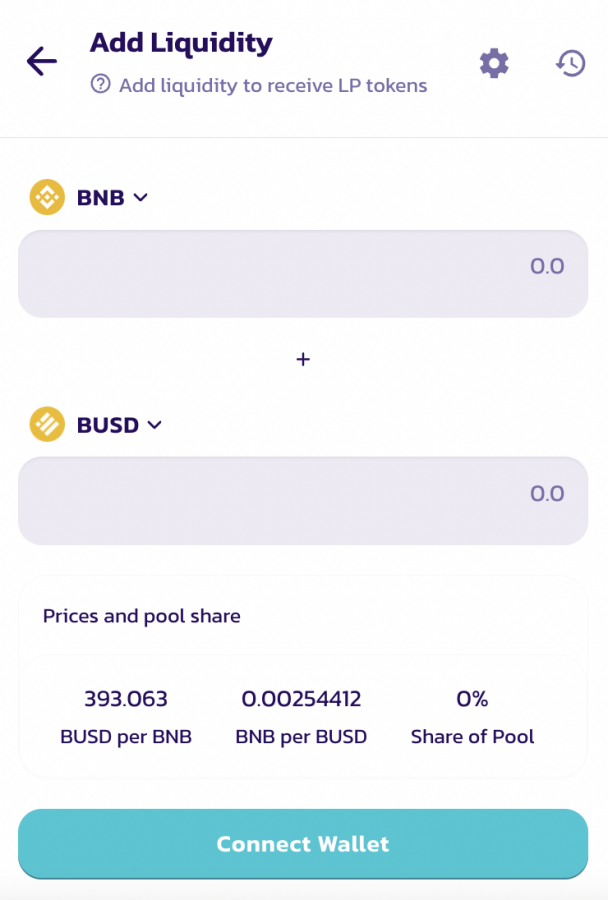

Yield Farming Pairs

Another important thing to know about yield farming crypto sites is that each liquidity pool comes as a trading pair.

- As a basic example, let’s say that the smart contract deposits funds into a BTC/ETH pool.

- In doing so, you are providing liquidity for both Bitcoin and Ethereum, which, in turn, ensures that sufficient levels of capital are available on this trading pair.

- In this example, the liquidity is likely being provided to an exchange that offers a trading market on BTC/ETH.

And with this in mind, when you engage in yield farming crypto services, you need to consider volatility levels for both of the digital tokens in the respective pair.

Reward Coins

When you deposit funds into a traditional savings account, interest is paid in the respective currency. For instance, depositing $1,000 into a Wells Fargo savings account at an APY of 1% would generate $10 worth of interest per year.

However, in the case of yield farming crypto sites, there are a couple of clear differences to consider.

- First and foremost, your interest payments will be distributed in digital assets as opposed to fiat money.

- Second, there can and will be a variation in the digital asset that your interest is paid in.

- Crucially, this will largely depend on the crypto yield farming platform that you decide to use.

- For example, if the yield farming site specializes in the digital assets operating on top of the Binance Smart Chain, then your rewards might be paid in BNB.

- On the other hand, the yield farming site might distribute rewards in its own native token.

As such, this is something to consider in your search for the best yield farming crypto platform for your requirements.

Lock-Up Period

We have made reference to lock-up periods several times throughout this guide. In a nutshell, this refers to the amount of time you will be required to lock your tokens up for prior to being able to make a withdrawal.

- For instance, Crypto.com offers up to 14% per year on stablecoins when you lock your tokens up for at least three months (CRO staking requirements also apply).

- This means that – in a similar nature to traditional bonds, you won’t receive your initial principal investment back until the lock-up period concludes.

- With that said, you also have platforms like Quint, which offer flexible accounts.

- This means that you won’t be required to lock your tokens up for a minimum number of days or weeks. And as such, you can withdraw your tokens from the platform at any given time.

The lock-up terms stipulated by your chosen yield farming crypto platform are a crucial metric to consider before signing up.

After all, if you need access to your digital assets but your tokens are locked away in a smart contract – you won’t have any way of making a withdrawal until the minimum redemption period passes.

Distribution Frequency

Another thing to bear in mind when searching for the best yield farming crypto platform is with respect to the distribution frequency of your interest payments.

For example, platforms like Quint distribute interest payments anytime users want. This then allows you to re-inject the funds back into an interest-paying account, which in turn, will allow you to benefit from compound growth.

On the other hand, some crypto yield farming sites will distribute interest at the end of the lock-up term. This means that you won’t have access to any funds – including rewards and your initial principal investment until the lock-up period has concluded.

Is Yield Farming Crypto Profitable?

It goes without saying that the primary objective for engaging with a crypto yield farming site is to make money. However, that begs the question – just how profitable is crypto yield farming?

There is no hard and fast answer to this question, as too many variables are at play. For example, the first thing to consider is the specific APY that you will be paid for lending your tokens out to a liquidity pool.

In its most basic form, if you lend $2,000 worth of crypto at an APY of 10%, then in 12 months’ time, your digital asset portfolio will now be worth $200 more.

However, it’s not this simple in the world of crypto yield farming, as your rewards are paid in digital tokens as opposed to fiat money.

And as such, you need to consider that the value of the digital tokens being invested and received as interest will fluctuate as per market forces.

Let’s look at a simplistic example to help clear the mist:

- We’ll say that you decide to invest in an Ethereum pool that offers an APY of 6% per year

- You invest a total of 1 ETH, which, at the time of the deposit, is worth $3,000

- 12 months later, your 1 ETH investment has generated 0.06 ETH in interest payments – taking your total balance to 1.06 ETH

- Based on a price of $3,000 at the time of the investment 12 months prior, your balance of 1.06 ETH would be worth $3,180

- However, with Ethereum now trading at $4,000 per token, your balance of 1.06 ETH is now worth $4,240

As per the above example, a core objective of crypto yield farming is not only to earn an attractive APY, but to see the value of the respective token increase in the open marketplace.

If this does happen, you will earn money on two fronts – interest and capital gains.

However, as we explain in more detail shortly, should the value of the token go down while engaging in crypto yield farming, your investment could be worth less at the time of withdrawal.

What Cryptos Can You Yield Farm?

As we briefly mentioned earlier, there is virtually no limit to the number of digital assets that can be used to earn interest via crypto yield farming.

This is because the main concept of yield farming is to provide a specific trading pair with sufficient levels of liquidity.

And, when you consider that all crypto trading pairs require liquidity for the purpose of providing optimal market conditions, this means that you have plenty of options when it comes to choosing a token.

With that being said, the specific liquidity pool that your tokens are deposited into will have a major impact on how much interest you can make.

For example:

- If you were to provide liquidity for a major pair like ETH/BTC or BNB/ETH, then the APYs on offer are going to be somewhat modest.

- However, if adding funds to a less liquid pool like AAVE/ETH, more competitive rates of interest will be available.

- At the other end of the spectrum, if the liquidity pool concerns a newly launched digital token with a tiny market capitalization, then you might be able to earn a triple-digit APY.

Once again, the cryptocurrency that you decide to farm should be dependent on your risk tolerance. A good way to mitigate the long-term risks of crypto yield farming is to spread your investments out across a variety of pairs.

Crypto Yield Farming Taxes?

You likely know that many countries will tax cryptocurrency profits in the form of capital gains. In other words, if you buy $1,000 worth of Ethereum and cash out at $1,500 – then $500 of this figure could be liable for tax.

However, you might also be required to pay tax on any gains you make from interest-earning tools such as crypto yield farming. Depending on your country of residence, this could be taxed in the same manner as earnings made via interest accounts or dividend payments.

With that said, crypto-related taxes – especially with regards to yield farming, is a highly complex area. And as such, it’s best to speak with a qualified advisor that specializes in digital currency taxes.

Crypto Yield Farming vs Staking

There is often a misconception that crypto yield farming and staking refer to the same thing. However, while both tools allow you to generate interest on your idle cryptocurrency tokens, there are some differences.

At the forefront of this is where your tokens are deposited.

- In the case of yield farming, your crypto is deposited into a smart contract. In turn, the smart contract will distribute your funds into a liquidity pool.

- When engaging in crypto staking, your digital tokens are usually deposited directly into the respective blockchain network.

There are benefits and drawbacks related to both crypto yield farming and staking, so it’s worth having a think about which tool is best for your investment goals and risk tolerance.

For example, crypto staking is potentially safer than yield farming, as the tokens are locked on the blockchain network as opposed to a third-party smart contract.

But, this means that the yield on offer when staking crypto is typically much lower when compared to yield farming. Moreover, when you stake crypto, you can only do so on a blockchain network that utilizes the proof-of-stake consensus mechanism.

Yield farming, however, can generally be accessed on any cryptocurrency.

Is Crypto Yield Farming Safe?

Before getting started on your crypto yield farming journey, it is crucial to consider the risks.

After all, when you consider that many liquidity pools offer double and even triple-digit APYs, the risk of loss is going to be much higher when compared to conventional savings accounts.

The main risks that we identified when reviewing the best crypto yield farming platforms are as follows:

Token Price Volatility

The first risk that you need to consider when engaging with a crypto yield farming strategy is with respect to the market value of the token.

For instance:

- Let’s say that you invest $1,000 into a liquidity pool of a newly launched token – which yields 50% per year

- At the end of the first year, you will have 50% more tokens that you originally started with

- In theory, this means that your $1,000 is now worth $1,500

- However, if the value of the respective token has since dropped by over 80% – your original investment is now worth considerably less

This is because your $1,500 worth of tokens now carries a market value of just $300.

This is why it might be best to only invest funds into liquidity pools that contain established, large-cap tokens.

Although you still face the prospect of the token going down in value while being farmed, the risk of this happening will be lower when compared to less liquid projects.

Platform Risk

Many of the best crypto yield farming tools are offered by third-party platforms. Irrespective of whether the platform operates on a centralized or decentralized basis, you need to remember that your funds are never 100% sure.

- For example, if investing funds into a centralized yield farming site, you are trusting your funds with the respective provider.

- This means that you need to trust that the provider will keep your funds safe and away from the threat of remote hackers.

- You also need to trust that the centralized platform will pay you the interest it owes you – and that it fulfills your withdrawal request when the time comes to cash out.

In the case of a decentralized platform, your agreement will be honored by a smart contract. However, while smart contracts are known for their immutable and transparent characteristics, they are not 100% foolproof.

By this, we mean that there is every chance that a bad actor finds a vulnerability in the underlying code. If this does happen, your funds could be at risk.

Rug Pulls

In the cryptocurrency space, rug pulls refer to digital token projects that are created with the sole purpose of theft.

This can happen when the developer behind the project runs away with the digital assets that are collected during the initial fundraising campaign.

And as such, by injecting funds into a high-yield farming crypto project that turns out to be a rug pull, you will likely lose the entire value of your principal investment.

Liquidity Risk

Another risk that needs to be considered before you invest funds into a crypto yield farming pool is with respect to liquidity.

By this, we mean that should the respective pool come with a minimum lock-up period, you won’t be able to access your funds until the redemption period clears.

This can be highly problematic if you need access to fast cash – but the funds are locked up in a liquidity pool.

Conclusion

This beginner’s guide on crypto yield farming has discussed every benefit and potential drawback of this niche sector.

The key takeaway is that the best yield farming crypto platforms in the market allow you to earn interest on your idle digital assets in a safe and flexible manner.

We found that the overall best provider in this market is OKX – which offers various passive income opportunities via staking, P2P lending and earning options on DeFi products as well. Used by over 20 million investors, the exchange allows you to purchase Tamadoge (TAMA) – a popular new cryptocurrency that recently raised $19 million in its crypto presale.

#cryptocurrencyinviestments #cryptocurrencyeducation #cryptocurrencyrevolution

#allsortofcryptocurrency #cryptocurrencytop10 #cryptocurrency_news #instacryptocurrency

#cryptocurrencymemes #investincryptocurrency #cryptocurrencyinvestment

#cryptocurrencyisthefuture #cryptocurrencyinvesting #newcryptocurrency

#cryptocurrencylife #cryptocurrencytrade #cryptocurrencylifeinvest

#cryptocurrencymillionaire #cryptocurrencytrader #cryptocurrency_updates