If you’re an eligible active-duty military member, veteran or surviving spouse, you can use a VA home loan — backed by the U.S. Department of Veterans Affairs (VA) — to buy a new property or refinance an existing mortgage. VA loans come with big perks — no need to make a down payment, for example — but there are some potential downsides, as well. As you begin the mortgage process, it’s important to learn all the details of what it means to have a loan backed by the VA.

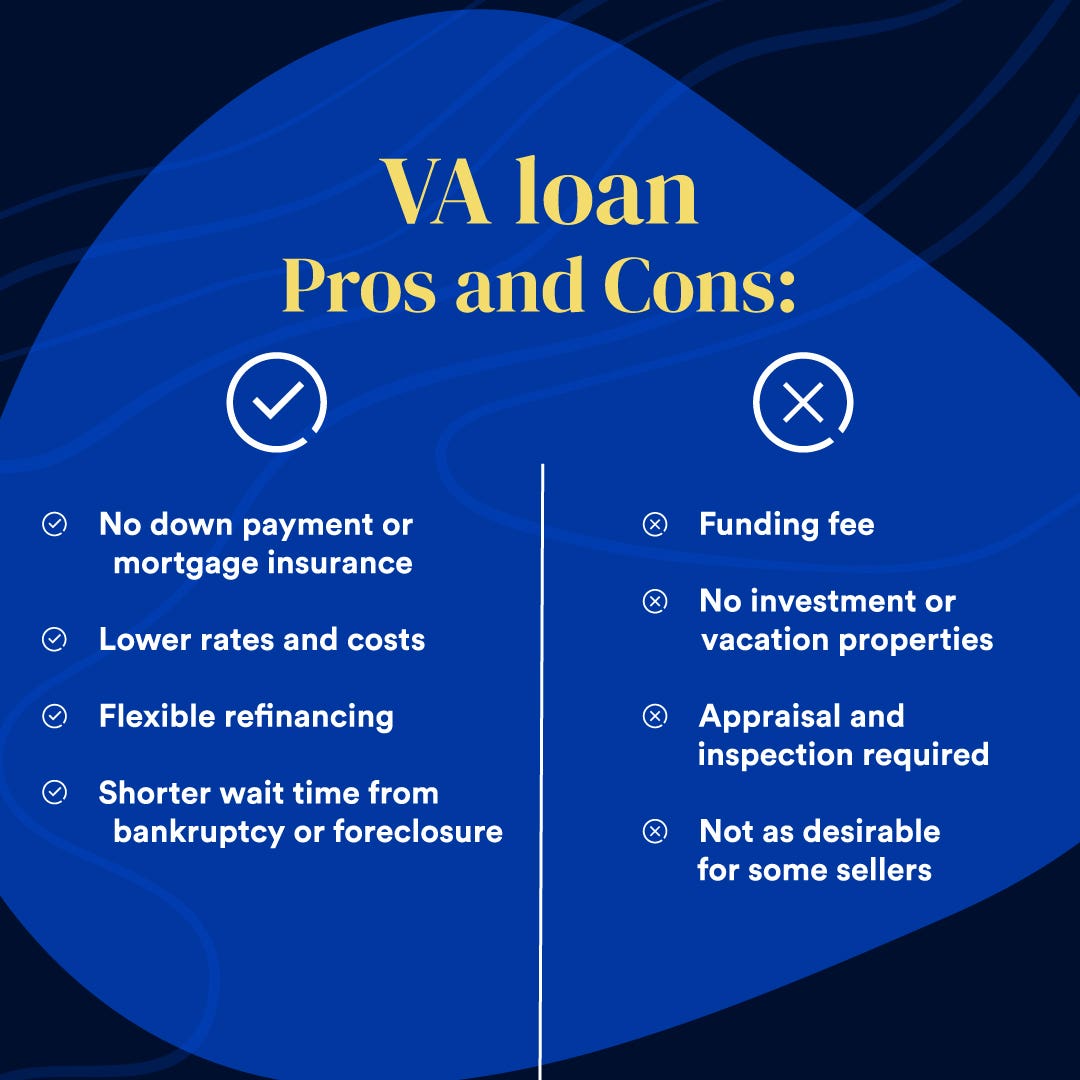

Pros and cons of a VA loan

Any time you’re making a major financial decision, it’s important to weigh the upsides and downsides, and a VA loan is no exception.

Benefits of a VA loan

VA loans come with a long list of big benefits for prospective homeowners. The advantages of VA loans include:

No down payment requirement

While conventional mortgages require a down payment of at least 3 percent of the purchase price, VA loans allow eligible borrowers to become homeowners without putting a penny down upfront. That makes a big difference: Recent Bankrate data shows that 40 percent of Americans who don’t own homes cite an inability to cover a down payment and closing costs as a primary driver for continuing to rent.

No mortgage insurance

If you’re comparing VA loans vs. FHA loans and conventional loans, VA-backed loans offer a big point of differentiation: no mortgage insurance. That’s a fee you’ll pay on all FHA loans — both an upfront premium and an annual premium throughout the loan term. You’ll also pay private mortgage insurance on a conventional mortgage if your down payment is less than 20 percent.

Lower interest rates

Lenders tend to charge lower rates for VA loans than they do on conventional loans, which means you can save a lot of money on interest in the long run, especially over a 30-year loan.

Lower closing costs

The closing costs associated with a VA loan might be less than those for other loans, since the VA limits the origination fee a lender can charge to no more than 1 percent of the mortgage.

Easier qualifications

The VA doesn’t have a minimum credit score requirement, and some lenders allow for lower scores compared to conventional loans. VA loans also allow for a higher debt-to-income (DTI) ratio, which can help you qualify for a more expensive or larger home.

Convenient refinancing options

With a VA cash-out refinance option, you can finance up to 90 percent of the value of your home; or you can opt for an Interest Rate Reduction Refinance Loan (IRRRL) that can potentially lower your rate through a streamlined process that doesn’t require an appraisal. Both refinancing options might make a VA loan more appealing overall.

Easier to get back on your feet after a financial hurdle

You also won’t need to wait as long to get a VA loan if you’ve been through a foreclosure, bankruptcy or short sale, says Kerry Sherin, consumer advocate for Ownerly, a home valuation company based in New York City.

“The waiting period for a VA loan can be up to half the time of a traditional loan: two years following a foreclosure, two years after a short sale unless all payments are on time — in which case there is no waiting period — two years after a Chapter 7 bankruptcy and 12 months after on-time payments while in Chapter 13,” says Sherin.

Mortgage is assumable

VA loans are assumable, meaning that a buyer — who, with lender approval, does not need to be a veteran — can take over the terms of the VA loan on the home they’re buying instead of receiving a new loan. VA loan assumptions are especially beneficial when interest rates are on the rise, as you could assume a loan with better terms than you could get in the current market. While loan assumptions require extra steps for the seller to keep their full VA loan entitlement after the sale, they can be an excellent perk for a buyer.

Disadvantages of a VA loan

There’s a flip side to every form of financing, including VA loans. The disadvantages include:

Required VA funding fee

While you won’t pay for mortgage insurance with a VA loan, you will pay a funding fee at closing (although this fee can be financed into your loan, increasing the total amount you owe). If you’re taking out your first VA loan and putting down less than 5 percent, the funding fee equates to 2.15 percent of the loan amount. If you do plan to put money down or have obtained a VA loan in the past, the fee can range from 1.25 percent (for first-time or repeat borrowers putting at least 10 percent down) to 3.3 percent (for repeat borrowers with less than 5 percent down).

Not all borrowers are required to pay the funding fee. For example, if you receive compensation for service-connected disabilities or are a veteran’s surviving spouse, you might be exempt from paying the funding fee.

Property restrictions

VA loans limit the type of property you can buy (and your purpose for it). First off, manufactured homes are subject to more scrutiny, including a structural engineering examination. Additionally, properties purchased with a VA loan are designed to be owner-occupied, so it’s more challenging to use a VA-backed loan to earn rental income. It is possible, though, if you live in one unit of a multi-unit property and rent out the other units.

Less flexibility

With a VA loan, you aren’t allowed to waive certain contingencies, such as the home inspection or appraisal, to make your loan offer more attractive to a seller. Some sellers, for that matter, are also less inclined to accept an offer with VA loan financing. They might assume that some myths about VA loans are true and place more weight on an offer from a buyer with a conventional loan.

Is a VA loan the best option for you?

For many borrowers, VA loans are a slam dunk. However, even if you’re eligible, there are times when a VA loan might not be your best choice.

“For example, if you are an eligible borrower who currently owns a home but wants to sell and purchase another primary home to yield a large down payment — 20 percent or more — from the sale that you can put toward your next home purchase, a VA loan may not make sense for your next property,” says Rob Killinger, senior loan officer at Movement Mortgage in Massachusetts. “If you were to use a VA loan in this scenario, you may be required to pay the VA funding fee, whereas a conventional loan program would not require such a fee.”

On the other hand, a VA loan offers special benefits that other financing does not. “For instance, a qualified borrower could purchase a two- to four-unit property with a zero down VA loan that they plan to live in instead of a single-family home,” says Killinger. “In comparison, a conventional loan requires a minimum 15 percent down on a multi-unit property.”

Still, the funding fee can be expensive. If you are planning to remain in your home for less than two years, it might not be worth it to pay this fee to get a VA loan.

If you’re still not sure whether a VA loan makes sense for you, consult closely with your loan officer, who can present all of the different mortgage options you qualify for and help guide your decision.

Alternatives to a VA loan

A VA loan isn’t your only choice of financing. Consider the following options, especially if you don’t qualify for a VA loan:

- Conventional loan – There is no funding fee on a conventional loan, and you can use it to purchase investment properties and second homes. The interest rates tend to be higher than for VA financing, however, and a down payment is also required, as well as private mortgage insurance if you’re putting down less than 20 percent.

- FHA loan – An FHA loan is also backed by the government and requires you to pay an upfront mortgage insurance premium, similar to the VA loan’s funding fee. However, you’ll also pay an annual mortgage insurance premium. Your interest rate might also be higher.

- USDA loan – As with a VA loan, there is no down payment required for a USDA loan, but it is only for borrowers in designated rural areas. USDA loans also come with income restrictions, and the property must be a single-family home. Plus, only 30-year fixed-rate financing is available.