Tesla is not only the world’s largest carmaker, but the firm has since surpassed a market capitalization of $750bn – and even reached the $1trn mark back in 2021.

If you’re wondering how to buy Tesla stock in 2022, this guide will walk you through the process. We’ll also review some popular options where investors can buy Tesla stock.

How to Buy Tesla Stocks in 2022

To get the ball rolling, we will show you how to invest in Tesla stock with the broker of your choice. Follow this simple guide to get started:

- ✅Step 1 – Open a Trading Account: Users can head over to the website of their preferred broker and begin the registration process. Enter your personal details and create a username and password.

- 🛂Step 2 – Upload ID: Get your newly created account verified instantly by uploading a copy of your ID. Choose from a passport, state ID, or driver’s license. Users may also be required to provide a proof of address document, such as utility bill or bank statement.

- 💳Step 3 – Deposit Funds: Users can deposit funds by choosing a payment method which may include e-wallets, credit/debit cards, and ACH.

- 🔎Step 4 – Buy Tesla Stock: Users can search for Tesla stock on the search bar of their platform and begin the open order process. Enter the amount you wish to invest and confirm the transaction.

Your capital is at risk. 83.45% of retail investor accounts lose money when trading CFDs with this provider.

Step 1: Decide Where to Buy Telsa Stock

In order to buy Tesla stock online – you will first need to open a brokerage account with a popular trading platform. The sections below review a few popular stock brokerages that allow users to invest in Tesla stock.

1. Capital.com

Capital.com is a popular platform for buying Tesla stock. Capital.com is a leading CFD broker regulated by entities like the FCA, ASIC, and CySEC. Users can trade 3,600 stock CFDs with Capital.com (including Tesla), all with a minimum investment amount of 0.1 shares.

Capital.com is a popular platform for buying Tesla stock. Capital.com is a leading CFD broker regulated by entities like the FCA, ASIC, and CySEC. Users can trade 3,600 stock CFDs with Capital.com (including Tesla), all with a minimum investment amount of 0.1 shares.

With Capital.com, stock trading is entirely commission-free. The only fee to be aware of is the bid/ask spread, which can be as low as 0.7 points for highly-traded equities like Tesla. Trades can be placed through Capital.com’s browser-based platform or the mobile app, which features real-time price charts and a selection of technical indicators.

It’s important to note that Capital.com doesn’t currently accept US traders due to regulatory compliance.

Deposits can be made from as little as $20, with full support for PayPal and Apple Pay. Certain jurisdictions can also benefit from leverage, with up to 5:1 offered on stock trading. Finally, Capital.com also has a built-in AI system that monitors users’ trading behaviour and helps them make more informed investment decisions.

| Number of Stocks | 3,600+ |

| Deposit Fee | Free |

| Fee to Buy Tesla Stock | Commission-free |

| Minimum Deposit | $20 |

Your capital is at risk. 83.45% of retail investor accounts lose money when trading CFDs with this provider.

2. eToro

If you’re looking for a low-cost and safe way to buy Tesla stock in under five minutes from start to finish – another popular broker is eToro. In choosing this broker, you can buy Tesla stock for just $10 using fractional investing. As such, there is no requirement to purchase a full Tesla stock.

Moreover, eToro offers one of the cheapest ways to invest in Tesla – not least because the broker does not charge any commission. We also found that spreads on blue-chip stocks like Tesla can be tight – which will reduce investment costs. Additionally, you’ll have access to one of the popular stock apps on the market.

Once you have added Tesla stocks to your eToro portfolio, you may want to diversify across other companies. At eToro, you will have thousands of stocks and ETFs from lots of different exchanges – both in the US and overseas. Regarding the latter, this is inclusive of markets in Europe, Asia, the Middle East, Canada, and more.

In addition to low fees and fractional stocks, eToro offers copy trading tools. This allows you to invest in the stock market in a passive nature, as you will can copy an experienced trader like-for-like. For instance, if the trader buys Tesla and Lucid stocks, the same position will be mirrored in your own portfolio.

It’s also worth looking at the dozens of ‘Smart Portfolios’ offered by eToro. These track stocks from specific niche markets – such as electric vehicles or start-ups. Once you’ve chosen a smart portfolio, your basket of assets will be rebalanced and maintained by the eToro team. Both of these passive investment tools come without additional fees.

In terms of getting started, eToro requires a minimum deposit of $10 to open an account. You can fund your account in various ways – including ACH, bank wire transfer, debit/credit cards, and even e-wallets like Neteller and PayPal. No deposit fees are charged by eToro, if you opt to fund your account in US dollars.

| Number of Stocks | 3,000+ |

| Deposit Fee | FREE |

| Fee to Buy Tesla Stock | Commission-Free |

| Minimum Deposit | $10 |

Your capital is at risk. 78% of retail investor accounts lose money when trading CFDs with this provider.

3. Webull

Another place where you can buy Tesla stock in a low-cost manner is Webull. This popular stock broker is home to millions of US clients of all skillsets. By opening an account with this broker, you will not be required to meet a minimum deposit. Then, you can proceed to buy Tesla stock at 0% commission.

Another place where you can buy Tesla stock in a low-cost manner is Webull. This popular stock broker is home to millions of US clients of all skillsets. By opening an account with this broker, you will not be required to meet a minimum deposit. Then, you can proceed to buy Tesla stock at 0% commission.

Although spreads at Webull are typically higher than those you will find at eToro, the broker is still very competitive. Webull allows you to buy Tesla stock via fractional investing. The minimum trade size is just $5 – which will appeal to investors on a budget.

In addition to Tesla, Webull is home to more than 5,000 other stocks. Other than a few ADRs, the vast majority of stocks offered by Webull are US-based.

You can also buy cryptocurrency at Webull from just $5 per trade. In terms of funding your Tesla stock purchase, Webull accepts ACH and US bank wires. The latter will cost you $8 per transaction, while the former is processed fee-free. Webull also offers a user-friendly mobile app – so you can trade stocks and other assets on the move.

| Number of Stocks | 5,000+ |

| Deposit Fee | ACH – free / Bank wire – $8 |

| Fee to Buy Tesla Stock | Commission-Free |

| Minimum Deposit | $0 |

Your capital is at risk.

Now that you’ve read both reviews you might want more details by reading our eToro vs Webull article.

Step 2: Research Tesla Stock

Once you have decided where to buy stocks in Tesla, the next step is to research Tesla as a company. In doing so, you can make sure that Tesla is a suitable stock investment for your financial goals.

With this in mind, the subsequent sections of this guide on how to buy Tesla stock will cover the following research points:

- What Tesla does as a company in terms of its business model

- Review of Tesla’s stock price history

- Features of Tesla’s stock

What is Tesla?

Founded in 2003, Tesla is an electric carmaker that has since become the largest vehicle manufacturer globally in terms of market capitalization.

Founded in 2003, Tesla is an electric carmaker that has since become the largest vehicle manufacturer globally in terms of market capitalization.

This means that Tesla is now bigger than established car companies like Ford – which has been trading for over 100 years.

- Not only are Tesla models better for the environment, but in comparison to traditional fuel-based cars, they are more efficient and cost-effective.

- This is why Tesla models are now flying off the shelf – with the firm often unable to meet customer demand.

- Some of the most successful Tesla models to date include its Model S, Model 3, and Model X vehicles.

- In addition to its electric car fleet, Tesla is also behind a number of other innovative products and services.

- For instance, Tesla’s Megapack solar panels can be applied directly onto rooftops via conventional tilling systems.

- This means that new homes can be moved into with solar tiles already installed.

Moreover, Tesla has also created its own native artificial intelligence (AI) framework that allows Tesla cars to be switched over to driverless mode.

The AI has the capability to install much-needed software updates remotely. We should also make reference to the Tesla Megapack, which is a large-scale battery that can fuel power stations via lithium technology. As climate activists and governments ramp up their efforts to reduce carbon emissions, Tesla stands as one of the most popular ethical stocks for its drive towards the electrification of the automotive industry.

Tesla Stock Price – How Much is Tesla Stock Worth?

Tesla first went public in 2010 – with the electric car company opting for the NASDAQ exchange. During its IPO campaign, Tesla priced its stocks at $17, which valued the company at approximately $2 billion. With that said, Tesla has since initiated a 5-for-1 stock split – which it executed in 2020. As such, its original IPO price should be viewed at a price of roughly $3.80 per share.

Notably, when Tesla first went public, there was a lot of skepticism about the firm. After all, even in 2003, electric cars were still viewed as a fad. As we now know, Tesla has since gone on to become one of the most popular stocks of all time. In fact, had you invested in Tesla’s IPO back in 2003 and held onto your stocks until March 2022, you would have been looking at gains of over 28,000%.

Your capital is at risk. 83.45% of retail investor accounts lose money when trading CFDs with this provider.

To put that in perspective, an original investment of $5,000 during the IPO campaign would have been worth over $1.4 million.

More recently, Tesla stocks have increased in value by around 900% in the last five years. In comparison, the broader NASDAQ Composite has grown by just 66%. However, over the past year, Tesla’s share price has fallen by just over 8%. In comparison, the NASDAQ Composite is down by around 23%.

Tesla Market Capitalization

When it comes to market capitalization, Tesla became a trillion-dollar company back in 2021. This made it one of the largest companies in the US – alongside the likes of Apple, Microsoft, and Amazon. At the time of writing, Tesla’s market cap now sits at $750 billion, following the recent share price decline.

Tesla Stock Split

As noted above, Tesla executed its first stock split in August 2020, at a rate of 5-for-1. This was followed by a 3-for-1 stock split that occurred in August 2022.

Tesla Index Funds

Tesla was first added to the S&P 500 index in October 2020. This was a major achievement for the firm, as it took just 10 years for Tesla to go from its IPO campaign to an S&P 500 company.

Tesla EPS and P/E Ratio

As per its annual reports, Tesla’s earnings per share (EPS) over the prior four years are as follows:

- 2021: $1.63

- 2020: $0.64

- 2019: $-0.98

- 2018: $-1.14

As you can see, it wasn’t until 2020 that Tesla was able to move its EPS into positive territory. And the reason for this is simple – Tesla did not report its first full-year profit until January 2021, a total of 18 years after the firm was founded.

In terms of its price-to-earnings (P/E) ratio, as of writing, this stands at a whopping 87.61 times. To put this into perspective, the broader NASDAQ exchange has a P/E ratio of just 22.11 over the past 12 months.

Tesla Stock Dividends

Like many growth stocks, Tesla to date has never paid a dividend to shareholders. After all, it wasn’t until early 2021 that Tesla was able to report its first full-year profit.

With that said, Tesla clearly has sufficient levels of free cash flow when you consider that in late 2020, the electric carmaker invested $1.5 billion from its balance sheet to buy Bitcoin.

However, many high-growth companies opt to reinvest profits, rather than distribute them as dividends. Although this means investors don’t get a recurring income stream, it does provide scope for higher capital gains in the future.

As a prime example, fellow NASDAQ stock Apple has grown by over 270% in the past five years – which has been made possible due to the company’s low dividend payout ratio.

Features of Tesla Stock

Now that we have covered the technicals, in this section we take a much closer look Tesla’s stock fundamentals:

Strong Quarterly Earnings Report

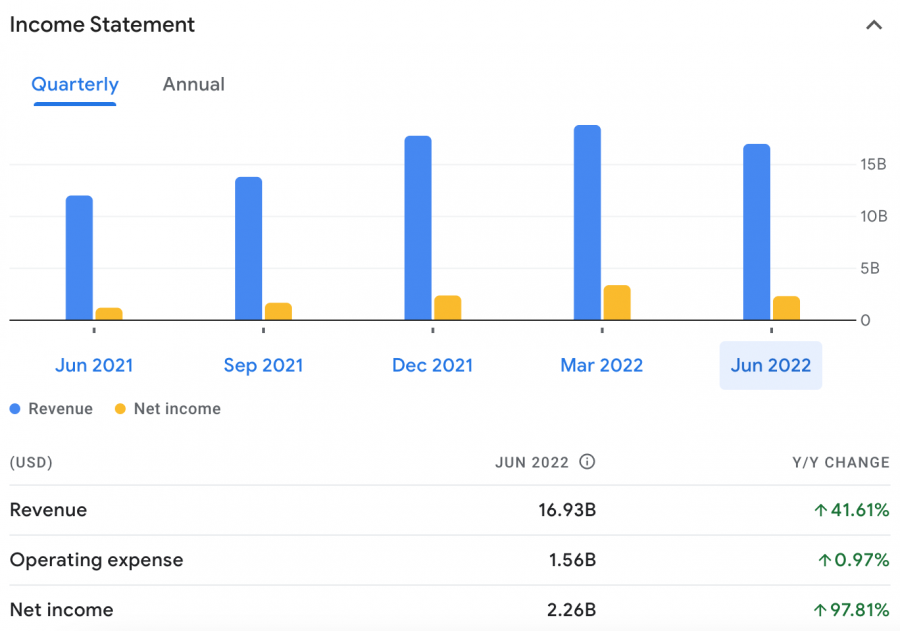

Tesla’s most recent quarterly earnings report provided some strong results. First and foremost, revenues were up over 41% year-on-year, with net income growing by more than 97%.

Net profit margins increased by 39%, while operating income grew by 87%. The only chink in the armor with Tesla’s most results was that the gross margin on vehicle sales decreased slightly.

Vehicle Delivery Figures Continue to Rise

Another metric to look at before you buy Tesla stock is with respect to the firm’s vehicle delivery numbers.

This essentially takes into account two key figures – the number of vehicle orders Tesla is getting from customers and at what rate the firm is able to meet this demand.

In 2021, Tesla reported an impressive 1 million vehicle deliveries. To put this into perspective, this stood at just under 368,000 and 500,000 in 2019 and 2020 respectively.

Crucially, market analysts predict that in 2022 – Tesla could double its vehicle delivery figures to 2 million. In order for Tesla to meet its goals, the firm is has opened new production plants in Texas and Germany.

Tesla Competition

Another reason why you might want to analyze Tesla on is its competition.

- For example, fellow EV stock Nio, which is a Chinese manufacturer listed on the NYSE, has lost 52% of its stock price value in the prior 12 months, compared to a loss of just 8% in the case of Tesla.

- You then have US-based EV stock Rivian, which, since its November 2021 IPO listing, has lost 73% of its value. For more details on how to buy Rivian stock read our guide here.

It’s also worth looking at traditional car companies like Ford and General Motors – both of which are investing heavily into the growth of their electric vehicle division.

Over the prior 12 months, Ford stocks have decreased by 14%, while General Motors shares has fallen by 37%.

Step 3: Open an Account & Buy Shares

For users interested in buying Tesla stock, the next step is learning how to do so. After choosing a popular brokerage of your liking, here is how to begin trading Tesla stock.

Step 1: Open a Stock Broker Account

Users can head over to the chosen broker they wish to begin trading with and download the stock app. Traders are required to enter their personal details and create their account by confirming their username and password.

Step 2: Upload ID

The next step is to verify your identity by uploading a valid photo ID. Users can do so by sending a copy of your passport/driver’s license and proof of address.

Step 3: Deposit Funds

The next step for users is to deposit funds into the account. Choose one of the available payment methods and then deposit money into the trading account.

Some of the available payment methods may include credit/debit card options, bank transfers or e-wallets like PayPal.

Step 4: Buy Tesla Stock

The final step is to begin purchasing Tesla stock. Search for the stock by entering the name on the platform’s search bar to continue. Users can now create a new buy order position. Enter the amount you wish to enter into the position and confirm the transaction.

Conclusion

In summary, Tesla is one of the most popular stocks available in the market. However, the stock often attracts high volatility levels as well. Therefore, users should carefully review and analyze the stock before opening new positions.

For users looking to invest in Tesla, you can review the available stock brokerages and decide which platform suits your trading needs.

#stocks #stockmarket #investing #trading #money #forex #investment #finance #invest #bitcoin #business #investor #entrepreneur #cryptocurrency #trader #financialfreedom #crypto #wallstreet #wealth #daytrader #motivation #forextrader #success #daytrading #nifty #forextrading #sharemarket #stock #millionaire