Buying a home is arguably the most important purchase that you’ll ever make, which is why it’s important to make the right decision. Given the high costs of a housing purchase, the odds are that you will need to take out a home mortgage loan.

While the basic premise of all mortgages is the same (you’ll be using your new property as collateral for a loan that enables you to purchase the property), there are many different options at your disposal. Here’s all you need to know about the different types of mortgages.

The Importance Of Understanding The Types Of Mortgages

The Importance Of Understanding The Types Of Mortgages

No two people are the same, especially when it comes to buying a home. As such, banks and lenders offer various mortgage products in order to serve the different needs of a diverse market. Understanding the finer details of the contrasting mortgage types ultimately enables you to select the most suitable route for buying your property.

Some of the variables that could influence your decision include:

- DOWN PAYMENT SIZE – Some mortgages provide a 0% down payment option while others are better suited to a 10% or 20% down payment.

- PROPERTY PRICE – The right mortgage for a $100,000 loan might not be the best choice for a $1,000,000 home loan.

- LOAN-TO-VALUE RATIO – When the down payment is a significant percentage (over 50%) of the property price, a specific mortgage type may be better.

- DEBT-TO-INCOME RATIO – Banks factor in your other debts against your earnings to ensure that you are capable of making repayments and your situation can influence which option is best.

- SOLO OR JOINT APPLICATION – Depending on whether you’re buying the property alone or with your spouse, different home loans may be more suitable.

- CREDIT HISTORY – Credit scores are another influential factor that can impact the overall repayment structure.

Other factors, such as the duration of the mortgage loan, will also influence the situation. By understanding the different mortgage loans, it’s possible to find a solution that suits your budget and situation to produce the lowest overall repayment.

Types Of Mortgages Explained

Types Of Mortgages Explained

When analyzing mortgage options, there will be a number of additional factors to consider in your bid to find the best mortgage. After all, the contrasts between one lender and the next can be huge. Nevertheless, the mortgage type will always provide the foundation for making the right decision.

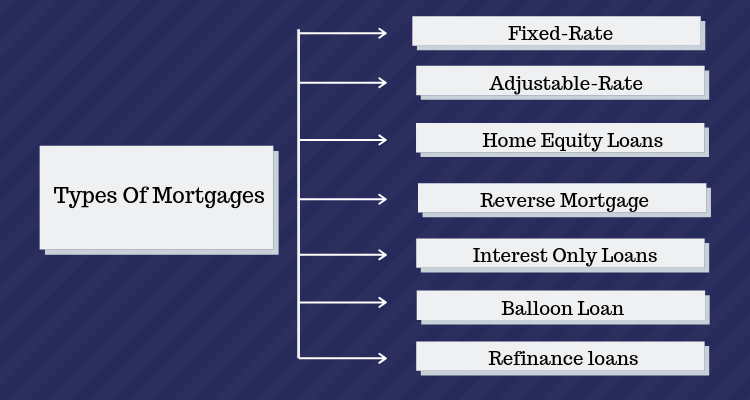

While there are other mortgage types available, especially if you’re looking to become an investor or landlord, home loans are broken into seven main categories.

Fixed-Rate Mortgages

A fixed-rate mortgage is the most common mortgage option by far. It is an agreement in which your payments and interest rates are set at a guaranteed level throughout the duration of the loan. This makes the financial management aspects of the mortgage loan far easier to control.

The term of the agreement can be personalized to suit individual requirements based on financial status and personal preference. Most applicants will apply for a mortgage length of 15 or 30 years. Older applicants should know that most lenders will only offer a term up to the month that you reach retirement age.

Interest rates are lower on a shorter agreement because it poses less of a risk to the bank or lender. So, even though a 15-year mortgage means that you have half the time of a 30-year one, the monthly premiums will not be double the price.

Adjustable-Rate Mortgages (ARM): Fluctuating Interest Rate

ARMs are also a popular mortgage option, even if they are a little less common. Several mortgage products fall under the category of ARMs, but they all focus on the idea of using a fluctuating interest rate that moves up and down to reflect the economic environment.

So homeowners with an ARM get the added benefit of knowing that an economy that results in lower interest rates will bring savings. The most common ARM is the Variable Rate Mortgage, which has fluctuating interest rates that run alongside a third-party index. Rates may change every 6 or 12 months, as set out by the agreement.

Another option is the hybrid ARM, which starts the agreement on a fixed rate for a set period of time (often set as 3 or 5 years) before switching to the variable rate. Option ARMs can get complicated but are a good option for people wanting to borrow more than traditional lending would offer.

Home Equity Loans

Otherwise known as a second mortgage, home equity loans allow you to take out a secondary loan based upon the equity you’ve built up. While you can only borrow against the equity you’ve already built, they can be a good option for financing home upgrades or accessing money in emergency situations.

Home equity loans tend to have a larger interest rate, although the smaller sums involved open the door to shorter-term agreements. It runs alongside the standard home loan agreement, though, meaning the payments throughout the duration will feel higher than normal.

Equity lines of credit are also available. They work in a very similar manner to other lines of credit agreements but are made against the equity of the property.

What is a Reverse Mortgage?

A reverse mortgage is a concept built exclusively for senior citizens and serves to offer access to equity in the home via a loan. This can be facilitated as a set lump payment or monthly repayments, as well as via a line of credit.

Reverse mortgages do not normally require the homeowner to make payments while still living in the property. The loan does not have to be paid back until the last borrower passes away or moves from the home for one whole year.

Addition Read: Your Guide To Reverse Mortgage Loans

Interest Only Loans for Hybrid Type of Mortgage

An interest-only loan can be thought of as a type of hybrid mortgage. It works on the principle of simply paying off the interest for the opening period of the mortgage (often 1-3 years) before then switching to your traditional fixed-rate or variable repayments.

This is a good option if you are worried about meeting repayments through the transitional phase due to home repair costs as well as the fact you’ll have recently made a down payment. However, the short-term cushion will mean that the future repayments are larger because you’ll have to make up for the lost time.

After all, a 20-year mortgage on a 3-year interest only plan is practically a 17-year mortgage as you won’t have knocked anything off the loan agreement until the start of the fourth year. Weighing up the pros and cons is largely a matter of personal preference for individual circumstances.

What Is a Balloon Loan?

If you are familiar with balloon car loans, the payment structure works in a very similar manner when dealing with balloon mortgages. Essentially, you pay a low fee (perhaps even an interest-only repayment) for the duration of the mortgage agreement before clearing the full balance on the final payment.

This type of mortgage is usually a lot shorter, with 10 years being the most common duration. As such, the fact that you’ll have to clear a substantial balance at the end of the agreement makes it an unsuitable solution for many. However, those that are set to quickly reach and sustain a position of greater revenue may opt for this route.

How Does Refinancing a Loan Work?

Refinance loans are another option that is open to homeowners that are already several years into their mortgage. They can be used to reduce interest payments and change the duration of the agreement. This is because it is an entirely new home loan agreement that is used to replace the existing one.

The new loan is used to pay off the original mortgage, essentially closing that deal before opening the new term agreement. This can be used to update your homeownership status to reflect changing life situations, or to change the lender.

Refinancing can be very useful in times of economic hardship, but homeowners need to do their research to see the full picture as it can be damaging in many situations. If it was always the right option, every homeowner would choose it.

Conclusion

Conclusion

Finding the right mortgage is one of the most important financial challenges that you’ll face, and it’s a process that starts with selecting the right type of mortgage for your situation. While you may think that the variances between different mortgage products are small, the impact that they can have on your future is huge. If you find that the home loan process is intimidating and complicated, seek out advice from a lender like A and N Mortgage. The team of professionals at A and N Mortgage, one of the best mortgage lenders in Chicago, will help you apply for a home loan and find an arrangement that works best for you.

A and N Mortgage Services Inc, a mortgage banker in Chicago, IL provides you with high-quality home loan programs, including FHA home loans, tailored to fit your unique situation with some of the most competitive rates in the nation. Whether you are a first-time homebuyer, relocating to a new job, or buying an investment property, our expert team will help you use your new mortgage as a smart financial tool.