Uniswap is a decentralized exchange (DEX) platform popular in the DeFi space. Built on the Ethereum Blockchain, the native token of that exchange platform has the same name, Uniswap with the ticker UNI.

UNI made over 100x gains during its first bull run from late 2020 to early 2021, and after its correction in 2022 many investors are looking to buy the dip. In this guy we review how and where to buy Uniswap token, one of the most sought after DeFi coins in the crypto markets.

How to Buy Uniswap (UNI) – Quick Guide

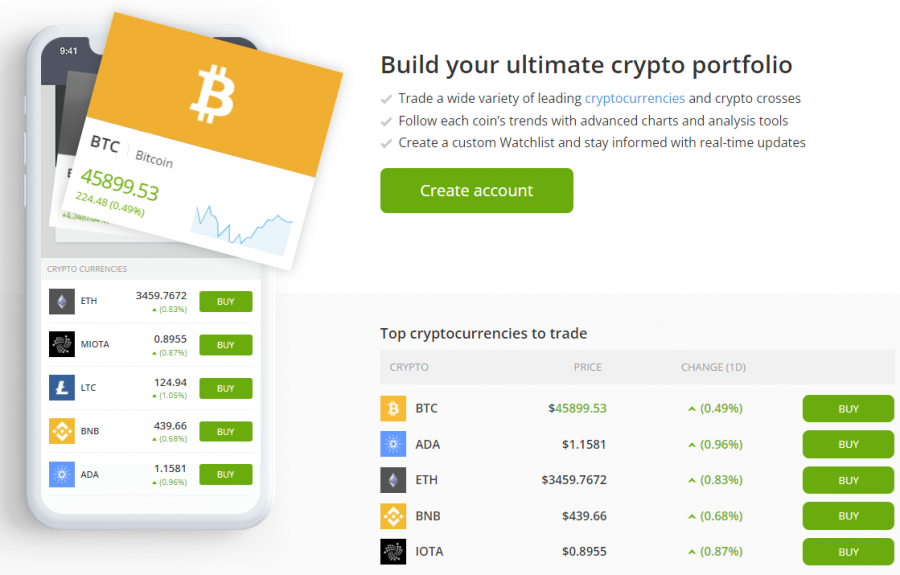

To buy Uniswap tokens, we recommend eToro which has listed UNI and is one of the leading crypto platforms in terms of regulation and security. Follow these steps:

- ✅Step 1: Create an account: Sign up at eToro.com by completing the quick account creation process Enter your details, choose your user credentials, and proceed to the next step.

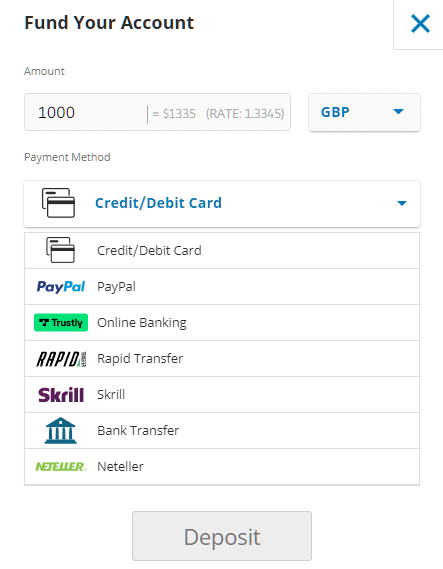

- 💳 Step 3: Deposit: eToro requires you to have at least $10 in your account to start trading Uniswap and other cryptos. Deposit methods include debit cards, credit cards, bank transfers, PayPal, Neteller, Skrill and more.

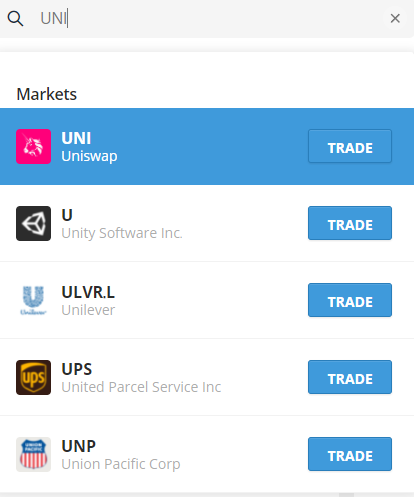

- 🔎Step 4: Search for UNI: Once you’re on your dashboard, search for the Uniswap token by entering “Uni” in the search bar. UNI will be the first result you see in the dropdown menu.

- 🛒Step 5: Buy Uniswap: On the Uniswap page, click on the “Trade” button. It will show you a dialogue box – prompting you to enter the desired amount you want to invest in Uniswap. Enter an amount and click on “Open Trade” to finalize your investment.

Where to Buy Uniswap Coin – Platform Reviews

Below we list and review the best places to buy Uniswap in more detail:

1. eToro: Overall Best Platform to Buy UNI Token in 2022

Launched in 2007, eToro has now gained over 27 million users. A regulated online crypto broker with certifications from SEC, FINRA and other government authorities including in the UK and Australia, eToro meets strict regulatory standards. This trading platform also puts accessibility as its priority – allowing beginners to create a crypto account within a couple of minutes.

Launched in 2007, eToro has now gained over 27 million users. A regulated online crypto broker with certifications from SEC, FINRA and other government authorities including in the UK and Australia, eToro meets strict regulatory standards. This trading platform also puts accessibility as its priority – allowing beginners to create a crypto account within a couple of minutes.

eToro enables you to buy Uniswap coins on a spread only basis – when buying Uni token, you only pay the difference between its buying and selling price. Also, eToro provides a fee-free facility of zero transaction fees to US-based traders or users transacting in USD. This support extends to all payment methods, including debit/credit cards, domestic wire transfers, ACH and even PayPal. The minimum deposit is $10 to start investing in crypto.

eToro is not limited to UNI tokens – it hosts 60+ cryptocurrencies that you can add to your portfolio, including ApeCoin, Cardano, Decentraland and more. If you’re trying to diversify your portfolio, you can invest in a Smart Portfolio, a crypto package containing many tokens handpicked by the eToro management team – allowing you to hedge your bets.

One of its Smart Portfolios is a collection of DeFi coins including Uniswap and others like Aave, Bancor, Compound, DYDX and Maker.

eToro also supports copy trading, which lets you copy the portfolio of successful eToro users. Just pick a user, and eToro will automatically mirror their investment for your account. Over the course of 2021 eToro copytraders averaged an ROI of over 30%.

Cryptoassets are a highly volatile unregulated investment product.

2. Crypto.com: Margin Trade Uniswap Token

Uniswap was listed on Crypto.com on September 18th 2020, where it offers UNI/USDT, UNI/USDC and UNI/BTC spot trading pairs, as well as margin trading with leverage.

Since then, this platform has become one of the best for futures trading. Crypto.com has an easy to use interface and quick account creation process – requiring only the entry of user details and document submission. It also has a mobile app to trade on the go.

If you want to invest in Uniswap using debit or credit cards, Crypto.com provides you with speedy transactions. It allows you to buy UNI tokens instantly, albeit you’d need to pay a 2.99% transaction fee.

However, Crypto.com provides a 30-day free trading model – allowing you to buy and sell Uniswap for a month without worrying about any trading fees. After the trial period’s end, Crypto.com’s commission becomes 0.4% per trade. But you can bypass paying it by owning the platform’s native token – CRO.

If you don’t’ want to limit yourself to just one currency on Crypto.com, you can expand your portfolio by looking at its other offerings. The platform holds 250+ tokens, all popular and gaining tremendous traction in the market. Additionally, Crypto.com provides interest for your crypto investments. There is no lock period on these investments, and your selected token determines the APY. Also, Crypto.com offers a debit card that you can use to spend your cryptocurrency to buy real-world assets.

Cryptoassets are a highly volatile unregulated investment product.

3. Binance: Trade Uniswap with Low Fees

Binance has high trading volumes of more than $10 billion per day and more than 100 million registered users. Binance has quickly become the favourite place to purchase any cryptocurrency. To buy Uniswap on this platform, you can use USD or crypto. Going by the traditional route is convenient but pricey – costing 4.5% transaction fees. On the other hand, Crypto transactions cost only 0.10% per trade.

Opt for ACH and wire transfers if you don’t want to pay a transaction fee when using standard payment methods. But keep in mind that you’d be trading off cost for time, as funds can take several days to reach your Binance account. Regardless of what method you choose, tokens will populate your wallet once the transaction is complete.

Binance web wallet is unique. In addition to providing traditional security tools, it also offers cold storage, device whitelisting and a special insurance policy for crypto traders. It is known as SAFU or Safe Fund for Users, and it compensates the users if someone hacks their account. Another storage facility by Binance is the Trust Wallet. It is non-custodial, easy to use, and you can download it on your IOS and Android devices.

Cryptoassets are a highly volatile unregulated investment product.

4. Coinbase: Reputable Cryptocurrency Exchange to List UNI

If you want to invest in Uniswap, which is easy to use and caters to traders worldwide, Coinbase is a good choice. Founded in 2012 by three friends who couldn’t open a bank account because their respective banks refused to acknowledge them as small business owners, Coinbase has since evolved into a NASDAQ listed company.

If you want to invest in Uniswap, which is easy to use and caters to traders worldwide, Coinbase is a good choice. Founded in 2012 by three friends who couldn’t open a bank account because their respective banks refused to acknowledge them as small business owners, Coinbase has since evolved into a NASDAQ listed company.

Since starting, Coinbase has gained 90 million trading accounts. It is one of the most trusted platforms in America. And even though it lacks in the customer-support department, it makes up for it with an interactive UI and a transparent approach to crypto trading. Furthermore, if you want to purchase Uniswap using fiat currencies directly, Coinbase allows you to do so.

Investing in UNI is easy with Coinbase. Once on board this platform, you can buy Uniswap coin with a bank account, bank card or other cryptocurrencies. But remember, the transaction fee for using a debit card is 3.99%. We recommend using bank transfers on Coinbase.

Also use Coinbase Pro to reduce fees further – it drops the transaction fee to 0.5% per trade.

Cryptoassets are a highly volatile unregulated investment product.

What is Uniswap?

Most crypto trading across the globe takes place on centralized platforms. Launched in 2018, Uniswap challenged this dominance by introducing the concept of a decentralized exchange.

Built on the top of the Ethereum Blockchain, Uniswap is a DEX that allows for permissionless transactions of ERC20 tokens without the need of a middleman. All the users maintain control of their funds and thus, are in total control of their private keys – protecting their assets on their terms.

Ultimately open source and freely interactable for all who wish to enter the crypto space, Uniswap is the adopter of DeFi – Decentralized Finance – a concept that has grabbed the attention of those seeking fewer regulations and more freedom in the digital economy.

Currently, Uniswap exchange is the world’s fourth-largest DEX platform. It holds more than $3 billion worth of crypto assets in its protocol.

The key driving force behind Uniswap is AMM or Automated Market Maker. It is a smart contract – providing tokens and managing liquidity pools. By leveraging the interplay between the supply and demand of tokens in these pools, it effectively manages the token prices to keep them fair.

The current centralized environment of blockchain is not without issues. Under the control of a centralized authority, it is susceptible to unfair changes that can deter the interest of crypto enthusiasts. By staying decentralized, Uniswap gives everyone a voice in developing its protocol – indirectly taking inputs to build a better DeFi ecosystem.

That’s where the UNI token comes in. It is the governance token of Uniswap, and owning it allows the holders to have a say in the decentralized exchange development. Over time, this token has accumulated more power. For instance, after the introduction of Uniswap v.2, a new protocol came. It sends 0.5% of every 0.30% of the trading fee to a Uniswap fund to develop the DEX. Although currently turned off on the community’s request, the liquidity providers will start receiving 0.25% of the trading pool fees if it turns back on in future.

Even though Uniswap is a DEX, its native token, UNI, is available on centralized exchanges such as eToro.

Further reading: How to Buy DUMBLE Token

Is Uniswap a Good Investment?

Ever since its launch, and the emergence of decentralized finance, people have been asking whether investing in Uniswap is a good option. Uniswap is now the fourth largest decentralized exchange globally and has set a precedence for the blockchain space that few can match.

Cryptos and DeFi tokens are volatile however, so be prepared to hold for the long-term and use dollar cost averaging (DCA) to get a better average entry.

We’ve covered where to buy Uniswap coin, and in terms of why to buy it, below are factors to consider:

Decentralized Exchanges are the Future of Finance

It wouldn’t be an understatement to say Uniswap was years ahead of its time when it launched. The UNI token is the native of the Uniswap DEX. And when you have a say in the development of this platform, you’d have the power to direct the course of DeFi’s future.

Also, new regulations have allowed centralized exchanges such as Coinbase, and Binance to allow fiat-to-crypto purchases. But these rules are unique and these trading platforms aren’t capable of hosting all crypto assets.

That factor creates a void that can be filled with the presence of DEXs.

Uniswap empowers the crypto community by facilitating peer-to-peer crypto trading. Built on the Ethereum protocol, the smart-contract enabled trading ensures a fair exchange of currencies between people. Additionally, this DEX allows the traders to swap more than 30,000 assets. For those looking to make big money on obscure investments, Uniswap has become a haven.

Passive and Flexible Income via Liquidity Pools

Unlike centralized staking, on which centralized exchanges depend when deciding the price of tokens, Uniswap operates on liquidity pools.

Using a liquidity pool crypto traders can earn passive income by locking in their tradable securities. With each successful trade using the investor’s liquidity, 0.3% transaction goes to the investor’s wallet. It is a concept known as Liquidity Mining. In this instance, the investors are called liquidity providers (LP).

Basically, you lock in your assets that you won’t use. Still, because these assets support current transactions on the blockchain, you earn money while doing what many might consider nothing.

For long term investors, this is akin to earning free money.

With Uniswap, investors can earn UNI tokens by simply supplying them to the liquidity pool supporting the DEX. Therefore, those banking upon Uniswap’s popularity in the crypto space will make more if UNI has more investors.

In this day and age, generating passive income is more than just vanity; it is a mode of survival. People are yearning to enhance their income in meaningful ways. Uniswap, with its decentralized approach to finance and reward-through-liquidity-pools model, provides the same benefits as stock ownership.

Rapid Growth in the Crypto Space

Uniswap has become the most forked cryptosystem. By utilizing its open-source, enthusiasts are creating their DeFi ecosystems. Many popular DEXs branched out from this protocol, such as Sushiswap, Pancakeswap, Dodo, Curve, Burgerswap etc. The current trends suggest that more derivatives will continue to emerge. The global crypto market currently stands at $2 trillion, clearly indicating a wave of new investors in the crypto space.

The influx of new investors has swelled the transaction volumes – playing a pivotal role in enhancing the value of several DEXs, primarily UNISWAP and the UNI token.

Last year, Uniswap averaged $1.5 billion (per day) in transactions alone.

Due to this growth, investors are eager to jump aboard this crypto-gravy train; you might want to do the same.

But remember that Uniswap is a crypto asset, and it is volatile. And recently, it has drawn the ire of some regulatory bodies who have put some transactions under scrutiny.

High Total Value Locked Value but Bearish PA

Even though Uniswap is gaining some mass adoption, its price has been in a bear cycle. This is debatably not something to be alarmed about as corrections in crypto are standard, especially in altcoins.

Now could be a good time to buy UNI tokens as the current total value locked (TVL) is $8,097,263,894. This valuation makes it one of the most significant DeFi projects.

By the end of 2022, market gurus speculate that Uniswap will cross $1 trillion in total transaction volume.

Uniswap Price

The Uniswap price today is ranging from $8 – $12 and the trading volume in a typical 24 hours period can exceed $240 million. The circulating supply of UNI tokens today is 690 million and the market cap $5.6 billion.

At its peak, the price of Uniswap reached $45 in March 2021. Since then, it has been in a bear market, retracing around 80% of its bull market gains – although that is standard even for the best altcoins.

Uniswap has been in a sideways trading range and bear cycle so far in 2022. It opened 2022 at a price of $17, and the current 2022 high is $19.87.

Since February however it appears to have found a bottom at $7.50 and began to move up, in March it closed the first green monthly candle since October 2021.

Uniswap Price Prediction

Usually a well-known asset being down 80% after four red monthly candles would be a good time to buy, and the UNI price did move up in March 2022. Over the remainder of 2022 it would make sense if Uniswap retested the $13-$14 level which acted as strong support in mid 2021.

Uniswap has followed an interesting trajectory when it comes to price. The trends showed that prices were down, while the developer activity was up.

The price action now is a lot different to the Uniswap graph back in 2021 when it reached a $22.5 billion market cap and an ATH token price of $45, however behind the scenes the project has not been abandoned.

Uniswap price chart via Coinbase

Despite that recent trajectory, many are bullish about Uniswap’s performance in the short term. The trend has had a bullish uptick in March of this year – rising 37% in the latter two week of the month.

Coupled with the high buying volumes, it is safe to say that UNI tokens could have found a bottom at the 2022 lows of just over $7. The overall DeFi markets did undergo a correction in Q1 2022 although show signs of recovery now.

The Uniswap DEX native token has taken several steps to solve the issue of liquidity in the DeFi ecosystem. These initiatives and other updates in its roadmap will continue to fuel its value.

Best Ways to Buy Uniswap Token

To buy Uniswap, you have many options before you. But choose your preferred method carefully, for what is convenient might be pricey, and vice versa.

Using the best crypto trading platforms we have reviewed, you can leverage the following methods to invest in UNI tokens.

Buy Uniswap with Debit or Credit Card

Buying Uniswap with a conventional debit card or debit card is possible thanks to platforms like eToro. The process is simple, and all it takes is choosing any debit or credit card and making the payment.

Be careful about the platform you choose. Crypto.com offers the same utilities as eToro as far as the payment methods go, but the transaction fee is high. On crypto, you must pay a 2.99% transaction fee for using a debit card to invest. On the other hand, choosing eToro allows you to invest free of charge as long as you use US-based debit/credit cards.

Buy Uniswap with PayPal

If you don’t want to deal with the hassle of attaching your card details and waiting for bank transfers to complete the transaction, you can opt for PayPal payment instead. The process is simple, and all it takes is inputting your PayPal details and letting the automated eToro system take it from there. As the process is fast, you’ll instantly populate your wallet with UNI tokens.

Buy Uniswap without KYC

Even though Uniswap coin is a governance token of a decentralized platform, you still need a centralized portal – like eToro – to purchase it unless you’re confident enough to use Uniswap DEX. In the long run, holding crypto on a regulated centralized platform can be safer for beginners.

Best Uniswap Wallet

After learning how to buy Uniswap coins, think about how you must store them. Private-key-enabled wallets are suitable for crypto assets, and these wallets are downloadable as mobile apps or desktop software. The leading wallet providers to watch out for are Solflare Wallet, Crypto Wallet and Sollet wallet. In addition to giving you security, they allow you exclusive access to provide keys.

But they are not enough. Your crypto investment needs stringent security measures implemented so that they don’t hamper your interactivity with your tokens. That’s where the eToro Money crypto wallet is useful.

Free to use and available on iOS and Android phones, the eToro wallet was designed keeping beginners in mind. Thus, missing private keys won’t be an issue because the eToro wallet would save them.

How to Buy Uniswap Token – Complete Tutorial

Now we’ve reviewed where to buy Uniswap coin safely, below is step by step guide on how to do so:

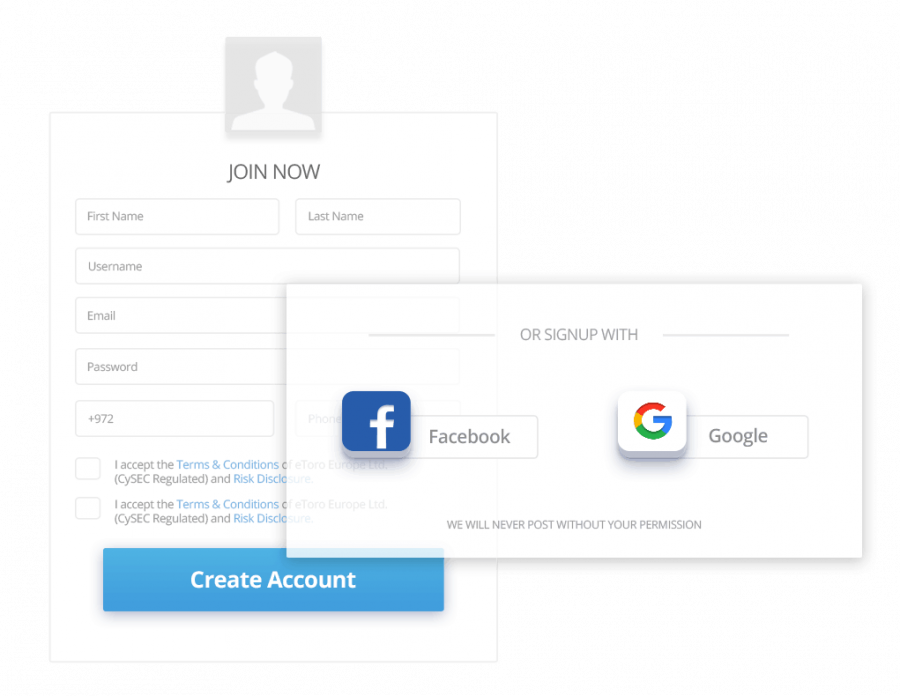

Step 1: Open a Crypto Account on eToro

First, visit the official eToro website and start the registration process. Enter your email address and name.

Don’t be apprehensive about giving away your details. eToro takes stringent security steps to keep the details safe.

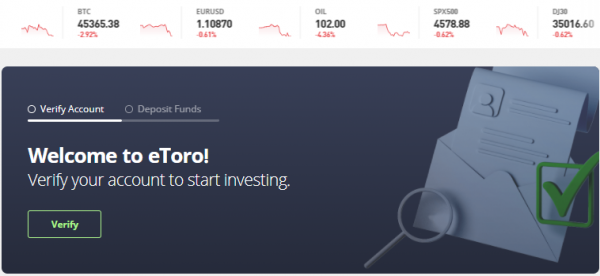

Step 2: Upload KYC Documents

You can’t proceed with your investment if the SEC-regulated trading platform – eToro – doesn’t recognize you as genuine individual investor. After entering your details, provide a government-issued ID and residential proof – this is an anti-money laundering regulation.

The procedure is quite simple and won’t take more than two minutes. Submit a copy of the government ID, and upload utility bills as residential proof.

Step 3: Deposit Funds

You need at least $10 to invest in Uniswap on eToro. Use any method you prefer to make that minimum deposit. The options are bank cards, bank transfer, Skrill, Paypal and eWallets like Skrill and Neteller.

There is no transaction fee involved in eToro, as long as you pay in US dollars.

Step 4: Search for Uniswap

Once on the eToro dashboard, enter “UNI” on the search bar. When you see the option appear, select the “Trade” button. eToro will open a list of relevant markets to buy UNI.

Step 5: Buy UNI

With eToro, you can invest in crypto assets using fiat currency but first-time investors first need to set it up. After completing the process, move the slider to indicate how much you’re willing to invest, and then press the “Open Trade” button to buy your UNI token.

Cryptoassets are a highly volatile unregulated investment product.

How to Sell Uniswap

With eToro, you can sell back your Uniswap and exchange it for fiat money using a simple process.

The process has the same low fees. All you need to do is go to the portfolio section and place your order to sell Uniswap for USD. Or you can open a second account on Crypto.com, transfer your tokens from eToro to it then sell them for USDT (Tether).

Selling into USDT and similar stablecoins allows you to protect your capital during bearish market conditions as they are pegged to the value of the US dollar.

Conclusion

Uniswap has pioneered the concept of decentralization. As the first DEX to become popular in the decentralized finance (DeFi) space, Uniswap is continually breaking new ground with its updates. Coinmarketcap ranks it at #27 in terms of market capitalization – one of the most valuable cryptos.

In terms of where to buy Uniswap tokens securely, eToro is the most regulated and safe crypto platform. It’s open to the United States and most of the world.

eToro also offers beginners simple ways to invest in Uniswap alongside other DeFi coins with its DeFi portfolio, and Copy Trader feature.

#cryptocurrency #cryptocurrencynews #cryptocurrencytrading #cryptocurrencyexchange #cryptocurrencymining #cryptocurrencymarket #cryptocurrencycommunity #cryptocurrencys #cryptocurrencyinvestments #cryptocurrencyinviestments #cryptocurrencyeducation #cryptocurrencyrevolution #allsortofcryptocurrency #cryptocurrencytop10 #cryptocurrency_news #instacryptocurrency #cryptocurrencymemes #investincryptocurrency #cryptocurrencyinvestment #cryptocurrencyisthefuture #cryptocurrencyinvesting #newcryptocurrency #cryptocurrencylife #cryptocurrencytrade #cryptocurrencylifeinvest #cryptocurrencymillionaire #cryptocurrencytrader #cryptocurrency_updates #tradingcryptocurrency #cryptocurrencysignals #cryptocurrencytradingplatform #cryptocurrencysolution #cryptocurrencytraders #cryptocurrency_for_dummies #cryptocurrencymalaysia #cryptocurrencytakingover #cryptocurrencybali #cryptocurrencyinvestors #cryptocurrencyindex #cryptocurrencyattorney