In short, stated income loans allow borrowers to simply state their monthly income on a mortgage application instead of verifying the actual amount by furnishing pay stubs and/or tax returns.

This simplified method was originally intended for self-employed borrowers with complicated tax schedules.

It became widespread in the lead-up to the financial crisis, often because borrowers found it that much easier to qualify for a loan by stating their income.

For that reason, stated income loans are also occasionally referred to as “liar’s loans” because it is suspected that many borrowers fudge the numbers in order to qualify for a home loan. Back to that in a minute.

How Does a Stated Income Loan Work?

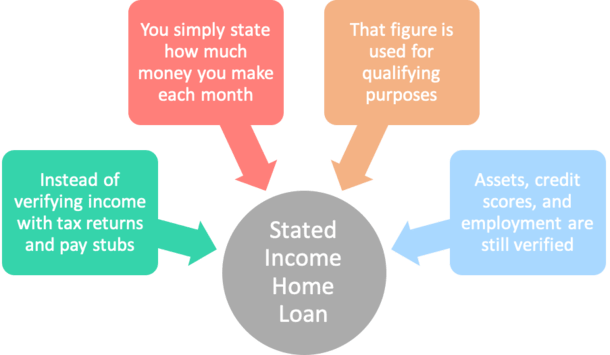

- Instead of documenting and verifying your income when obtaining a home loan

- By providing the lender with IRS tax returns and employment pay stubs

- A gross monthly income figure is simply inputted on the home loan application

- And not actually verified by anyone!

Prior to the housing crisis in the early 2000s, it was very common to use stated income to qualify for a mortgage loan.

Instead of providing tax returns and pay stubs from your employer, you could verbally state your gross monthly income and that is what would be used for qualification.

Clearly this was a high-risk approach to home loan lending, which is why it’s basically a thing of the past. However, there are new versions of stated income lending, which I’ll discuss below.

A Mortgage Doc Type for Every Situation

To get a better understanding of what a stated income loan is, it may help to learn about the many different mortgage documentation types available. There are actually several types of stated loans these days.

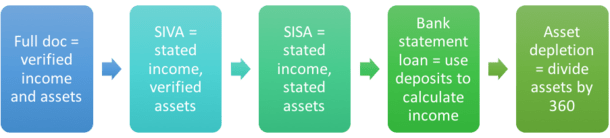

A full documentation loan requires that you verify income with tax returns and/or pay stubs and also verify assets by providing bank statements or similar asset documentation.

That’s just listed here for comparison sake; it’s not a stated income loan. It’s the typical way a mortgage borrower is underwritten.

A SIVA loan, or stated income/verified asset loan, allows you to state your monthly gross income on the loan application and requires you to verify your assets by furnishing bank statements or a similar asset document.

By state, I mean just inputting a gross monthly income figure on the loan application.

A SISA loan, or stated income/stated asset loan, allows you to state both your monthly gross income and your assets.

In this case, both items are simply stated, and the bank or lender will not ask you to verify the information.

In all these examples, a debt-to-income ratio will be generated because income figures are provided, even if it isn’t actually verified.

In cases where a borrower doesn’t even fill in the income box on the loan application, it is referred to as a no doc loan. See that page for more details.

Bank Statement Loans and Asset Qualification

- True stated income loans are rare these days

- Most lenders now require verified assets at a minimum

- Including bank statements, retirement accounts, etc.

- Meaning you may need to be asset-rich to qualify for a mortgage if your income won’t suffice

Nowadays, it’s a little more complicated. There are new methods of stating income post-mortgage crisis such as “alternative-income verification loans” and “bank statement loans.”

Bank Statement Loans

- Lender will ask for 12-24 months of bank statements

- And calculate your monthly income using deposit history

- Averaged over that time period

- To come up with qualifying income

Instead of simply stating what you make, the lender will ask for at least 12 months of bank statements, maybe 24, to determine your income. These can be personal bank statements, business bank statements, or both.

They will then calculate your monthly income by averaging those deposits over the accompanying 12- or 24-month period.

If you’re a self-employed borrower, you may also be asked to provide a Profit and Loss Statement (P&L) that substantiates the deposits.

Again, everything needs to make sense, and any large deposits will be flagged and require explanation.

In other words, taking out a loan or having someone make deposits into your bank account will likely be noticed/scrutinized by the underwriter.

Asset Qualification

- Lender adds up all your assets

- Subtracts your proposed loan amount from that number

- Then tallies up all your liabilities and multiplies them by X months

- If your remaining assets exceed your liabilities you may be approved

There is also a way of qualifying for a mortgage using just your assets, with no requirement to disclose income or employment.

This method requires borrowers to have a lot of liquid assets.

The lender usually adds up all your assets (checking, savings, stocks, bonds, 401k, etc.) and subtracts the proposed loan amount and closing costs.

Then they total up all your monthly liabilities, such as credit card debt, auto loans, etc. and taxes and insurance on the subject property and multiply it by a certain number of months.

Let’s assume a $400,000 loan amount and $800,000 in verifiable assets. And pretend our borrower owes $3,000 a month for their car lease, credit cards, and taxes/insurance.

They’ll multiply that total by say 60 (months) and come up with $180,000.

Since our borrower has more than $180,000 in verified assets remaining after the loan amount is deducted, they can qualify for the mortgage using this method.

Note that reserves to cover 2+ months of mortgage payments and closing costs will also usually be required.

Asset Depletion

- Lender adds up all your assets

- Then divides that total by 360 (months)

- Which is the length of most mortgages

- To come up with your qualifying monthly income

Then there’s so-called “asset depletion,” which again favors the asset-rich, income-poor borrower. These types of loans are actually backed by Fannie Mae and Freddie Mac and are calculated a bit differently.

Generally, the lender will take all your verifiable assets and divide them by 360, which is the typical 30-year term of a mortgage represented in months.

These assets may be assigned a 100% value if cash, and perhaps 70% if they are retirement funds and you are below retirement age. Once tallied up, the figure is divided by 360 and that is your qualifying monthly income.

For example, if you have $1,000,000 in cash and $750,000 in retirement, you’d have a total of $1,525,000 ($1m + $525k).

We then divide $1,525,000 by 360 and come up with around $4,250 per month in income. As you can see, a very asset-rich borrower can’t get very far using this method.

However, the lender may be able to add other income such as Social Security, pension, etc. to stretch the numbers a bit further, or use a shorter term, such as 180 months if it’s a 15-year fixed.

This type of loan might be well-suited for a retired high-net worth individual.

Employment and Credit Still Verified on a Stated Loan

- Even if stated income is permitted to qualify

- You’ll probably still need to verify your employment

- And document your assets (bank statements, retirement accounts, etc.)

- Your credit report will also be pulled to ensure you pay your bills on time

In some of the cases above, the bank or lender will verify your employment by calling your employer, or request a CPA letter or business license if you are self-employed.

If you’re retired, they obviously won’t, but they’ll still want to verify any retirement income you take in.

This is important because your job title will determine what you can reasonably state in the way of gross monthly income.

If you’re a doctor, it’d be normal to state that you make $50,000 a month. But if you’re a kindergarten teacher, underwriters won’t believe that you’re making $10,000 a month.

It’s just not likely, nor does it make sense for the position. And for this reason, many loans that “overstate” income will subsequently be declined.

It’s actually quite common to see a mortgage declined on the basis that the income does not match the job title/description, or seems too high for the related position.

And if you’re curious where underwriters determine how much a certain occupation should earn, check out Salary.com. That’s where many are instructed to pull the numbers to see if it adds up.

Another “setback” to a stated income loan is that a bank or lender can ask that you fill out an IRS Form 4506-T, which basically authorizes the lender to request your tax returns from the IRS for the previous two years.

Although it’s not common for them to actually look up your returns, it can be enough to deter a would-be “liar” from overstating their income.

It’s most common for a lender to pull a 4506 only if you become delinquent on the loan in a short period of time.

But if they do pull a 4506 and find that you indeed overstated income, you could be face some steep consequences, so take caution.

Additionally, a mortgage lender will still pull your credit report to determine if you’re a sound borrower.

Since they’re taking more risk by extending financing without verified income, they have to pay close attention to what they can verify.

If you are seeking a stated income mortgage, it’s imperative that you have good credit to obtain a favorable mortgage rate.

Sure, you might be able to get approved with a 620 score, but you’ll pay more as a result.

Stated Income Mortgage Rates Are Higher

- If you choose to state your income as opposed to verifying it

- Expect a higher mortgage interest rate, all else being equal

- And a lower max LTV (or higher minimum down payment)

- To account for increased risk of the unknown…

If you do choose to state your income, you must pay a premium because you’re putting more uncertainty and risk in the hands of the lender and subsequent buyer of the loan if sold on the secondary market.

For this reason, mortgage interest rates on stated income loans are often .25% to .50% higher than a full doc loan.

Of course, it depends on all the loan details. It might be possible for someone to state their income and get a lower rate than someone going full doc if they have better credit, and/or a larger down payment.

Conversely, someone with poor credit requesting a reduced doc loan might get a mortgage rate several percentage points higher than the typical, going rate. It can get expensive fast.

Related to that, you may also find that you’ll have to put down a larger down payment or sport a higher credit score to obtain the financing you need when going the stated or asset-verification route.

Again, this becomes an issue of layered risk, and because you chose to state your income, the lender may limit risk in other departments such as credit and down payment.

In closing, after some years of intense credit tightening, there are now plenty of options for those who may have trouble qualifying for a mortgage using traditional income.

However, you’ll often pay the price for this convenience in the form of a higher mortgage rate and/or be forced to come to the table with a larger down payment, more reserves, and more scrutiny. So be prepared.