There is often a misconception that in order to trade forex successfully, traders must possess high-level skills in technical analysis.

However, through the use of a managed forex account, investors can sit back and allow an experienced currency trader to do the hard work for them.

In this guide, we compare the best forex managed accounts in the market today for fees, minimum deposits, past performance, withdrawal terms, and more.

The Best Forex Managed Accounts in 2022 List

Our market research found that the best forex managed account providers in 2022 are those listed below:

- eToro – Great Alternative to Managed Forex Accounts via Copy Trading

- Capital.com – Access Managed Trading Accounts via MT4 Signals

- Alpari – Managed Forex Account Offering PAMMs

![]()

Your capital is at risk. 78% of retail investor accounts lose money when trading CFDs with this provider

Top Forex Managed Accounts Reviewed

When compiling our list of the best forex managed account providers, we explore a range of important factors surrounding previous trading performance, fees, and withdrawal terms.

This is in addition to the reputation of the provider, supported pairs, and customer service.

Read on to make an informed decision on the best forex managed account in the market today.

1. eToro – Great Alternative to Managed Forex Accounts via Copy Trading

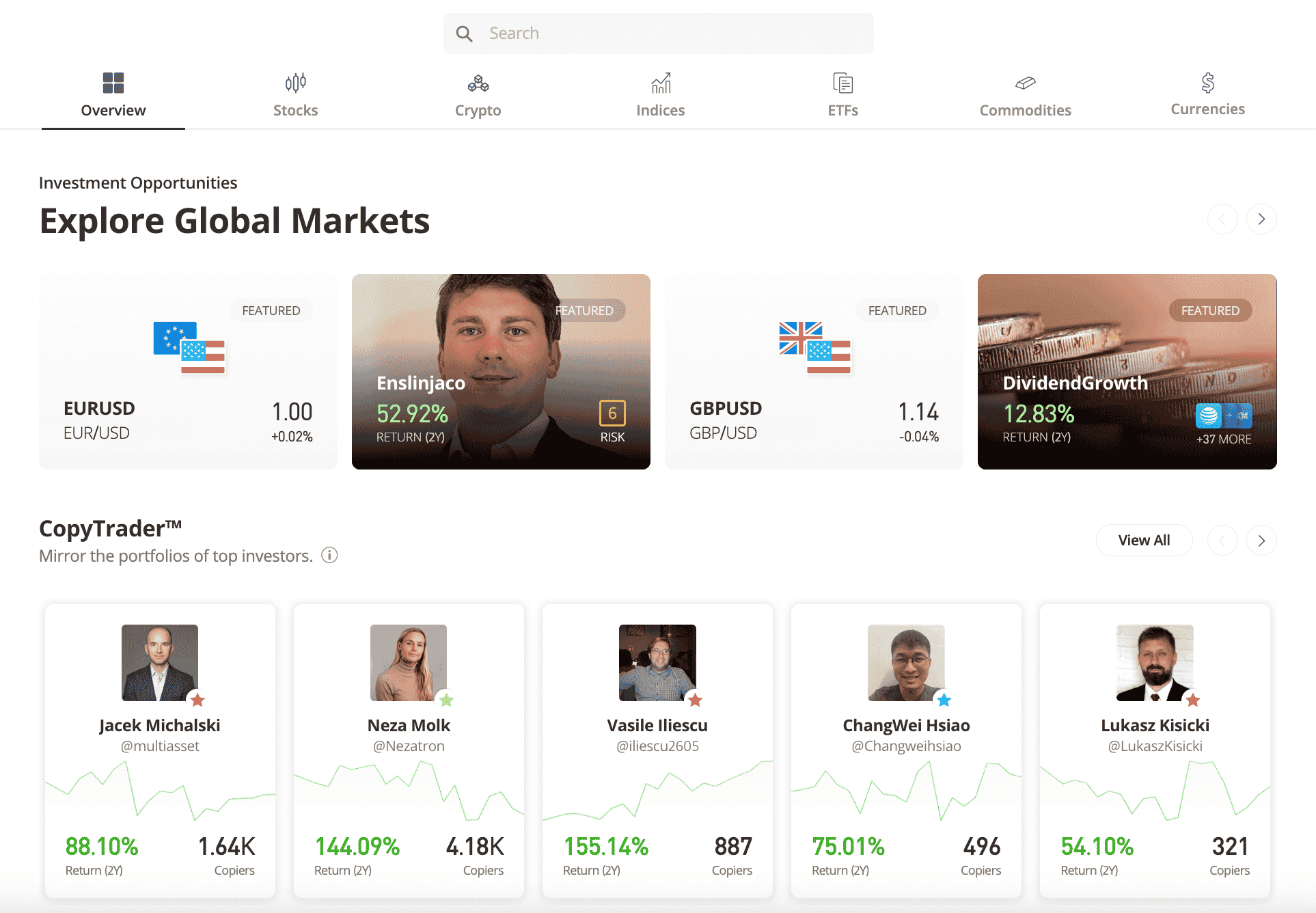

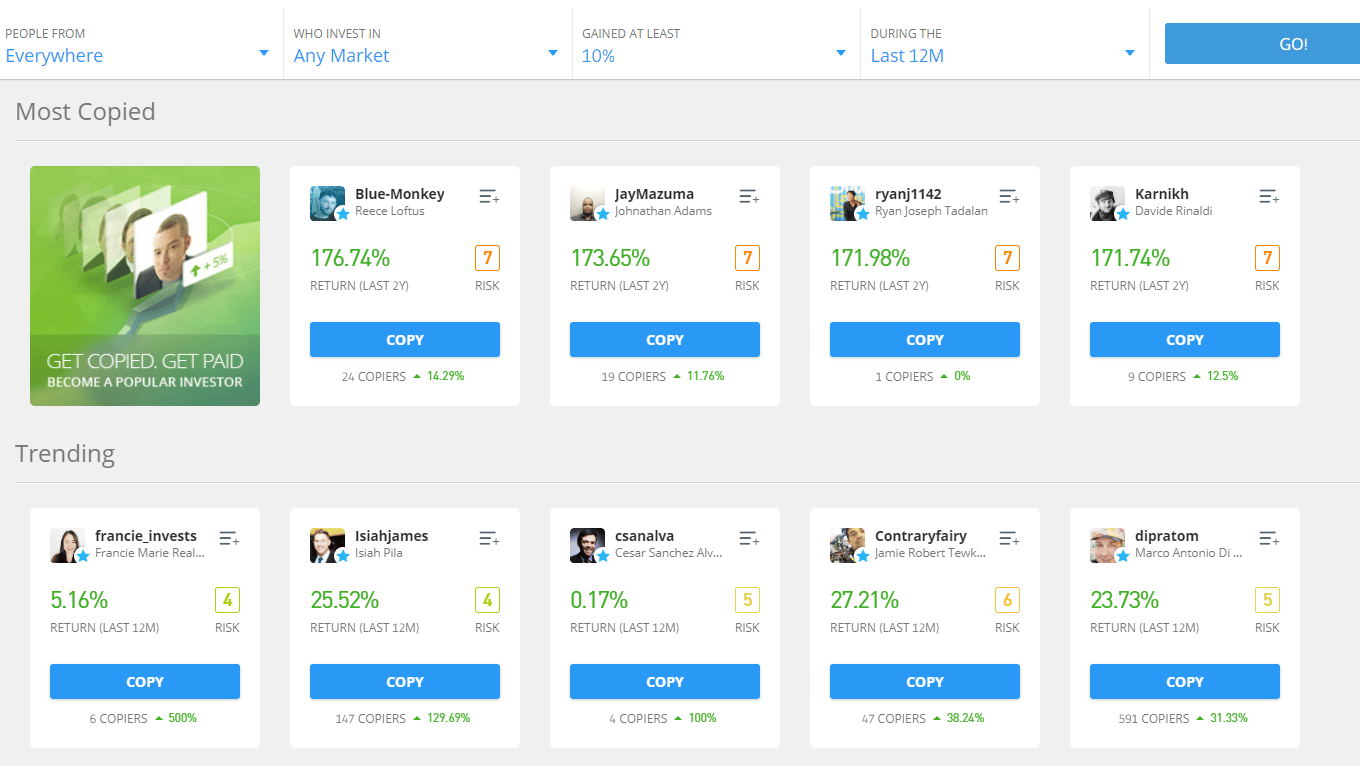

Technically speaking, eToro does not offer a managed forex account per se. It does, however, offer a regulated Copy Trading service that for all intents and purposes, provides the same structure as a managed account. With that said, the eToro Copy Trading tool comes with a wide range of benefits that in many ways, cannot be rivaled.

First and foremost, investors will have access to thousands of verified eToro traders to choose from – many of which specialize exclusively in forex. eToro offers a full breakdown of all key statistics concerning the trader, such as their average monthly return, maximum drawdown, risk level, average trade duration, preferred market, and more. Talking of risk, eToro has a wide range of tools and options geared towards risk management in forex.

This means that investors can really dig deep before choosing a trader to copy. After a selection has been made, eToro only requires a minimum investment of $200 for each forex trader that is copied. Thereon, all future positions that the forex trader enters and exits will be mirrored in the user’s eToro account.

Stakes are, however, entered automatically on a proportionate basis. For example, let’s say that the investor allocates $500 to a forex trader, who subsequently risks 5% of their capital on a USD/CAD position. Via the Copy Trading service, this position will be added to the user’s eToro portfolio at a stake of $25 (5% of $500).

Unlike conventional managed forex accounts, eToro offers full flexibility over the Copy Trading portfolio. This means that investors can add or remove assets at any time. Moreover, there is no minimum redemption period, so investors can stop copying a forex trader whenever they wish – without paying a penalty fee.

While we are on the discussion on fees, there are no commission-sharing agreements when opting for the eToro Copy Trading tool. This is in stark contrast to traditional managed accounts, which typically charge fees on two fronts. This is often an annual fee and a share of any profits generated.

At eToro, forex traders that have signed up for the Copy Trading program earn commissions from the broker itself, based on the amount of money allocated to the individual. Copy Trading, therefore, will see the investor indirectly pay standard fees as if they were investing on a DIY basis.

In the case of eToro, forex is traded on a spread-only basis at eToro. Another fee to be aware of is overnight financing, which is charged on leveraged positions kept open past standard trading hours. In terms of safety, eToro is a regulated brokerage firm with licenses issued by the SEC, FCA, ASIC, and CySEC. Its trading platform is used by more than 25 million people worldwide.

eToro accounts can be opened seamlessly and verification rarely takes more than 1-2 minutes. The minimum deposit starts at $10, albeit, as noted above, $200 or more is required for the Copy Trading service. When making a deposit in US dollars, there are no fees to pay. Payments can be made via a bank wire, debit/credit card, or a range of supported e-wallets.

We should also make reference to the Smart Portfolio service offered by eToro. This offers a professionally managed portfolio across dozens of strategies. This does, however, only focus on stocks and crypto – so forex is not supported. Nonetheless, this offers a way to diversify some investment capital away from currency exchange movements.

| Service | Forex copy trading |

| Fees | No additional fees or profit sharing |

| Withdrawals | No restrictions – un-copy at any time |

| Minimum investment | $200 |

| Minimum withdrawal | $5 |

What we like

- Great alternative to managed forex accounts

- Regulated by the SEC, FCA, ASIC, and CySEC

- Minimum investment of $200 per trader

- No redemption period – withdraw funds at any time

- No additional fees or commission-sharing agreements

- Access to the best forex pairs to trade in 2022

- Also supports also assets – including stocks, crypto, commodities, and more

Visit eToro Now

2. Capital.com – Access Managed Trading Accounts via MT4 Signals

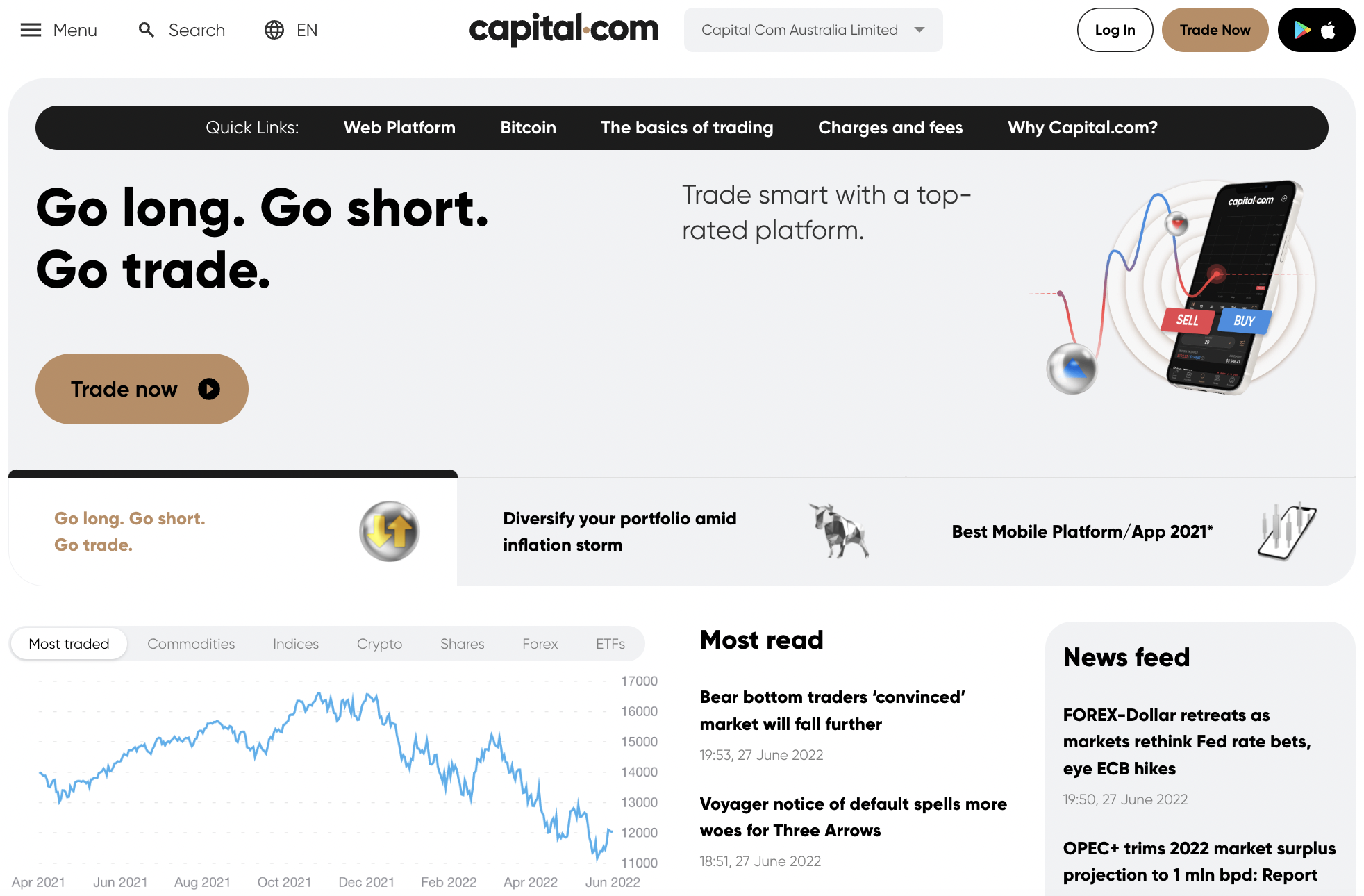

![]() Another great alternative to consider when searching for the best forex managed accounts is Capital.com. This provider is primary a CFD trading platform that is home to over 130 forex markets in addition to thousands of stocks, ETFs, commodities, and crypto assets.

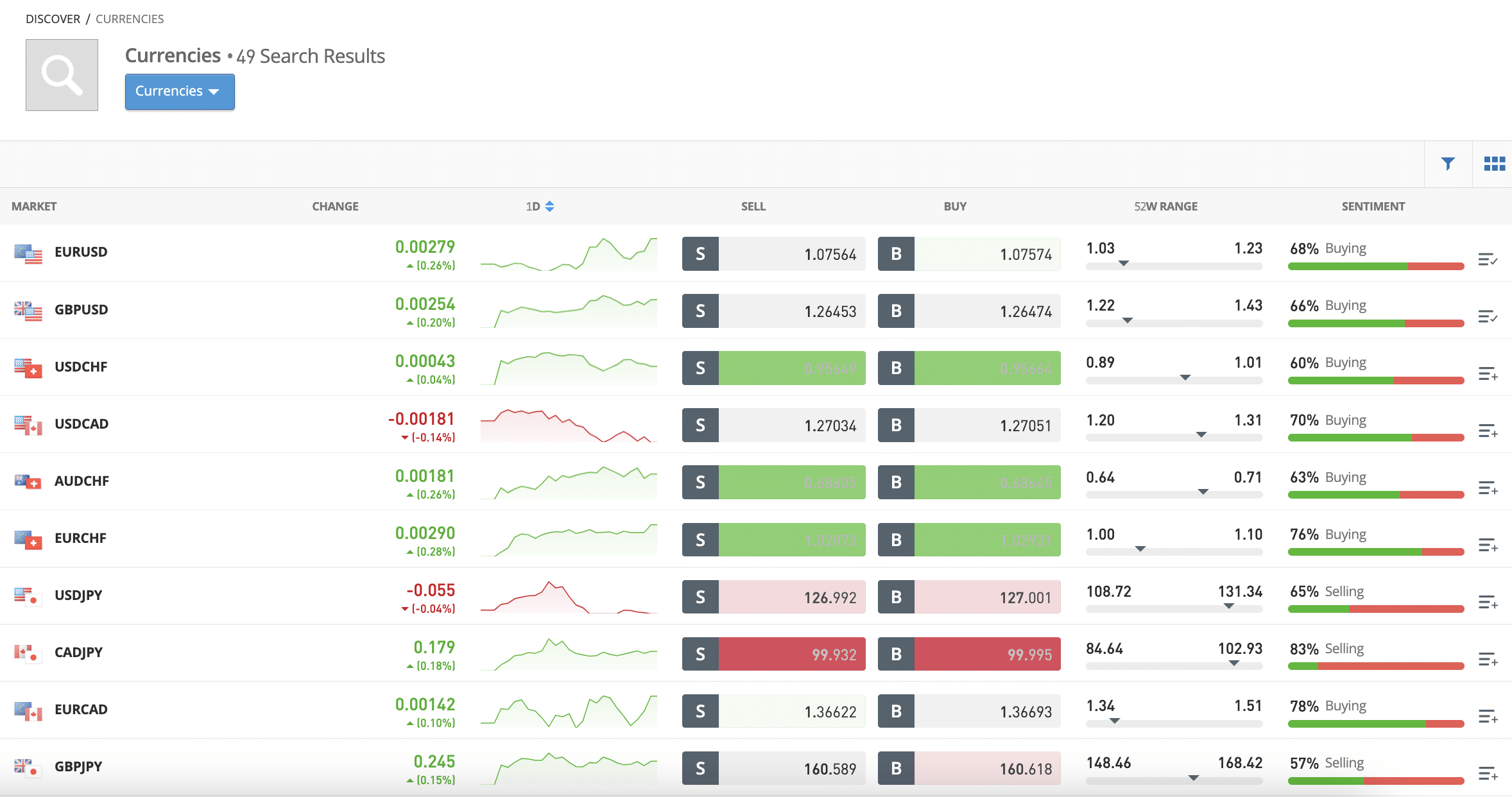

Another great alternative to consider when searching for the best forex managed accounts is Capital.com. This provider is primary a CFD trading platform that is home to over 130 forex markets in addition to thousands of stocks, ETFs, commodities, and crypto assets.

With that said, Capital.com is also one of the best MT4 brokers. This means that passive investors can select a suitable MT4 signal to copy, and then link their account to Capital.com to benefit from a range of perks. This includes the ability to trade on a commission-free basis across all markets and access leverage.

MT4 offers a huge selection of forex trading signals that can be implemented passively, some of which offer superb historical returns. The very best signals on offer come with a fee of between $30-$70. MT4 offers a wealth of statistics related to each signal, which ensures that investors can make an informed decision.

To get the ball rolling, traders can open a Capital.com account from $20 when making a deposit via a debit/credit card or e-wallet ($250 on bank wires). There are no fees to open an account, deposit/withdraw funds, or connect to MT4. Risk-management tools can be deployed on the MT4 signal, which will subsequently be replicated on the Capital.com account.

| Service | MT4 signals |

| Fees | Average fee of $30-$70 for top MT4 signal providers. 0% commission trading on Capital.com. |

| Withdrawals | No restrictions – stop copying and withdraw funds at anytime |

| Minimum investment | 0.01 lot minimum forex trade size |

| Minimum withdrawal | $50, or the full balance if remaining funds are below this level |

- Copy successful forex strategies via MT4 signals

- Connect MT4 to Capital.com for 0% commission trading

- No restrictions of withdrawals

Visit Capital.com Now

Your capital is at risk. 80.61% of retail investor accounts lose money when trading CFDs with this provider.

3. Alpari – Managed Forex Account Offering PAMMs

Those in the market for the best forex managed account might also consider Alpari. This forex broker offers percentage allocation management module accounts – or simply a PAMM. For those unaware, PAMM accounts utilize a split capital allocation model.

Those in the market for the best forex managed account might also consider Alpari. This forex broker offers percentage allocation management module accounts – or simply a PAMM. For those unaware, PAMM accounts utilize a split capital allocation model.

For example, 70% of the forex trader’s capital might be self-funded, while the balance is provided by investors. At Alpari, investors will have a variety of forex traders to choose from. In fact, the platform is home to more than 1,800+ individual forex traders that have signed up for the PAMM program.

An informed decision can be made when selecting a PAMM account by exploring the historical performance of the trader. As is the case with most managed forex accounts that utilize a PAMM structure, both profits and losses are split between the trader and investors. At Alpari, there is also a profit-sharing commission of 20% to take into account.

This is, however, only on the proviso that the trader has a profitable month.

| Service | Forex PAMM accounts |

| Fees | 20% profit-sharing agreement |

| Withdrawals | Redemption period depends on the chosen PAMM |

| Minimum investment | Set by the PAMM forex account manager |

| Minimum withdrawal | Not stated |

What we like

- Forex trading managed accounts utilizing the PAMM model

- More than 1,800 traders to choose from

- A completely passive way to trade forex

Best Forex Managed Accounts Compared

For a comparison of the best forex manage account providers discussed above, refer to the comparison table below:

| Forex Brokers | Service | Fees | Withdrawals | Min Investment | Min Withdrawal |

| eToro | Forex copy trading | No additional fees or profit sharing | No restrictions - un-copy at any time | $200 | $5 |

| Capital.com | MT4 signals | Average fee of $30-$70 for top MT4 signal providers. 0% commission trading on Capital.com. | No restrictions - stop copying and withdraw funds at anytime | 0.01 lot minimum forex trade size | $50, or the full balance if remaining funds are below this level |

| Alpari | Forex PAMM accounts | 20% profit-sharing agreement | Redemption period depends on the chosen PAMM | Set by the PAMM manager | Not stated |

What is a Managed Forex Account?

Managed forex accounts enable investors to automate the trading process. This means that investors are not required to personally research or analyze forex trends or place any orders. On the contrary, the forex trading process is managed on behalf of investors.

Traditionally, managed forex trading accounts were offered in the form of a PAMM or MAM (Multi-Account Manager). Both account types offer a way for investors to allocate funds to an experienced trader that will subsequently enter buy and sell positions with their own capital. The investor would then have direct exposure to any profits (or losses) made by the trader.

However, both PAMMs and MAMs have slowly but surely been fazed out by forex brokers. Instead, the shift appears to be moving in the favor of copy trading platforms. As we noted earlier in our eToro review, Copy Trading follows the same concept as managed forex accounts. The key difference is that trades are copied via a brokerage account at a proportionate level.

From the perspective of the investor, this means lower investment requirements, more flexibility, and virtually no restrictions on withdrawals. Furthermore, unlike conventional forex managed accounts, Copy Trading alternatives oftentimes do not charge commission-sharing fees.

Benefits of Using a Forex Managed Account

The best managed accounts for forex - whether that's in the form of PAMMs, MAMs, or Copy Trading, offer a full host of benefits that might appeal to both newbies and experienced traders.

This includes:

No Experience Needed

Perhaps the clearest benefit that the best forex managed account providers offer is that investors can begin trading currencies online for speculative purposes without needing to have any prior experience.

Contrary to what many so-called forex gurus say, this marketplace is more than complex.

The only way to make consistent profits is to have an understanding of how to read forex charts, which in itself requires advanced knowledge of technical and economic indicators. Becoming comfortable using forex indicators can take several years to achieve.

This is why managed forex accounts are increasingly popular with complete beginners. Behind the scenes, the chosen trader will perform technical analysis and subsequently enter buy and sell positions accordingly.

In turn, the investor will gain exposure to any positions entered and thus - have a stake in any profits made.

Passive Trading Experience

As noted above, the best forex managed accounts enable beginners to trade currencies in a completely passive nature. After all, once the investment is made, the chosen trader will take care of all research and order-placing processes.

With that said, managed forex accounts are not only suitable for beginners. On the contrary, those that have experience in trading currencies but little time to do so might find this passive investment model of interest.

Trade Around the Clock

There is only so many hours of the day that forex traders can dedicate to their craft. This is also the case when investing in a managed forex account, which is facilitated by a human trader.

However, bearing in mind that the best forex managed accounts offer small investment minimums, it is possible to trade around the clock by diversifying across several traders from multiple time zones.

This ensures that the investment funds are constantly being put to work.

Personal Trading Capital

There is often a misconception that managed forex accounts represent reckless trading principles. This is because there is a misunderstanding that traders only utilize capital allocated from investors.

However, this sentiment could not be further from the truth. The reason for this is that traders offering their forex managed account services will actually be entering positions with their own investment capital.

The managed forex account side of things is simply an extra revenue source for the trader, for instance, in terms of commission-sharing agreements.

What do You Need to Get a Managed Forex Account?

Historically, the best forex managed accounts in the market were offered in the form of PAMMs and MAMs.

Both account types typically required a larger upfront investment in addition to unfavorable commission-sharing agreements and drawn-out withdrawal restrictions.

However, as the industry has since made a sizable transition to Copy Trading services, access to this marketplace is now open to traders of all budgets. For example, if opting for the service offered by eToro, a minimum of just $200 per copied forex trader is required.

And, getting started rarely takes more than a few minutes. It's now just a case of opening an account, making a deposit with a debit/credit card or bank wire, choosing a trader to copy, and deciding on an investment sum.

Conclusion

Traditional managed forex accounts used to come in the shape of PAMMs and MAMs, alongside high minimum investment requirements and unfavorable profit-sharing terms.

Fast forward to 2022 and it is now possible to trade forex passively with a small amount of capital. At eToro, for example, the regulated platform offers a regulated Copy Trading tool that requires a minimum of just $200 to get started.

Moreover, no additional fees or commissions charged to utilize the Copy Trading tool, nor are there any restrictions on withdrawals.

#forextrader #trading #forextrading #money #forexsignals #cryptocurrency #trader #investment #crypto #forexlifestyle #investing #business #entrepreneur #invest #binaryoptions #blockchain #forexmarket #forexlife #stocks #success #daytrader #btc #bitcoinmining #investor #stockmarket #binary #fx #finance