The decentralised finance (DeFi) asset class has now grown into a more than $250 billion behemoth. The growth of this asset class is forecasted to rise exponentially over the next decade making now a very interesting time to invest in DeFi stocks.

In this ‘Best DeFi Stocks to Buy’ guide, we go through some of the most popular stocks to invest in that are set to capitalise on the growth of the DeFi sector.

Popular Defi Stocks to Watch in 2022

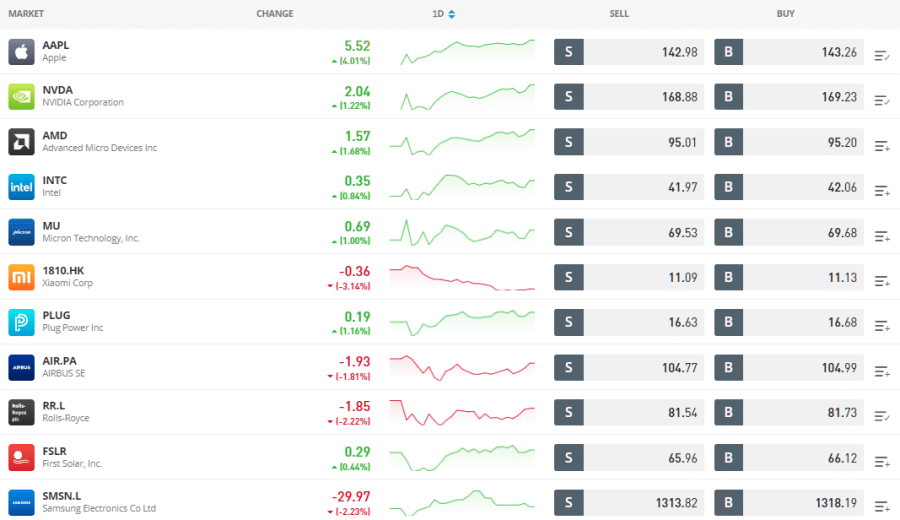

Below is a list of the most popular DeFi stocks. These are discussed in more detail further down this guide so you can find the most popular stocks for your portfolio.

- Battle Infinity – Best DeFi Cryptocurrency to Buy in 2022

- DeFi Coin – Overall Most Popular DeFi Investment for Pure Growth

- Block Inc – Most Popular DeFi Stock for Long Term Growth

- Coinbase – Most Popular DeFi Accessibility with Yields

- Riot Blockchain – High-Rated Bitcoin Miner Set to Benefit from DeFi

- IBM – High-Rated DeFi Stocks as DIA Migrates to IBM Cloud for Web3

- Canaan Inc – High-Rated Crypto Miner Set to Benefit from DeFi

- Meta Platforms – Registered 8 New Trademarks for Metaverse, Crypto & DeFi

- Mastercard – Investing Heavily in DeFi Space & Blockchain-Based Finance

- DeFi Portfolio – Ready Made Smart Portfolio Providing Exposure to DeFi Assets

- ProShares Bitcoin Strategy ETF – A Broader Investment into DeFi & Crypto

You can invest in nearly all of these DeFi stocks through the eToro platform with 0% commissions.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

A Closer Look at the Most Popular Defi Stocks

When it comes to choosing the most popular DeFi stocks it’s important to consider safety first and foremost. DeFi is a new and exciting sector but it is also still very young.

Therefore, choosing investments that can benefit from DeFi growth in the future but are also solid investments today is essential in building a safe and diversified portfolio.

Read on to learn more about the most popular DeFi stocks to watch.

1. Battle Infinity – Best DeFi Cryptocurrency in 2022

For users looking to invest in the DeFi space, we recommend Battle Infinity as a potential investment opportunity in 2022. Battle Infinity is a popular crypto asset and a decentralised gaming platform, that offers users a metaverse platform – Battle Arena. An alternative to DeFi stocks, the Battle Infinity cryptocurrency feature lets users earn rewards while participating in blockchain-based games.

Within the Battle Arena, users can participate in 6 different P2E games. For example, the IBAT Premier League is one such P2E game, which is also the world’s first decentralised-blockchain NFT-based sports fantasy game.

Another game is the Battle Swap. In this play to earn game, users earn IBAT tokens which can be converted into another currency using the Battle Swap DEX integrated into the game and all its battle arenas. IBAT tokens are the in-game crypto coins that act as a utility token for all Battle Infinity platforms. These tokens run on the Binance Smart Chain and are based on the BEP-20 protocol.

Users can earn IBAT rewards by participating in the various games, and even access the IBAT swap to exchange IBAT tokens with other cryptos. Additionally, the Battle Infinity platform offers staking opportunities with IBAT. Users can participate in solo staking activities to earn a potentially high APY, by locking up tokens in liquidity pools for a minimum period of 1 month.

Battle Infinity is gearing up to be one of the hottest DeFi tokens, as it plans to deploy NFT land sales and integrate land maps and battle arenas as part of its future roadmap. Users can stay up to date on the platform by accessing the Battle Infinity Telegram Group

Cryptoassets are a highly volatile unregulated investment product.

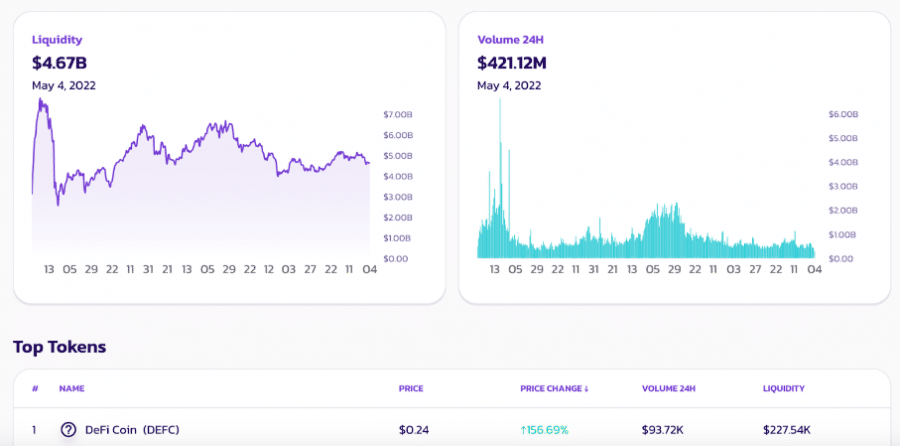

2. DeFi Coin – Overall Most Popular DeFi Investment for Pure Growth

If you are looking for pure investment growth from the DeFi sector, then buying DeFi Coin (DEFC) could be for you. Just like the IBAT token of Battle Infintiy, DeFi Coin is a cryptocurrency token that is set to directly benefit from the growth in the sector.

DeFi Coin is the native token of the DeFi Swap Decentralised Exchange (DEX). This exchange offers the ability to swap your crypto assets, stake them for high DeFi interest rates and access yield farming products.

Interestingly, the coin’s protocols also incentivise long-term holding and growth by providing ‘static rewards’ to its holders. This is possible through the 10% tax levied on any transactions of DeFi Coin. 50% of this is distributed back to the holders while the other 50% is put back into the liquidity pool.

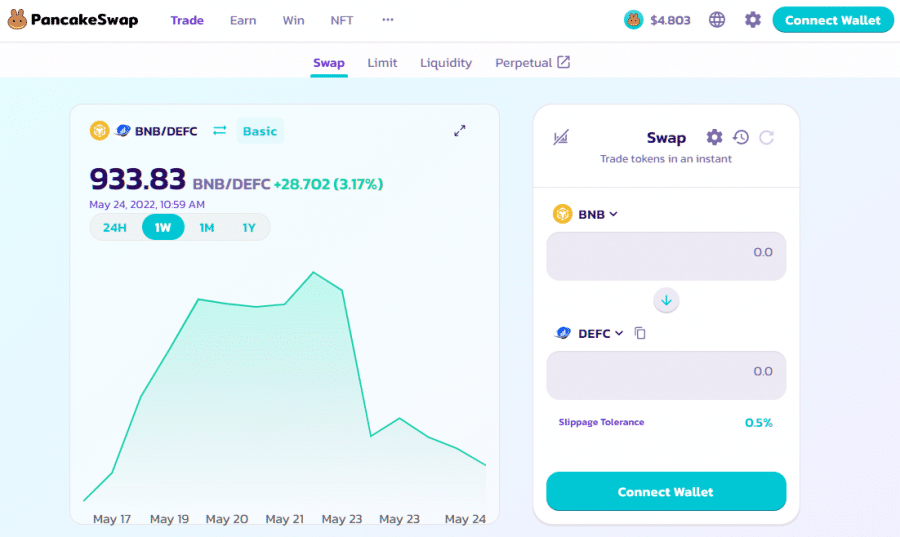

In early May, DeFi Coin was the main gainer on the Pancake Swap decentralised exchange highlighting the popularity of the coin which is already available on the Bitmart centralised exchange.

With plans for more centralised crypto exchange listings, DeFi Coin could surge back to its all-time high of $4.00 recorded in July 2021.

Cryptoassets are a highly volatile unregulated investment product.

3. Block Inc – Most Popular DeFi Stock for Long Term Growth

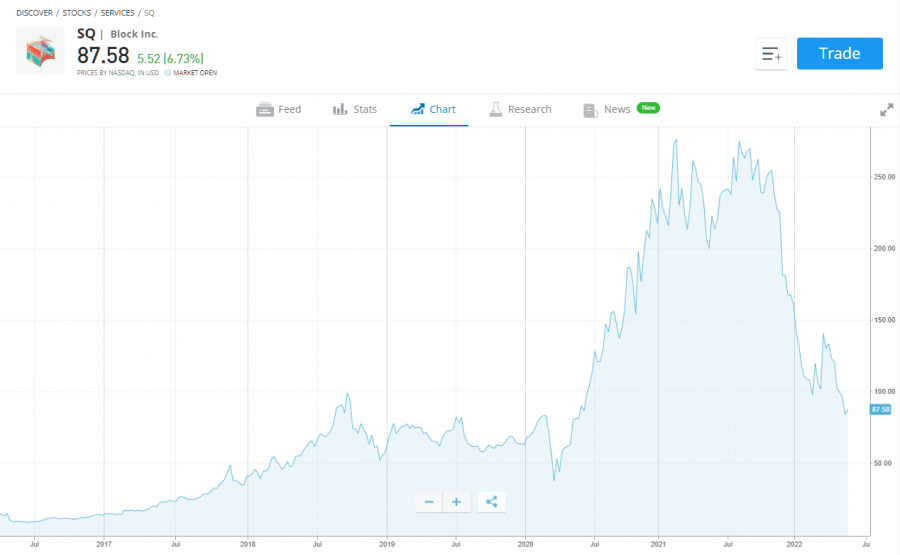

In December 2021, Block Inc changed its name from Square as a sign of intent of its cryptocurrency and blockchain ecosystem focus. The company is going all-in to try and capitalise on the decentralised finance (DeFi) growth.

It has already announced plans to use Intel’s new blockchain accelerator chip which supposedly provides a 1,000 times better performance than current graphic processor units used for cryptocurrency mining.

Block already has a ready-made product to turn into a DeFi giant through its Cash App. By shifting these transactions onto a decentralised public ledger, Block could become the leader in DeFi making it one of the most popular DeFi stocks to invest in.

Block’s share price has put in an impressive performance in recent years. Most notably from 2015 to late 2018 and from early 2020 to the middle of 2021. Since recording an all-time high at $289.23 in August 2021 the share price is down around 70%.

However, this sell-off has been in-line with the broader market stock market decline. But, it does provide a very interesting opportunity to buy stocks with multiple revenue streams from the crypto and DeFi space.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

4. Coinbase – Most Popular DeFi Accessibility with Yields

Coinbase is one of the most well-known cryptocurrency exchanges in the world with more than 73 million users. While users have mainly been limited to the buying, selling, transferring and storing of digital assets, in late 2021 the exchange announced plans to make DeFi more accessible to its users.

Now, the crypto exchange provides the ability to access the high yields offered by DeFi through their Dai tokens with no fees or lock up periods. Dai is a stablecoin that is pegged to the US dollar. Coinbase has made it easy to earn DeFi yield by depositing your Dai into Compound Finance which is a leading DeFi protocol to access interest rates between 2.83% and 5.39%.

While this is Coinbase’s first foray into the world of DeFi, it is already available to users in more than 70 countries. As it operates one of the world’s biggest cryptocurrency exchanges – and potentially the next biggest NFT marketplace – it is set to benefit the most from a rise in DeFi demand.

Coinbase’s share price has had a rocky ride since its initial public offering (IPO) in April 2021. Since the all-time high price of $429.00 – recorded on the day of its IPO – the stock is now down around 85% to record new all-time lows.

The share price has been hit by a decline in the cryptocurrency market and the stock market. However, it is only a matter of time before sentiment improves in both sectors which is where Coinbase’s share price will shine making it one of the most popular DeFi stocks to invest in.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

5. Riot Blockchain – High-Rated Bitcoin Miner Set to Benefit from DeFi

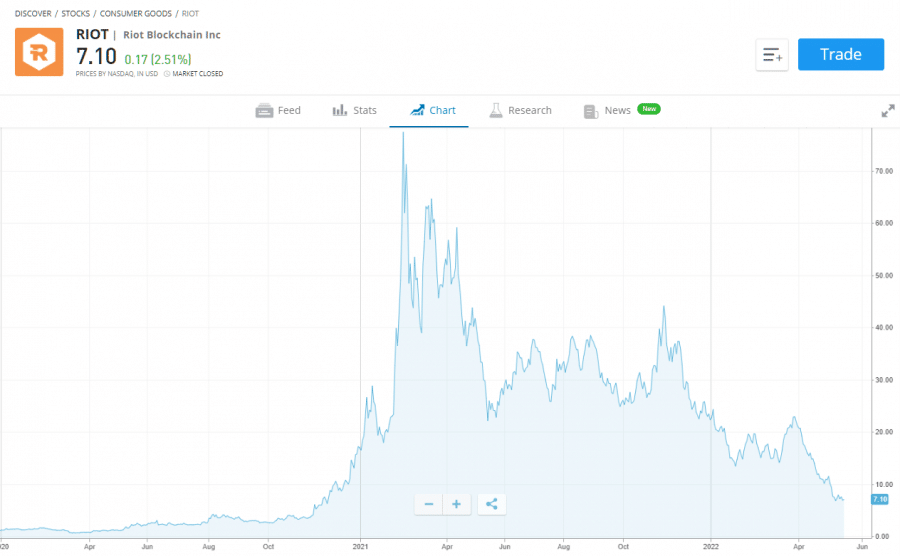

Riot Blockchain is a company well-known for its Bitcoin mining operation in the United States. As the DeFi sector grows, it’s likely transactions in some of the biggest and most well-known cryptocurrencies such as Bitcoin and the Ethereum blockchain will also grow.

One concern with Riot Blockchain is the fact that Bitcoin mining is seen as energy intensive and not climate-friendly. However, Riot recently bought a 300 megawatt facility in Texas which will give it the lowest Bitcoin mining price in the world, helping to lift its revenues.

Riot Blockchain’s share price has been extremely volatile in recent years. From 2019 to 2020 the share price stagnated and traded in a small price range. However, from October 2020 to February 2021, the share price surged more than 3,400% higher.

Since recording a new all-time high at $79.50 in February 2021, the share price is now down around 90%. This coincided with a 50% drop in the price of Bitcoin and a global stock market sell-off in early 2022.

However, with the share price so low it could represent an interesting opportunity for patient investors willing to risk a small amount for long-term gains. A break above the $23.00 price level would bring more confidence that buyers are regaining control.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

6. IBM – High-Rated DeFi Stocks as DIA Migrates to IBM Cloud for Web3

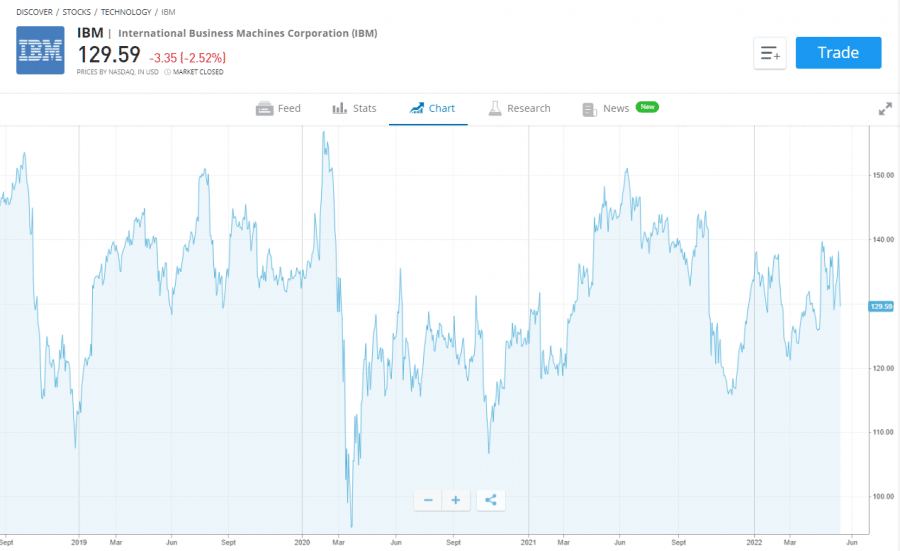

International Business Machines (IBM) has been rebranding itself as a leader in blockchain technology. Many Fortune 500 companies use the IBM Blockchain service. At the beginning of last year, DIA (Decentralised Information Asset) migrated its platform to IBM Cloud.

DIA is a cross-chain, end-to-end, open-source data and oracle platform for Web3. It is currently used in a wide range of DeFi applications such as to get information regarding DeFi’s lending and borrowing rates for a specific asset, as well as to get the most recent data for farming pool services.

The migration of the platform to the IBM Cloud is a big boost for IBM and its IBM Cloud Hyper Protect Service which manages how financial data is sourced, processed, stored and published which is key to running a successful DeFi protocol.

IBM’s share price has experienced many up and down swings in recent years and lacks an overall trend bias. However, the IBM stock price is currently up on the year while most other stocks are down, highlighting some underlying strength.

As the DeFi and blockchain technology space grow, IBM is set to benefit the most making it one of the most popular DeFi stocks.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

7. Canaan Inc – High-Rated Crypto Miner Set to Benefit from DeFi

Canaan Inc is another cryptocurrency mining stock similar to Riot Blockchain. The company is regarded as a supercomputing solutions provider and invented the first Bitcoin mining machine in 2013.

The company is headquartered in China but trades on the Nasdaq Stock Exchange through an ADR (American Depositary Receipt). As the DeFi protocols grow in popularity, they will allow users to do much more with the crypto assets they hold.

Bitcoin – being the largest cryptocurrency in the world – is likely to benefit from a rise in the adoption of DeFi protocols which also means that crypto miners like Canaan will benefit too.

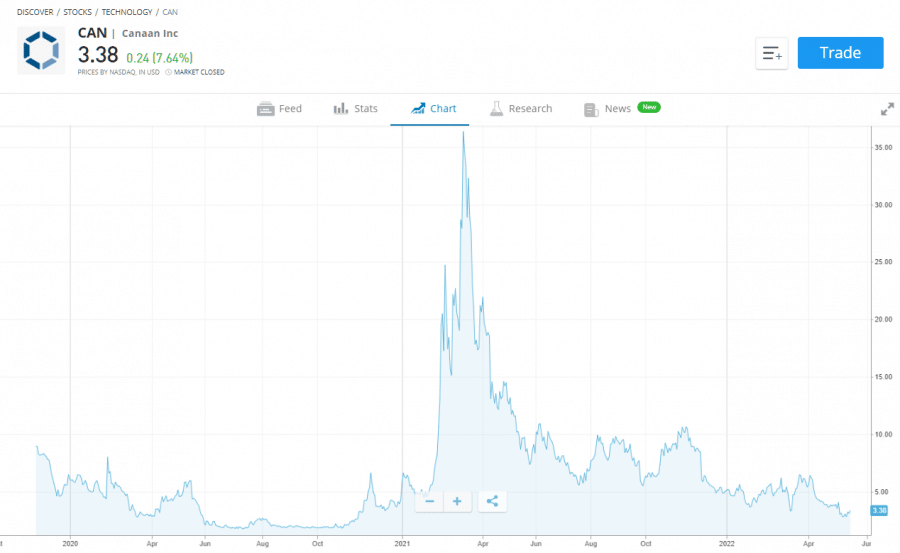

Canaan’s stock price remained in a tight price range from 2020 to 2021. From January to March 2021, the stock price surged more than 520% higher to a record high of $39.10. However, since then, the stock price has fallen more than 90% lower.

The combination of a cryptocurrency and stock market crash hurt most crypto mining stocks. But, this could represent a low-risk opportunity for long-term patient investors willing to take on more volatility.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

8. Meta Platforms – Registered 8 New Trademarks for Metaverse, Crypto & DeFi

In October 2021, Facebook changed its name to Meta Platforms highlighting its intent to focus on the metaverse – a new digital world. The shift in focus has some investors very excited as the metaverse is another key growth area such as DeFi applications.

Currently, Meta Platforms has eight new trademark applications pending that are due for approval in January 2023. These include trademarks related to the metaverse, cryptocurrency and decentralised finance (DeFi).

The current trademarks include applications for online networking services for cryptocurrency investing and to build hardware and software for crypto-related services and the metaverse. Meta has both capital and brainpower and is likely to become a leader in the metaverse, crypto and DeFi space.

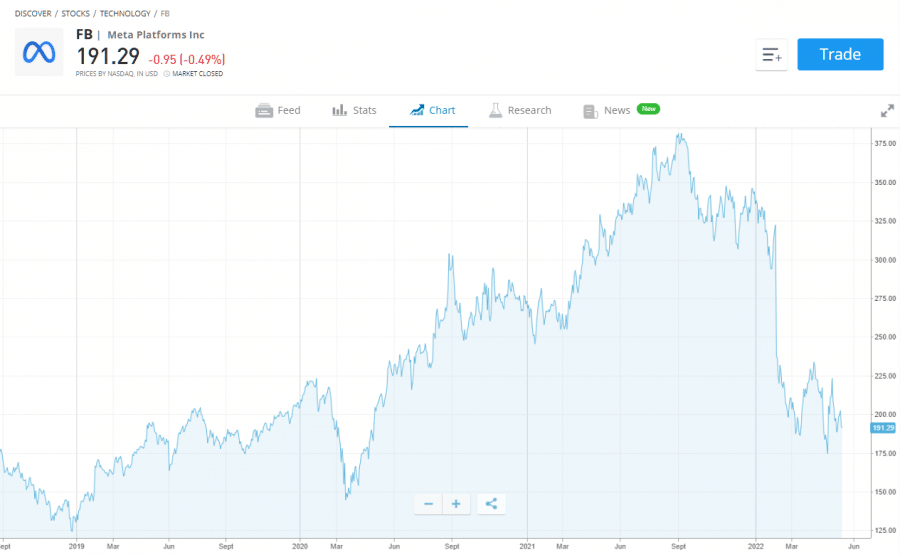

Meta’s share price has been on an incredible run higher since its IPO. In fact, from the lows of the pandemic in March 2020 the share price surged more than 180% higher to a new all-time high price of $384.33 in August 2021.

Since then the share price has fallen around 50% lower.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

9. Mastercard – Investing Heavily in DeFi Space & Blockchain-Based Finance

Mastercard may not seem like one of the most obvious DeFi stocks to invest in. After all, many DeFi advertisements call for an upheaval of traditional banking institutions. However, Mastercard is a company that is embracing change and new technologies.

First off, Mastercard and other institutions such as JP Morgan invested in a $65 million funding round for ConsenSys which is a key player in the crypto space. In fact, Mastercard also started the Mastercard Start Path crypto program to help crypto and DeFi companies launch.

But the payments company has also made its own moves such as acquiring CipherTrace to bring blockchain-based finance technology into its own products. One of the most popular areas in DeFi right now is in the digital payment sectors which could lead to Mastercard becoming a key player in the DeFi space.

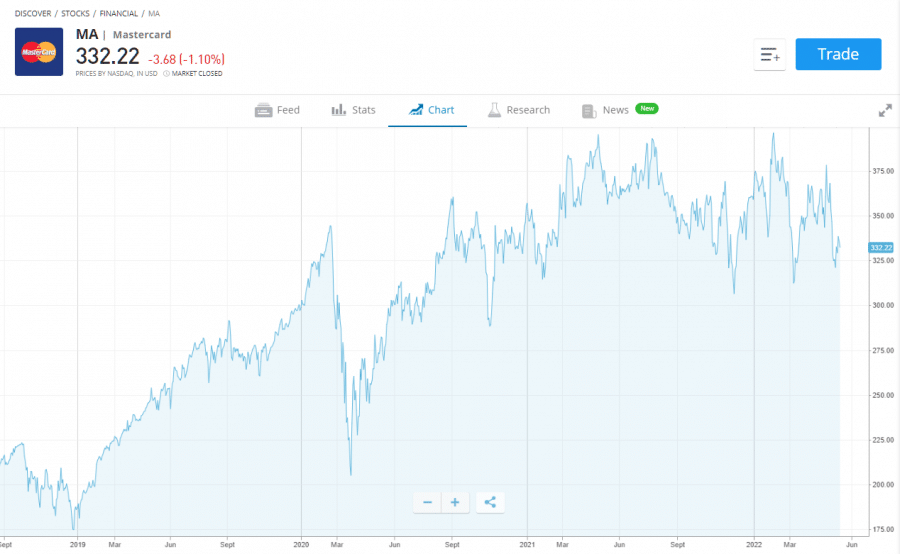

Since 2007, Mastercard’s share price has risen more than 7,600%. The stock recorded a new all-time high at $401.56 in April 2021. Since then, the stock price has fallen only 18% lower which is far less than other technology companies and the 30% sell-off in the Nasdaq 100 index during the first quarter of this year.

The underlying strength of this stock in a global stock market sell-off makes Mastercard one of the most popular DeFi stocks. It’s also a diversification play as the company’s main revenue streams are still driving the company forward.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

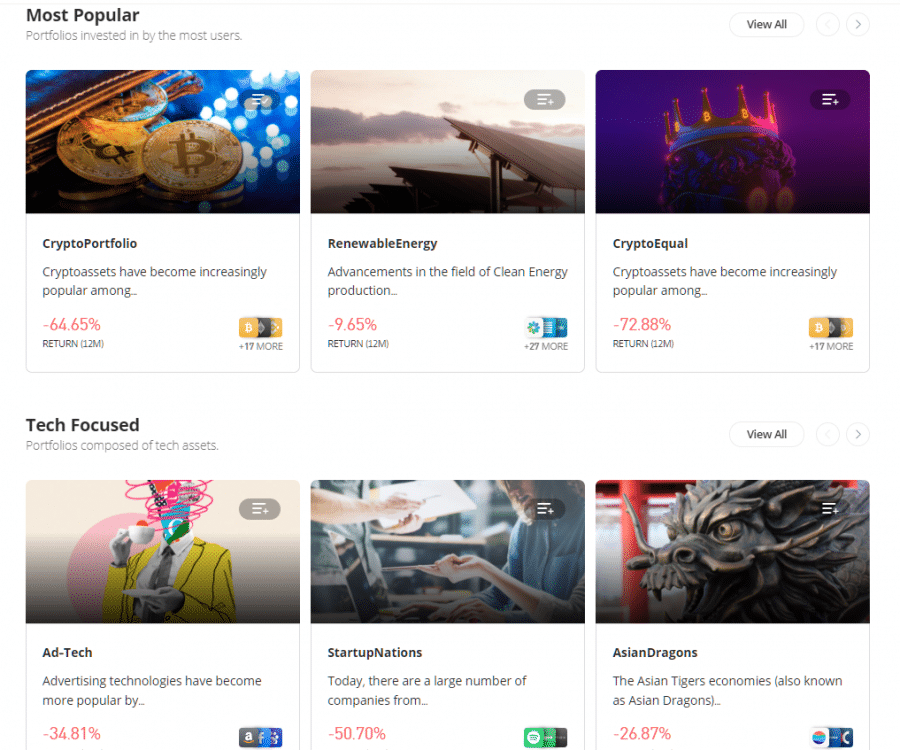

10. DeFi Portfolio – Ready Made Smart Portfolio Providing Exposure to DeFi Assets

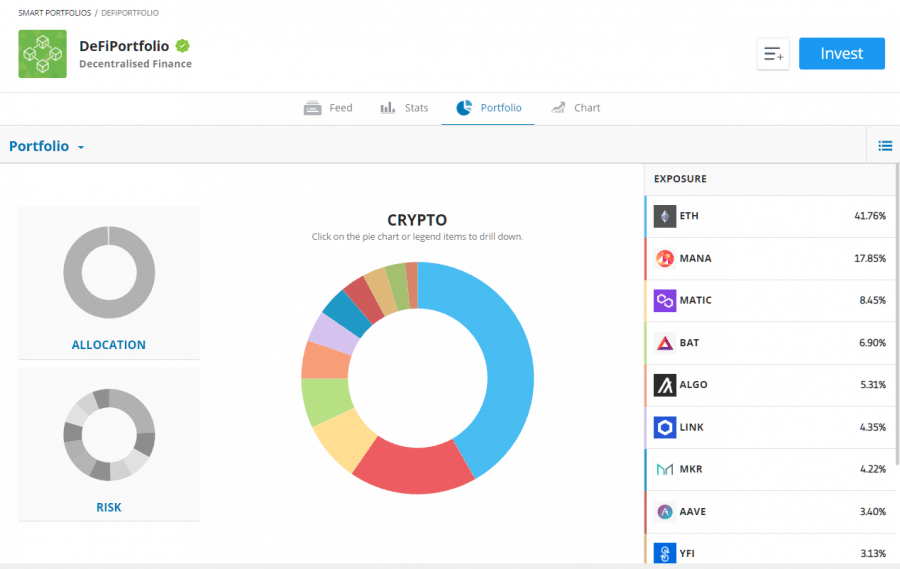

Another alternative, yet interesting way to capitalise on the DeFi space is to invest in ready made portfolios that are made up of DeFi assets. FCA regulated broker eToro, provides just that.

The eToro Smart Portfolios are collections that allow eToro clients to diversify their holdings by having the ability to invest in different assets from just one investment. In a way, the portfolios are similar to an ETF (exchange traded fund) which holds a basket of different securities tracking a certain theme but allows you to invest in one asset, the fund.

One of the many eToro Smart Portfolios available is called Decentralised Finance. The DeFi Portfolio selects crypto assets that are part of the DeFi space, making them ready for you to invest in at the click of a button.

Currently, the allocation is mainly made of DeFi coins such as Ethereum (ETH), Polygon (MATIC), Chainlink (LINK), Yearn Finance (YFI) and others.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

11. ProShares Bitcoin Strategy ETF – A Broader Investment into DeFi & Crypto

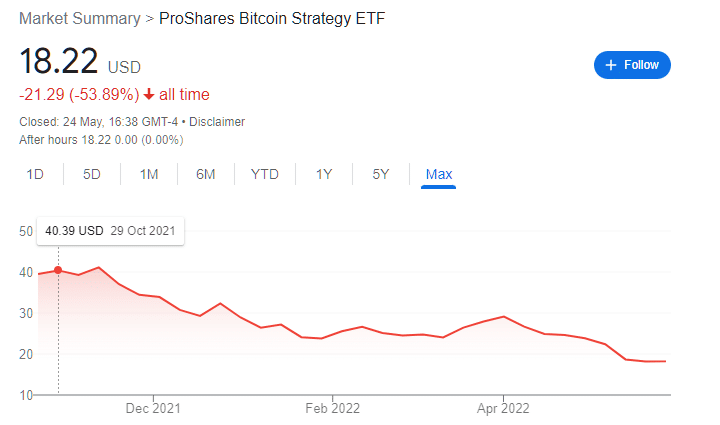

If you’re interested in accessing the growth of the DeFi and crypto market but like to have a broader exposure then the ProShares Bitcoin Strategy ETF could be for you. This is the first US bitcoin-linked ETF (exchange traded fund) that allows investors to gain exposure to the returns of Bitcoin in a much simpler and transparent way.

The fund tries to track the performance of Bitcoin through the purchasing of Bitcoin futures contracts. As the use of DeFi grows around the world, it will also increase the use of cryptocurrencies. As Bitcoin is the world’s largest crypto it stands to reason that it could benefit from the adoption of DeFi.

Since the fund’s inception in 2021, the price has fallen more than 50% lower. The timing of the launch also coincided with a global cryptocurrency market and stock market sell-off.

However, as the fund is a way for institutions to gain exposure to Bitcoin, it’s likely demand will pick up once the overall sentiment around the crypto industry improves.

What are Defi Stocks?

DeFi stocks are companies that are either directly or indirectly involved in decentralised finance (DeFi). DeFi is a new area of digital finance that leverages the power of blockchain technology smart contracts to validate and execute financial transactions.

The ethos around DeFi is that it bypasses centralised financial institutions like traditional banks and clearing houses. In time, this will enable more transparency and cheaper transaction costs.

There are different types of companies that are labelled under the DeFi stocks banner. For example, companies such as IBM help other companies move operations onto the blockchain. Mastercard plans to use the blockchain to facilitate its current business. Other companies provide access to DeFi platforms for investors to invest in DeFi projects.

While the DeFi space is expected to become an $800 billion industry, it is still relatively new. Therefore, it’s wise to diversify a stock portfolio into a variety of DeFi stocks that already have established revenue streams.

Are DeFi Stocks a Sound Investment?

Here are just a few reasons why you may want to learn how to invest in DeFi stocks today.

The DeFi Sector is Expected to Grow to $800 Billion

In 2020, decentralized finance grew 14x and is now worth around $80 billion. While it is still relatively small, the sector is expected to grow to $800 billion market cap in the next decade.

As more businesses, communities and people use cryptocurrency and blockchain networks, DeFi stocks will also capitalise on the increased adoption helping to boost underlying revenues.

DeFi Stocks that Embrace Digital Finance will Benefit Shareholders

Many analysts point to the fact that decentralised finance is a threat to centralised institutions. After all, if all transactions are done on a public ledger that cannot be tampered with then human errors and accounting problems at centralised institutions could be a thing of the past.

Therefore, the companies that embrace DeFi today will likely reward shareholders in the long term. Those who do not may get left behind. Companies such as Block Inc, IBM and Mastercard are just a few who are already looking to the future and incorporating DeFi technology into their operations.

How to Buy Defi Stocks

If you are looking for the most popular exposure to the DeFi sector, then purchasing DeFi coins is by the far the way to go. Follow this 5 step guide to purchase DeFi coin and capitalise on this emerging area of digital finance.

Step 1: Create a Wallet

It’s important to store your DeFi coins in a safe and secure crypto wallet. It doesn’t get any better than Trust Wallet which is free to download.

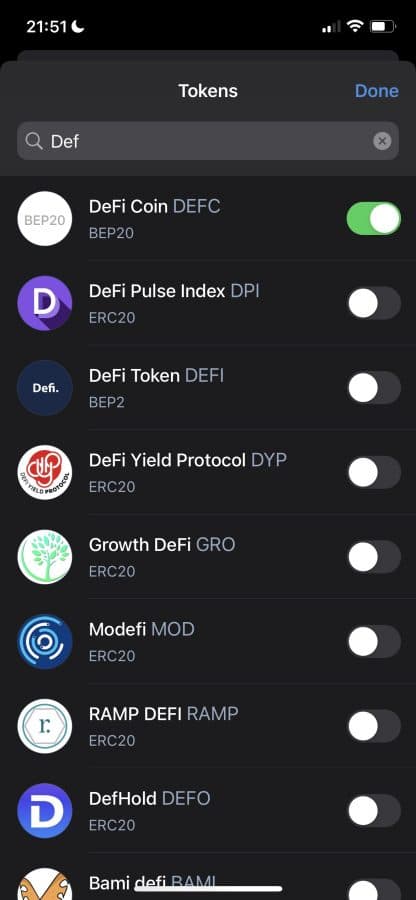

Step 2: Add DeFi Coin to the Wallet

You now need to add DeFi coin to your wallet so it can be held securely once you purchase it. Click on the prompt and search for DeFi Coin.

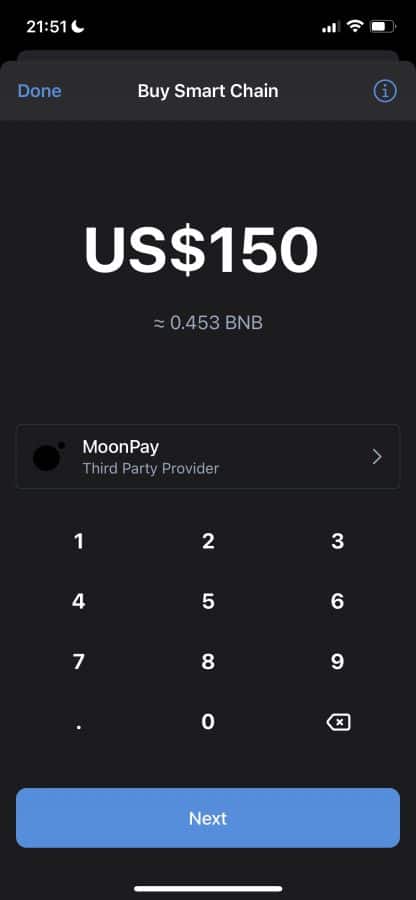

Step 3: Buy Binance Smart Chain (BSC) First

You now need to buy Binance Smart Chain first to then covert into DeFi Coin. Tap on Smart Chain in the Trust wallet and then tap buy. Here, you may need to provide verification documents and confirm the transaction with your bank.

Step 4: Convert your BSC to DeFi Coin

Now you have BSC in your wallet, go to the Browser section at the bottom of the screen, or Dapps, and open PancakeSwap. Once here, click on Exchange and set the slippage to 15% to convert your BSC to DeFi Coin.

Pancakeswap will not charge you any fees or commissions to trade DeFi Coin.

Where to Buy Defi Stocks

If you want to buy DeFi stocks then you can do so with FCA regulated broker.

You can buy stocks from all over the world and access other markets such as commodities, indices and the crypto market with Bitcoin (BTC), Ethereum (ETH), Uniswap (UNI), Luna (TERRA), Avalanche (AVAX), AAVE and many more.

Furthermore, you can also access products such as CFDs which allow you to profit from rising and falling markets across stocks and cryptos. This means you can trade the most popular NFT stocks, while investing in the most popular metaverse stocks or most popular cannabis stocks.

You can also access Smart Portfolios which allows you to invest in different themes with just one click.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Conclusion

Growth in the DeFi sector is undeniable. One of the ways to capitalise on the sector growing to more than $800 billion is to have direct exposure to DeFi. You can do this by investing in DeFi Coin.

DeFi Coin is a community-driven token where the developers have skin in the game as they burned all of their tokens to participate with everyone else. Not only is there a high level of transparency but holders can earn passive rewards and watch their investment grow over time.

You can purchase DeFi Coin through the popular DeFi crypto decentralized exchange Pancakeswap without paying any commissions.

#stocks #stockmarket #trading #forex #trader #wallstreet #daytrader #forextrader #finance #options #pips #forexsignals #forexlife #investing #forextrading #nyse #invest #investment #forexmarket #profit #daytrading #stocktrading #wealth #nasdaq #technicalanalysis #currency #foreignexchange #billions #investments #investor