$20,000 is the foundation of a solid investment portfolio. But to build a portfolio that produces returns long into the future, it’s important to put that money towards the right investments.

In this guide, we’ll explain how to invest $20k for short and long-term profits and highlight where to invest $20,000 right now.

11 Best Ways to Invest $20k in 2022

Learning how to invest $20k is easy. We’ve picked out the 10 best ways to invest 20,000 dollars in 2022.

- IMPT -Earn Crypto Rewards by Reducing CO2 Emissions

- Crypto Projects – Huge Return Potential on New Projects Like Tamadoge

- Stocks – Traditional Investments in Individual Companies

- ETFs – Instant Diversification across Sectors, Countries, and Themes

- Index Funds – Match the Performance of the Overall Stock Market

- Crypto Interest Accounts – Earn Ultra-high Yields on Crypto Holdings

- REITs – Invest in Real Estate without Buying a Home

- NFTs – Buy Digital Artworks with Exclusive Benefits

- Peer-to-peer Lending – Lend Out Your Money and Build a Portfolio of Rates

- Bonds – The Low-risk, Low-reward Approach to Investing

- Copy Trading – Mimic the Portfolios of Experienced Traders

We think investing in cryptocurrency projects with high potential is one of the best things to do with $20k. One great example of such a project is Tamadoge – click below to learn more.

A Closer Look at the Best Ways to Invest $20,000

Want to know more about how to invest 20,000 dollars? We’ll take a closer look at the 10 best places to invest $20k today.

1. IMPT – Earn Crypto Rewards by Reducing CO2 Emissions

Built on the Ethereum blockchain, IMPT is a cryptocurrency project that allows investors to directly contribute to environmental sustainability.

Partnering with thousands of businesses and retailers, IMPT issues tokenized Carbon Credits – which can be bought by customers to fund environmental projects and take part in green energy investing. These Credits are minted as NFTs on the IMPT network and can be bought with IMPT tokens.

To earn tokens, investors must simply buy products with IMPT’s partnered brands. After each purchase, IMPT tokens representing a percentage of the brand’s sales margin are distributed to each buyer. Alternatively, IMPT tokens can be bought on the IMPT platform with fiat currency payment methods.

IMPT tokens are leveraged to buy Carbon Credits – which are permits that represent a certain amount of carbon emissions removed from the atmosphere. These Credits can either be traded or burnt to offset the emissions they represent. Since the NFTs are represented as new transactions on a decentralized ledger, burning the asset removes any trace of the asset and eradicates any chance of fraud or double counting of the asset.

With a $20K investment, traders can set aside a portion of their funds to join the IMPT presale. In the ongoing presale round, IMPT has set aside 600 million tokens, which accounts for 20% of the maximum supply.

Over 203 million tokens have been sold so far at $0.018 per token. To learn more about this exciting project, join the IMPT Telegram channel.

2. Crypto Projects – Huge Return Potential on New Projects like Tamadoge

Cryptocurrencies have created a new high-risk, high-reward asset class for investors. While cryptocurrencies can be volatile – that is, their prices move rapidly either up or down – savvy crypto investors have generated returns of thousands of percent from top tokens.

When investing in crypto projects, it’s important to think carefully about the properties of different tokens. Established mega-cap tokens like Bitcoin and Ethereum are well known and have attracted institutional investment, which bodes well for their future. These coins’ days of highly explosive growth may be behind them, but they are still potentially high return investments.

New crypto projects offer investors a chance to get in on the ground floor of a token. Investing in new and emerging tokens is highly risky since there’s no guarantee that a cryptocurrency will take off or even that the project will come to fruition. However, coins that do success can generate enormous returns that are nearly impossible to match in the stock market.

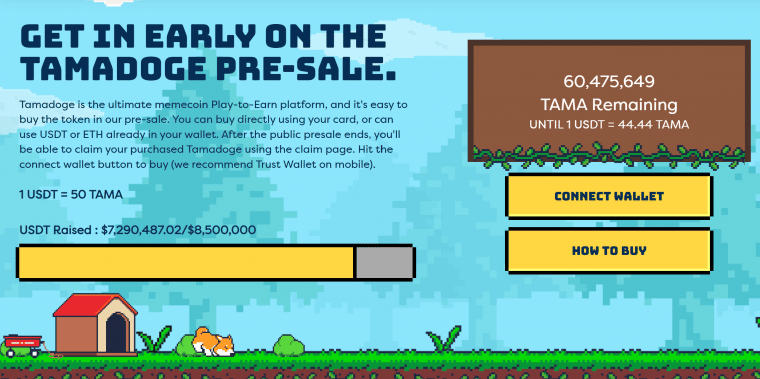

Two of the best emerging cryptocurrencies for 2022 that investors may want to consider are Tamadoge and Battle Infinity. Both are play-to-earn crypto projects with a lot of potential and strong fundraising results ahead of their launches.

Tamadoge in particular is worthy of investors’ attention because it offers a deflationary cryptocurrency. In this blockchain game, players can purchase NFT pets and upgrades from the in-game marketplace. Players earn TAMA, the game’s native cryptocurrency, when they win battles with their pets. However, 5% of the TAMA used for every transaction in Tamadoge is removed from circulation and burned.

That means that the supply of TAMA diminishes over time, and it diminishes faster as more players join Tamadoge. Over time, this could result in demand being greater than supply and send the price of TAMA higher.

Investors can get in early on TAMA through one of the best crypto presales of the year. The Tamadoge presale has already raised more than $7 million out of its $8.5 million target, so time is limited to buy TAMA at pre-ICO prices. Investors can purchase TAMA with a credit card, Ethereum, or Tether, and phone support is available to help first-time crypto investors purchase TAMA.

Check out the TAMA presale today as a top $20k investment!

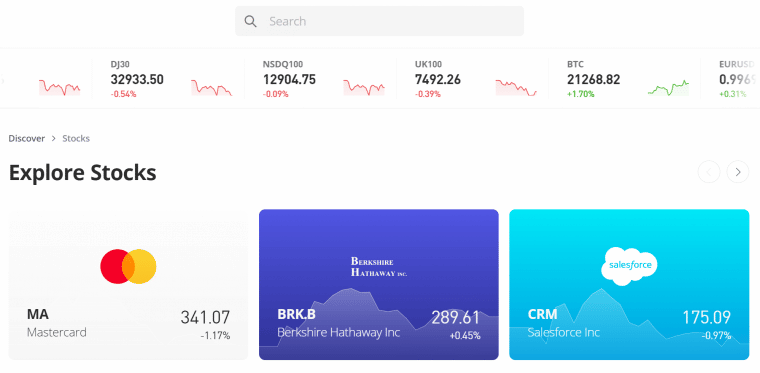

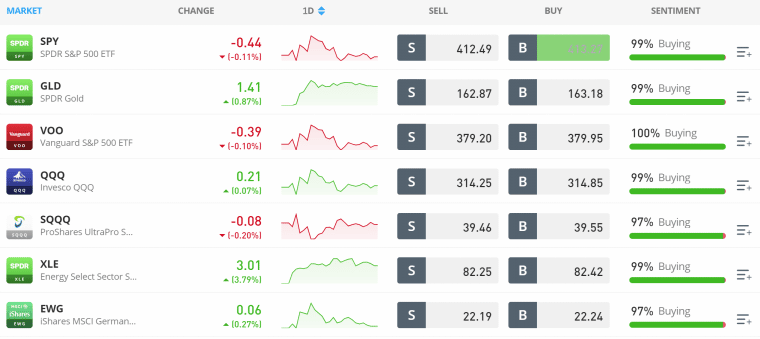

3. Stocks – Traditional Investments in Individual Companies

The answer to the question, ‘What can I invest in with $20k?’ is stocks for the majority of investors. Investing in individual stocks has long been one of the most common ways to invest. For long-term investors with a moderate risk tolerance, it could be the best way to invest $20k.

There are multiple types of stocks to invest in, including growth, value, and dividend stocks. Growth stocks are those that investors expect will grow rapidly over the coming years. They often have high stock prices relative to their earnings since investors anticipate that earnings will increase quickly. Value stocks are those that have low stock prices relative to their earnings.

Dividend stocks are those that pay dividends, usually on a quarterly or annual basis. Dividend stocks can pay annual yields of up to 10% and they provide steady income that investors can use for everyday expenses or to reinvest.

When investing in stocks, it’s important to research the company behind the stock. Many investors look at metrics like profit and revenue growth, long-term debt, customer acquisition, and more. Investors can also look to Wall Street analysts to find out what professional investors think about specific companies.

To invest in stocks, investors need a stock brokerage. We recommend eToro because it offers 0% commission on stock trades.

4. ETFs – Instant Diversification across Sectors, Countries, and Themes

ETFs, or exchange-traded funds, are baskets of stocks or other assets that investors can purchase in a single trade just like stocks. What makes ETFs one of the best $20k investments is that they contain dozens or even hundreds of different stocks. So, investors get instant diversification across multiple companies.

ETFs can contain a wide variety of different assets, but most are focused on specific market sectors or themes. For example, investors can find ETFs for 5G stocks or the energy sector. Some ETFs also offer exposure to specific countries. For example, there are ETFs that focus on Chinese stocks or stocks from emerging economies.

When investing in ETFs, keep in mind that these funds charge fees known as expense ratios. Expense ratios are typically less than 1% for most popular ETFs, but they can be more expensive for niche funds.

Investing $20k with ETFs is simple. Investors can purchase a wide range of ETFs through most stock brokerages, including eToro.

5. Index Funds – Match the Performance of the Overall Stock Market

Index funds are a lot like ETFs, except they’re designed to mimic the performance of major stock market indices like the S&P 500, NASDAQ 100, or FTSE 100. In effect, index funds enable investors to match the performance of the broader stock market without betting on individual companies or sectors.

Index funds have a major advantage over ETFs as well: they’re low cost. Whereas expense ratios for ETFs are often 0.40% or more, expense ratios for index funds are often less than 0.20% and can be less than 0.10% of the total amount invested. That saves investors a significant amount of money over the long term.

Investing in index funds isn’t always the most exciting, but it can be a good option for long-term investors who want to practice passive investing. Over the long run, major market indices have returned about 10% per year on average. Investors can purchase a variety of index funds from stock brokerages like eToro.

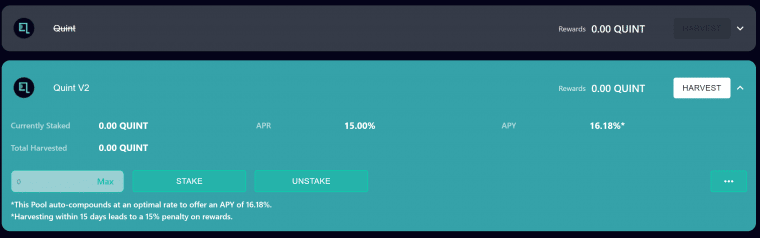

6. Crypto Interest Accounts – Earn Ultra-high Yields on Crypto Holdings

Crypto interest accounts are like traditional savings accounts, but for cryptocurrency holdings. With a crypto interest account, investors can earn high interest rates on a wide variety of coins ranging from Bitcoin and Ethereum to stablecoins like Tether and USD Coin. Whereas interest rates at traditional banks are often below 1% APY, interest rates on top cryptocurrencies can be 20% APY or higher.

Many top crypto exchanges offer crypto interest accounts with varying rates for different coins. Some also require that you hold an exchange’s native cryptocurrency in order to receive the best rates.

One of the best crypto interest accounts today is offered by Quint. Quint has its own cryptocurrency, QUINT, which investors can stake and earn interest rates up to 16.18% APY. Quint also offers combined staking for QUINT and BNB with interest rates up to 39.08% APY. Interest is automatically reinvested, which compounds the returns over time.

7. REITs – Invest in Real Estate without Buying a Home

REITs, or real estate investment trusts, can be thought of as ETFs for real estate. They are funds that own multiple properties and enable investors to buy a share of the overall real estate portfolio. When investors buy a share of an REIT, they benefit whenever the value of the real estate in the REIT goes up.

Many REITs also pay dividends to investors. This money comes from rent or lease payments to the REIT, which then passes that money onto shareholders. Note, though, that REITs can have large operating expenses, so a lot of the money that these portfolios make is reinvested in the real estate itself.

There are many different types of REITs with different areas of focus. For example, some REITs focus on residential homes that can be rented out. Others focus on commercial properties for retail or medical professionals. Some REITs even invest in farmland.

REITs are available at most stock brokerages, including eToro.

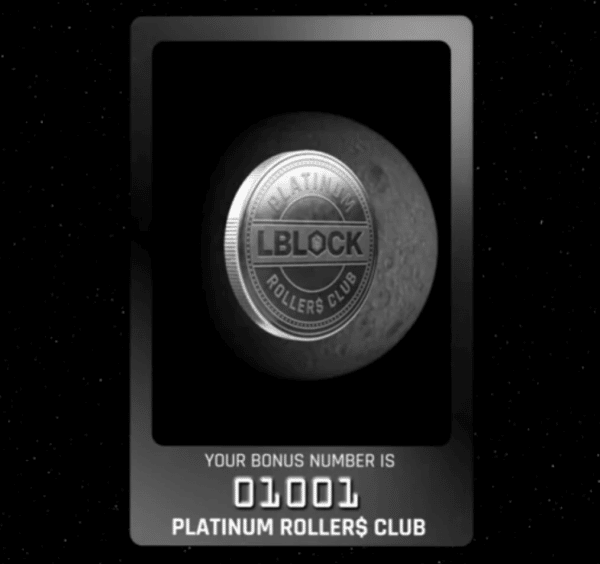

8. NFTs – Buy Digital Artworks with Exclusive Benefits

NFTs, or non-fungible tokens, have seen huge inflows of investment from both crypto enthusiasts and more traditional art lovers. These unique tokens are one-of-a-kind and offer ownership over a digital asset like a work of digital art. As the NFT market has boomed, many NFTs have appreciated in value quickly and achieved strong resale values – making them a potential target for investors.

When investing in the best NFTs, keep in mind that the popularity of the collection matters a lot. Some collections capture the cultural zeitgeist and explode in value. Others fizzle out and lose value. There’s no way to know for sure what the next big NFT collection will be, although some artists have had stronger track records than others.

Perhaps the best place to invest $20k in the world of NFTs is Lucky Block. Lucky Block’s Platinum Roller Club NFTs aren’t digital artworks, but rather offer entry into a daily giveaway with a $10,000 prize. Each NFT holder has a 1-in-10,000 chance of winning each day, and investors can lend out their NFT for steady income as well.

Lucky Block Platinum Rollers Club NFTs are available today at the NFT exchange Launchpad.

9. Peer-to-peer Lending – Lend Out Your Money and Build a Portfolio of Rates

Peer-to-peer lending platforms allow any investor to act like a traditional bank. With one of these platforms, investors can lend out their money to individuals and businesses in need of cash. Investors can see the interest rate they’ll get for their money, the borrower’s risk rating, and more details needed to make a lending decision.

What’s great about peer-to-peer lending platforms is that investors can create a custom portfolio of loans. They may have a few high-risk loans that pay high interest rates and a few low-risk loans with lower interest rates.

There are many peer-to-peer lending platforms in the cryptocurrency world as well. Crypto lending platforms make it easy to lend out popular cryptocurrencies like Bitcoin or Ethereum to other investors. Importantly, many of these loans are overcollateralized, meaning that investors should be protected from losing money even if the borrower stops making payments.

10. Bonds – The Low-risk, Low-reward Approach to Investing

Bonds are one of the least exciting ways to invest $20,000. But, they’re also one of the safest ways to invest. For the most part, bonds pay low interest rates for several years, then repay the entire face value of the bonds at the end of their terms. Bonds are often used by investors to diversify their portfolios away from riskier assets like stocks and cryptocurrencies.

There are several types of bonds available, including government and corporate bonds. Government bonds are issued by national, state, or local governments, while corporate bonds are issued by companies. There are many bond ETFs that give investors exposure to a mix of government and corporate bonds, and investors can find these funds at brokerages like eToro.

Keep in mind that some bonds are riskier than others, and offer higher interest rates as a result. For example, bonds offered by the government of a war-torn country may be much riskier than bonds issued by the US government and may offer much more attractive rates to investors.

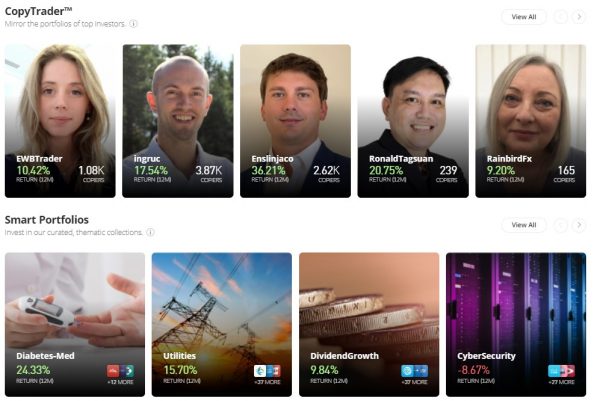

11. Copy Trading – Mimic the Portfolios of Experienced Traders

Copy trading is perhaps the best way to invest $20k for short term profit. With copy trading platforms, investors can automatically copy the portfolio of a more experienced trader or investor. If a trader buys or sells a stock, the investor’s portfolio will automatically buy or sell that same stock immediately.

Copy trading is supported by a variety of brokerages including eToro. On eToro, investors can see a trader’s portfolio, overall strategy, recent trades, and performance. It only takes $200 to start copy trading, so investors have the option to copy as many as 100 different traders with a $20,000 investment.

Keep in mind that copy trading can be risky, since not all traders will be profitable all the time. The good news is that investors are free to stop copying at any time or can use a portion of their portfolio for self-directed investments in stocks, crypto, or other assets.

How to Choose the Best $20k Investments For You

With so many ways to invest $20,000, it’s important that investors pick the best way to invest $20k to meet their their goals and investing preferences. Here are a few of the key factors to consider when deciding how to invest $20k.

Investment Goals

An investor’s investment goals should be at the center of their investment strategy. Investing for retirement is very different from investing to make a quick profit, after all. Every investor should know what they want to achieve by investing and then choose how to invest $20,000 accordingly.

For investors who want to make a quick profit, more volatility and risk might be worthwhile in exchange for potentially greater returns. For retirement investors, it may be preferable to choose safer investments that are more likely to compound returns over time.

Risk Tolerance

Risk tolerance is an individual preference that every investor should consider. Simply put, some investments are more risky – that is, more likely to lose money – than others. In general, higher risk investments offer higher returns than lower risk investments. That’s what makes taking on extra risk potentially worthwhile.

All investments involve risk, but assets like cryptocurrencies are generally considered high risk. Stocks could be considered moderate risk, while bonds are low risk. However, there are high and low risk assets within each of these categories. Investors should never invest more than they are willing to lose.

Return Targets

How much an investor wants to make from investing will also influence their choice of what to invest $20k in. Investing takes time, so a small return may not be worth the effort involved. In that case, investors might be happy with passive investments like index funds.

On the other hand, investors seeking greater returns may want to spend time researching individual stocks or cryptocurrencies. These assets can offer higher potential returns, although they also involve more risk.

Volatility Tolerance

Volatility is a measure of how rapidly the price of an asset swings up or down. More volatile assets, like cryptocurrencies, can go up several percent one day and down several percent the next. In contrast, low volatility assets like bonds rarely change more than a tenth of a percentage point in value from day to day.

Investors should have a strong stomach if they plan to invest in highly volatile assets. It’s also important to consider the investment timeframe. High volatility can make it more difficult to exit an investment when an investor needs to.

Where to Invest $20k – the Best Option?

Figuring out what to invest $20k with can be a challenge, especially for first-time investors. There are a lot of different asset classes to choose from and tons of options within each asset class.

Based on our research, we think the best way to invest $20k today is in IMPT – the native cryptocurrency of the carbon-nuetral project of IMPT. Offering investors the opportunity to reduce carbon emissions, IMPT is available to buy on presale for $0.018 per token.

How to Invest $20k – Tamadoge Tutorial

Want to know how to invest $20k in Tamadoge, our top pick for the best place to invest $20k today? We’ll walk investors through the steps to buy TAMA during the project’s ongoing presale.

Step 1: Download a Metamask Wallet

In order to invest in TAMA, investors need one of the best crypto wallets. We suggest using Metamask because it’s free and available for most web browsers. Head to Metamask’s website and download the wallet.

Step 2: Visit the Tamadoge Presale

Head to Tamadoge’s presale platform and click ‘Connect Wallet.’ Add the Metamask wallet details to connect.

Step 3: Buy TAMA

Investors can now purchase TAMA using a credit card, Ethereum, or Tether. The minimum purchase is $30. First-time crypto investors who need a hand with this process can contact Tamadoge’s phone support for assistance.

Step 4: Claim TAMA

Tamadoge will release all purchased TAMA tokens to investors at the end of the presale. Return to the presale platform and connect the Metamask wallet to claim the tokens.

Conclusion

Now that investors know the best way to invest $20,000, it’s time to get started. With cryptocurrency projects like IMPT, investors can access sustainable projects at the low cost of just $0.018 per token.

#investment #realestate #investing #money #business #invest #bitcoin #property #investor #entrepreneur #trading #forex #realtor #finance #cryptocurrency #realestateagent #home #stockmarket #success #wealth #crypto #financialfreedom #forsale #luxury #stocks #motivation #forextrader #househunting #blockchain