Saving up thousands of dollars is a good first financial step. But to make the most out of those savings, it’s important to invest them.

If you’re wondering, ‘What can I invest in with 25k?’ then this guide is here to help. We’ll explore how to invest $25k and help readers decide where to invest $25,000 right now.

11 Best Ways to Invest $25k in 2022

$25k is a lot of money to invest, so it’s important to understand how to invest $25k safely and effectively. Here are the 10 best ways to invest $25k in 2022:

- IMPT – Invest $25K in a Cryptocurrency that is helping solve Climate Change

- Top Crypto Projects – Invest in Emerging Cryptocurrencies like Tamadoge

- Stocks – Own a Piece of the World’s Best Companies

- REITs – Invest in Real Estate through the Stock Market

- Crypto Staking – Earn High Interest on Crypto Holdings

- ETFs – Invest in a Specific Themes or Market Sectors

- Index Funds – Passively Match the Market’s Return

- NFTs – Invest in One-of-a-kind Digital Artwork and Games

- Copy Trading – Mimic the Moves of Experienced Traders and Investors

- Commodities – Trade Metals, Food Supplies & More on the Global Market

- Bonds – A Relatively Safe Investment to Balance a Portfolio

Investing in new high potential crypto projects like Tamadoge is our number one pick – click below to learn more.

A Closer Look at the Best Ways to Invest $25,000

With so many $25k investment options to choose from, it’s important to pick the right ones to build a diversified and profitable portfolio. Let’s take a closer look at how to invest $25,000 today.

1. IMPT – Invest $25K in a Cryptocurrency that is helping solve Climate Change

IMPT is a blockchain-based carbon emissions-reducing project that caters to businesses and buyers. With IMPT, traders can access one of the most sustainable cryptocurrency projects with the potential to multiply their investment.

On the IMPT platform, IMPT tokens are leveraged to buy Carbon Credits – which are permits that represent 1 ton of carbon emissions removed from the atmosphere. IMPT has connected with multiple retailers and businesses that want to play a role to make up for the emissions that have been generated by industrial production, travel and more.

Through the IMPT marketplace, customers can buy products from businesses and earn IMPT tokens. These tokens represent a percentage of the sales margin that the businesses have set aside for sustainable practices. On the IMPT website, the tokens can be used to buy Carbon Credit NFTs – which have been minted as NFTs.

The 1 ton of CO2 emissions can either be burnt by the holder or traded as an investment. According to IMPT’s whitepaper, participants can track their impact on reducing their carbon footprint via a social platform. In the future, burning Carbon Credits will let users access multiple benefits, such as earning free tradable NFT minted on the platform.

Interested readers can diversify a portion of their $25K into the IMPT presale and buy a minimum of 10 tokens for $0.018 a piece. With a maximum supply of 3 billion tokens and the sustainable use cases that IMPT offers, the project can lead to significant gains once the presale concludes.

Interested readers can access the IMPT Telegram channel to stay updated with the IMPT project.

2. Top Crypto Projects – Invest in Emerging Cryptocurrencies like Tamadoge

One of the top ways to invest $25k in 2022 is to put money into cryptocurrency projects. The crypto market is currently experiencing a crypto winter, with prices lower than they have been in years. For savvy investors, the crypto winter could represent an opportunity to buy crypto at rock-bottom prices before the market begins to recover.

There are hundreds of different crypto projects for investors to compare, but a good place to start is with the largest cryptocurrencies by market cap. Bitcoin remains the world’s largest and most widely accepted cryptocurrency, and it’s attracted an impressive amount of investment from traditional financial firms. Ethereum is also a large player in the crypto space and may be worth holding as part of a diversified crypto portfolio.

Emerging crypto tokens are where investors can find more high-risk, high-reward investment opportunities. These new cryptocurrencies require investors to have a strong stomach, but they can also return hundreds or even thousands of percent on investment if they take off.

Among the best new cryptocurrencies today are Tamadoge and Battle Infinity. Tamadoge is particularly worth a closer look, since this new cryptocurrency project is designed to rise sharply in value over time.

Tamadoge is a play-to-earn crypto game in which players can buy NFT pets and battle them against one another. As players battle and win, they earn TAMA, the native cryptocurrency of the Tamadoge ecosystem. TAMA can be used to purchase more NFT pets as well as in-game upgrades that help players win and earn.

Importantly, 5% of the TAMA used in every transaction is removed from circulation and burned. This means that the supply of TAMA is constantly decreasing – and in fact, it decreases more quickly the more that people join and play Tamadoge. The net effect is that as the game’s popularity increases, the supply of TAMA goes down, and the price of the coin can be expected to go up as a result.

Tamadoge is currently holding one of the best crypto presales of 2022 in order to offer TAMA to investors at a low, pre-ICO price. This represents a unique opportunity for investors to buy TAMA before the game launches and the token’s deflationary cycle begins. For investors who are new to cryptocurrency, Tamadoge offers phone support to make investing during the presale easier.

The presale has already raised more than $9.4 million, and investors have a limited time before all of the available TAMA tokens are sold. So, check out the TAMA presale today to invest in Tamadoge!

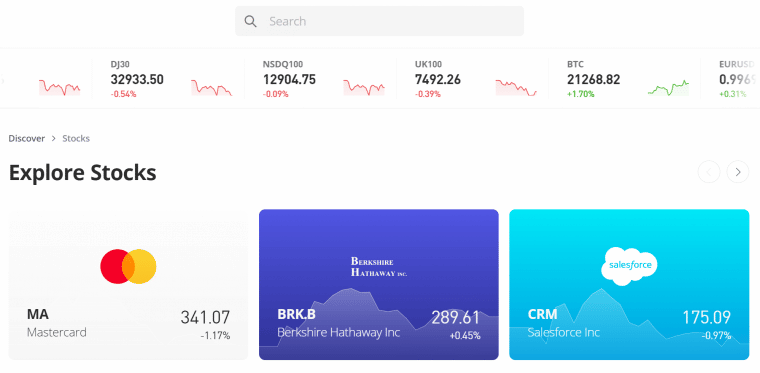

3. Stocks – Own a Piece of the World’s Best Companies

Stocks are among the most common types of assets in investors’ portfolios. Stocks represent fractional ownership in some of the world’s biggest and best companies. Did you know that some investors consider the stock markets to be the best way to invest $100k in 2022?

There are several different types of stocks investors can choose from. Growth stocks are shares of companies that are growing rapidly. Often, the prices of these stocks are high relative to earnings right now because investors are looking towards the future. Value stocks are the opposite. They offer low prices relative to earnings, and they often represent shares in well-established companies who have reliable but slow-growing businesses.

Dividend stocks are stocks that pay investors a dividend each month, quarter, or year. Dividends are a form of recurring income, which can be important for some portfolios.

When investing in stocks, it’s important for investors to look carefully at the company behind the ticker symbol. The best companies have strong and growing earnings as well as a moat that protects them from competition.

Importantly, investors will need a stock brokerage in order to invest in individual stocks. Check out eToro, which offers 0% commission for stock investing and has tons of tools for researching stocks.

4. REITs – Invest in Real Estate through the Stock Market

REITs, or real estate investment trusts, are companies or funds that enable anyone to invest in real estate. Individual investors can purchase REITs just like stocks – so there’s no need to take out a mortgage or identify the perfect piece of land to start investing.

There are many different types of REITs for investors to choose from. Some invest in residential homes and generate returns by renting them out. Others develop commercial buildings or lease out commercial space. Some REITs even invest in valuable farmland. This diversity means that investors who want to start investing $25k can create a portfolio of different real estate holdings.

When investing in REITs, be sure to look at the fees the fund charges and how much money is reliably returned to investors. Some REITs offer high dividends and don’t reinvest much in their properties. Others offer minimal dividends, but work on appreciating their share price by investing funds in new property,

Investors can find a wide selection of REITs to invest in at stock brokerages like eToro.

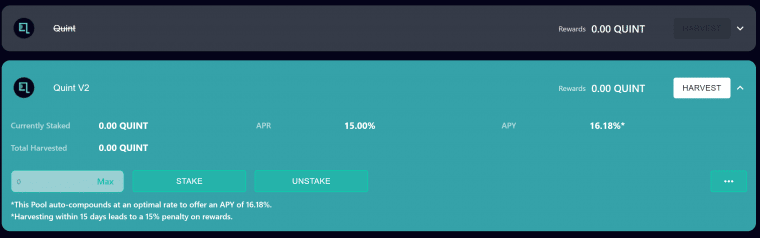

5. Crypto Staking – Earn High Interest on Crypto Holdings

Many of the blockchains that popular cryptocurrencies run on use a security protocol known as proof of stake. With proof of stake, crypto holders need to stake some of their tokens in order to validate transactions on the network. If they act faithfully and keep the network running smoothly, they’re rewarded with new cryptocurrency,

Individual crypto investors can use crypto staking to earn interest on their crypto holdings. There are many platforms that facilitate staking on top altcoins and offer double-digit interest rates.

Even better, many crypto interest accounts pay out token rewards on a daily or weekly basis, enabling investors to compound their returns.

One of the best crypto staking platforms in 2022 is Quint. This is a beginner-friendly cryptocurrency that enables investors to stake QUINT tokens and earn interest of 16.18% APY. Quint also enables investors to stake a combination of QUINT and BNB to earn interest of 39.08% APY. That’s hundreds of times higher than the interest available at most banks.

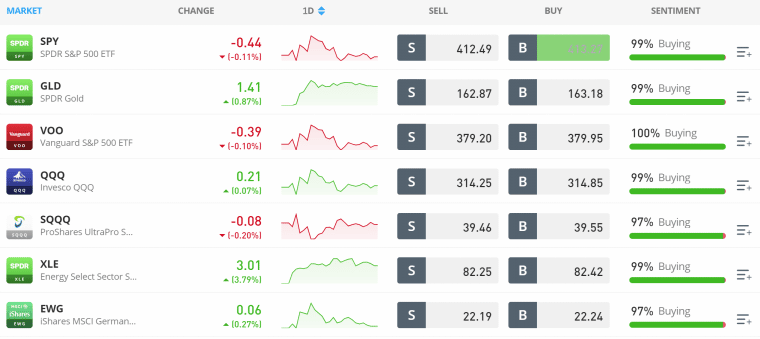

6. ETFs – Invest in a Specific Themes or Market Sectors

ETFs, or exchange-traded funds, are baskets of stocks or other assets that investors can purchase in a single trade. A single ETF might contain dozens or even hundreds of different stocks, all in different proportions. They offer a simple way to build a diversified portfolio.

One of the neat things about ETF investing is that ETFs can be used to invest in specific market sectors or themes. For example, there are ETFs that include all of the stocks in the US transportation sector. There are also ETFs that bring together 5G stocks from many different market sectors for investors who think 5G technology is the next big thing.

When investing in ETFs, be sure to look at the fees a fund charges. This is known as the fund’s expense ratio. Expense ratios are generally under 1% even for actively managed ETFs, making them a cost-effective way to invest in a wide variety of stocks.

ETFs trade on stock exchanges, so they’re available from most stock brokerages. eToro offers hundreds of ETFs with 0% commission.

7. Index Funds – Passively Match the Market’s Return

Index funds are a type of ETF or mutual fund that mimic the composition of a major stock market index. For example, there are index funds for the S&P 500 and the NASDAQ 100.

These funds contain the same stocks, in the same proportions, as those market indices. That means that if the S&P 500 rises by 1%, an S&P 500 index fund will also rise by 1%.

Many investment experts recommend index funds as the best place to invest $25k. Index funds are passively managed and typically have expense ratios of 0.25% or less, making them very inexpensive. In addition, since index funds typically contain dozens or hundreds of stocks, they’re relatively well-diversified. Finally, the S&P 500 has historically gone up by around 10% per year and few people have been able to beat the market by stock trading.

Investors can find index funds for the major US stock indices and markets around the world at eToro.

8. NFTs – Invest in One-of-a-kind Digital Artwork and Games

NFTs, or non-fungible tokens, are a type of unique digital token that lives on blockchains. NFTs aren’t cryptocurrencies. Whereas every token of a specific cryptocurrency is the same, every NFT is completely unique. Investors can think of the best NFTs somewhat like digital art or digital collectibles.

The NFT market has skyrocketed in value in recent years, and hot new NFT projects are being released all the time. While recent performance is no guarantee that NFTs will continue to gain value, there are many signs that investors are still eager to buy NFTs from top collections.

One of the best NFTs to buy in 2022 is the Lucky Block Platinum Rollers Club NFT. This digital collectible isn’t a piece of art, but rather an entry ticket into a daily giveaway. Every day, Lucky Block gives away $10,000 to one lucky NFT holder.

Since there are only 10,000 Platinum Rollers Club NFTs, each NFT holder has a 1-in-10,000 chance of winning $10k every day. Investors who don’t want to take their chances can also lend out their NFT and earn steady income on it.

Investors can buy Lucky Block NFTs at Launchpad, an online NFT marketplace.

9. Copy Trading – Mimic the Moves of Experienced Traders and Investors

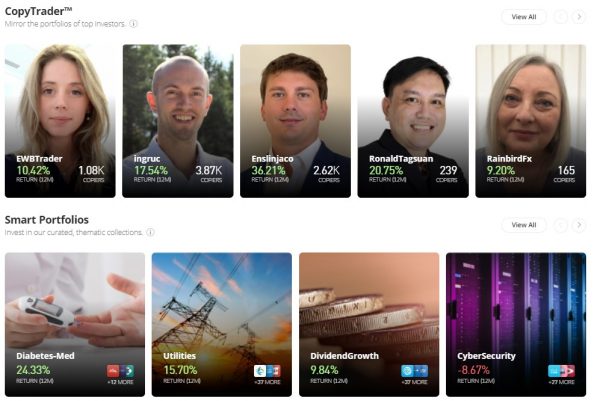

Copy trading platforms offer a way to actively trade stocks and other assets without having to put in a lot of work. It’s considered by some to be the best way to invest $25k for the short term. With copy trading, investors simply set aside some money in their portfolios to mimic the moves of a more experienced trader. When the trader buys or sells a stock or other asset, the investor’s account will copy the trade automatically.

On platforms like eToro, investors can see a trader’s performance, recent trades, and some basic details about their strategy. There are thousands of traders to potentially copy, so investors have the ability to pick and choose who they want to copy or to copy multiple traders.

Copy trading can also be used to build a more diversified portfolio when investing $25k. Many of the investors available to copy focus on specific market sectors or asset classes. So, investors can simply spread their $25,000 investment across multiple traders. eToro only requires a $200 minimum investment per copy trader, making this form of investment very accessible.

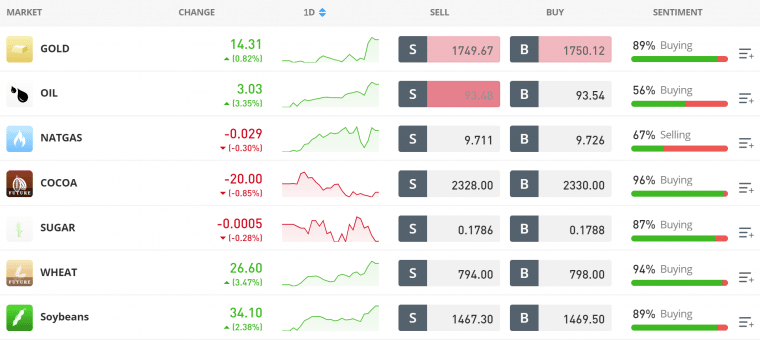

10. Commodities – Trade Metals, Food Supplies & More on the Global Market

Commodities are an asset class that includes precious metals like gold and silver, food products like cacao and soybeans, and energy supplies like crude oil and natural gas. Commodities trade on the global market, and their prices can go up or down in response to a variety of different global events.

One of the key reasons to trade commodities is that their prices are uncorrelated with the stock market. That is, the price of stocks may fall across the board, but that won’t impact the price of most commodities much. So, commodities can provide a hedge for investors who are heavily invested in stocks or cryptocurrencies.

However, keep in mind that trading commodities can be complex. Many commodities trade with futures contracts, although platforms like eToro allow commodities trading through simpler contracts for difference (CFDs). Many investors prefer to focus on just 1 or 2 commodities that they research deeply rather than attempt to invest in dozens of different commodities.

11. Bonds – A Relatively Safe Investment to Balance a Portfolio

Bonds are essentially IOU slips. They represent ownership of debt owed by governments or companies. Typically, when an investor buys a bond, they receive regular interest payments over the life of the bond at the bond’s preset interest rate. When the bond expires, the investor receives the amount that they originally paid for the bond back.

Bonds aren’t the most exciting investment most of the time. However, it’s important to think about bonds when deciding how to invest $25k. That’s because bonds represent a relatively low-risk asset class that can balance out a portfolio. This may be especially important for investors who put most of their $25k investment in stocks and cryptocurrencies.

Keep in mind that bonds aren’t risk-free. Companies and governments can default on their bonds, in which case investors may not get all of their money back. In general, riskier bonds pay higher interest rates, so investors can choose the risk-reward balance that best suits them.

How to Choose the Best $25k Investments for You

A major part of learning how to invest $25k is figuring out how to identify which investments make sense for a portfolio. It rarely makes sense to invest $25,000 in a single asset or even a single asset class, so investors will typically choose several options for what to invest $25k in.

Here are some of the things to consider when choosing the best way to invest $25k.

Investment Goals

An investor’s goals are foundational to their investing strategy. The best way to invest $25k for retirement is very different from the best way to invest $25k to supplement short-term income.

Investors should start by thinking about what they hope to achieve by investing $25,000. Based on that, they can decide what investment timeframe they’re interested in and what amount of risk they’re willing to take on. Every investor will be different and what to invest $25k with will depend on their goals.

Risk

Risk is a natural part of investing, but not every asset involves the same amount of risk. Some investments are more risky, meaning that they have a higher chance of losing money. In general, cryptocurrencies are considered very risky, stocks moderately risky, and bonds not very risky.

The flip side to risk is that higher-risk assets generally offer higher potential returns. New cryptocurrency projects might return thousands of percent in a single year, for example, while low-risk bonds might only return 1-5% per year.

Volatility

Volatility is a measure of how quickly the price of an asset changes. A stock that shoots up in value one day and then crashes the next is considered much more volatile than a stock that only changes in value by a fraction of a percent each day.

Volatility matters because it can affect the timeframe of an investment. If an investor has all the time in the world to hold something, they might not mind volatility – there’s no pressure to sell at a moment when the asset might be crashing, and they can wait until it skyrockets again. If an investor has a set timeline, they could be forced to sell while an asset is down.

Diversification

One of the most important things to keep in mind when deciding on the best way to invest $25k is diversification. Diversification means having multiple assets that move in different directions inside a portfolio.

Diversification is important because it protects investors from market downturns. Say the stock market crashes. If an investor put all of their $25k in stocks, then they are going to be stuck holding for a while or selling investments while the market is down.

On the other hand, say an investor split their money between stocks, cryptocurrencies, bonds, and commodities. Even though the stock market crashes, bonds and commodities are doing well. Investors can sell these high-performing assets if they need cash and potentially use that cash to invest in undervalued stocks while the stock market is down.

How to Invest $25k – Tamadoge Tutorial

Now that investors know the best way to invest $25k, it’s time to get started. We’ll walk through the steps to invest in Tamadoge, one of the best new crypto projects for 2022.

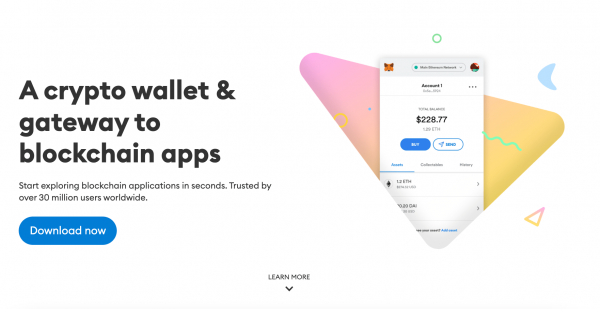

Step 1: Download a MetaMask Wallet

Investors need a crypto wallet in order to buy TAMA during the presale. We recommend MetaMask because it’s free to use, highly secure, and works on most web browsers. Simply head to MetaMask’s website and download the wallet to get started.

Step 2: Visit the Tamadoge Presale

Head to the Tamadoge presale and click ‘Connect Wallet.’ Add the MetaMask wallet to the platform.

Step 3: Buy TAMA

Investors can purchase TAMA during the presale using a credit card, Ethereum, or Tether. The minimum purchase during the presale is $30. Investors who are new to cryptocurrency and need a helping hand can call the Tamadoge team for phone support.

Step 4: Claim TAMA

Purchased TAMA tokens will be released to investors at the end of the presale. Return to the Tamadoge presale website and reconnect the Metamask wallet to claim the purchased tokens.

Conclusion

Our list of the 10 best ways to invest $25k can help investors decide where to invest $25,000 right now. For investors in search of top crypto projects, it’s worth checking out impt. This cryptocurrency project offers a deflationary cryptocurrency and is offering investors a chance to get in early during the presale. Check out the IMPT presale and invest in this token for only $0.018 right now.

#investment #realestate #investing #money #business #invest #bitcoin #property #investor #entrepreneur #trading #forex #realtor #finance #cryptocurrency #realestateagent #home #stockmarket #success #wealth #crypto #financialfreedom #forsale #luxury #stocks #motivation #forextrader #househunting #blockchain