With an investment of $250k, this would provide access to most asset classes – whether that’s real estate, stocks, index funds, IPOs, or crypto.

The purpose of this guide is to explore the best way to invest $250k in a diversified and risk-averse manner, to ensure that the investor is not over-exposed to a single marketplace.

11 Best Ways to Invest $250k in 2022

The best $250k investments to consider today are listed below:

- IMPT – Sustainable Cryptocurrency Project with $10 million Presale Cap

- Invest in Top Crypto Projects – Invest in Undervalued Crypto Presales Like Tamadoge

- Dividend Stocks – Invest in Stocks That Consistently Pay and Increase Dividends

- Growth Stocks – Target High-Growth Companies

- REITs – Create a Diversified Portfolio of Real Estate

- Index Funds – Invest in a Basket of Stocks

- 401 (k)s and IRAs – Funnel Investments Into a Tax-Efficient Account

- IPOs – Invest in a Company Before it Lists on a Stock Exchange

- NFTs – Buy an NFT and Flip it On Open Marketplaces

- Crypto Staking – Earn Passive Income on Long-Term Cryptocurrency Investments

- Copy Trading – Inject Capital Into a Successful Trader

We explore the best way to invest $250k across the above methods in much greater detail in the following sections of this guide.

A Closer Look at the Best Ways to Invest $250,000

The most important consideration to make when assessing how to invest $250k is that the portfolio must be built in a diversified manner. This means that the investor should avoid putting all of their investment eggs into one basket.

With this in mind, we will now explore 10 of the best ways to invest $250k in today’s market.

1. IMPT – Sustainable Cryptocurrency Project with $10 million Presale Cap

When investing with a large number of funds – diversification is an important strategy that will allow one to tap multiple economic markets and increase the chance of making returns. One such diversification strategy is by investing in the IMPT presale – a new project that leverages blockchain technology to offset carbon emissions from the environment.

With a total supply of 3 billion, 600 million IMPT tokens are available to purchase during the first presale round for just $0.018 per token. Purchasing IMPT allows investors to buy Carbon Credits – which are permits representing a certain amount of CO2 emissions that will be removed from the atmosphere.

On the IMPT platform, Carbon Credits are minted as NFTs and can be purchased with IMPT tokens. Once an investor holds this NFT – they can either trade the asset or burn the Carbon Credit.

The IMPT whitepaper states that burning the NFT will result in the elimination of emissions from the atmosphere. IMPT tokens can be purchased from the IMPT platform – which has partnered with multiple businesses that are willing to offer a portion of their sales margin as tokens, which will be used for the carbon offset program.

On the other hand, the tokens can be directly bought from the IMPT platform via Transkak by using fiat payment methods such as credit and debit cards. The first presale round has already collected $3.6 million of its $10.8 million targets in under 2 weeks. Not only does this cryptocurrency promote socially responsible investing, but investors can also get in early before the token is released on global exchanges.

If IMPT were to reach a mere $1 billion market cap – the price of IMPT would reach a price in excess of $1.8. While the token is far away from this price range, the unique utility that IMPT offers in the fight against climate change makes it one of the top cryptos to watch right now.

Access the IMPT Telegram channel to stay updated with the IMPT project.

2. Invest in Top Crypto Projects – Invest in Undervalued Crypto Presales Like Tamadoge

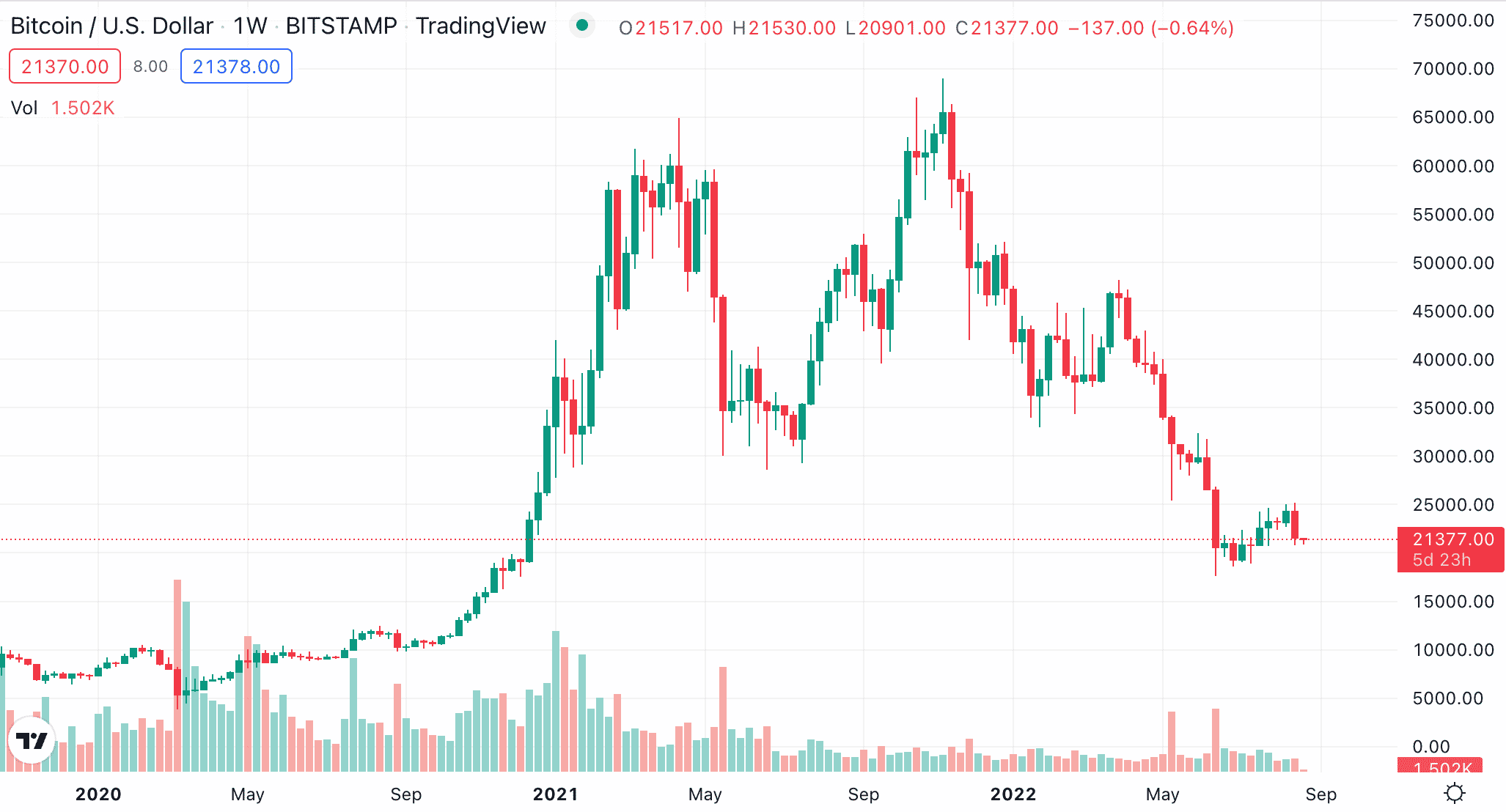

All portfolios should allocate some investment funds into high-growth markets. At the forefront of this is crypto, which remains the best-performing asset class of the prior decade. For instance, in the 10 years prior to writing this guide, Bitcoin was trading at approximately $10 per token. And today? The same digital currency is worth $20,000.

This means that those holding onto their Bitcoin tokens for 10 years would now be looking at portfolio growth of nearly 200,000%. The stock market, in comparison, has returned less than 200% over the same timeframe. Moreover, we should also note that in late 2021, Bitcoin was trading at over $68,000 per token.

This means that a Bitcoin investment 10 years ago would have been worth nearly 680,000% more when the digital currency was at its peak. With that said, when Bitcoin goes through a bearish market – like it is right now, this enables investors to invest in cryptocurrency at a discounted price.

This low-entry level also enables investors that bought Bitcoin when it was inching towards its all-time high to average down their cost-price. Another example of a high-growth cryptocurrency that has generated sizable returns in a short period of time is BNB. The digital currency – which is backed by the Binance exchange, was launched in late 2017 at approximately $0.11.

Based on prices as of writing, BNB has since generated growth of over 250%,000. When BNB hit an all-time high in 2021, however, lifetime gains since its inception in 2017 amounted to over 600,000%. Now, buying established cryptocurrencies like Bitcoin and BNB during the current bear market offers an attractive entry price.

However, these digital currencies are already large-cap assets, which means that the upside potential will be a lot more modest when compared to historical gains. As a result, those looking to buy cryptocurrency with the intention of making significant returns might instead consider a newly launched project.

The best way to gain exposure to a new crypto project is by investing in its respective presale ICO (initial coin offering). This will offer an allocation of the total supply to early investors at a discounted price. In turn, this provides the new crypto project with the working capital they need to develop its business and bring its products or services to the masses.

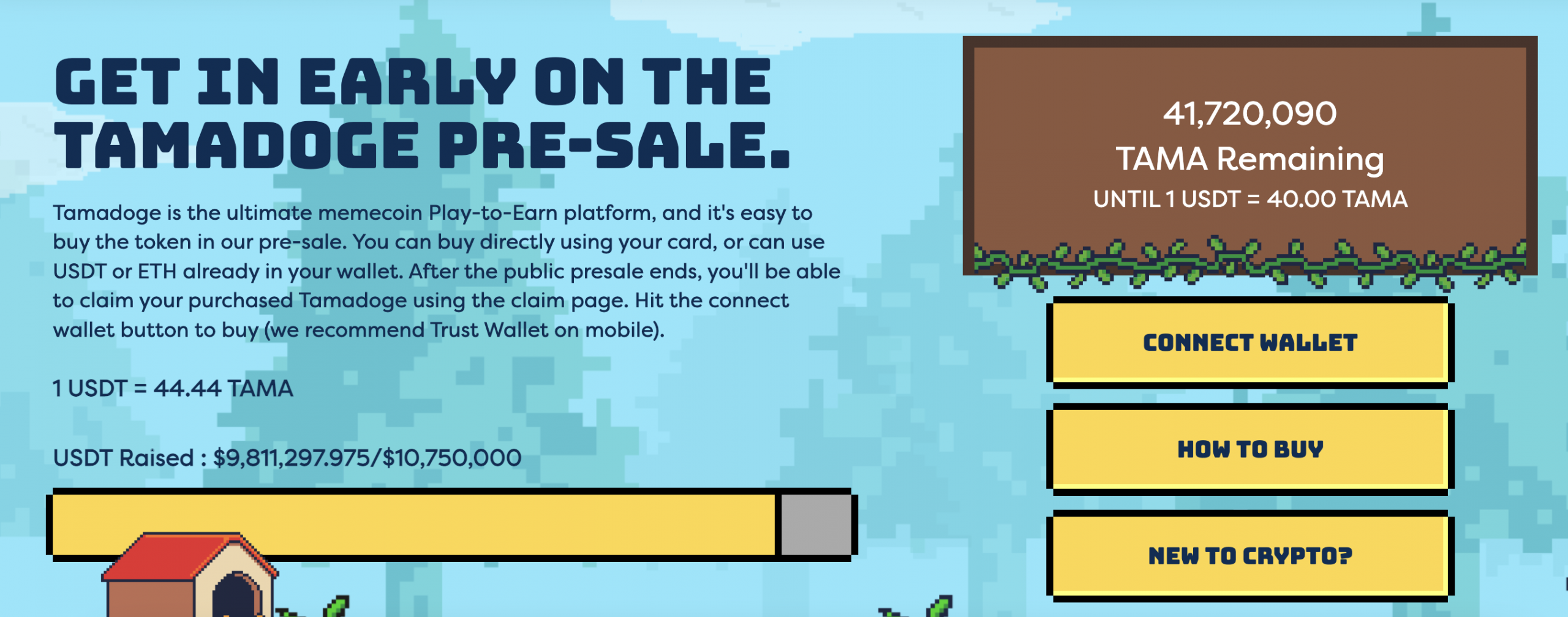

To offer some insight into up-and-coming presales that are worth a look, Tamadoge stands out. Its presale has been operational for several weeks and has already raised in excess of $9.8 million. As such, the presale will soon sell out. In terms of its objectives, Tamadoge is building a play-to-earn crypto game.

Players will first need to mint an NFT, which generates a virtual pet with randomly selected traits and characteristics. The player can feed, train, and even battle their pets with other users. The idea is that players can win rewards for progressing through the game, which is paid in TAMA tokens.

Tamadoge will also be launching its own metaverse world, alongside in-game assets and immersive experiences through augmented reality. As such, those looking for the best way to invest $500k may find Tamadoge to be an enticing new crypto project. Another newly launched project to keep an eye on is Battle Infinity. Its IBAT token was recently launched on the PancakeSwap exchange after raising its presale hard cap of over $5 million in just 24 days.

IBAT continues to generate attractive returns for early investors even during this bear market. As such, IBAT remains one of the best coins on Pancakeswap at this moment in time. The project appeals to those that have an interest in fantasy sports and multiplayer games. Crypto rewards – paid in IBAT, as well as NFTs and in-game assets, can be won by Battle Infinity players.

Learn More: Read our guide on the best crypto winter tokens to buy at a discount.

3. Dividend Stocks – Invest in Stocks That Consistently Pay and Increase Dividends

Dividend stocks are also worth considering when evaluating the best way to invest $250k. The reason for this is that dividend stocks offer portfolio growth in two ways. First, just like any other publicly-listed company, if the value of the dividend stock increases, this will result in capital gains for the investor.

Second, the respective stock will pay a dividend to shareholders every three months. This means that the investor will generate regular, consistent income for as long as the company continues to pay dividends. Of course, even the best dividend stocks in the market can run into financial issues, meaning that there is no guarantee that payments will continue indefinitely.

For example, in the midst of the pandemic, many companies decided to cut or outright suspend their dividend policy. However, the good news is that there are a collection of dividend ‘aristocrats’ and ‘kings’ that have a long-standing track record of paying and increasing the size of their dividends – even during bear markets and recessions.

Aristocats refers to stocks that have increased their dividend payments for at least 25 consecutive years. Dividend kings, on the other hand, have achieved this feat for no less than 50 consecutive years. This is an unprecedented timeframe, considering how many market cycles we have gone through over the prior five and more decades.

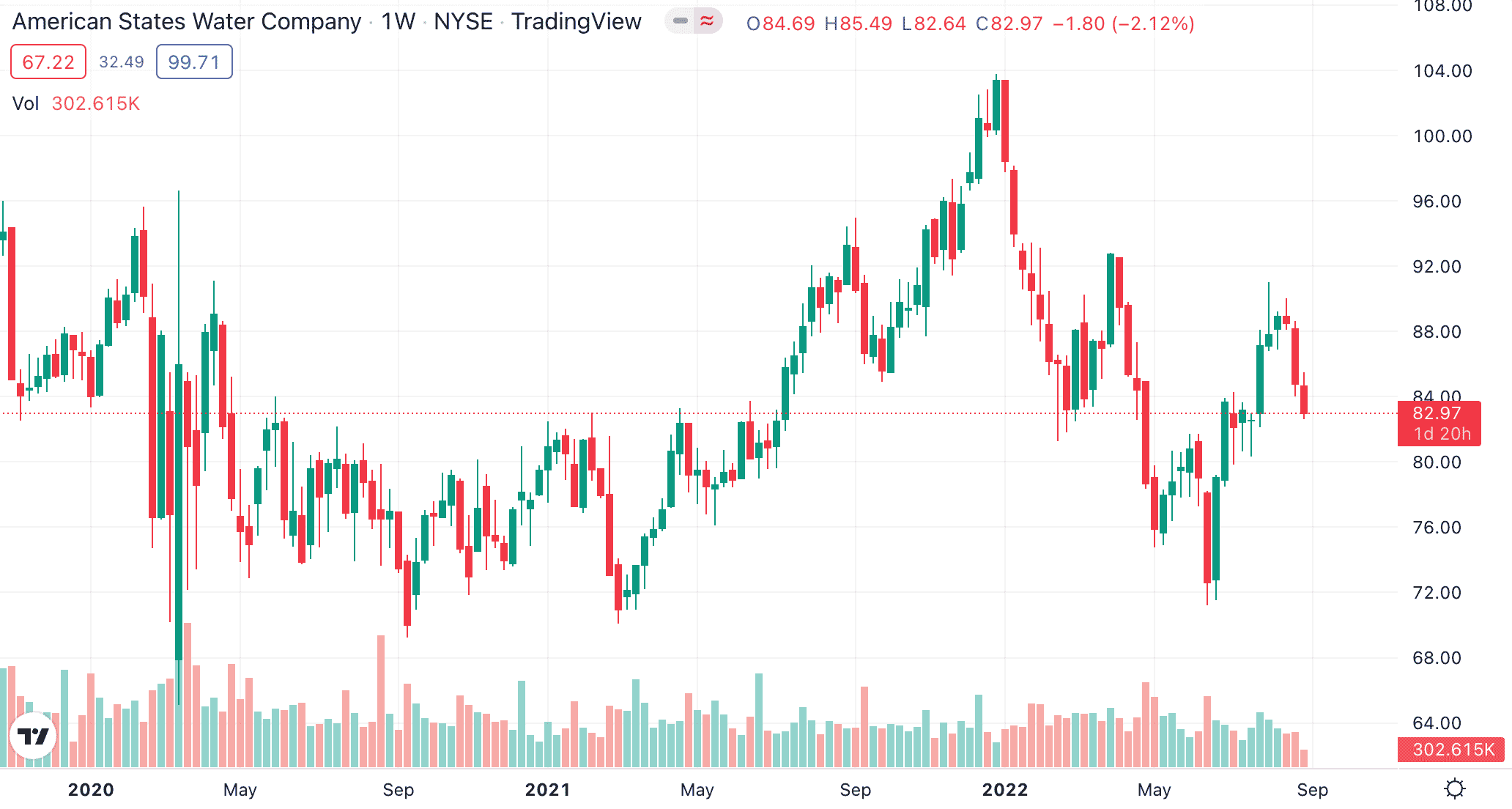

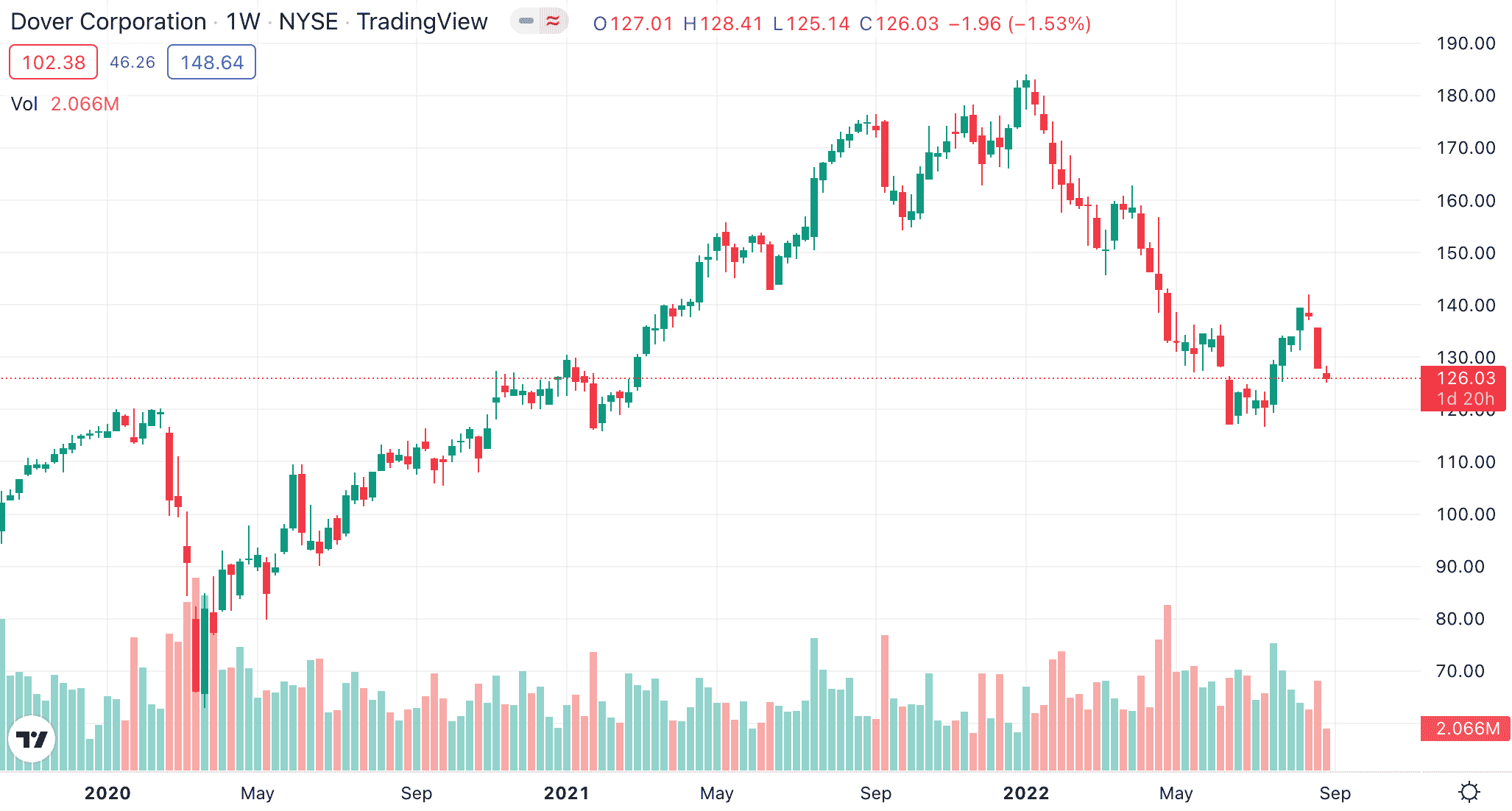

Some of the longest-standing dividend kings in this marketplace include everything from American States Water, Dover, Procter & Gamble, 3M, Coca-Cola, and Colgate-Palmolive. Let’s take American States Water as a prime example – which has increased the size of its annual dividend for 67 consecutive years.

This mid-cap stock is not only offering a running dividend yield of 1.92% as of writing, but it has generated stock gains of nearly 70% over the prior five years. The second-longest standing dividend king at 66 years is Dover. This stock is offering a running dividend yield of 1.62% as of writing, which is in addition to five-year stock gains of over 80%.

Crucially, by holding a portfolio of dividend kings over many decades, the investor can place less reliance on the stock price of each company. After all, as long as the dividend payment in dollar terms continues to rise, this will result in a very attractive flow of quarterly payments.

Furthermore, seasoned investors will look to reinvest dividend payments back into the stock market as soon as the funds arrive. This enables investors to benefit from compound growth. In other words, the newly purchased stocks will also earn dividends. In addition to dividend kings, it is also worth exploring companies that offer an above-average yield.

This will enable the investor to target higher incoming payments in the shorter term. It is also worth considering an ETF that specifically tracks consistent dividend stocks. You can read more about how to trade ETFs by reading our guide. Either way, those of the view that dividend stocks represent the best way to invest $250k can create a commission-free portfolio at eToro, across more than 2,500 US and international companies.

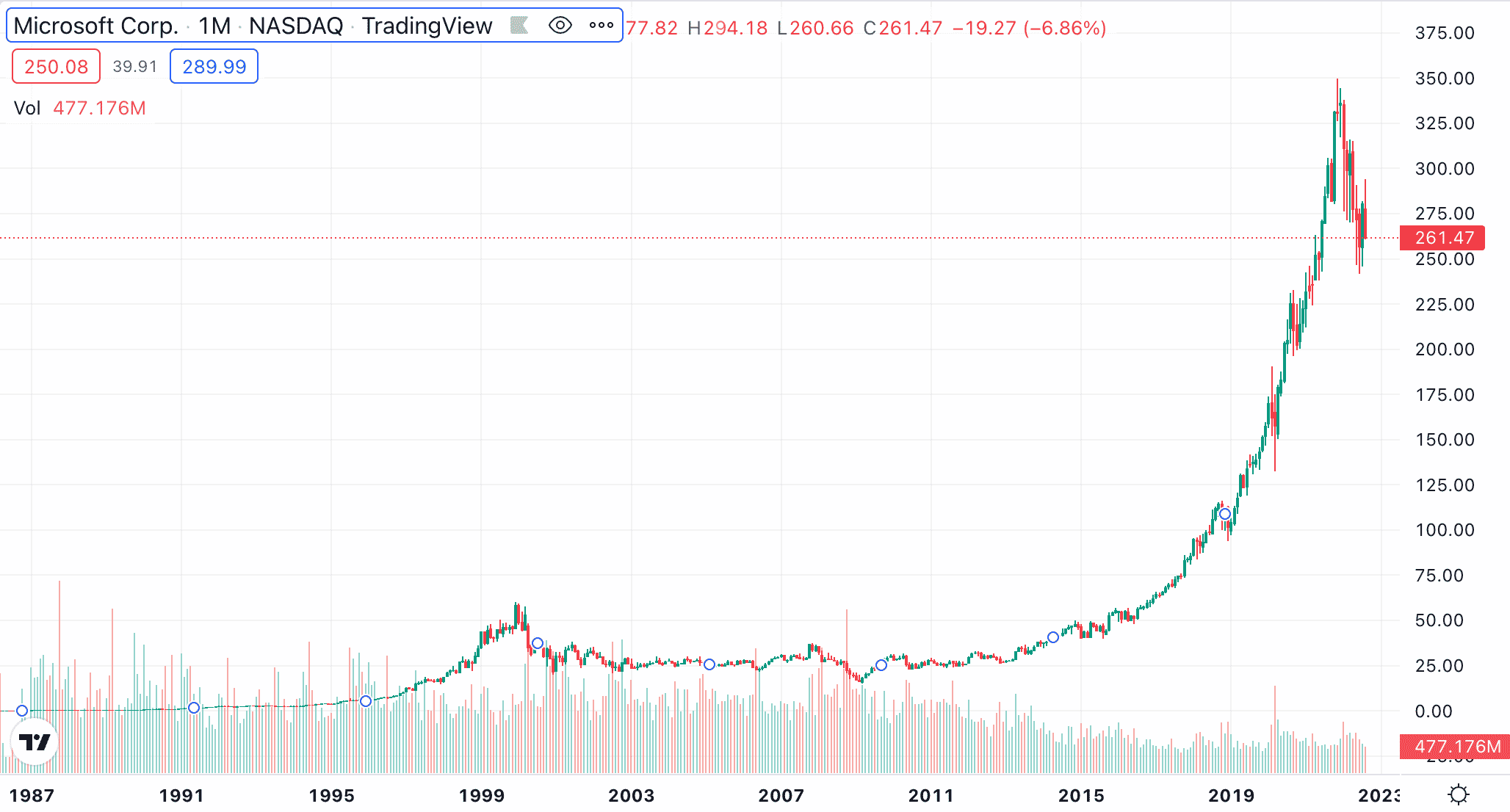

4. Growth Stocks – Target High-Growth Companies

Although there will always be exceptions – dividend stocks typically generate slower growth in terms of their share price trajectory. With this in mind, when assessing the best way to invest $250k, it is also worth exploring growth stocks. This generally refers to companies that have the potential to grow at a faster rate than the market average.

In some cases, this will be because the company is still young, and thus – it hasn’t yet reached its full potential. In other cases, growth stocks can also be established companies that have the capacity to diversify and innovate, meaning that they continue to enjoy above-average share price gains.

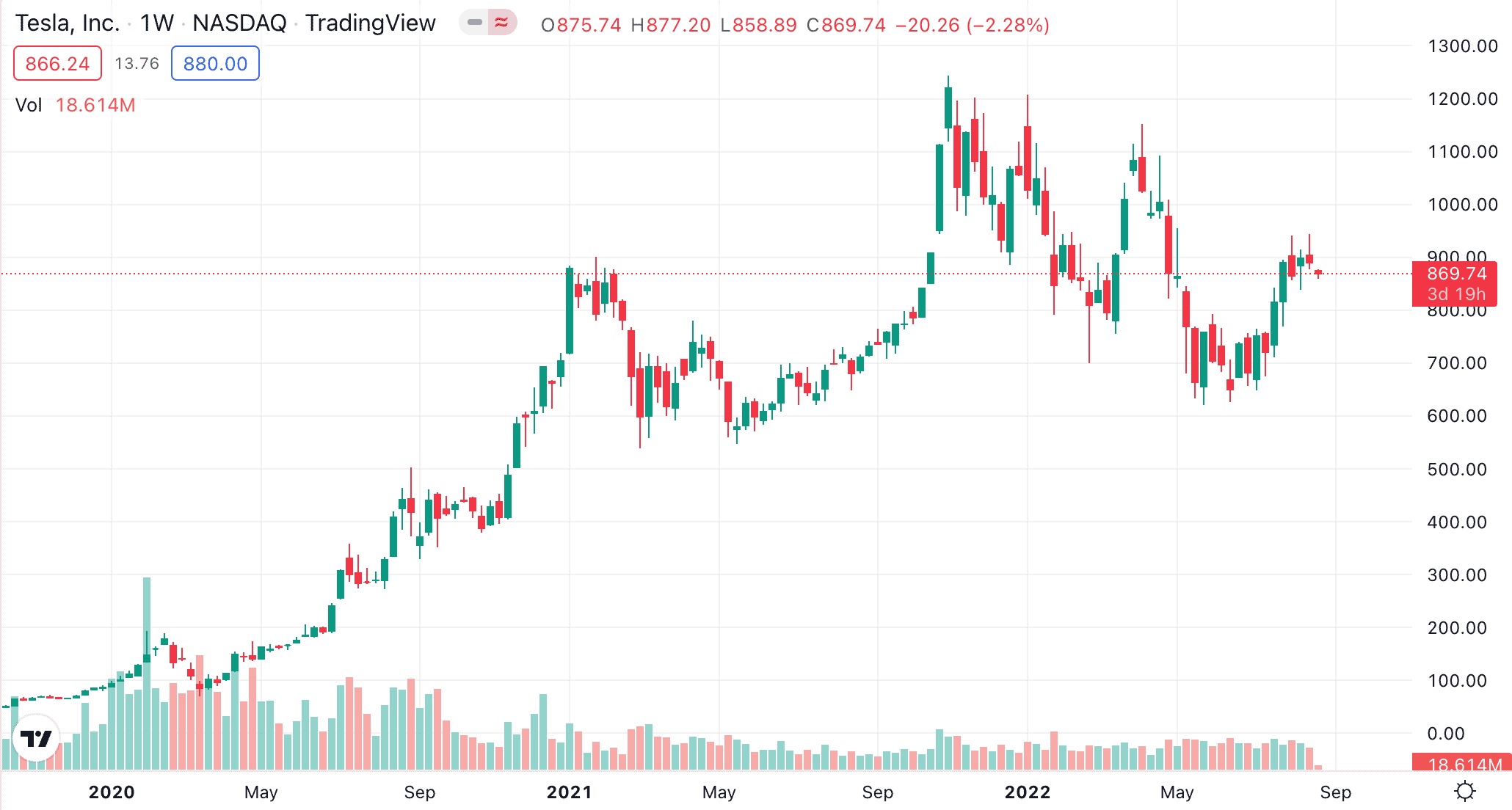

One of the most traded growth stocks in this marketplace is the electric car maker Tesla. This popular stock went public in 2010 at a price of just $1.28 (adjusted for its recent share split). As of writing, Tesla is trading at over $275, which represents growth of over 20,000%. This means that an investment of $10,000 in 2010 would now be worth more than $2 million.

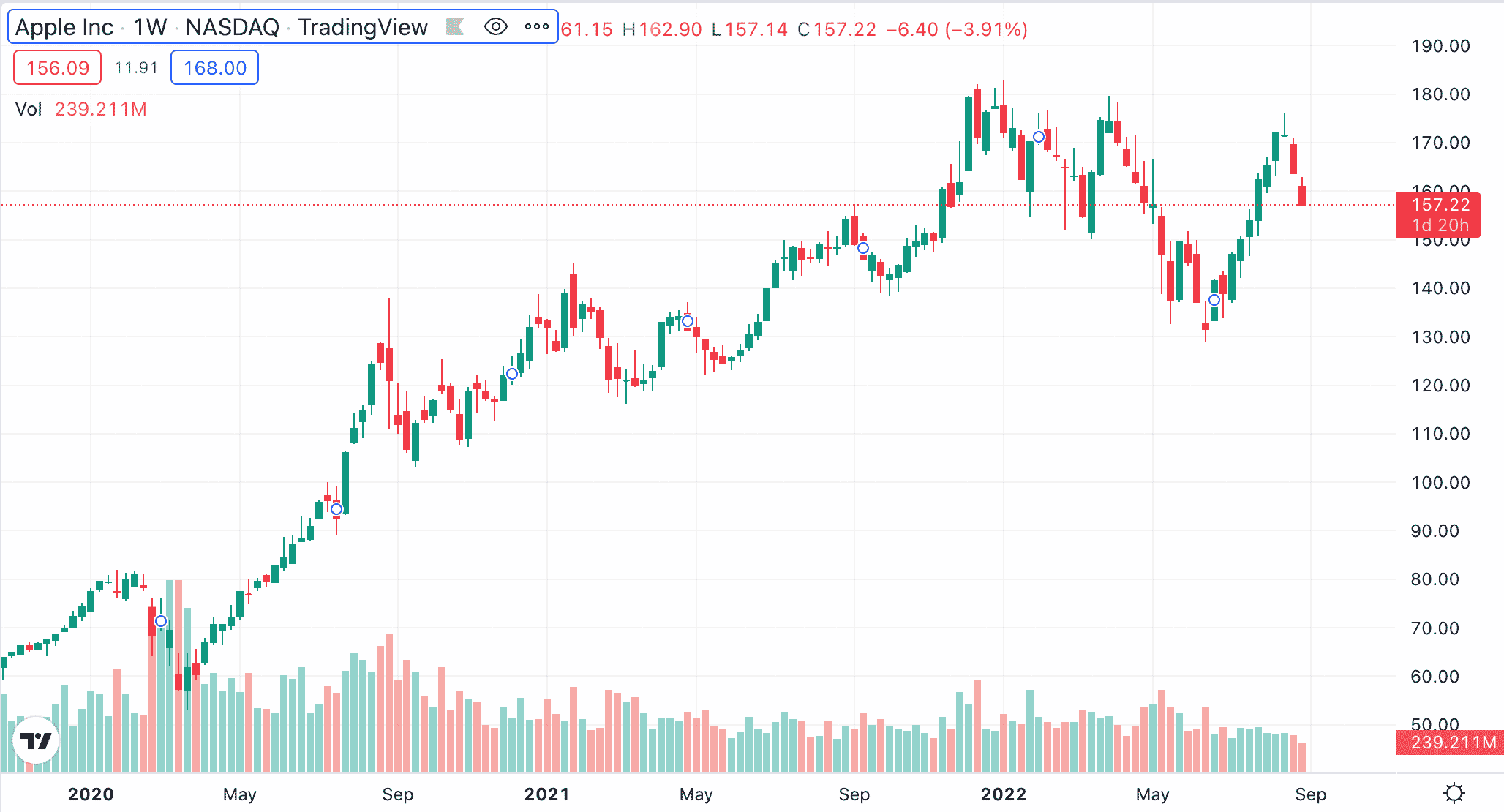

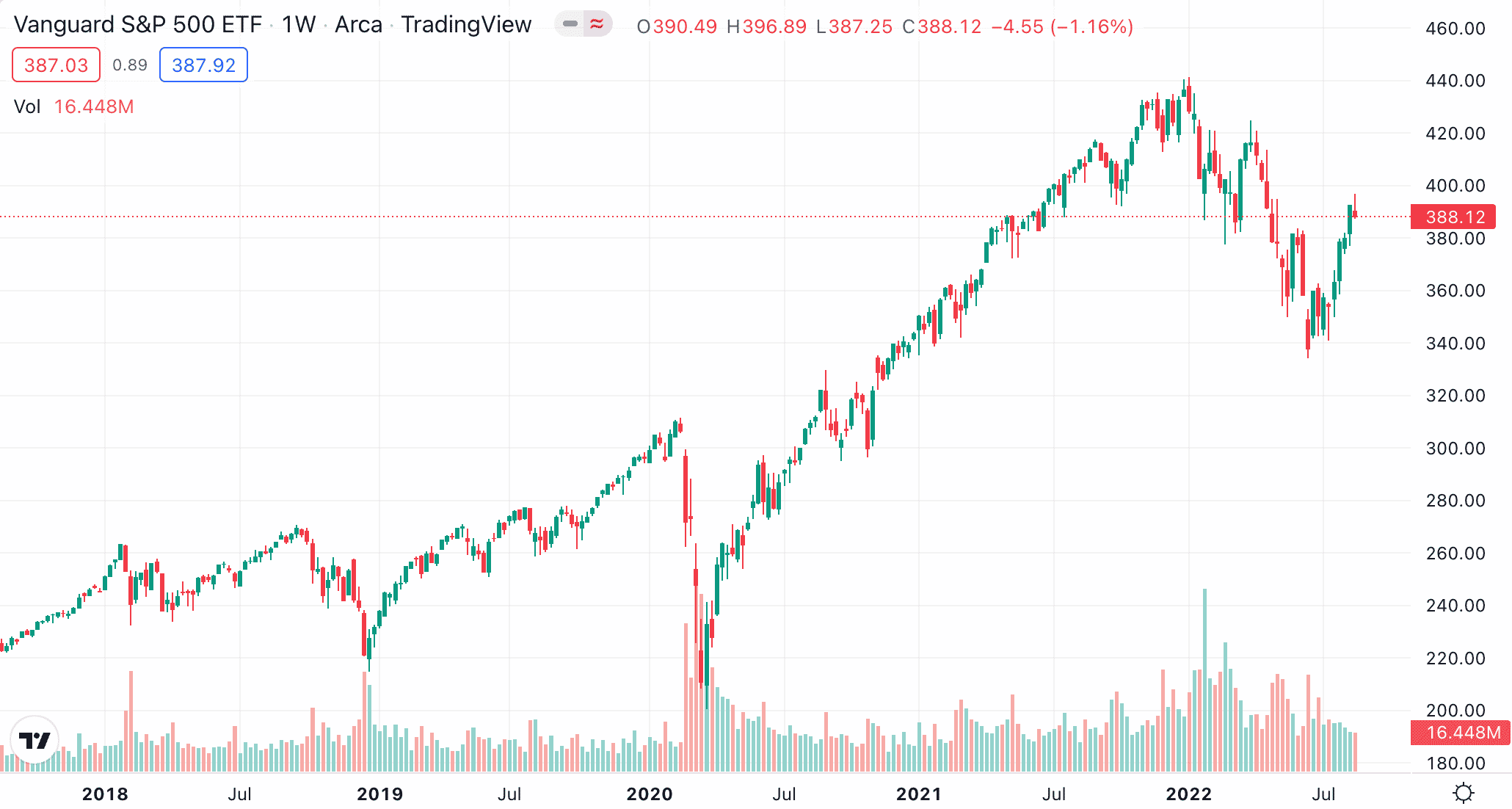

The likes of Amazon and Apple – although established blue-chip companies, should also be viewed as growth stocks. After all, not only do they continue to develop and launch innovative products and services, but they consistently outperform the broader market. For instance, over the prior five years of trading, the S&P 500 has grown by nearly 60%.

In comparison, Amazon and Apple have grown by approximately 160% and 280%, respectively. Another way to find high-growth stocks is to explore current market trends. For example, many investors are now turning to oil and gas companies, due to ever-increasing global energy prices.

Examples include Devon Energy and ConocoPhillips, which, over just 12 months of trading, have generated growth of 150% and 100%, respectively. Both of these companies also offer above-average dividend payments, with a running yield of 6.6% and 4% as of writing. Another way to find suitable growth stocks when assessing how to invest $250,000 is to look for emerging technologies.

For instance, high-growth markets include artificial intelligence, machine learning, and blockchain. By investing $250k in pureplay stocks that are active in these industries early, this will often result in an attractive entry price. It is also possible to invest in an ETF that tracks growth stocks, which will suit those that wish to approach this market passively.

It should, however, be noted that in many cases, growth stocks do not pay dividends. This is because growth stocks choose to reinvest their retained profits back into the development of the company. In order to buy growth stocks, it is important to choose a low-cost broker. eToro, for instance, offers hundreds of growth stocks at 0% commission.

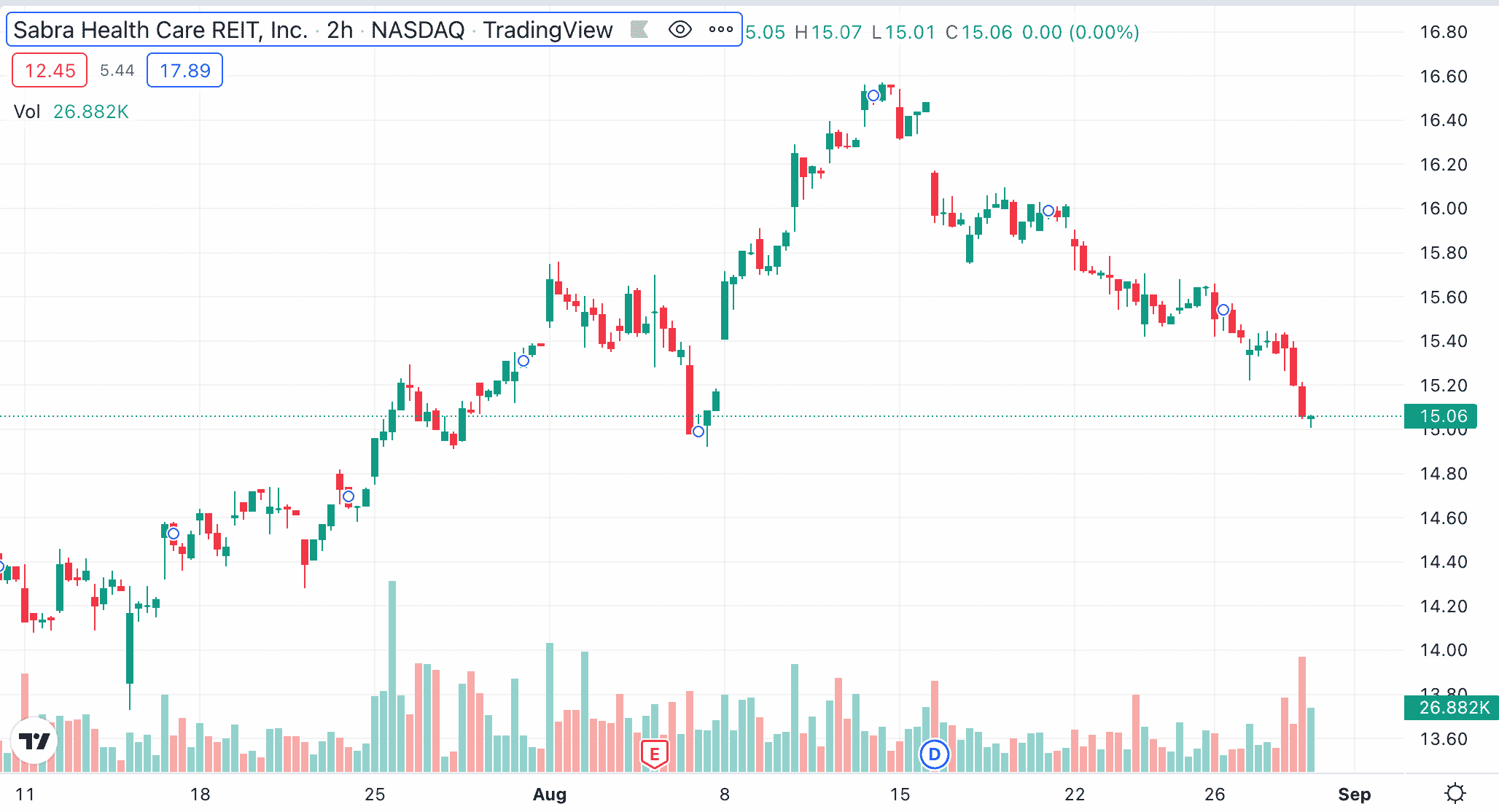

5. REITs – Create a Diversified Portfolio of Real Estate

It goes without saying that real estate offers a solid marketplace for those wondering how to invest $250k. However, investors should perhaps consider avoiding injecting their entire $250k capital into a single property. Instead, diversification is key in the real estate market. This means gaining exposure to a wide range of housing markets to mitigate the risk.

One of the best ways to invest $250k into the real estate market in a diversified manner is to opt for a REIT (real estate investment trust). The main concept of investing in REITs is not too dissimilar to conventional ETFs. This is because the REITs, on behalf of their investors, will buy and maintain a broad portfolio of properties.

The REIT will likely be listed on a public stock exchange via an ETF investment, which makes it simple to gain exposure to its portfolio of assets. The market price of the REIT will either increase or decrease based on the value of the properties that it holds. For instance, if the broader housing market is strong, the REIT will likely appreciate.

Another major benefit of investing in a REIT is that dividends are usually distributed every month. Dividends represent any incoming rental payments that the REIT collects from its tenants. REITs are also popular with investors that wish to diversify across many different real estate markets.

For example, some REITs will focus on residential apartments and multi-family complexes throughout the US. Others will have exposure to large shopping malls and distribution warehouses. Some REITs will focus exclusively on the healthcare sector – by owning and renting hospitals and medical centers.

Either way, unlike traditional real estate, REITs are as liquid as stocks. This is because the investor can cash out their REIT position during standard market hours. It’s just a case of selling the respective REIT shares via an online broker. eToro offers a wide range of residential, commercial, and healthcare REITs on a commission-free basis.

6. Index Funds – Invest in a Basket of Stocks

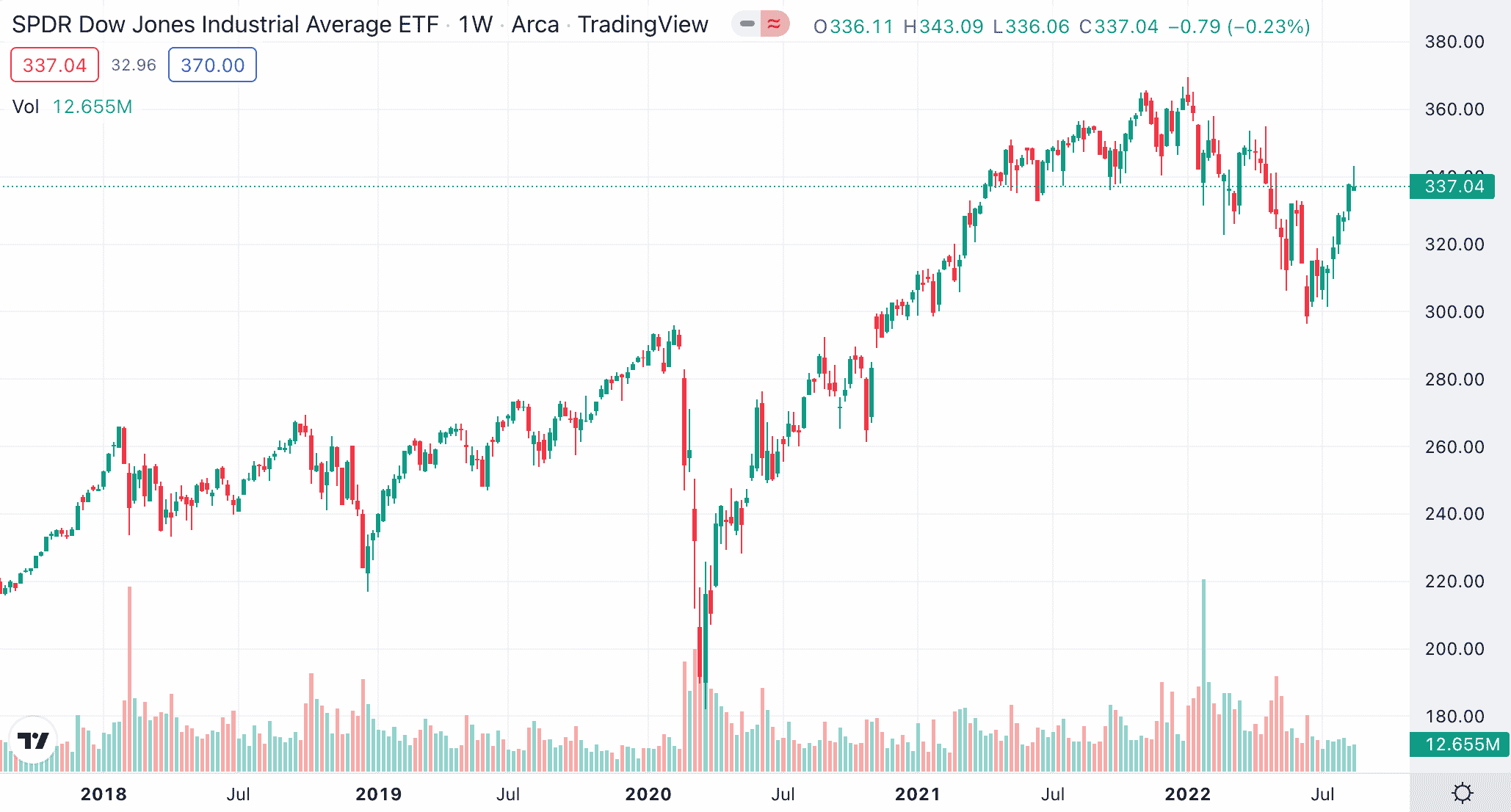

Index funds are a popular choice with retail investors. This asset class will appeal to those that wish to invest in the stock market but are unable or unwilling to pick individual companies – perhaps because of a lack of experience or time. In a nutshell, index funds will track a basket of stocks from a predefined market.

The most traded index funds globally include the Dow Jones and S&P 500 – both of which have followed a similar upward trajectory over many decades. The Dow Jones is an index fund that tracks the performance of 30 selected companies. Each company is an established, large-cap stock that has a consistent dividend policy in place.

Moreover, stocks within the Dow Jones index will come from a variety of industries and sectors. The full list of Dow Jones companies includes:

- 3M

- American Express

- Amgen

- Apple

- Boeing

- Caterpillar

- Chevron

- Cisco

- Coca-Cola

- Dow

- Goldman Sachs

- Home Depot

- Honeywell

- IBM

- Intel

- Johnson & Johnson

- JPMorgan Chase

- McDonald’s

- Merck

- Microsoft

- Nike

- Procter & Gamble

- Salesforce

- Travelers

- UnitedHealth

- Verizon

- Visa

- Walgreens Boots Alliance

- Walmart

- Walt Disney

As per the above, investing in a Dow Jones index fund would provide exposure to all 30 companies. However, it is important to remember that index funds are weighted. This means that one company can have a larger share of the index fund when compared to others. In the case of the Dow Jones, the weight of each company is based on its stock price.

For example, UnitedHealth represents over 10% of the Dow Jones weighting, with a share price and market capitalization of $519 and $485 billion, as of writing. However, although Microsoft has a market capitalization of nearly $2 trillion, it represents just 5.4% of the Dow Jones. This is because, as of writing, the share price of Microsoft stands at $261.

Most index funds, however, opt for a weighting system based on market capitalization – as this is more indicative of the influence that the stock has on the broader economy. The S&P 500 is a great example of this, which weights its index based on valuation. For example, Apple, Microsoft, Amazon, and Tesla each carry the largest weight in the S&P 500.

In addition to the Dow Jones and S&P 500, there are many other index funds to explore. For instance, index funds will focus on a particular stock type. This might include a basket of dividend stocks or companies from emerging economies. Index funds also offer access to a broad selection of growth stocks and even bonds.

Either way, index funds are also perhaps the best way to invest $250k for income. For instance, investing in index funds such as the Dow Jones index would provide quarterly dividends. As noted, this is because all 30 Dow Jones companies have a dividend policy in place. Many companies within the S&P 500 also pay dividends on a quarterly basis.

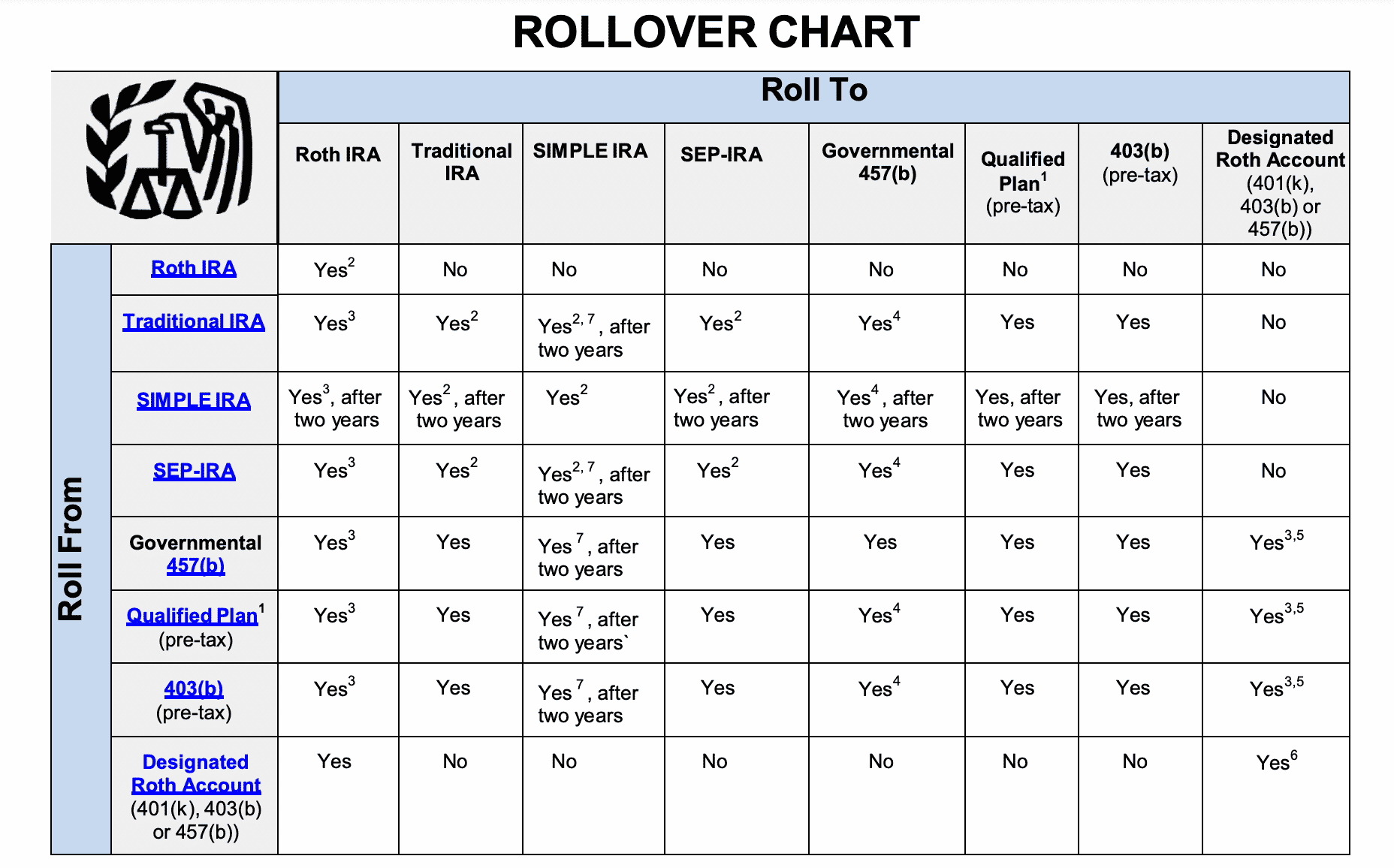

7. 401 (k)s and IRAs – Funnel Investments Into a Tax-Efficient Account

When assessing how to invest $250k, it is important to be aware of any tax implications that might arise. In simple terms, tax is typically payable on realizable gains. For instance, this could mean selling stocks at a profit or receiving dividends. With this in mind, investors in the US should consider investing through a suitable tax-efficient account.

This is usually a choice between a 401 (k) or an IRA, albeit, with an investment of $250k, both of these plans could be maxed out. Starting with the 401 (k), this plan is offered by more than 50% of employers in the US. The plan offers under 50s the opportunity to invest in a tax-efficient manner at up to $20,000 annually. Over 50s can invest even more, at $27,000.

By choosing a traditional 401 (k), the tax on the investments is deferred until retirement. For instance, if the worker were to allocate $1,000 from their paycheck into the 401 (k), the full $1,000 would be invested without any tax paid. This would allow the capital to grow at a faster rate. However, the tax will be deducted when withdrawals from the 401 (k) are eventually made.

On the other hand, a Roth 401 (k) enables workers to withdraw from their 401 (k) at the age of retirement without paying any tax. Instead, the tax is taken from the worker’s salary as it normally would. Another benefit of 401 (k)s is that some employers have a matching contribution scheme in place.

For example, the employer might match 4% of all annual 401 (k) contributions made. This means that by maximizing the full $20,000 allowance, this would generate an additional $800 in investment capital. This $800 could then have several decades to appreciate and grow, which is in addition to the original contributions.

After maxing out a 401 (k) plan for the year, investors might consider switching over to an IRA. This account type can be opened with an online broker and both Roth and traditional plans are often supported. The investor will have access to a wide range of assets when investing through an IRA, albeit, limits stand at $6,000 annually or $7,000 for those over 50.

8. IPOs – Invest in a Company Before it Lists on a Stock Exchange

Another option to consider when evaluating the best way to invest $250,000 is to inject capital into the best upcoming IPOs (initial public offerings). This is the process undertaken by companies when they plan to list on a stock exchange for the first time. The IPO, therefore, gives investors a chance to buy stocks in the company early and thus – at an attractive price.

Not all IPOs go on to generate returns, but many do. One of the most successful IPOs of all time was Tesla, which went public in 2010. As we noted earlier, Tesla stock has since gone on to generate growth of over 20,000%. Other notable IPOs include Amazon, Apple, and Microsoft – all of which have grown to become multi-trillion dollar companies.

HCA Healthcare is another example of a successful IPO, with the firm going public in 2011. As of writing, the stock is up over 535% since its IPO date. However, it is also important to remember – especially in recent years, that many IPOs have failed to live up to their hype.

A prime example of this is Uber, which went public in 2019. As of writing, Uber stock is trading at 30% below its IPO price. An even bigger IPO failure was Coinbase. Compared to its 2021 IPO valuation, Coinbase stock is now trading 80% lower. As a result, while IPOs should still be considered when assessing how to invest $250k, only a small amount of capital should be allocated.

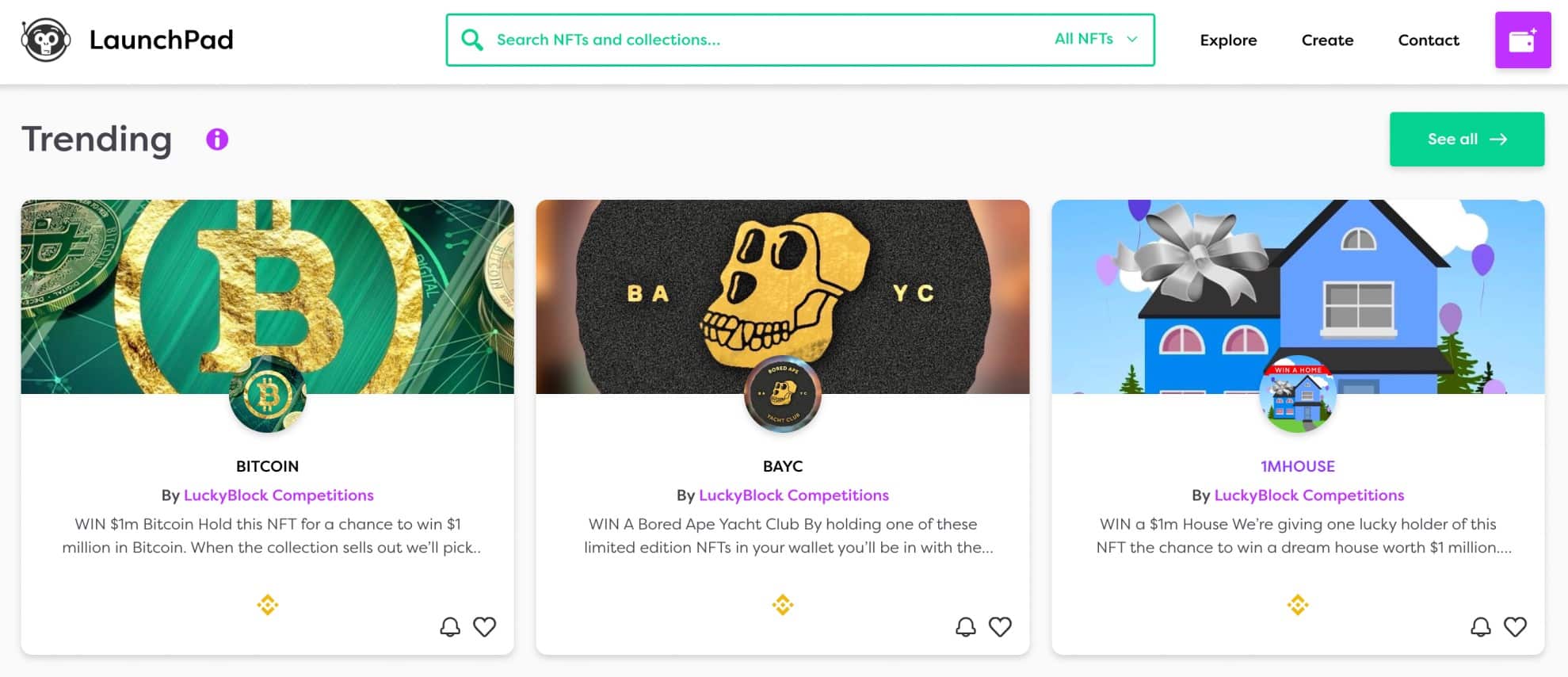

9. NFTs – Buy an NFT and Flip it On Open Marketplaces

Another high-growth market to consider when assessing what to invest $250k is NFTs (non-fungible tokens). This niche marketplace operates in the blockchain space, insofar that NFTs are digital assets. However, unlike legacy cryptocurrencies, such as Bitcoin or Ethereum, each NFT is unique from the next.

Moreover, NFTs can represent ownership of an asset. This means that a tradable marketplace exists, as NFTs make the ownership transfer simple and secure. Although this industry is new, some investors have generated sizable gains by flipping NFTs. This refers to the process of investing in an NFT and listing it for a higher price on an online marketplace.

A great example here is the Bored Ape Yacht Club NFT. 10,000 NFTs from within this collection were minted in 2021 and sold to investors at just under $200 each. Since the minting process, Bored Ape NFTs have sold for up to $3 million. While finding the next Bored Ape collection is no easy feat, it is worth exploring the Launchpad.XYZ website for potential flipping opportunities.

We came across one collection, in particular, that could be of interest – Lucky Block. This newly launched project has built an online platform that supports NFT competitions. This means that to enter a competition, the user must purchase an NFT. In doing so, not only will the user receive a ticket entry into the prize draw, but ongoing crypto rewards.

The rewards are distributed in LBLOCK tokens – which was behind one of the most successful crypto presales of 2022. Put simply, after selling out its presale in January 2022, LBLOCK went on to record gains of over 6,000%. In terms of the competitions on offer at Lucky Block, this includes everything from a Lamborghini and a Bored Ape Yacht Club NFT to $1 million in BTC.

10. Crypto Staking – Earn Passive Income on Long-Term Cryptocurrency Investments

In a similar nature to dividend stocks and bonds, crypto staking is also suitable for those with $250k to invest in a passive manner. Once again, taking into account that crypto assets are high-risk products, it wouldn’t be advisable to invest the entire $250k. However, a small allocation of funds into this space would enable the investor to generate passive income.

In its most basic form, staking requires the investor to deposit crypto tokens into the platform. In doing so, the platform will pay a regular, fixed rate of interest to the investor. The interest payments are often distributed daily or weekly and will be paid in the same crypto asset that is being staked.

Some staking platforms will pay dividends at the end of the term – which might be anything from a few days to a year. In some cases, investors will have access to a more attractive APY when choosing a longer staking term. On the other hand, the shorter the lock-up term selected, the lower the APY.

Nonetheless, a simplistic example of how staking works is as follows:

- The investor stakes 10 ETH on a six-month term, at an APY of 10%

- This means that over the course of a year, the investor would generate an additional 1 ETH (10% of 10 ETH)

- However, as the staking term is six months, the generated rewards will amount to 0.5 ETH

- After six months have passed, the investor gets 10.5 ETH back

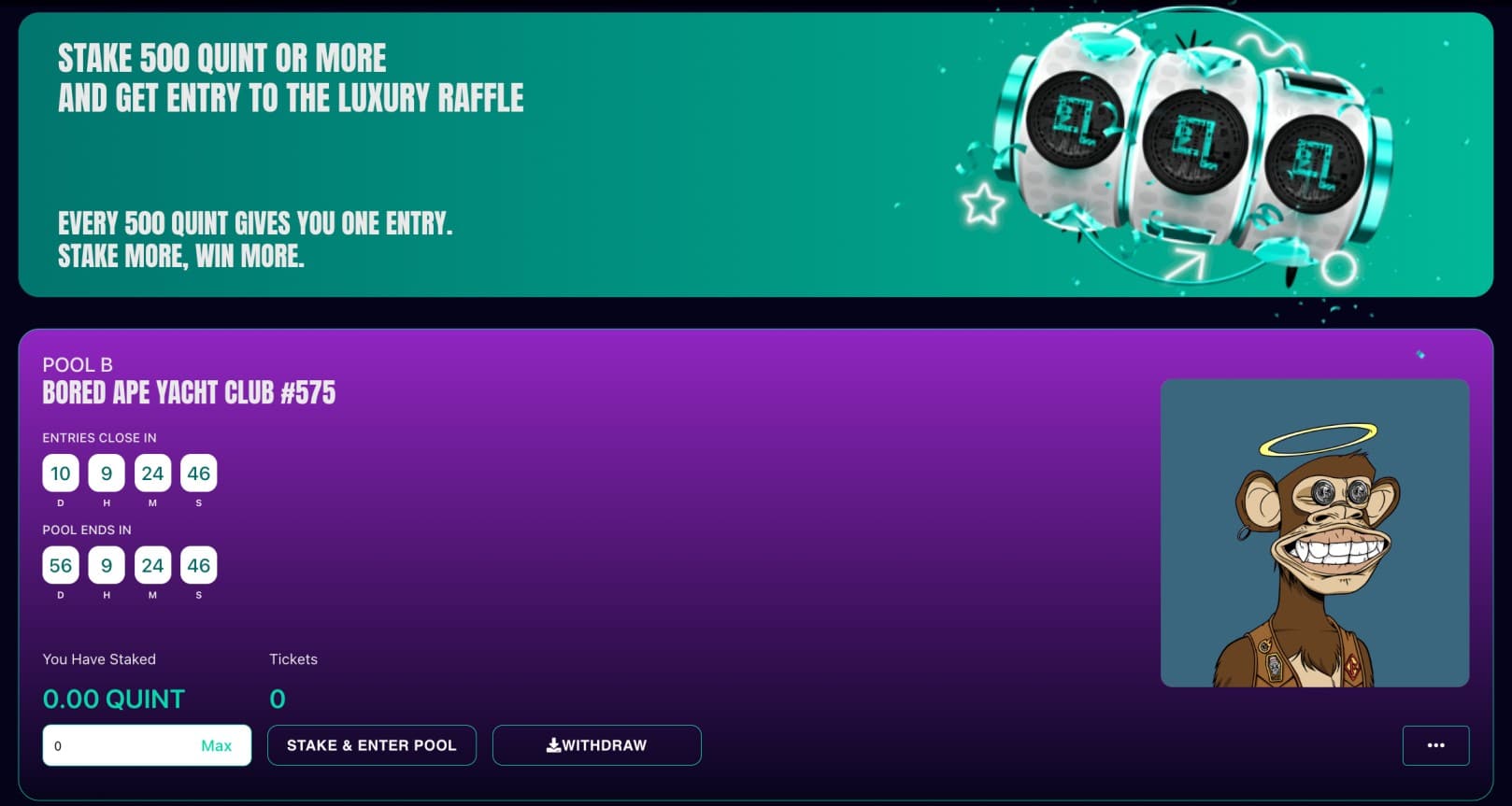

In terms of platforms, Quint is well worth checking out for its super staking concept. Put simply, by staking funds in a Quint pool, investors will earn interest on the deposit in addition to competition tickets.

The latter, as of writing, provides entry into a competition that is offering a Bored Ape Yacht Club NFT as its prize. After the respective competition is drawn, the prize will be distributed and staked tokens will be returned to all investors – including interest.

11. Copy Trading – Inject Capital Into a Successful Trader

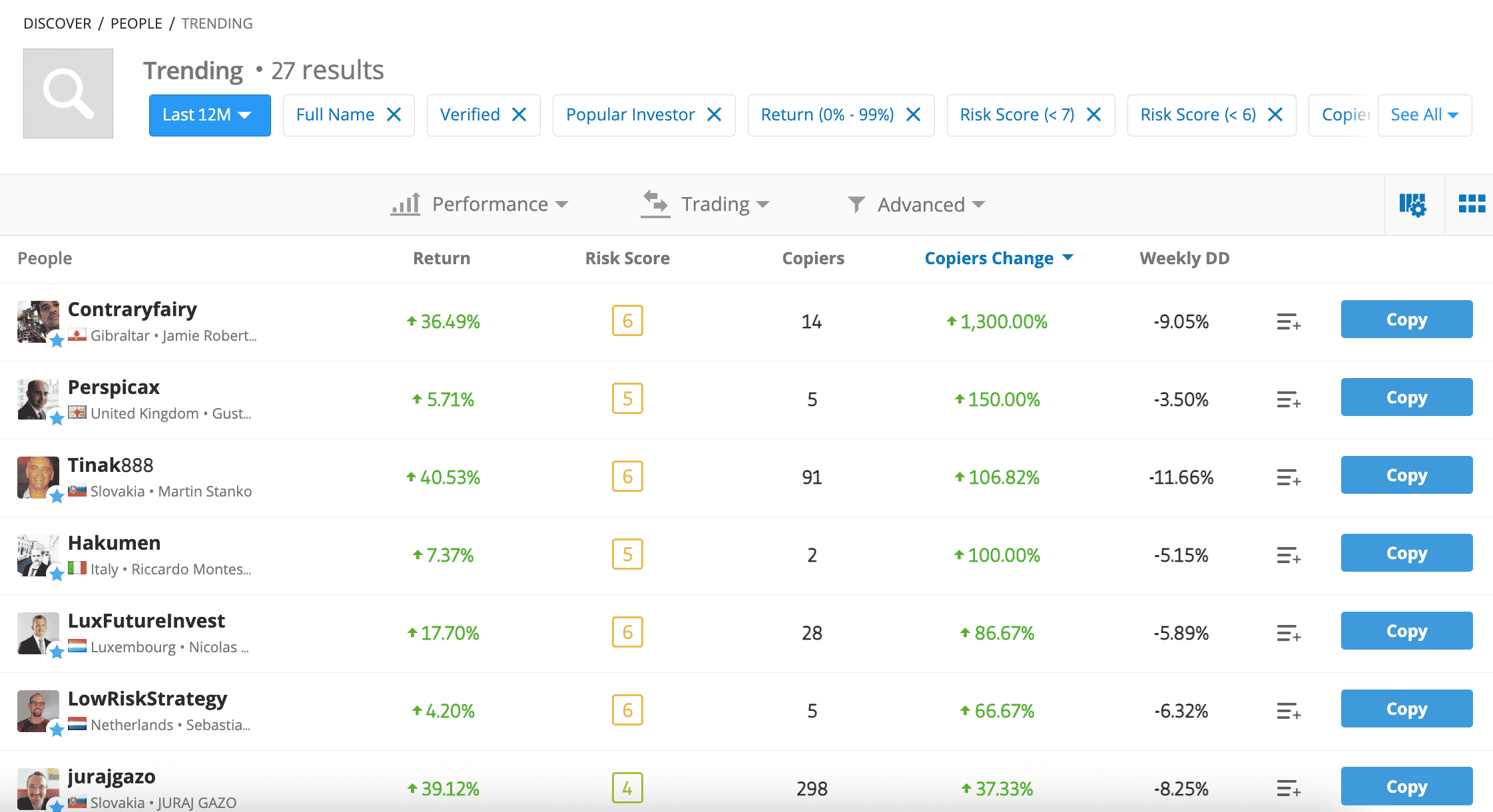

The final product that we will discuss today is Copy Trading, which is one of the best ways to invest $250k in a passive nature. In its most basic form, the eToro Copy Trading platform enables registered users to mirror the investments of a selected trader. For instance, if the trader buys Devon Energy stock, the same position will be carried over to the eToro user.

The purpose of this feature is to enable eToro users to buy and sell assets in a passive way, by automatically mimicking the positions of a trader that has a proven track record. It is important to spend some time researching the many traders that can be copied on eToro. The platform offers many statistics and data feeds that can assist with this goal.

For example, upon clicking on the profile of a trader, it is possible to view their metrics surrounding historical gains since joining eToro, average monthly returns, risk score, preferred markets, average position duration, and the total number of followers. After making a decision, the eToro user can allocate just $200 to the trader that they wish to copy.

In doing so, all future positions will be copied, but at a proportionate amount. For instance, let’s say that the eToro user decides to invest $5,000 into a trader. The chosen trader allocates 15% of their capital into Shell stock. This means that the eToro user, who invested $5,000, will automatically enter a Shell stock position at $750 (15% of $5,000).

There is no minimum redemption period when copying a trader, so eToro users can cancel or reduce the position at any time. Moreover, the eToro user will not pay any additional commissions from copying a trader. It is also possible to add or remove assets from the Copy Trading portfolio.

How to Choose the Best $250k Investments For You

In the sections above, we have explored 10 methods to consider when assessing what to invest $250k with. Crucially, our key objective is to offer a range of potential assets and markets so that investors can make their own informed decisions.

Now, we will discuss some of the key factors to bear in mind when evaluating what to invest in with $250k.

Additionally, if you’re enjoying this article so far you might want to check out our guide on the best ways to invest $100k in 2022.

Remain Diversified

It goes without saying that when exploring the best way to invest $250 safely, investors should ensure that they remain diversified at all times – even during bullish markets.

This simply means that instead of opting to pick one or two investments, the portfolio should cover dozens or even hundreds of different assets.

With the availability of ETFs and index funds, achieving this goal has never been easier. Nonetheless, a diversified portfolio should not only cover multiple asset classes but also a good split of income and growth markets.

Passive or Active

Another metric to consider when assessing the best place to invest $250k is whether the investor wishes to trade passively or actively.

Being an active trader means placing frequent buy and sell orders, and generally keeping tabs on the financial markets on a day-to-day basis. This will suit an investor that has the perfect combination of trading experience and time on their hands.

With that said, those without the necessary time or skills to actively trade the markets might be more suitable for a passive investment strategy.

This will incorporate asset classes like index funds and ETFs, both of which are professionally managed on behalf of the investor. This means that there is no requirement to maintain the portfolio, as both rebalancing and reweighting are taken care of.

Upside Potential and Risk

The key thing to remember when evaluating where to invest $250k is that each identified asset class will come with a predefined level of risk and potential upside. In other words, as higher returns are sought by the investor, more risk needs to be taken.

- For example, perhaps the best way to invest $250k short term, in the eyes of an investor that has a high tolerance for risk, is crypto.

- After all, crypto assets have a tendency to provide rapid pricing swings in a short period of time.

- This means that catching the right token at the right time can result in gains that would otherwise not be available elsewhere.

- This is one of the core reasons why crypto presales – such as the one being offered by Tamadoge as of writing, remain popular.

However, it is also important for a $250k investment portfolio to carry less risky assets. This will offer a more balanced long-term portfolio, and this might include lower-risk assets like bonds, blue-chip stocks, and REITs.

Short or Long-Term Holdings

It is also wise for the investor to assess whether they plan to hold their chosen assets in the long or short term. This is because some marketplaces are more conducive for long-term investors.

For instance, investing in growth stocks requires time and patience, not least because it can take many years for the company to reach its full potential.

On the other hand, some crypto assets will offer a rapid upward trajectory that might only last a few weeks or months. This means that the investor will likely want to ride the upward trend for as long as possible, before cashing out prior to the reversal.

Where to Invest $250,000 Right Now – The Best Option?

We mentioned above that one of the best ways to invest $250k for high-growth potential is to search for up-and-coming crypto presales. To recap, by investing in a presale launch, this offers investors a discounted token price.

Then, when the presale concludes and the token is listed on a public exchange, this will be at a higher price. Hence, in many cases, presale investors have an immediate upside as soon as the token is listed.

For this reason, the likes of IMPT are attractive significant volumes of capital, with the project’s presale already raising over $3.5 million in its first round in under two weeks.

How to Invest $250k – Tamadoge Tutorial

Investing in a crypto presale requires a slightly different process when compared to a traditional stock IPO.

The reason for this is that instead of going through a broker, crypto presale investors can complete the investment directly on the website of the respective project.

Below, we explain the four steps required to invest in the Tamadoge presale before it ends.

Step 1: Get MetaMask Wallet

The typical presale investment process requires investors to swap an established crypto asset for the token being offered by the project. In this case, the Tamadoge presale is offering its native TAMA token, in exchange for either USDT or Ethereum.

But, before getting to that stage, the investor will first need to get a suitable crypto wallet that connects to the Ethereum network, which is the blockchain that TAMA operates on.

Trust Wallet is a popular option for those that prefer investing via a mobile app. However, we much prefer the seamless investment process offered by MetaMask – which is accessible as a browser extension for Edge, Chrome, and Firefox.

MetaMask can be downloaded for free and the setup process takes just minutes.

Step 2: Transfer ETH or USDT to MetaMask

As noted above, the Tamadoge presale requires either Ethereum or USDT tokens.

- However, we should also note that to fast-track the process, investors can buy Ethereum with a debit or credit card on the Tamadoge website, with the payment being processed by a third party.

- Those that prefer this slightly more expensive option can skip to the next step of this walkthrough.

The conventional option, however, is to buy Ethereum or USDT tokens from a crypto exchange and then transfer the funds over to MetaMask or Trust Wallet.

Step 3: Connect MetaMask to Tamadoge Presale

The investor will need to connect their crypto wallet to the Tamadoge presale website to complete the exchange.

Simply visit the Tamadoge homepage and click on ‘Buy’, before selecting ‘Connect Wallet’.

Take note, those using a wallet other than MetaMask will need to select ‘Connect Wallet’, and subsequently scan the QR code that appears.

Step 4: Invest in Tamadoge Presale

As per the image below, the Tamadoge presale has already raised nearly $10 million. Moreover, the image highlights that when the presale sells a further 41 million TAMA, the price will increase.

As such, timing is everything when investing in this presale.

Nonetheless, to complete the presale investment, choose the payment currency from either Ethereum or USDT. Enter the number of tokens to be swapped and confirm the investment.

After the Tamadoge presale has finished, the TAMA tokens can be claimed and subsequently transferred to the investor’s crypto wallet.

Conclusion

In conclusion, having access to trading capital of $250k offers a full range of investment opportunities. Investors should, however, ensure that they do not become over-exposed to a small number of markets.

Instead, the risk-averse approach is to create a highly diversified number of assets, covering everything from REITs and dividend stocks to index funds and crypto.

Those in the market for a high-growth and trending marketplace might consider the IMPT presale – which is allowing buyers to invest in IMPT for just $0.018 per token.

#investment #realestate #investing #money #business #invest #bitcoin #property #investor #entrepreneur #trading #forex #realtor #finance #cryptocurrency #realestateagent #home #stockmarket #success #wealth #crypto #financialfreedom #forsale #luxury #stocks #motivation #forextrader #househunting #blockchain