Nations all over the world are looking to replace fossil fuels with cleaner energy. Some renewable energy companies could reap the benefits of this move towards carbon neutrality for years to come.

It’s crucial to carry out thorough research prior to investing in clean energy stocks.

With this in mind, this guide will take a closer look at popular renewable energy stocks to watch in 2022.

11 Popular Renewable Energy Stocks to Watch in 2022

Below, we have listed 10 popular renewable energy stocks to watch in 2022.

- IMPT – Innovative Alternative to Renewable Energy Stocks

- NextEra Energy – Large-Scale Wind and Solar Energy Producer

- Green Plains – Multifaceted Agri-Tech and Biorefining Company

- First Solar – Global Solar Panel Manufacturer

- SolarEdge – Smart Energy and Inverter Business Model

- Ormat – Supplier of Clean Geothermal Energy Technology

- Atlantica Sustainable Infrastructure – Green Energy Solutions Operator and Provider

- Clearway Energy – US-Based Solar, Wind, and Energy Storage Company

- Hannon Armstrong – Growing Company Dedicated to Sustainable Infrastructure

- Algonquin Power & Utilities – Utility Conglomerate Building a Diverse Clean Energy Portfolio

- Plug Power – Industry Leading Green Fuel Cell and Hydrogen Developer

Prior to buying sustainable energy stocks, it’s important to research the best renewable energy companies. This should include assessing the company’s ESG rating and obtaining a clearer idea of its long-term objectives.

If you want to invest in renewable energy stocks, you can do so using popular regulated investment platforms like eToro

A Closer Look at Sustainable Energy Stocks

Below, investors will see our analysis of some of the most popular sustainable energy stocks to watch in 2022. We’ve included key details such as ESG ratings and stock performance.

This is in addition to any relevant projects the clean energy company has now or in the pipeline.

Note: Do note that the Carbon Disclosure Project (CDP) is utilized by some publicly traded corporations. As such, this ESG rating framework features on some of the charts used on this page. However, one of the most globally respected ESG grading systems is offered by MSCI, so where possible, we have included this score within each review. For further reading we’ve pinpointed the best ESG investing stocks to watch in 2022.

1. IMPT – Innovative Alternative to Renewable Energy Stocks

IMPT is an innovative ecosystem based on the blockchain. This project has the goal of aiding socially responsible and sustainable focussed companies and individuals in offsetting their carbon footprint.

So, how does it work? Companies and individuals can either shop and acquire carbon credits, or purchase them on the IMPT platform. Put otherwise, IMPT tokenizes carbon credits. These are offered as NFTs – which ensures that ownership is verifiable and transferable via the blockchain.

The project’s next phase will see the creation of a marketplace where people can purchase and trade these carbon credits. The IMPT platform wants to simplify the way we measure our impact on the increasingly concerning issue of climate change.

IMPT also incorporates a points reward system. That is to say, individuals and businesses will receive ‘impact points’ for their positive contributions to reducing their carbon footprint. Find more information about this project on the IMPT whitepaper.

IMPT works with more than ten thousand retail brands that devote a set portion of their profit margin to ecological initiatives. Just some of the retailers that have agreed to commit to IMPT include Asos, Adidas, Chanel, New Balance, Apple, and Booking.com.

The platform has also collaborated with a range of environmentally friendly projects. This includes wind farms, forest conservation, green energy generation facilities, and many more. Prior to selecting a project, investors can check out the compensation quality to ensure it meets their expectations.

The platform’s own IMPT cryptocurrency will also be available and after its launch – can be used to buy carbon credit NFTs directly on the platform. Furthermore, services provided by third parties, such as Stripe and Transak, will facilitate purchases.

This will enable investors to buy IMPT tokens using fiat money. Additionally, IMPT is integrating popular cryptocurrencies like Ethereum, Bitcoin, Solana, Polygon, and Binance Coin for those that want to swap them for IMPT tokens.

Investors can stay up to date with the latest developments by subscribing to the IMPT Telegram channel.

2. NextEra Energy – Large-Scale Wind and Solar Energy Producer

In addition to being a leading producer of wind and solar energy globally, NextEra Energy also provides electric utilities and end customers with it. This climate change stock operates facilities spanning 119 sites across North America.

NextEra Energy operates over 17,000 megawatts of solar and wind generation in this region alone. In addition, it uses clean fossil fuels within natural gas facilities. Furthermore, the company is also behind a range of subsidiaries, including NextEra Energy Partners, NextEra Energy Resources, and Florida Power & Light Company.

Following its merger with Gulf Power in January 2021, the latter company became the biggest vertically integrated regulated utility in the US. In terms of performance, NextEra reported an increase of 11.9% year over year in its Q4 2021 earnings report.

This company has invested over $20 billion in renewable and clean technologies. Furthermore, through 2025, NextEra Energy intends to invest between $85 billion-$95 billion in energy storage and generating projects.

The goal is to increase its portion of the $2 trillion clean energy industry. At the time of writing, NextEra Energy has 20 universal energy storage facilities in development and operation. This renewable energy stock has increased by more than 140% in the last five years of trading.

ESG rating according to MSCI: AA

3. Green Plains – Multifaceted Agri-Tech and Biorefining Company

Leading agri-tech firm Green Plains specializes in converting renewable crops into valuable, long-lasting components. Green Plains, based in Nebraska, is the third-largest manufacturer of ethanol fuel globally

The company exports around one billion gallons of its production annually both domestically and abroad. The non-ethanol division of the renewable energy firm could be well-positioned to gain from the robustness of the world protein and renewable corn oil markets

At the time of writing, Green Plains has produced 11 billion gallons of low-carbon biofuel and reduced its Co2 emissions by 44.7 MMT (Million Metric Tonnes). Moreover, in September 2022, Green Plains, Tallgrass, and Pacific Northwest National Laboratory announced new funding from the US Department of Energy.

This is with the goal of promoting the development of greener aviation fuel using bioproducts. Bearing in mind that part of Green Plains’ continuing transformation includes developing and implementing new technologies to create sustainable aviation fuel, this should aid in funding catalyst optimization.

Over five years of trading, this clean energy stock has increased by almost 80%.

ESG rating according to MSCI: N/A – Not disclosed

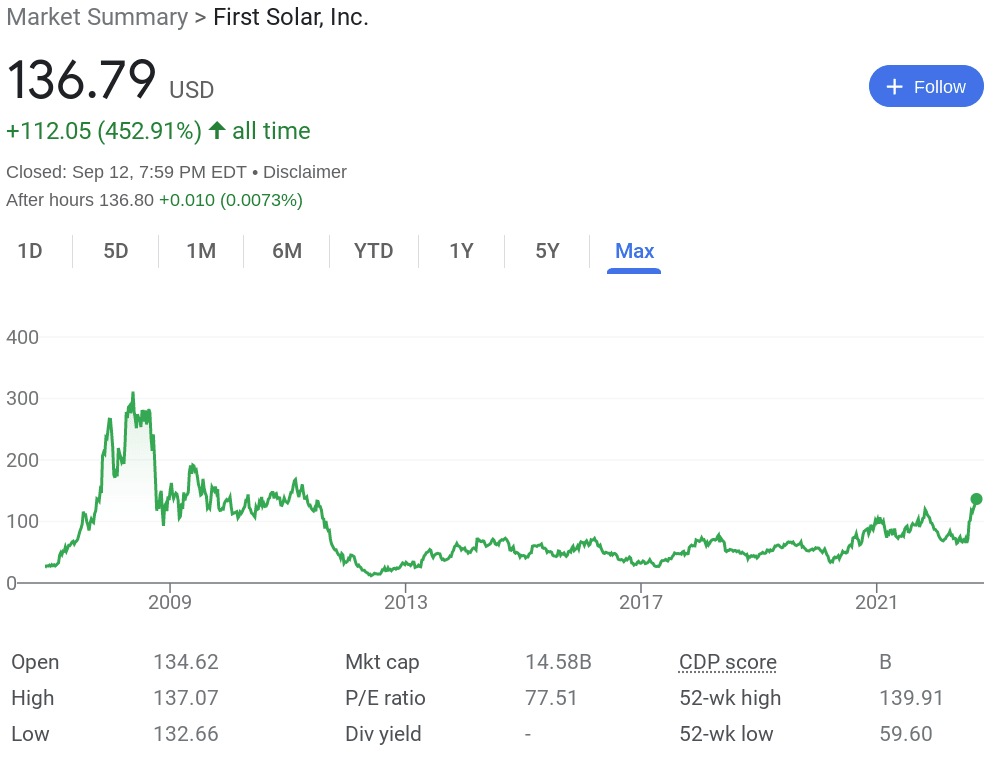

4. First Solar – Global Solar Panel Manufacturer

US-based company First Solar is among the top 10 producers of this technology globally. This is one of the most popular clean energy stocks to watch in 2022. First Solar’s photovoltaic (PV) solar modules outperform many commercially available technologies in terms of carbon and water footprints.

In July 2022, First Solar revealed that it has a record-breaking backlog of 44.3 GWDC of orders. Demand for the company’s cutting-edge thin-film PV solar modules has been driven by its ability to provide its clients and partners with long-term supply assurance. Not to mention access to its most cutting-edge technologies through its agile contracting method.

In addition to its plants in the US, First Solar also has operations in Vietnam and Malaysia, and it is now constructing its first manufacturing facility in India. This is expected to start production in the second half of 2023.

First Solar anticipates taking full advantage of the high margins and better service in two significant and expanding markets. The company expects to produce more than 20 GWDC of annual worldwide production capacity in 2025. As such, First Solar is a popular choice among those keen on investing in sustainable energy stocks.

First Solar stock has increased by over 171% in five years of trading.

ESG rating according to MSCI: N/A – Not disclosed

5. SolarEdge – Smart Energy and Inverter Business

Anyone researching the ins and outs of buying sustainable energy stocks will have likely heard of SolarEdge. Creating and producing the optimal inverter systems used to increase the energy output of solar panels is SolarEdge’s specialty.

Through a variety of initiatives, SolarEdge has assisted businesses of all sizes in switching to environmentally friendly and affordable renewable energy sources. As we touched on, SolarEdge inverters enhance the power generated by solar panels. This in turn helps to reduce the cost of creating cleaner energy.

The business has also begun to use its knowledge of inverters to develop other intelligent energy solutions. Furthermore, SolarEdge has increased the range of goods it offers by acquiring companies that specialize in several energy market categories.

This includes uninterruptible power supply, electric vehicle powertrains, storage, car charging, grid services solutions, and various batteries.

In the last five years of trading, this sustainable energy stock increased by over 1,000%.

ESG rating according to MSCI: BBB

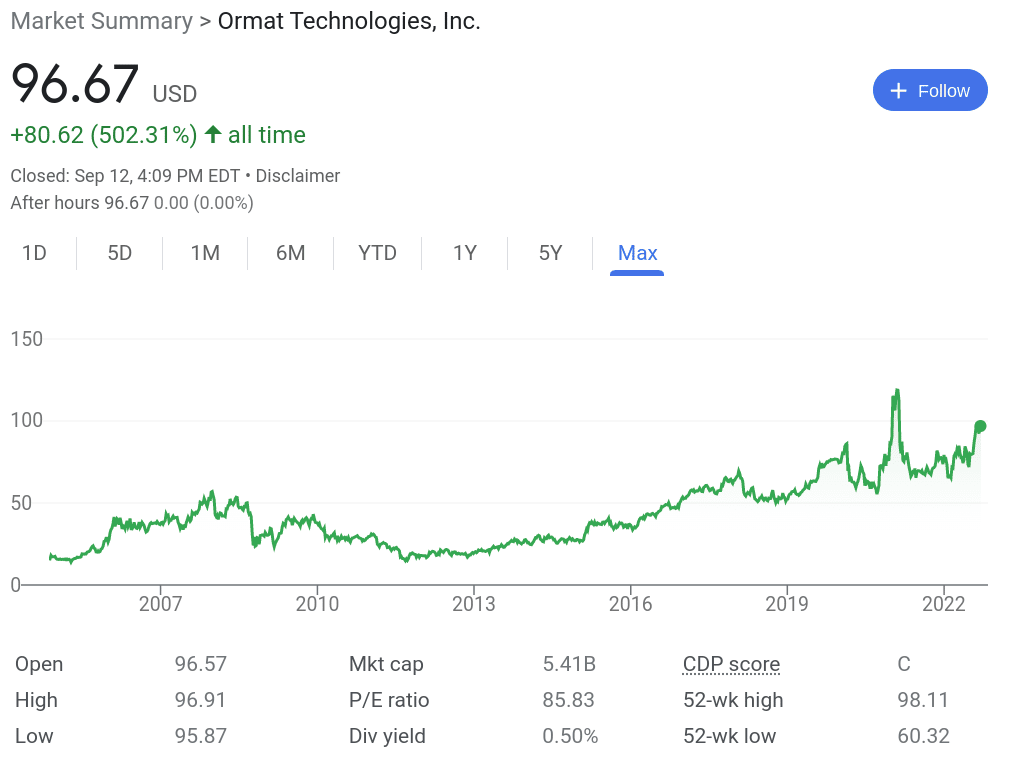

6. Ormat – Supplier of Clean Geothermal Energy Technology

Globally, Ormat has designed, built, and installed power plants with a combined gross geothermal capacity of around 3,200 MW. This is one of the more popular clean energy stocks to watch in 2022, as the activities of Ormat are expanding into a range of renewable projects.

This includes solar PV and energy storage services. The company’s purchase of power portfolio stands at around 1.2 GW. The US, Guadeloupe, Kenya, Guatemala, Honduras, and Indonesia are just a few countries where Ormat’s products are sold.

Additionally, it owns an 88 MW portfolio of energy storage in the US alone. Moreover, the opening of Casa Diablo IV, a 30 MW geothermal plant that is set to service many Californian regions, was announced in mid-2022.

In the past five years of trading, this renewable energy stock has increased in value by almost 68%.

ESG rating according to MSCI: N/A – Not disclosed

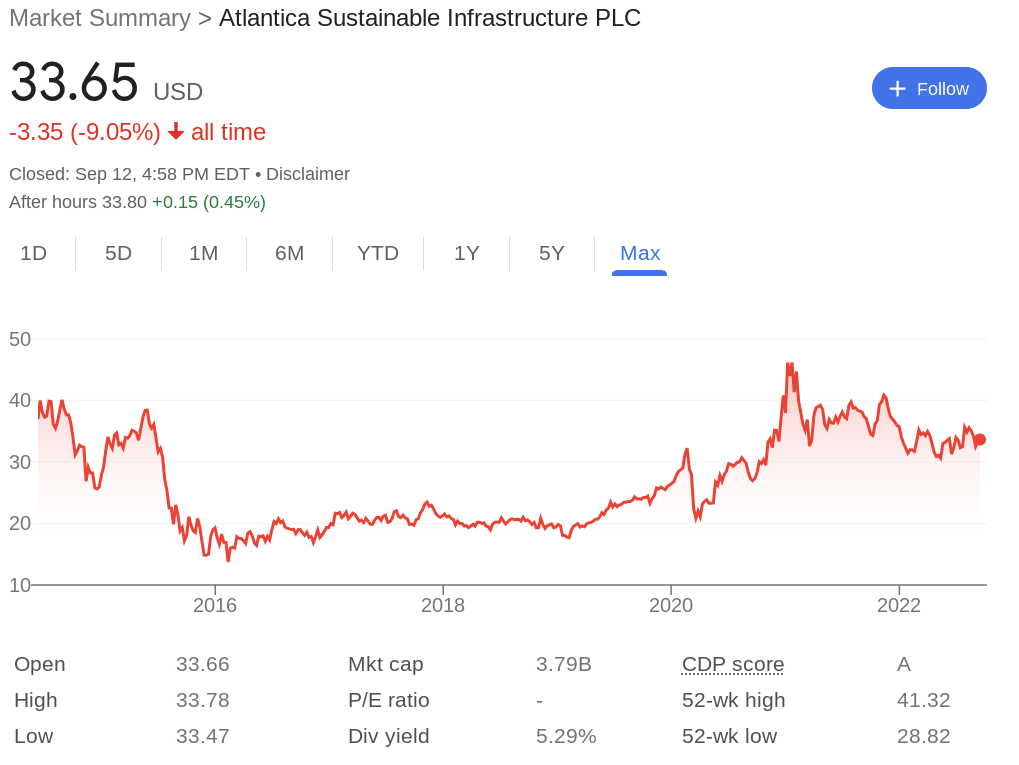

7. Atlantica Sustainable Infrastructure – Green Energy Solutions Operator and Provider

As its name suggests, Atlantica Sustainable Infrastructure is a firm that specializes in green energy investing and sustainable infrastructure. The majority of its operations are focused on purchasing and managing renewable energy assets. Despite being listed on the NASDAQ, the corporation is headquartered in the UK.

Nonetheless, the principal objective of Atlantica Sustainable Infrastructure is to play a significant role in the ongoing transition to a more sustainable world while generating long-term value for its shareholders. This is a popular clean energy stock for those looking for a dividend income.

At the time of writing, the running dividend yield is at 5.29%, and the last quarterly payment was $0.44 per share. Atlantica Sustainable Infrastructure also provides solutions for transmission, transportation infrastructures, and water assets, as well as its natural gas resources.

Additionally, Atlantica Sustainable Infrastructure allocates capital to electric transmission lines, heat storage, and renewable energy throughout the US, Canada, Mexico, Peru, Chile, Colombia, Uruguay, Spain, Italy, Algeria, and South Africa.

ESG rating according to MSCI: N/A – Not disclosed

8. Clearway Energy – US-Based Solar, Wind, and Energy Storage Company

One of the biggest owners of renewable energy production plants in the US is Clearway Energy. Solar, wind, and natural gas power facilities are all part of Clearway Energy’s sizable portfolio, making it a popular renewable energy stock for investors.

Furthermore, under lengthy, fixed-rate power purchase agreements, Clearway Energy sells the electricity these plants generate to utilities and significant corporate consumers. In mid-2022, the business completed the sale of its thermal assets, subsequently bringing in $1.46 billion.

Like Atlantica Sustainable Infrastructure, Clearway Energy also pays dividends. In this case, the running dividend yield is 3.67% at the time of writing. The last quarterly payment was $0.21 per share.

Over five years of trading, Clearway Energy’s stock price has risen by over 107%.

ESG rating according to MSCI: N/A – Not disclosed

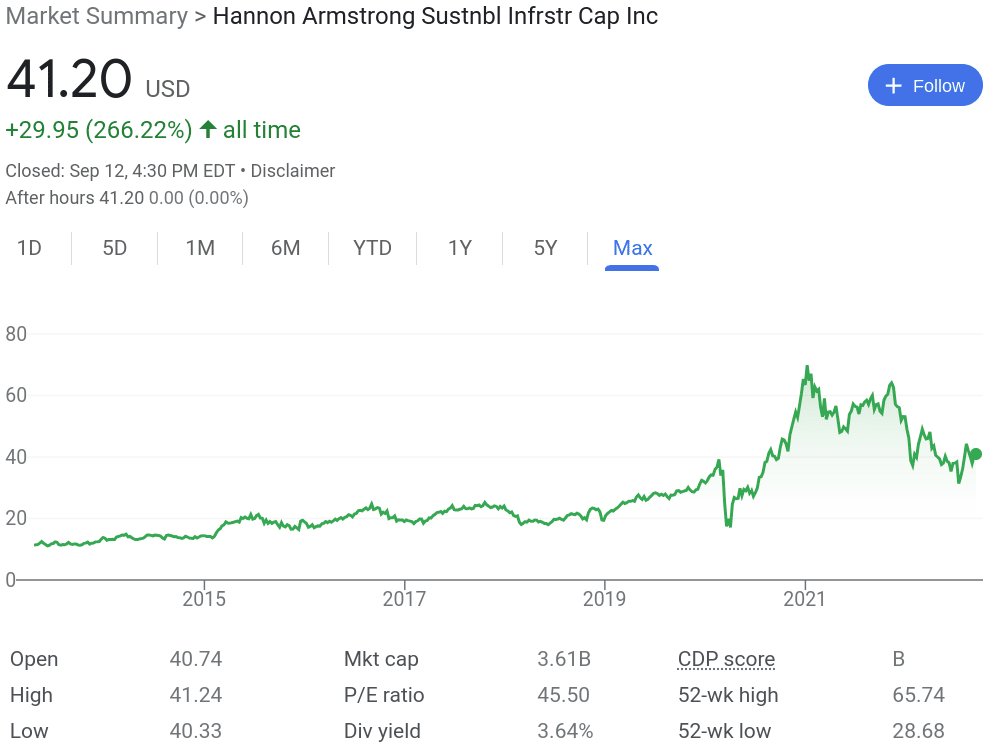

9. Hannon Armstrong – Public Company Dedicated to Sustainable Infrastructure

Looking for alternative energy stocks? Hannon Armstrong is a publically traded company that invests in climate solutions by providing capital to a range of firms involved in various sustainable infrastructure markets.

Hannon Armstrong’s objective is to provide attractive returns via a diverse portfolio of projects with potentially long-term and reliable revenue flows. The idea is to invest in tried-and-true technologies that lower carbon emissions or boost resistance to climate change.

The investments made by Hannon Armstrong have varied greatly. This covers equity, partnerships, land ownership, loans, and other forms of financing. Gain-on-sale securitization deals, services, and asset management are additional ways that the company generates recurring revenues.

This alternative energy stock has increased by nearly 70% over the last five years.

ESG rating according to MSCI: N/A – Not disclosed

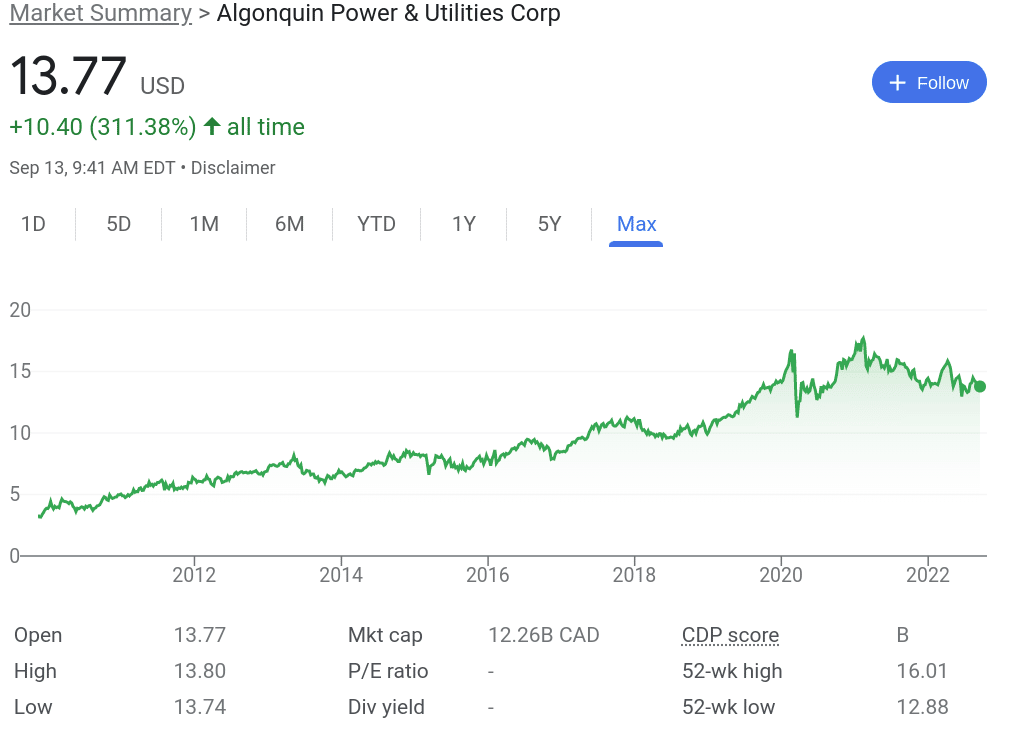

10. Algonquin Power & Utilities – Utility Conglomerate Building a Diverse Clean Energy Portfolio

Algonquin Power & Utilities is based in Canada and concentrates on renewable energy and regulated utilities. Through smart acquisitions and continued development of top-tier renewables, the conglomerate is concentrating on achieving quick, sustainable growth.

Over a million customer connections get regulated natural gas, water, and electricity utility services from the corporation through its operational business. This is predominantly in North America. Furthermore, over 4 GW1 of clean, renewable wind, solar, hydro, and thermal power production facilities are either operational or being built as part of its expanding portfolio.

As such, Algonquin Power & Utilities owns and operates assets all across the US and Canada as part of its renewable energy segment. According to the platform, it has a total gross producing capacity of about 2.3GW.

Over 80% of the company’s electrical output is sold in accordance with a range of long-term contracts. Promisingly, the contracts have a production-weighted remaining life of an estimated 12 years.

In five years of trading, Algonquin Power & Utilities stock has gone up by 30%.

ESG rating according to MSCI: AA

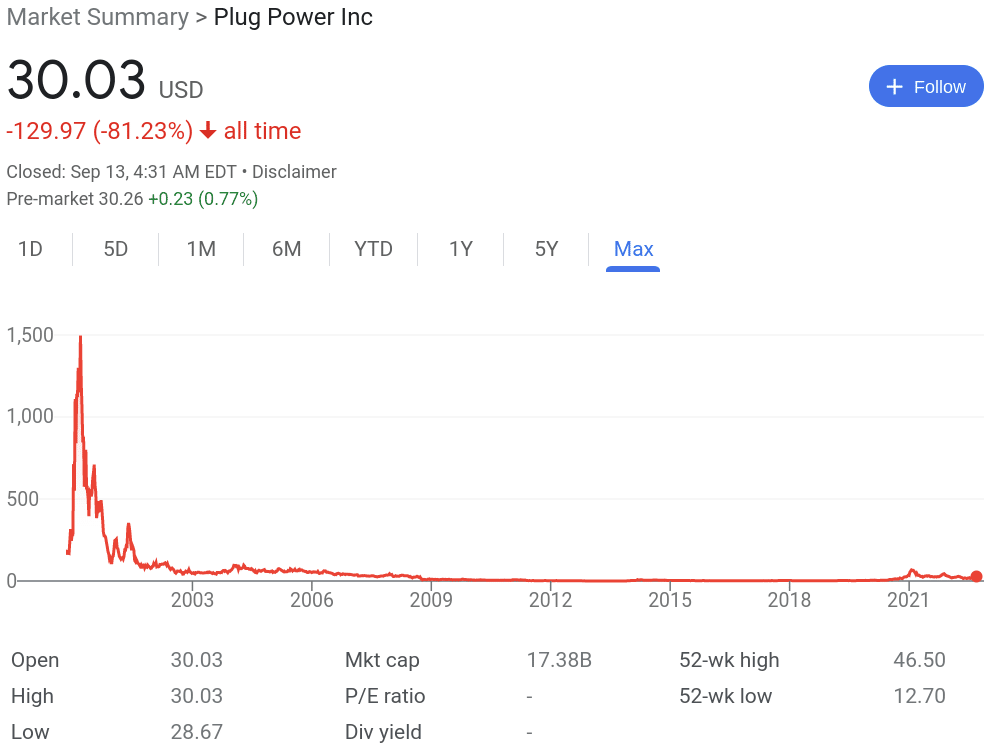

11. Plug Power – Industry Leading Green Fuel Cell and Hydrogen Developer

Plug Power offers turnkey hydrogen fuel cell solutions. Specifically, the company focuses on fuel cell processing and proton exchange membrane technology. Plug Power also provides green hydrogen generating, storage, and dispensing infrastructure, along with battery hybrid technology.

The company develops complete clean hydrogen and zero-emission fuel cell solutions for supply chain and logistics. This includes on-road electric cars, the stationary power sector, and other uses. Essentially, the company produces and markets fuel cell devices that may take the place of batteries and diesel generators in fixed backup power applications.

Products and services provided by Power Plug target the North American and European material handling markets. Renewable energy sources like wind and solar power can be used to create hydrogen. By 2024, Plug Power expects to use more than 80 tons of hydrogen, and it has also committed to achieving a 50% green content.

Based on its price at the time of writing, in the past five years, Plug Power stock has increased by over 1,170%.

ESG rating according to MSCI: A

What are Renewable Energy Stocks?

The world economy is moving as quickly as possible to change its energy sources due to the large amounts of greenhouse gasses causing global warming.

As such, many nations are looking to switch from carbon-based fossil fuels that are damaging to the planet.

- Finding sustainable power sources is one of the ways in which world leaders are looking to tackle climate change.

- Renewable energy stocks are publically traded companies that focus on creating power from sustainable or natural sources.

- This includes creating energy using sources such as the sun/solar, wind, water/hydro, geothermal, and biomass to name a few.

- A green energy stock can also refer to a publically traded company that creates fuel cell solutions, or necessary solar panel equipment such as inverters.

- Alternative energy stocks can be inclusive of those that merely invest in the aforementioned industry by providing capital to leverage their growth.

Renewable energy is likely to play a huge part in the world’s transition to a more sustainable source of power.

Prior to investing in renewable energy stocks, carry out plenty of research to arrive at an informed decision.

Why do People Invest in Green Energy Stocks?

At the time of writing, an estimated 20% of the electricity produced by the US power industry comes from renewable energy sources. This percentage is expected to grow over the course of time.

The majority of the green sources of energy being used include wind, solar, and hydroelectricity among others we’ve mentioned in this guide. Over the past ten years, the sector has experienced rapid growth.

This has increased the ability to produce power and develop the innovative technologies that harness it. However, the pace has picked up even further in the last couple of years, as global concerns about climate change intensify.

In order to assist the economy in decarbonizing quickly, the goal for most countries is to pick up the pace even more. As such, various companies and institutions are being forced to think about how they might contribute to the decarbonization process.

To acquire power generated from renewable sources, several businesses are concluding power purchase agreements with electric utilities and other providers. This is a potential benefit to big players in the industry such as Next Era and Clearway Energy.

Others, however, are directly funding renewable energy development initiatives. Although some engage in renewable energy to be seen as globally conscious citizens, clean power is becoming more affordable thanks to lowering costs for solar panels, wind turbines, and energy storage batteries.

As a result, this seems to make the industry a more interesting investment prospect. A $1.2 trillion infrastructure plan with financing to speed up investments in cleaner energy was signed by President Biden in late 2021.

Moreover, a $369 billion tax and climate measure that would aid the nation’s move away from fossil fuels was also agreed upon by Congress. By putting out and approving laws to boost investment in the industry, governments are aiming to speed up the process of global decarbonization.

Regulated Stock Broker Offering Sustainable Energy Stocks

In order to buy sustainable energy stocks, it’s crucial to find a suitable brokerage. Also bear in mind the cost of doing so. That is to say, trading platforms typically stipulate charges such as commission and deposit fees.

Below is a review of a commission-free trading platform that offers access to all of the green energy stocks discussed on this page:

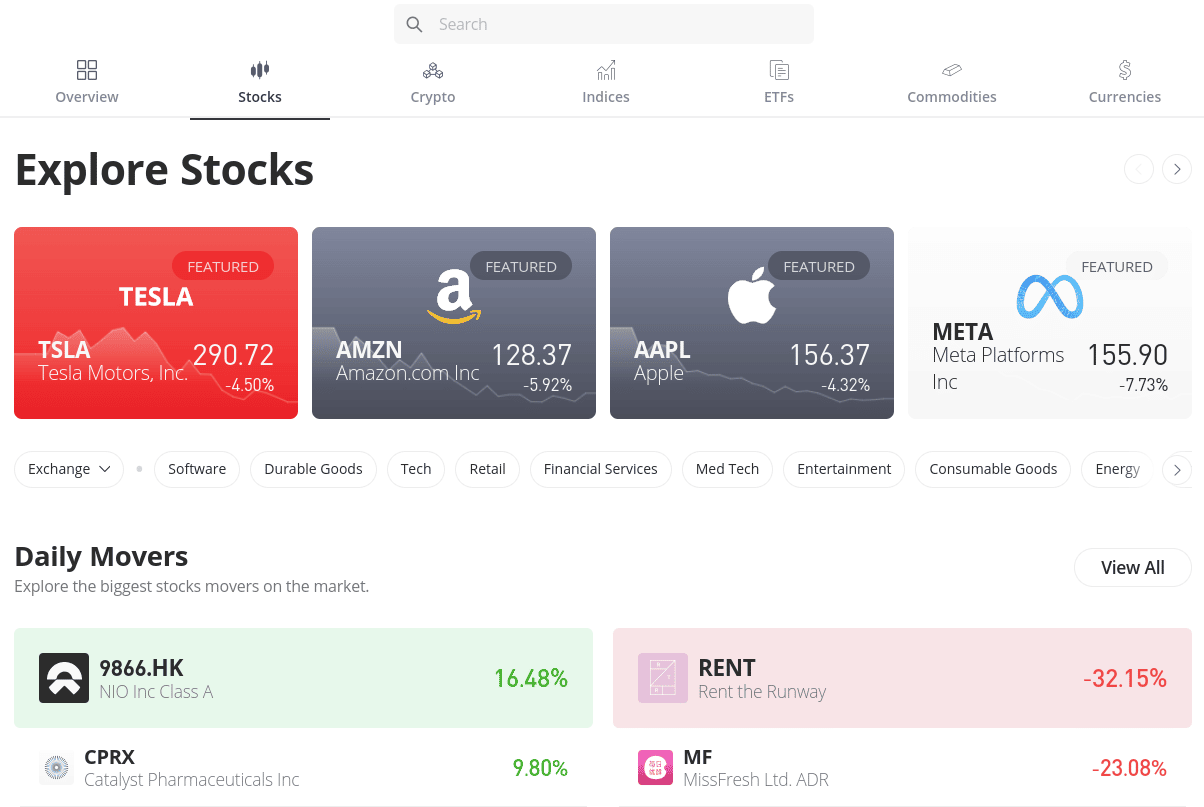

eToro – Regulated Renewable Energy Stock Broker

Those looking to buy sustainable energy stocks without commission might consider eToro. This trading platform offers more than 2,500 stocks on a commission-free basis and is regulated by the SEC, the FCA, ASIC, and CySEC.

eToro’s long list of equities includes all of the renewable energy stocks we’ve analyzed in this guide making it a popular option for traders interested in socially responsible investing. As such, it’s possible to create a diverse portfolio of assets at eToro. Additionally, there is a range of ETFs for those who wish to invest in a basket of equities, all of which are also commission-free.

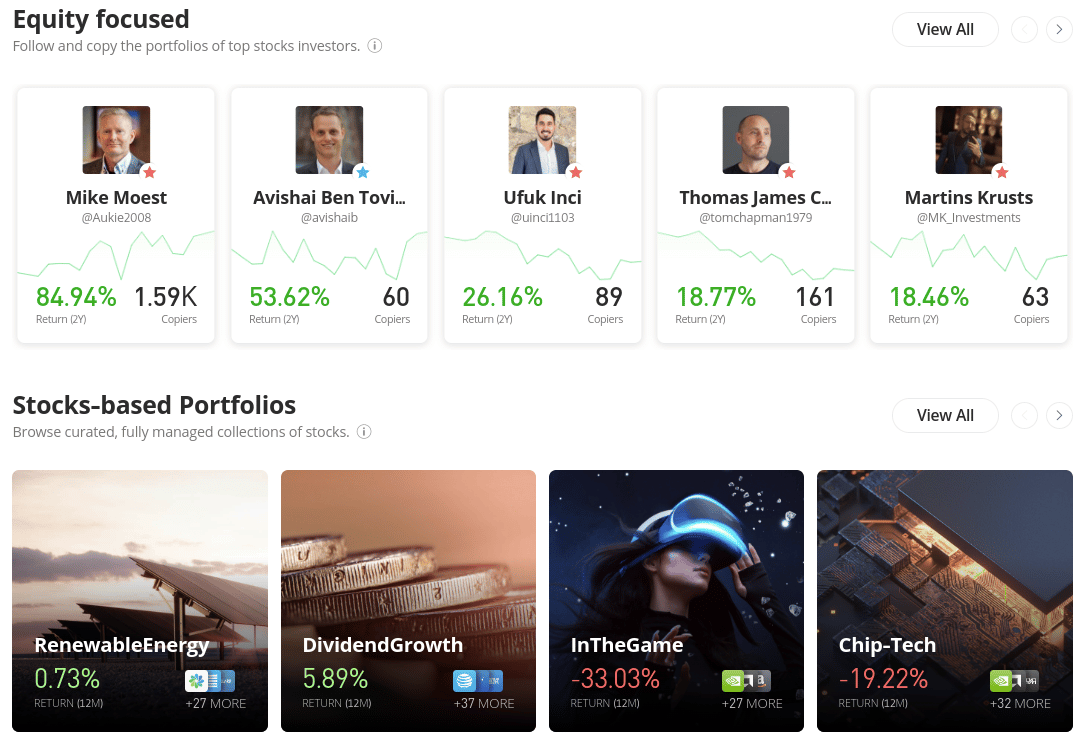

Meanwhile, Smart Portfolios offer an algorithmic approach to trading stocks, cryptocurrencies, and more. This could appeal to those who wish to take a hands-off approach to stock investing. There are Smart Portfolios focused on utility companies, for instance. However, one notable option is the RenewableEnergy portfolio, which features multiple sustainable stocks. eToro also supports some of the best green investment funds in 2022.

We found this Smart Portfolio to include NextEra, SolaEdge, Clearway Energy, First Solar, and some of the other stocks we have analyzed today. eToro also happens to be a Copy Trading platform. For those unaware, this means that an investor is able to allocate funds to Copy Trading and mirror the buy and sell orders of a stock trader of their choosing.

Additionally, this platform offers sustainable cryptocurrency options such as IOTA and Cardano among others. The commission fee on crypto assets is 1% for each buy and sell order. eToro accepts a range of different payment types when making a deposit to invest. This includes e-wallets such as Skrill, PayPal, and more.

Alternatively, credit/debit cards, ACH, and wire transfers are acceptable forms of payment. The minimum deposit starts at $10 and there is no transaction fee for residents of the US.

Traders and investors might also find this eToro review helpful. It offers a more detailed analysis of the broker’s offerings, features, and more

Conclusion

This guide has analyzed popular sustainable energy stocks to watch in 2022.

Popular clean energy stocks to watch include NextEra Energy – a wind and solar producer, in addition to Green Plains, a biorefining and agri-tech company. We also found First Solar to be one of the most popular solar panel manufacturing stocks.

However, we rank IMPT as the best asset for anyone interested in eco-friendly investing – visit the site today to learn more and get in on this fantastic initiative early.