This beginner’s guide will rank and review the 10 best forex brokers in India right now.

Each review covers a wide range of important talking points, such as the type of forex markets supported, commissions and spreads, account minimums, and regulations.

We also explain how to get started with an Indian forex broker in less than five minutes via a detailed step-by-step tutorial.

The 10 Best Forex Brokers in India

The list below outlines the 10 best forex brokers in India to consider opening an account with today:

- Capital.com – Overall Best Forex Broker in India

- AvaTrade – Regulated Forex Broker That Supports MT4 and MT5

- Pepperstone – Best Forex Broker in India for Raw Spread Accounts

- Forex.com – Established Forex Broker With Competitive Fees

- Oanda – Trade 70+ Forex Pairs and Claim a $5,000 Welcome Bonus

- XM – Multiple Forex Trading Accounts and Minimum Deposit Just $5

- HotForex – High Leverage Forex Broker Located Offshore

- FXTM – High Leverage Forex Broker Located Offshore

- Zerodha – Top Indian Broker With Multiple Asset Classes

- CMC Markets – Trade More Than 330+ Forex Pairs

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

Best Indian Forex Brokers Reviewed

The reviews below offer a comprehensive overview of the best forex brokers in India.

Consider reading through each review to make an informed decision on which forex broker to choose.

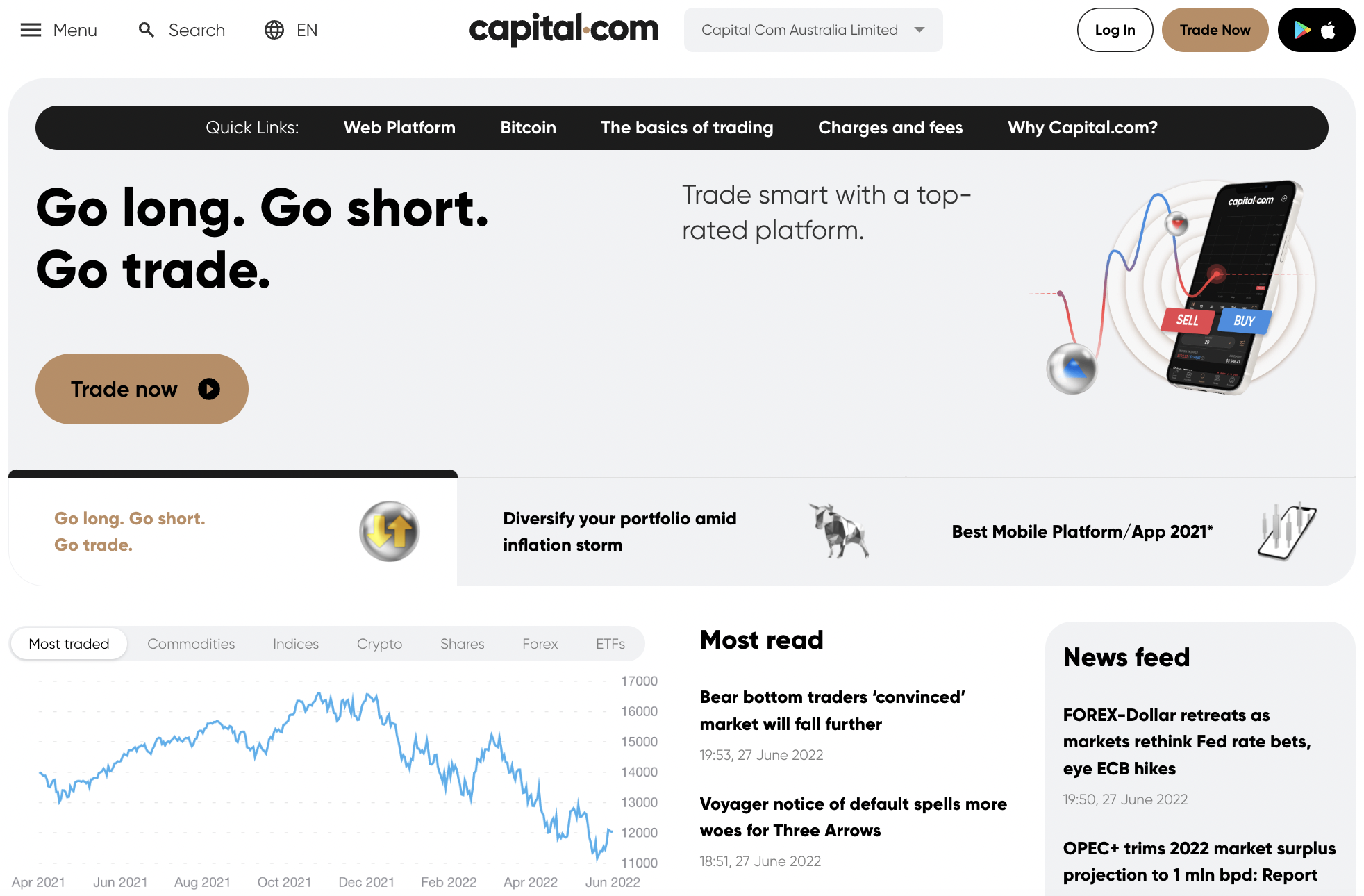

1. Capital.com – Overall Best Forex Broker in India

![]()

In terms of supported markets, fees, payments, and regulatory standing – Capital.com is a clear winner as the overall best forex broker in India. A minimum deposit of just $20 is required when opening an account and adding funds via an e-wallet or debit/credit card ($250 minimum on bank wires).

Indian traders will have access to almost 140 currency pairs. No commissions are charged on the Capital.com platform and spreads are very competitive. No deposit or withdrawal fees are charged either. Capital.com offers access to the forex markets via CFDs, so Indian traders can apply leverage to their positions.

Account holders can trade online or via the Capital.com app for iOS and Android. MT4 is supported too – which will suit more advanced traders. Capital.com also offers markets on indices, cryptocurrencies, hard metals, energies, and stocks. All supported markets can be entered with either a long or short position.

Capital.com is regulated by the FCA, ASIC, CySEC, and NBRB. Therefore, this is one of the best forex brokers in India for safety. There is also the option to open a demo account at Capital.com. This can be opened free of charge and comes alongside a pre-loaded balance of $10,000.

What We Like

- Overall best forex broker in India

- Trade forex with leverage

- Regulated by ASIC, FCA, CySEC, and NBRB

- Nearly 140 forex trading pairs

- Great forex trading app

- Also supports commodities, crypto, stocks, and indices

- 0% commission and tight spreads

- Buy Bitcoin CFDs in India with Capital.com

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

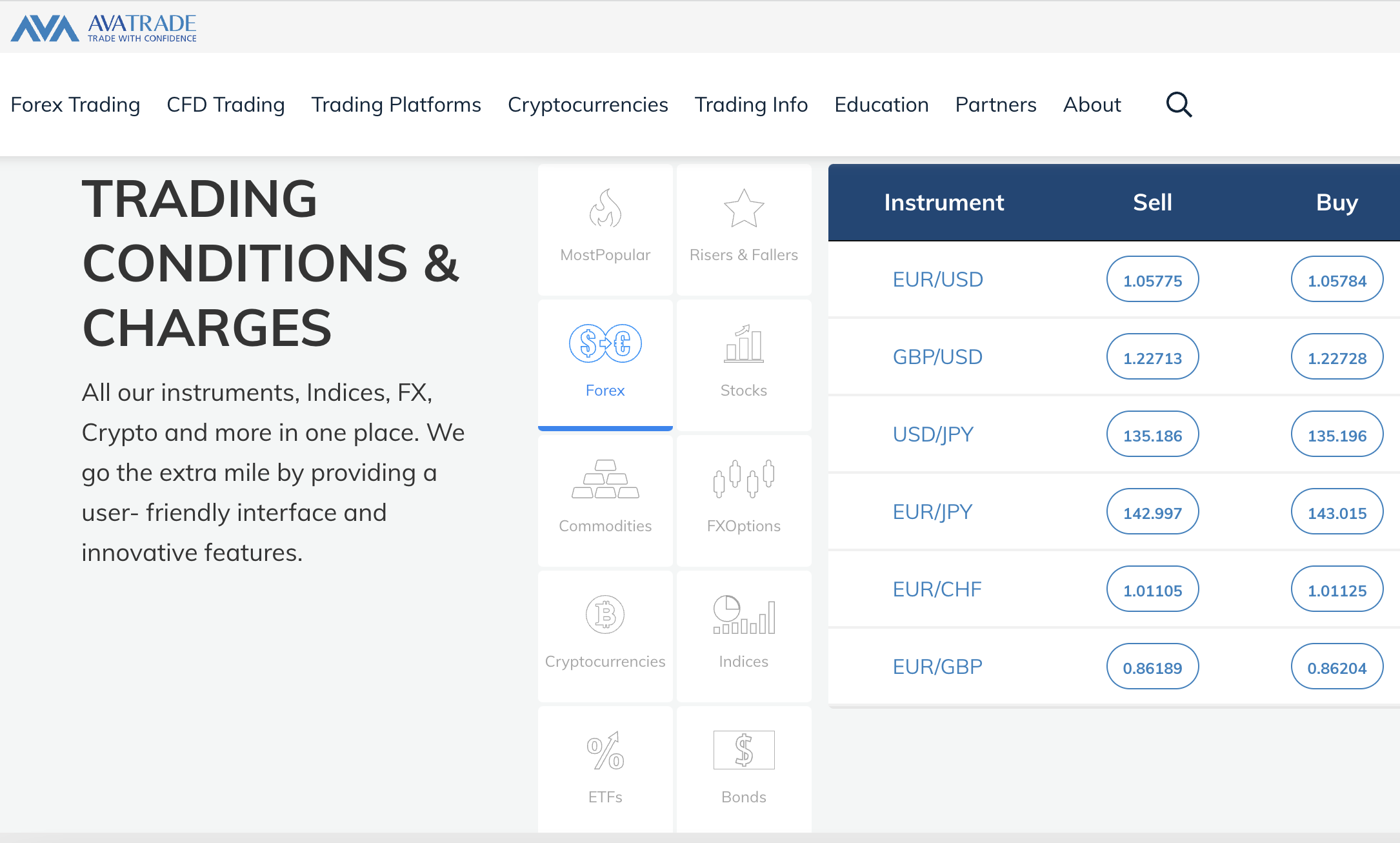

2. AvaTrade – Regulated Forex Broker That Supports MT4 and MT5

The next provider to consider from our list of the best forex brokers in India is AvaTrade. This broker can be accessed through a variety of platforms – such as MT4, MT5, and cTrader. There is also the AvaTrade web trader, as well as AvaTradeGO. The latter is the broker’s native mobile app for iOS and Android.

AvaTrade is popular for its high leverage limits and low trading fees. In terms of the latter, AvaTrade is a 100% commission-free broker. Spreads are typically very competitive here, with EUR/USD starting at 0.9 pips. A minimum deposit of just $100 is required to open an account at AvaTrade.

No deposit or withdrawal fees apply here and supported payment types are inclusive of debit/credit cards and e-wallets. Supported markets include 55 forex pairs across the majors, minors, and exotics. Other markets include stocks, ETFs, indices, metals, cryptocurrencies, and energies.

AvaTrade is regulated in eight different jurisdictions and the platform has a solid reputation for account security. We also like that AvaTrade offers educational tools. This gives beginners the opportunity to learn how to trade in a risk-averse manner. To aid its educational materials, AvaTrade also offers a free demo account.

What We Like

- One of the best regulated forex brokers in India

- Compatible with DupliTrade

- Leverage offered on all markets

- Top MT5 forex broker

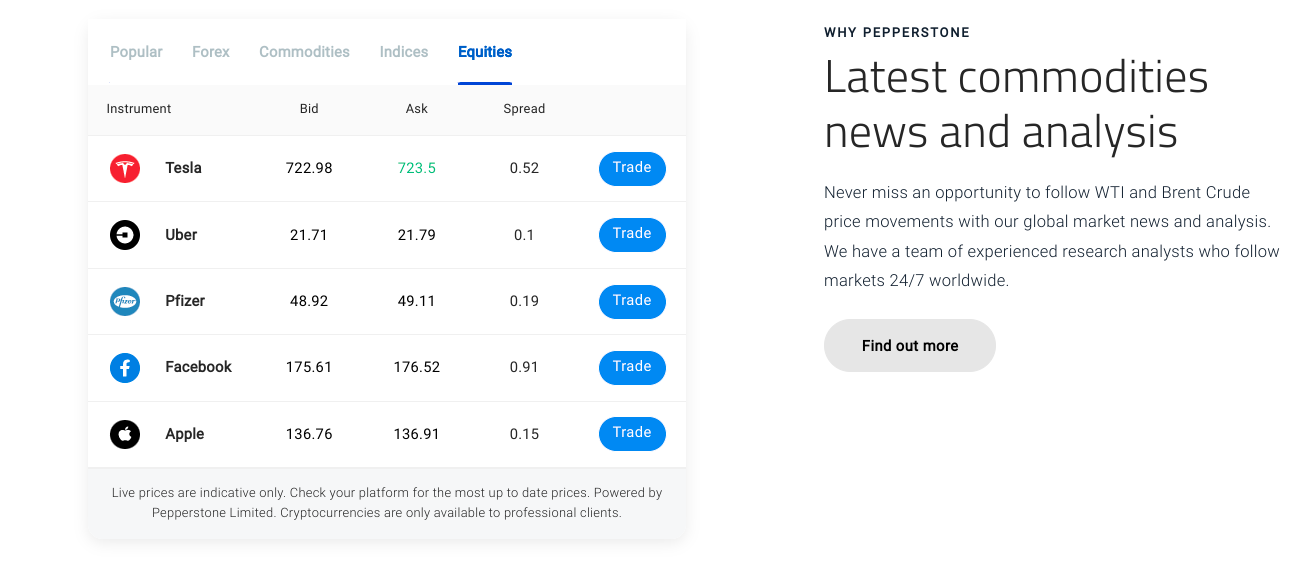

3. Pepperstone – Best Forex Broker in India for Raw Spread Accounts

![]()

We found that Pepperstone is one of the best brokers for forex in India for those that seek ECN-like accounts. The raw account at Pepperstone offers access to the best rates in the market and thus – zero spreads are often available on major forex pairs.

This particular account type will suit traders that generally invest larger volumes. At the other end of the scale, causal investors with a smaller amount of available capital will perhaps prefer the standard Pepperstone account. While this does come with spreads that start from 0.6 pips, no commissions are charged.

Both account types at Pepperstone allow Indian traders to get started without needing to meet a minimum deposit. Payments can be facilitated via a bank wire or a debit/credit card. Pepperstone also offers non-forex markets on its platform, which is inclusive of metals, energies, stocks, indices, cryptocurrencies, and more.

What We Like

- Raw spreads from 0 pips on major pairs

- Supports some of the best forex trading platforms in India – including MT4/MT5

- 0% commission accounts are also available

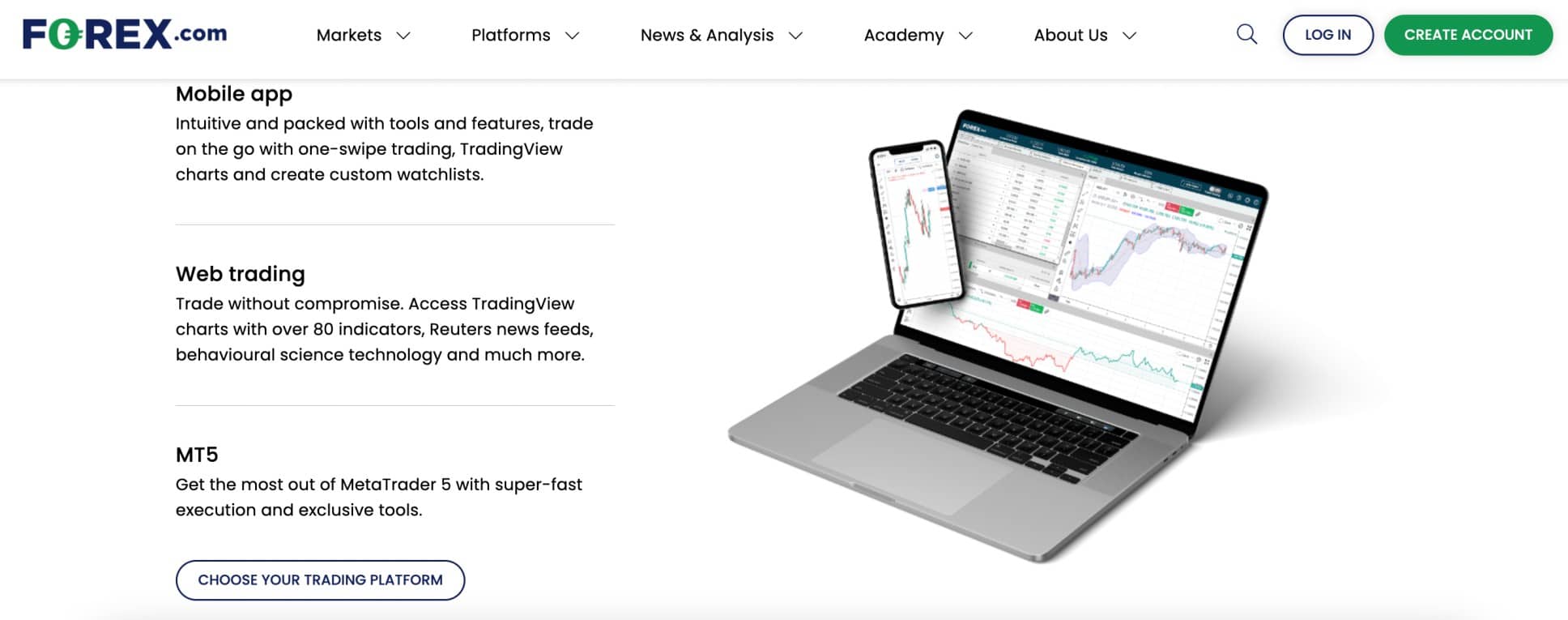

4. Forex.com – Established Forex Broker With Competitive Fees

Forex.com is an online trading platform that largely focuses on currencies. Indian traders will be able to buy and sell over 80+ pairs and two account types are offered.

First, the standard account is suited for casual investors that wish to trade via the Forex.com website or mobile app. Second, there is also an account that links directly to MT5. Both accounts are commission-free and come with variable spreads that start at 1 pip.

Forex.com is also one of the best forex brokers in India for analysis and research. This includes everything from market insights and real-time pricing to economic news and technical indicators. Forex.com also allows Indian traders to buy Bitcoin CFDs, alongside a range of other digital assets. CFDs can also be traded on options, indices, stocks, commodities, and metals.

What We Like

- Supports more than 80 currency pairs

- One of the cheapest forex brokers in India

- Great educational academy for beginners

5. Oanda – Trade 70+ Forex Pairs and Claim a $5,000 Welcome Bonus

Oanda is a global forex brokerage with more than 20 years of experience. The broker offers traders in India the ability to trade more than 70 major and minor currency pairs with leverage up to 50:1. The spreads at Oanda aren’t the lowest we’ve seen, but at 1.2 pips fees for the EUR/USD trading pair are still quite competitive.

Traders at Oanda can take advantage of numerous trading tools. The broker offers its own user-friendly trading platform for web, desktop, and mobile alongside platforms like MetaTrader 4 and TradingView. In addition, Oanda has a daily forex news feed and professional technical analysis for the most popular forex pairs. New traders will also find helpful guides to forex trading.

For a limited time, Oanda is offering new traders a welcome bonus worth up to $5,000 when they open an account and deposit $50,000. Traders with smaller accounts can also qualify for a bonus – traders who open an account and deposit $500 or more will receive $500. There is no minimum deposit for traders who don’t want to spring for the bonus.

What We Like

- Trade 70+ forex pairs with spreads from 1.2 pips

- Earn a $5,000 welcome bonus

- Offers a proprietary trading platform for web, desktop, and mobile

6. XM – Multiple Forex Trading Accounts and Minimum Deposit Just $5

XM is one of the best Indian forex trading platforms for budget investors. All supported account types at this broker require a minimum deposit of just $5. This can be funded with a debit/credit card, bank wire, and other a number of other accepted payment methods.

In addition to small deposits, we like that XM offers leverage of up to 1:1000 on major forex pairs and less on other asset classes. The minimum trade required at XM is just 0.01 lots. We also like that XM has developed its own mobile app, which is free to download across iOS and Android devices. It is also possible to trade online via MT4 and MT5.

When it comes to fees, this depends on the account type. For example, swap-free, standard, and micro accounts come with a minimum spread of 1 pip on majors. The ultra-low account is more competitive, with majors trading from 0.6 pips. All supported account types are commission-free.

What We Like

- Trade more than 55+ forex pairs at 0% commission

- Spreads start from just 0.6 pips

- 16 trading platforms across PCs, smartphones, and tablets

7. HotForex – High Leverage Forex Broker Located Offshore

HotForex is another top-rated platform to consider from our list of the best forex brokers in India. We like that the broker offers more than 1,200 trading products, which cover everything from forex and stocks to commodities and cryptocurrencies.

There are 15 different payment methods supported, which are inclusive of bank wires and debit/credit cards. Fees are very competitive here too, albeit, this will depend on the chosen account type. For example, the raw account offers zero spreads on majors and a commission policy of $3 per lot.

This account type comes with a minimum deposit of $200 alongside a maximum leverage facility of 1:500. Casual traders may prefer opening a micro account. This offers commission-free forex trading with a starting spread of 1 pip. The micro account offers higher leverage limits of 1:1000 and the minimum deposit is just $5.

What We Like

- Leverage limits of up to 1:1000

- Account minimums start from just $5

- One of the best forex brokers with low spreads

8. FXTM – High Leverage Forex Broker Located Offshore

![]()

Forex Time, more commonly referred to as FXTM, is an online broker that is utilized by more than 4 million clients. Users on this platform can access over 1,000+ markets across forex, stocks, indices, and more. FXTM is known for its fast execution times and competitive pricing structure.

There are several account types to choose from, with the micro plan requiring a minimum deposit of just $10. This account does not attract any commissions and the spread starts at 1.5 pips. The advantage account requires a minimum deposit of $500 and this comes with spreads that start at 0 pips.

The commission charged on this account averages $0.40 to $2, depending on the trade volume. In terms of making a deposit, Indian traders can add INR to their accounts via UPI and Netbanking. No fees apply and the funds should clear within 24 hours. Finally, we also like that FXTM offers customer support via live chat, WhatsApp, Telegram, and Messenger.

What We Like

- More than 1,000 markets supported

- Deposit from just $10 to get started

- 0% commission accounts offered

9. Zerodha – Top Indian Broker With Multiple Asset Classes

Zerodha is perhaps best known in India for its stock brokerage accounts. However, the platform offers a wide range of other products, including currency derivatives.

This allows Indian traders to speculate on the future value of a currency pair without taking ownership. Moreover, currencies can be traded in the form of futures and options contracts, with the platform supporting US-listed exchanges.

When it comes to fees, Zerodha charges the lower of Rs. 20 or 0.03% on forex intraday positions. Zerodha is registered with the Securities & Exchange Board of India (SEBI) – so the broker is considered safe.

What We Like

- SEBI-registered broker

- Great for diversification purposes

- Access the US intraday currency market

10. CMC Markets – Trade More Than 330+ Forex Pairs

CMC Markets is arguably the best forex broker in India for supported markets. After all, this platform is home to more than 330+ forex pairs. The broker aims to provide some of the best forex quotes in the market by combining eight data feeds from tier-one financial institutions.

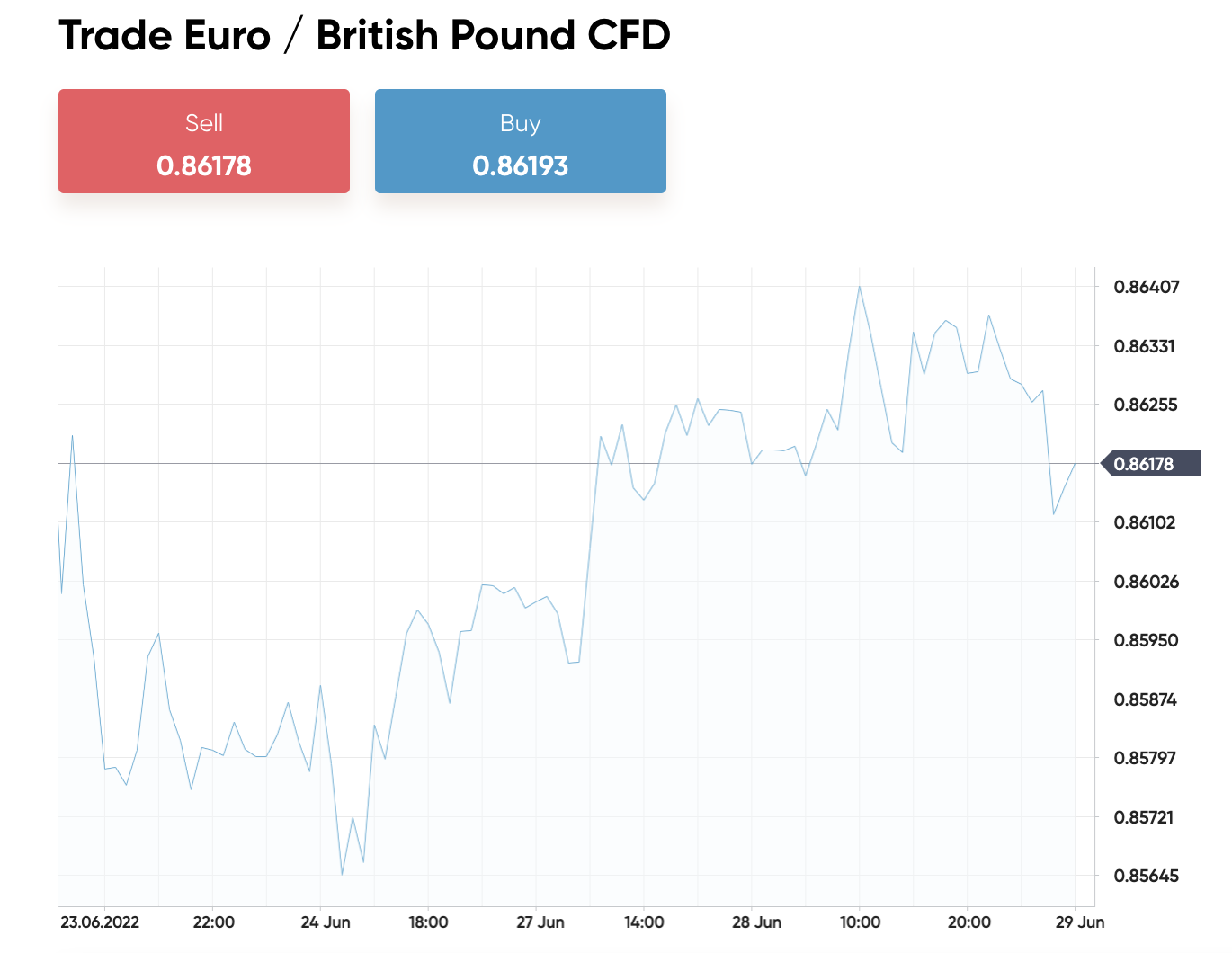

Slippage is minimal here too, with average execution speeds standing at 0.0045 seconds. In terms of fees, CMC Markets charges a minimum spread of 0.7 pips on EUR/GBP, while GBP/USD stands at 0.9 pips. No commissions are charged on forex at CMC Markets, so all fees are built into the spread.

CMC Markets also offers access to other CFD asset classes, which is inclusive of commodities, stocks, indices, treasuries, and ETFs. We also like that CMC Markets supports lots of different trading platforms. This includes a web and mobile platform designed by CMC Markets, as well as compatibility with MT4.

What We Like

- Buy and sell more 330+ forex pairs

- Supports forex baskets for added diversification

- Heavily regulated

Top Indian Forex Trading Brokers Compared

For a recap on the best forex brokers in India that we reviewed above, check out the table below:

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

How we Select the Best Indian Forex Brokers

In the sections below, we explain the core factors that we look for when ranking the best forex brokers in India.

Regulation and Safety

Top forex brokers in India will be regulated by at least one reputable financial body.

This is one of the main reasons why we choose Capital.com as the overall best forex trading platform in India, as it is regulated by CySEC, ASIC, NBRB, and the FCA.

Range of FX Pairs

We prefer forex brokers that offer a wide range of markets across the majors, minors, and exotics.

The likes of Capital.com and CMC Markers offer approximately 140 and 330 forex pairs respectively. This ensures that Indian traders always have access to profit-making opportunities around the clock.

Fees

When choosing the best forex broker in India, investors need to look at what trading and non-trading fees are charged.

Trading Commissions

Some forex brokers charge trading commissions. This will either come in the form of a percentage (e.g. 0.2%) or a flat (e.g.$3 per lot) rate.

Capital.com, however, offers 0% commission trading on all supported markets – not only on forex but other asset classes too.

Spreads

Be sure to check what spreads the forex broker charges before opening an account.

This will often be displayed as a ‘minimum’ spread, which means that outside of busy market hours this will likely increase.

Some forex brokers offer zero spread accounts, but this will attract a commission. After all, brokers are in the business of making money.

Capital.com offers the perfect combination of low spreads and zero commissions.

Leverage Fees

When applying leverage to a forex trading position, additional fees will apply.

This will be charged each day that the leveraged position remains open. The specific fee will depend on the pair, stake, amount of leverage, and the respective broker.

Funding

Deposit and withdrawal fees are sometimes charged by forex brokers.

Capital.com, however, offers fee-free payments across all supported methods.

Trading Tools

We like brokers that offer tools and features that can enhance the trading experience.

This might include customizable charts that come packed with technical and economic indicators.

Watchlists and alerts are also useful for staying up-to-date with how the forex markets are performing.

We also like the market insights and financial news developments offered by Capital.com.

Minimum Deposit

The best forex brokers in India have an affordable minimum deposit policy that will appeal to those on a budget.

Capital.com requires a first-time deposit of just $20.

Demo Account

Consider choosing a forex broker that offers a demo account.

This will allow newbies to practice their forex trading strategies and get to grips with the broker in question.

Mobile App

The best forex brokers in India that we reviewed today offer a solid, user-friendly app. Most brokers will optimize a trading app for both iOS and Android.

This will connect to the user’s brokerage account, meaning that they can buy and sell forex pairs on the move.

Customer Service

Top-rated customer service should not be overlooked when searching for the best forex brokers in India.

Live chat and telephone support offer real-time assistance, so avoid brokers that only provide an email service.

Best Forex Signals in India

Those with no prior experience in trading currencies might consider a forex signals service. At Learn2Trade, for example, the provider offers up to 3 forex trading signals per day to its premium plan members.

Each signal will inform the member of the currency pair that should be traded, and whether they should speculate long or short. Learn2Trade signals will also state the suggested entry and exit order prices to execute.

In other words, Learn2Trade does all of the required research and technical analysis behind the scenes, meaning that members have the opportunity to trade forex passively.

An example of a Learn2Trade forex signal is as follows:

- Pair: EUR/GBP

- Direction: Buy Order

- Limit: 0.8611

- Take-Profit: 0.8790

- Stop-Loss: 0.8520

For those that wish to try the premium forex signals offered by Learn2Trade, the platform offers a 30-day moneyback guarantee to all new customers.

Your capital is at risk.

How to Start Forex Trading in India

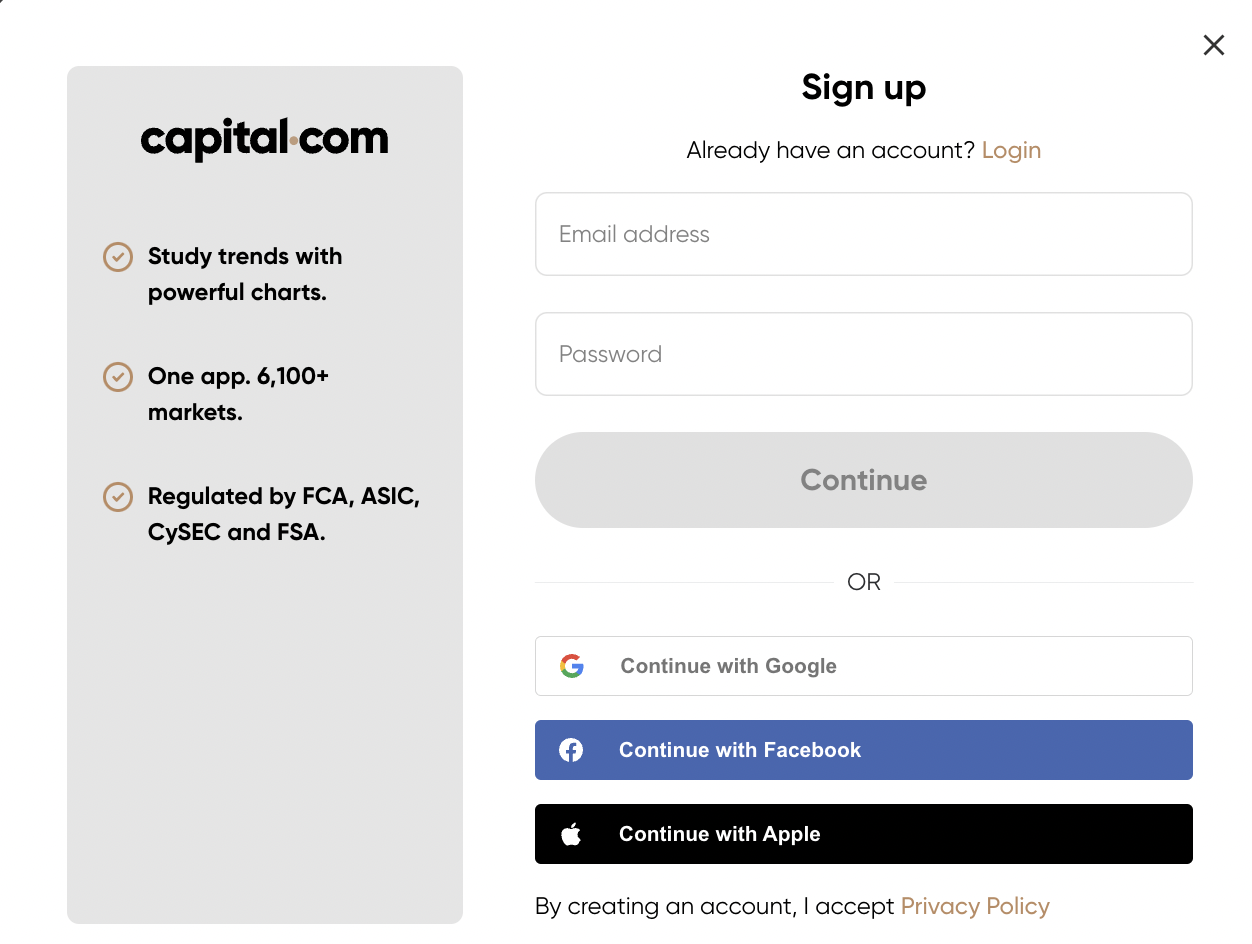

Complete beginners might appreciate the step-by-step guide below, which explains how to get started with the best forex broker in India right now – Capital.com.

Step 1: Open a Capital.com Forex Broker Account

Those without a Capital.com account will need to register some personal details. This is inclusive of a first and last name, nationality, home address, and cell phone number.

Capital.com will need to verify the details given, so be sure to enter the registration form accurately.

Step 2: Upload ID

To get verified, upload some ID. Most traders will opt for a driver’s license or passport.

The document needs to be government-issued and still be in date.

Step 3: Deposit Funds

Next, meet the minimum deposit of $20 if using a debit/credit card or e-wallet. Users will need to deposit at least $250 if opting for a bank wire.

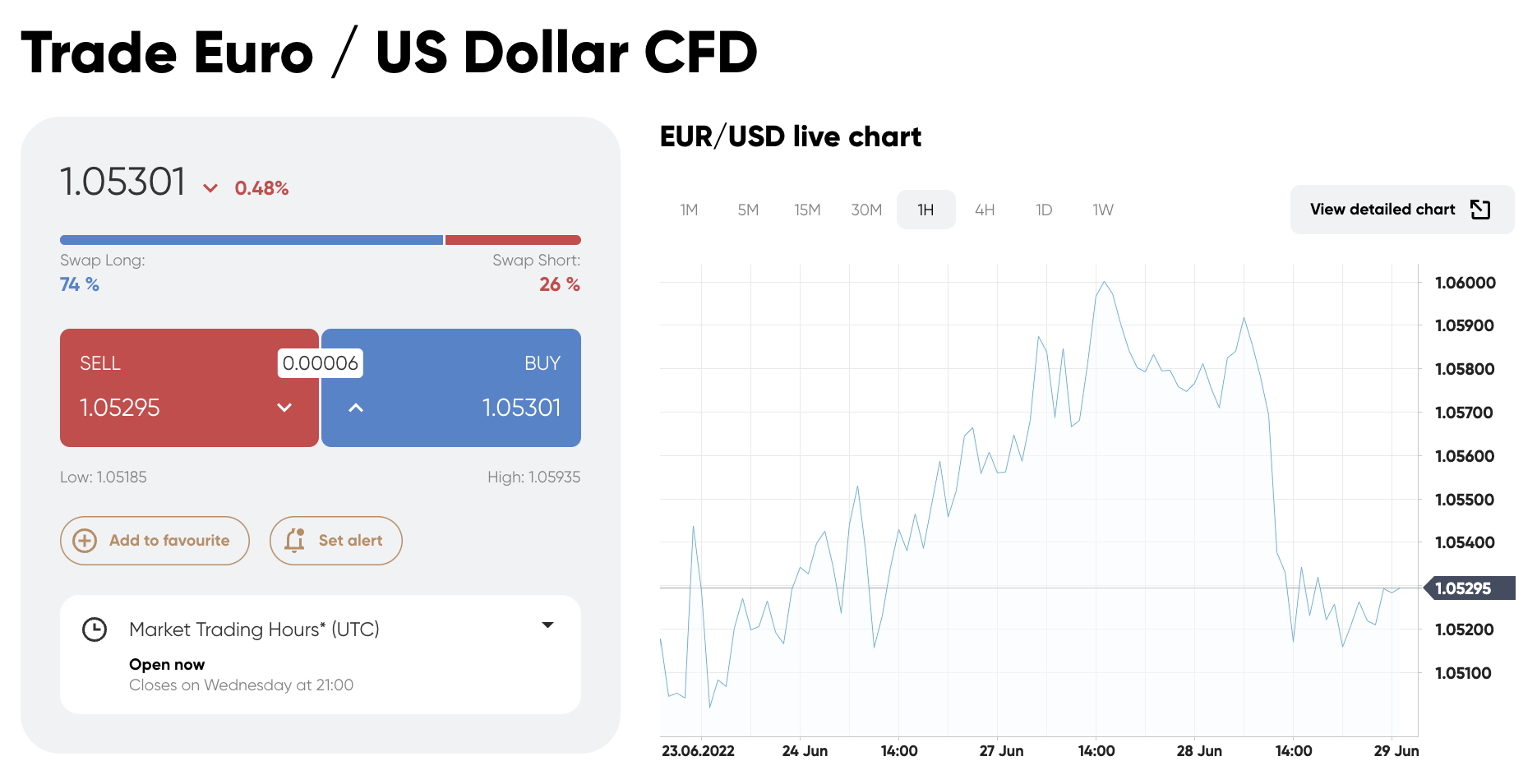

Step 4: Search for Forex Pair

In the search bar, the user will need to type in the forex pair that they wish to speculate on.

Our example, in the image above, shows that the user is searching for EUR/GBP.

Step 5: Trade Forex

Choose from a buy (long) or sell (short) order and type in the required stake.

Set up a limit, stop-loss, and take-profit order to ensure that the position is entered in a risk-averse manner.

Confirm the order to place a commission-free forex trading position at Capital.com.

Conclusion

In summary, we found that Capital.com is the overall best forex broker in India right now for low fees and account minimums, as well as its support for almost 140 currency pairs.

No commissions are charged by the broker and spreads start from a very competitive 0.6 pips. Moreover, when making an instant deposit via a debit/credit card or e-wallet, Indian residents are required to meet a minimum of just $20.

#forextrader #trading #forextrading #money #forexsignals #cryptocurrency #trader #investment #crypto #forexlifestyle #investing #business #entrepreneur #invest #binaryoptions #blockchain #forexmarket #forexlife #stocks #success #daytrader #btc #bitcoinmining #investor #stockmarket #binary #fx #finance