The Metaverse concept is tipped to be the next big thing in the evolution of the internet. Put simply, the Metaverse can be referred to as an interactive digital universe facilitated by immersive technologies such as augmented and virtual reality.

In this guide, we offer some insight into what the Metaverse is and how you can leverage this technology from an investment perspective. We also discuss the Best Metaverse stocks to watch in 2022, and how you can invest on a commission-free basis.

Popular Metaverse Stocks to Watch in 2022

Below, we have rounded up a list of the popular Metaverse stocks.

- Battle Infinity – Best Metaverse Game to Invest in 2022

- Lucky Block

- Meta Platforms

- Roblox

- Nvidia

- Autodesk

- Unity Software

- Coinbase

- Nike

- Match Group

- Microsoft

Your capital is at risk

These companies listed above belong to various sectors, contributing to the Metaverse in different ways.

Before you choose the popular Metaverse stocks for your portfolio, we suggest that you read the detailed analysis that we have included in the next section.

A Closer Look at the Popular Metaverse Stocks

If you’re looking to buy stocks or if you’re wondering how to invest in the metaverse you’ll need to ensure you research the market thoroughly beforehand. Unlike the majority of software platforms in the market, the Metaverse isn’t something that can function as a single entity.

In fact, it brings together several technologies and industries – including but not limited to digital infrastructure, virtual experiences, artificial intelligence, blockchain technology, spatial computing, and more.

The popular Metaverse stocks that we have analyzed below consider a mix of companies that contribute to this virtual world in one way or another.

Read on to find out their roles in the Metaverse and how they might benefit from this emerging concept.

1. Battle Infinity – Overall Best Metaverse Crypto for 2022

After carefully researching the hottest Metaverse cryptos and projects on the market, we’ve determined that Battle Infinity (IBAT) could be primed to become the Metaverse asset of the year. The project is a wildly exciting Metaverse P2E gaming platform that provides investors with the opportunity to earn in a multitude of ways. The project comprises 6 different platforms, each of which boasts its own unique set of features. What’s more, the project has already been KYC-verified by CoinSniper.

As we mentioned, Battle Infinity is split into six platforms which include a dedicated platform to stake IBAT (the project’s native currency), an NFT marketplace for both creators and in-game items, and even a decentralized exchange players can use to trade their winnings for fiat or another cryptocurrency. However, while each of these features shows extreme promise, the most exciting is the IBAT Battle Arena, an exquisitely crafted Metaverse world.

Within the IBAT Battle Area, players own their own unique NFT-based avatar which can be customized to the user’s whims, with various accessories bought from the Battle Market like clothing, sunglasses, and even new hairstyles. Furthermore, players are free to walk around and interact with the immersive Metaverse world using a keyboard and mouse, controller, or a VR headset.

With the massive variety of Metaverse functionality (run concerts, attend parties, etc) and a whole host of additional features packed into the project, Battle Infinity is a must-watch for 2022. While the project is still in its early stages, investors can ensure they don’t miss any updates by joining the Battle Infinity Telegram group.

Your capital is at risk.

2. Lucky Block – Exciting Crypto Project Offering NFT Competitions

Leading the way when it comes to the best metaverse stocks for 2022 is Lucky Block. It’s important to note that Lucky Block is actually a cryptocurrency, not a stock, making it ideal for boosting your portfolio’s diversification. In addition, Lucky Block has enormous potential from a metaverse standpoint, which has caused a tremendous buzz around the token.

Leading the way when it comes to the best metaverse stocks for 2022 is Lucky Block. It’s important to note that Lucky Block is actually a cryptocurrency, not a stock, making it ideal for boosting your portfolio’s diversification. In addition, Lucky Block has enormous potential from a metaverse standpoint, which has caused a tremendous buzz around the token.

Broadly speaking, Lucky Block is an innovative crypto gaming platform that looks to improve the user experience for players drastically. By porting the gaming process over to the blockchain, Lucky Block ensures that geographical boundaries are removed, allowing anyone to play. In addition, since all transactions are viewable through the public ledger, Lucky Block’s platform is much more transparent than traditional systems.

As noted in Lucky Block’s whitepaper, the platform is made functional through LBLOCK – Lucky Block’s native token. LBLOCK was listed on PancakeSwap in January 2022 and immediately began a huge bull run, culminating in an all-time high of $0.009617. This helped push Lucky Block to a fully-diluted market cap of over $750 million, which is remarkable for a new listing.

Lucky Block’s value has sunk by over 70% from these highs and is trading around the $0.001950 level at the time of writing in April 2022. However, this presents an exciting opportunity to buy Lucky Block at a discount since numerous upgrades are in the pipeline. These include the upcoming release of Lucky Block’s iOS and desktop applications and the hugely-anticipated FIAT ramp.

Notably, Lucky Block’s roadmap also highlights plans for metaverse incorporation during Phase 4 of the platform’s development, with a developer fund being used to finance the creation of additional online crypto games. With over 55,000 people now part of Lucky Block’s Telegram group, these upgrades will be met with enthusiasm – hinting that another bull run could be on the horizon.

Cryptoassets are a highly volatile unregulated investment product.

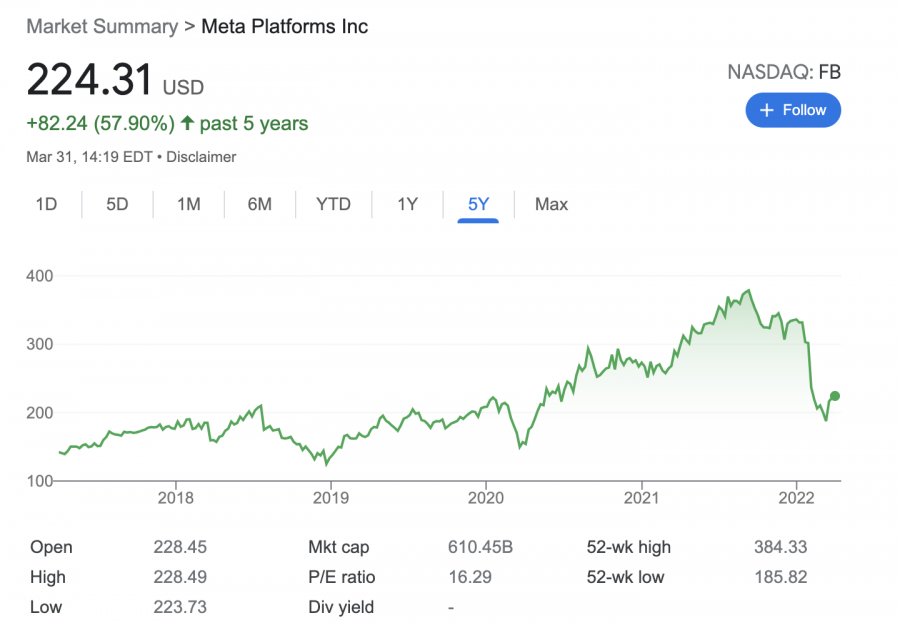

3. Meta Platforms

In December 2021, Facebook announced that would be rebranding its business to Meta Platforms, indicating its entry into the future of the Metaverse concept. The firm has already started investing heavily in the development of immersive technologies and now has a successful product in the market – the VR headset Oculus.

On top of this, Facebook has also announced that it is working on an AI supercomputer. That said, the company’s primary revenue is still generated from its social media networks – which include Facebook and Instagram. Meta Platforms has already created a large built-in user base via these platforms, which will help to establish its presence in the Metaverse.

Moving forward, Meta will be able to leverage its existing audience to monetize on the Metaverse beyond just selling VR headsets. Looking at its stock price action, Meta Platforms has performed extremely well since going public in 2012. In the last half-decade, the share value of this company has increased by nearly 60%.

However, recently, Meta Platforms has been facing some struggles due to heightened competition from TikTok. Consequently, Meta has reported a profit decline, which has also led to a drop in its share value. Between September 2022 and March 2022, the stock dropped by around 40%.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

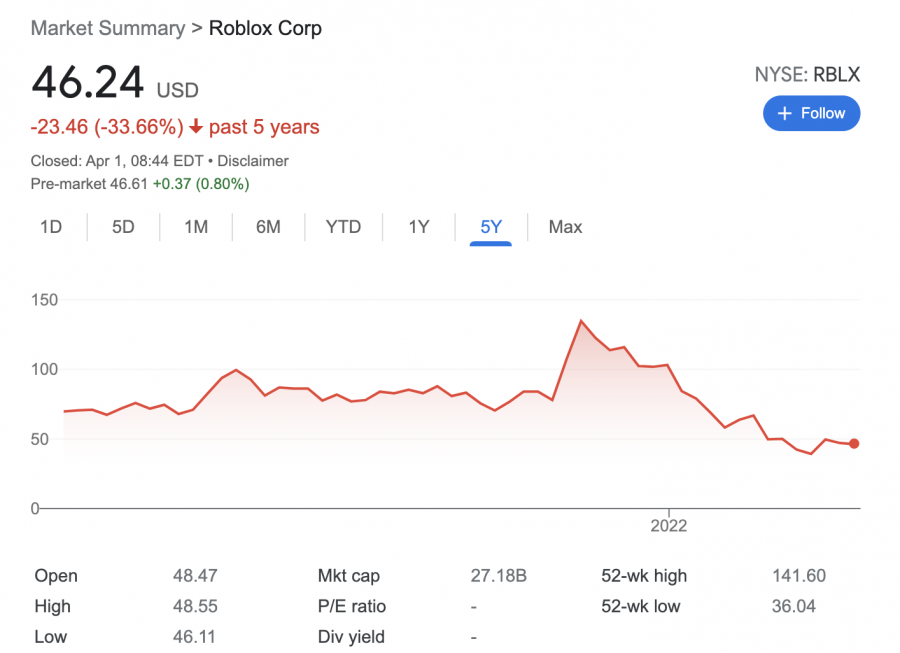

4. Roblox

Roblox is a video game developer that has already built a virtual world in the Metaverse. The company was founded in 2004 and already plays a major role in the gaming sector. However, its entry into the Metaverse has further increased popularity among young audiences as well as investors.

Roblox’s platform on the Metaverse already has over 47 million daily active users. Over the past couple of years, Roblox has hosted several virtual events and concerts and was thus able to gain a big head start in the Metaverse scene.

The company went public in March 2021 and its stock has since witnessed enhanced volatility. In the course of one year, Roblox stock hit its all-time high of $141, whereas its lowest price was about $35. This represents a variation of 300% in its share value. Although the platform is seeing increased revenues, recent earnings fell short of the predictions made by analysts.

This is primarily because Roblox is most popular among users under the age of 16. The platform become hugely famous during the COVID-19 pandemic when the young demographic had the ability to spend more time online. With schools reopening, engagement on the Roblox platform has reduced.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

5. Nvidia

In addition to companies creating virtual worlds and products for the Metaverse, you can also look at stocks that engage in behind-the-scenes operations. An example of a popular Metaverse stock that fits this criterion is Nvidia, a semiconductor company that produces fast-processing chips and graphics processing units.

Nvidia’s chips are already integrated into Meta Platform’s upcoming supercomputer, the AI Research SuperCluster – which is expected to play a crucial role in building technologies for the Metaverse. Nvidia has also invested in 3D technology and has already built a scalable, real-time reference development platform called Omniverse.

Although the aforementioned enterprise product has been in the market for a short time, it is already being used by thousands of creators. Alongside Omniverse, Nvidia’s GPUs will be in high demand in terms of offering a 3D content experience in the Metaverse.

From an investor’s point of view, Nvidia is already enjoying impressive growth in the sectors of video gaming and big data.

At the time of writing, the firm is offering a running yield of just under 0.60%. In the past five years, Nvidia stock has increased by a whopping 980%.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

6. Autodesk

Autodesk is a well-established company that designs and makes software products for the engineering industry. Its products include AutoCAD and Revit – both of which have become a staple for architects and structural engineers to draft and model their designs.

However, outside the construction sector, AutoCAD is also heavily used by animators and visual effects artists for its 3D software tools. The company’s suite of products designed specifically for VR and 3D animations makes it suitable fit for the Metaverse.

Initially, Autodesk offered a one-time purchase model. This meant that users could keep on working with the same version, purchasing a new product only when they needed an upgrade. However, Autodesk has since switched to a subscription model that requires an annual license.

This strategy has helped the company create a recurring income stream and, in turn, increase its revenue. AutoDesk debuted on the NASDAQ exchange in 1985 and since then, the stock generated solid returns for investors. Over the past five years, the share price of AutoDesk has climbed up by over 150%.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

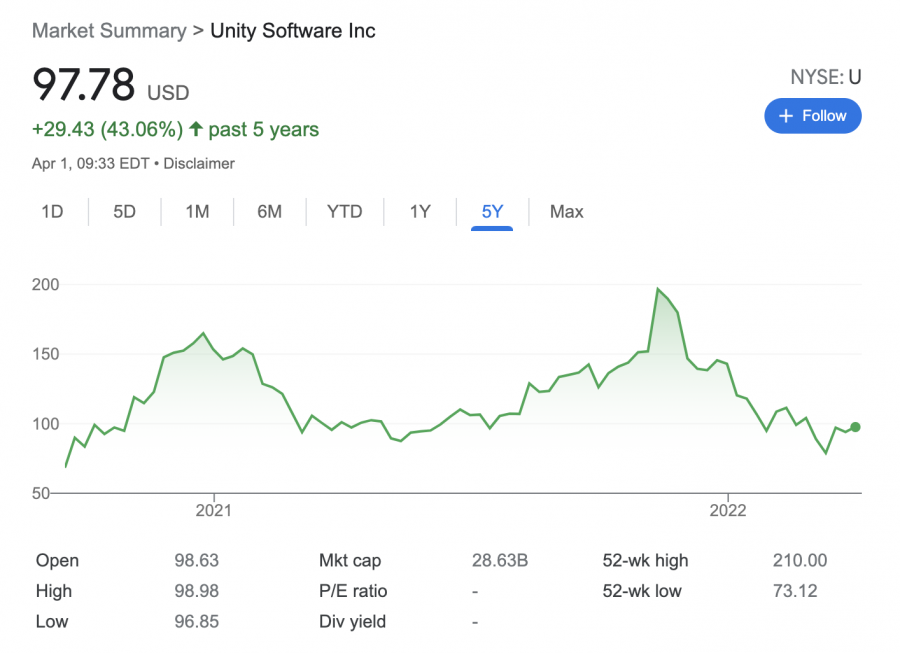

7. Unity Software

Unity Sofware is another company that is set to play a significant role in the expansion of the Metaverse. The platform offers various solutions that allow the development of software programs. It provides tools for designers, architects, and engineers to develop 3D content for the virtual world, which now includes the Metaverse.

The company is working on several platforms – such as Insomniac Events, to create new Metaverse worlds. Unity Sofware is also investing heavily in the gaming industry. Since becoming a public company in 2020, the stock value of Unity Sector has increased by nearly 45%.

Like many other tech stocks, Unity Software also faces pressure from its investors. Recently, the firm’s acquisition of the visual effects company Weta Digital has left shareholders concerned – especially since Unity Software had to raise capital to facilitate the investment. However, in the long run, some analysts expect Weta Digital to be a fruitful venture for Unity Software.

That said, Unity Software has also devised a few other notable partnerships outside the Metaverse market. In December 2021, the company got on board with eBay to offer a 3D view solution to selected sellers. It has also announced a new collaboration with Hyundai Motor Company to build a digital-twin factory to improve logistics.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

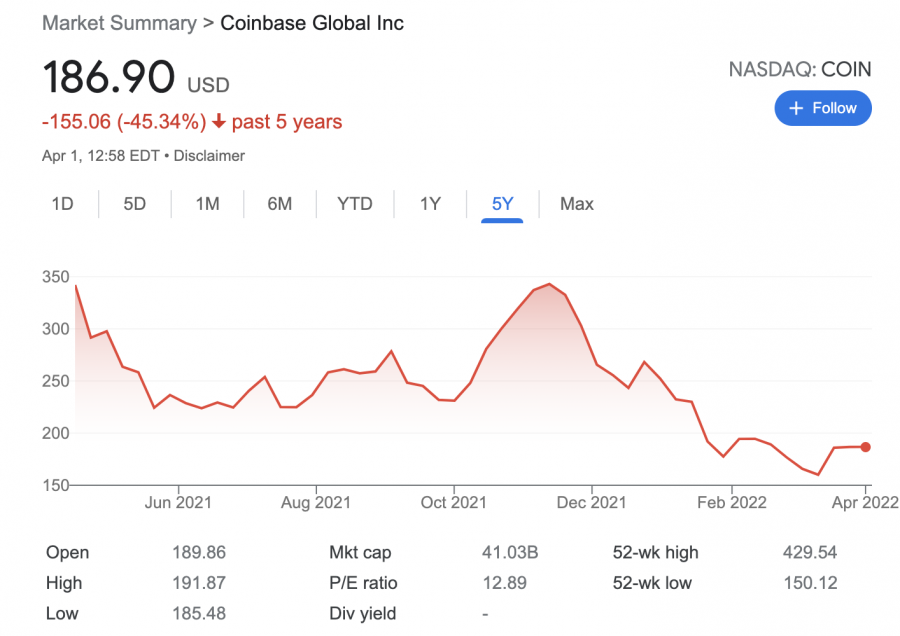

8. Coinbase

The leading cryptocurrency exchange Coinbase is also one of the biggest beneficiaries of the Metaverse. To explain further, you should understand that crypto-assets form the backbone of the Metaverse.

Apart from buying and selling digital assets, Coinbase also facilitates other crypto-related services, such as credit cards, interest accounts, and more. And, the platform allows you to invest in NFTs via its new marketplace – which enables Coinbase to take advantage of the growth of the Metaverse.

Coinbase has also announced that it is working on developing technology that will allow its users to purchase their own avatars for Metaverse games.

After becoming a public-traded company in April 2021, Coinbase stock reached its all-time high of about $430 in November of the same year. However, since then, its share value has dropped by about 65%. This is mainly due to the sharp decline in cryptocurrency prices, which translated to lower transaction volumes and revenues for Coinbase.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

9. Nike

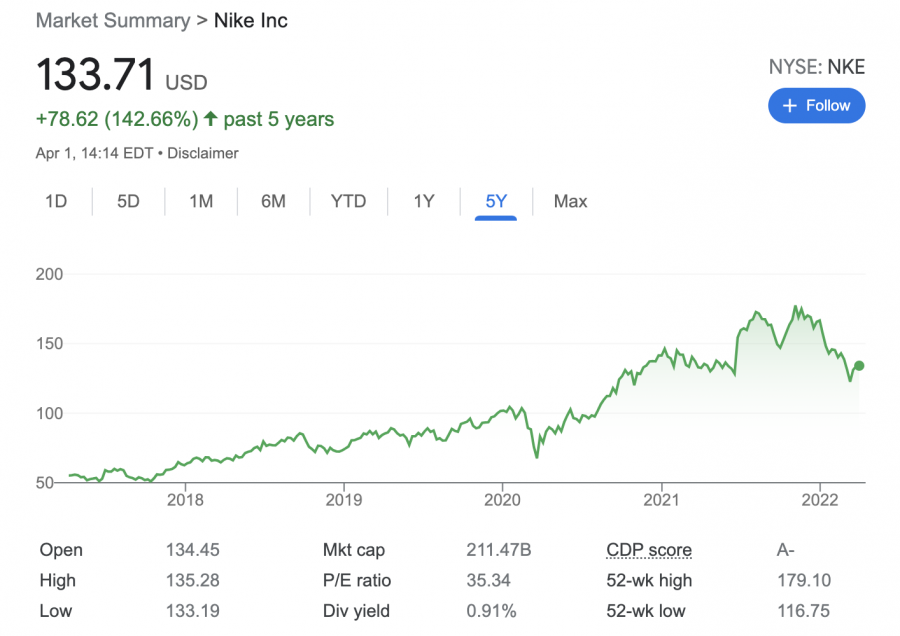

The share value of Nike has climbed by nearly 150% over the last five years. The company has also witnessed continued revenue growth, boosted by its digital marketing strategies and direct-to-customer business model. Needless to say, Nike is a leader in the sports apparel industry and already has an established customer base in the real world.

That said, Nike is also looking for ways to enter into the Metaverse. In December 2021, it announced the acquisition of RTFKT, a leader in the NFT shoe market. This move will help Nike in developing digital sneakers, designed to be wearables in virtual worlds such as Decentraland, making it also one of the most popular NFT stocks to buy.

Nike has previously created an online experienced inside Roblox, allowing players to purchase its digital apparel. Moreover, Nike also expects to use the Metaverse for advertising and as a way to showcase its products to users. Nike also pays a running dividend yield of 0.9% as of writing.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

10. Match Group

As the owner of apps such as Tinder and OkCupid, Match Group might not come across as a metaverse stock first glance. However, this company has revealed its plans to take its match-making efforts to the virtual world. Match Group aims to roll out avatar-based virtual experiences to its portfolio of apps.

As an initial step in this market, Match Group has already tested its in-app virtual currency called Tinder Coins. These allow users to buy in-game features and perks. Moreover, the company has also started designing its live virtual world, named Single Town. In this, users will be represented by their avatars and can engage with others via an audio link in virtual locations.

The share price growth of Match Group has been impressive in recent years. For instance, over the past five years alone, its share value increased by over 250%. Its revenues were boosted further during the pandemic market, however, the stock failed to sustain its momentum to the close of 2021.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

11. Microsoft

Software powerhouse Microsoft is also set to start its journey into the world of Metaverse. It plans to create an enterprise Metaverse, which will essentially have a virtual representation of all Microsoft tools. The company has already announced the launch of Microsoft Mesh, which facilitates real-time collaboration in the virtual world.

Mesh will come with a set of pre-built immersive spaces for meetings and social mixers, allowing users to create avatars and interact with each other. The company also has plans to acquire the gaming giant Activision Blizzard, which will play a crucial role in helping Microsoft build its own world in the Metaverse.

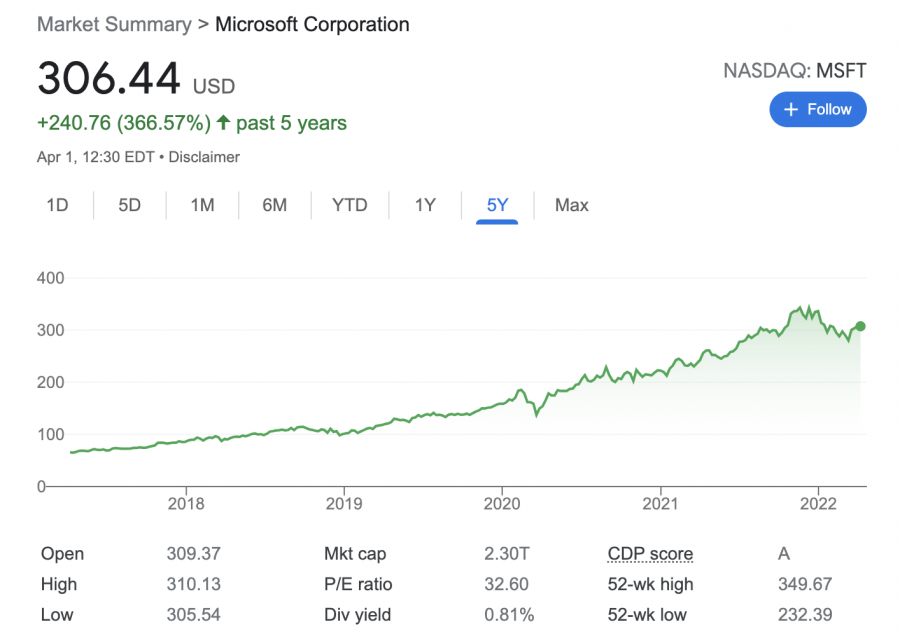

On top of this, unlike the majority of tech stocks, Microsoft pays dividends. This stands at a running dividend yield of 0.8% at of writing. Microsoft shares continue to perform well – with gains of over 350% in the past five years.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

What are Metaverse Stocks?

Before you learn how to invest in Metaverse stocks, you should understand what this emerging concept encompasses. In a nutshell, the Metaverse is a collection of virtual worlds designed to foster social interaction.

Each user will have their own avatar and will be able to engage with different virtual experiences via advanced human-computer interaction hardware such as AR and VR headsets.

That said, the Metaverse is in its early stages. Therefore, perhaps, the best Metaverse stocks to buy today are companies that are already flourishing but whose growth is likely to be further boosted by this digital world.

These firms could belong to several sectors, including:

- Gaming – such as Roblox

- Immersive technology – such as Facebook

- Blockchain-related services – such as Coinbase

- Digital infrastructure – such as Nvidia and Autodesk

- Retail – such as Nike

Firms such as Autodesk and Unity Software are helping to design the building blocks for established businesses like Nike to enter the Metaverse.

Moving forward, as the Metaverse expands, we might see a lot more companies create their own version of the virtual world.

Metaverse Penny Stocks

For those unaware, Metaverse penny stocks are companies that trade at less than $5 per share – as defined by the SEC.

If you are interested in this category of Metaverse stocks, here are some stocks in the sector:

- Alpha Metaverse – Metaverse stock for exposure in the esports gaming sector

- Blue Hat – Metaverse stock providing interactive entertainment technology

- Meta Materials – Metaverse stock offering AR eyewear

While Metaverse penny stocks might come across as solid investments due to their low-cost entry, you should also bear in mind that they tend to be volatile.

Moreover, there is additional risk involved if the penny stock trades on the OTC markets – as there might not be enough information about the firm in the public domain.

Metaverse Stock Price

As we discussed earlier, the Metaverse concept is still in its infancy. In other words, it might take several years before this virtual world exists in its fullest form.

That said, many companies are investing heavily into the Metaverse, contributing in order to get an early foothold in this digital scene.

And some Metaverse stocks have already been able to reap the benefits.

- For instance, Roblox was founded back in 2004.

- However, it entered its Metaverse product as recently as April 2021 and started trading publicly around the same time.

- Roblox stock hit an all-time high in November 2021, at the peak of the COVID-19 pandemic.

- That said, with lockdowns ending and schools reopening, the target demographic of Roblox is spending less time on the platform.

- Consequently, recent earnings missed the expectations of Wall Street analysts, and thus – Roblox shares have since dropped.

As you can see, while the Metaverse can be a driver for growth, at the same time, there are other factors that can affect the value of stocks operating in this industry.

Moreover, due to the rising exposure of the Metaverse, there are a lot of entrants vying for a competitive edge in this space.

Taking this into account, we suggest that you examine the popular Metaverse stocks extensively to understand their possibilities and drawbacks before you risk any capital.

Where to Buy Metaverse Stocks

By now, you likely have a firm idea of what the Metaverse is and how you can gain exposure to this emerging technology.

Next, we will now discuss where to buy Metaverse stocks today without paying any commission.

eToro

eToro is a popular social trading platform that gives you access to the stock market in a simple and transparent way. This online broker makes zero commission stock investing available to more than 3,000+ US and international equities. Moreover, you will be able to buy Metaverse stocks in fractional quantities from just $10. Since eToro supports over 15 international markets, you’ll also be able to add the popular dividend stocks and oil stocks to your portfolio with low fees.

eToro is a popular social trading platform that gives you access to the stock market in a simple and transparent way. This online broker makes zero commission stock investing available to more than 3,000+ US and international equities. Moreover, you will be able to buy Metaverse stocks in fractional quantities from just $10. Since eToro supports over 15 international markets, you’ll also be able to add the popular dividend stocks and oil stocks to your portfolio with low fees.

Not only does this broker support all the popular Metaverse stocks we discussed today, but it also has a prebuilt portfolio that focuses specifically on this sector. eToro’s MetaverseLife is a smart portfolio that includes stocks such as MetaPlatforms, Adobe, Autodesk, Nvidia, Roblox, and more.

It also includes some of the popular Metaverse crypto coins – allowing you to gain exposure to a different asset class and diversify at the same time.

Another aspect that makes eToro a popular broker is that the platform offers a popular stock app for extra convenience. It lets you get started in less than five minutes with a $10 minimum deposit to buy stocks on eToro. Not only that, eToro facilitates social trading – meaning, you can follow, interact, share ideas and strategies, and even copy other investors on the platform.

eToro is also an excellent place to buy cryptocurrencies in a low-cost environment. Furthermore, you will also be able to store your digital assets for as long as you wish in the eToro wallet for free. The broker also extends support to other assets such as ETFs, indices, commodities, and forex trading.

And crucially, eToro is regulated on multiple fronts by top financial authorities – including the SEC in the US, FCA in the UK, ASIC in Australia, and CySEC in Cyprus. This indicates that the provider takes security and safety seriously.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Conclusion

The Metaverse is expected to usher in the next phase of evolution in the internet ecosystem.

However, it is crucial to bear in mind that it will take time and enhanced technological advancements before this virtual world becomes fully accessible and affordable to the public.

With that said, one project stood out from the rest. Battle Infinity shows massive potential for growth in the near future. It’s got a well-defined roadmap, a plethora of incredible features, and a rock-solid team. While it’s still early days, Battle Infinity seems to be gearing up to take the crypto industry by storm.