South African residents in the market for an online forex broker will have plenty of options to choose from. In this guide, we help clear the mist by reviewing and ranking the 10 best forex brokers in South Africa today.

To help our readers make an informed decision, our reviews focus on core factors surrounding supported pairs, payments, commissions, spreads, regulation, customer service, and more.

The 10 Best Forex Brokers in South Africa

For a quick overview of the 10 best forex brokers in South Africa, check out the list below:

- Capital.com – Overall Best Forex Broker in South Africa

- eToro – Low-Cost Forex Broker With Copy Trading Tools

- Libertex – One of the Best Forex Trading Apps in the Market

- AvaTrade – Regulated Forex Broker That Supports MT4 and MT5

- Pepperstone – Best Forex Broker in South Africa for Raw Spread Accounts

- Forex.com – Established Forex Broker With Competitive Fees

- XM – Multiple Forex Trading Accounts and Minimum Deposit Just $5

- HotForex – High Leverage Forex Broker Located Offshore

- IG Markets – Trusted Forex Broker With 80+ Pairs

- Interactive Brokers – Access to Interbank Currency Quotes

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

Each of the above forex brokers will differ in terms of the service offered, so be sure to read our comprehensive reviews before making a decision.

Best South African Forex Brokers Reviewed

We spent countless hours comparing the best brokers for forex in the South African market.

In the reviews below, the 10 best forex brokers in South Africa are ranked for the service offered, fees, supported currency markets, payments, leverage, and more.

1. Capital.com – Overall Best Forex Broker in South Africa

![]()

Capital.com was a clear winner as the overall best forex broker in South Africa. Those seeking low trading fees will appreciate that Capital.com does not charge any commissions and spreads start from a very competitive 0.6 pips on EUR/USD.

There are no fees to open or maintain an account, nor to deposit or withdraw funds. We like that Capital.com offers nearly 140 forex trading pairs across the majors, minors, and exotics. Each and every supported major pair can be traded with leverage of up to 1:30. Pairs from the minor and exotic categories will be offered with leverage of up to 1:20.

The minimum lot size at Capital.com is 0.01 – which will appeal to those on a budget. We also like that Capital.com offers a fully-fledged demo account that comes pre-loaded with $10k in paper trading funds. This will suit beginners that wish to practice their forex trading strategies before placing a real money order.

Capital.com offers a variety of trading platforms that users can choose from. The web-based platform is native to Capital.com and this can be accessed via a standard browser. Capital.com also offers a mobile app for iOS and Android that connects to the user’s main account. Alternatively, more experienced traders might consider connecting their account to MT4.

Either way, all supported platforms offer a variety of trading tools such as real-time pricing, customizable charts, and more. Capital.com is also the best forex broker in South Africa for those that wish to trade other asset classes. This includes thousands of stocks and ETFs, as well as cryptocurrencies, indices, and commodities.

When it comes to safety and security, the Capital.com platform is regulated by ASIC, CySEC, NBRB, and the FCA. There is a minimum deposit of $20 to get started, but this requires funding to be made via an e-wallet or debit/credit card. Bank wires will require a higher first-time minimum of $250.

What We Like

- Overall best forex broker in South Africa

- Trade forex with leverage

- Regulated by ASIC, FCA, CySEC, and NBRB

- Nearly 140 forex trading pairs

- Great forex trading app

- Also supports commodities, crypto, stocks, and indices

- 0% commission and tight spread

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

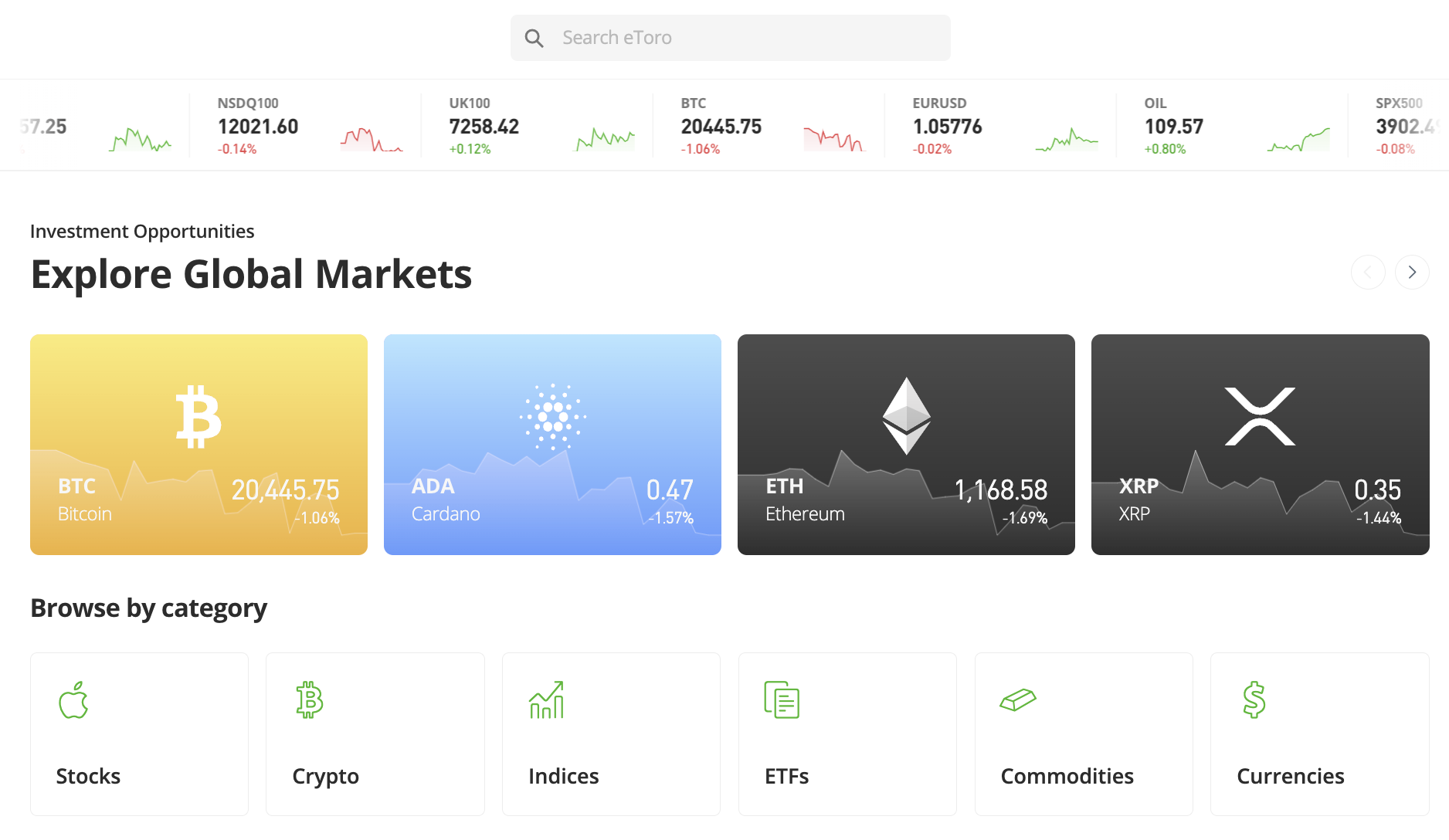

2. eToro – Low-Cost Forex Broker With Copy Trading Tools

eToro is the next option to consider when searching for the best forex brokers in South Africa. This platform is super user-friendly and it offers a wide variety of tools that will appeal to beginners. For example, the Copy Trading tool enables eToro users to replicate the investments of a successful forex trader.

Each and every position entered by the chosen trader will be copied over to the user’s portfolio. Moreover, this will be at an amount proportionate to the Copy Trading investment – which starts at $200. Those wishing to trade forex on a DIY basis will find nearly 50 currency pairs at eToro.

The minimum trade size per order is 0.01 lot. eToro offers leverage of up to 1:30 on major pairs and 1:20 on minors and exotics. No forex trading fees are charged by eToro other than the spread – which starts at 1 pip per slide. eToro also offers other asset classes on its platform, which is ideal for those that wish to diversify.

This includes CFDs in the form of metals, energies, agricultural products, and indices. eToro also allows South Africans to buy shares at 0% commission, and from a minimum stake of $10. There is also the option to buy Bitcoin and more than 70 other cryptocurrencies at a fee of just 1% plus the market spread. As such, eToro has been dubbed by many investors as one of the best crypto exchanges in South Africa.

Another popular feature offered by eToro is its Smart Portfolios. These are pre-selected investment portfolios that track a specific marketplace or strategy. Each portfolio is managed by the eToro team, which allows South Africans to invest in the financial markets passively.

To open an eToro account, users will only need to meet a minimum deposit of $50. South African residents can deposit funds via a local bank transfer, debit/credit card, Paypal, and other supported e-wallets. Safety and legitimacy are assured at eToro, as the broker is authorized and regulated by the FCA, CySEC, SEC, and ASIC.

What We Like

- Regulated by multiple financial bodies

- Very user-friendly trading platform

- Spread-only forex trading model

- Popular NASDAQ broker in South Africa

- Supports Copy Trading and Smart Portfolios

- Top mobile app for iOS and Android

- Also supports stocks, ETFs, cryptocurrencies, and commodities

- Offers one of the safest and best crypto wallets in South Africa

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider

3. Libertex – One of the Best Forex Trading Apps in the Market

Next up we have Libertex, which is perhaps the best trading app in South Africa. This mobile app for both Android and iOS allows traders to speculate on forex while on the move. Dozens of major, minor, and exotic currency pairs are supported, and spreads on EUR/USD start from just 0.3 pips.

In most cases, major forex pairs can be traded at 0% commission. The minimum deposit to get started with Libertex is just $10. The platform accepts a wide variety of payment methods – such as e-wallets, debit/credit cards, and bank transfers.

Payments can be made via the Libertex app or website. In addition to forex, we like that Libertex offers CFDs via indices, commodities, and cryptocurrencies. There is also the option to invest in real shares. Those that prefer to trade on their desktop device will appreciate that Libertex supports MT4 and MT5.

Libertex is also the best trading app in South Africa for those that wish to trade in a risk-free manner. This is because all new account holders will have access to a $50k demo trading facility. Not only will this suit newbies, but experienced pros that wish to test new trading strategies.

What We Like

- Best trading app in South Africa

- Top MT4 forex broker

- Advanced trading and analysis tools

- Great selection of forex markets

- 0% commission on major pairs

Your capital is at risk. 70.8% of retail investor accounts lose money when trading CFDs with this provider.

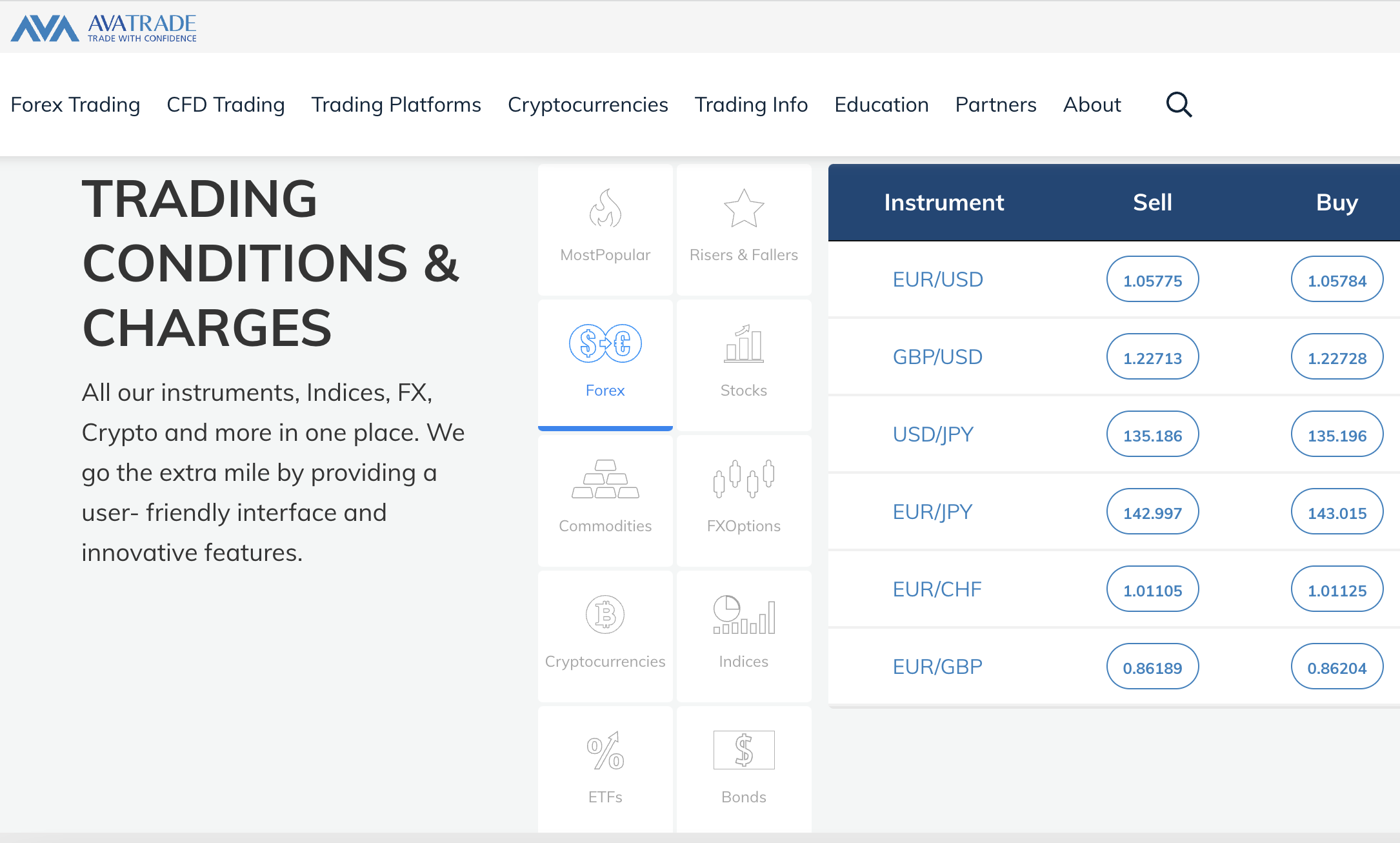

4. AvaTrade – FSCA Regulated Forex Broker That Supports MT4 and MT5

AvaTrade is a heavily regulated CFD broker that is licensed by no less than eight financial bodies. This is inclusive of South Africa’s primary regulator – the FSCA. The platform offers 55 currency pairs across the majors, minors, and exotics.

There are no commissions payable when trading forex on AvaTrade. Spreads are competitive too, with EUR/USD starting at just 0.9 pips. Other supported markets on the AvaTrade platform include stocks, indices, cryptocurrencies, and commodities – all of which are represented by CFDs.

AvaTrade is also perhaps the best broker for forex trading in South Africa for advanced strategies. Through the broker’s primary web trading platform – users can access drawing tools, indicators, advanced order types, and more. There is also compatibility with MT4 and MT5.

Just like Libertex, AvaTrade is also a strong contender for the best trading app in South Africa. AvaTradeGO – which is available as an iOS and Android app, allows users to buy and sell currency pairs at the click of a button. While it is very user-friendly, the app still comes packed with advanced tools and features.

What We Like

- One of the best FSCA regulated forex brokers

- Compatible with DupliTrade

- Leverage offered on all markets

- Top MT5 forex broker

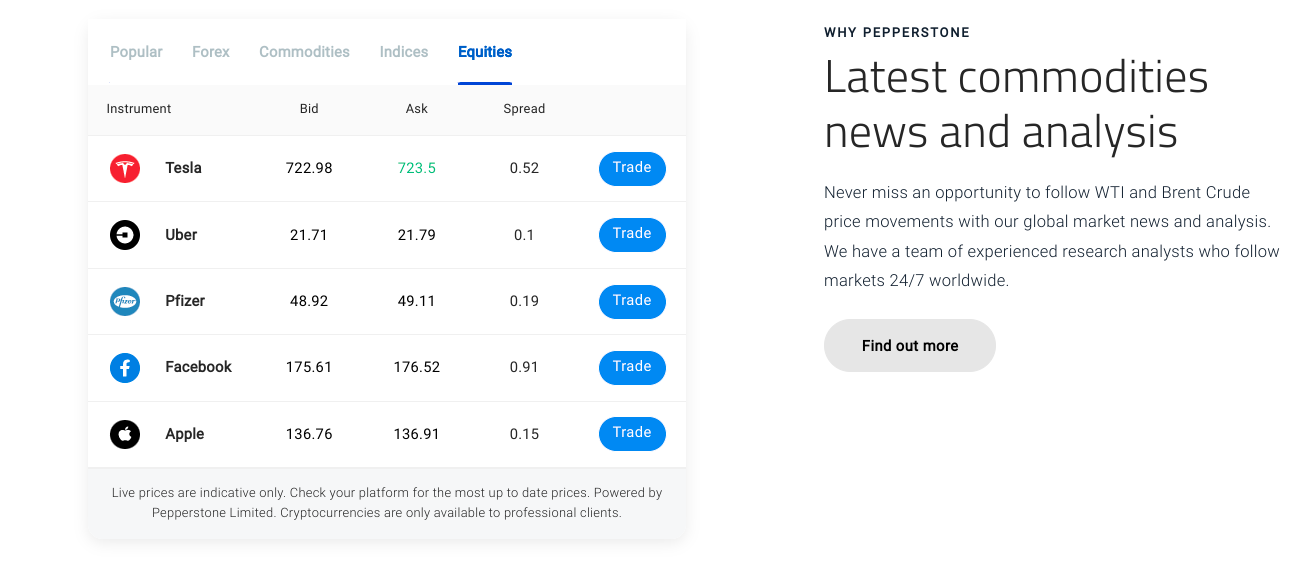

5. Pepperstone – Best Forex Broker in South Africa for Raw Spread Accounts

![]() Pepperstone is one of the best forex brokers in South Africa for seasoned traders who typically open positions with a larger amount of capital. The platform offers raw spread accounts, which are not too dissimilar to ECN plans.

Pepperstone is one of the best forex brokers in South Africa for seasoned traders who typically open positions with a larger amount of capital. The platform offers raw spread accounts, which are not too dissimilar to ECN plans.

The reason for this is that the raw spread accounts offer direct access to other market participants, which includes tier-one investment houses. And therefore, Pepperstone is able to offer spreads that start from 0 pips when trading major pairs. This will attract a commission of just $3.50 per $1 million traded.

Pepperstone also offers a trading account for less experienced investors. The standard account offers zero commission trading alongside a variable spread that starts at just 0.6 pips. Both accounts have access to advanced trading tools and features via MT4 and MT5.

Customer service is also highly rated at Pepperstone, which is accessible on a 24/7 basis. Pepperstone also offers the opportunity to diversify into other CFD markets, with the platform supporting stocks, indices, commodities, and more. To open an account with Pepperstone, users can make a deposit via a debit/credit card or bank wire.

What We Like

- Raw spreads from 0 pips on major pairs

- Supports some of the best forex trading platforms – including MT4/MT5

- 0% commission accounts are also availabl

6. Forex.com – Established Forex Broker With Competitive Fees

As the name implies, Forex.com is a specialist currency brokerage firm. It offers access to over 80 currency pairs, which includes a broad selection of exotics. Forex.com was first launched in 2001, which makes it one of the most established brokers in this space.

Forex.com is perhaps the best forex broker in South Africa for education. The platform offers a huge selection of beginner guides and explainers on all things forex. We also like that the platform requires a minimum first-time deposit of just $100 and that demo trading accounts are supported.

The standard account at Forex.com offers spreads of 0.5 pips when trading EUR/USD. This account does not attract any commissions. Other accounts are offered for more experienced traders – including access to the STP markets. All currency pairs at Forex.com can be traded with leverage.

Forex.com also offers a trading app for iOS and Android. This comes packed with features – including the ability to create custom watchlists and access real-time market prices. In addition to currencies, Forex.com also supports crypto, shares, indices, and commodities.

What We Like

- Supports more than 80 currency pairs

- One of the cheapest forex brokers in South Africa

- Great educational academy for beginners

7. XM – Multiple Forex Trading Accounts and Minimum Deposit Just $5

XM is an online forex broker that aims to appeal to traders of all experience levels and budgets. There are multiple account types to choose from – each of which requires a minimum first-time deposit of just $5. Furthermore, the minimum lot size on this platform amounts to just 0.01.

Both the standard and swap-free accounts at XM are commission-free and attract a minimum spread of 1 pip. The ultra-low account – which is also commission-free, is more competitive with a minimum spread of 0.6 pips. XM offers its own proprietary mobile app for iOS and Android, across both smartphones and tablets.

Those wishing to trade online or via desktop software can connect their XM account to MT4 or MT5. In total, XM offers 55 currency pairs, alongside other CFD assets such as stocks, indices, and commodities. We found that XM is also one of the top forex brokers in South Africa for leverage, with limits of up to 1:1000 on offer.

This means that a $500 position on a major pair like GBP/USD would allow the user to access trading capital of up to $500,000. We should also note that XM offers the ability to invest in real shares from the US, UK, and Germany at a commission of $1, $9, and $5 respectively.

What We Like

- Trade more than 55+ forex pairs at 0% commission

- Spreads start from just 0.6 pips

- 16 trading platforms across PCs, smartphones, and tablets

- Many forex indicators via MT4

8. HotForex – High Leverage Forex Broker Located Offshore

Another high-leverage forex broker to consider today is HotForex. Just like XM, this top-rated platform offers leverage of up to 1:1000 on major currency pairs, and less on other markets. There are several account types to choose from here, albeit, the micro plan is perhaps more suited to newbies.

This requires a minimum first-time deposit of $5 and attracts a spread of 1 pip on EUR/USD. On the other hand, there is also a raw account that offers zero spreads on most major pairs. Those that are new to currency trading might consider opening a demo account with HotForex.

This offers risk-free trading and subsequently the ability to test the platform out before making a financial commitment. In total, there are over 1,200 financial instruments supported by HotForex, which includes 50 forex pairs. Traders also have access to CFDs in the form of commodities, stocks, cryptocurrencies, and more.

When it comes to trading platforms, both MT4 and MT5 are supported. Users will also have access to a range of trading tools, such as an economic calendar, advanced market insights, and position calculators. Finally, HotForex supports a wide range of convenient payment methods – including debit/credit cards issued by Visa and MasterCard, as well as e-wallets like Skrill.

What We Like

- Leverage limits of up to 1:1000

- Account minimums start from just $5

- One of the best forex brokers with low spreads

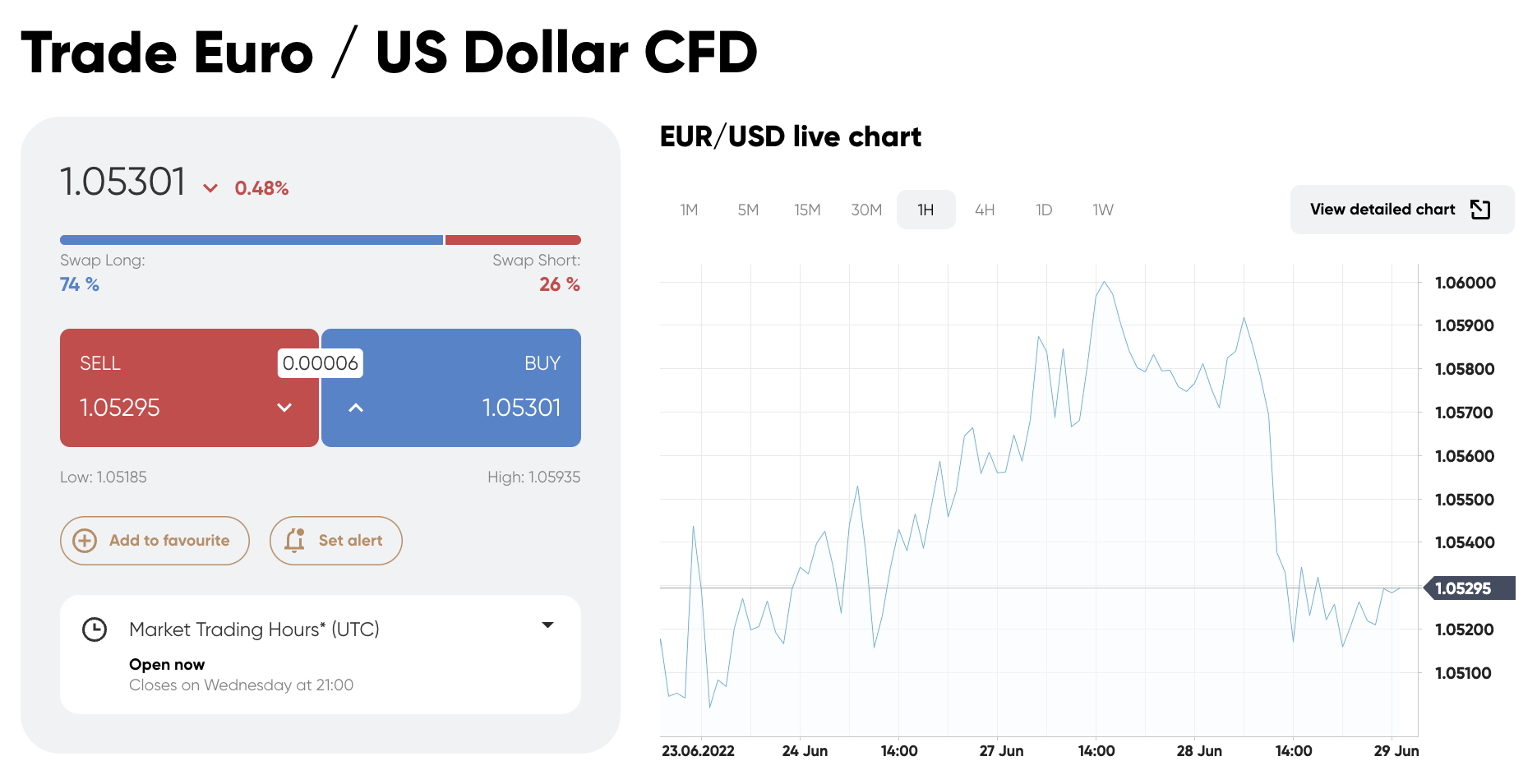

9. IG Markets – Trusted Forex Broker With 80+ Pairs

The next platform to consider from our list of the best forex brokers in South Africa is IG Markets. This brokerage has been operational since the 1970s and it has a strong regulatory standing. Users will have access to more than 80 forex pairs here, which includes lots of emerging currencies.

DMA accounts at IG Markets offer a minimum spread of 0.6 pips on EUR/USD, alongside a commission of just $10 for every $1 million worth of forex traded. Minor pairs, such as EUR/GBP and EUR/JPY, come with a minimum spread of 0.9 pips and 1.5 pips respectively.

IG Markets offers high leverage limits to retail investors. For example, when trading major pairs, leverage of up to 1:200 is on offer. This turns a $100 position into trading capital of $20,000. Those wishing to trade on the move can download the free IG Markets app for their iOS or Android device.

Online traders can access the primary IG platform via a web browser. Alternatively, third-party platforms like ProRealTime and MT4 are supported, which will appeal to more advanced traders. The minimum deposit to open an account at IG Markets is $250 and debit/credit cards are supported. However, there is a fee of 1% and 0.5% on Visa and MasterCard respectively.

What We Like

- Best South Africa forex trading platform for trust

- Competitive commissions

- Great mobile app with full functionality

10. Interactive Brokers – Access to Interbank Currency Quotes

![]()

Interactive Brokers is a household name in the global investment scene. The platform offers a highly comprehensive forex trading platform that comes with support for more than 100 pairs. Perhaps, most importantly, this provider is the best forex broker in South Africa for large-scale investors.

The reason for this is that Interactive Brokers is a true ECN provider. This means that users will have access to interbank currency rates, which, in turn, offer competitive spreads across the board. In many cases, this will amount to a spread of just 1/10 of a pip. Trading commissions amount to between 0.08 and 0.2 basis percentage points (bps), depending on the 30-day volume.

Another reason to choose Interactive Brokers is that the platform offers deep levels of liquidity. We also like that the Interactive Brokers platform is highly advanced. This offers a wide selection of sophisticated tools that will give users the best chance possible of predicting the future direction of the forex markets.

For example, there are technical and economic indicators, customizable charts, drawing tools, screeners, real-time pricing feeds, and more. Interactive Brokers also offers custom order types that ensure traders can enter and exit a position in a bespoke manner. Finally, there is no minimum deposit requirement at Interactive Brokers.

What We Like

- South African traders can access deep liquidity levels

- Spreads start from just 1/10th of a pip

- Access to the interbank wholesale market

Top South African Forex Trading Brokers Compared

The best forex brokers in South Africa as per our comprehensive research are summarized in the comparison table below.

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

The figures provided in the table above are correct as of writing. Readers are advised to verify core brokerage data before creating an account.

How we Select the Best South African Forex Brokers

The criteria that we utilize to compare and rank the best forex brokers in South Africa are discussed in the section below.

This will help readers perform their own research and thus – choose a suitable currency trading provider.

Regulation and Safety

The number one priority that we look for when reviewing the best forex brokers in South Africa is the regulatory standing of the provider.

Some forex brokers are regulated by the FSCA – which oversees the South African financial services industry. With that said, international brokers will often hold licenses from other bodies.

For example, Capital.com – which is one of the best regulated forex brokers in South Africa, is licensed by financial authorities in the UK, US, Belarus, and Cyprus.

eToro is also heavily regulated, which is why the broker is now used by more than 25 million people.

Range of FX Pairs

Each and every forex broker that we discussed today offer a full suite of major and minor pairs. Most platforms offer a good selection of exotics too, albeit, the number of markets will differ from one broker to the next.

Capital.com stands out in this department, as the platform offers almost 140 pairs. This will give traders the opportunity to diversify into more volatile markets and economies.

Fees

When it comes to fees, this is a very important metric that we consider when reviewing the best forex brokers in South Africa.

This includes the following:

Trading Commissions

The two most important trading fees to consider are commissions and spreads. Many of the platforms discussed today – such as Capital.com and eToro, allow users to trade forex without paying a commission.

On the other hand, platforms like Interactive Brokers charge between 0.08 and 0.2 bps per slide. Other forex brokers will charge a percentage commission.

For instance, if the platform charges 0.10% per slide and the trader enters a position worth $1,000 – then the commission will amount to $1.

Commissions will often vary depending on the specific account type that the user decides to open – so this is an important metric to check.

Spreads

The spread refers to the difference between the buy and sell price of a forex pair and this is a key way that trading platforms make a profit regardless of whether the markets are bullish or bearish.

At Capital.com, spreads start at 0.6 pips on major pairs, which is in addition to its commission-free offering. Some of the best forex brokers in South Africa discussed today offer zero-spread accounts.

This means that users will get interbank wholesale prices when trading, albeit, commissions will apply. For instance, for every $1 million traded, Pepperstone requires a commission of $3.50.

Leverage Fees

The vast majority of forex brokers offer access to the currency markets via contracts-for-differences (CFDs). These are leveraged financial products which means that traders will need to pay interest for each day that the position remains open.

The best forex brokers in South Africa offer competitive overnight financing fees. We particularly like eToro in this context, as the platform displays the overnight fee in terms of dollars and cents.

Funding

Capital.com and many other top-rated forex brokers allow South African residents to deposit and withdraw funds fee-free. However, we also came across platforms like IG, which charges 0.5% and 1% respectively on Visa and MasterCard deposits.

Trading Tools

The best forex brokers in South Africa offer a variety of tools that allow traders to make informed investment decisions.

Capital.com, for instance, offers customizable charts, economic indicators, and real-time pricing feeds.

eToro is also notable here, as the platform offers a Copy Trading service, which enables users to ‘copy’ the positions of an experienced forex trader.

In other words, it is possible to actively trade currencies on the eToro platform without needing to do any market research or manually place orders.

Minimum Deposit

The minimum deposit required at an online forex broker will determine whether or not the platform is budget-friendly. Those depositing funds with a debit/credit card or e-wallet will only need to meet a $20 minimum at Capital.com.

At eToro, the minimum stands at just $50. IG Markets requires much more at $250 – which might be unaffordable for some. Beginners should never deposit more than they can afford to lose.

Demo Account

The best forex brokers in South Africa will offer a demo account to new users. This should mirror live market conditions and come with a suitable amount of paper funds.

Beginners, in particular, should consider using a demo account before making a real money deposit. This will provide the opportunity to get to grips with ever-changing forex prices, as well as trading and analysis tools.

Mobile App

Seasoned traders will often combine an online trading platform with an app. This ensures that the individual is never more than a click away from accessing the forex markets.

Both Capital.com and eToro offer user-friendly trading apps that have been optimized for iOS and Android devices. This is inclusive of both smartphones and tablets.

Customer Service

Finally, the best forex brokers in South Africa that we came across offer real-time customer support via a live chat facility.

This offers the most convenient way to speak with a customer representative, rather than having to wait for an email reply.

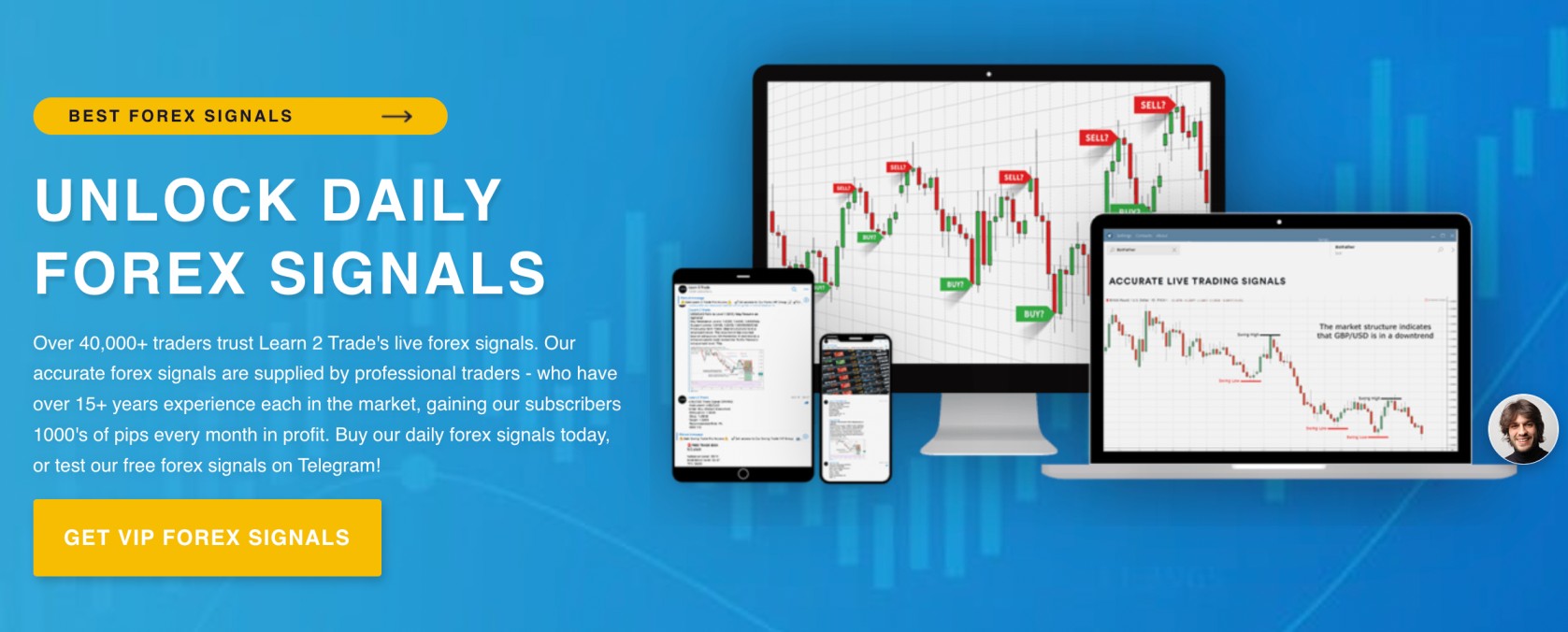

Best Forex Signals in South Africa

Forex signals are worth considering should the trader not possess any prior forex experience. This will see the user sign up with a forex signal provider and pay a monthly membership fee.

In turn, the user will receive regular trading suggestions from the provider, based on technical analysis. For example, the signal might tell the trader to place a sell order on USD/ZAR at an entry price of 16.0768.

The signal might also suggest entering a take-profit order at 15.0877 and a stop-loss at 16.1661. Either way, the best forex signals in this space will provide all of the required data for the member to trade semi-passively.

In terms of notable providers, we found that Learn2Trade stands out in this marketplace. The platform has been operational for over 15 years and it claims a win rate of 76%.

Those signing up for a Learn2Trade premium plan will get up to three forex signals per day – delivered in real-time via the Telegram group. There is a 30-day moneyback guarantee on offer, which will allow new members to try Learn2Trade out.

Your capital is at risk.

How to Start Forex Trading in South Africa

Those trading forex for the very first time can follow the step-by-step walkthrough below to get started with Capital.com right now.

This top-rated provider offers access to nearly 140 pairs at 0% commission and tight spreads, alongside fee-free deposits and withdrawals.

Step 1: Open a Capital.com Forex Broker Account

The first step is to visit the Capital.com website and open an account. Enter an email address and chosen password, before clicking on ‘Continue’.

As is the case with all regulated forex brokers, Capital.com will now need to collect some basic personal information.

Step 2: Upload ID

The next step is to complete the KYC (Know Your Customer) process. This requires a copy of a government-issued ID (such as a passport or driver’s license) so that Capital.com complies with anti-money laundering regulations.

In most cases, the document will be validated in less than five minutes – leaving the trader with a fully verified account.

Step 3: Deposit Funds

To deposit funds into the Capital.com account, the user can opt for a debit/credit card or e-wallet. These payment types require a minimum deposit of only $20.

Bank wires are supported too but do note that this payment type increases the minimum to $250. All payment types at Capital.com can be utilized fee-free.

Step 4: Search for Forex Pair

Once the user has a funded Capital.com account, the next step is to utilize the search bar at the top of the page. This will allow the user to find the forex pair that they wish to trade.

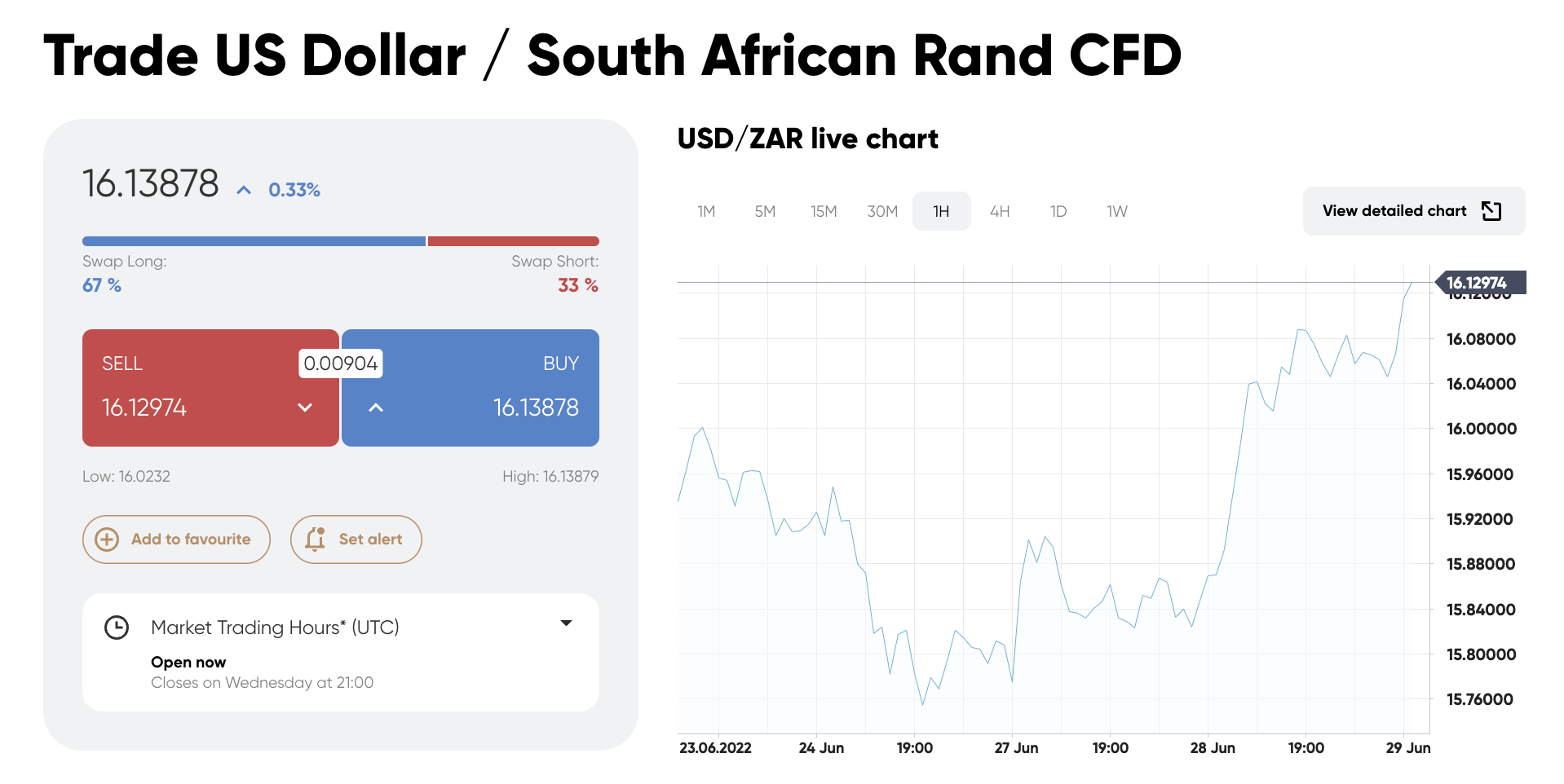

In the image above, we are searching for USD/ZAR.

Step 5: Trade Forex

The trader will now need to determine whether they wish to go long (buy) or short (sell) on the chosen forex pair.

Enter a stake and set up a limit order – which specifies the price that the trade should be executed. Or, to enter the trade instantly at the next best available price, opt for a market order.

Users can also set up stop-loss and take-profit orders for risk management purposes.

Conclusion

Deciding on which forex broker is the best in South Africa can be a cumbersome process, not least because dozens of platforms are active in this market. Nonetheless, overall, we prefer Capital.com.

This platform requires a minimum first-time deposit of just $20 and no commissions are charged when trading forex. In addition to nearly 140 currency pairs, Capital.com users have access to stocks, commodities, cryptocurrencies, and more.

Spreads are tight at Capital.com too, and the provider offers both an online trading platform and an app for iOS and Android.

#forextrader #trading #forextrading #money #forexsignals #cryptocurrency #trader #investment #crypto #forexlifestyle #investing #business #entrepreneur #invest #binaryoptions #blockchain #forexmarket #forexlife #stocks #success #daytrader #btc #bitcoinmining #investor #stockmarket #binary #fx #finance