In order to buy digital assets like Bitcoin or Cardano, you will need to have an account with a trusted crypto exchange. With the crypto markets showing signs of recovery – back over $1 trillion USD ($1.3 trillion CAD) – investors are increasingly moving back into ‘risk on’ assets.

Your chosen exchange should support a wide range of markets, tools, and payment methods – and offer competitive trading fees. In this guide, we compare the 8 best crypto exchanges in Canada this year with in-depth reviews.

The Best Canadian Crypto Exchanges for 2022

Before we get to our comprehensive platform reviews, check out the below list of the best crypto exchanges in Canada:

- Crypto.com – Overall Best Crypto Exchange Canada traders are accepted at

- Bitbuy – Popular Canadian-Based Exchange

- Binance – Lowest Fee Crypto Exchange for Trading

- Coinbase – One of the Best Bitcoin Exchanges in Canada for Beginners

- Kraken – Top Cryptocurrency Exchange in Canada for Margin Trading

- CoinSmart – Most User-friendly Crypto Exchange

- Gemini – Full-featured Exchange with 75+ Cryptos

- Wealthsimple – Canadian Regulated Crypto Exchange

As you can see from the above list, each crypto exchange in Canada will appeal to a specific type of investor. And as such, it’s important to read through our exchange reviews before choosing a provider.

The Top 8 Crypto Trading Platforms Canada Reviewed

For those looking to buy cryptocurrency in Canada, picking a top-rated and trusted exchange is an important first step.

In selecting the best crypto exchanges in Canada for our top 8 list, we looked at everything from safety and trust, fees, and supported payment methods to mobile compatibility, customer service, and the end-to-end trading experience.

The results of our in-depth research process can be found in the reviews outlined below.

1. Crypto.com –Overall Best Crypto Exchange Canada for 2022

If you’re thinking of buying a few different digital currencies with the view of diversifying your risk, Crypto.com is the best crypto exchange in Canada for this purpose.

At this platform, you can buy crypto across 250+ markets, trade either spot markets or margin trade with leverage, and you’ll also have access to one of the best crypto wallets in Canada.

For example, in terms of large caps, you’ll be able to invest in Bitcoin, Ethereum, Cardano, Litecoin, Shiba Inu, Dogecoin, and more. If you’re also looking at DeFi coins, Crypto.com covers everything from Decentraland Compound, and Stratis to Maker, VeChain, and Polygon.

We also like that Crypto.com supports a wide range of stablecoins, which can come in handy when it appears that the broader markets are about to turn south. When it comes to trading fees, this will depend on a number of factors – such as if you are a market maker or taker and whether you hold any CRO tokens, which is the digital currency backed by Crypto.com.

With that said, the most you will pay to buy Bitcoin and another supported digital asset for that matter is just 0.4%. Although this is slightly more expensive than the previously discussed BitBuy, this still only works out at $0.20 for every $50 traded. Deposit fees will vary depending on your chosen payment method, albeit, bank transfers are the cheapest option.

Debit and credit cards are supported too and are charged at 2.99% per transaction. We should note that the exchange is just one segment of the wider Crypto.com ecosystem. For example, the platform offers crypto interest accounts which, as the name implies, allows you to generate a yield on your digital currency investments.

The highest APY on offer is 14.5%, albeit the specific rate offered to you will depend on the crypto asset, lock-up term, and whether you are happy to stake CRO tokens. Another popular feature offered by Crypto.com is its trading app – which is compatible with both Android and iOS devices.

| Number of Cryptos | 250 |

| Fee Structure | Maker/taker commission model |

| Fee to Buy Bitcoin | Maximum of 0.4% per slide |

| Minimum Deposit | $20 |

Pros

- Over 250+ crypto coins supported

- Accepts debit/credit cards and bank transfers

- Great reputation

- Offers crypto interest accounts and lending services

- Competitive fees

Cons

- Visa and MasterCard deposit cost 2.99%

- More suited to beginners

2. BitBuy – Popular Canada-Based Crypto Exchange

BitBuy stands out as one of the best Canadian crypto exchanges for several reasons. When choosing this crypto broker, you will be trading via a platform that has been approved by the Ontario Securities Commission and is registered with FINTRAC. This ensures that you can buy and sell crypto online in a safe way.

In addition to offering a secure customer experience, BitBuy stands out when it comes to user-friendliness. This is because you can instantly buy crypto such as Dogecoin in Canada via an Interac e-Transfer. And, when using this payment method, you only need to meet a minimum deposit of $50. This will appeal to first-time investors that wish to start off with small stakes.

Although conventional bank wires are also supported by BitBuy, this requires a deposit of at least $20,000. In terms of fees, Interac e-Transfer deposits cost just 1.5% – so a $50 transaction would yield a small charge of $0.75. This 1.5% fee will also kick in when you eventually cash out your BitBuy balance.

Trading fees, on the other hand, are significantly lower. For instance, on each buy and sell order that you place, you will pay a commission of just 0.20%. As such, that’s a fee of just $0.10 for every $50 traded. Although BitBuy is perfect for inexperienced traders, this crypto exchange also caters to seasoned investors through its Pro Trade platform.

This gives you access to charts provided by TradingView, so you can perform in-depth technical analysis with ease. When it comes to supported markets, BitBuy is home to 15 leading digital currencies as of writing. Additional tokens will, however, be added in the very near future. Moreover, Bitbuy also offers one of the best crypto apps in Canada, so you can buy and sell cryptos anytime and anywhere.

In its current form, markets include Bitcoin, Ethereum, Litecoin, EOS, AAVE, Polkadot, Chainlink, SushiSwap, and more. Another key reason why we found that BitBuy is the overall best crypto exchange in Canada is that it offers superb customer support. This ensures that at any given time – 24/7, you can receive assistance when needed.

| Number of Cryptos | 15 |

| Fee Structure | Fixed commission structure |

| Fee to Buy Bitcoin | 0.2% per slide |

| Minimum Deposit | $50 |

Pros

- Approved by the Ontario Securities Commission

- Registered with FINTRAC

- Low deposit and trading fees

- Supports Interac e-Transfer payments from just $50

- 24/7 customer service

Cons

- Just 15 digital currencies supported

- Bank wire payments require a minimum of $20,000

3. Binance – Lowest Fee Crypto Exchange for Trading

Binance stands out as one of the top crypto exchanges in Canada for low trading fees. Just like Crypto.com, this popular exchange offers a maker/taker model which promotes lower commissions when trading volumes increase or you hold the platform’s native token – BNB.

Binance stands out as one of the top crypto exchanges in Canada for low trading fees. Just like Crypto.com, this popular exchange offers a maker/taker model which promotes lower commissions when trading volumes increase or you hold the platform’s native token – BNB.

With that said, the most you will ever pay to buy and sell crypto at Binance is 0.10% per slide. And as such, that’s a fee of just $0.05 for every $50 traded. To get funds into your Binance account so that you can start trading crypto, you can use a debit/credit card, bank account transfer, or a direct digital asset deposit.

Fees will vary depending on your chosen payment method. With that said, if you wish to deposit Canadian dollars, you will first need to upload some ID as part of a KYC procedure. Nevertheless, Binance is typically suited to those that wish to actively trade crypto across a wide number of projects.

This is because you will have access to hundreds of crypto assets across more than 1,000 markets. And, if you wish to access more complex trading products – such as leveraged tokens or futures, Binance also has you covered. Binance also offers all of the tools that you need to try and predict the future direction of the market.

For example, you can access technical indicators, chart drawing tools, and real-time data provided by TradingView. In terms of safety, Binance is home to a good number of internal security features – such as two-factor authentication and a Safe Asset Fund for Users (SAFU), which is essentially a reserve pot set up to cover successful hacking attempts.

However, it must be noted that Binance is not licensed by any Canadian authorities – or any regulatory bodies for that matter. And as such, you do need to consider the risks of using an unregulated crypto exchange before opening a Binance account. Finally, Binance also offers crypto savings accounts across a huge selection of supported tokens.

| Number of Cryptos | 1,000+ markets |

| Fee Structure | Maker/taker commission model |

| Fee to Buy Bitcoin | Maximum of 0.1% per slide |

| Minimum Deposit | Depends on payment method |

Pros

- Hundreds of coins across 1,000+ markets

- Low commissions of just 0.10% per slide

- Supports fiat money deposits and withdrawals

- Great tools for advanced traders

- One of the largest crypto exchanges for liquidity

Cons

- Not regulated by any licensing body

- Has previously been hacked

4. Coinbase – One of the Best Bitcoin Exchanges in Canada for Beginners

Although Coinbase is somewhat lacking in tools and features – and charges some of the highest fees in this industry, the platform is still regarded as the best Bitcoin exchange in Canada for beginners. Crucially, even if you have never bought or sold crypto previously, you should find Coinbase easy to use.

To get the ball rolling, you can visit Coinbase and open an account in less than five minutes – which includes the process of uploading a copy of your government-issued ID. Then, you can buy cryptocurrency instantly with your regular debit or credit card. You will, however, pay a rather hefty fee of 3.99%.

The most cost-economical option is to execute a local bank transfer over to Coinbase, which will allocate the aforementioned transaction fee. When the funds are credited to your Coinbase account – which can take 1-3 working days, you will then pay a standard commission of 1.49% per slide to buy and sell crypto.

To counter its high fee policy, Coinbase goes above and beyond when it comes to account safety. First and foremost, Coinbase is not only regulated in the US to offer crypto exchange services to both retail and institutional clients but the firm is listed on the NASDAQ as a public stock. And, this means that you can be sure you are dealing with a legitimate exchange company.

Moreover, in terms of internal security controls, 98% of all client digital funds are held offline in cold storage. When you log into your Coinbase account, you will need to go through a two-factor authentication process – which is also informed when withdrawal requests are made. IP address and device whitelisting are another two security controls that Coinbase has in place.

While Coinbase does lack when it comes to trading tools and features, you can easily diversify here. This is because Coinbase supports over 100 different crypto assets – most of which are large-cap projects. Coinbase also offers crypto staking services, but there are only six coins supported and much better yields are available elsewhere.

| Number of Cryptos | 50+ markets |

| Fee Structure | Fixed commission model |

| Fee to Buy Bitcoin | 3.99% with debit/credit card, 1.49% standard |

| Minimum Deposit | $50 is recommended |

Pros

- Regluated in the US and listed on the NASDAQ

- Supports 50+ coins

- Accepts debit/credit cards and bank transfers

- Great security features

- Perfect for beginners

Cons

- High payment and commission fees

- Limited trading tools and features

5. Kraken – Top Cryptocurrency Exchange in Canada for Margin Trading

Although Kraken originally started off as a crypto exchange targeted at European investors, the platform has since begun offering services to clients in the US and Canada. Founded in 2011 and launched in 2013, Kraken is without a doubt one of the most established crypto exchanges in this marketplace.

As such, you can be sure that you are using a credible crypto exchange with a long-standing track record. In terms of stand-out features, many Canadian investors will open a Kraken account with the view of accessing leveraged crypto products. For instance, Kraken offers margin accounts with leverage of up to 1:5 on spot trading markets.

This means that a $50 stake on Bitcoin would be amplified to $250. Moreover, if you have an understanding of how futures work and wish to access crypto derivatives in this manner, the exchange offers leveraged markets at up to 1:50. This subsequently turns your $50 stake into an open position of $2,500.

Even if you have no interest in leveraged crypto products, Kraken is still worth considering if you’re looking to actively trade digital currencies. This is because the most you will pay in commission when buying and selling crypto at Kraken is 0.26% per slide. Although cheaper options are available elsewhere – such as BitBuy and Binance, this is still competitive.

And, just like many other exchanges that we have reviewed today, a maker/taker model is in place. This means that by trading larger volumes, you can reduce your commission rate. When it comes to asset diversity, Kraken supports over 65+ digital currencies. The minimum deposit required to get started is just $10, which will appeal to budget-focused investors.

Kraken is also popular from an education standpoint, as the exchange offers lots in the way of learning materials. We also like Kraken for its global customer support, which operates 24 hours per day, 7 days per week, 365 days per year. Finally, in terms of account safety, Kraken claims to keep 95% of all client crypto deposits offline in air-gapped cold storage.

| Number of Cryptos | 65+ |

| Debit Card Fee | Not available in the UAE |

| Fee to Buy Bitcoin | Up to 0.26% per slide |

| Minimum Deposit | No minimum stated |

Pros

- Offers margin of 1:5 on spot markets

- Leverage of 50x on futures trading

- First founded in 2011

- 65+ coins supported

- Suitable for both beginners and experienced investors

Cons

- Leveraged products are high risk

- Does not offer a native wallet

6. CoinSmart – Most User-friendly Crypto Exchange

CoinSmart is a Candian crypto exchange that offers trading on 16 of the most popular cryptocurrencies. While the selection isn’t enormous, you’ll find coins like Bitcoin, Ethereum, Shiba Inu, Polygon, Avalanche, and more. You can even trade stablecoins like USD Coin.

CoinSmart stands out because it makes trading cryptocurrencies as simple as possible. You can create a new account in minutes and make a deposit by credit or debit card, Interac e-transfer, SEPA, or bank transfer. You can also fund your account with any crypto wallet. All deposits are available for trading the same day, so there’s no wait to start buying crypto.

Fees at CoinSmart vary based on your deposit method. If you buy crypto with a bank transfer, the fee is just 1.5% on purchases up to $1,999 and there’s no fee on purchases over $2,000. Credit and debit card purchases, on the other hand, can carry fees up to 6%. The minimum purchase at CoinSmart is $100.

You can transfer crypto purchased from CoinSmart to any crypto wallet, or leave it in your exchange account for simple safekeeping. The platform has basic tools for tracking your portfolio, but don’t expect advanced visualizations – CoinSmart mainly aims to keep things simple for investors.

| Number of Cryptos | 16 |

| Fee Structure | Fixed commission structure |

| Fee to Buy Bitcoin | 1.5% for purchases under $2,000 |

| Minimum Deposit | $100 |

Pros

- No fee on bank transfers over $2,000

- Same-day deposits

- Very easy to use

- Built-in custodial wallet

Cons

- Only 16 cryptocurrencies available

- Fees up to 6% for debit/credit purchases

7. Gemini – Full-featured Exchange with 75+ Cryptos

Gemini is a comprehensive crypto exchange and crypto management platform that offers trading on more than 75 different coins. It’s a great option if you’re interested in buying altcoins and stablecoins that aren’t available at some of the smaller Canadian exchanges.

Gemini offers both instant buy and spot trading modules to cater to beginner and advanced traders. Spot trading is competitively priced at just 1.5% per trade for trades over $200. Spot trading costs 0.40% when you take liquidity or 0.20% when you make liquidity. Gemini’s ActiveTrader trading platform makes it easy to set up limit and stop orders to help you take advantage of the lower maker fees.

In addition to the exchange features, Gemini has a crypto interest account, a crypto rewards credit card, an integrated wallet, and its own stablecoin. The Gemini interest account offers yields up to 8.5% APY with no lock-in periods, while the rewards credit card can earn you 3% crypto back on your everyday purchases.

The Gemini dollar, GUSD, is an exchange-backed stablecoin that’s worth 1 USD. Gemini makes it easy to send GUSD across borders using the Gemini Pay module that’s built into the exchange.

| Number of Cryptos | 75 |

| Fee Structure | Fixed commission or maker/taker fees |

| Fee to Buy Bitcoin | 1.5% |

| Minimum Deposit | None |

Pros

- Trade 75 different cryptocurrencies

- Competitive instant buy and spot trading fees

- Interest account with up to 8.05% APY

- Crypto rewards credit card available

Cons

- High fees for instant purchases under $200

8. Wealthsimple – Canadian Regulated Crypto Exchange

Wealthsimple is best known as a robo-advisor for stock investing. However, this brokerage recently launched a crypto exchange that now offers more than 40 different cryptocurrencies. Despite being relatively new, Wealthsimple’s exchange has a lot going for it.

What makes this exchange unique is that it’s fully regulated by Canadian financial authorities. Wealthsimple operates as a restricted dealer through the Canadian Securities Administrators’ Regulatory Sandbox. All customer cryptocurrencies are protected by Coincover, an insurance service that works with exchanges to ensure your coins are safe in the event of a hack.

Wealthsimple makes it easy to instantly buy crypto online or through a mobile app for iOS and Android. You can trade as little as $1 at a time and the platform accepts deposits by bank transfer or crypto wallet transfer.

Wealthsimple doesn’t charge fees for deposits, instead using spreads to make money from crypto trading. These spreads are not transparent, but Wealthsimple says that you’ll never pay more than 2% for a trade.

| Number of Cryptos | 43 |

| Fee Structure | Spreads |

| Fee to Buy Bitcoin | Up to 2% |

| Minimum Deposit | $1 |

Pros

- Trade 75 different cryptocurrencies

- Competitive instant buy and spot trading fees

- Interest account with up to 8.05% APY

- Crypto rewards credit card available

Cons

- Spreads are not transparent

Fees at the Cheapest Crypto Exchanges Canada

To ensure you choose the best crypto exchange for your requirements – check out our comparison table below.

| Exchange Platform | Number of Coins | Fee Structure | Fee for Buying Bitcoin | Supported Payments |

| BitBuy | 15 | Fixed commission | 0.20% | Interac e-Transfer, bank wire |

| Crypto.com | 250+ | Maker/taker commission model | Up to 0.40% | Debit/credit card, bank wire |

| Binance | 1000+ | No fees on savings accounts | Up to 0.10% | Debit/credit card, bank wire |

| Coinbase | 50+ | Fixed commission | 1.49% | Debit/credit card, bank wire |

| Kraken | 65+ | Maker/taker commission model | Up to 0.26% | Debit/credit card, bank wire |

| CoinSmart | 16 | Fixed commission | 1.5% | Debit/credit card, Interac e-transfer, bank wire |

| Gemini | 75 | Maker/taker commission model | Up to 0.40% | Debit/credit card, bank wire |

| Wealthsimple | 43 | Spread | Up to 2% | Interac e-transfer, bank wire |

How do Cryptocurrency Exchanges Work?

If you’re new to crypto exchange platforms, then you should know that they work much the same as a traditional stock brokerage site. This is because your chosen crypto exchange will give you access to the digital currency markets.

Just like a stock brokerage, you will first need to open an account with your chosen crypto exchange – which not only requires some basic personal information and contact details but some ID paperwork.

Moreover, you will also need to deposit funds into your crypto exchange account so that you can proceed to buy and sell digital currencies. The best Canadian Bitcoin exchanges support CAD payments via debit/credit cards and Interac e-Transfer.

Once your account is funded, you can then trade crypto assets from the comfort of your home. In many cases, you can also access your crypto exchange account via a mobile app – which allows you to trade on the move.

How to Choose the Best Cryptocurrency Exchange for You

It’s always a good idea to independently research different platforms to ensure you choose the best crypto exchange in Canada for your requirements.

No two platforms are the same in terms of fees, safety, tools, supported markets, and many other important metrics – so ensure you do your homework before proceeding.

In the sections below, we discuss the most important things to look for when deciding on the best crypto exchange for you.

Regulation

Many crypto exchanges allowing Canadians to open an account are actually not regulated in any jurisdiction. And, in choosing such an exchange, you can never be sure that your funds are safe.

As such, when choosing a crypto exchange in Canada, your first port of call should be to check where the platform stands from a regulatory perspective.

BitBuy, for instance, is approved by the Ontario Securities Commission. Binance, on the other hand – although used by over 100 million people, is not regulated in any country that it operates in. It has however established a good reputation among crypto investors.

All the CA facing crypto exchanges we reviewed in this guide were unaffected by the ‘crypto contagion’ and market downturn of mid 2022.

Tradable Cryptos

If you’re looking to buy a top-10 crypto in terms of market capitalization – such as Bitcoin, Ethereum, Cardano, or BNB – then the likelihood is that your chosen digital token will be listed by most exchanges.

However, if you wish to buy a less popular token – such as an up-and-coming DeFi coin, then you will need to check that the digital asset is listed before signing up.

Sign-up Offers

As the crypto exchange space becomes more and more oversaturated, this rise in competition has resulted in a number of platforms offering new customers a signup bonus.

This might come in the shape of a free amount of crypto when you meet a minimum deposit threshold or a rebate on commissions. Either way, be sure to read the terms and conditions of the offer before claiming it.

Fees

When choosing the best crypto exchange in Canada for your requirements, you need to check what fees are charged by the platform. First, consider deposit fees for your chosen payment method.

For instance, Interac e-Transfers at BitBuy cost 1.49% while debit/credit card payments at Coinbase are charged at 3.99%. Next, check the pricing structure on crypto buy and sell orders.

At BitBuy, for instance, you will pay 0.20% per slide, and at Coinbase, 1.49%. The likes of Crypto.com, Binance, and Kraken have a maker/taker model, which offers lower commissions when you trade larger amounts.

Tools & Features

Platforms like Coinbase offer a bare-bones service, which means other than being able to buy and sell crypto, you won’t have access to much in the way of tools and features.

Other platforms, however, offer a much broader crypto ecosystem. For instance, at Crypto.com, you can earn interest on idle digital currency deposits. Over at Binance, you can access highly advanced trading tools alongside leveraged markets.

Payment Methods

Remember that you will need to deposit funds before you can trade digital currencies at your chosen exchange. If you’re looking to deposit Canadian dollars, check out which payment methods are supported.

Debit/credit cards and Interac e-Transfers are the best options for Canadians. Take note, some exchanges only support deposits via crypto.

Customer Service

The best crypto exchanges in Canada are home to a customer support department that operates 24 hours per day, 7 days per week. Some exchanges, however, only offer support during certain hours and days.

You should also check which support methods are available – such as live chat or email. The former is the most convenient, as you can often receive support in real-time.

How to Use a Crypto Exchange

Now that you have all of the information you need to choose the best crypto exchange for your requirements – we can conclude this guide by showing you how to get set up with an account right now.

For this tutorial, we explain the process with top-rated exchange BitBuy, albeit, the process is the same on most platforms nonetheless.

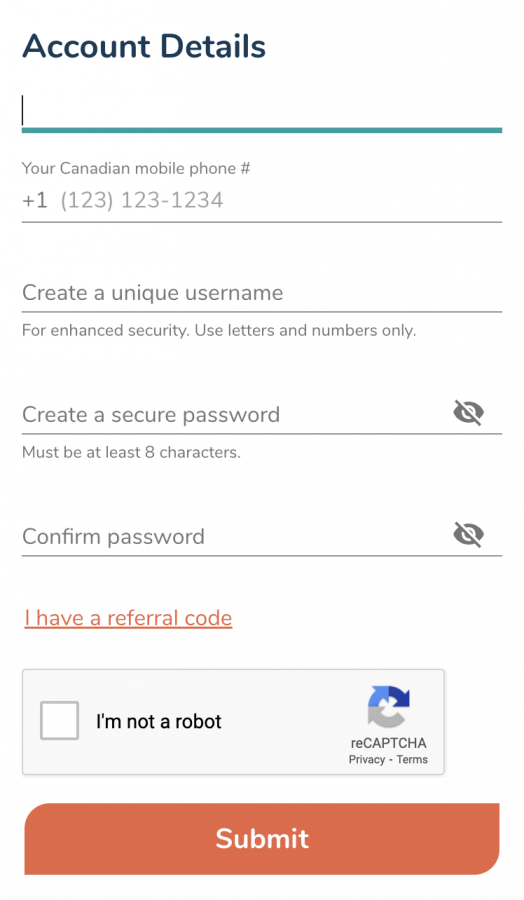

Step 1: Open an Account

Visit the BitBuy website and open a free trading account.

This will require you to enter some personal information surrounding your name, address, and more. You also need to supply your email address.

Step 2: Verification

Before you can trade crypto at BitBuy, you need to go through a KYC process.

This will require several verification documents – such as a copy of your government-issued ID and a recently issued bank statement.

Step 3: Deposit Funds

You can now deposit funds via Interac e-Transfer ($50 minimum) or a bank wire ($20,000 minimum).

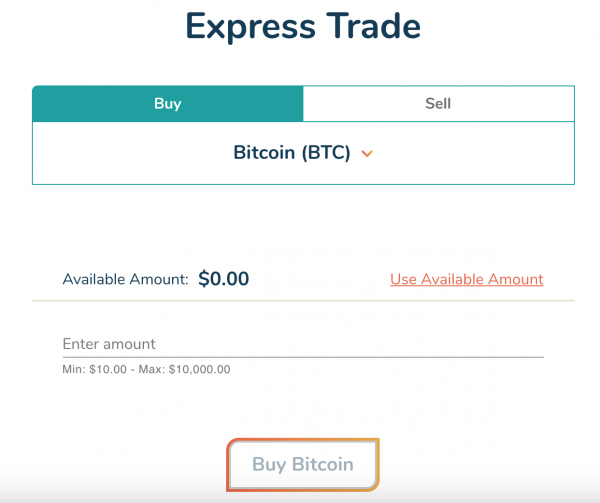

Step 4: Buy Crypto

BitBuy offers 15 crypto assets that you can buy instantly. First, click on the ‘Express Trade’ button and choose the cryptocurrency you wish to buy.

Then, enter the amount of money that you would like to invest into the respective crypto asset. Finally, confirm the order – and BitBuy will add the digital tokens to your wallet.

Conclusion

If you are just starting out in the world of digital currency trading, it’s crucial that you choose the best crypto exchange for your requirements from the very get-go.

A good exchange will not only offer a safe trading environment but low fees and lots of supported markets. Overall, we found that Crypto.com is the best crypto exchange in Canada.

#cryptocurrency #cryptocurrencynews #cryptocurrencytrading #cryptocurrencyexchange #cryptocurrencymining #cryptocurrencymarket #cryptocurrencycommunity #cryptocurrencys #cryptocurrencyinvestments #cryptocurrencyinviestments #cryptocurrencyeducation #cryptocurrencyrevolution #allsortofcryptocurrency #cryptocurrencytop10 #cryptocurrency_news #instacryptocurrency #cryptocurrencymemes #investincryptocurrency #cryptocurrencyinvestment #cryptocurrencyisthefuture #cryptocurrencyinvesting #newcryptocurrency #cryptocurrencylife #cryptocurrencytrade #cryptocurrencylifeinvest #cryptocurrencymillionaire #cryptocurrencytrader #cryptocurrency_updates #tradingcryptocurrency #cryptocurrencysignals #cryptocurrencytradingplatform #cryptocurrencysolution #cryptocurrencytraders #cryptocurrency_for_dummies #cryptocurrencymalaysia #cryptocurrencytakingover #cryptocurrencybali #cryptocurrencyinvestors #cryptocurrencyindex #cryptocurrencyattorney