Being able to sort payroll quickly and efficiently is one of the most important factors for any business. It’s imperative that payroll is properly managed to ensure staff are paid both on time and the correct amount.

It’s a tedious task for most businesses, but there are options to help streamline the process. In this article, we’re going to look at the best payroll software in the UK and determine which product is right for your business.

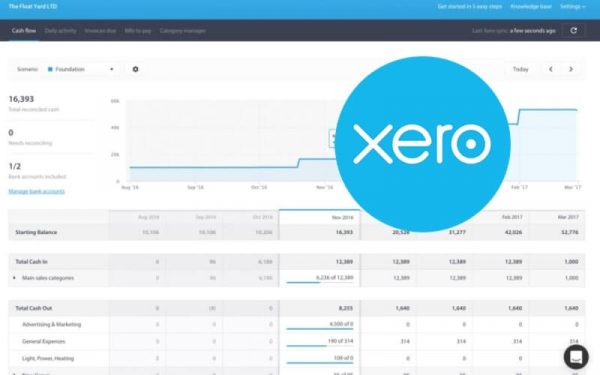

Our Pick for the Best Payroll Software UK for 2022 – Xero

Xero takes the top spot in our pick as the best payroll software for 2022. Here are a few reasons why:

- Cloud-based software means that there is nothing to download and can be accessed by admins or employees from anywhere in the world

- Multiple pay rates allow you to set pay for jobs based on skill, rather than on a per person basis

- The ability to quickly create graphs and analytics lets businesses easily identify which employees get paid the most and allows them to link this to other business software to measure output based on pay

Best Payroll Software UK – Top 16 List

The list below includes the best payroll software in the UK. This is a list that will continue to chop and change, so make sure that you bookmark this page to stay up to date with any changes that we make.

- Xero – Best payroll software UK for 2022

- Sage Business Cloud –Simple 4 step payroll process with UK-based customer support

- Intuit QuickBooks – Best payroll and accounting software for small businesses in the UK

- Rippling – Fastest software to run payroll

- ADP – Best enterprise-scale payroll software in the UK

- Patriot – Most user-friendly payroll software

- Resource Guru – Best for tracking employee hours across projects

- OnPay – Best payroll software for managing benefits

- Remote – Best for remote employees

- Kashflow – Best payroll company software good value

- Iris Payroll Software – One of the oldest payroll management systems in the world

- Free Agent – Great value payroll software tool

- HMRC Payroll Software (HRMC Basic PAYE Tool)– Best for direct links to HMRC

- Moneysoft Payroll Manager –RTI compliant and easy to use

- BrightPay – Allows you to let employees log timesheets

- Oasis – Excellent value for money for smaller businesses

Best Payroll Software UK – Compared

In this section, we review how each of these payroll software work in a little more detail. All the products that we’ve mentioned here are rated as some of the best in the UK for accounting, but they do have different features that you need to be aware of and may suit one business over another.

1. Xero – Best Payroll Software UK

Xero is one of the biggest brands on our list and is well known in the business sector. It takes the top spot as the best payroll software in the UK for several reasons, but it was the platform’s ability to scale with a business that was standout.

It was launched back in 2007 which makes it one of the oldest software that we’ve tested, but it’s Xero’s drive to improve that has made it last as long as it has. Its relatively recent move to cloud-based financing means that it’s now as accessible as ever.

Xero comes with a range of features that includes HMRC submissions, hours tracking, flexible calendars, multiple pay rates, encrypted pay slips and expense refunds.

Pricing

Xero comes with a 30-day free trial, making it the best free payroll software in the UK. Pricing then starts from just $10/month with the starter package allowing for up to 5 employees. It’s then an additional $1/month for each employee you add to the software.

Pros

- Fantastic value for money

- Easily scalable for small businesses as they grow

- Links seamlessly to HMRC

- Multiple pay rates can be added for each employee

Cons

- Steep learning curve

2. Sage Business Cloud – Simple 4 step payroll process with UK-based customer support

Sage Business Cloud also known as Cloud Payroll Software has been online since 2011 and now boasts a massive customer base of over 1,000,000 users. Its ability to link to a range of Sage products make this an easy option for a lot of business, but the Payroll function is worthy of a spot on our list alone.

One of the many highlights that comes within a platform like Sage is the user-friendly nature of the software. It’s extremely easy for businesses to both start from scratch and implements it into existing products, especially if they are already using Sage.

Features that come with Sage Business Cloud include things like RTI ready, payments and deductions, workplace pensions, pay slips, P60 printing and automatic updates.

Pricing

Pricing starts from just $7/month and this includes the use of up to 5 employees. Payment scales are gradually based on the number of employees. For businesses of 50+ employees, you can upgrade to Sage 50cloud Payroll, which unlocks all features.

Pros

- Very easy to use

- Can integrate into a wide range of business management platforms

- Cloud-based with no programs needed to install

- HMRC compliant

Cons

- Software speed can be slow

- Can take up to 7 days to clear prenote

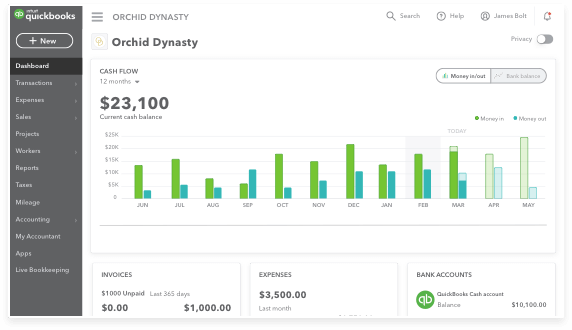

3. Intuit QuickBooks – Best for Businesses in the Construction Industry

QuickBooks acquired PaySuite back in 2014 and from that created Intuit QuickBooks as part of its payroll platform. Since then, the company now boasts over 5 million businesses, making it one of the biggest, most well-used payroll platforms on the market.

The tool has been initially set up to work with businesses in the construction industry and even though we would argue this is where it’s still best used, it can easily be adapted in other business sectors.

QuickBooks comes with a range of features that includes HMRC submissions, automatic pension enrolment, employee self-service, video support, real-time insights, a construction industry scheme and payslip creation.

Pricing

Intuit QuickBooks starts from just $4/month plus $1 for each employee on your system. It’s one of the most affordable payroll software that you can get, but it comes with a catch. You need to be running QuickBooks to use this function as an add-on to use at this price.

Pros

- Great value for money if you’re already using QuickBooks

- Easy to use and get started for new businesses

- Video call support should you need any help down the line (included with price)

- Best for construction industry businesses

Cons

- Lots of steps meaning it can be difficult to troubleshoot

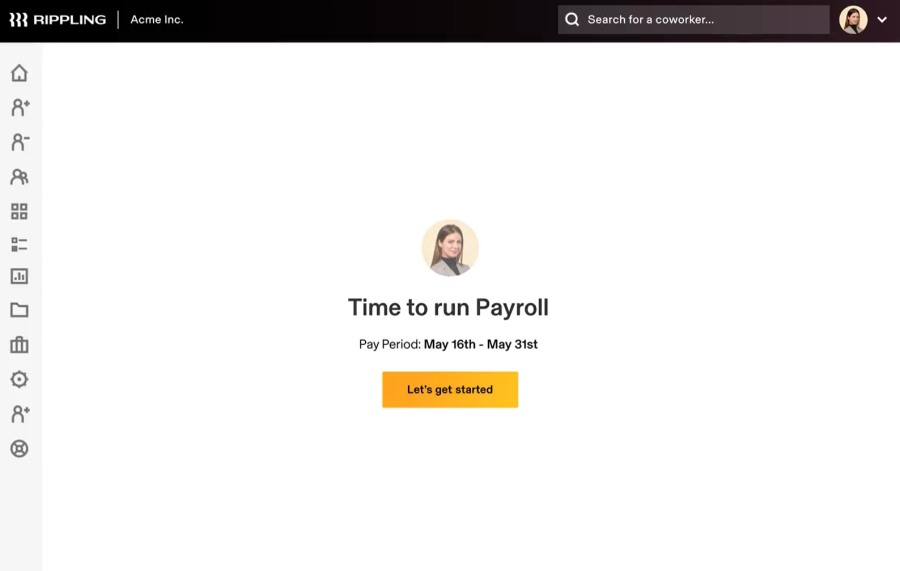

4. Rippling – Fastest Software to Run Payroll

Rippling offers incredibly fast payroll. Business managers can select a pay period, review hours, and initiate payments in less than 90 seconds. Most of the process is automated, ensuring that nothing is ever missed despite the fast pace of this payroll software.

Rippling is also quite flexible. The software can run payroll for both employees and contractors, and there are few limitations on where in the world payments can be sent. Rippling also works for hourly employees and can be used to manage paid time off.

On top of that, Rippling handles compliance and tax filings automatically. The platform offers a reporting dashboard so managers can see where money is flowing, but these reports aren’t as comprehensive as we might hope. The good news is that Rippling integrates with a wide range of business platforms for managers who want even more insight into their time and pay data.

Pricing

Rippling starts from $8 per employee per month, but pricing for individual businesses is offered by quote only. Discounts are available for businesses who use multiple Rippling HR software platforms.

Pros

- Run payroll in less than 90 seconds

- Works for contractors and hourly employees

- Wide range of integrations

- Automatic compliance and tax filings

Cons

- Limited reporting and analysis tools

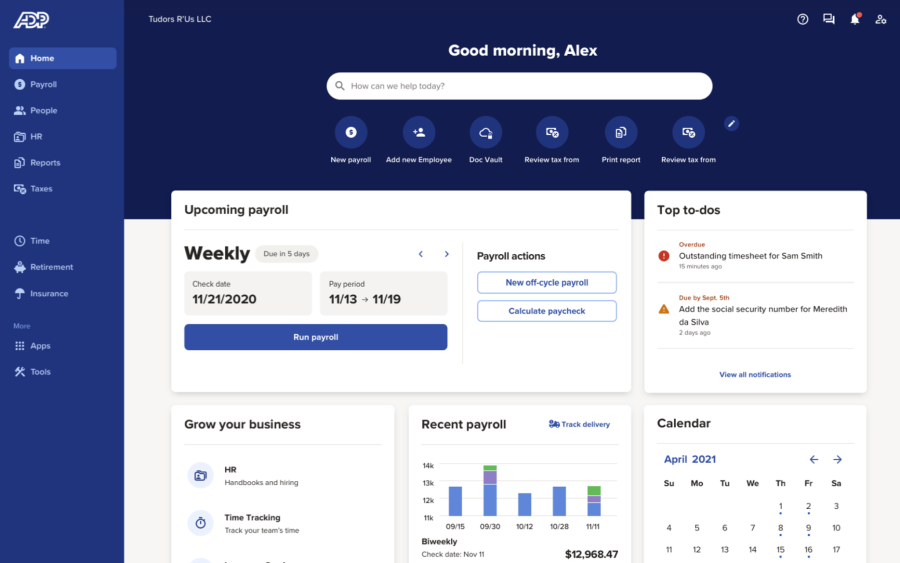

5. ADP – Best Enterprise-scale Payroll Software in the UK

ADP is a full-service payroll solution trusted by nearly 1 million business around the world. Its software is highly capable, yet simple to use, making it suitable for businesses of all sizes.

ADP integrates with most time and attendance tracking tools, including tools available from ADP at additional cost. The software automatically checks the data for anomalies and is able to process payroll in seconds for most businesses. Payroll taxes are calculated and paid automatically. In addition, ADP takes care of all tax and compliance filings.

Enterprise-scale businesses can link ADP to recruiting and talent management services. They can also add on retirement and insurance benefits, putting all of a company’s employee financial flows on a single platform.

Employees have access to a self-service web portal and mobile app, reducing demands on an HR team’s time. In addition, ADP customer support is available 24/7 to help with any issues.

Pricing

ADP offers pricing by quote only. There are multiple packages available depending on whether a business needs HR tools in addition to payroll. Benefits management is available through add-ons.

Pros

- Trusted by nearly 1 million companies worldwide

- Offers HR and talent management tools

- Self-service mobile app for employees

- 24/7 customer support

Cons

- Can be expensive, especially for benefits management

6. Patriot – Most User-friendly Payroll Software

Patriot offers an affordable and easy-to-use payroll software that’s ideal for many small businesses in the UK. With this software, managers can run payroll an unlimited number of times for any custom payroll periods.

There’s no limit to how many locations can be added and Patriot can run payroll for salaried employees, hourly employees, and contractors. Each hourly employee can have up to 5 different hourly rates, which is more flexibility than most businesses need. Patriot also handles reimbursements for car or cell phone allowances, travel, and more.

Running payroll with Patriot can be done in 3 simple steps and only takes a few minutes. The platform offers detailed reports for managers. There’s also a self-service portal and mobile app for employees.

For businesses that don’t already have time tracking software, Patriot offers its own as an add-on.

Pricing

Patriot offers payroll starting at $17 per month + $4 per employee. It’s one of the most affordable payroll software platforms available for businesses that don’t need a lot of bells and whistles.

Pros

- Very affordable pricing

- Easy 3-step process to run payroll

- Up to 5 hourly rates for each employee

- Handles reimbursements

Cons

- Doesn’t support retirement or insurance benefits

7. Resource Guru – Best for Tracking Employee Hours across Projects

Resource Guru is a project management software designed to help managers schedule team members and keep track of their capacities. While that’s the platform’s primary focus, it also has some very useful tools for payroll, particularly for businesses that need to bill clients based on hours worked.

In Resource Guru, employees can easily track all of the hours they spend on various projects and differentiate between billable and non-billable hours. Managers can quickly see how many hours employees worked and compare that to their timesheets for processing payroll.

Resource Guru doesn’t run payroll itself, but the software integrates with payroll processors like Xero.

Pricing

Resource Guru starts at only $2.50 per user per month. Businesses can try out the software free for 30 days. Keep in mind that integration with a payroll processor will require a separate subscription.

Pros

- Track time across multiple projects

- Drag and drop tasks between employees

- Integrates with most timesheet software and payroll processors

- 30-day free trial

Cons

- Does not process payroll directly

8. OnPay – Best Payroll Software for Managing Benefits

OnPay is one of the best payroll software platforms in the UK for businesses that want to manage benefits alongside payroll. With OnPay, employers can easily offer health insurance, life and disability insurance, paid time off, commuter benefits, and retirement plans. OnPay even handles liability insurance related to company vehicles.

It also helps that OnPay is very simple to use for running payroll. Payroll can be executed in seconds, including through the OnPay mobile app. The software automatically flags unusual hours or payments to make sure nothing is missed. OnPay also integrates with accounting software like Quickbooks and Xero to make sure wages are accounted for in business cash flow.

Another benefit to OnPay is that HR tools are included with every plan. The software handles onboarding paperwork, vacation scheduling, and employee records. Organisation charts are created automatically to make sure businesses know who’s in charge of what and what human resources are available at all times.

Pricing

OnPay offers a single pricing plan that costs $36 per month plus $4 per employee. This is somewhat pricey, but keep in mind that HR tools and benefits management are included in that cost.

Pros

- Benefits management built-in

- Run payroll on mobile

- Integrates with Quickbooks and Xero

- Includes HR management tools

Cons

- Expensive for businesses that just want basic payroll

9. Remote – Best for Remote Employees

Remote is a payroll and HR management software designed with the needs of modern, majority-remote businesses in mind. The software makes it easy to run payroll in multiple countries simultaneously and doesn’t require in-house administration from a centralised office.

Part of what makes remote special is that the company has legal and HR experts in countries around the world. These experts are up to date on local laws and do all the legwork necessary to ensure businesses remain in compliance when hiring employees and contractors.

Even benefits are tailored to employees’ home countries, which makes businesses more competitive in hiring around the world. Remote takes on the work of managing these plans, so HR experts don’t need to become experts in medical insurance in a far-off country.

Pricing

Remote offers international payroll for free for contractors, which is a hard deal to pass up. However, running payroll for remote international employees is by quote only. Depending on the country an employee resides in, expect to pay $299-$599 per employee per month.

Pros

- Run payroll in countries around the world

- Local experts ensure compliance

- Offer benefits packages tailored to each country

- Free to run payroll for contractors

Cons

- Very expensive for full payroll and benefits management

10. Kashflow – Best Value for Money Payroll Software in the UK

Kashflow was set up in 2004 by its founder Dave Jackson. At the time, the then business owner had rapidly grown out of the Excel spreadsheet they were using for payroll and instead decided to start from scratch.

One of the best things about Kashflow is its ease of use. It was designed as a small business accounting software initially, but it’s possible to use this software for medium and even larger operations. The software is fully HMRC compliant and has flexible payroll that can switch between weekly and monthly payments.

Some of the main features on Kashflow include RTIs, finalizing of payslips, employee self-service (allows employee access to payslips and other payroll data), holiday pay and a huge range of reports. It’s worth noting that reports can be linked with other programs to factor in costs and expenditures for projects within PLM systems.

Pricing

Kashflow offers incredible value for money and programs start from just $6.75/month. With this, you get access for up to 5 employees. You can upgrade this package to the “plus” package with rates starting at $22.50/month. You then pay extra per employee that you add.

Pros

- Great value for money

- Ideal for smaller businesses to get started and allows for growth

- Direct access to HMRC

- Automated payroll options

Cons

- Additional monthly charges for some of the most important features

11. Iris – Oldest Payroll Manager Software in the UK

Iris has been running for over 40 years in some form and is widely regarded as one of the most popular payroll software in the world with over 330,000 businesses currently in use.

This accounting software is widely regarded as one of the easiest to use and as a result, is a firm favorite for businesses of all sizes. One of the more recent additions of automated payments means that you can pay staff directly from Iris, which is a great addition.

Iris comes packed with features and one of the more notable is that of the Job Retention Scheme (JBS) which allows users to track the workforce during times of furlough. On top of this, it also includes flexible benefits, flexible payroll options (22 to choose from), HMRC compliant, auto-enrolment, payslip printing and a holiday diary.

Pricing

Iris has one of the biggest and best free payroll software on the market. With this, you get access to up to 10 employees, complete free of charge. Moving up to the “Business” package is a big leap, with prices then starting at $96/year with a $230 up-front fee.

Pros

- Best for free payroll software access

- Great for small and growing businesses, capable of hosting large corporations as well

- Great use of JRS for furloughed workers

- Lots of packages to choose from

Cons

- Expensive jump from free to starter

- Inclusion of one of sign-up fees

Best Small Business Payroll Software UK

When it comes to testing for the best payroll software, one thing we always try and look at is how accessible is each product for a range of business sizes. For example, a local pub who have 6 employees are not going to have the same needs as a Fortune 500 company.

Small businesses need to narrow down the list of needs and requirements about what makes payroll software work for them. Software for payroll for small business has different criteria to software for a larger business, and must be:

- Easy to implement – The platform needs to be easy to implement into an existing program or it needs to be easy to start from scratch. The learning curve needs to be very shallow as it’s likely this won’t be run by a dedicated finance department.

- Have a good value for money – Time is money, regardless of your business size, but spending huge amounts each month on payroll software for most small businesses will not be viable. It’s impossible to say what is and isn’t good value without knowing how the business works, but a lot of the platforms we’ve spoken about earlier will allow up to 15 employees for less than $30/month.

This is not an ultimate list, but it addresses key points that small businesses need to consider when looking to get acquainted with the best payroll software. If you’re looking to see who our top three for payroll software for small businesses would be, we’ve listed them below:

- Kashflow – Great value for money and an easy learning curve

- Iris – Very cheap to get started with and can grow as the business grows

- Sage Business Cloud – Huge range of features that can be linked to other Sage products

Best Free Payroll Software UK

When you look at the best free payroll software you need to think about what sort of functionality, you’re getting to not part any money with. A lot of the products that we’ve mentioned so far include some sort of free software that you can trial for 14-30 days, but to get something that is completely free is rare.

However, Iris does allow users an unlimited amount of time on its free platform which allows businesses to have up to 10 employees on their accounts at any one time. This is by far and away from the best free payroll software on the market.

One of the best things about Iris is that the free platform allows you access to most of the main features. It’s only as you move beyond 10 employees that you will need to start paying for its services.

We will also add here that Iris has been voted as one of our top payroll software picks overall and not simply because part of it is free. The only downside is that fees can jump steeply and you may be asked to pay a signing-on fee, which is less than ideal.

What is a Payroll Software?

One of the most important parts of any business is its staff and with each staff member, you will need to pay them. Unfortunately, it’s not as easy as agreeing on a cost per month (salary) and then paying that sum to them on a certain date, which is where payroll software comes in.

Most countries have taxes that need to be paid and other fees, such as National Insurance in the UK and private healthcare in the US, which all need to be taken off salaries. The concept of payroll software is that it allows companies to automate exactly what needs to be paid and to who.

In years gone by these sorts of things would need to be done manually and if you’re dealing with businesses with hundreds of employees, this can be incredibly time-consuming. Good payroll software will work any deductions out for you and even process payments as required once this is done.

How does Payroll Software Work?

The software will vary based on which tool you use, but the concept of most of them is very similar.

It starts by adding employees to your database. For this, you will need to include things like personal information, but most importantly, how much they earn based on how many hours they work. Most will allow you to log weekly and monthly hours, which then means you can add full-time, part-time and even freelancers to payroll products.

You’re able to set up the software so that it dedicates the taxes from the employee automatically. If the person is a freelancer or a business, then this will need to be done by them, but anyone working for the company as a direct employee will have tax deducted before it’s been paid.

As a simple process, this will then pay the employee at the desired time and then log it on the system.

Payroll software includes a lot more features than this and some work better than others. Links to things like HMRC for tax purposes, real-time insights into payments made and pension enrolments can all be added if needed.

What are the Benefits of Using a Payroll Software in the UK?

There are lots of reasons why a company would look to use a payroll system and we’ve listed some of these below:

- Time – The first and most obvious reason is to save time. The systems can be fully automated so that it deducts any taxes or money that needs to be taken from a basic salary and then pays the exact right amount to the employee. This can be set to work on a consistent basis from here onwards.

- Money – A good payroll software will save the company a huge amount of money in time saved from manually doing payroll. As we stated earlier, time is money when it comes to business so generally, if you’re saving time, you’re saving money.

- Accuracy – There is no room for human error here with an online system. Mistakes are almost eliminated, and it means that people will be paid on time, every time.

How to Choose a Payroll Software in the UK

We’ve included a range of what we believe is the best payroll software on the market right now. However, we also realize that this is not a one-size-fits-all model, so you need to be able to pick out the right software for your business’s needs.

Below we’ve listed some of the areas that you need to look to choose the best payroll software for your business.

Real-Time Information (RTI)

You need the patrol software to give you real-time information about what is being paid and to whom. This should allow you to see and change things like tax dedications, especially when dealing with the likes of HMRC who will be looking for an RTI feature within each business.

Easy to Add in Features

Lots of businesses need to be able to add in things like bonuses, overtime, and commission. Make sure your payroll software allows you to do this quickly and easily. For payroll that is more consistent, look for features like automated rules and schedules which will allow you to run these programs a lot easier.

Pension Scheme

In the UK, most businesses are required employees to automatically enroll in a pension scheme. Most of the best payroll software will include a feature that allows you to do this. It may seem like an insignificant feature, but for larger businesses, this will save a lot of time and money but utilizing this.

Cloud-Based

Try and find software that is cloud-based and in turn, allows you to access the payroll from anywhere in the world on a smartphone or tablet. This is a feature that’s only just starting to be more popular and in years to come, will be a game-changer, especially as more of us are working from home.

Conclusion – What is the Best Payroll Software in the UK?

Our top pick for the best payroll software would be Xero. The platform is ideally suited for businesses of all sizes and allows small businesses to grow without being overwhelming.

With a competitive pricing package and 30-day free trial that unlocks all features, Xero has to be one of several payroll options that you simply must sample before making a final reduction. Use the link below to get access to your free 30-day trial with Xero.

#cryptocurrency #cryptocurrencynews #cryptocurrencytrading #cryptocurrencyexchange #cryptocurrencymining #cryptocurrencymarket #cryptocurrencycommunity #cryptocurrencys #cryptocurrencyinvestments #cryptocurrencyinviestments #cryptocurrencyeducation #cryptocurrencyrevolution #allsortofcryptocurrency #cryptocurrencytop10 #cryptocurrency_news #instacryptocurrency #cryptocurrencymemes #investincryptocurrency #cryptocurrencyinvestment #cryptocurrencyisthefuture #cryptocurrencyinvesting #newcryptocurrency #cryptocurrencylife #cryptocurrencytrade #cryptocurrencylifeinvest #cryptocurrencymillionaire #cryptocurrencytrader #cryptocurrency_updates #tradingcryptocurrency #cryptocurrencysignals #cryptocurrencytradingplatform #cryptocurrencysolution #cryptocurrencytraders #cryptocurrency_for_dummies #cryptocurrencymalaysia #cryptocurrencytakingover #cryptocurrencybali #cryptocurrencyinvestors #cryptocurrencyindex #cryptocurrencyattorney