Cryptocurrencies are becoming increasingly popular among investors and investors - not least because of the profit opportunities. However, especially for beginners and newcomers to the crypto world, understanding cryptocurrencies can be daunting. And not only that: another challenge lies in finding the right platform for trading cryptocurrencies. In this article, the 8 best crypto brokers in German-speaking countries are presented and compared.

Brief overview of crypto exchanges list: Crypto exchanges comparison 2022

These are the top crypto exchanges right now:

- eToro - top dog among the best crypto exchanges 2022

- Crypto.com – Very good crypto exchange with a beginner-friendly app

- Capital.com – Best CFD broker for trading crypto CFDs

- Huobi – Good crypto exchange to get interest

- Coinbase – Particularly beginner-friendly crypto broker

- Binance – One of the largest crypto exchanges in the world

- Bitpanda – Austrian crypto broker with a good offer

- Bison App - Modern crypto broker on the smartphone

In the next section we take a closer look at the crypto exchanges.

The best crypto brokers and exchanges in detail - our crypto exchange comparison

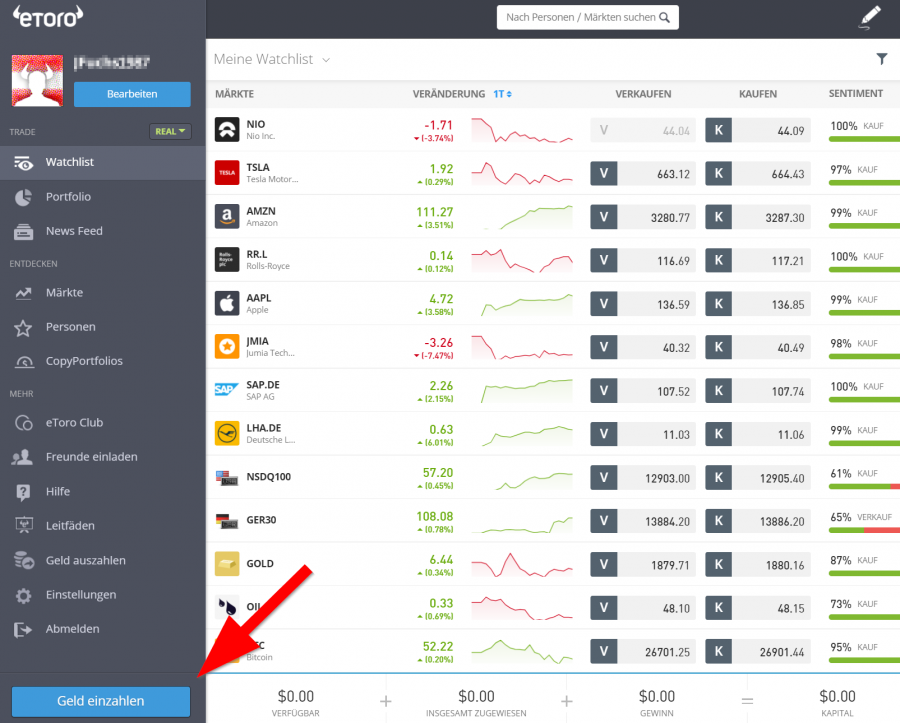

1. eToro - top dog among the best crypto exchanges 2022

The most popular provider is eToro, which is not only the safest crypto broker, but also the cheapest.

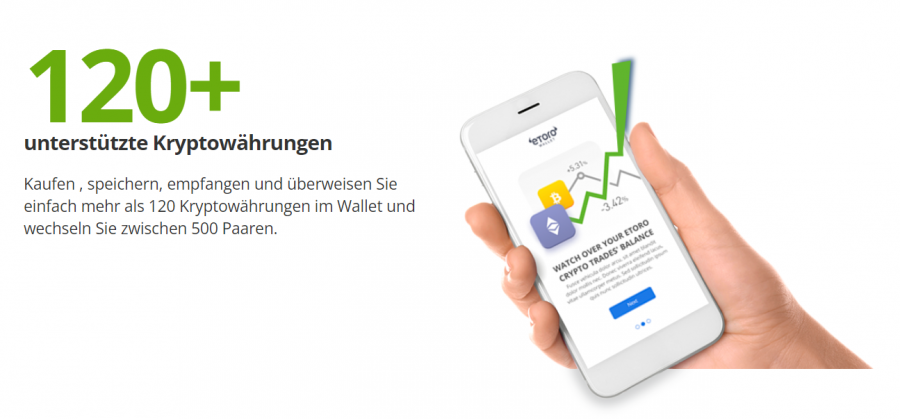

eToro is a multi-asset platform that offers both cryptocurrency trading and CFD trading. At eToro one stands over64 cryptocurrencies to choose from, including popular coins like Bitcoin , Ethereum and Litecoin . It is completely free to open an account on eToro, and all registered users are given a $100,000 demo account for free, which can be used to practice buying cryptocurrencies and other assets.

eToro does not charge any deposit or trading fees other than spreads . Trading on the eToro platform takes place in various fiat currencies, including, of course, euros. The minimum deposit for buying cryptocurrencies is just 50 euros.

In addition, it has licenses from authorities in Australia and CySEC, as well as the FCA, so security should not be an issue. Customers also have a deposit guarantee of 20,000 US dollars - making the broker one of the safest in the industry.

Another attractive aspect of eToro is social trading . This allows users to network with each other. In addition, you can make use of CopyTrading , which allows you to copy the portfolio of other successful traders 1:1.

As the name suggests, this feature allows one to copy an experienced trader with solid experience in the digital currency space.

The eToro staking is also particularly attractive . This is a method of passively generating income on eToro – just for holding cryptocurrencies. As a reward, you get the cryptocurrency you keep. The tokens used remain in the possession of the users, of course, but - similar to a savings account - you receive interest on holding certain cryptocurrencies. eToro currently offers staking for Cardano (ADA) , Tron (TRX) and Ethereum (ETH) . The rewards (between 75 and 90%) are paid out at the end of the month.

If you also want to invest in other financial products than just cryptocurrencies, you can also use eToro to buy thousands of stocks and ETFs at 0% commission. There is also an opportunity to trade forex, commodities, indices and more. In terms of user-friendliness, eToro is ideal for both beginners and advanced users. One can access the eToro account through the provider's website or by downloading the iOS/Android app. In addition, eToro also offers its own free crypto wallet with the eToro Money Wallet .

| Number of cryptocurrencies | fees | Bitcoin fee | minimum deposit |

| 64 | spreads | 1% | 50 euros |

What we like about eToro:

- Good crypto selection that is continuously being expanded

- Innovative and unique features such as automatic staking

- The world's largest social trading network

- Very user friendly

- Adapted to all levels and all types of traders and investors

- Low fees

2. Crypto.com

Crypto.com is a new platform and a very good alternative to eToro. Founded in 2016, Crypto.com today boasts an impressive user base of over 10 million customers. Aimed at both novice and advanced traders, the platform offers a web-based exchange and a handy mobile app. Crypto.com exchange allows users to buy and sell cryptocurrencies with a 0.4% fee. However, those who use the CRO cryptocurrency issued by Crypto.com can significantly reduce these fees.

Crypto.com is a new platform and a very good alternative to eToro. Founded in 2016, Crypto.com today boasts an impressive user base of over 10 million customers. Aimed at both novice and advanced traders, the platform offers a web-based exchange and a handy mobile app. Crypto.com exchange allows users to buy and sell cryptocurrencies with a 0.4% fee. However, those who use the CRO cryptocurrency issued by Crypto.com can significantly reduce these fees.

Crypto.com offers numerous benefits to its users, including numerous rewards, high trading speeds, and low fees. It has a strong security system and an overall wide range of cryptocurrencies including Bitcoin, Ethereum and meme currencies like Dogecoin and also Shiba Inu. Besides CRO, Crypto.com also offers its users the possibility to buy cryptocurrencies with credit and debit cards.

Similar to eToro, staking is a big advantage on Crypto.com . Anyone who buys the native cryptocurrency CRO and keeps it for at least 6 months will receive interest. It must be noted that CRO is blocked for this period, i.e. you cannot trade the cryptocurrency. Additional benefits come with staking, including higher APRs , rebates , and premium Visa cards .

You can also buy and sell NFTs (non-fungible tokens) on Crypto.com. Because of the increasing popularity, the Crypto.com NFT marketplace was launched in March 2021 . Here you create an additional account to choose from a variety of NFTs from different areas such as art, games or sports. Buying NFTs is free, selling or creating an NFT is charged at 1.99% per NFT.

In addition to the trading app, Crypto.com also offers a free, non-custodial crypto wallet app that supports over 100 different coins . The wallet app even allows users to send crypto to other Crypto.com wallets at different speeds, offering the opportunity to save on network fees.

| Number of cryptocurrencies | fees | Bitcoin fee | minimum deposit |

| 250 | Maker/Taker Fees | from 0.4% | 20 euros |

What we like about Crypto.com:

- Intuitive app for buying crypto

- Suitable for beginners as well as advanced

- Low fees of just 0.4%

- Offer of over 250 cryptocurrencies

- Staking + Earn feature for passive income

- Crypto Credit Card

- NFT marketplace

3. Capital.com

Capital.com is the best crypto CFD broker tested. In addition, the provider is the world's first AI-supported trading platform. That said, Capital.com uses algorithms to find custom trades - and it's unique.

Capital.com is the best crypto CFD broker tested. In addition, the provider is the world's first AI-supported trading platform. That said, Capital.com uses algorithms to find custom trades - and it's unique.

In addition, the provider is known for its huge selection of cryptocurrencies and low prices. For tech-savvy investors, the platform offers a myriad of tools for analysis, some of which are very extensive and sophisticated. Advanced traders in particular can go into depth here.

What is disadvantageous about Capital.com is that all trades must be done through CFDs and leveraged . This makes it a platform reserved for experienced traders with higher risk tolerance. You cannot buy here yourself, and all investments involve high risk. In other words, you cannot buy the underlying value directly.

| Number of cryptocurrencies | fees | Bitcoin fee | minimum deposit |

| 250+ | spreads | 0.5% | from 20 euros |

What we like about Capital.com:

- AI driven platform that finds trades based on past trading patterns

- Large selection of cryptocurrencies

- Favorable conditions

- Offers countless tools for analysis, many of which are very extensive

- User friendly

4. Huobi

Huobi Global is a leading crypto exchange with a strong presence in Asian markets. Founded in 2013, Huobi offers a digital asset ecosystem that includes crypto trading, derivatives trading, staking, crypto lending, crypto yield products, and more. Huobi supports trading in more than 400 cryptocurrencies and regularly adds new assets to the platform. Huobi is particularly attractive for anyone who wants to generate passive income - some tokens support an APY of 100%. Thanks to staking , you can currently earn interest on 6 different coins. Zilliqa (ZIL), Terra (LUNA), Solana (SOL), aelf (ELF), Persistance (XPRT) and Casper (CSPR) are currently supported.

Huobi Global is a leading crypto exchange with a strong presence in Asian markets. Founded in 2013, Huobi offers a digital asset ecosystem that includes crypto trading, derivatives trading, staking, crypto lending, crypto yield products, and more. Huobi supports trading in more than 400 cryptocurrencies and regularly adds new assets to the platform. Huobi is particularly attractive for anyone who wants to generate passive income - some tokens support an APY of 100%. Thanks to staking , you can currently earn interest on 6 different coins. Zilliqa (ZIL), Terra (LUNA), Solana (SOL), aelf (ELF), Persistance (XPRT) and Casper (CSPR) are currently supported.

But Huobi is not only suitable for staking - after all, the exchange offers a wide range of cryptocurrencies, including DeFi tokens and new cryptocurrencies .

In terms of fees, Huobi is very well in the middle, when trading cryptocurrencies, a fee of 0.20% is charged.

Huobi is available as a web-based platform and as a mobile app for Android and iOS.

The exchange also offers VIP account tiers based on the number of Huobi Experience (EXP) points a user has accumulated. Users accumulate EXP based on their trading volume and cryptocurrency holdings held on the exchange. Depending on the amount of EXP accumulated in the last 30 days, a user can upgrade to Advanced, Insider, Premier, Ambassador, or Partner.

| number of cryptocurrencies | fees | Bitcoin fee | minimum deposit |

| 400 | commissions | 0.2% basic fee | 100 euros |

What we like about Huobi:

- Low fees

- Supports credit and debit cards

- Partly free crypto deposits

- Useful wallet

- Ability to Stake and up to 50% APY with the Earn feature

5. Bitpanda

Bitpanda is a crypto broker based in Austria, which accordingly mainly addresses customers from Europe. The platform features low fees, a crypto index fund, and an intuitive interface.

Bitpanda is a crypto broker based in Austria, which accordingly mainly addresses customers from Europe. The platform features low fees, a crypto index fund, and an intuitive interface.

The exchange was founded in 2014 and has since grown into one of the most popular cryptocurrency exchanges in Europe for buying and selling cryptocurrencies. While initially only cryptocurrencies could be traded, other assets such as stocks, ETFs, commodities and indices are now also available to users.

Bitpanda is very attractive to many as it offers a very intuitive and easy-to-use interface for buying and selling cryptocurrencies. The exchange also offers a variety of payment options that make it easy for cryptocurrency beginners to buy cryptocurrencies such as Bitcoin and Co.

Bitpanda Academy contains a lot of useful information, broken down by different types of investors. For example, beginners might want to know how blockchain technology works and what exactly a crypto wallet does. Intermediate articles cover things like consensus models and smart contracts.

Another benefit of Bitpanda is their own Visa card. This no-fee debit card offers between 0.5% and 2% rewards for spending. Users can choose which assets to use for payments, making it easy to spend cryptocurrency. However, it's worth noting that crypto spending may not bode well for long-term buy-and-hold investors.

| Number of cryptocurrencies | fees | Bitcoin fee | minimum deposit |

| 25+ | from 1.49% | from 1.49% | depending on the cryptocurrency |

What we like about Bitpanda:

- Good range of cryptocurrencies and other assets

- Very user friendly

- Wide range of training material

- Low fees

- Own Bitpanda Visa card

6. Bison app

The Bison app is a relatively new cryptocurrency trading app. Behind it is the traditional stock exchange Boerse Stuttgart. The aim of the Bison app is to make cryptocurrency trading suitable for the masses. Crypto trading and account setup is therefore easy: you download the app, register and verify yourself and you are ready to go.

The Bison app is a relatively new cryptocurrency trading app. Behind it is the traditional stock exchange Boerse Stuttgart. The aim of the Bison app is to make cryptocurrency trading suitable for the masses. Crypto trading and account setup is therefore easy: you download the app, register and verify yourself and you are ready to go.

The app can be downloaded on Android and iOS devices. The Bison App is modern and user-friendly. You don't need a wallet, securities account or anything like that. All you need to trade cryptos is the app. With the app you keep track of the market, your own investments and the current prices.

In addition, there is an exclusive crypto radar that shows the mood for the most important crypto currencies. You can see which coins are being discussed without having to use other social networks. Price alerts can also be set individually.

The minimum deposit in the Bison app is 20 euros. However, there is a big minus point with the payment methods: A deposit is only possible by bank transfer. Accordingly, you need to fund your checking account and fund the account.

| number of cryptocurrencies | fees | Bitcoin fee | minimum deposit |

| 20+ | spreads | 1.49% | 20 Euros |

What we like about Bison App:

- Partner of the Stuttgart Stock Exchange

- User-friendly and modern design

- Good additional functions

7. Binance

Binance is probably one of the largest crypto exchanges in the world. In the last year 2021 alone there were over 28 million active users on the crypto exchange - there are now over 100 million users. As a crypto exchange, Binance offers some advantages for its customers. Due to the significant trading activities, one enjoys great liquidity and access to most cryptocurrencies, including of course Bitcoin, Ethereum and many new cryptocurrencies .

Binance is probably one of the largest crypto exchanges in the world. In the last year 2021 alone there were over 28 million active users on the crypto exchange - there are now over 100 million users. As a crypto exchange, Binance offers some advantages for its customers. Due to the significant trading activities, one enjoys great liquidity and access to most cryptocurrencies, including of course Bitcoin, Ethereum and many new cryptocurrencies .

Trading commissions on Binance start at around 0.1 percent, and the platform’s KYC process is fairly straightforward. Binance also offers leveraged trading and access to crypto futures, allowing traders to buy crypto larger than wallet balance. In total, over 1000 crypto pairs are available.

In addition to the possibility of buying cryptocurrencies, Binance also offers an NFT marketplace . The marketplace is integrated into the Binance exchange, i.e. you do not need an additional account to buy NFTs. BNB, BUSD and ETH are accepted as payment methods.

Another advantage of Binance is if you own the native cryptocurrency Binance Coin. Because all those who own BNB tokens can reduce the fees. There are also numerous trading tools and charts that are particularly suitable for experienced investors. Binance staking is also supported.

| number of cryptocurrencies | fees | Bitcoin fee | minimum deposit |

| 1000+ | spreads | spreads | 20 Euros |

What we like about Binance:

- Largest crypto exchange worldwide

- Large selection of cryptocurrencies

- Competitive conditions

- Numerous tools for experienced traders

- Fee reduction when trading BNB tokens

- NFT marketplace

8. Coinbase

Founded in 2012, Coinbase quickly became a popular crypto trading platform, especially among newcomers. It offers a variety of cryptocurrencies for sale, purchase and trading - either through the web application or through the in-house app. In contrast to other providers, however, the fees on Coinbase are comparatively high. For example, you pay a fee of 3.99% if you want to pay by credit card.

Founded in 2012, Coinbase quickly became a popular crypto trading platform, especially among newcomers. It offers a variety of cryptocurrencies for sale, purchase and trading - either through the web application or through the in-house app. In contrast to other providers, however, the fees on Coinbase are comparatively high. For example, you pay a fee of 3.99% if you want to pay by credit card.

However, that doesn't stop Coinbase from delighting millions of users - not least because of the great ease of use and choice of cryptocurrencies . The beginner-friendly user interface in particular attracts many newcomers, who in return accept the high fees. Experienced traders can also use Coinbase Pro.

In addition, Coinbase also offers numerous training materials, making it easy for beginners to get started in cryptocurrency trading. Similar to eToro, Coinbase also has its own wallet - over which you have full control thanks to the private keys.

| Number of cryptocurrencies | fees | Bitcoin fee | minimum deposit |

| 100+ | Spreads, Fixed Fees & Commissions | from 0.4% to 1.49% | from 50 euros |

What we like about Coinbase:

- User-friendly crypto exchange

- Large selection of cryptocurrencies

- Good crypto wallet

- Opportunities to Stake

- Own credit card that can be loaded with cryptos

- Lots of training material

- Very good customer service

The Crypto Exchanges Fees Comparison: Crypto Exchanges List for Costs

| number of coins | Credit and debit card fee | Fee for buying cryptos | Wallet | |

| eToro | 64 | 0.50% | 1 % | ✅ |

| Crypto.com | 150+ | 2.99% (free for the first 30 days) | 0.4% | ✅ |

| Capital.com | 400+ | oA | from 0.20% | ✅ |

| Huobi | 400+ | oA | 0.20 | ✅ |

| Bitpanda | 25+ | oA | from 1.49% | ✅ |

| bison app | 20+ | oA | from 0.75% | ✅ |

| binance | 1000+ | until 10% | 0.10% | ✅ |

| Coinbase | 100+ | 3.99% | 1.49% | ✅ |

What is a crypto exchange?

A crypto exchange is a marketplace where you can buy and sell cryptocurrencies such as Bitcoin , Ethereum or Dogecoin . Crypto exchanges work similarly to other trading platforms that you may be familiar with. Providers provide you with different accounts where you can create different types of orders to buy, sell and speculate in the crypto market.

Some crypto exchanges support advanced trading features like margin accounts and futures trading. Others have features like staking or crypto loans that allow you to earn interest on your crypto holdings. The best exchanges offer education, news, and other tools to keep customers up to date.

How do crypto exchanges work?

As mentioned above, crypto exchanges facilitate trading between buyers and sellers. This is no different from a traditional stock exchange, which allows market participants to buy and sell stocks in the open marketplace.

- Depending on whether you choose a centralized or decentralized exchange, the process for buying cryptocurrency is very similar:

- First you have to open an account with the chosen crypto exchange - depending on the exchange you have to confirm your identity afterwards

- The next step is to deposit funds into the exchange’s account before you can start trading crypto – regulated brokers like eToro offer plenty of options here

- You then select the desired currency and confirm the purchase

Types of crypto exchanges in our crypto exchange comparison

Centralized Exchanges

Centralized crypto exchanges (CEX) are managed by one organization. Centralized exchanges make it easier to get started with cryptocurrency trading by allowing users to convert their fiat currency, such as euros, directly into cryptocurrencies or use them to buy cryptos . The vast majority of crypto trading takes place on centralized exchanges.

Some crypto enthusiasts oppose centralized exchanges because they go against the decentralized ethos of cryptocurrency. Even worse, in the eyes of some crypto users, the company or organization may require users to follow Know Your Customer (KYC) rules. These require each user to reveal their identity, similar to applying for a bank account, to combat money laundering and fraud.

Nevertheless, a centralized exchange such as eToro is a safe and reputable crypto exchange. Although you do without complete anonymity, in return you get a large range of assets , high security measures , a free demo account and functions such as CopyTrading .

Decentralized Exchanges

Decentralized crypto exchanges (DEX) distribute the responsibility for facilitating and verifying crypto trading. Anyone willing to join a DEX network can certify transactions, similar to blockchains. This can help increase accountability and transparency, and ensure that an exchange can keep going regardless of the state of the company that created it.

The problem is that decentralized exchanges are much less user-friendly , not only from an interface standpoint but also in terms of currency conversion. Decentralized exchanges, for example, don't always allow users to deposit with fiat currencies and exchange them for crypto. This means that in order to obtain crypto that you then use on a decentralized exchange, you must either already own crypto or use a centralized exchange.

The following points should be considered when choosing the best crypto exchange in our crypto exchange comparison:

When choosing a suitable crypto exchange, there are a few things to consider so that you can trade cryptocurrencies with the lowest possible risk. These would be:

security

First and foremost, one must choose a crypto exchange that is both secure, reliable, and regulated. There is now a wide range of crypto exchanges, so you should also inquire about the licenses before opening an account with the respective exchange. Because which licenses the platform has and which regulations have been implemented says a lot about security.

At the top is eToro, which not only has a full license from CySEC and FCA, but also from ASIC. The platform is also registered with FINRA, which opens the doors to the lucrative US marketplace. Anyone who entrusts their capital to an unregulated exchange runs the risk of losing the money invested.

Fees and Costs

Your profit is largely determined by the fees of the respective crypto exchange. The less you pay to the broker or spread, the more money you have left when selling cryptocurrency. However, finding out the exact fees of a crypto exchange in advance can sometimes be difficult. Therefore, one should pay attention to transparency and use our crypto exchange fee comparison - a reputable crypto exchange specifies which fees are to be paid and what trading costs the customer has to pay.

There are also differences here, for example Coinbase pays a fixed fee of 1.49% per trade, while other exchanges such as eToro charge different fees. For example, you can already buy Bitcoin on eToro with a 1% spread.

Crypto exchanges such as Huobi or Binane charge commissions, which can be reduced by buying native cryptocurrencies.

Offer of the crypto exchange

A large selection is of course better than a narrow one. Not only do you get more choice, you also get the opportunity to diversify your portfolio. While some exchanges only offer the major cryptocurrencies like Bitcoin, it is better if the offer is more diversified. At eToro, for example, you can not only invest in over 64 cryptocurrencies , but also in other assets. This is important because you don't just invest your capital in one good, but split it up accordingly.

user friendliness

Ease of use shouldn’t fall short either, after all a crypto exchange needs to be easy to navigate . It is not highly recommended to use a platform with advanced analysis tools if you are a beginner. You should make sure that you have everything at a glance. Beginners in particular will find their way around very quickly with eToro, for example.

functions and tools

Crypto exchanges differ quite a bit in terms of tools and features. While some crypto exchanges hardly offer any additional functions and focus purely on the exchange of cryptos, other exchanges offer advanced tools for analysis, evaluation and risk management.

For example, Binance offers a sophisticated trading platform with charting tools, technical indicators, custom order types, and more. This is very good especially for advanced traders.

However, beginners and experienced traders are also in good hands with eToro: In addition to numerous training material, charts, analyzes and social trading , eToro is a pioneer in copy trading. The CopyTrading function allows users to copy trades from successful investors 1:1 and thus generate passive income.

apartment

If you don't just want to trade from home, you need an app . Because a good crypto exchange without its own app is simply not a good crypto exchange. After all, the smartphone is now our everyday companion. An in-house app, such as from eToro, makes it possible to trade flexibly.

However, when choosing the crypto exchange, you should also make sure that the app is easy and intuitive to use. If the crypto exchange does not offer its own app, you should check in advance whether the desktop or web application is also optimized for the mobile device.

payment methods

When choosing the right crypto exchange, the payment options also play an important role. While some crypto exchanges offer cryptocurrencies only, there are also exchanges that offer credit, debit cards, and wire transfers. However, these are usually linked to high fees, so it is advisable to determine the fees in advance. For example, at the crypto exchange, you pay a fee of 3.99% if you deposit with a credit card. However, eToro only charges 0.5%.

In addition, eToro also offers other payment options, including PayPal .

Wallet

Whether you need a crypto wallet or not ultimately depends on the exchange you choose and personal preferences. For example, some crypto investors are uncomfortable with having their digital tokens stored on an exchange. Rather, they want control of their private keys.

Whether you need a crypto wallet or not ultimately depends on the exchange you choose and personal preferences. For example, some crypto investors are uncomfortable with having their digital tokens stored on an exchange. Rather, they want control of their private keys.

However, if you're a complete novice and don't understand how private keys work, you probably won't want to take responsibility for your digital wallet.

Instead, one could consider buying cryptocurrencies from a regulated exchange like eToro and leaving the tokens there until cashed out. This is much more convenient for novice investors. In addition, eToro offers a high level of protection.

Customer service

The cryptocurrency market is highly volatile, often you simply need help, even if it is only of a technical nature. Accordingly, it is important that customer service in German is available around the clock. The best crypto exchanges accordingly offer a live chat , such as eToro. Other contact options are also available here, for example by e-mail.

With some exchanges, however, you have to be patient a little longer.

What taxes are involved when trading cryptocurrencies?

Assuming you have benefited from some favorable price movements and made a profit on your investment, you may want to withdraw those profits to spend in the real world. This is where taxation comes in, which can seem complicated at first – especially for beginners.

Cryptocurrencies are considered private assets in Germany , which means they are subject to individual income tax and not capital gains tax. The most important thing to know is that Germany only taxes cryptocurrency if it is sold within the same year that it was bought.

So, while Germany taxes certain crypto events like short-term trades, mining, and staking, the tax rules for cryptocurrencies are far more relaxed than other countries. This is because Bitcoin and other cryptos are not treated as property under German tax laws.

Instead, cryptocurrency is classified as "other assets" and the sale is a "private disposal." This distinction is important because the private sale of assets is tax-privileged in Germany. As a "private sale", crypto profits are completely tax-free in Germany after a holding period of one year. In addition, any winnings up to 600 euros per year are tax-free.

Any income from crypto trading is declared in the annual income tax return – as are regular income, profits and losses.

How to buy cryptocurrencies on a crypto exchange: guide

Buying cryptocurrencies does not necessarily have to be complicated - provided you find the right crypto exchange for yourself. To make this process easier for you, we recommend using the eToro platform to buy and sell cryptocurrencies. Trading cryptocurrencies through eToro is easy, fast and most importantly secure . The guide below shows how easy it is to buy cryptos on eToro.

Note: Signing up is similar for many crypto exchanges featured in this article. However, some crypto exchanges like Coinbase require additional steps as you are trading crypto to crypto. It is best to contact the provider directly.

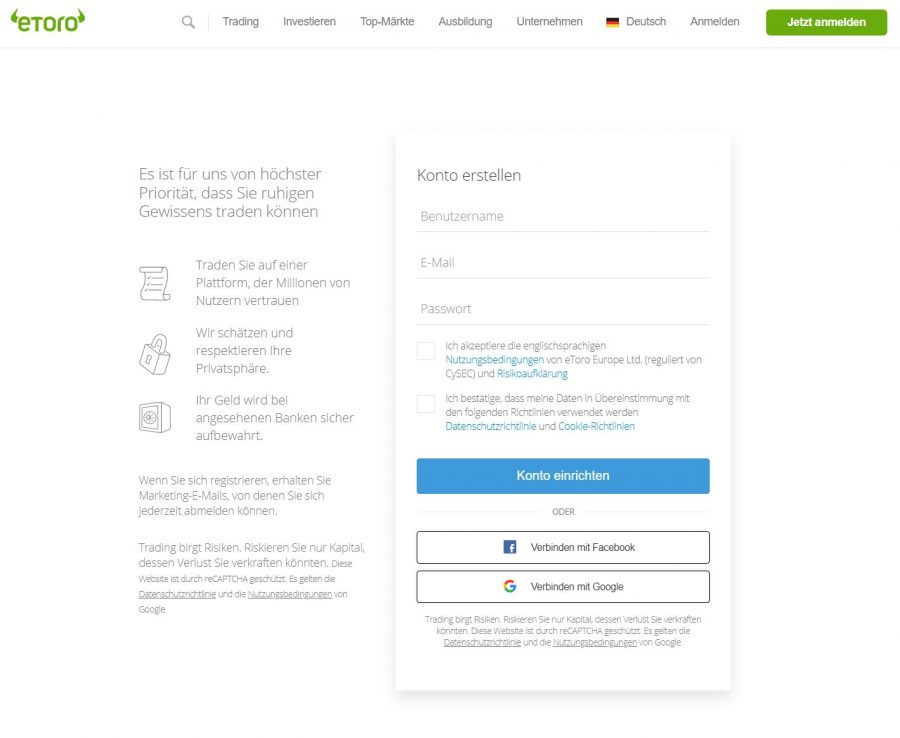

1st step: opening an account

First, click Sign Up Now on the eToro home page. You'll be taken to a login page where you'll need to provide a username, email address, and choose a unique, strong password. You can also speed up the signup process by connecting an existing Facebook or Google account to eToro and signing up that way.

2nd step: verification

The next step is identity verification. This is necessary as eToro is regulated by some of the world's leading bodies. Every new user must complete the Know Your Customer (KYC) process to have their accounts verified.

You will need proof of identity and proof of residence. The verification is usually completed quite quickly.

3rd step: Deposit money

In order to start trading, one needs to deposit funds into the client account. To buy cryptocurrencies via eToro, a minimum deposit of 50 euros is required. You can choose from different payment options, these would be:

- Debit and Credit Cards (Visa, MasterCard, Maestro)

- PayPal

- Skrill

- Neteller

- INSTANTLY

- International bank transfer

eToro only charges 0.5% on deposits – regardless of the payment method. This is a lot cheaper than some of its main competitors, with Coinbase charging 3.99% to buy Bitcoin and other cryptocurrencies with a debit card.

4th step: buy cryptocurrency

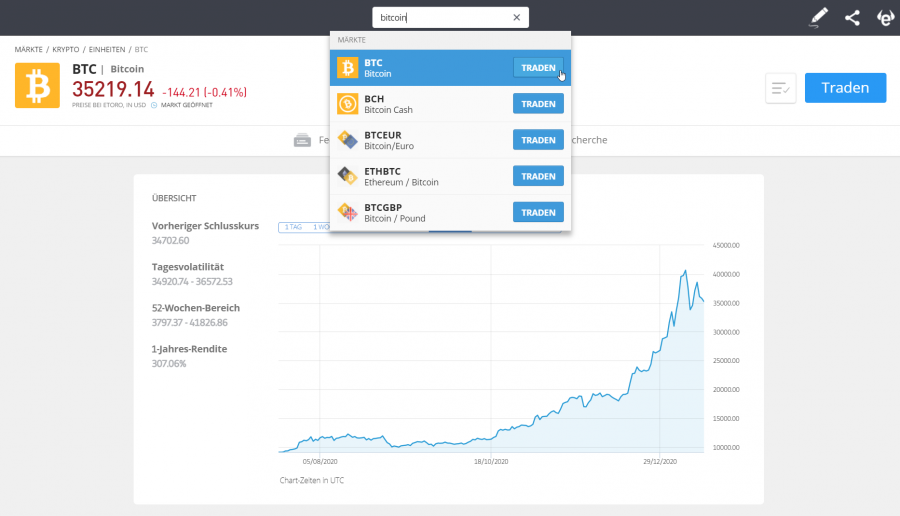

The last step is to buy the desired cryptocurrencies. At eToro you can choose from 64 cryptocurrencies . The offer is constantly being expanded. To buy the desired cryptocurrency, simply enter it in the search field.

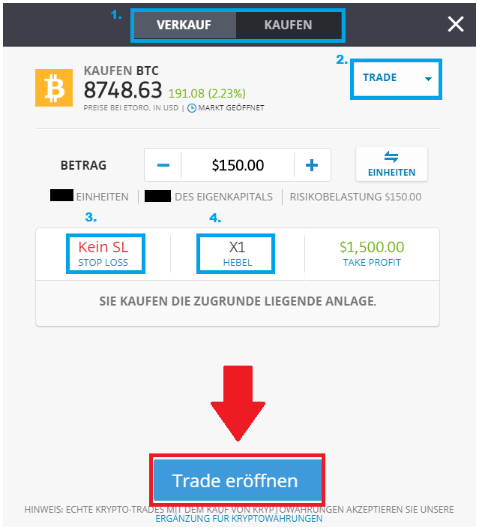

Let's say you want to buy bitcoin, type "bitcoin" or "BTC" in the search bar and click on the first result that comes up. If you click on Trade , a small window opens for trading with the respective cryptocurrency:

Here you can then enter the amount for which you want to buy the cryptocurrency. You can also make other settings. Placing a trade completes the purchase of the cryptocurrency, which can then be seen in the portfolio.

Current news on the crypto exchange comparison: 08/29 – 09/04/2022

- eToro Buys US Competitor Gatsby to Expand Trading Offering: Israeli social trading and multi-asset brokerage firm eToro has secured the regulatory nod to acquire fee-free trading app Gatsby to expand its US business . The acquisition, which includes approximately $50 million in cash and common stock, was originally approved by the U.S. Financial Industry Commission (Finra) back in December 2021. Co-founded by Jeff Myers and Ryan Belanger-Saleh in 2018, Gatsby is a commission-free options and stocks trading app aimed at younger traders.

- Crypto.com sues woman after mistakenly sending her $10 million: A woman received $10.5 million in an accidental transaction from popular cryptocurrency platform Crypto.com — and then reportedly spent it on a luxury home. The lady only asked for a $100 refund. Crypto.com has not yet commented on this.

- Huobi will not be bought by FTX: Rumors earlier this month claimed FTX would buy crypto exchange Huobi Global, but its CEO Sam Bankman-Fried says it is not happening. FTX founder and CEO Sam Bankman-Fried said today that his cryptocurrency exchange has no plans to acquire Huobi Global.

The best crypto exchanges in comparison: conclusion

The crypto market is an exciting field for investments. Cryptocurrencies are fast-growing digital currencies and are viewed by many as the future of money.

Crypto assets are also highly volatile, which means there are large fluctuations at times. But whether you want to make money from falling or rising prices, staking, or simply holding cryptos - choosing the right crypto exchange can be a challenge. It is important that you agree in advance which criteria are an absolute must and which ones you could compromise on.

In addition, you should think about the capital employed, risk management and risk tolerance. The popular crypto broker eToro , for example, is recommended for both beginners and advanced traders . In addition to cryptocurrencies, it also offers stocks, ETFs, commodities and much more. In addition, eToro offers fair fees with a very good selection. With the eToro demo account, you can also familiarize yourself with the platform before actually trading live.

#cryptocurrency #cryptocurrencynews #cryptocurrencytrading #cryptocurrencyexchange #cryptocurrencymining #cryptocurrencymarket #cryptocurrencycommunity #cryptocurrencys #cryptocurrencyinvestments #cryptocurrencyinviestments #cryptocurrencyeducation #cryptocurrencyrevolution #allsortofcryptocurrency #cryptocurrencytop10 #cryptocurrency_news #instacryptocurrency #cryptocurrencymemes #investincryptocurrency #cryptocurrencyinvestment #cryptocurrencyisthefuture #cryptocurrencyinvesting #newcryptocurrency #cryptocurrencylife #cryptocurrencytrade #cryptocurrencylifeinvest #cryptocurrencymillionaire #cryptocurrencytrader #cryptocurrency_updates #tradingcryptocurrency #cryptocurrencysignals #cryptocurrencytradingplatform #cryptocurrencysolution #cryptocurrencytraders #cryptocurrency_for_dummies #cryptocurrencymalaysia #cryptocurrencytakingover #cryptocurrencybali #cryptocurrencyinvestors #cryptocurrencyindex #cryptocurrencyattorney