More and more people are opting to purchase shares in Vietnam, thanks to the growth in accessibility of many major trading platforms. Purchasing shares is now as simple as creating an account with an online broker, making a deposit, and placing a trade – all of which can be accomplished in a matter of minutes.

In this guide, we’ll discuss how to buy stocks in Vietnam, reviewing a selection of the popular trading platforms to choose from before providing a step-by-step walkthrough of the investment process.

Where to Buy Stocks in Vietnam – Popular Stock Brokers Reviewed

The first step when deciding how to buy shares in Vietnam is to choose a trading platform to partner with.

There is now an abundance of brokers that accept Vietnamese clients. With that in mind, reviewed below are eight regulated stock brokers in Vietnam, with particular attention paid to their fee structure, trading features, and asset selection.

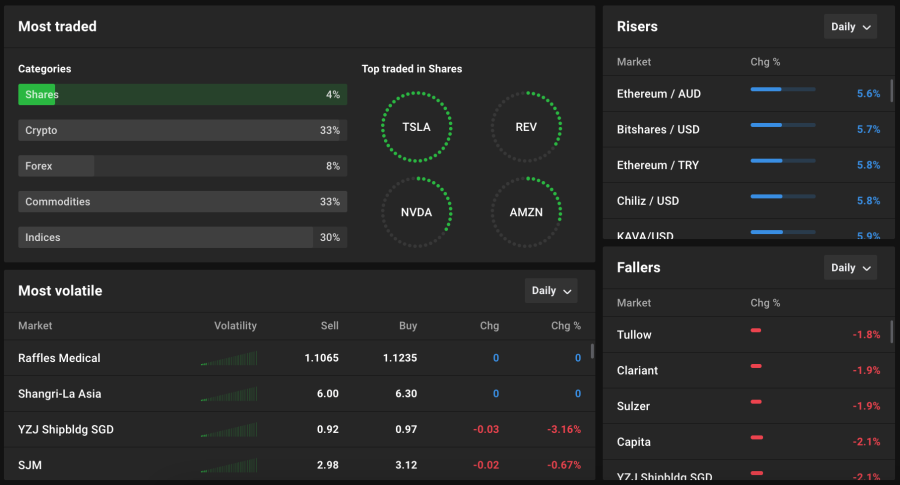

1. Capital.com

![]() Through our research and testing, we’ve found that Capital.com is a popular stock CFD trading platform Vietnam. Capital.com is a world-renowned CFD broker that offers a wide array of markets to trade. Although not directly regulated in Vietnam, Capital.com is regulated by the FCA, CySEC, ASIC, and the FSA.

Through our research and testing, we’ve found that Capital.com is a popular stock CFD trading platform Vietnam. Capital.com is a world-renowned CFD broker that offers a wide array of markets to trade. Although not directly regulated in Vietnam, Capital.com is regulated by the FCA, CySEC, ASIC, and the FSA.

As a CFD broker, all of Capital.com’s fees are built into the bid/ask spread – which tends to be extremely tight for highly-traded equities (e.g. Amazon). This also means Capital.com doesn’t charge commissions when opening or closing a trade.

Users can trade over 3,500 stock CFDs with Capital.com and 30 stock indices from across the globe. Capital.com also offers real stock trading, although this is only available in the UK and the EU. At present, Capital.com users can invest in equities from seven major stock exchanges.

Apart from allowing users to buy US stocks in Vietnam, Capital.com also provides an array of ETFs, commodities, and currency pairs to trade. The minimum deposit when creating a trading account is only $20 (465,000 VND), which can be made via credit/debit card, bank transfer, PayPal, or Apple Pay. Notably, deposits and withdrawals are free to make, with no inactivity fee to worry about.

Capital.com’s trading experience is streamlined, as users can invest via the browser-based portal or the mobile app. The latter is handy since it features various order types and real-time charting features. Users can even use Capital.com’s free demo account, which provides a risk-free experience within the market.

| Number of Stocks | 3,500+ |

| Pricing Structure | 0% commission + spread |

| Cost to Buy Amazon Shares | Variable spread – can be as low as 0.7 points |

Your capital is at risk. 78.91% of retail investor accounts lose money when trading CFDs with this provider.

2. eToro

Another option for investors wondering how to buy stocks in Vietnam is eToro. eToro is one of the world’s largest online brokers, with over 26 million registered clients. One of eToro’s traits is its high level of security, thanks to direct regulation from the FCA, ASIC, CySEC, FinCEN, and FINRA.

Another option for investors wondering how to buy stocks in Vietnam is eToro. eToro is one of the world’s largest online brokers, with over 26 million registered clients. One of eToro’s traits is its high level of security, thanks to direct regulation from the FCA, ASIC, CySEC, FinCEN, and FINRA.

Like Capital.com, eToro offers a vast selection of stock CFDs to trade. At present, users can trade 2,000 different stocks across 17 stock exchanges located throughout the world. All trading fees are included in the bid/ask spread, meaning there are no commissions when users buy shares on eToro. eToro also represents one of the crypto exchanges in Vietnam, as users can trade over 70 different digital currencies.

The minimum investment amount with this leading social trading platform is only $10 (232,500 VND), making this platform ideal for beginners. Regarding the account opening process, Vietnamese traders can sign-up digitally and fund their accounts using a credit/debit card, bank transfer, or e-wallet (e.g. PayPal, Skrill). eToro’s minimum deposit threshold is only $50 (1,162,500 VND), with a 0.5% conversion fee for non-USD deposits.

eToro also provides a way to gain exposure to popular shares to invest in via the ‘SmartPortfolio’ feature. This feature allows users to invest in professionally managed portfolios without paying a management fee. eToro also has a useful ‘CopyTrader’ feature, which will enable users to automatically copy the trades placed by other eToro users – again, with no additional fees.

| Number of Stocks | 2,000 |

| Pricing Structure | 0% commission + spread |

| Cost to Buy Amazon Shares | Variable spread – can be as low as 0.7 points |

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

3. Interactive Brokers

For experienced investors looking for a share trading platform in Vietnam, Interactive Brokers is a popular option. Interactive Brokers allows users to invest in shares through a well-established platform regulated by the FCA and the SEC.

For experienced investors looking for a share trading platform in Vietnam, Interactive Brokers is a popular option. Interactive Brokers allows users to invest in shares through a well-established platform regulated by the FCA and the SEC.

With interactive brokers, users can trade on a remarkable 83 different stock exchanges – which will appeal to those wondering how to buy penny stocks. In addition, Interactive Brokers offers a fractional investing service (on US and EU stocks) that allows users to purchase ‘fractions’ of a share rather than the whole thing.

Vietnamese traders must opt for the ‘IBKR Pro’ account, which charges either a fixed rate or a tiered price structure. Commissions vary depending on which stock market is being traded, with US-based shares priced at $0.005 per share, with a minimum fee of $1 (23,253 VND). Aside from these trading fees, Interactive Brokers charges no deposit, withdrawal, or inactivity fees.

| Number of Stocks | 10,000+ |

| Pricing Structure | Commission (varies depending on the market) |

| Cost to Buy Amazon Shares | $0.005 per share (min $1) |

4. Saxo Bank

Saxo Bank is a Danish investment bank regulated by the FSA and the FCA. This bank has a fantastic worldwide reputation and offers 28 stock markets to trade on. Much like Interactive Brokers, Saxo Bank’s trading fees are volume-based, priced at $0.02 per share – with a minimum fee of $10 (232,530 VND).

Saxo Bank is a Danish investment bank regulated by the FSA and the FCA. This bank has a fantastic worldwide reputation and offers 28 stock markets to trade on. Much like Interactive Brokers, Saxo Bank’s trading fees are volume-based, priced at $0.02 per share – with a minimum fee of $10 (232,530 VND).

Users wondering how to invest in shares in Vietnam will find that the process is simple with Saxo Bank, as it can be completed online in minutes. However, the minimum deposit threshold is relatively high for Vietnamese clients, set at $2,000 (46,506,000 VND).

Vietnamese clients can fund their accounts via bank transfer with no additional fees. Withdrawals are also free to make and can take as little as one business day to arrive. Finally, Saxo Bank excels when it comes to trading resources, as the platform offers a ‘trading ideas’ feature, extensive charting options, and a wide range of fundamental data sources.

| Number of Stocks | 20,000+ |

| Pricing Structure | Volume-based commission |

| Cost to Buy Amazon Shares | $0.02 per share (min $10) |

5. XTB

Another option for where to buy shares in Vietnam is XTB. XTB is a platform for those wondering how to invest in stocks, as it has been around since 2002 and is regulated by the FCA. As a CFD broker, XTB offers access to approximately 1,900 equities, along with ETFs, indices, currencies, commodities, and more.

A volume-based fee is charged whenever a stock trade is placed, equaling 0.08% for US-based equities. However, there is a minimum fee of $8 (186,024 VND) per trade, which can be higher for international equities.

XTB has no minimum deposit threshold and supports a massive range of payment methods, including several e-wallets (e.g. PayPal, Skrill, Neteller). Users can also deposit via bank transfer for free, although credit/debit card transfers usually come with a fee for Vietnam-based traders.

| Number of Stocks | 1,900 |

| Pricing Structure | Volume-based commission |

| Cost to Buy Amazon Shares | 0.08% (min $8) |

6. Pepperstone

Traders wondering where to invest in shares in Vietnam may also wish to research Pepperstone. Pepperstone is an Australia-based broker regulated by the FCA and ASIC, offering over 900 stock CFDs to trade.

Traders wondering where to invest in shares in Vietnam may also wish to research Pepperstone. Pepperstone is an Australia-based broker regulated by the FCA and ASIC, offering over 900 stock CFDs to trade.

These CFDs can be traded through MetaTrader 5 (MT5), and Pepperstone even offers up to 5:1 leverage when equity trading. In addition, users can also link with various social trading platforms, such as Myfxbook and DupliTrade, to automate the trading process.

In terms of fees, Pepperstone’s spreads tend to be low compared to other CFD brokers, with no minimum fee. This broker also doesn’t charge any deposit, withdrawal, or inactivity fees – with deposits supported via credit/debit card, bank transfer, or e-wallet. Pepperstone also offers a free demo account and numerous educational videos for beginners.

| Number of Stocks | 900+ |

| Pricing Structure | 0% commission + spread |

| Cost to Buy Amazon Shares | Varies depending on market conditions |

7. IC Markets

IC Markets allows investors to buy US stocks in Vietnam safely and flexibly. Although known for its FX trading services, IC Markets does offer around 1,600 stock CFDs to trade, along with 25 equity indices. IC Markets can also integrate with ZuluTrade, allowing users to copy the trades placed by other traders.

IC Markets allows investors to buy US stocks in Vietnam safely and flexibly. Although known for its FX trading services, IC Markets does offer around 1,600 stock CFDs to trade, along with 25 equity indices. IC Markets can also integrate with ZuluTrade, allowing users to copy the trades placed by other traders.

This broker is regulated by several leading entities, such as ASIC, CySEC, and the FSA, ensuring users are safe whilst trading. In terms of fees, IC Markets incorporates these into the spread, meaning no commissions are charged.

Deposits and withdrawals are free to make with IC markets, although the minimum deposit amount is slightly higher, set at $200 (4,650,600 VND). However, IC Markets makes up for this with some stellar trading features, including a ‘trading ideas’ service and a real-time newsfeed.

| Number of Stocks | 1,600 |

| Pricing Structure | 0% commission + spread |

| Cost to Buy Amazon Shares | Varies depending on market conditions |

8. AvaTrade

Rounding off our list of where to buy stocks in Vietnam is AvaTrade. AvaTrade is a CFD broker that offers a wide range of stocks to watch now, whether in the US or the UK. This broker integrates with MT5, meaning most stocks can only be traded through that platform.

Rounding off our list of where to buy stocks in Vietnam is AvaTrade. AvaTrade is a CFD broker that offers a wide range of stocks to watch now, whether in the US or the UK. This broker integrates with MT5, meaning most stocks can only be traded through that platform.

AvaTrade also offers several social trading features, such as its ‘AvaSocial’ app, allowing users to follow and chat with other traders. In terms of safety, although AvaTrade isn’t regulated in Vietnam, oversight is provided by leading entities such as the Central Bank of Ireland.

As with most CFD brokers, AvaTrade’s fees are built into the bid/ask spread. This spread does vary, although it can be as low as 0.5 points during peak trading hours. Finally, AvaTrade’s minimum deposit is $100 (2,325,300 VND) and is entirely free to make.

| Number of Stocks | 600+ |

| Pricing Structure | 0% commission + spread |

| Cost to Buy Amazon Shares | Variable spread – can be as low as 0.5 points |

Popular Vietnam Stock Brokers Compared

For those wondering how to buy shares in Vietnam right away, the table below presents a comprehensive breakdown of all the features to keep in mind when choosing between the eight brokers discussed in the previous section:

| Platform | Number of Stocks | Pricing Structure | Cost to Buy Amazon Shares | Supported Payment Methods | Deposit Fees | Withdrawal Fees | Inactivity Fees |

| Capital.com | 3,500+ | 0% commission + spread | Variable spread – can be as low as 0.7 points | Credit/debit card, bank transfer, PayPal, Apple Pay | No | No | No |

| eToro | 2,000 | 0% commission + spread | Variable spread – can be as low as 0.7 points | Credit/debit card, bank transfer, PayPal, Skrill, Neteller | 0.5% conversion fee | $5 (116,265 VND) | $10 (232,530 VND) per month after one year of inactivity |

| Interactive Brokers | 10,000+ | Commission (varies depending on the market) | $0.005 per share (min $1) | ACH, check, online bill payment | No | No | No |

| Saxo Bank | 20,000+ | Volume-based commission | $0.02 per share (min $10) | Bank transfer | No | No | Yes – up to $150 (3,487,950 VND) after six months |

| XTB | 1,900 | Volume-based commission | 0.08% (min $8) | Credit/debit card, bank transfer, e-wallet | No | No | Yes – €10 (244,470 VND) per month after one year |

| Pepperstone | 900+ | 0% commission + spread | Varies depending on market conditions | Credit/debit card, bank transfer, e-wallet | No | No | No |

| IC Markets | 1,600 | 0% commission + variable spread | Varies depending on market conditions | Credit/debit card, bank transfer, e-wallet | No | No | No |

| AvaTrade | 600+ | 0% commission + variable spread | Variable spread – can be as low as 0.5 points | Credit/debit card, bank transfer, e-wallet | No | No | Yes – $50 (1,162,650 VND) per quarter |

Your capital is at risk. 78.91% of retail investor accounts lose money when trading CFDs with this provider.

The Basics of Buying Stocks in Vietnam

The first port of call for investors researching how to buy stocks in Vietnam is understanding what stocks are and how they work. Put simply, stocks are financial instruments representing a share of ownership in a particular company – which is why they are often referred to as ‘shares’.

The most popular stock brokers in Vietnam allow retail and corporate investors to purchase these shares by providing access to stock exchanges, which are large markets where stocks are traded. Stocks have a set price, determined by supply and demand factors, representing their ‘value’ within the market.

How do I Find Popular Shares to Watch in Vietnam?

A commonly asked question by investors is, “How do you find popular stocks to research?” Although there are countless avenues to research, three of the most popular are discussed below:

Utilize Social Media

When researching what stocks to watch now, one approach is to scour social media for ‘trending’ companies – as these tend to be showcasing either bullish or bearish momentum. Although retail traders sometimes get a bad rap, there are numerous useful social media sites for finding stocks.

Conduct Technical Analysis

Some of the most popular shares to watch right now in Vietnam in 2022 can be found through technical analysis. For those who are unaware, technical analysis is used to identify trading opportunities by using historical data from a company’s stock price chart.

There are countless ways to conduct technical analysis, with hundreds of indicators and tools able to be employed.

Review Earnings Reports

Finally, the most popular stocks to watch now tend to be those that have reported stellar earnings results – whether that be in terms of revenue growth, net income growth, or EPS growth.

Financials play a role in stock market performance, so the companies performing well financially tend to exhibit upwards price movement. However, this isn’t always the case – so answering the question of “How do you find popular stocks to watch?” usually involves combining more than one form of analysis.

10 Popular Stocks to Watch Now in Vietnam

In this section of our guide on how to buy stocks in Vietnam, we’re going to focus on some of the most promising companies on the market right now. Below are ten popular shares to watch in Vietnam.

1. Palantir Technologies (PLTR)

Investors researching how to buy US stocks from Vietnam may be interested in adding Palantir Technologies to their portfolio. Palantir Technologies is a US-based software company specializing in ‘Big Data’, working for the US government and private clients.

Investors researching how to buy US stocks from Vietnam may be interested in adding Palantir Technologies to their portfolio. Palantir Technologies is a US-based software company specializing in ‘Big Data’, working for the US government and private clients.

The company was founded by Peter Thiel, who is known for co-founding PayPal with Elon Musk. Although PLTR shares have been hit hard lately, primarily due to rising inflation and higher interest rates, the company’s financials are still solid – meaning a rebound could soon be on the cards.

Your capital is at risk. 78.91% of retail investor accounts lose money when trading CFDs with this provider.

2. Grab Holdings (GRAB)

Grab Holdings is a Singapore-based tech company known for providing the ‘Grab’ app – which offers many of the same services as Uber. These include ride-hailing, food delivery, digital payments, and more.

Grab Holdings is a Singapore-based tech company known for providing the ‘Grab’ app – which offers many of the same services as Uber. These include ride-hailing, food delivery, digital payments, and more.

Grab Holdings went public in December 2021 through a SPAC, although shares immediately plummeted after the opening bell.

Your capital is at risk. 78.91% of retail investor accounts lose money when trading CFDs with this provider.

3. VanEck Vietnam ETF (VNM)

Traders wondering how to buy shares in Vietnam passively may wish to research the VanEck Vietnam ETF. Although not technically a ‘stock’, this ETF provides broad exposure to the Vietnamese equity market. The VanEck Vietnam ETF has over $375 million in net assets and invests in over 60 Vietnam-based companies.

Traders wondering how to buy shares in Vietnam passively may wish to research the VanEck Vietnam ETF. Although not technically a ‘stock’, this ETF provides broad exposure to the Vietnamese equity market. The VanEck Vietnam ETF has over $375 million in net assets and invests in over 60 Vietnam-based companies.

Your capital is at risk. 78.91% of retail investor accounts lose money when trading CFDs with this provider.

4. Vingroup JSC (VIC)

Another of the 10 popular stocks to research right now is Vingroup JSC. Vingroup JSC is the largest Vietnamese company and has operations in a wide array of sectors, including technology, real estate, retail, and more.

Another of the 10 popular stocks to research right now is Vingroup JSC. Vingroup JSC is the largest Vietnamese company and has operations in a wide array of sectors, including technology, real estate, retail, and more.

The company has been around since 1993 and has become synonymous with the rise of Vietnamese businesses over the past few decades.

Your capital is at risk. 78.91% of retail investor accounts lose money when trading CFDs with this provider.

5. Meta Platforms (META)

Meta Platforms, formerly Facebook, has had a tricky time of late. Changing privacy laws have hampered the company’s advertising revenue, although it remains one of the ‘Big 5’ tech stocks within the US.

Meta Platforms, formerly Facebook, has had a tricky time of late. Changing privacy laws have hampered the company’s advertising revenue, although it remains one of the ‘Big 5’ tech stocks within the US.

Those researching how to invest in international shares in Vietnam will often see Meta Platforms mentioned, as it is consistently one of the most-traded stocks with retail traders.

Your capital is at risk. 78.91% of retail investor accounts lose money when trading CFDs with this provider.

6. Vinhomes JSC (VHM)

No list of what shares to watch now in Vietnam would be complete without mentioning Vinhomes JSC. Vinhomes is a subsidiary of the previously-mentioned Vingroup and is Vietnam’s largest commercial real estate developer. Vinhomes remains the second-largest publicly traded company in the country.

No list of what shares to watch now in Vietnam would be complete without mentioning Vinhomes JSC. Vinhomes is a subsidiary of the previously-mentioned Vingroup and is Vietnam’s largest commercial real estate developer. Vinhomes remains the second-largest publicly traded company in the country.

In terms of reach, Vinhomes has operations in 40 cities and boasts a market cap of 272.2 trillion VND. Much like its parent company, Vinhomes has had a tough time due to economic conditions.

Your capital is at risk. 78.91% of retail investor accounts lose money when trading CFDs with this provider.

7. Amazon (AMZN)

Amazon needs no introduction, as huge volumes of traders consistently research how to buy Amazon shares in Vietnam. Although no longer under the stewardship of Jeff Bezos, Amazon continues to dominate the e-commerce sector – even after its poor Q1 2022 earnings results.

Amazon needs no introduction, as huge volumes of traders consistently research how to buy Amazon shares in Vietnam. Although no longer under the stewardship of Jeff Bezos, Amazon continues to dominate the e-commerce sector – even after its poor Q1 2022 earnings results.

Amazon recently had a stock split, which significantly lowered the share price, making shares more accessible to retail investors.

Your capital is at risk. 78.91% of retail investor accounts lose money when trading CFDs with this provider.

8. Alibaba (BABA)

Alibaba is a Chinese tech company with operations in various sectors, including e-commerce, retail, and internet services. BABA shares are publicly traded on the NYSE, with the company consistently ranked as one of the largest in the world in terms of revenue.

Alibaba is a Chinese tech company with operations in various sectors, including e-commerce, retail, and internet services. BABA shares are publicly traded on the NYSE, with the company consistently ranked as one of the largest in the world in terms of revenue.

Alibaba’s share price has been volatile of late due to China’s recent ‘Zero COVID’ policy. However, now that restrictions have eased and the Chinese government has softened its stance on working with the US, things are beginning to look up for Alibaba.

Your capital is at risk. 78.91% of retail investor accounts lose money when trading CFDs with this provider.

9. Hoa Phat Group JSC (HPG)

Another popular Vietnamese stock to invest in is Hoa Phat Group. Hoa Phat Group is a Vietnam-based company involved in iron and steel production, with a market cap of over 120 trillion VND.

Another popular Vietnamese stock to invest in is Hoa Phat Group. Hoa Phat Group is a Vietnam-based company involved in iron and steel production, with a market cap of over 120 trillion VND.

The company also has agriculture and real estate operations, making it one of the largest conglomerates in the country. Like many Vietnamese stocks, Hoa Phat Group’s share price has plummeted in recent weeks.

Your capital is at risk. 78.91% of retail investor accounts lose money when trading CFDs with this provider.

10. Nvidia (NVDA)

Rounding off our list of popular shares to watch now in Vietnam is Nvidia. Nvidia is a tech company that specializes in semiconductors – with a focus on GPUs, APIs, and other forms of hardware.

Rounding off our list of popular shares to watch now in Vietnam is Nvidia. Nvidia is a tech company that specializes in semiconductors – with a focus on GPUs, APIs, and other forms of hardware.

Nvidia has also branched into artificial intelligence and cryptocurrency, which will appeal to investors who buy Bitcoin in Vietnam. Shares have dropped significantly over the previous six months due to supply chain issues and rising inflation. However, Nvidia remains one of the most talked-about companies in the US market.

Your capital is at risk. 78.91% of retail investor accounts lose money when trading CFDs with this provider.

How to Buy Penny Stocks in Vietnam

Certain investors (especially those with a risk-seeking nature) may be keen to learn how to buy penny stocks in Vietnam. The critical thing to remember about these stocks is that they are highly volatile due to their small market caps and low level of liquidity.

Unlike the popular shares to watch right now that we covered earlier, penny stocks tend only to be offered by a select few platforms. One of these platforms is Interactive Brokers, which provides access to penny stocks listed on US stock exchanges. However, beginner investors may wish to stick with more liquid assets – as penny stocks are usually unpredictable and hard to analyze.

Are Shares Taxed in Vietnam?

The taxation rules for how to buy stocks in Vietnam can be slightly hazy, considering the Vietnamese government has only recently loosened policies surrounding equity investments by foreigners. However, as it stands, any Vietnamese or foreign investor (regarded as a resident within the country) will have to pay a 20% tax on capital gains.

For example, if an investor makes a 500,000 VND profit on an equity trade, then 100,000 VND must be paid in tax. Notably, tax rules are ever-changing and are much different for non-residents who invest in Vietnamese equities.

How to Buy Stocks in Vietnam – Conclusion

In conclusion, this guide has taken an in-depth look at how to buy stocks in Vietnam, reviewing a selection of popular brokers and presenting a walkthrough of the investment process

#cryptocurrency,#cryptocurrencynews,#cryptocurrencytrading,#cryptocurrencyexchange,#cryptocurrencymining,#cryptocurrencymarket,#cryptocurrencycommunity,#cryptocurrencys,#cryptocurrencyinvestments,#cryptocurrencyinviestments,#cryptocurrencyeducation,#cryptocurrencyrevolution,#allsortofcryptocurrency,#cryptocurrencytop10,#cryptocurrency_news,#instacryptocurrency,#cryptocurrencymemes,#investincryptocurrency,#cryptocurrencyinvestment,#cryptocurrencyisthefuture,#cryptocurrencyinvesting,#newcryptocurrency,#cryptocurrencylife,#cryptocurrencytrade,#cryptocurrencylifeinvest,#cryptocurrencymillionaire,#cryptocurrencytrader,#cryptocurrency_updates,#tradingcryptocurrency,#cryptocurrencysignals,#cryptocurrencytradingplatform,#cryptocurrencysolution,#cryptocurrencytraders,#cryptocurrency_for_dummies,#cryptocurrencymalaysia,#cryptocurrencytakingover,#cryptocurrencybali,#cryptocurrencyinvestors,#cryptocurrencyindex,#cryptocurrencyattorney