STP (Straight Through Processing) trading is a forex model that allows clients to send their orders straight to the market without requiring a dealing desk. The best STP brokers for forex will support multi-asset trading at low fees with various features at tools at the users’ disposal.

This guide reviews and examines the 10 best STP forex brokers to invest with in 2022.

The 10 Best STP Brokers in 2022 List

The table below provides an overview of the 10 best STP brokers to trade with this year.

- Capital.com – Overall Best Multi-Asset STP Broker to Invest With This Year

- eToro – Top STP Broker with Fractional Sharing, Regulated by FCA, ASIC & CySEC

- XTB – Top Rated STP Broker with Low EUR/USD Spread

- Libertex – STP Broker Supporting MetaTrader 4 (MT4)

- Skilling – STP Trading Platform with 70+ Technical Indicators

- Avatrade – STP Brokerage with Built-in CFD Platform

- IG – STP Broker listed on the London Stock Exchange

- Pepperstone – STP Broker Platform with Crypto CFD Trading

- Plus500 – Access over 120 Technical Indicators for STP Trading

- Forex.com – Trade with up to 50x Leverage on Dozens of FX Pairs

Your capital is at risk. 78.91% of retail investor accounts lose money when trading CFDs with this provider.

Best STP Forex Brokers Reviewed

The sections below analyze the top STP forex brokers online by looking at the available assets, trading fees, features and more.

1. Capital.com – Overall Best Multi-Asset STP Broker to Invest With This Year

Capital.com is a global STP trading broker, offering 138 forex pairs on its platform. Facilitating direct-to-market trades, Capital.com can be accessed through the web-based interface and the app – available on iOS and Android.

A CFD (Contract for Differences) broker, Capital.com offers retail clients up to 1:30 leverage trading options, making it one of the best high leverage brokers. Capital.com takes a minimum spread of 0.6 pips on EUR/USD pairs by Charging spreads on forex trades.

A multi-asset brokerage, this STP broker also allows investors to trade ETFs, commodities, cryptos and more.

One of the safest brokers to use in 2022, Capital.com is regulated by the Financial Conduct Authority (FCA) and CySEC (Cyprus Securities and Exchange Commission). When using a debit/credit card or e-wallet, there is a minimum deposit of only $20.

However, there is a minimum deposit of $250 for traders who use wire transfers as a payment method.

What We Like

- Low minimum deposit

- 30:1 leverage options

- 138 forex pair

Your capital is at risk. 78.91% of retail investor accounts lose money when trading CFDs with this provider.

2. eToro – Top STP Broker with Fractional Sharing

eToro is another popular STP brokerage, with over 27 million platform users residing in over 140 countries. The platform offers CFD trading options on forex pairs, commodities and cryptocurrencies.

One of the best low margin rate brokers, eToro, typically charges under 1 pip for the EUR/USD trading pair. Moreover, retail investors can leverage their forex positions by up to 30x.

Furthermore, eToro is a social trading platform that offers multiple features for investors to help each other. For example, CopyTrading is an available feature that lets beginner and inexperienced traders to copy the exact trades of more skilled investors.

Offering fractional sharing options, eToro lets UK and US investors begin trading with a $10 investment. Interested readers can deposit using debit/credit cards, bank transfers and e-wallets like PayPal, Neteller and more.

What We Like

- 47 currency trading pairs

- Multiple payment options

- Low minimum deposit of $10 (UK & US)

- Social Trading features

Your capital is at risk.

3. XTB – Top STP Broker with Low EUR/USD Spread

XTB is a global STP and FX trading brokerage that nearly half a million traders use.

Along with 48 FX currency pairs, XTB offers more than 2,100 instruments, including ETFs, stocks, commodities, indices and more.

To attract high-risk investors, the platform also provides 30x leverage trading opportunities. For the popular EUR/USD pair, XTB charges a low minimum spread of just 0.0006. A safe and secure platform, XTB is regulated by global bodies such as the Financial Conduct Authority.

More than 1,500 CFD instruments can be accessed from XTB’s mobile app, desktop version or web-based platform. The trading platform offers superior execution speeds, customizable options and various performance-based statistics and technical indicators.

Read our XTB review to learn more about this STP broker.

What We Like

- 1,500+ CFD trading options

- Very Low Spreads for EUR/USD pair

- Regulated by the FCA

Your capital is at risk.

4. Libertex – STP Broker supporting MT4

Libertex is a popular STP broker that lets traders access 51 FX pairs, commodities, indices, ETFs, cryptocurrencies, stocks and options. Notably, the broker has over 3 million platform members and is one of the best CySEC forex brokers to watch.

Along with a proprietary trading platform, interested investors can access Libertex via MetaTrader 4 and MetaTrader5.

Libertex does not charge any spreads on their FX trades, charging commission instead.

With a minimum deposit of $100, investors can begin trading with credit/debit cards, wire transfers and multiple e-wallets. A CFD trading platform, traders can also access leverage trading options with Libertex and educational material is on hand to learn to trade with proper risk management, as well as customer service support.

What We Like

- MT4 and MT5 Trading

- No Spreads

- 51 FX Pairs

- Regulated by CySec

5. Skilling – STP Trading Platform with 70+ Technical Indicators

Skilling is an MT4 platform that supports STP trade executions. The platform offers 73 FX currency pairs and 800 + securities across 17 global markets.

Notably, Skilling offers a standard account which charges no commissions and very low spreads. For example, the popular EUR/USD FX pair can be traded for only 0.7 pips. Alternatively, traders looking to trade large volumes in FX can join the premium account.

By paying only $35 per $1 million traded, investors will enjoy a low spread of 0.1 pips (on the EUR/USD pair).

Skilling’s platform features more than 70 technical indicators, market news feed and analysis-based statistics. The minimum deposit on Skilling is $100, while the premium accounts have a higher minimum deposit of $5,000.

| No. of Currency Pairs | Max Leverage | Other Assets | Minimum Deposit | Spread for EUR/USD | Accepted in US |

| 73 | 1:10 | Stocks, commodities, indices | $100 ($5,000 on premium account) | 0.7 pips (0.1 pips with premium account) | Yes |

What We Like

- Multi-Asset STP Brokerage

- 70+ technical indicators

- Low Spreads with the Premium Account

6. Avatrade – STP Broker with Built-in CFD Platform

With over 300,000 users, Avatrade is a popular STP broker that offers 54 FX currency pairs, cryptocurrencies, indices, commodities and more on the platform.

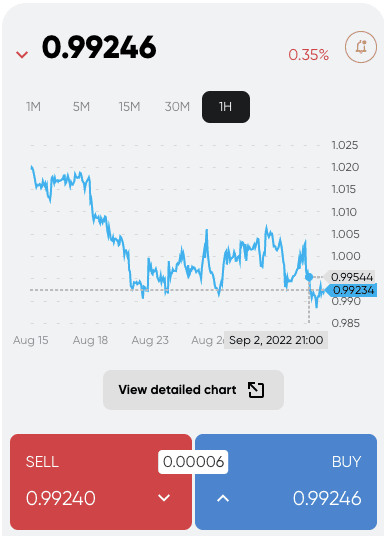

One of the best pairs to trade in forex, the EUR/USD pair, can be traded at a competitive spread of 0.99 pips per trade. Platform members can access the standard platform or choose to trade using MetaTrader 4 and MetaTrader5.

Alternatively, members can access AvatradeGo – the platform’s mobile app. To access CFD options trading, users can also use AvaOptions, the brokerage’s own options trading platform. High-risk investors can access up to 30x leverage when trading EUR/USD and other popular FX pairs.

Avatrade allows interested investors to begin trading via bank transfers, debit/credit cards and e-wallets such as PayPal, Neteller, Skrill and more. You only need to make a minimum deposit of $100 to start.

| No. of Currency Pairs | Max Leverage | Other Assets | Minimum Deposit | Spread for EUR/USD | Accepted in US |

| 55 | 1:30 | Stocks, commodities, indices, CFD options | $100 | 0.99 pips | No |

What We Like

- Options Trading Platform available

- Multiple Payment Methods

- Multi-asset platform

7. IG – STP Broker listed on the London Stock Exchange

Launched in 1974, IG is one of the world’s biggest online stock brokerage platforms. Notably, the platform is regulated by the FCA and Germany’s Federal Financial Supervisory Authority (BaFin). Moreover, the IG Group is a listed on the London Stock Exchange (LSE).

More than 290,000 platform members can access over 100 FX currency pairs with IG.

The popular EUR/USD pair is available to trade at the low spread of 0.6 pips. A cost-effective broker, IG does not charge additional commission on its trades.

Investors can access 20x leverage on majors and 30x on minor/exotic pairs. Moreover, professional investors can apply up to 200x leverage when trading with IG.

Apart from currencies, investors can access ETFs, CFDs, Options trading, stocks and IPOs via IG. The platform charges a minimum deposit of $250, which can be deposited using credit and debit cards. For example, depositing with MasterCard leads to an additional 0.5% per transaction, while VISA deposits attract a 1% charge.

| No. of Currency Pairs | Max Leverage | Other Assets | Minimum Deposit | Spread for EUR/USD | Accepted in US |

| 100 | 1:30 (1:200 for professional clients) | ETFs, CFDs, Options trading, stocks and IPOs | $250 | 0.6 pips | Yes (only for Forex) |

What We Like

- Listed in the LSE

- 200x leverage for professional clients

- 100 FX currency pairs

8. Pepperstone – STP Broker with Crypto Leveraging

Pepperstone is an Australian-based STP broker launched in 2015. Investors can access over 60 FX currency pairs via the web-based platform. Pepperstone also offers three mobile trading platforms – the MT4, MT5 and cTrader.

These third-party trading platforms provide investors with a range of trading tools and charts which help facilitate trading in FX, commodities and cryptocurrencies. Platform members can access the EUR/USD trading pair at pips per spread. The platform also attracts a $3.5 commission per lot per trade.

To stand a chance to multiply returns, investors can access 30x leverage on major FX pairs and even apply 2x leverage on cryptocurrencies.

One of the advantages of Pepperstone is that it requires no minimum deposit when investing. Traders can use wire transfers, bank transfers, credit/debit cards and e-wallets such as PayPal, Poli Transfer, and more to begin investing.

Registered with the Australian Securities and Investments Commission (ASIC), Pepperstone is one of the best ASIC regulated forex brokers to watch right now. The brokerage is also registered with other regulatory bodies, including the FCA and BaFin.

| No. of Currency Pairs | Max Leverage | Other Assets | Minimum Deposit | Spread for EUR/USD | Accepted in US |

| 60+ | 1:30 (1:2 for crypto) | Crypto, commodities, stocks | None | 0.8 pips | No |

What We Like

- Three Mobile Trading Platforms

- Leverage on Cryptocurrencies

- Registered with Multiple Regulatory bodies

9. Plus500 – Access over 120 Technical Indicators

Launched in 2008, Plus500 is a popular STP broker with nearly half a

million platform users. On the brokerage, traders can access more than 70 FX currency pairs, stocks, ETFs, commodities and cryptocurrencies.

Moreover, users can access market indices and options trading on Plus500. The popular EUR/USD currency pair attracts an average spread of only 0.7 pips.

The lack of additional account trading fees makes the brokerage a cost-effective choice for users. A safe platform, Plus500 is regulated and authorised by the FCA and the CySEC.

After creating an account, investors can access an intuitive trading experience via the web-based platform and mobile app. With over 120 technical indicators and charting options, platform members can customize and try to leverage the best forex signals.

Leverage trading is another feature that can be utilized on Plus500. For example, major FX pairs allow up to 30x leverage. Plus500 allows investors to begin trading with credit/debit cards, e-wallets and bank transfers. Interested readers must make a minimum deposit of $100 before accessing the platform.

| No. of Currency Pairs | Max Leverage | Other Assets | Minimum Deposit | Spread for EUR/USD | Accepted in US |

| 70 | 1:30 | stocks, ETFs, commodities and cryptocurrencies | $100 | 0.7 pips | No |

What we Like

- 120+ technical indicators

- 70 FX pairs

10. Forex.com – 50x Leverage on FX Pairs

Launched in 2001, Forex.com is a global FX and CFD trading brokerage.  Forex.com leverages its STP Pro Model to offer investors direct access to trades from liquidity providers.

Forex.com leverages its STP Pro Model to offer investors direct access to trades from liquidity providers.

The platform offers more than 90 FX currency pairs, including major, minor and exotic pairs. With the STP Pro Model, investors can access the popular EUR/USD pair at a minimum spread of 0.1 pips.

According to the model, a $1 million trading volume will attract just a $60 commission, which equates to only 0.00006%.

Forex.com offers a range of assets via CFDs, including stocks, indices, metals and energies.

Major pairs like the EUR/USD can be leveraged by up to 50x, which works well for high-risk traders. Forex.com is the brand of StoneX Financial Ltd, whose parent company StoneX Group, is listed on the NASDAQ exchange.

The platform is also registered with the FCA and the Securities and Futures Commission of Hong Kong (SFC).

| No. of Currency Pairs | Max Leverage | Other Assets | Minimum Deposit | Spread for EUR/USD | Accepted in US |

| 90+ | 1:50 | stocks, commodities, indices | $100 | 0.1 pips | Yes |

What we Like

- 90+ FX pairs

- Very low spreads with STP Pro Model

- Parent Company is listed on NASDAQ

Best Forex STP Brokers Compared

The sections below summarizes the main features of the top 10 STP brokers to invest in 2022.

What is an STP Broker?

STP stands for straight-through processing. This trading method is used for forex brokerages that electronically transmit trades straight to the market. STP brokers execute trades for their clients by sending them directly to the liquidity providers.

This process differs from market maker brokers, who send their clients’ trades to a trading desk where the trades are matched with other incoming orders.

There are many similarities between STP and ECN brokers, with many platforms being referred to as STP ECN brokers or STP/ECN brokers.

Benefits of Using an STP Broker

Here is a look at some of the main benefits of trading with an STP brokerage:

Faster Trading

The main benefit of using an STP broker is that trades are processed directly. Investors do not need to wait for their trades to match other incoming orders. Instead, trades are conducted electronically and fasten the entire trading process.

Low Risk

Compared to market maker brokers, STP brokers offer far lower risk while trading. For example, when trading with a market maker broker, your broker acts as the counterparty in the trade. This means that the brokers benefit when the investors trade fails.

On the other hand, an STP broker does not bet against the clients’ trades, giving them more of a reason to execute the trade with the best rate possible. With a successful bid, the brokers receive a commission or spread in return, keeping both the parties satisfied.

How to Trade with an STP Broker

The sections below show you how to begin trading with Capital.com – one of the most popular STP brokers on the market in 2022.

Step 1: Create a Capital.com Account

Firstly, visit the Capital.com website and create an account.

Provide basic details, including your full name, phone number and email address.

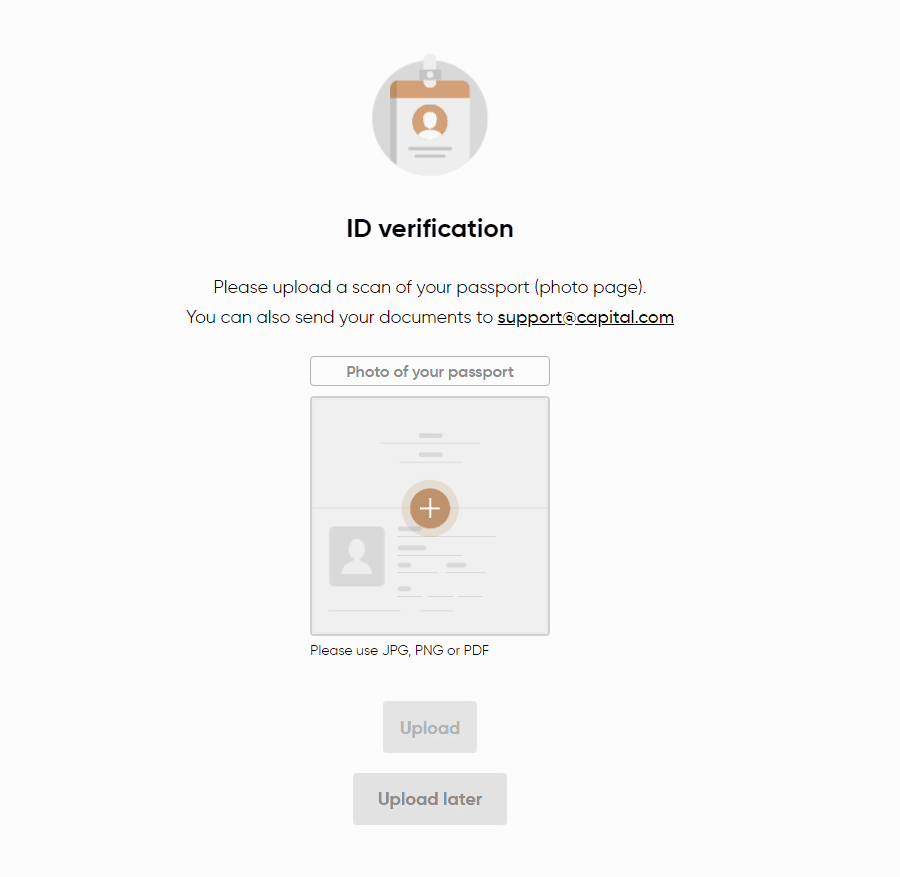

Step 2: Account Verification

Investors must verify their accounts by providing a proof of identity. This can be done by uploading a passport copy or a driver’s license.

Moreover, a proof of residency must also be submitted by providing a bank statement or a relevant utility bill.

Step 3: Deposit Funds

To deposit fiat currency, head to ‘My Accounts’ and click on deposit.

Investors can select a preferred payment method and deposit a minimum of $20 ($250 with wire transfer).

Step 4: Buy Assets

Once the funds have been deposited, investors can search their chosen asset on the search bar and press ‘enter’.

Enter the amount you wish to deposit into the trade and click on buy to continue.

Conclusion

This guide has reviewed 10 of the best STP brokers to look at in 2022. After comparing the available options based on their fees, available FX options and assets, we recommend Capital.com as the best STP broker. This global brokerage allows investors to trade 138 currency pairs at a low spread rate.

Read our Capital.com review to learn more about this top stock brokerage.

#forextrader #trading #forextrading #money #forexsignals #cryptocurrency #trader #investment #crypto #forexlifestyle #investing #business #entrepreneur #invest #binaryoptions #blockchain #forexmarket #forexlife #stocks #success #daytrader #btc #bitcoinmining #investor #stockmarket #binary #fx #finance