Nio is a Shanghai-based multinational automotive company that specializes in the design and development of electric vehicles.

The company is still in its growth stage and therefore today – we offer a beginner-friendly guide on how to buy Nio stock.

We also discuss how Nio has performed since it went public and whether or not this growth stock is a good fit for your portfolio.

How to Buy Nio Stock – Quick Guide

Below you will find a quick guide on how to buy Nio stock.

When you are learning how to invest in stocks, you are best advised to do so at a reputable trading platform. For this, eToro is the best option in the market.

This is because eToro allows you to buy Nio stock in under five minutes without paying a single cent in trading commission.

- ✅ Step 1: Open an eToro Account

Upon selecting ‘Join Now’, a sign-up form will populate. All you have to do is enter some basic personal information in the relevant fields to tell the brokerage who you are. You will also be asked to enter a username and password of your choosing. - 💳 Step 2: Deposit Funds

The minimum deposit at eToro is just $10 and you can select one of many supported payment types. Enter $10 or more where it says ‘Amount’ and take your pick from the list of e-wallets, credit/debit cards, and other banking options. - 🔎 Step 3: Search for Nio Stock

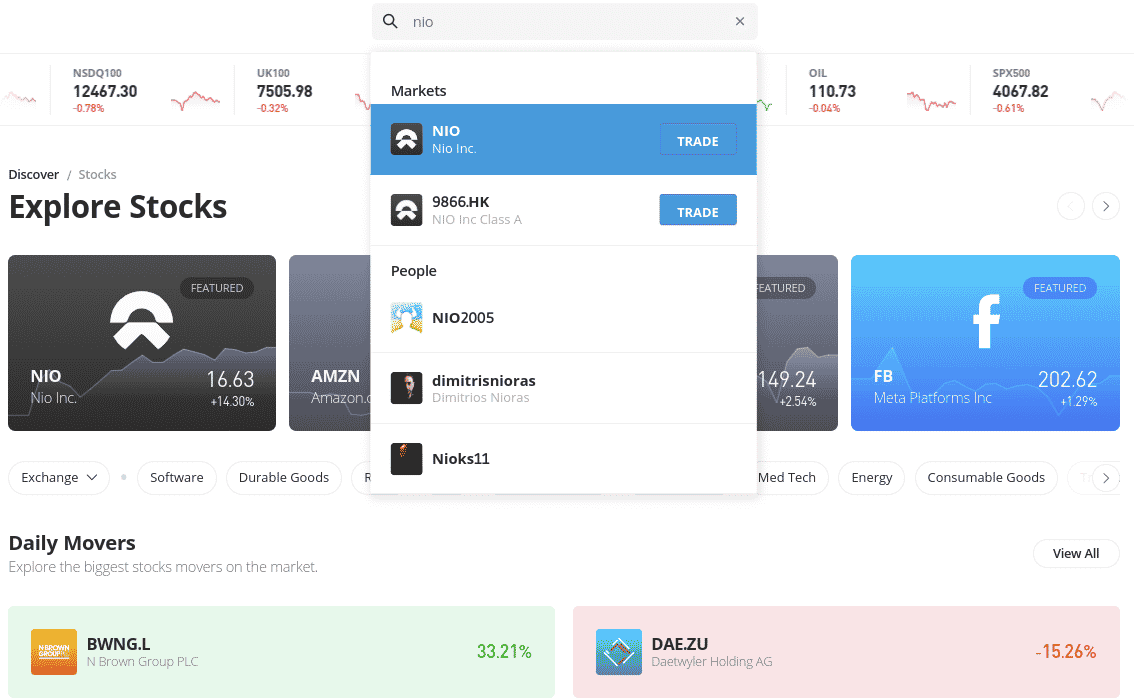

Look for Nio by entering the company name into the search bar on the main page of the platform. The moment you see it in the list, you can click ‘Trade’ to go straight to the order form to buy Nio stock, or just click it to view the firm’s price chart and social commentary. - 🛒 Step 4: Buy Nio Stock

Assuming you are ready to buy Nio stock now, you can complete the order form you see after clicking ‘Trade’. Enter an amount of $10 or more. Click ‘Open Trade’ to complete your Nio stock investment.

You will see a more detailed step-by-step account of how to buy stocks on eToro further down – should you need more guidance.

Step 1: Choose a Stock Broker

Deciding on where to buy Nio stock might seem daunting, but we’ve saved you plenty of online legwork by reviewing the top trading platforms with this listing.

The best trading platforms will be able to provide you with access to lots of assets in addition to Nio stock in a user-friendly space.

Low trading fees, having multiple payment types to choose from, and the option of fractional trading, are also advantages offered by the following platforms.

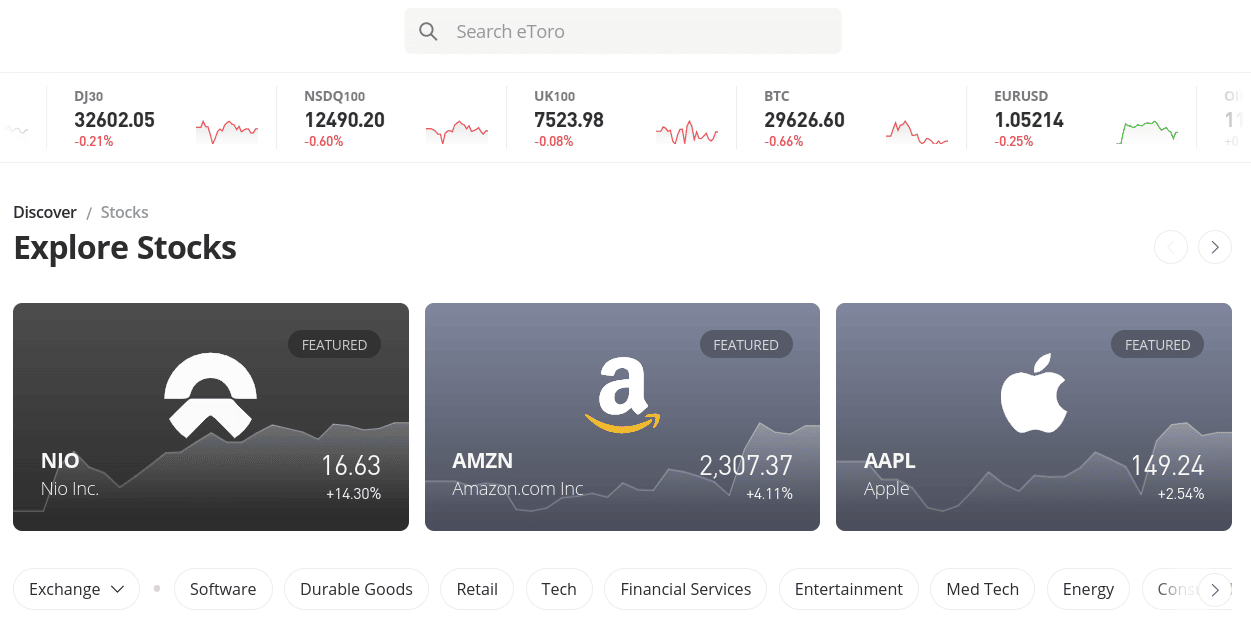

1. eToro – Overall Best Place to Buy Nio Stock

eToro offers a multitude of different markets and has more than 2,500 stocks for you to buy and sell, including Nio. This is the overall best place to buy Nio stock right now. You can start by allocating just $10, which at the time of writing will add a fraction of Nio stock to your portfolio.

Furthermore, the minimum deposit is also only $10 for US traders and you are not required to pay any fees when funding your account with USD. This broker accepts payment types such as debit and credit cards, as well as e-wallets that comprise Neteller, Skrill, and PayPal.

You can also make a deposit using a bank wire or Rapid Transfer. As a US trader, you can invest in Nio stock with no commission fees, which only leaves the market spread. We also found a diverse range of ETFs which, again, US traders can buy and sell on a commission-free basis.

If you want to diversify, you can also access the best cryptocurrencies in the US with just a 1% commission payable. Additionally, there is a range of Smart Portfolios to invest in. This entails investing $500 or more to a Smart Portfolio that focuses on stocks and thus adding a basket of equities to your portfolio automatically.

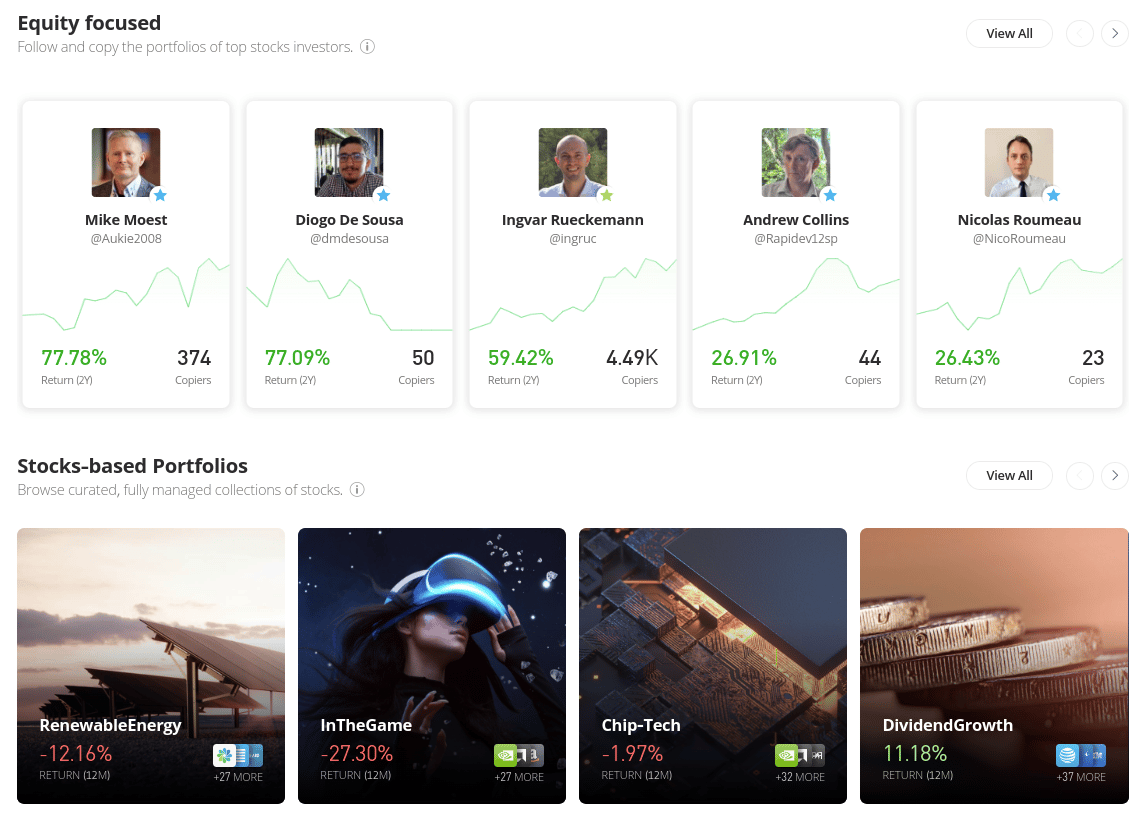

These are regularly rebalanced by eToro and you will find a range of curated collections and themes. Alternatively, you might consider allocating some of your stock investing funds to eToro’s standout feature: Copy Trading. This feature enables people at all skill levels to mirror the trading positions of seasoned investors.

Every single buy and sell order created by the person of your choosing is subsequently added to your own portfolio. As such, this offers newbies a way to shorten the learning curve and means you don’t need to research individual stocks to start investing. eToro also offers a free cell phone app that is really easy to navigate and will enable you to trade stocks on the go.

You could opt to familiarise yourself with how to buy Nio stock via the free paper trading account on offer. This is given to you automatically alongside a real account and is loaded with $100,000 in demo funds to help you to brush up on your trading skills.

| Number of Stocks | 2,500+ |

| Deposit Fee | FREE |

| Fee to Buy Nio | Commission-Free |

| Minimum Deposit | $10 |

What We Like:

- More than 2,500+ stocks

- Buy Nio stock at 0% commission

- Minimum deposit only $10

- Regulated by numerous top-tier entities

- Accepts PayPal and debit/credit card deposits

- User-friendly stock trading app

Your capital is at risk.

2. Webull – Buy Nio Stock From Only $5 Via Fractional Trading

Webull is another top choice for beginners, but also for intermediate and seasoned traders. That is to say, the platform is simple enough to use for all skill sets and also offers advanced trading tools. You can buy US stocks with no commission here, too.

Webull is another top choice for beginners, but also for intermediate and seasoned traders. That is to say, the platform is simple enough to use for all skill sets and also offers advanced trading tools. You can buy US stocks with no commission here, too.

However, international stocks are offered as ADRs and can attract fees, so be mindful of that. There are more than 5,000 stocks listed at Webull. Trading tools include stock screeners, technical indicators, price charts, and a paper trading account loaded with demo funds.

Webull supports fractional trading. This means you can invest in Nio in fractional quantities of just $5 if you wish. This is a great way for newbies to ease themselves into stock trading and steadily build a portfolio. Creating an account from which to buy Nio stock is simple enough.

When it’s time to make a deposit so you have funds available, you can select A bank wire or ACH. The latter is free of charge, whereas bank wire transfers command a fee of $8 on each and every transaction, which can soon add up.

There is no minimum deposit here. There is another fee to consider if you opt for bank a wire – withdrawals. Cashing out via this method will attract a fee of $25 on every transaction. Webull also offers a stock app that can be downloaded to your cell phone for free and enables you to monitor your Nio investments on the move.

| Number of Stocks | 5,000+ |

| Deposit Fee | ACH – free / Bank wire – $8 |

| Fee to Buy Nio Stock | ADRs range between $0.01 and $0.03 per share |

| Minimum Deposit | $0 |

Pros

- No minimum deposit

- Minimum stock investment is just $5

Cons

- International stocks offered via ADRs only

- No copy trading tools

- Does not support e-wallets or debit/credit cards

Your capital is at risk.

Step 2: Research Nio Stock

You will, of course, need to research the company in full when learning how to invest in Nio stock.

This includes exploring Nio’s stock price history as well as what the company does and how it generates its revenue.

We talk about all these key factors next to help you familiarise yourself with how to buy Nio stock in an informed manner.

What is Nio?

Nio is a growing EV (electric vehicle) maker. Based in Shanghai, the company has expanded its global reach since it was created in 2014. Additionally, Nio is actively expanding its capacity in China.

Moreover, the company offers its full charging infrastructure in Norway and is launching in Denmark, Sweden, the Netherlands, and Germany in 2022.

- Nio has a goal of offering its services and infrastructure in 25 or more countries by the year 2025

- Although Nio isn’t as well-known as its American counterpart Tesla, at the time of writing, it’s listed as one of the top five EV companies in the world by market cap

- The ES8, the company’s first electric car, went on sale to the general public in December 2017, and deliveries began in the summer of 2018

- Next came the ES6 came later in the same year. Since then, Nio has released the EC6, ET7, and ET5, with variations of each

Nio also has a substantial research and development department focused on creating next-generation technologies in networking, artificial intelligence, and autonomous driving.

- In 2018, NIO’s invention led to the creation of the first Battery Switch station

- This provided Nio consumers with a unique 3-minute battery swap service

- This service has revolutionized the EV industry

- Nio revised its Battery-as-a-Service (BaaS) model a few years after its release

- The company now allows consumers who are enrolled in battery swaps to opt out and purchase their EV battery outright

The Fast Company World Changing Ideas awards acknowledged NIO’s Battery As a Service (BaaS) in 2021.

Nio’s vehicles are equipped with the NOMI platform, which the business says is one of the most powerful in-car AI assistants built by a Chinese company. It functions as a digital AI companion that personalizes the driving experience.

Nio Stock Price – How Much is Nio Stock Worth?

In 2018, Nio stock was added to the NYSE in the shape of ADRs at $6.26 each. For those unaware, ADRs enable international companies to list their stock on US exchanges. Nio is also on the Hong Kong exchange and has been approved for a listing in Singapore’s marketplace.

Nio stock remained under $10 until mid-2020. In July 2020, the company raked in roughly $1 billion in funding from China’s industrial Anhui province’s economic development agencies. As such, Nio decisively handled any liquidity concerns. This was in addition to an extra infusion from early investor Tencent Holdings.

This went down well with investors. From June 1 to July 10, 2020, the stock of NIO increased by more than 170%. Additionally, Nio sales rebounded impressively from the initial COVID-19 pandemic fallout. Nio stock reached its highest value of the year in November 2020 when it hit $54. This came following the news that Nio was right on track to expand into the European market.

Nio started 2021 trading at around $50 and by June of the same year had reached its all-time high of $62. In November 2021, Nio delivered 270% more EVs than the same time in 2020. However, by the end of 2021, developments in China caused Nio stock to fall. The country’s Finance Ministry announced that NEV subsidies will be slashed by 30% in 2022.

Nio stock went from $40 at the end of November to $20 by the end of January 2022. 2022 has been a rocky road for Nio shareholders so far. Stock is up nearly 47% over five years of trading and in Q1 2022 – Nio’s financial results presented a positive increase in deliveries, improved margins, and a rise in revenue.

- That said, Nio’s stock price is down over 76% from the aforementioned all-time high.

- This is largely because a new wave of COVID-19 hit China, causing mass lockdowns.

- Nio’s factories are located in Shanghai and the company has had to halt production temporarily.

- As such, this has affected the stock price of Nio.

Many market analysts think that Nio stock is likely to recover as China’s lockdowns are expected to ease by June 2022.

EPS and P/E Ratio

Prior to placing an order to buy Nio stock, make sure you look at some of the firm’s core financials.

To see a simple indication of the health of a company and how much growth you might expect, you can look at the EPS and P/E ratios, as summarized below:

- In 2019, Nio’s annual EPS was $-1.59. This illustrates a decline of over 84% from the year before

- In 2020, the annual EPS was $-0.73. This was a 54% increase from 2019

- In 2021, Nio’s annual EPS was $-1.05. This was a decrease of almost 44% from the previous year

- The twelve-month trailing EPS is $-0.99

- Nio’s P/E ratio is 0 as the company is not profitable yet

Nio’s sales are projected to increase by over 100% in 2022, according to the company. The carmaker feels confident in its ability to overcome the supply constraints that have hit the industry as a whole.

The company is currently working with partner CATL to increase battery supply.

Moreover, Nio expects to have enough high-end semiconductor processors under contract with Qualcomm and Nvidia, and to satisfy its manufacturing targets in 2022, which includes various new models.

Market Capitalization

At the time of writing, Nio has a market capitalization of over $22 billion. This places it in the top five EV companies in the world.

Index Funds

Nio is a composite of numerous index funds and the ETFs that track them. If you want to buy Nio stock via a basket of assets, you could opt for the iShares Core MSCI Emerging Markets or the First Trust NASDAQ Clean Edge Green Energy Index Fund.

Both can be traded at eToro with 0% commission payable. Adding a fund to your portfolio is a great way to diversify your EV investments with a single transaction.

Nio Stock Price Prediction

When you’re learning how to buy Nio stock, you will see many price predictions in the online space.

These should be taken with a pinch of salt.

Nonetheless, the general consensus on the future of Nio from both bulls and bears is as follows:

- The consensus price target for Nio according to multiple analysts who provide 12-month forecasts is $30.63

- The high estimate is $81.33 and the low estimate is $22.63

- According to the same analysis, the median estimate is up 114% from the previous price

If you elect to buy Nio stock today, make sure you do so off the back of your own research and not someone else’s forecasted price.

As we said, you can also look at its previous performance and financial reports to help you make an informed choice.

Nio Stock Dividends

Nio does not pay dividends. This is largely because the EV maker is yet to turn a profit.

If you were hoping for a passive income, you can access thousands of the best dividend stocks in fractional quantities at eToro. The lowest investment is just $10 and you will pay 0% commission on all dividend stocks and ETFs.

Is Nio Stock a Good Buy?

Whether or not you should buy Nio stock will depend on a range of factors. Namely, your personal experience, tolerance for risk, and trading interests.

Below you will see some more information about Nio, including upcoming and existing projects. This should aid your decision-making process when deciding whether to buy Nio stock.

Nio Provides the EV Industry With Innovative Charging Solutions

China’s electric vehicle sector is booming. This massive growth opportunity in the Chinese EV industry puts NIO in a unique position to grow and expand its market share. Nio has a lot of room for expansion, thanks in part to technical advancements.

- Nio sets itself apart with its industry-leading battery swap technology, Battery as a Service (BaaS). This is a subscription model that separates the vehicle and the battery

- Instead of charging the battery, it can be replaced at one of Nio’s swap stations located throughout China

- As we touched on, Nio continues to develop its battery-swapping technology in both China and Norway and will expand further throughout 2022. In China alone, Nio has 900 swap stations at the time of writing, a number that continues to grow

- Using the ES8 as an example, the EV automatically parks at the switching station after pressing a button on the center display. This causes it to raise, allowing for the removal of the battery pack

- The replacement battery pack takes just a minute to install, and ES8 is ready to roll out again

This is highly innovative as in just a few minutes, car owners may drive to a Nio garage and pick up a replacement battery. This feature allows for Nio’s EVs to be recharged many times faster than would be the case with traditional recharging technology

Furthermore, Nio cars can still be recharged in the traditional manner. When compared to charging, battery-swap technology is a preferable transfer format. This is largely because it allows for faster power replenishment and battery upgrading.

Nio is also in talks with Chinese and international competitors to license its battery swap systems and technologies. This could be a gamechanger for the revenue model of Nio moving forward.

Nio is Hedging Risk of Potential Removal From the NYSE

When you are researching how to buy Nio stock, you may have seen news surrounding Chinese companies facing expulsion from US equity marketplaces.

Put simply, Nio and hundreds of other US-listed Chinese companies have been added to a list of corporations facing delisting from American exchanges by the SEC.

Here’s what happened:

- In 2020, former President Donald Trump signed legislation called the Holding Foreign Companies Accountable Act.

- This requires US-listed foreign corporations to adhere to stricter auditing requirements.

- Those who do not obey the new guidelines may be removed from US exchanges such as the NYSE.

- To reduce the possibility of delisting, large Chinese businesses with US listings, such as JD.com and Alibaba have undertaken secondary listings, primarily in Hong Kong

- In March 2022, Nio, which is traded on the NYSE, completed a secondary listing in Hong Kong

- Nio’s stock will also be traded on a third exchange in Singapore – the SGX.

Moreover, if the company is delisted in the US, this gives the automaker more fundraising options. With that said, Nio is doing everything within its power to maintain its stock listing on the NYSE.

The company continues to comply with the updated regulations and applicable laws in both China and the US. That said, Nio is in a much better position should the worst-case scenario happen.

The EV Manufacturer is Well-Positioned for Global Expansion

The Shanghai Automobile Innovation Park is home to Nio’s worldwide headquarters. This site is largely responsible for integrated vehicle development, research, and manufacturing.

Nio’s North American headquarters, located in the heart of Silicon Valley, serves as a worldwide software development center of operations, employing hundreds of people. The company also has a 100-person office in Munich, which is generally regarded as a design hotspot.

Additionally, Nio has premises in London, a department that is in charge of the company’s many performance programs and its development of supercars.

Nio’s quick growth may be credited to a flurry of early investments from companies like Lenovo, Sequoia, Tencent, TPG, Temasek, and Baidu.

In terms of plans for expansion, the manufacturer inaugurated its first battery-swapping station in Norway in January 2022. The company plans to build a total of 20 in the nation.

As we said, Nio aims to have 5,000 swapping stations worldwide by 2025. Around 1,000 of them will be outside China. The company’s expansion will continue in Germany, Denmark, Sweden, and the Netherlands.

All in all, the EV maker aims to compete with the likes of Tesla in the long run.

EV Sales and Deliveries Are Positive

As we touched on, Nio also develops EV charging stations. In addition to this, the company offers roadside support, insurance, maintenance, and comprehensive data bundles. Having said that, the majority of its revenue is from its fleet of EVs.

As such, when you buy Nio stock, you will need to regularly check on the company’s sales and delivery reports as it could offer you some idea of potential revenue growth.

Despite challenges faced by many companies during the COVID-19 pandemic, whether supply issues or factories being forced to close, Nio has upped its EV deliveries.

Nio released delivery reports for March 2022 and here’s what we found out:

- In March 2022, Nio shipped 9,985 vehicles, an increase of almost 38% over the previous year.

- The ET7, Nio’s flagship premium electric sedan, commenced delivery at the end of March 2022

- In the first quarter of 2022, the company delivered a record 25,768 automobiles. That’s a 28.5% increase year over year

- Some of the EVs being delivered by Nio include ES8, ES6, EC6, and ET7

- The company plans to begin delivering the highly anticipated ET5 by late 2022, which is a smaller Sedan

Delivery growth slowed down during the Chinese New Year at the start of 2022, however, as you can see, Nio rebounded in the months that followed. Market commentators expect this trend to continue, helped by its expansion into the aforementioned countries.

For instance, the company’s flagship ET7, which is an electric Sedan, is set to be rolled out in Germany by the end of 2022. It’s likely the ES8 and ET5 will follow. The same goes for Denmark, the Netherlands, and Sweden.

Step 3: Open an Account & Buy Stock

It’s stress-free and convenient to open an account and buy Nio stock at eToro right now. As this was the overall best place to buy Nio stock in our earlier reviews, you’ll find a detailed walkthrough below.

Step 1: Open an eToro Account

Click ‘Join Now‘ and you will see a form appear for you to complete. Enter your desired username and password and your email address.

This can be followed by your first and last name, cell phone number, address, and social security number.

eToro also asks traders for some basic information about their investing history. This isn’t too invasive and is simply to gauge how much expertise you have and to offer you the best experience.

Step 2: Upload ID

All regulated brokers require traders to complete the KYC process prior to placing an order to buy Nio stock. eToro is no different and makes the process quick and painless.

- Attach a copy of your ID when prompted

- This must show your full name, date of birth, and a clear photo, as well as a valid issue date

- You can opt for a passport, state ID, or driver’s license

- Next, you will be promoted to attach a copy of a recently issued bank statement, electricity bill, or tax letter

There is a full list of accepted ID and residency documentation on the eToro platform if you need alternative options.

Step 3: Deposit Funds

eToro accepts deposits as low as $10 from US investors. To buy Nio stock today, fund your account with $10 or more and choose your preferred payment method from what is supported by the broker.

eToro will allow you to buy stocks with a credit card. Alternatively, you can fund your account using a debit card, bank wire, Rapid Transfer, and e-wallets.

The latter is inclusive of Neteller, PayPal, and Skrill. After entering your details, confirm your deposit and eToro will fund your account accordingly.

Step 4: Search for Nio Stock

At this stage, you have created an eToro account from which to buy Nio stock and have funds to invest with. All you need to do now is type ‘Nio’ into eToro’s search bar.

When you see it, click ‘Trade’ to indicate you wish to place an order to buy Nio stock now.

Step 5: Buy Nio Stock

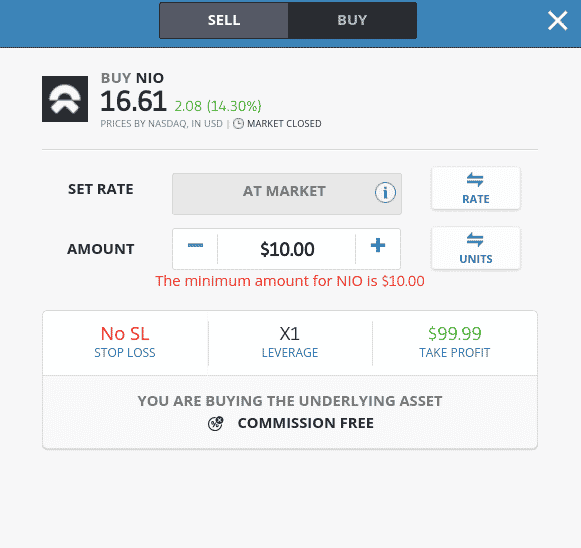

You can buy Nio stock now by entering $10 or more in the ‘Amount’ box. As you can see, here we are allocating $10 to a buy order.

Due to the price of the stock at the time of writing, this means we are opting to purchase a fraction of a share.

When you are happy with the details you’ve entered, you can confirm your order.

Next, eToro will add Nio stock to your list of invested assets. The full list of your investments can be found under ‘Portfolio’. This is where you can also close any positions as and when you are ready to cash out.

Nio Stock: Buy or Sell?

You should decide whether buying Nio stock is the right thing for you based on your own findings, goals, and risk tolerance.

With that said, many market analysts consider Nio stock a buy right now.

- The industry as a whole has suffered the effects of the COVID-19 pandemic, which led to the closure of factories and therefore halted production

- Moreover, there have been massive chip shortages that have affected EV manufacturers across the board

- That said, Nio has bounced back well from the aforementioned struggles. The company is still a start-up in the industry, so is yet to turn a profit

- However, Nio has plans to expand even further afield

- The process has already begun, with Nio battery swapping stations now in Norway as of January 2022

- By the end of 2022, Nio plans to offer EV battery charging networks and solutions to Sweden, Germany, Denmark, and the Netherlands. This is in addition to it increasing its presence in China and beyond

By 2025, Nio aims to have more than a thousand of its battery swapping stations outside of China in places such as the US and Europe. As such, you could buy Nio stock now, at a time when it is trading almost 77% beneath its all-time high.

Some market analysts foresee Nio stock being priced at around $55 by the year 2025. If this prediction is correct, you could be looking at gains of almost 280% by 2025. That said, bear in mind that this is only speculation.

Conclusion

It’s never been more convenient to buy Nio stock in the US. The EV manufacturer and battery swap station supplier is on track to achieve its goal of expanding beyond China to Norway, Denmark, the Netherlands, Sweden, and Germany.

Many market analysts think this EV stock is undervalued and thus – could produce attractive gains in the near future. The company is performing well financially for a start-up that was caught out by the COVID-19 outbreak and chip shortage issues.

When deciding where to buy Nio stock, eToro is well worth your consideration. This broker is regulated by the SEC, ASIC, the FCA, and CySEC – and US clients can invest with 0% commission.

eToro accepts fee-free US dollar deposits via credit/debit cards, e-wallets like PayPal, and more.

#cryptocurrency,#cryptocurrencynews,#cryptocurrencytrading,#cryptocurrencyexchange,#cryptocurrencymining,#cryptocurrencymarket,#cryptocurrencycommunity,#cryptocurrencys,#cryptocurrencyinvestments,#cryptocurrencyinviestments,#cryptocurrencyeducation,#cryptocurrencyrevolution,#allsortofcryptocurrency,#cryptocurrencytop10,#cryptocurrency_news,#instacryptocurrency,#cryptocurrencymemes,#investincryptocurrency,#cryptocurrencyinvestment,#cryptocurrencyisthefuture,#cryptocurrencyinvesting,#newcryptocurrency,#cryptocurrencylife,#cryptocurrencytrade,#cryptocurrencylifeinvest,#cryptocurrencymillionaire,#cryptocurrencytrader,#cryptocurrency_updates,#tradingcryptocurrency,#cryptocurrencysignals,#cryptocurrencytradingplatform,#cryptocurrencysolution,#cryptocurrencytraders,#cryptocurrency_for_dummies,#cryptocurrencymalaysia,#cryptocurrencytakingover,#cryptocurrencybali,#cryptocurrencyinvestors,#cryptocurrencyindex,#cryptocurrencyattorney