XRP is the native digital currency of the Ripple blockchain – which allows banks to transfer funds on a cross-border basis in a low-cost and fast manner.

If you’re wondering how to buy XRP today for your cryptocurrency portfolio – this guide will explain how to complete the process in less than five minutes with a regulated broker.

How to Buy XRP – Quick Steps

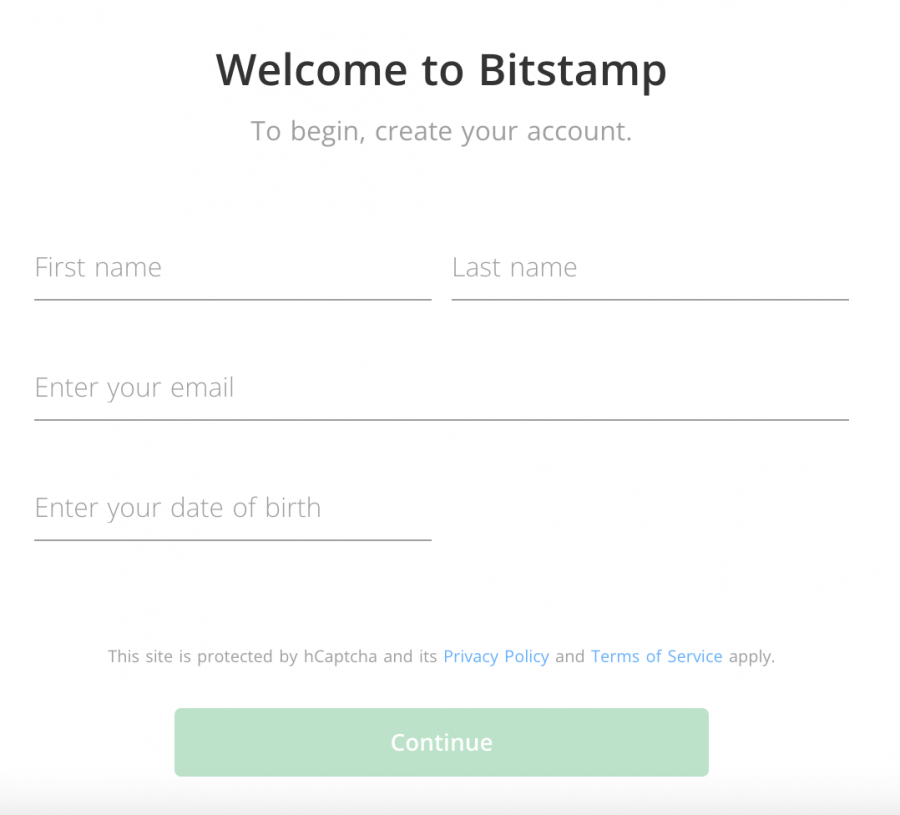

If you’re looking to buy XRP right now in the fastest and cheapest way possible – the step-by-step guide will walk you through the process with the highly-respected broker, Bitstamp.

Take note, Bitstamp has no minimum deposit amount and no fees are charged on ACH/SEPA deposits:

- ✅ Step 1: Open a Bitstamp Account: Head over to Bitstamp’s homepage and click ‘Get Started’. Enter your name, email address, and date of birth to create an account, then upload photo ID and proof of address for verification.

- 💳 Step 2: Deposit Funds: Click ‘Deposit’ on your Bitstamp dashboard and choose which payment method you’d like to use. ACH/SEPA deposits are free to make and have no minimum funding requirement.

- 🔎 Step 3: Search for XRP: Search for XRP on the Bitstamp trading platform and click ‘Buy’ when it appears.

- 🛒 Step 4: Buy XRP: In the order box on the right side of your screen, choose your trade type, enter the amount of money you’d like to invest in XRP, and click ‘Buy’ to facilitate the purchase.

If you’re looking to buy cryptocurrency in 2022, you’ll need to pick a trusted crypto broker or exchange that suits your trading style and financial needs.

Where to Buy XRP

The best crypto exchanges in this space allow you to buy XRP safely and in a low-cost way. Moreover, your chosen exchange should also support your preferred payment method – such as a debit/credit card or ACH.

If you’re still wondering where to buy XRP for your personal requirements – consider the pre-vetted platforms reviewed below.

1. Bitstamp – Overall Best Place to Buy XRP for 2022

Our recommended platform when it comes to buying XRP is Bitstamp. Bitstamp is a low-fee crypto exchange that is ideal for beginners and experienced investors alike. The platform has been around since 2011 and provides trading services for over 4 million people worldwide.

Bitstamp offers over 50 cryptocurrencies to trade (including XRP) and stores 98% of customers’ assets offline, significantly boosting the security level. In terms of fees, Bitstamp only charges 0.5% on each trade, which is one of the lowest rates on the market. Users can also buy cryptocurrency instantly using a credit or debit card, although this will be accompanied by a 5% transaction fee.

Sign up via the links on Business 2 Community to unlock a Bitstamp sign up bonus.

Bitstamp also allows free ACH/SEPA deposits, with no minimum deposit threshold. In terms of the trading experience, Bitstamp ensures it is one of the best altcoin exchanges on the market by offering an array of advanced trading tools, along with the ability to set up your own trading interface. Users can also download Bitstamp’s dedicated mobile app, which features numerous order types and analytical tools.

Bitstamp offers one of the best crypto savings accounts called ‘Bitstamp earn’, which provides up to 5% APY on specific coins. The broker also has a dedicated market insights section, which rounds up the latest news and updates in the crypto market. Finally, since the Bitstamp platform is powered by a similar engine to the NASDAQ, all orders are executed rapidly, regardless of market conditions.

Cryptoassets are a highly volatile unregulated investment product.

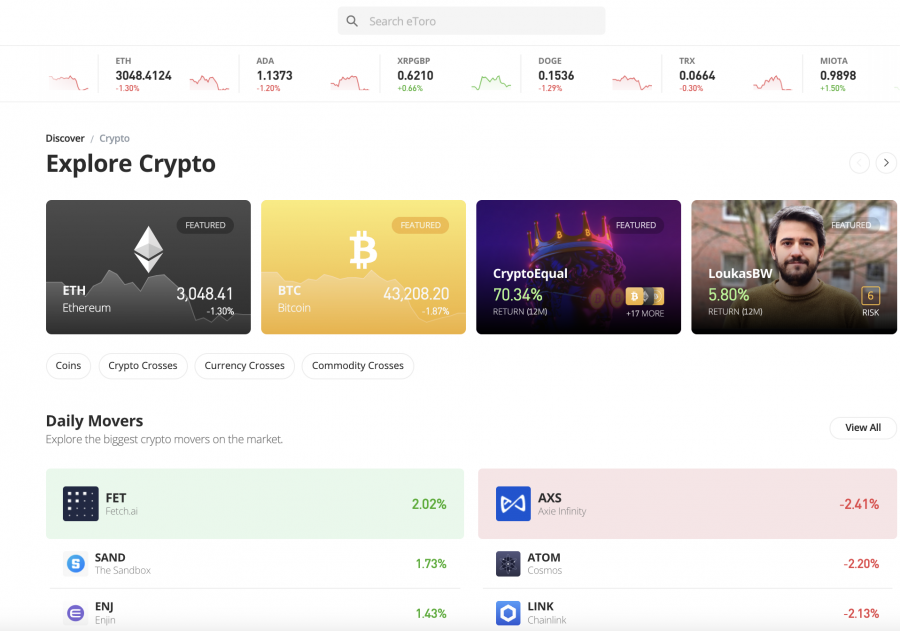

2. eToro – Secure Trading Platform with Cost-Effective Fee Structure

Founded in 2007 and now used by over 20 million traders, eToro is a popular online broker that is authorized and regulated by the SEC. In addition to FINRA membership, the platform is also licensed by bodies in Cyprus, the UK, and Australia. The eToro website is very simple to use and you can open a crypto account in less than five minutes. In doing so, you will be able to buy XRP on a spread-only basis.

Founded in 2007 and now used by over 20 million traders, eToro is a popular online broker that is authorized and regulated by the SEC. In addition to FINRA membership, the platform is also licensed by bodies in Cyprus, the UK, and Australia. The eToro website is very simple to use and you can open a crypto account in less than five minutes. In doing so, you will be able to buy XRP on a spread-only basis.

In simple terms, this means that the only fee that you need to pay is the gap between the buy and sell price of XRP. Moreover, as a US client depositing funds in USD, you won’t need to pay any transaction fees on any of the payment methods supported by eToro. This includes everything from debit/credit cards and domestic bank wires to Paypal and ACH. In terms of account minimums, you only need to deposit $10 at eToro to get started.

Once you have completed your XRP purchase, you might then consider buying a number of other promising cryptocurrencies. Some examples of supported tokens include Bitcoin, Cardano, Binance Coin, EOS, AAVE, Decentraland, and The Graph. Alternatively, you can also invest in a diversified basket of digital assets via the eToro CryptoPortoflio. In a nutshell, this is a pre-made portfolio that is managed and rebalanced by the eToro team – so you will be investing passively.

Additionally, the copy trading feature is another passive investment tool that allows you to inject capital with a successful eToro user. Anything that your chosen trader subsequently goes on to invest in will be mirrored in your own account. When it comes to storage, eToro offers one of the best crypto wallets in the market – which can be downloaded as a mobile app for iOS and Android smartphones. Finally, in addition to cryptocurrencies, eToro also supports stocks, forex, ETFs, indices, and more.

Cryptoassets are a highly volatile unregulated investment product.

3. BitDD — Top Crypto Exchange with Attractive Reward Schemes

BitDD doesn’t offer XRP yet. However, if you’re diversifying your portfolio to accommodate top cryptocurrencies like Bitcoin, Ethereum, TRON, Litecoin, and Chainlink, we recommend BitDD. It currently offers up to 14.5% interest p.a on crypto deposits.

New traders stand a chance to win up to 500 free USDT from the platform. What’s more? BitDD has launched a welcome reward program with 8888 USDT up for grabs daily, aimed at expanding its user base from 500,000 to 2M in a year.

BitDD is known for its high security and compliance standards. In fact, the crypto exchange has received a Money Service Business – Money Service Provider (MSB) financial license from the United States Treasury Department. This gives it a competitive edge in the market, where over 80% of trading platforms operate without certification. BitDD provides safe and secure currency and derivatives transaction services for top digital assets like BTC, ETH, and USDT.

The key highlight of BitDD is ‘Fast Trades’. The set of cutting-edge analytic tools makes crypto trading accessible and profitable for all users, regardless of their expertise. The platform also offers 90-day free trading to give you the time to explore the ecosystem. And you can reach out to the 24×7 support team and VIP account managers to make the most of the platform’s features and reward schemes.

BitDD is led by a team of industry experts with an excellent track record spanning over 20 years in financial investment and blockchain technology. The project is actively partnering with traditional regulators and bank partners to strengthen its foothold in the market.

Cryptoassets are a highly volatile unregulated investment product.

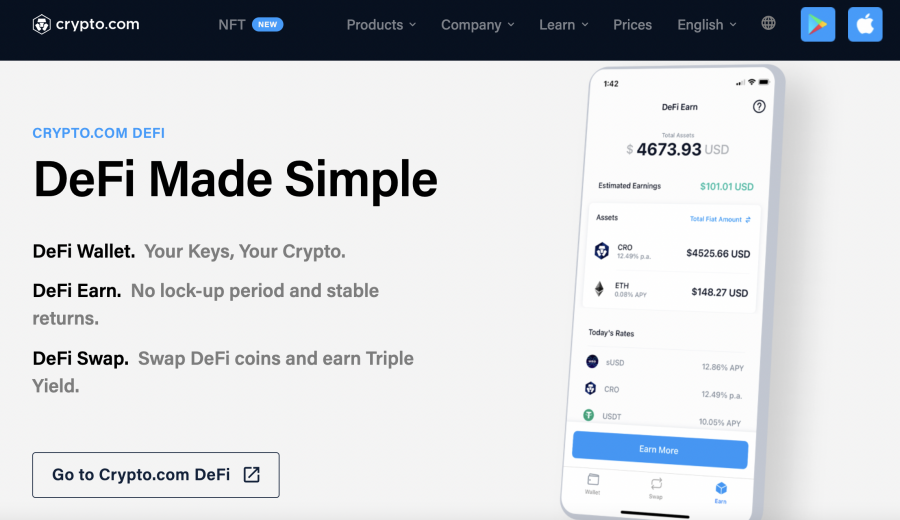

4. Crypto.com – Good Place to Buy XRP With a Debit Card

Crypto.com offers a user-friendly way to buy XRP from the comfort of home. You can complete your purchase after opening an account and uploading some ID. While some users prefer to use the Crypto.com website to buy and sell digital currencies, the provider also offers a popular mobile app for iOS and Android. Either way, when you buy XRP at Crypto.com – the fastest payment method is to opt for a debit card.

Crypto.com offers a user-friendly way to buy XRP from the comfort of home. You can complete your purchase after opening an account and uploading some ID. While some users prefer to use the Crypto.com website to buy and sell digital currencies, the provider also offers a popular mobile app for iOS and Android. Either way, when you buy XRP at Crypto.com – the fastest payment method is to opt for a debit card.

This will allow you to purchase your chosen number of tokens instantly, albeit, the standard fee for debit card transactions at Crypto.com is 2.99%. The good news, however, is that for the first 30 days after opening your account, this fee is waivered. When it comes to commissions, Crypto.com charges a standard rate of 0.4% per slide. You can, however, reduce your commission by trading higher volumes or holding the platform’s native token – CRO.

Once you have invested in XRP, you might then consider checking out the 250+ other supported tokens on the Crypto.com platform. Moreover, the platform offers a range of other crypto-centric services, such as the ability to earn interest on your investments. There are no lock-up periods to benefit from an interest-earning account and APY rates will vary depending on the respective token. Finally, Crypto.com also offers its own debit card that allows you to spend your crypto in the real world.

Cryptoassets are a highly volatile unregulated investment product.

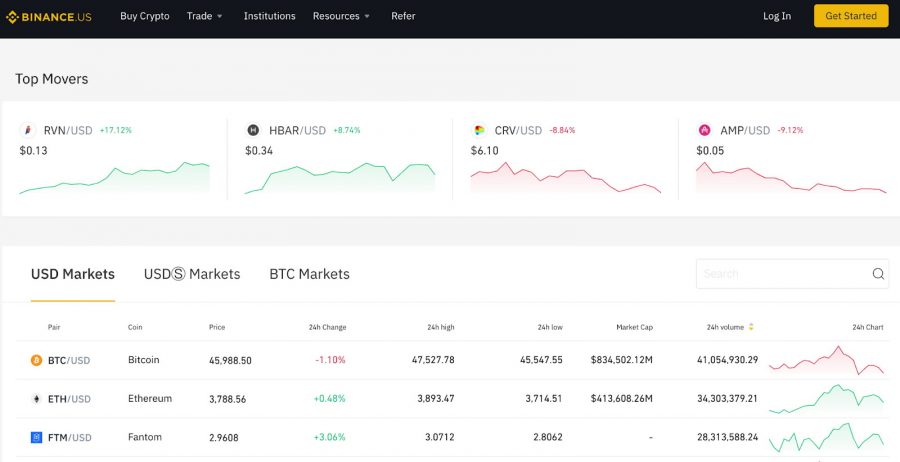

5. Binance – Buy XRP With Crypto at Super-Low Fees

Binance is by far the most popular exchange in the cryptocurrency trading arena, with volumes that often surpass $10 billion per day. Moreover, the exchange is home to over 100 million trading accounts. In order to buy XRP at Binance, you can either deposit funds with dollars or crypto. The latter, however, offers the cheapest way to access XRP, not least because you will only pay a commission of 0.10% per slide.

Binance is by far the most popular exchange in the cryptocurrency trading arena, with volumes that often surpass $10 billion per day. Moreover, the exchange is home to over 100 million trading accounts. In order to buy XRP at Binance, you can either deposit funds with dollars or crypto. The latter, however, offers the cheapest way to access XRP, not least because you will only pay a commission of 0.10% per slide.

If opting for a debit or credit card payment, the specific fee will depend on your location. For instance, those in the US will pay 4.5% of the transaction amount – which is expensive. Banking options – such as ACH and wires, are fee-free, but it can take several days for the funds to land in your Binance account. Nevertheless, once you have bought XRP, the tokens will then be placed in your Binance web wallet.

The web XRP wallet offers a range of security tools, such as two-factor authentication, device whitelisting, and cold storage. Furthermore, Binance also has a Safe Asset Fund for Users (SAFU), which is an insurance policy to help compensate traders in the event of a hack. Alternatively, Binance also offers a non-custodial storage facility in the form of the Trust Wallet, which can be downloaded free of charge on both iOS and Android devices.

Cryptoassets are a highly volatile unregulated investment product.

What is XRP?

Launched in 2012, XRP is the native digital currency of the Ripple blockchain. In its most basic form, Ripple offers a highly efficient payments network to banks and financial institutions, which allows stakeholders to perform cross-border transactions in a cheap, fast, and cost-effective way.

As a result, this allows banks and financial institutions to move away from the SWIFT network, which is not only slow and expensive but fraught with red tape. Furthermore, and as we discuss in more detail shortly, the Ripple network is ideal for banks and institutions that wish to transact in emerging currencies that lack liquidity in the broader market.

This is because XRP acts as a bride of liquidity, so interbank transactions can be executed in an efficient and timely manner without needing to utilize the services of corresponding banks. With that being said, although XRP is aimed at banks and financial institutions, the digital token trades freely in the cryptocurrency markets.

And as such, anyone can buy and sell XRP at the click of a button. Like any other digital asset that trades on public exchanges, the value of XRP will rise and fall throughout the day. Therefore, when you buy XRP for your own portfolio, you will make a profit if the value of XRP increases – in relation to your original cost price.

Note: Although Ripple operates as a legal entity in the US, you cannot buy XRP stock. Instead, the only way to invest in Ripple is to buy XRP tokens from an online exchange.

Is XRP a Good Investment?

XRP is one of the most established cryptocurrency tokens in this industry. This gives the project a solid foundation and track record that very few tokens can mirror.

However, whether or not XRP is a viable investment for your portfolio remains to be seen. In order to make an informed investment decision today, we would suggest researching the project from top to bottom.

To help you along the way, below we explore some of the core reasons why you might decide to buy XRP.

Interbank Transaction Speed

We briefly mentioned above that Ripple and XRP allow banks and financial institutions to move away from the SWIFT network, which has dominated the vast bulk of interbank transactions since the 1970s.

- In fact, trillions of dollars worth of capital go through the SWIFT network each and every day – even though the framework is slow, expensive, and filled with regulatory red tape.

- Regarding transaction speeds, interbank transfers that currently go through SWIFT can take 3-5 working days to settle, especially if less-liquid currencies are being used.

- However, in the case of Ripple and XRP, the average transaction time is just 3.86 seconds.

- Not only is this the case irrespective of where the sender and receiver are based – but the specific currencies being used in the transaction.

Moreover, it is important to note that XRP is not just faster than legacy networks like SWIFT. On the contrary, when you compare XRP to the likes of Bitcoin – which requires 10 minutes to settle a transaction, XRP is actually one of the fastest blockchains in this industry.

And as such, Ripple and XRP have the required efficiency levels to become the go-to network for global payments.

Cross-Border Fees

In addition to slow transactions, SWIFT and other legacy payment networks can be expensive. This is especially the case when banks and financial institutions are required to send and/or receive an emerging currency.

This is because – as we cover in more detail shortly, emerging currencies suffer some low liquidity levels, and thus – transactions require the services of corresponding banks.

However, in the case of Ripple and XRP, the underlying technology permits super-cheap transfer fees – regardless of the currency of the location of the transacting parties.

In fact, since the Ripple network was launched, the average transaction fee stands at just $0.0008007. This means that banks and financial institutions can transfer significant sums of capital while paying just a tiny fraction of a cent in fees. It is important to note that XRP transaction fees are also cheap in comparison to other blockchain networks.

- For example, over the prior year, Bitcoin has averaged a transaction fee of between $2 and $60.

- Ethereum is equally as expensive, with the blockchain charging an average fee of between $4 and $70 over the prior year.

With this in mind, XRP is also suitable for lower-level transactions, while the likes of Bitcoin and Ethereum aren’t.

Scalability

When you come across the term scalability in the blockchain industry, this refers to the number of transactions that a network can facilitate on a per-second basis.

- For example, Bitcoin is able to handle just 7 transactions per second.

- In the case of Litecoin and Dogecoin, an average of just 56 and 33 transactions per second can be processed.

- However, XRP is significantly more scalable, with the Ripple network consistently handling 1,500 transactions per second.

- With that said, Ripple also notes that should it need to – its network can mirror that of Visa, which can handle up to 65,000 transactions per second.

This is absolutely crucial if Ripple and XRP wish to become the dominant payments network in the global interbank transaction industry.

After all, trillions of dollars worth of currency change hands between banks and financial institutions each and every day.

Solves Liquidity Issues

We briefly mentioned earlier that when banks and financial institutions transact in emerging currencies, there is often a lack of liquidity available in the market.

And as such, the utilization of corresponding banks is required to facilitate the transaction – which results in payments attracting high fees and low processing times.

Here’s an example of how the current process typically works when emerging currencies are transferred via SWIFT:

- Let’s say that a bank in Thailand wishes to send funds to a financial institution in Kenya

- The currencies being used in this transaction are the Thai baht and Kenyan shilling. Neither of these currencies is in high demand on a global scale, which means that there is very little liquidity in the market.

- As such, the transaction will initially see the Thai baht sent to corresponding bank A.

- Then, the funds will be sent to corresponding bank B.

- Next, corresponding bank B will transfer Kenyan shilling to the beneficiary.

As you can see from the above, when going through SWIFT, a transaction consisting of emerging currencies requires four stakeholders – which includes two intermediaries in the form of corresponding banks.

This is perhaps where Ripple really stands out, as the network still offers super-fast and cheap transactions regardless of what currencies are being exchanged.

This is because XRP acts as a bridge of liquidity. As such, the same example outlined above would not only alleviate the need for corresponding banks but it would be completed in less than four seconds at an average fee of $0.0008007.

XRP Price Performance

Now that we have explored the underlying technology of Ripple, we can now explore how XRP has performed in the open marketplace from an investment perspective.

- When XRP was first launched nearly a decade ago, CoinMarketCap notes that the token was trading at just $0.0056.

- While the value of the token remained flat for several years, it went on a parabolic run in 2017 to hit highs of over $3.40.

- This means that those investing in XRP at launch and holding on until late 2017 would have been looking at significant gains of over 60,000%.

- And as such, an initial investment of just $500 would have been worth over $300,000.

However, since peaking at more than $3.40, XRP has dropped in value by a considerable amount. In fact, XRP was trading at just $0.84 at the turn of 2022. This represents a decline of over 75% from its highs of late 2017.

On the other hand, if you like the sound of the Ripple project and believe that XRP has a fruitful future ahead, then this low entry price allows you to invest in the project at a huge discount.

Risks of Buying XRP

The only way to make an informed decision as to whether or not XRP is a suitable investment product is to consider both the risks and potential upside.

And as such, the sections below will open your mind to some of the main drawbacks to consider before you elect to buy XRP.

XRP Performance vs Broader Crypto Market

First and foremost, investors should be wary of the fact that in comparison to the broader cryptocurrency markets, XRP has performed poorly. More specifically, we are referring to the price action of XRP since its peak in late 2017.

For instance, virtually all cryptocurrencies at this time witnessed parabolic growth, with many breaching all-time highs between December 2017 and January 2018. Bitcoin, for example, breached $20,000 per token – which at the time, was a new high.

However, what was to follow was a prolonged bearish market for most digital assets. And as such, just like XRP, the value of the wider cryptocurrency markets took a major hit.

However, moving into 2021, a trend reversal came to fruition and new all-time highs were being smashed across the industry. Bitcoin and Ethereum, for example, breached highs of $68,000 and $5,000 respectively.

Crucially though, XRP has not managed to experience the same level of success as its cryptocurrency counterparts, with the digital token still worth considerably less than its prior highs of 2017.

- For example, we mentioned that at the turn of 2022, XRP was priced at $0.84 per token, which is 75% than its prior 2017 peak of over $3.40.

- In comparison, Bitcoin was priced at $44,000 in early 2022, which is 120% higher than its 2017 peak.

- Other cryptocurrencies – such as Binance Coin, have grown by over 2,000% during the same timeframe.

Ultimately, this means that XRP is experienced serious growth issues while the rest of the industry has since kicked on.

Interbank Transactions Require XRP for Less Than 4 Seconds

Another risk to consider before you buy XRP is that the digital token is only needed during the interbank transaction process for a matter of seconds.

This is because XRP is paired against the respective fiat currencies as a means to provide liquidity – but, once the transaction has been settled, the token has no use for the bank or financial institution involved in the transfer.

This can seriously hinder the demand for XRP, which in turn, can have a hugely negative impact on its ability to increase in value in the open marketplace.

Circulating Supply

You should also consider the risk that comes with the overall supply of XRP, insofar that as of writing, the team behind Ripple holds and controls 52% of all outstanding tokens.

This is an issue in cryptocurrency terms, as Ripple claims that its network is decentralized. However, with the team holding over 52 billion XRP, this equates to a significant amount of capital in dollar terms.

And as such, every time Ripple decides to release additional tokens into the circulating supply, this will have a negative impact on its value.

XRP Price

Although we have already discussed the XRP price action since the digital currency was launched, we are yet to explain how valuation is actually determined.

If you’re new to the world of cryptocurrencies, the good news is that the price of XRP works virtually the same as a traditional NYSE or NASDAQ stock. That is to say, just like stocks, the price of XRP is dictated by demand and supply.

So, as more and more become interested in the Ripple project and subsequently buy XRP for their portfolio, this will have a positive impact on its valuation. Equally, if the opposite happens – meaning more and more people are looking to sell, the XRP price will decline.

XRP Price Prediction

In terms of XRP price predictions, the most important thing for this digital currency to achieve is an approach back to its prior all-time high. As noted earlier, this stands at just over $3.40 – which was hit in late 2017.

Now, based on an early 2022 price of $0.84, this would require an upside of over 300%. Although this might sound high – this is nothing in cryptocurrency terms.

After all, many cryptocurrencies managed to grow in value by over 10,000% in 2021 alone. With that said, another thing to consider when making XRP price predictions is that based on a token value of $0.84 – this translates into a market capitalization of $40 billion.

Therefore, with such a large-cap valuation already in place, it could be argued that the upside potential with XRP is somewhat limited in comparison to other cryptocurrencies.

Ways of Buying XRP

This guide has thus far covered the following key topics:

- Best place to buy XRP – including reviews of top Ripple brokers for 2022

- Reasons to buy XRP

- Risks of investing in XRP

- XRP price action and predictions

Moving on, we will now discuss the best way to buy XRP online, in terms of paying for your digital tokens.

Buy XRP With Credit Card or Debit Card

Buying XRP from the comfort of your home can be achieved in less than five minutes when using a credit/debit card.

All you need to do is quickly register an account with a low-cost broker like Bitstamp, enter your card details, and that’s it – your XRP tokens will be added to your portfolio instantly.

With that being said, the average fee on credit/debit card payments in the crypto space is between 3-5% – so it’s important that you do your homework before opening an account. For instance, at Crypto.com and Binance – you will be charged 2.99% and 4.5% respectively.

Buy XRP With Paypal

Some cryptocurrency brokers will also allow you to deposit and withdraw US dollars via your Paypal account.

If you do decide to buy XRP with Paypal, you will benefit from an extra layer of security – insofar as you will not be required to enter your credit/debit card details directly.

In terms of where to buy XRP with Paypal, eToro allows you to do this on a fee-free basis. Once again, this is on the proviso that your Paypal account is funded in USD. Otherwise, you will pay a fee of 0.5%.

Buy XRP With Neteller or Skrill

If you hold funds in an alternative e-wallet, eToro also allows you to buy XRP with Neteller and Skrill. Alternatively, you might even consider depositing funds via WebMoney. Either way, no fees apply for USD deposits and the transaction will be processed instantly

Choosing an XRP Wallet

When it comes to wallets, XRP works differently from virtually all other cryptocurrencies. This is because Ripple requires you to allocate 20 XRP as a reserve. That is to say, if you wish the wallet to remain active, you cannot withdraw this 20 XRP.

Based on a price of $0.84 per XRP as of writing, this amounts to just under $17. \And of course, when XRP peaked at $3.40 – this would require a total lock-up of $68.

As a result, this will not be suitable for people that wish to invest a small amount of money into XRP. The good news is that if you buy XRP from the SEC-regulated broker eToro, this 20 XRP minimum is not required.

This is because as soon as you make your purchase – which requires a minimum investment of just $10, the XRP tokens will be added to your eToro web wallet. The tokens will remain there safely until you are ready to cash out.

How to Buy XRP – Tutorial

This guide has covered each and every factor that you need to be made aware of before you invest in XRP.

If you’ve made your mind up and wish to learn how to buy Ripple right now with the low-fee trading platform Bitstamp in less than five minutes – follow the detailed step-by-step guide below.

Step 1 – Open a Bitstamp Account

Navigate to Bitstamp’s homepage and click ‘Get Started’. Enter your name and date of birth, then provide a valid email address to create your account.

Step 2 – Verify Account

To gain full use of your Bitstamp account, you will have to verify your identity. To do so, click ‘Personal account verification’ on your profile page and fill in the form required for Bitstamp’s KYC checks. You’ll then be asked to upload proof of ID (e.g. passport) and proof of address (e.g. bank statement) for verification purposes.

Step 3 – Make a Deposit

Once verification is complete, click ‘Deposit’ on your dashboard and choose whether you will be using ACH or SEPA (depending on your location). Select which currency you wish to deposit, and Bitstamp will provide you with their bank details and a personal message.

You will then have to manually transfer the money from your bank account to these details whilst quoting the personal message in the reference box. Once this has been completed, the funds will be transferred and available in your account in 1-2 business days.

Step 4 – Buy XRP

Head over to Bitstamp’s web-based trading platform (or mobile app) and search for XRP. Click ‘Buy’, and an order box will appear on the screen. In this box, choose which order type you’d like to use, enter your position size, and click ‘Buy’ again to facilitate the trade.

Cryptoassets are a highly volatile unregulated investment product.

How to Sell XRP

We noted earlier that once you invest in Ripple at eToro, the tokens will be added to your web wallet without requiring the 20 XRP lock-up.

As such, if you want to sell XRP, you can do this at any given time by heading over to your portfolio and executing a sell order. The tokens will then be sold for US dollars and the proceeds added to your account.

Conclusion

Ripple and its underlying XRP token offer a highly efficient blockchain network for banks and financial institutions to transact on a cross-border basis.

Unlike legacy payment systems such as SWIFT, Ripple permits fast, cheap, and burden-free transactions irrespective of the location of the sender or receiver, or the currencies being used.

If this project aligns with your long-term investment goals – you can buy XRP right now with low fees by partnering with Bitstamp. There is no minimum deposit threshold to worry about when using this platform and trades can be opened with fees as low as 0.5%.

#cryptocurrency #cryptocurrencynews #cryptocurrencytrading #cryptocurrencyexchange #cryptocurrencymining #cryptocurrencymarket #cryptocurrencycommunity #cryptocurrencys #cryptocurrencyinvestments #cryptocurrencyinviestments #cryptocurrencyeducation #cryptocurrencyrevolution #allsortofcryptocurrency #cryptocurrencytop10 #cryptocurrency_news #instacryptocurrency #cryptocurrencymemes #investincryptocurrency #cryptocurrencyinvestment #cryptocurrencyisthefuture #cryptocurrencyinvesting #newcryptocurrency #cryptocurrencylife #cryptocurrencytrade #cryptocurrencylifeinvest #cryptocurrencymillionaire #cryptocurrencytrader #cryptocurrency_updates #tradingcryptocurrency #cryptocurrencysignals #cryptocurrencytradingplatform #cryptocurrencysolution #cryptocurrencytraders #cryptocurrency_for_dummies #cryptocurrencymalaysia #cryptocurrencytakingover #cryptocurrencybali #cryptocurrencyinvestors #cryptocurrencyindex #cryptocurrencyattorney