"

Insurtech Market Size And Forecast by 2031

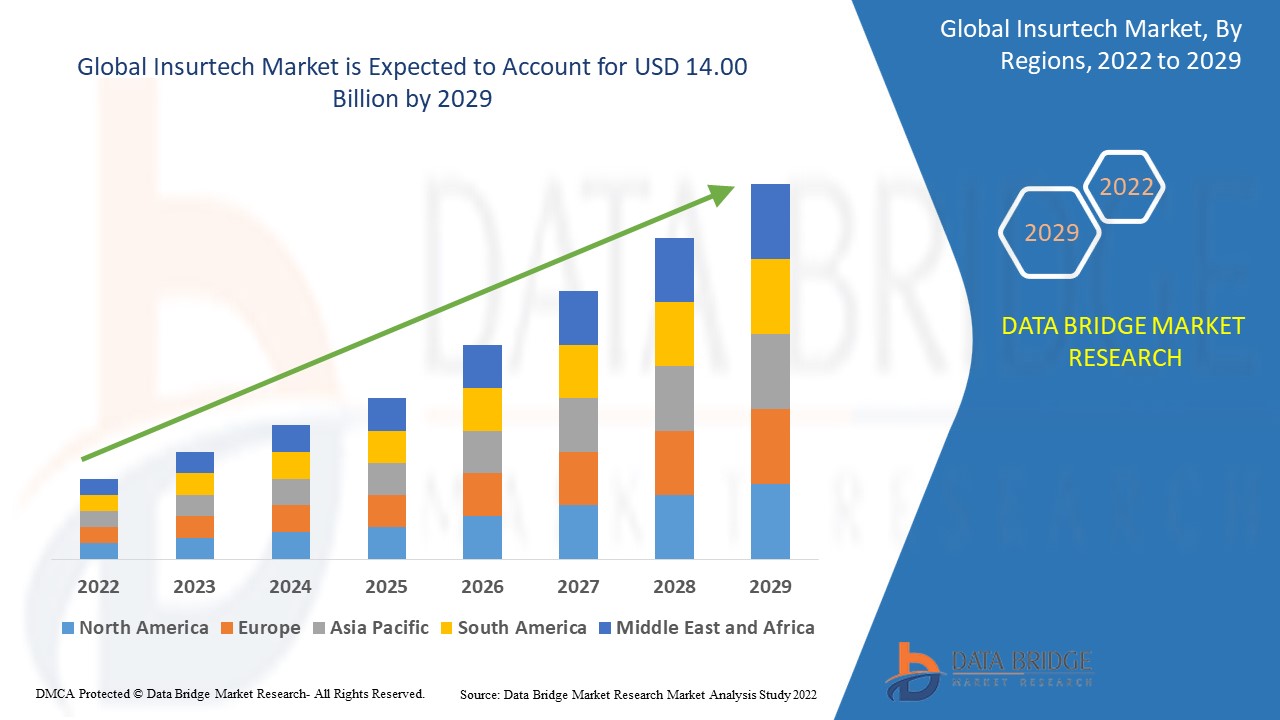

Global Insurtech market size was valued at USD 5.16 billion in 2023 and is projected to reach USD 19.53 billion by 2031, with a CAGR of 18.10% during the forecast period of 2024 to 2031. . Insurtech Market report provides a holistic evaluation of the market. The report offers comprehensive analysis of Size, Share, Scope, Demand, Growth, Value, Opportunities, Industry Statistics, Industry Trends, Industry Share, Revenue Analysis, Revenue Forecast, Future Scope, Challenges, Growth Drivers, leaders, graph, insights, Research Report, companies, overview, outlook and factors that are playing a substantial role in the market.

Global Insurtech Market Segmentation Analysis

Global Insurtech Market, By Product (AI, Hadoop, Block Chain), Application (Products, Services), Type (Auto, Business, Health, Home, Speciality, Travel) - Industry Trends and Forecast to 2029

Get a Sample PDF of Report - https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-insurtech-market

Which are the top companies operating in the Insurtech Market?

The “Global Insurtech Market ”study report will provide a valuable insight with an emphasis on the global market. The report profiles noticeable organizations working in the water purifier showcase and the triumphant methodologies received by them. It likewise reveals insights about the share held by each organization and their contribution to the Insurtech Market extension. This Insurtech Market report provides the information of the Top 10 Companies in Insurtech Market in the market their business strategy, financial situation etc.

**Segments**

- **Insurance Type**: The insurtech market is expected to witness significant growth based on different insurance types such as health insurance, property and casualty insurance, life insurance, and others. With the increasing adoption of advanced technologies like AI and blockchain, these insurance types are projected to transform in terms of personalized offerings, streamlined processes, and improved customer experiences by 2031.

- **Technology**: The technological segment within the insurtech market is poised for substantial expansion as key technologies including artificial intelligence (AI), machine learning, Internet of Things (IoT), and blockchain continue to reshape the industry landscape. By 2023 and beyond, insurtech companies leveraging these technologies are likely to enhance operational efficiencies, risk management capabilities, and product innovation to stay competitive in the market.

- **End-User**: In terms of end-users, the insurtech market is expected to cater to both businesses and individual consumers in the coming years. Insurtech solutions tailored for small and medium enterprises (SMEs) are anticipated to gain traction by 2031, offering tailored insurance products, online claims processing, and risk assessment tools. Additionally, solutions targeting individual consumers for personalized insurance plans and seamless digital experiences are likely to drive market growth.

**Market Players**

- **Lemonade**: Lemonade is a prominent player in the insurtech market known for its AI-powered insurance platform that offers renters, homeowners, and pet health insurance. The company's disruptive approach to insurance has gained traction among tech-savvy consumers and investors, positioning Lemonade as a key player to watch in the market by 2031.

- **Root Insurance**: Root Insurance is another notable insurtech company that focuses on auto insurance and utilizes telematics and data analytics to offer personalized premiums based on individual driving behaviors. With a strong emphasis on customer-centric digital experiences and risk assessment, Root Insurance is expected to shape the future of auto insurance through innovative insurtech solutions.

- **The insurtech market is a dynamic and evolving sector that is witnessing significant growth driven by various segments such as insurance type, technology, and end-users. In terms of insurance type, the market is projected to experience transformation across health insurance, property and casualty insurance, life insurance, and others as advanced technologies like AI and blockchain are increasingly adopted. This transformation is expected to result in personalized offerings, streamlined processes, and improved customer experiences by 2031. The integration of these technologies is reshaping the industry landscape, with artificial intelligence (AI), machine learning, IoT, and blockchain playing pivotal roles in enhancing operational efficiencies, risk management capabilities, and product innovation within the technological segment of the insurtech market. Insurtech companies leveraging these technologies are likely to stay competitive and drive market growth in the years to come.

Regarding end-users, the insurtech market is set to cater to both businesses and individual consumers, with tailored solutions for small and medium enterprises (SMEs) gaining traction by 2031. These solutions are expected to offer customized insurance products, online claims processing, and risk assessment tools to meet the evolving needs of SMEs. Additionally, insurtech solutions targeting individual consumers for personalized insurance plans and seamless digital experiences are poised to drive market growth as consumer demand for convenient and user-friendly insurance services continues to rise. In this context, the intersection of technology advancements and changing consumer preferences is shaping the future of the insurtech market.

When it comes to market players, notable companies like Lemonade and Root Insurance are standing out with innovative approaches to insurance services. Lemonade is renowned for its AI-powered insurance platform offering renters, homeowners, and pet health insurance, appealing to tech-savvy consumers and investors alike. Lemonade's disruptive stance in the market positions it as a key player to watch as the insurtech landscape evolves over the next decade. On the other hand, Root Insurance focuses on auto insurance and utilizes telematics and data analytics to provide personalized premiums based**Market Players**

- DXC Technology Company (US)

- Trov, Inc. (US)

- Wipro Limited (India)

- ZhongAn (China)

- TCS (India)

- Cognizant (US)

- Infosys (India)

- Pegasystems (US)

- Appian (US)

- Mindtree (India)

- Prima Solutions (India)

- Fineos (Ireland)

- Bolt Solutions (US)

- Majesco (US)

- EIS Group (US)

- Oscar Insurance (US)

- Quantemplate (UK)

- Shift Technology (India)

The insurtech market is a dynamic landscape driven by various segments and key players that are shaping the industry's future. As the market continues to evolve, advancements in technology, changing consumer preferences, and innovative solutions are driving growth and transformation within the industry. The integration of advanced technologies like artificial intelligence (AI), machine learning, Internet of Things (IoT), and blockchain is revolutionizing how insurance products are developed, delivered, and experienced. These technologies are enhancing operational efficiencies, enabling personalized offerings, and improving customer experiences, positioning insurtech companies to stay competitive and meet the evolving needs of businesses and individual consumers.

In terms of end-users, the insurtech market is expanding its reach to cater to both businesses and individual consumers. Solutions tailored for small and medium enterprises (SMEs) are gaining traction, offering customized insurance products, streamlined processes such as online claims processing

Explore Further Details about This Research Insurtech Market Report https://www.databridgemarketresearch.com/reports/global-insurtech-market

Overview of the Insurtech Market Research Report

The Insurtech Market research report commences with an in-depth overview covering definitions, applications, product/service launches, developments, challenges, and regional analysis. The forecast underlines robust growth fueled by increasing consumption in diverse markets. Furthermore, the report delves into current market trends and key characteristics.

Objectives of the Report

Conduct a comprehensive investigation to forecast the value and volume of the Insurtech Market.

Analyze and project market shares for major segments within the Insurtech Market.

Depict the evolving landscape of the Insurtech Market across global regions.

Examine and assess micro markets, their contributions, and growth potential within the Insurtech Market.

Provide accurate insights into the factors driving the growth of the Insurtech Market.

Offer a detailed analysis of key strategies adopted by major companies, such as R&D, collaborations, agreements, partnerships, acquisitions, mergers, new product launches, and other strategic initiatives.

Market Overview

The study concentrates on the present state of the Insurtech Market, evaluating key statistics including CAGR, gross margin, revenue, pricing, production growth rate, volume, value, market share, and year-over-year growth. This thorough analysis is conducted using the latest primary and secondary research methods. Leading company profiles are scrutinized based on factors like the markets they serve, production, revenues, market shares, recent developments, and gross profit margins. The report also provides a detailed exploration of market drivers, constraints, opportunities, challenges, and trends within the market dynamics section.

Table of Contents:

Research Objectives and Assumptions

Research Objectives

Assumptions

Abbreviations

Market Purview

Report DescriptionMarket Definition and Scope

Executive Summary

Market Snapshot, By Type

Market Snapshot, By Application

Market Snapshot, By Region

Market Dynamics, Regulations, and Trends Analysis

Market Dynamics

Drivers

Restraints

Market Opportunities

And more...

Browse More Reports:

Mountain Bike Shoes Market

Emergency Beacon Transmitter Market

Transfusion Bottle Market

Three-Dimensional Conformal Radiation Therapy Market

Blockchain in Cold Chain Market

Biologics Market

Beauty and Personal Care Surfactants Market

Polymer Modified Bitumen Market

Insurtech Market

Gonorrhea Testing Market

Flavoured Table Butter Market

Household Humidifier Market

Coffee Machines Market

Cholera Vaccines Market

Liquid Chemical Sensors Market

Organic Dried Distiller’s Grain Market

Agriculture Chemicals Market

Data Bridge Market Research:

Today's trends are a great way to predict future events!

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC: +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"