- Terra, through the Luna Foundation Guard, has raised $1 billion to develop Bitcoin-denominated forex reserved for its native stablecoin, UST.

- The foundation says other than the stablecoin’s algorithmic nature, the funds will be an additional shield from contractionary cycle effects.

LUNA, the native cryptocurrency of the Terra ecosystem, has spiked by 13.7 percent in the past day to trade at $56.31. The momentum comes after the Luna Foundation Guard (LFG) raised a whopping $1 billion through the over-the-counter (OTC) sale of LUNA tokens.

The fundraiser was led by Jump Crypto and Three Arrows Capital. Other participants were GSR, DeFiance Capital, Republic Capital, and Tribe Capital among others.

Of note, the Luna Foundation Guard is a non-profit organization that Terra set up in January this year. LFG’s main objectives are to fund Terra’s projects in the decentralized finance (DeFi) industry and to maintain the stability of the peg of the network’s native stablecoin – TerraUSD (UST).

Terra and the Luna Foundation Guard building Stablecoin reserve

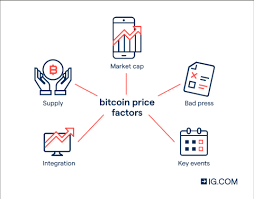

As for its latest funding, the LFG plans to use it in creating a Bitcoin-denominated forex reserve of the UST stablecoins. The organization said it chose the lead cryptocurrency since it considers BTC to be “less correlated to the Terra ecosystem.” LFG will release further details regarding the reserve’s function and design in the coming weeks.

Ranked 15th in the crypto market with a $12 billion market cap, UST is one of the most popular stablecoins in the DeFi ecosystem. It is also the first of its kind – an algorithmic stablecoin – to achieve such a feat in terms of market value. The term algorithmic means UST relies on supply and demand pressures to maintain its $1 price, rather than collateral. As Terra explains:

When the demand for Terra is high and the supply is limited, the price of Terra increases. When the demand for Terra is low and the supply is too large, the price of Terra decreases. The protocol ensures the supply and demand of Terra are always balanced, leading to a stable price.

Users of the Terra ecosystem can mint LUNA tokens by burning UST, or mint UST by burning LUNA tokens.

Such a mechanism portrays some superiority compared to using collateral, but it also carries its disadvantages. For instance, there is their reflexive nature, which Investopedia explains as the interaction between investor expectations and economic fundamentals. Reflexivity can lead to price trends that substantially and persistently deviate from the $1 equilibrium price of a stablecoin.

Additionally, there is the hypothetical risk of a “bank run” – a scenario in which a large number of users simultaneously request fund withdrawals, increasing the likelihood of sudden insolvency.

The LFG says combating these risks is part of why it chose a Bitcoin-based reserve:

Although the widespread adoption of UST as a consistently stable asset through market volatility should already refute this, a decentralized Reserve can provide an additional avenue to maintain the peg in contractionary cycles that reduces the reflexivity of the system.