The forex market is the largest trading sector globally, with trillions of dollars worth of currency changing hands each day.

Complete beginners might, however, find it challenging to make consistent profits – especially considering that forex trading requires solid knowledge of technical analysis.

This is why the copy trading phenomenon is becoming so popular, as it enables beginners to trade currencies passively by mirroring the positions of an experienced investor.

Therefore, the purpose of this guide is to explore the best forex copy trading platforms in the market today.

The Best Forex Copy Trading Platforms to Use for 2022

The best forex copy trading platforms in this space offer access to a large pool of experienced traders at low fees, alongside support for dozens of markets.

Below, we offer an overview of the best forex copy trading platforms to consider today.

- eToro – Overall Best Forex Copy Trading Platform This Year

- Capital.com via MT4 – 0% Commission Forex Trading Platform With 138 Pairs

- XTB via MT4 – Low-Cost Forex Broker With Support for MT4

- Vantage – Start Copy Trading with over 90,000 Forex Traders

- Axi – Award-Winning Broker Offering Copy Trading

- Pepperstone via Duplitrade – Automated Forex Trading With Zero Spreads

- AvaTrade via DupliTrade – Trade Forex via Automated Strategies

- XM via MT4 – Popular CFD and Forex Trading Platform

- NAGA – User-Friendly Platform With Proprietary Copy Trading Software

- ZuluTrade – Top Forex Copy Trading Platform for Data Aggregation

Investors can also read our guide on the best copy trading platforms for stocks, crypto, and commodities.

Best Forex Copy Trading Platforms Reviewed

Selecting the best forex copy trading platform will require the investor to focus on a number of core factors.

Firstly, you should have a good understanding of what forex trading is all about.This should initially focus on the copy trading tool itself – such as the number of investors that can be copied and whether any additional commissions will apply.

The investor will, however, also need to explore metrics surrounding the underlying broker – such as supported forex markets, fees and spreads, minimum deposits, and accepted payments.

Taking all of this into account and more – we found that the best forex copy trading platforms are those reviewed in the sections below.

1. eToro – Overall Best Forex Copy Trading Platform for 2022

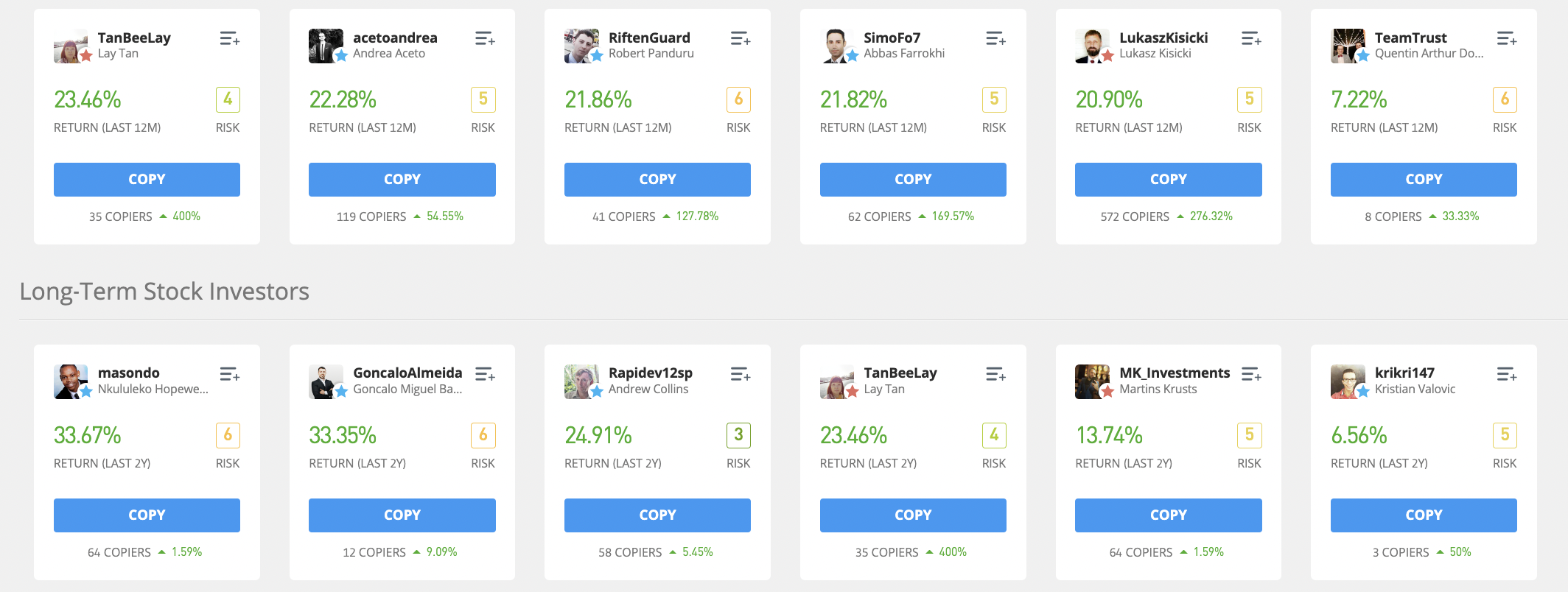

When comparing the many providers in this market, we found that eToro is a clear winner as the overall best forex copy trading platform this year. First and foremost, eToro has by far the largest pool of verified traders on its platform, many of which specialize in forex.

When comparing the many providers in this market, we found that eToro is a clear winner as the overall best forex copy trading platform this year. First and foremost, eToro has by far the largest pool of verified traders on its platform, many of which specialize in forex.

Moreover, eToro is used by more than 25 million clients, so the platform attracts vast sums of liquidity. Perhaps even more importantly, eToro is heavily regulated. This includes trading licenses with the SEC, ASIC, FCA, and CySEC. Therefore, eToro is arguably the best forex copy trading platform for safety and trust.

Before investors can access the eToro copy trading tool, they must first register and verify an account. Not only does it take less than five minutes to get started, but the minimum first-time deposit amounts to just $10 (US/UK clients, $50 elsewhere). And, several instant payment methods are supported – including Paypal, Skrill, Neteller, Visa, MasterCard, and more.

We should also note that US dollar deposits and withdrawals do not attract any fees. While in the case of other currencies, the deposit fee amounts to just 0.5%. Once the account is verified and funded, eToro users can then begin the research process. By this, we mean choosing from one of the many thousands of verified copy traders on the platform.

We found that eToro offers a wealth of information in this regard, all of which is backed by handy filters and search tools. For instance, the first port of call might be to sort copy traders by their preferred asset – in this case, forex. After that, the investor can assess the average monthly return of each forex trader since they joined eToro.

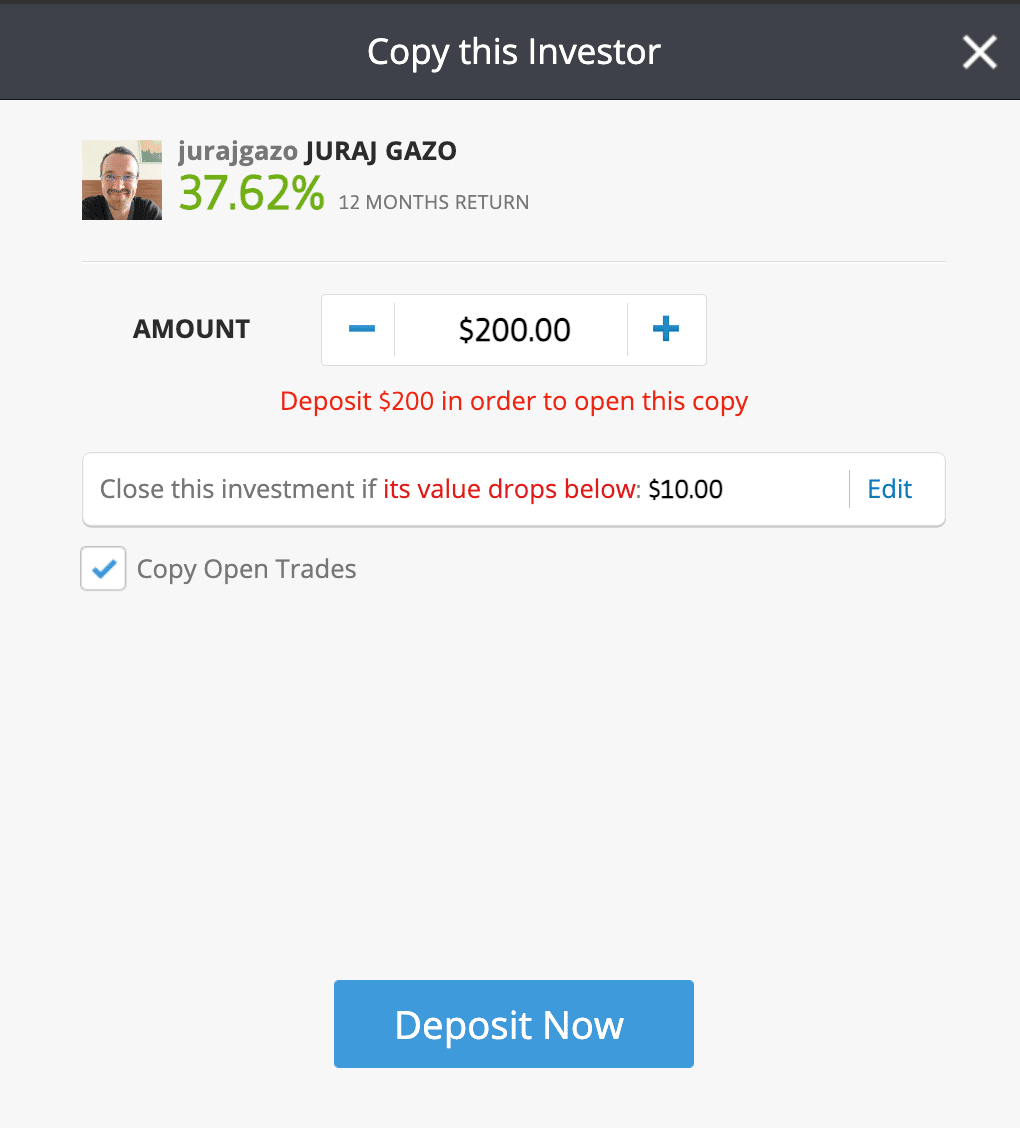

Naturally, traders with the best-performing portfolios should be favored. However, longevity, as well as risk and the average trade duration, should be taken into account too. After a suitable copy trader for forex has been selected, the eToro user can then elect to mirror all future trades at a minimum outlay of $200. Additionally, eToro users can join the eToro Club right now and receive one of the best forex bonus offers of $250 after depositing $5k or more into their live trading accounts.

All future positions will automatically be mirrored in the eToro account at a proportionate amount to the original investment. For example, if the user invests $200 and the forex trader risks 10% on a EUR/USD position, this will amount to a stake of $20. When it comes to fees, eToro does not charge any additional commissions for its copy trading service.

Instead, copy traders are remunerated by eToro, based on the number of followers they have. With that said, like all forex brokers, eToro is in the business of making money. As such, it charges a competitive spread from 1 pip per slide, with no commission application.

Another reason why we found that eToro is the best forex copy trading platform is that it offers leverage. Eligible traders will likely have access to leverage of up to 1:30 when trading forex, and less on other asset classes. Professional clients, however, will likely be offered much higher limits. eToro is also considered to be one of the best swap-free account brokers in 2022 as it allows users to speculate on popular forex pairs via its Isalmic trading account.

Supported forex markets on the eToro cover almost 50 pairs, most of which are majors and minors. In addition to forex, eToro also offers ETF trading, alongside commodities and indices. Users can also buy Bitcoin and more than 90 other digital currencies. eToro also offers more than 2,500 stocks, all of which are commission-free – even those based outside of the US markets.

Complete beginners will appreciate that eToro also offers a demo account. This mirrors all of the markets available on the eToro platform – including copy trading, albeit, users will be using paper money. eToro also offers a mobile app that is free to download on iOS and Android phones/tablets. This enables investors to keep track of their copy trading positions.

Pros

- The overall best copy trading platform integrating automated forex trading software

- Choose from thousands of verified copy forex traders

- Comment and ‘Like’ messages from other traders

- The minimum copy trading investment is $200

- No additional fees for using the copy trading tool

- Heavily regulated broker

- Supported assets include stocks, ETFs, forex, crypto, and commodities

Cons

- No support for third-party platforms like MT4

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

2. Capital.com via MT4 – 0% Commission Forex Trading Platform With 138 Pairs

![]()

Capital.com is a popular forex trading platform that supports a huge range of markets. Across 138 pairs, this covers all majors and minors and a diverse selection of exotics. Although the Capital.com platform does not offer proprietary forex copy trading services, it does support MT4.

And therefore, traders can utilize the copy trading tool on MT4 and connect their account to Capital.com. In doing so, all underlying trades performed will be conducted on a commission-free basis. Furthermore, Capital.com offers competitive spreads, with EUR/USD starting at just 0.6 pips.

In terms of what’s on offer via MT4, users can select from a broad range of traders and strategies to copy. Some are free while the most profitable traders charge a flat fee to gain access. For example, the North East Way strategy – which is priced at $67 on MT4, has generated real-time growth of over 8,000% since its inception in 2018.

Then there is the Greezly strategy, which has grown more than 4,000% since 2018. This particular option costs $30. Back to Capital.com, and just like eToro, this platform is heavily regulated.

The provider is licensed by the NBRB, FCA, ASIC, and CySEC. Capital.com requires a minimum deposit of $20 on debit/credit card and e-wallet transactions, and $250 when transferring funds via a bank wire. Capital.com is also one of the best forex copy trading platforms for those that seek access to alternative markets.

This CFD provider covers stocks, indices, commodities, cryptocurrencies, and ETFs. Leverage of up to 1:30 is available to retail clients when trading forex and the platform also supports an iOS and Android app.

Pros

- Trade forex passively via an MT4 link

- No commissions are charged on any supported markets

- Deposit from just $20 via a debit/credit card or e-wallet

- Regulated by multiple bodies

- 138 forex pairs and thousands of other CFD markets

Cons

- CFDs only – so no US clients

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

3. XTB via MT4 – Low-Cost Forex Broker With Support for MT4

XTB is another top-rated CFD broker that supports forex copy trading via MT4. Those preferring the MT4 route will appreciate that XTB offers some of the lowest trading fees in the forex market. For instance, when trading EUR/USD, spreads start at just 0.1 pip.

Traders also have the option of opening a swap-free account, meaning that extended positions do not attract overnight financing fees. The spreads on this account are, however, slightly higher than the standard account. XTB offers a good blend of markets across 49 forex pairs, which is in addition to stocks, commodities, indices, and ETFs.

The xStation app will also appeal to those that wish to keep tabs on their forex copy trading endeavors while on the move. There is no minimum account balance to meet at XTB, which will appeal to those on a trading budget. The platform also offers leverage of up to 1:500. However, limits will depend on the account holder’s country of residence and whether they are a retail or professional client.

Note: MT4 trading at XTB is now only accessible to existing users. New customers will need to use the provider’s proprietary platform – xStation 5.

Learn More: Read our full XTB review.

Pros

- Spreads start at just 0.1 pips

- High leverage limits for eligible clients

- XTB is also one of the best NDD forex brokers offering some of the tightest spreads on the market

Cons

- Does not support US clients

- MT4 is only accessible to existing clients

Visit XTB Now

78% of retail investor accounts lose money when trading CFDs with this provider.

4.Vantage – Start Copy Trading with over 90,000 Forex Traders

A global CFD trading platform, Vantage offers investment opportunities in multiple instruments, including Forex pairs, cryptos, commodities, indices and shares. Vantage offers its services through MT4 and MT5 trader – which offers thousands of charting and customization options for trades.

A global CFD trading platform, Vantage offers investment opportunities in multiple instruments, including Forex pairs, cryptos, commodities, indices and shares. Vantage offers its services through MT4 and MT5 trader – which offers thousands of charting and customization options for trades.

A STP/ECN account – Vantage offers two different main accounts. While the STP account offers commission-free trading, the ECN account lets investors trade FX pairs with a lower spread. For example, the ECN account takes an average spread of 0.2 pips while trading the popular EUR/USD pair.

One of the top features on Vantage is social trading. Vantage has partnered with Autotrade, to connect their users with over 900,00 forex traders. With Autotrade, Vantage users can copy the exact trades of the different investors. The 90,000 + traders are approved by Autotrade and are thus some of the most experienced professionals to copy trades from.

After creating a Vantage account in under 5 minutes, interested traders can connect their accounts with Autotrade to get started. While the STP account requires a $200 minimum deposit, the ECN account requires a $500 minimum deposit.

Pros

- MT4 Compatible

- No commission on STP account

- Low Spreads with ECN account

Cons

- High minimum deposit on ECN account ($500)

5. Axi – Award-Winning Broker Offering Copy Trading

Using Axi for Copy Trading means getting exposure to a platform that’s won several awards for its impeccable services. Traders wanting to copy the trades of professionals can access forex, stocks, indices, precious metals and even oil markets.

Using Axi for Copy Trading means getting exposure to a platform that’s won several awards for its impeccable services. Traders wanting to copy the trades of professionals can access forex, stocks, indices, precious metals and even oil markets.

What sets Axi apart from most platforms offering Copy Trading is that its top 50 investors have achieved returns of 263%. Beginners can filter the search for the professionals that provide results aligned with their goals. Axie lists key stats of the professionals so that copiers can gauge the right fit. The best part about Copy Trading on Axi is that it’s free. Some of the top investors charge subscription services.

To optimize results, beginners can copy multiple traders simultaneously. Axi recommends a minimum of $250 for Copy Trading, but lower balances are accepted. To use copy trading, traders need to connect their MT4 platform to the Copy Trading app. Axie provides detailed video tutorials on how to use MT4 and connect the app.

Although beginners copy the trades of professionals, they don’t have to mimic their risk. Beginners can adjust their risk settings to suit their goals.

Traders can combine two other features to Copy Trading to optimize their profits. Beginners should grasp the basics of technical analysis, and PsyQuation and AutoChartist assist. PsyQuation helps reduce trading mistakes by providing performance analytics, and AutoChartist scans the market for trading opportunities and alerts for potential trades.

Pros

- Top 50 investors provide 263% returns

- 400:1 leverage for elite accounts

- PsyQuation and AutoChartist tools

Cons

- Some investors charge subscriptions for Copy Trading

81.6% of retail investor accounts lose money when trading CFDs with this provider.

6. Pepperstone via DupliTrade – Automated Forex Trading With Zero Spreads

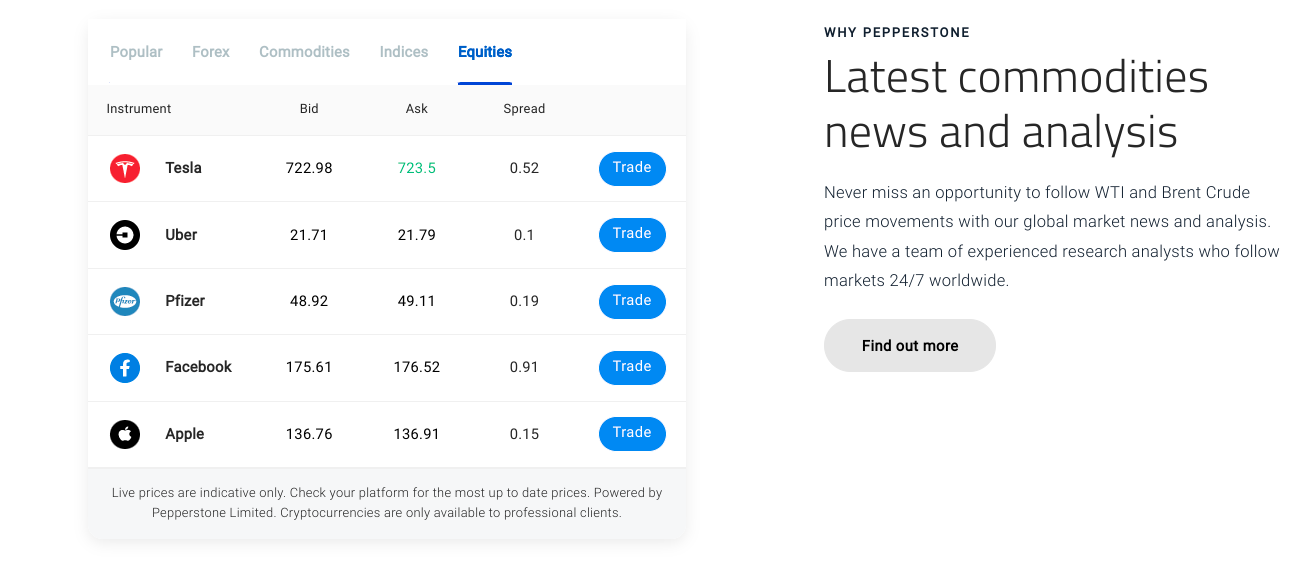

![]() Pepperstone is another top-rated trading platform that connects to DupliTrade. This platform might appeal to those that wish to trade with large volumes and benefit from the best spreads in the market. The reason for this is that Pepperstone offers raw spread accounts.

Pepperstone is another top-rated trading platform that connects to DupliTrade. This platform might appeal to those that wish to trade with large volumes and benefit from the best spreads in the market. The reason for this is that Pepperstone offers raw spread accounts.

This account offers direct access to market participants and Pepperstone does not add a mark-up on any of the spreads obtainable. As such, major pairs like EUR/USD can often be traded at 0.0 pips. The trader will need to pay Pepperstone a commission of $3.50 for every forex lot traded.

On the other hand, Pepperstone is also suitable for casual forex traders. Its standard account comes without a minimum deposit and as Pepperstone also supports MT4, this means that traders can avoid the $5,000 requirement at DupliTrade. The standard account also offers commission-free forex trading, albeit, spreads are less competitive.

Pros

- Razor accounts offer spreads from 0.0 pips

- No mark-up on spreads

Cons

- Does not support US clients

- Limited CFD markets when compared to other providers

81.18% of retail investor accounts lose money when trading CFDs with this provider.

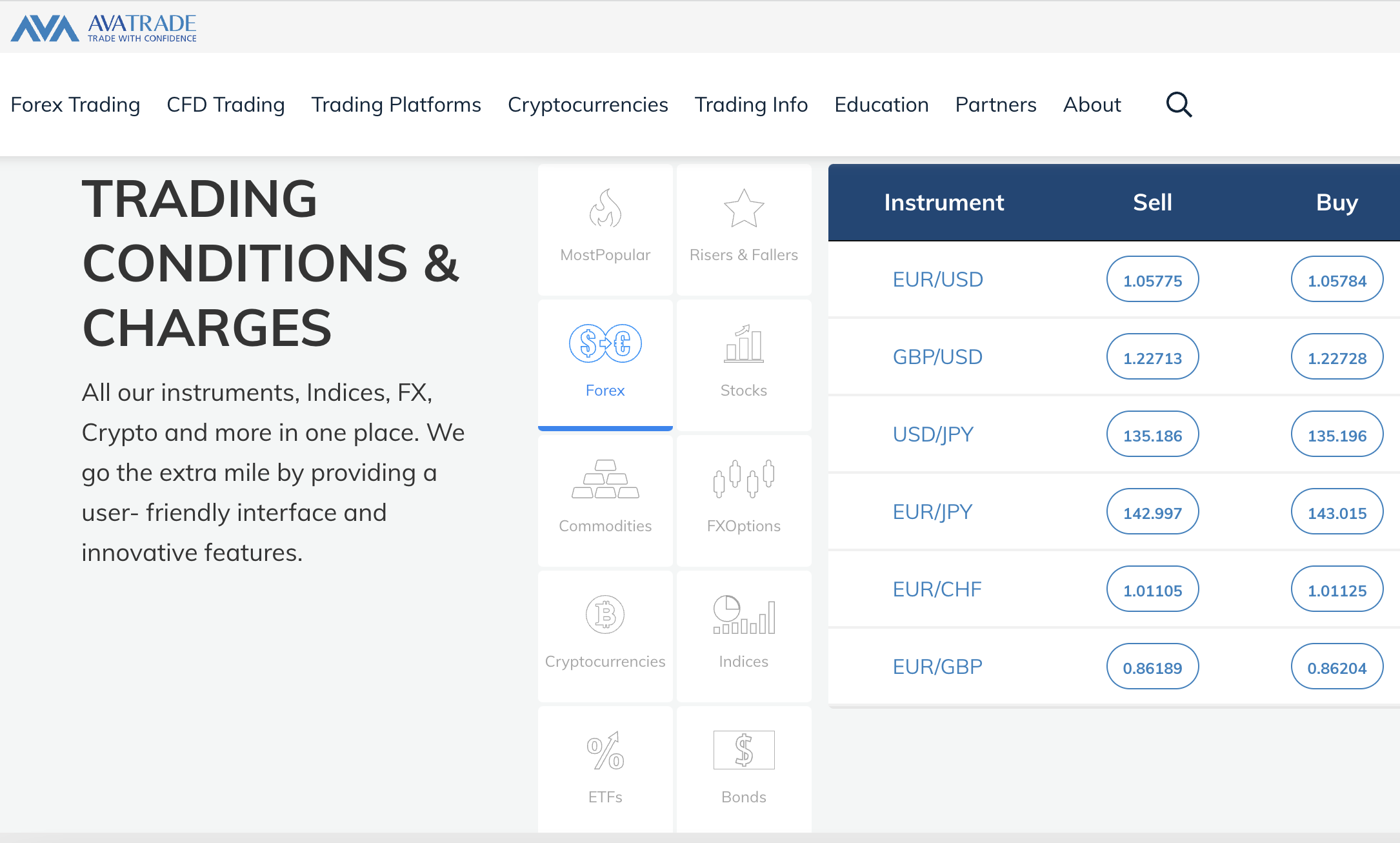

7. AvaTrade via DupliTrade – Trade Forex via Automated Strategies

The next provider to consider on our list of the best forex copy trading platforms is AvaTrade. Once again, this is another provider that does not offer its own proprietary copy trading software. AvaTrade does, however, support DupliTrade. This is a popular third-party platform that hosts automated strategies.

Each strategy has been created by an experienced trader and pre-vetted by the DupliTrade team. To offer some insight into what is available, the Legacy strategy has generated a net profit of 523% to date, across more than 23,000 positions. This strategy, which has more than 1,000 followers, claims to “oversee the relationship between long and short trades”.

It does this through trend trading and the strategy averages between 190-210 positions per month. This is a high-risk strategy considering that it suggests a leverage ratio of 1:100. This strategy focuses on three core pairs – EUR/JPY, AUD/JPY, and GBP/JPY.

Back to AvaTrade, after opening an account and connecting to DupliTrade, users will have access to commission-free trading across dozens of pairs. The AvaTrade platform is regulated by multiple financial bodies and requires a minimum first-time deposit of $100. However, do note that if opting for DupliTrade, the minimum deposit stands at $5,000.

No deposit or withdrawal fees are charged by AvaTrade and support payment methods include bank wires and debit/credit cards. Additionally, we should also note that AvaTrade supports MT4. As such, those that wish to copy the forex trades of an MT4 strategy can connect their account to AvaTrade at the click of a button.

| Copy Trading Platform | MT4, DupliTrade |

| No. Forex Pairs for Copy Trading | 55 |

| EUR/USD Spread | 0.9 pips |

| Max Leverage | 1:400 for eligible clients |

| Copy Trading Fees | None charged, but third-party fees might apply |

Pros

- 0% commission and spreads from 0.9 pips on EUR/USD

- Regulated by multiple licensing bodies

Cons

- Does not support US clients

- DupliTrade copy trading requires a minimum investment of $5,000

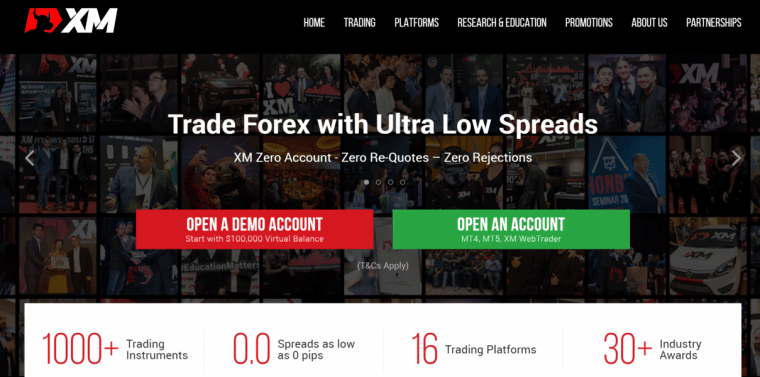

8. XM via MT4 – Popular CFD and Forex Trading Platform

XM is a CFD trading platform that offers trading on more than 55 forex pairs along with more than 1,000 stocks, indices, commodities, cryptocurrencies, and more. Fees for forex trading start from just 1.0 pips with a standard account, and traders can get spreads as low as 0.0 pips when trading with an ECN account (commissions apply). XM makes it easy to get started with a minimum deposit of just $5 and no deposit fees.

XM is a CFD trading platform that offers trading on more than 55 forex pairs along with more than 1,000 stocks, indices, commodities, cryptocurrencies, and more. Fees for forex trading start from just 1.0 pips with a standard account, and traders can get spreads as low as 0.0 pips when trading with an ECN account (commissions apply). XM makes it easy to get started with a minimum deposit of just $5 and no deposit fees.

XM doesn’t have its own trading platform, but it offers access to both MT4 and MT5 – both of which support forex copy trading. Users can purchase an automated strategy and then link their MT4 or MT5 account to XM. XM also offers a paper trading account so traders have an opportunity to test out their automated strategies before risking real money.

As a CFD specialist, XM does not support US clients. Nonetheless, traders from across Europe, the Middle East, Asia, and elsewhere are supported. XM has won more than 30 industry awards.

Pros

- Offers MT4 and MT5 access

- No commission charged to trade forex

Cons

- Does not support US clients

- Doesn’t offer its own forex mobile app

9. NAGA – User-Friendly Platform With Proprietary Copy Trading Software

NAGA offers proprietary copy trading tools directly on its website. The platform is best known for its user-friendly service, which will appeal to beginners. The platform is, however, home to a much smaller pool of verified copy traders when compared to the likes of eToro or MT4.

NAGA offers proprietary copy trading tools directly on its website. The platform is best known for its user-friendly service, which will appeal to beginners. The platform is, however, home to a much smaller pool of verified copy traders when compared to the likes of eToro or MT4.

Moreover, after exploring the NAGA pricing structure, we found that platform somewhat expensive – especially for casual traders. For example, irrespective of whether the copy trading position is profitable, NAGA account holders will be charged €0.99 per trade. Profitable positions of €10 or more will attract a huge commission of 5%.

In comparison, eToro does not charge any additional commissions to use its copy trading service, as traders are remunerated by the broker. Nonetheless, although NAGA does not have a minimum deposit policy in place, it does recommend that users get started with a balance of at least €250.

Pros

- User-friendly platform to copy trades in forex

- Great educational tools

Cons

- 5% commission taken on all trades that yield a profit of €10 or more

- €0.99 commission every time a position is copied

- Not available in the US or the UK

- A much smaller pool of verified traders when compared to eToro

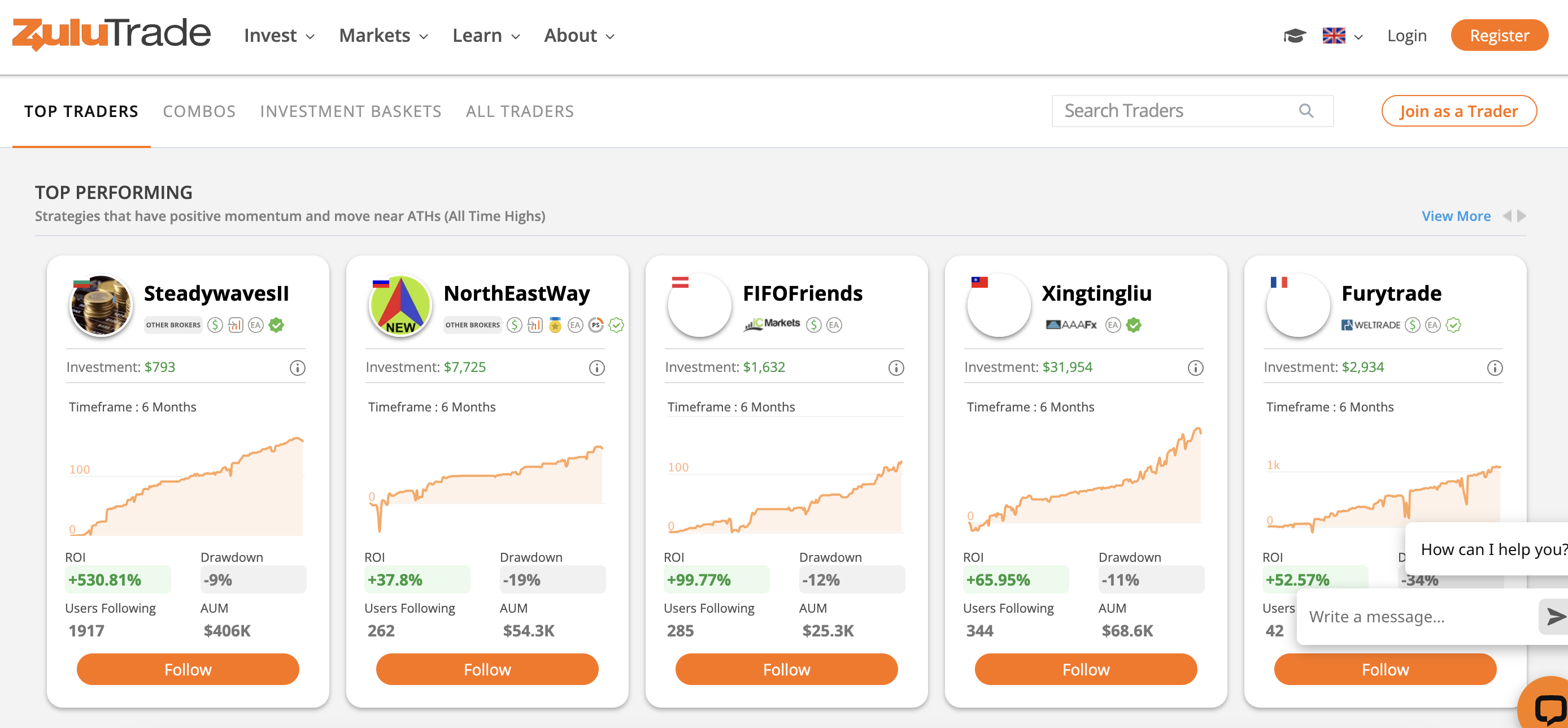

10. ZuluTrade – Top Forex Copy Trading Platform for Data Aggregation

![]() The final provider to consider on our list of the best forex copy trading platforms is ZuluTrade. In a similar nature to eToro and NAGA, ZuluTrade offers proprietary copy trading software. There are several reasons why ZuluTrade remains popular.

The final provider to consider on our list of the best forex copy trading platforms is ZuluTrade. In a similar nature to eToro and NAGA, ZuluTrade offers proprietary copy trading software. There are several reasons why ZuluTrade remains popular.

First and foremost, the ZuluTrade website itself is very clear and user-friendly. We like that beginners will not feel overburdened – even though users have access to a broad range of data. On this point, we like that ZuluTrade offers a wide variety of information on each copy trader that it hosts.

For example, it is possible to explore the historical returns of each trader, how many positions they typically place, the maximum drawdown, average trade duration, and more. It is also possible to get a full breakdown of each and every position that the respective trader has opened.

When it comes to fees, this will depend on the chosen account type. For example, profit-sharing accounts require a monthly fee of $30. Classic accounts require no fees at all. ZuluTrade also stands out for its social trading tools. This includes the option to post trading insights, as well as ‘Like’ and reply to comments.

Note: In a similar nature to DupliTrade, ZuluTrade does not offer brokerage services. Therefore, investors will need to connect their chosen brokerage account to ZuluTrade.

Pros

- Supports crypto, stocks, indices, forex, and commodities

- Great social feed

Cons

- Does not offer brokerage services

- A limited number of successful traders on the platform

- Profit-sharing accounts are charged at $30 per month

What is Forex Copy Trading?

Forex copy trading enables investors to mirror the positions of an experienced currency trader. For example, if the trader goes long on EUR/USD and closes the position at a profit of 1% a few hours later, the exact same trade will be replicated. Crucially, this allows investors of all skill sets to actively day trade forex in a passive way.

As such, this also means that the investor does not need to have any prior experience in trading forex. This is an important point, as in order to consistently trade forex successfully, there is a requirement to have strong knowledge in technical analysis. This is the process of reading and analyzing forex charts and trends through technical and economic indicators.

And, this advanced trading strategy can take many years to master. But, in the case of copy trading, beginners can simply select a suitable trader to copy and all future positions will be mirrored automatically like-for-like. There is no guarantee that forex copy trading will result in a profit for the investor, which is why the process of selecting a trader is so important.

How Does Copy Trading Forex Work?

Forex copy trading offers the opportunity to invest in seasoned currency traders in a passive nature.

However, this trading phenomenon isn’t without its risks – so in this section, we will explain how forex copy trading works in more detail.

Proprietary vs Third-Party Platform

The first thing to note is that forex copy trade tools are either offered on a proprietary basis or through a third-party platform.

- For example, in the case of eToro, which we found to be the overall best forex copy trading platform in the market, offers proprietary software.

- This means that the trader does not need to use a third-party platform in order to copy forex trades.

- On the contrary, not only does eToro offer copy trading tools directly on its website, but the platform is a fully-fledged brokerage.

- In fact, eToro offers nearly 50 of the best pairs to trade in forex on a spread-only basis.

- As a result, investors have all the tools they need to begin their forex copy trading endeavors after opening an account.

In contrast, some forex copy trading platforms do not offer brokerage services.

For example, when opting for the likes of MT4, DupliTrade, or ZuluTrade, investors are required to open an account with a broker in order to utilize the respective copy trading tool.

Selecting a Forex Trader

As we briefly mentioned above, the most important part of the forex copy trading process is selecting a suitable trader to follow. This is no easy feat, as there are many factors to take into account.

Moreover, the past performance of the respective trader is no guarantee that they will remain profitable in the future.

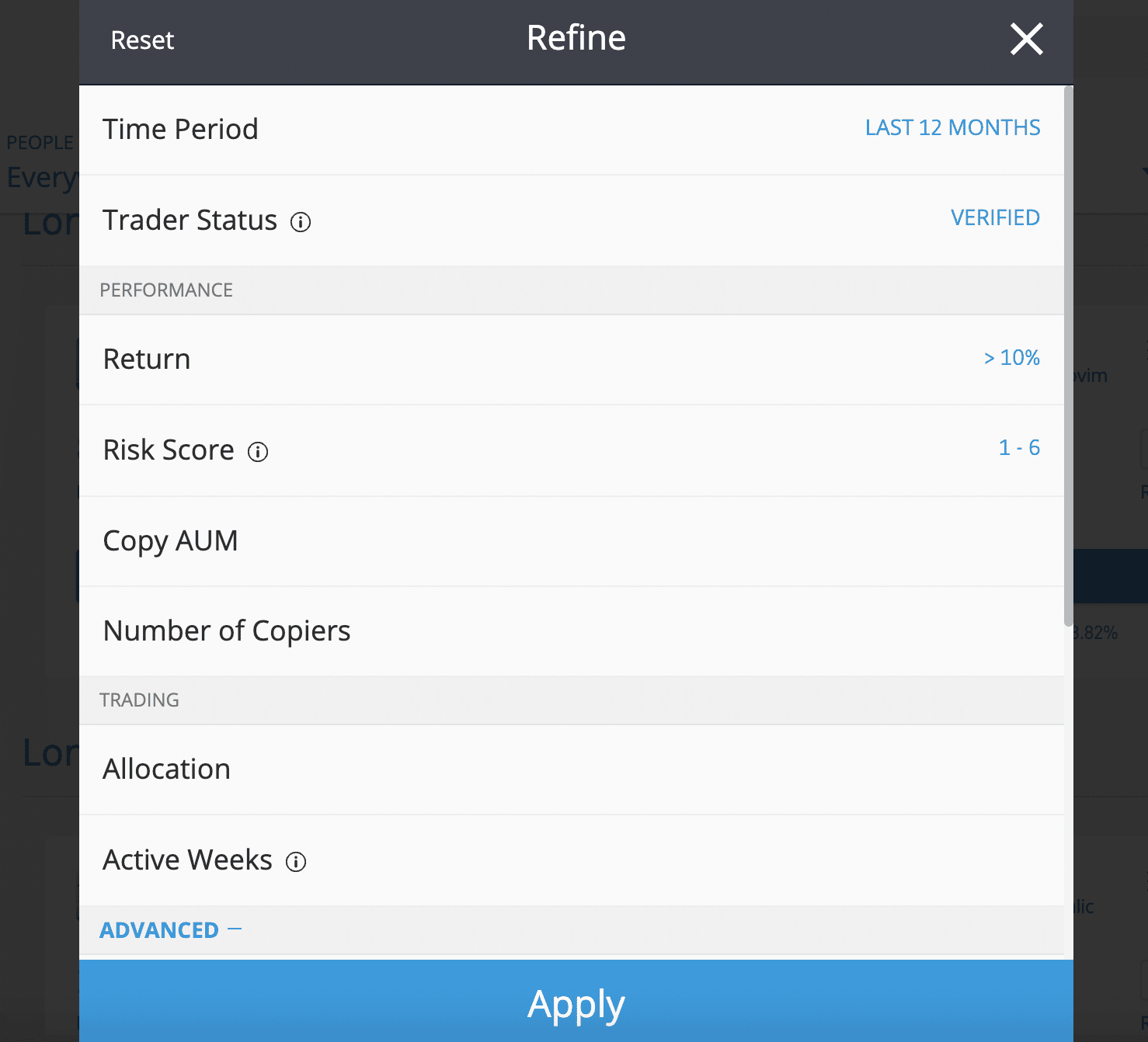

This is why the best copy trading platforms offer a wide range of filters to help investors find a suitable trader. For example, at eToro, investors can explore the following metrics via handy filters:

- The historical performance of the trader since joining eToro, on a month-by-month basis

- The risk score of the trader, calculated by the eToro algorithm

- The average trade duration. This can help indicate whether the trader is undertaking a day or swing trading strategy

- Maximum drawdown to date

- Preferred asset classes and markets

- Full breakdown of individual positions entered and closed

- Total number of followers and assets under management

In addition to the above, eToro also enables its verified copy traders to write up a full biography. This will display key information surrounding the trader’s experience, strategy, financial goals, risk tolerance, and more.

In fact, some copy traders on eToro will even host monthly webinars with their followers to discuss past results and future objectives.

Meet Minimum Investment

After selecting a trader to copy, the investor will need to determine how much capital they wish to invest. The minimum will usually be determined by the respective platform.

For example, at eToro, the minimum copy trading investment is $200. In contrast, DupliTrade requires a minimum investment of $5,000. This will be out of reach for traders that are on a budget.

Proportionate Stakes

Once the investment into the copy trader has been made, all future positions will be mirrored. However, it is important for the investor to understand how trading stakes are calculated.

After all, there is likely to be a disparity in how much both the copy trader and the investor decide to risk on each position. Fortunately, the best forex copy trading platforms in this space take a ‘proportionate’ route.

For example:

- Let’s say that the copy trader risks 5% of their portfolio of a GBP/USD position

- We’ll then say that the investor has allocated $200 to this particular copy trader

- Therefore, the investor will automatically stake $10 on the GBP/USD position

- This is because the trader risked 5%, so the investor does the same

Do note that some brokers supporting copy trading will have a minimum trade requirement in place. At eToro, this stands at $10 per trade.

Example of Forex Copy Trading

To help clear the mist, let’s look at a quick example of a forex copy trading position:

- The investor allocates $1,000 into a copy trader

- The trader risks 7% of their portfolio going short of AUD/USD

- This means that the investor automatically stakes $70 on the position

- Before the end of the trading day, the trader closes the AUD/USD at a profit of 4%

- This means that the investor will also close the position

- On a stake of $70, the trader makes a profit of $2.80

If the above position was carried out at eToro, no profit-sharing commissions would apply.

Forex Copy Trading vs Social Forex Trading

Copy trading refers to the practice of selecting a trader to mirror. As such, this is a passive investment tool.

Social forex trading, on the other hand, is more of a communication tool. Similar to Facebook or LinkedIn, forex social trading platforms enable users to create new threads, reply to comments, ‘Like’ posts, and more.

Moreover, forex social traders can share market insights with each other in a public setting.

eToro is both a copy social trading forex platform – all rolled into one.

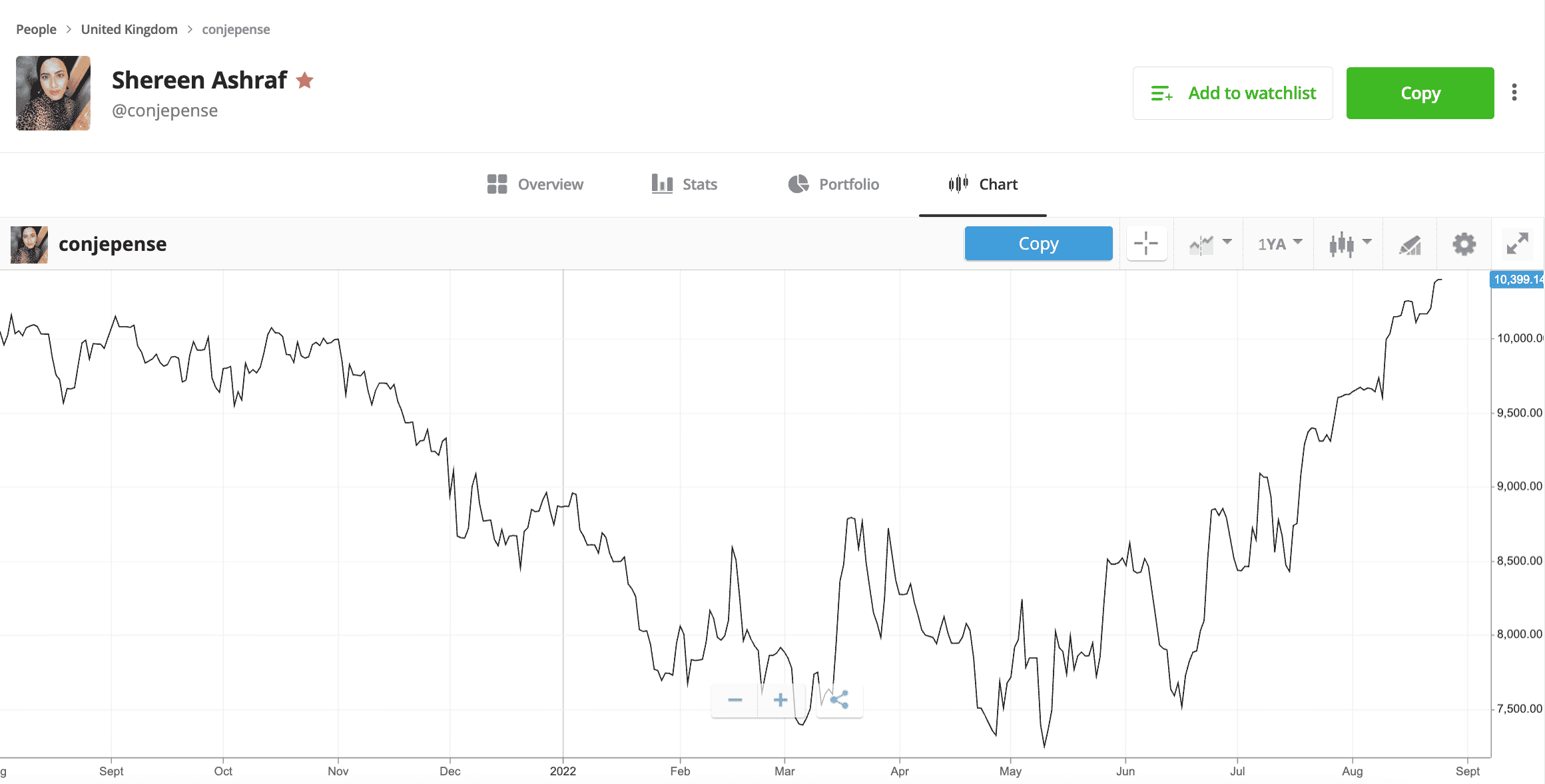

Best Forex Traders to Copy

Choosing the best forex traders to copy will require the investor to conduct in-depth research surrounding historical returns, risk, maximum drawdown levels, and more.

Below, we offer some insight into some of the most successful copy traders in the market today – all of which can be accessed on eToro.

Juraj Gazo

We briefly mentioned Juraj Gazo earlier, not least because he is one of the most popular copy traders on eToro. Gazo has more than 2,400 followers and 307 copiers.

In addition to forex, this popular trader also likes to gain exposure to stocks and ETFs.

In terms of historical performance, Gazo has generated returns of over 13% year-to-date, which is impressive considering the enhanced volatility that 2022 has presented. In the prior three years, Gazo has seen gains of 38%, 5%, and 40%.

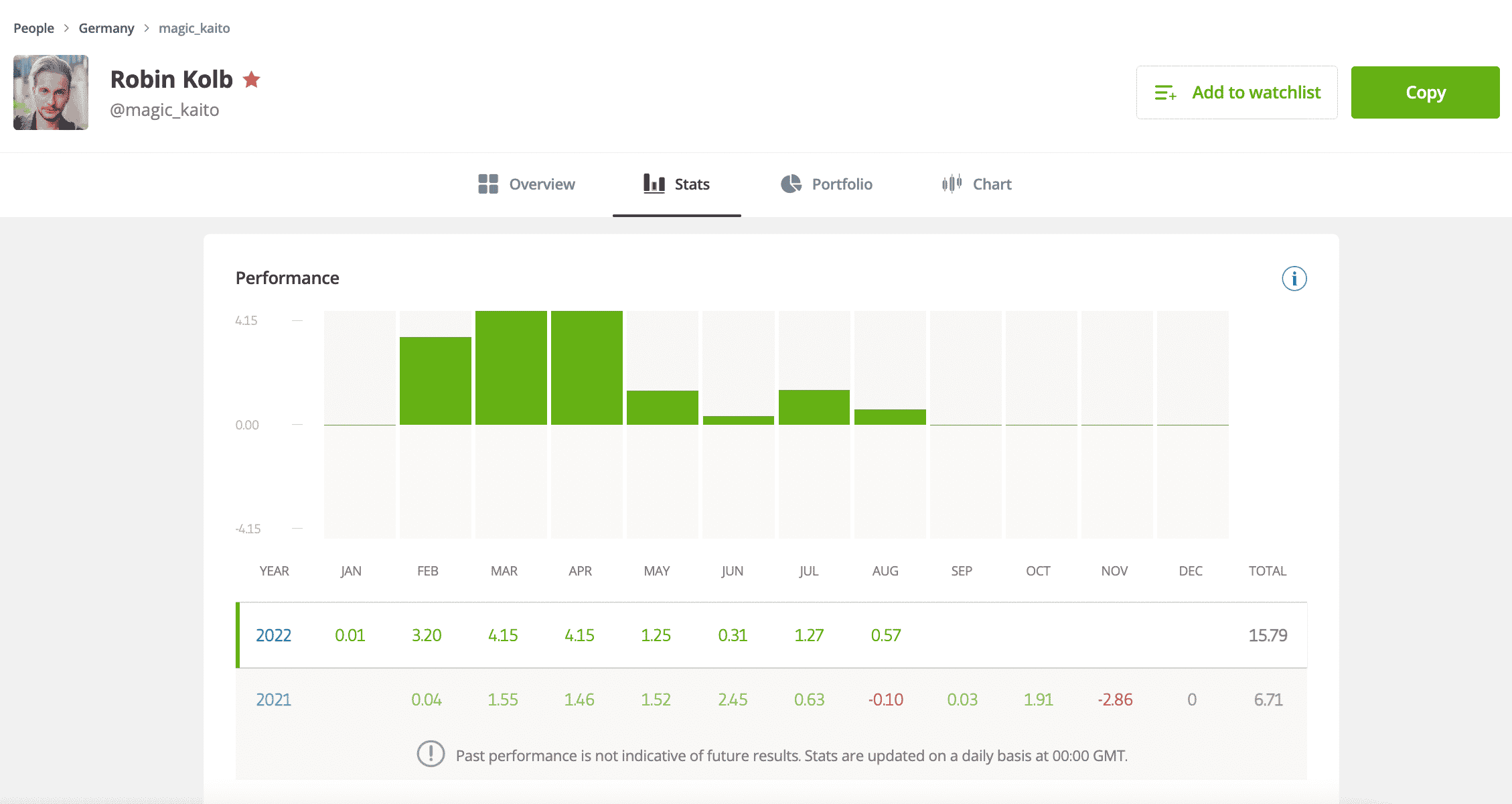

Robin Kolb

Robin Kolb is relatively new to eToro, with the trader joining the platform in February 2021. With that said, Kolb has hit the ground running nonetheless.

With 100% of his historical trades focused on currencies, Kolb is a specialist forex trader. Throughout the year 2021, Kolb finished the year with net gains of nearly 7%.

During the first eight months of 2022, the trader is up almost 16%. While gains to date are somewhat modest, this is because Kolb is a risk-averse trader. As such, Kolb has been assigned an eToro risk score of just 3.

Jose Labarta

Jose Labarta joined the eToro platform in late 2017. Since then, Labarta has returned some impressive gains. In 2020 and 2021, the trader ended the year with ROI of 7% and 29%, respectively.

During the first eight months of 2022, Labarta is up nearly 12%. Although Labarta also dabbles with indices, commodities, and ETFs from time to time, more than 80% of his historical trades have focused on forex.

Labarta is an active forex trader, with the individual placing an average of 7.38 trades per week.

Haobin

Haobin is a Singapore-based trader that largely focuses on forex. With that said, the trader does occasionally enter commodity-related positions. Nonetheless, Haobin joined in 2021 – so is relatively new to the platform.

With that said, Haobin is having a great 2022, with the trader up nearly 40% during the first eight months of trading.

Haobin is a fairly active trader, with approximately five positions entered each week. Of this figure, Haobin has witnessed 57% profitable weeks to date.

BrunoBGomes

BrunoBGomes joined eToro in 2021 and had a hugely successful year – closing the period with gains of just over 100%. For 2022, to date, the trader is up just under 7%.

In addition to forex, BrunoBGomes also likes to trade stocks, commodities, and ETFs. BrunoBGomes is, however, more of a swing trader, with an average holding time of two weeks.

Is Forex Copy Trading Profitable?

There is no way of knowing whether or not an investor will profit when allocating capital to a copy trading platform. After all, copy trading is a process that will see the investor mirror the positions of another trader.

In this sense, if the chosen trader enters a profitable position, this will be reflected in the investor’s account. On the other hand, if the trader makes a loss, the investor will also lose money.

In other words, copy trading is only as profitable as the trader being copied. This is why it is important to spend ample time researching the many copy traders available.

Moreover, it also makes sense to avoid being over-exposed to just one copy trader. Instead, investors might consider diversifying across several different traders. Not only from the forex space but perhaps other asset classes like stocks and commodities.

How to Copy Trade Forex on eToro

Below we offer a beginner’s guide on how to get started with the eToro copy trading tool in under five minutes.

This includes the process of opening an account, making a deposit, and choosing a trader to copy.

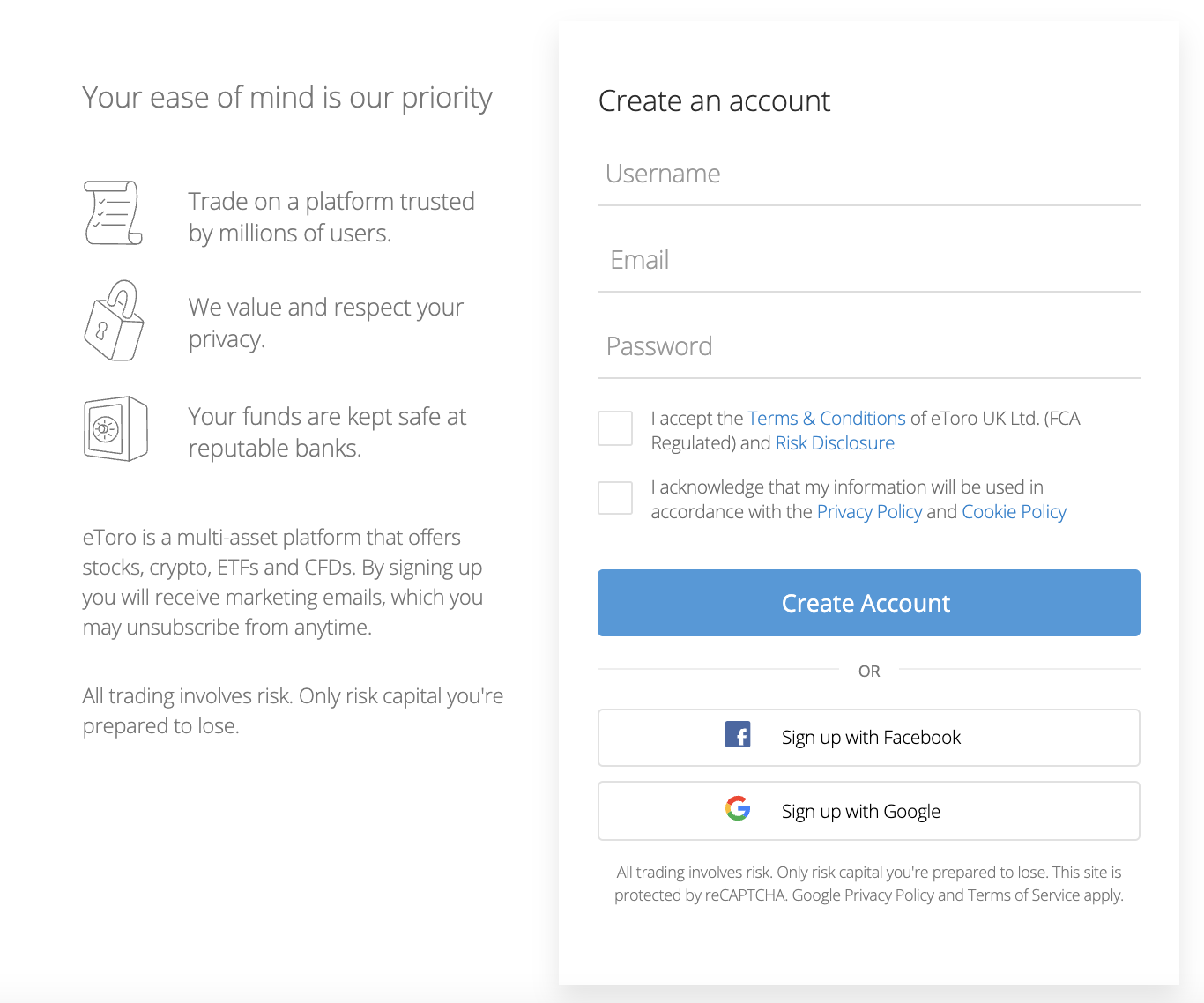

Step 1: Open an eToro Account

First, the investor will need to create a brokerage account with eToro. This process is simple and fast. The investor will need to provide some personal information and contact details.

eToro will send a code to the investor’s cell phone. When prompted, type in the code to complete the registration process.

Step 2: Upload ID

Now that an account has been opened, the investor will need to get verified. eToro accepts several documents for the identity verification process, such as a passport, driver’s license, and state ID.

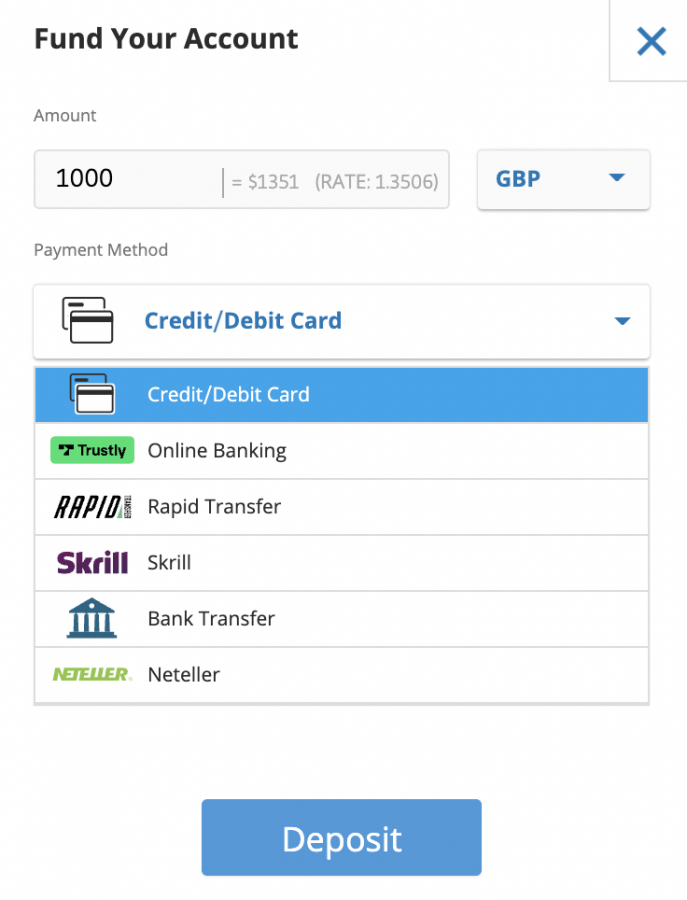

Step 3: Deposit Funds

The investor will now need to deposit some money. The minimum copy trading stake is $200 and US dollar payments are fee-free.

Supported payment methods on eToro include bank wires, Paypal, Skrill, Neteller, debit/credit cards, and more.

Step 4: Choose Trader to Copy

Next, click on ‘Discover’ followed by ‘View All’ – which is displayed next to ‘Copy Trader’.

In the top right corner of the page, click ‘Filter’. This enables the investor to find a suitable forex trader to copy based on a wide variety of variables.

Once a suitable forex trader has been identified, click on ‘Copy’.

Step 5: Confirm Copy Trading Investment

The final step is to let eToro know the size of the investment into the copy trader. As noted above, this can be any amount from $200 upwards.

Do note that by default, the ‘Copy Open Trades’ button is ticked. This ensures that open positions, as well as future trades, are copied.

Finally, click on ‘Copy’ to confirm the investment. Any open positions that the trader has will automatically appear in the investor’s eToro account – at a proportionate amount.

Conclusion

Forex copy trading is a suitable tool for both beginners and experienced traders alike. After selecting a seasoned trader to copy, the investor can enjoy a passive forex trading experience.

In terms of supported markets, verified traders, liquidity levels, and low fees – eToro is the best forex copy trading platform to consider today.

This platform is home to thousands of seasoned traders – all of which can be copied from $200 upwards. Plus, this regulated broker does not charge profit-sharing fees on successful trades.

#forextrader #trading #forextrading #money #forexsignals #cryptocurrency #trader #investment #crypto #forexlifestyle #investing #business #entrepreneur #invest #binaryoptions #blockchain #forexmarket #forexlife #stocks #success #daytrader #btc #bitcoinmining #investor #stockmarket #binary #fx #finance