At its peak, Bitcoin has since surpassed a total market capitalization of over $1 trillion. And as such, it makes sense that there are plenty of places that allow you to use Bitcoin as a means of payment.

In this guide, we take a look at 10 places that accept Bitcoin – both online and in-store.

Where to Spend Bitcoin

If you’re wondering who accepts Bitcoin – consider the 10 companies outlined below:

- Aqru – Overall Best Place to Spend Bitcoin to Earn 7% in Interest

- eToro – Spend Cryptos with Attractive Staking Rewards

- Crypto.com – Deposit Bitcoin into a Savings Account

- BlockFi – Spend Bitcoin Anywhere That Accepts Visa.

- Microsoft – Spend Bitcoin to Buy Products From the Microsoft Website.

- Starbuck – Top up Your Loyalty Card to Buy Starbucks Coffee

- AT&T – Settle Your Cell Phone and Broadband Bills With Bitcoin.

- Paypal – Spend Bitcoin at any Online Merchant That Accepts Paypal

- BitPay – Buy Real Estate With Bitcoin via the BitPay Website

- Overstock – Buy Thousands of Products Online With Bitcoin

Cryptoassets are a highly volatile unregulated investment product.

With so many crypto-hungry traders now looking to invest in Bitcoin, you might want to read on to take a closer look at the above companies that accept Bitcoin.

A Closer Look at Companies That Accept Bitcoin

If you’re amongst those who have decided to buy Bitcoin, you might be wondering how you can put your digital asset to use. Not only can you use Bitcoin to buy products and services – both online and in-store, but you can also utilize the digital currency to generate rewards in the form of interest.

Consider the 10 providers discussed below when deciding where to spend Bitcoin.

1. Aqru – Overall Best Place to Spend Bitcoin to Earn 7% in Interest

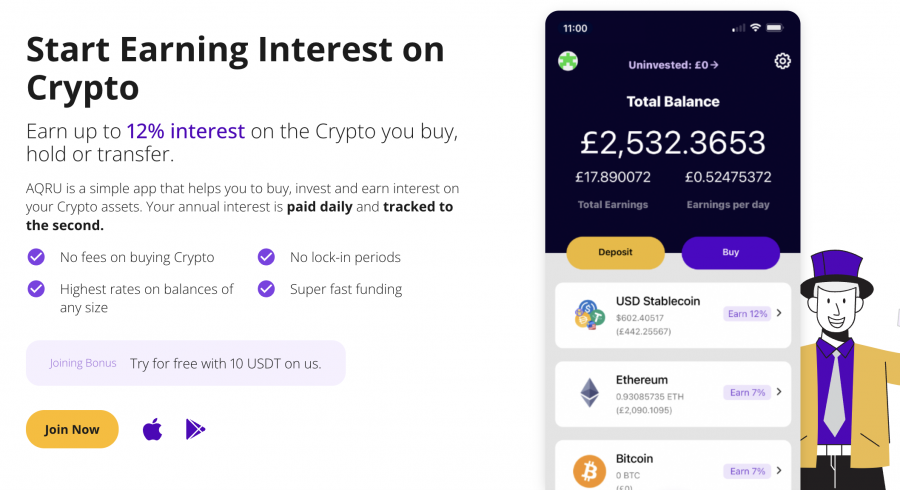

We found that the overall best place to spend Bitcoin in 2022 is with Aqru. This online platform allows you to deposit your BTC tokens into a crypto savings account and in doing so – you will earn interest on Bitcoin at a generous rate. Therefore you’ll be making money with cryptocurrency via a passive investment strategy. In fact, Aqru offers one of the best crypto interest accounts in this space at 7% per year.

This means that instead of spending Bitcoin on things you don’t need – you can continue to grow your allocation of tokens over time. And, most importantly, Aqru only offers flexible accounts – meaning that you can withdraw your Bitcoin at any time. Moreover, interest is paid daily, so you can compound your earnings much faster.

In addition to Bitcoin, Aqru also offers an APY of 7% on Ethereum. And, if you’re really looking to maximize your potential gains, Aqru even allows you to swap Bitcoin for a stablecoin like Tether or USD Coin – which will amplify your APY to 12%. We also like the fact that Aqru supports fiat money.

Not only does this mean that you can deposit USD, EUR, or GBP into a savings account – but you can also withdraw fiat back to your bank account. If you like the sound of spending Bitcoin on this platform, Aqru accounts can be opened in less than 10 minutes. You can complete the process online or via the Aqru crypto app.

Cryptoassets are a highly volatile unregulated investment product.

2. eToro – Popular Place to Spend Bitcoin with Copy Trading Tools and Low Trading Fees

Next up on our list of the best place to spend Bitcoin is eToro. This online platform is best known for its low-cost cryptocurrency and stock brokerage services – with more than 20 million people now using eToro to trade. Most beginner traders will be pleased to learn that you can buy Bitcoin with a credit card with low trading fees and tight spreads.

Next up on our list of the best place to spend Bitcoin is eToro. This online platform is best known for its low-cost cryptocurrency and stock brokerage services – with more than 20 million people now using eToro to trade. Most beginner traders will be pleased to learn that you can buy Bitcoin with a credit card with low trading fees and tight spreads.

For those unaware, crypto staking involves locking your tokens away for a certain period of time, and in return – you will be paid a rate of interest. With that said, at eToro, its crypto staking accounts are flexible, meaning that there is no lock-up period.

Moreover, in order to earn staking rewards at eToro, you don’t need to opt into the service. On the contrary, as soon as you buy crypto on this platform – staking rewards are automatically distributed. Once again, this will enable you to grow your crypto holdings much faster – as you will continue to grow the number of tokens that you own. eToro supports Cardano, Tron, and Ethereum when it comes to crypto staking. The reward amount of the monthly staking yield varies depending on whether you’re a bronze, silver, or diamond club member.

Another thing to note about eToro is that it also offers copy trading services – should you wish to invest your Bitcoin profits into other financial products. Put simply, this enables you to copy a seasoned crypto trader like-for-like. Meaning, if they buy Cardano, so will you. Finally, eToro staking can be accessed online or via its iOS/Android app. Moreover, if you’d like to learn how to buy Bitcoin with eToro, you can check out our simple guide today.

Cryptoassets are a highly volatile unregulated investment product.

3. Crypto.com – Deposit Bitcoin into a Savings Account

Crypto.com is a popular crypto exchange that offers over 250+ digital currencies that can be bought and sold at competitive fees. The platform also offers some of the best crypto savings accounts in the market – meaning that you can spend Bitcoin to grow your balance over time.

The amount of interest that you can earn on Bitcoin will depend on several factors – such as how long you decide to lock the tokens away for and whether or not you own CRO – which is native to Crypto.com. For example, the maximum rate on Bitcoin deposits is 6% annually – which requires 40,000 CRO tokens or more and a 3-month lock-up period.

With no CRO tokens, the rate on Bitcoin drops to 3%. If you want more control over your Bitcoin tokens, a flexible account with no CRO staking yields 0.5%. In addition to savings accounts, Crypto.com also enables you to spend Bitcoin at its leading NFT marketplace. This means that you can buy NFTs in exchange for your BTC tokens.

There are thousands of popular NFT series to choose from – some of which are backed by Aston Martin F1, Ugonzo Art, Snoop Dogg, and BossLogic. Moreover, when you spend Bitcoin here to buy NFTs – no commissions are charged. Finally, Crypto.com also allows you to spend Bitcoin to obtain a crypto loan – should you wish to raise some money without selling your tokens.

Cryptoassets are a highly volatile unregulated investment product.

4. BlockFi – Spend Bitcoin Anywhere That Accepts Visa

Another option that is worth considering when assessing how to spend Bitcoin is to apply for the BlockFi debit card. This pre-paid card is issued by Visa – meaning that you can use it at millions of merchants around the world – both online and in-store. Moreover, you can even use the BlockFi card to withdraw cash at ATMs.

Another perk with this debit card is that you can earn rewards in Bitcoin whenever you make an eligible purchase. This stands at 1.5% of the purchase amount and there are no limits in place. New customers can even earn up to 3.5% in Bitcoin rewards for the first 90 days – up to a maximum of $100.

Cryptoassets are a highly volatile unregulated investment product.

5. Microsoft – Spend Bitcoin to Buy Products From the Microsoft Website

Microsoft was one of the first major companies to embrace Bitcoin, with the tech firm accepting BTC payments way back in 2014 when the digital currency was still largely unknown. This is somewhat interesting when you consider that Microsoft founder Bill Gates is yet to make his stance on Bitcoin clear.

Nevertheless, you can spend Bitcoin across a wide variety of Microsoft products and services. In addition to buying desktop computers and laptops via the Microsoft website, you can also top up your Xbox Live account to purchase games and other add-ons. Moreover, Bitcoin can also be used to pay for Microsoft-backed apps.

6, Starbucks – Top-up Your Loyalty Card to Buy Starbucks Coffee

Next up on our list of where to spend Bitcoin is Starbucks. Now, we should note that the world’s largest coffee chain – which now stands at nearly 35,000 stores globally, does not directly accept Bitcoin at its cash registers. You can, however, use Bitcoin to top up a Bakkt account.

For those unaware, Bakkt is a leading rewards program in the US that allows users to earn points and subsequently spend them across a range of domestic stores – including Starbucks. As such, it’s just a case of topping up your Bakkt rewards account with Bitcoin and then using your card in a Starbucks store to pay for your daily coffee.

7. AT&T – Settle Your Cell Phone and Broadband Bills With Bitcoin

AT&T is the largest telecommunications company in the US – with the firm dominating the landline, cell phone, and broadband markets. As of 2019, AT&T joined the cryptocurrency revolution by announcing that it would start allowing customers to settle their bills with Bitcoin and other supported digital tokens.

In a similar nature to Starbucks, AT&T does not directly accept Bitcoin as a means of payment. The firm has, however, integrated with the leading third-party crypto payment processor BitPay. And as such, when it comes to paying your monthly bill, all you need to do is select BitPay at the checkout and proceed to settle up with Bitcoin.

8. PayPal – Spend Bitcoin at any Online Merchant That Accepts PayPal

Did you know that you can buy Bitcoin with PayPal? Another company that is looking to take the crypto industry to new heights is PayPal. The popular e-wallet provider now allows US clients to buy and sell Bitcoin and other cryptocurrencies directly on its website. However, what US clients can also do is pay for online purchases with Bitcoin – as long as the merchant in question accepts PayPal.

In what it calls Checkout with Crypto – you will first need to ensure that you have Bitcoin in your PayPal wallet. Then, when you get to the respective website and select PayPal as your chosen payment method – you will be given the option to settle up with crypto. Assuming you have sufficient Bitcoin in your wallet – the transaction will be completed in real-time.

9. BitPay – Buy Real Estate With Bitcoin via the BitPay Website

It was only a matter of time before Bitcoin would be accepted as a payment method to buy real estate. And this is now a reality with the help of BitPay. As we mentioned earlier, BitPay is a third-party payment processor that bridges the gap between Bitcoin and the real world.

And, should you wish to buy real estate with Bitcoin – the seller doesn’t even need to accept crypto assets to settle the transaction. On the contrary, BitPay acts as a third-party middleman. So, once you have secured a real estate deal with the seller, you would need to transfer your Bitcoin to BitPay. In turn, BitPay would convert the Bitcoin to USD and transfer the funds to the seller.

10. Overstock – Buy Thousands of Products Online With Bitcoin

Overstock is one of the largest online retailers in the US – with the platform home to thousands of products. This covers a range of home-based categories, including but not limited to furniture, lighting, bedding, bathroom products, and more. In a similar nature to Microsoft, Overstock has been accepting Bitcoin since 2014.

As such, it’s one of the earliest adopters of accepting crypto assets as a means of payment. In order to spend Bitcoin on the Overstock website, you will need to select crypto at the checkout process. Then, through its partnership with leading exchange Coinbase – the Bitcoin will be debited from your wallet to pay for the transaction.

What Can You Spend Bitcoin on?

Once you’ve invested in cryptocurrency what can you do with those digital assets? If you’re wondering where can you spend Bitcoin in the real world, the number of merchants accepting this digital currency is still relatively small – at least in the US.

With that said, more and more companies – especially small-to-medium businesses, are looking at integrating their payment systems with third-party processors to embrace the Bitcoin revolution.

For example, the likes of BitPay enable merchants to accept Bitcoin as a payment method without directly accepting it.

By this, we mean that the customer will use their Bitcoin wallet to pay for the transaction, and then the funds are converted to US dollars in real-time.

Is Spending Bitcoin a Good Idea?

Spending Bitcoin to buy products and services isn’t necessarily a good idea.

After all, Bitcoin is an emerging technology and payments network that has grown in value by a considerable amount since it was launched in 2009. As such, selling your Bitcoin to fund purchases might result in opportunity costs.

- For example, let’s suppose that you had sold your Bitcoin allocation in April 2020 to fund a new purchase.

- At this time, you would have sold at a rate of just $5,000 per token.

- However, had you avoided cashing out and instead held on for another year – the same Bitcoin was worth over $65,000 per token.

Ultimately, you should consider whether you really need to spend BTC before you decide to cash out your investment.

Consider Spending Bitcoin Rewards Only

Perhaps a more favorable long-term solution is to consider a Bitcoin interest account. In doing so, you can take a disciplined approach by only spending the interest that you earn.

For example, let’s suppose that you have $2,000 worth of Bitcoin at your disposal. If you were to deposit your Bitcoin into an Aqru savings account – you would be paid an APY of 7%.

This means that over the course of the year, you would earn $140 worth of Bitcoin. And best of all, your original Bitcoin deposit remains intact – so you haven’t wasted any of your tokens on unnecessary purchases.

You could, however, spend your $140 worth of Bitcoin interest payments, as this doesn’t impact your original allocation.

You can read more about crypto savings accounts here in our in-depth guide.

Raise Funds by Using Bitcoin as Collateral

If you are looking at how to spend Bitcoin because you do not readily have access to funds – there is another option that you might consider – a crypto loan. In a nutshell, platforms like Crypto.com offer crypto loans at a maximum LTV of 50% to those who deposit Bitcoin as collateral.

This means that if you have $2,000 worth of Bitcoin and you deposit the tokens into Crypto.com – you can receive up to $1,000. There are no credit checks deployed by Crypto.com and all loans are approved instantly. Best of all, you are not required to sell your Bitcoin – meaning that you will still benefit if its market value increases.

You can read more about crypto loans here in our in-depth guide.

Will More Companies Start Accepting Bitcoin?

It remains to be seen whether more companies will start accepting Bitcoin. On the one hand, it’s likely that – alongside the likes of Microsoft, PayPal, and Overstock, more firms will begin to explore the potentialities of Bitcoin as a means of payment.

- However, it should also be noted that in its current form – Bitcoin isn’t overly ideal as a medium of exchange.

- First, Bitcoin transactions take 10 minutes to confirm. This is far too long when you consider that traditional cash and debit/credit card transactions are settled instantly.

- Second, Bitcoin transaction fees are still on the high side. Even when they average $1-2 per transaction, this is still too high for the digital currency to be used to pay for everyday necessities.

Another drawback with companies accepting Bitcoin is that cryptocurrencies are still not classed as legal tender in the US. In fact, the only country in the world that defines Bitcoin as legal tender is El Salvador.

How to Spend Bitcoin?

To conclude this guide on where to spend Bitcoin – we will now explain how you can utilize your BTC tokens wisely by earning 7% per year in interest at Aqru.

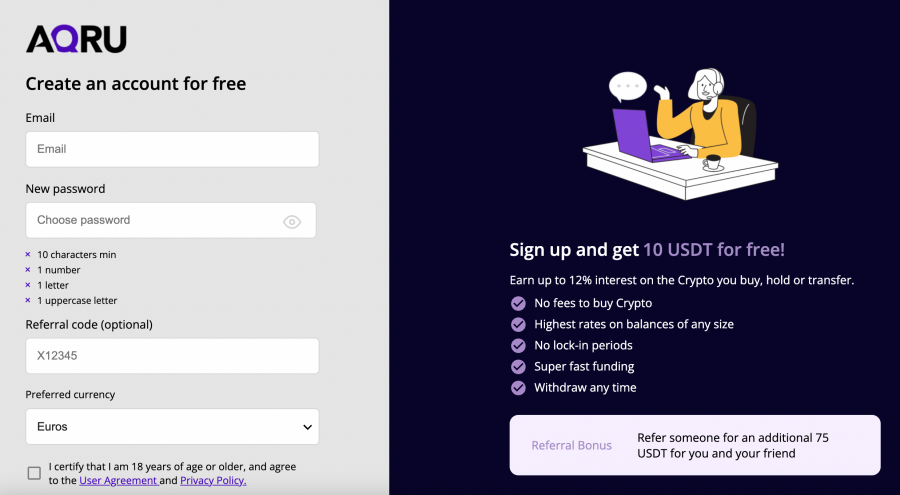

Step 1: Open an Account

You will first need to register an account with Aqru before you can spend Bitcoin and start earning interest. This should only take you a couple of minutes and will initially require you to enter your email address and choose a password.

Next, you will need to provide some personal information – such as your name, nationality, and home address.

Step 2: KYC

As a regulated platform, Aqru will also ask you to verify your account. You can do this by uploading a copy of your government-issued ID.

Step 3: Deposit Bitcoin

Now that you have a verified account with Aqru, you can proceed to deposit your Bitcoin tokens into the platform. You can obtain your wallet address from within your Aqru account.

Copy it to your clipboard and then head to the wallet that is currently storing your Bitcoin. After confirming the transfer, the Bitcoin should land in your Aqru account within 10-20 minutes.

Step 4: Earn 7% Interest on Bitcoin

As soon as your Bitcoin is deposited into your Aqru account – you will start earning interest from the very get-go. Your interest payments will be paid each and every day – so you can easily track how much you are earning.

If you want to spend Bitcoin from your earned interest, you can elect to make a deposit. However, it’s best to let your balance build up, as Aqru charges a withdrawal fee of $20.

Conclusion

This guide has discussed the best ways to spend Bitcoin – both online and in-store. We’ve covered a variety of recognized merchants – such as Microsoft, Overstock, Paypal, and Starbucks.

However, we found that the overall best place to spend Bitcoin is at Aqru. In doing so, you will earn interest of 7% per year, and thus – you can build your Bitcoin holdings over the course of time, rather than cashing out.