- Bitcoin miners face the heat as selling pressure rises

- Daily activity and velocity declines, however, retail investors show faith

Bitcoin miners were one of those sections of the crypto community who were impacted massively by the crypto winter, thanks to the selling pressure. According to the founder of Capriole Fund, Charles Edwards, the increase in miners’ stress could also paint a negative outlook for the king coin in the long term.

Read Bitcoin’s [BTC] Price Prediction 2022-2023

A spike in miners’ pressure has always led to a price drop in the past. If the miner pressure continues to decline, there is a possibility that BTC’s prices would drop even further. Short sellers could thus take advantage of this opportunity.

The miner’s dilemma

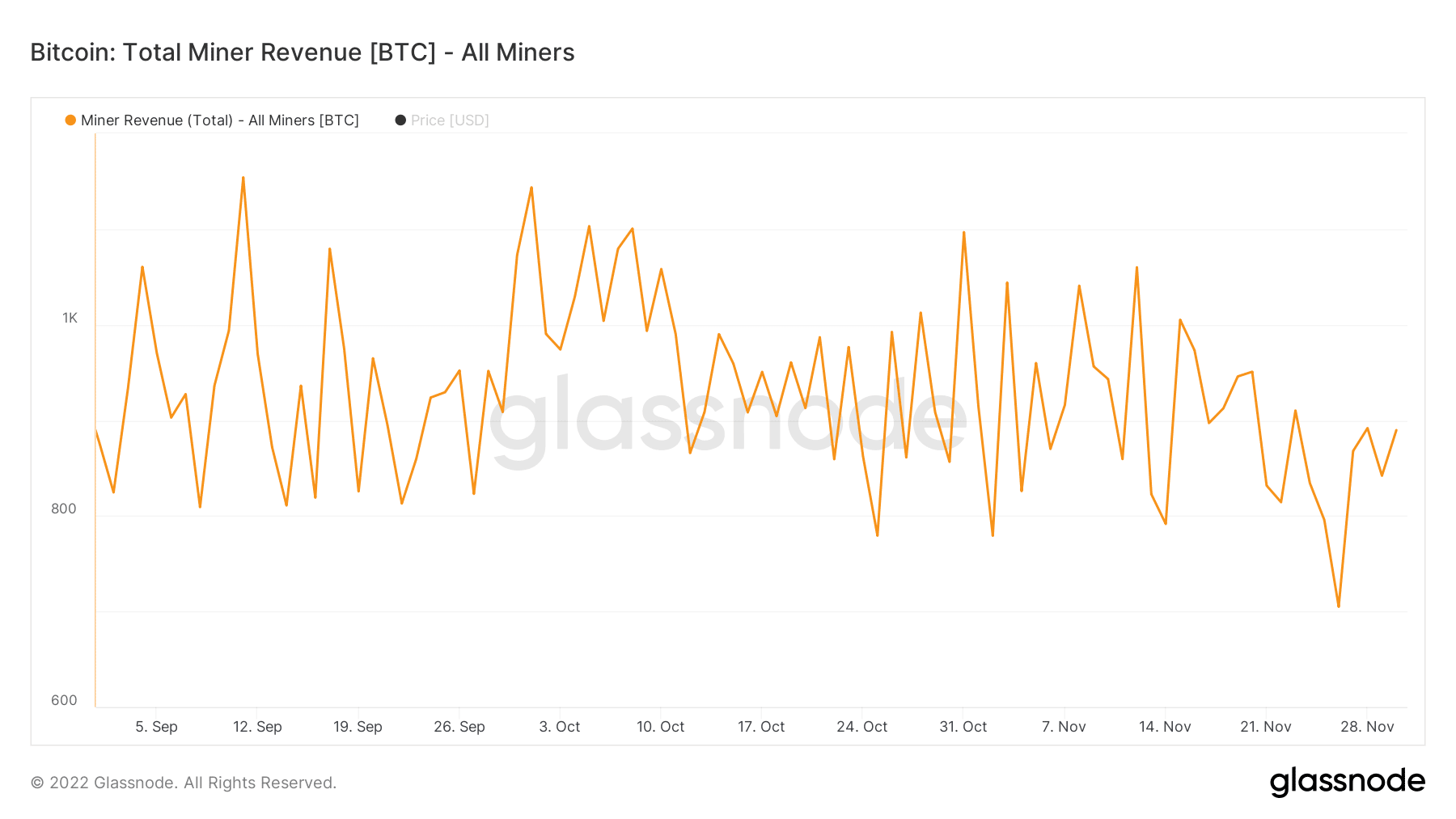

One reason for the increasing sell pressure on miners can be the declining miners’ revenue. As can be seen from the image below, the miner revenue for Bitcoin declined significantly over the last two months.

This decline in revenue has been forcing miners to sell their BTC to make a profit. Bitcoin’s hashrate, on the other hand, continued to increase according to data provided by Messari.

A growing hashrate indicated that it would take more computational effort for miners to mine Bitcoin. Coupled with growing energy costs, it would be very difficult for miners to stay profitable under these conditions.

Investors’ continued hope in Bitcoin

Despite these bearish signals, retail investors continued to show faith in Bitcoin. According to data provided by Glassnode, the number of addresses having more than 0.1 Bitcoin reached an all-time high on 1 December. Along with that, the number of addresses holding more than 10 coins also reached a 22-month high.

Unfortunately, large addresses holding over a thousand coins were observed to be exiting their positions.

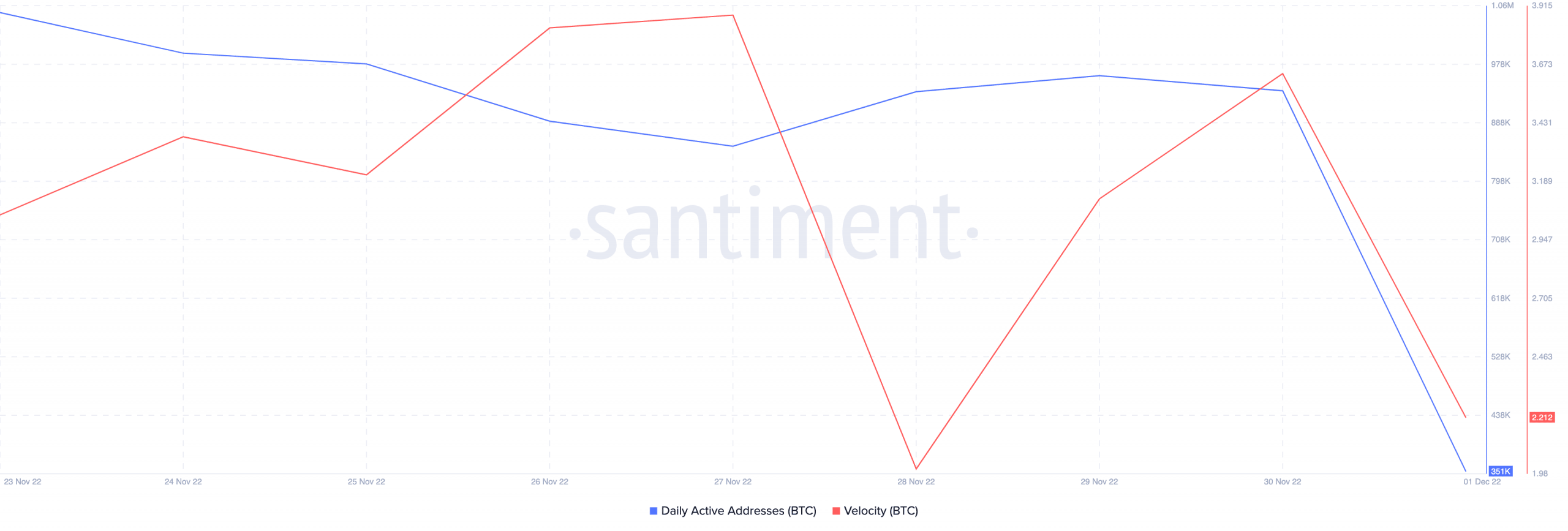

In terms of on-chain metrics, Bitcoin witnessed a drop in activity. Its daily active addresses observed a decline over the past few days. Along with that, Bitcoin’s velocity also took a hit. Thereby, suggesting that the frequency at which BTC was being traded had declined immensely.

It remains to be seen whether Bitcoin will succumb to the pressure and drop further in terms of price.

However, at the time of writing, the ratio of longs to shorts was 0.96, suggesting that there were more people shorting Bitcoin in the last 24 hours, according to Coinglass.