- Last week’s Bitcoin inflows stood at a total of $14 million

- Short-ETH investment products witnessed inflows of $14 million as well

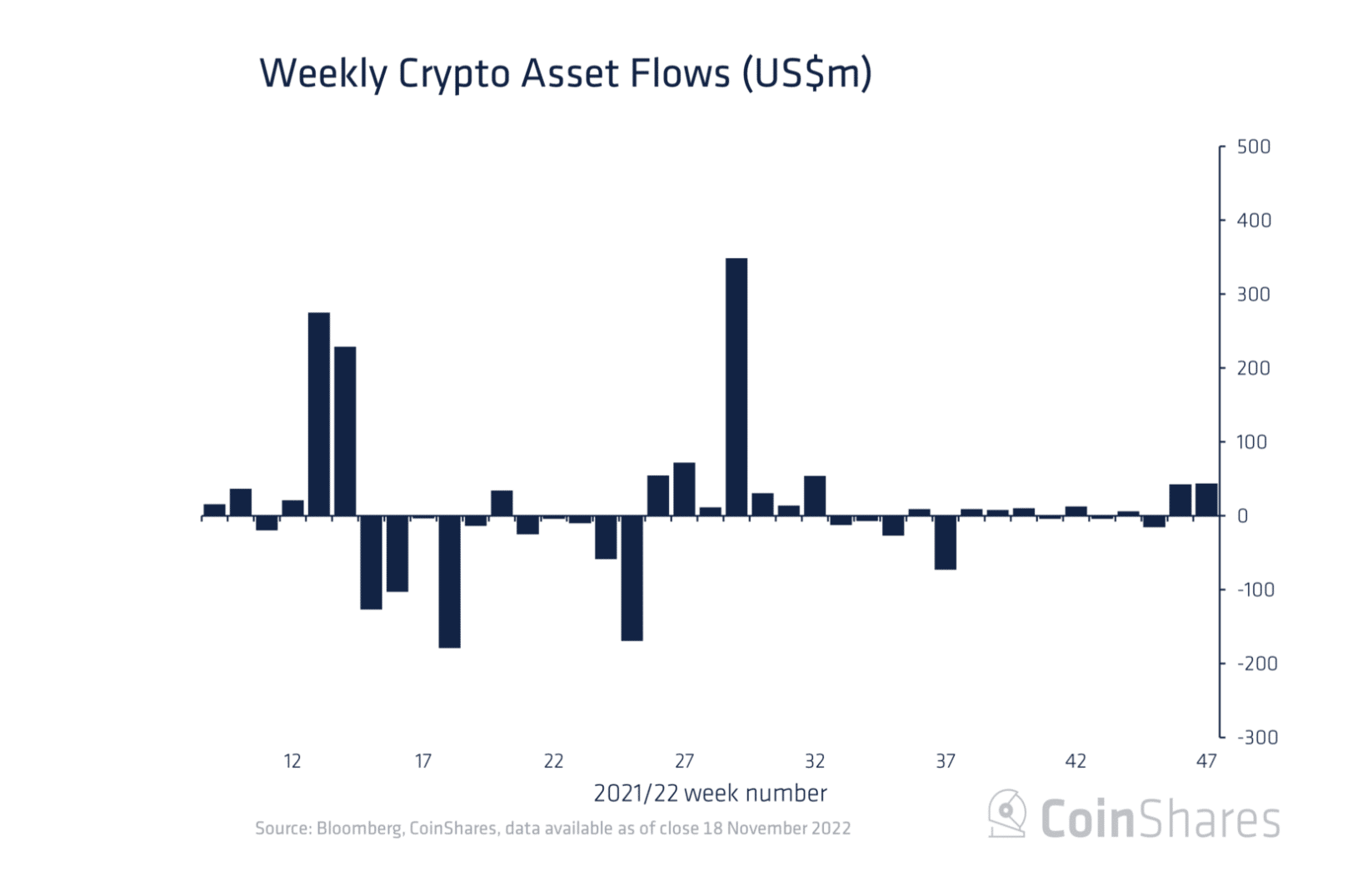

The inflows into digital asset investment products stood at a total of $44 million last week. This figure represented the largest weekly inflows in 15 weeks, CoinShares found in a newly published report.

Last week’s inflow represented a 5% growth from the $42 million recorded inflows the previous week.

With $44 million recorded in inflows last week, the total inflows into digital asset investment products on a month-to-date basis stood at $67.7 million. On a year-to-date (YTD) basis, this was $558 million, data from CoinShares showed.

Bitcoin and short investment products

As the general cryptocurrency market attempts to recover from the collapse of cryptocurrency exchange FTX, CoinShares opined that the 15-week high in inflows for this asset class represented “very mixed sentiment amongst investors.”

The renewed interest in digital asset investments following the collapse of FTX and its sister firm Alameda Research played out last week. This was because inflows for leading coin Bitcoin [BTC] totaled $14 million. The inflows recorded brought the YTD inflows for the king coin to $331 million. This was a 5% increment from the YTD index of $317 million recorded in the previous week.

Still, a king, Bitcoin’s YTD inflows represented 59% of the YTD total inflows of $492 million recorded by all assets considered by CoinShares in the report.

As for short investment products, Coinhares found that inflows into this category of assets represented 75% of the total inflows logged last week. CoinShares further opined that this suggested that negative sentiment continued to trail the market, “ likely being a direct result of the ongoing fallout from the FTX collapse.”

The report stated that this brought the total assets under management (AuM) to a 2-year low of $22 billion.

What about the altcoins?

For Ethereum [ETH], the leading alt recorded minor outflows of $0.08 million, bringing its month-to-date inflows to $5.1 million. However, this represented a mere 8% of the total inflows recorded in investments so far this month.

Short-Ethereum investment products, on the other hand, saw the largest inflows of $14 million. Per CoinShares: