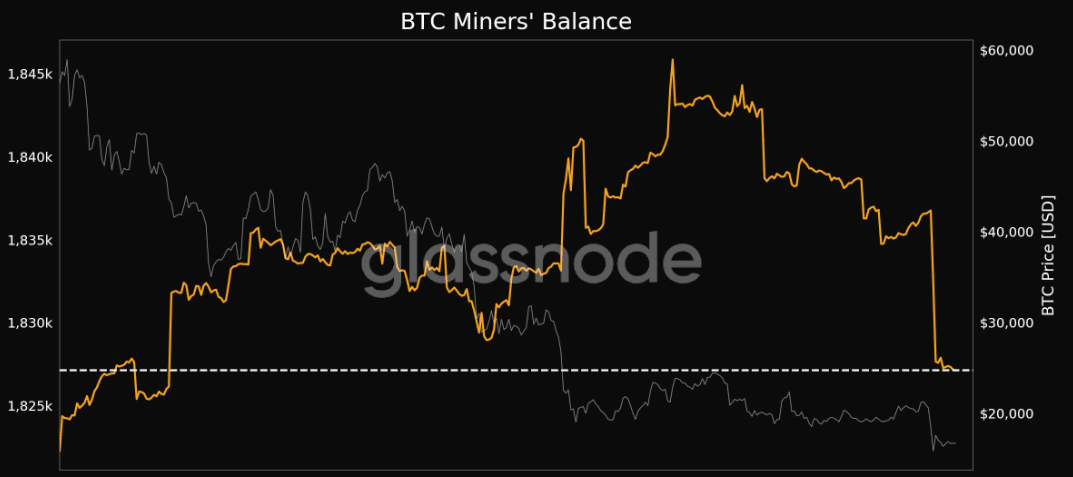

- Bitcoin miners’ wallet balance fell to the minimum value in ten months

- Overall market condition and mining sector state revealed that miners could remain unprofitable unless the market cycle changes

Bitcoin [BTC] miners’ resolve to scale through the barrenness attached to the current market condition might have been tested again. The wallet balances of BTC miners hit a ten-month low, according to a recent revelation from Glassnode.

In essence, this decrease meant that miners had not halted selling. As a matter of fact, the situation implied that the sell-offs had increased incredibly.

Read Bitcoin Price Prediction for 2023-2024

Lead, and others will follow

However, wallet balance was not the only factor affected by BTC’s price. According to an earlier disclosure by Glassnode, the hash price also plunged to an all-time low on 18 November.

Hence, this placed an intense pressure on the miners to get rid of a significant quantity of their holdings. Of course, these trades might not be intended for profits, especially as BTC was trading at $16,692. Since mining requires huge operational costs, the selling pressure may be able to foot the bills.

However, the negatives did not end with the balances and hash price. A further look at the on-chain data showed that other aspects of the mining sector had contributed to the erasure of almost all growth recorded in 2022.

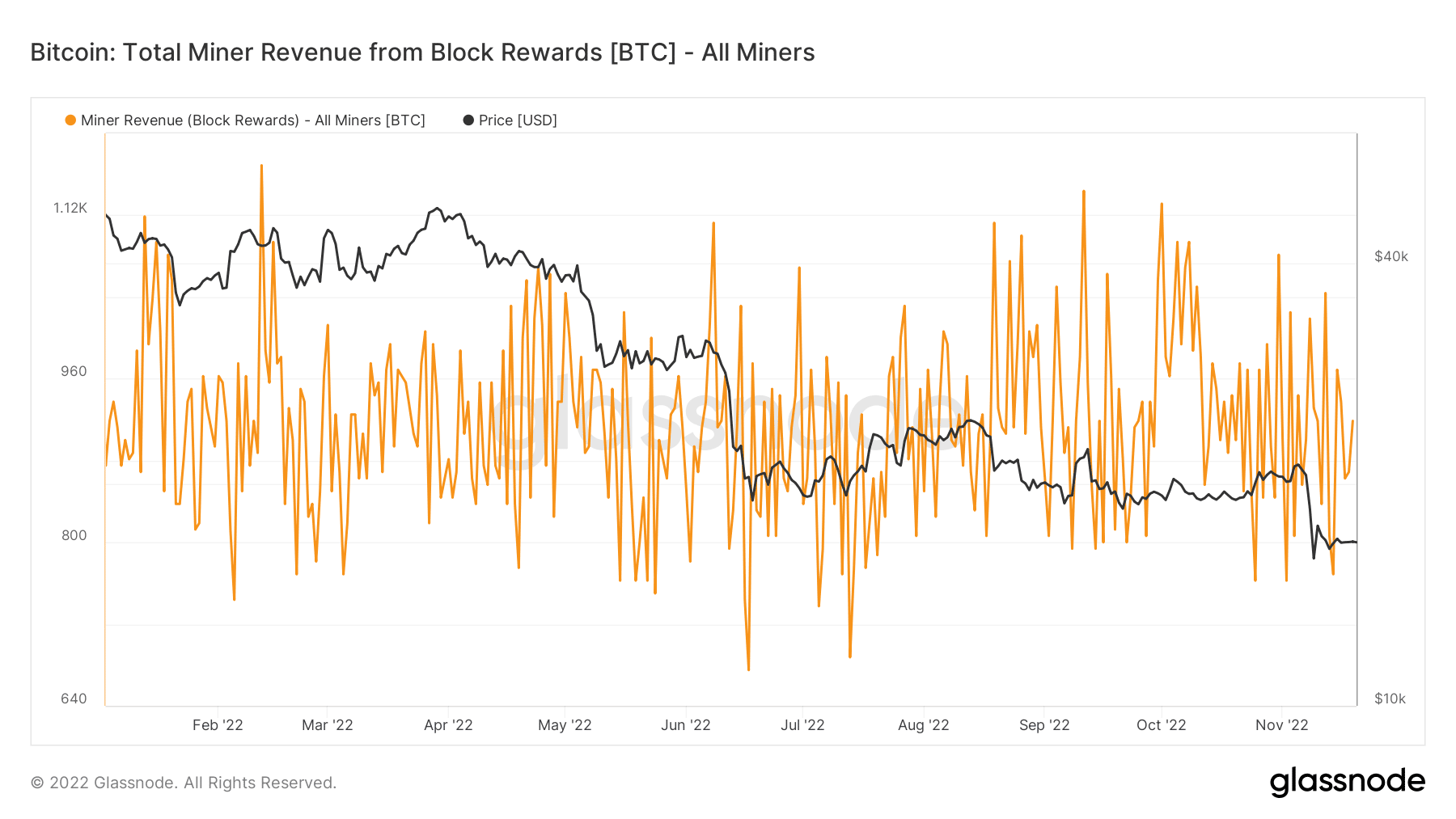

Notably, miners’ block rewards over the last few days have been less than impressive. At press time, the block rewards added up to 918.75 BTC. This indicated that miners have been minting new coins at a slower rate. This could affect BTC’s circulation for both retail and whale investors.

With this in mind, it was obvious that the hard work put in by these miners might not yield positive results as 2022 draws nearer to a close.

As challenging as it gets for Bitcoin miners…

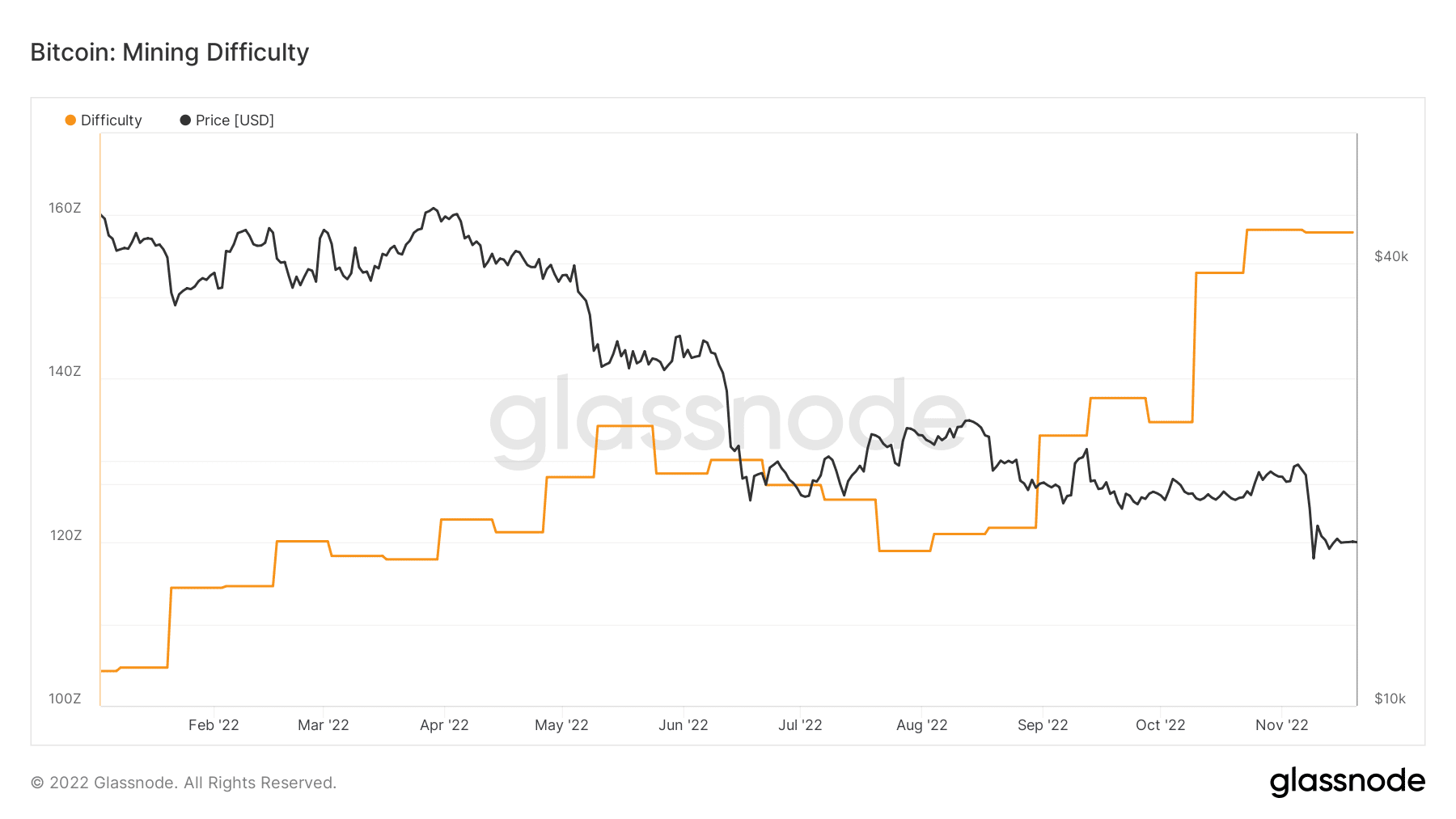

Despite the miners’ actions, there was no ease while validating transactions, large in part due to the position displayed by the BTC mining difficulty. As press time, the mining difficulty was 157,892,441,654,367,000,000,000.

This indicated that miners needed more computational power to create new blocks and earn rewards. So, BTC’s mining followed a similar path as its price.

In conclusion, the overall industry condition did not benefit miners at the time of writing. Moreover, a BTC price surge was less likely to happen in the short term. Hence, Bitcoin miners might need a change in the market cycle to return to profitability.