- Bitcoin exchanges outflows witness a surge in the last few days

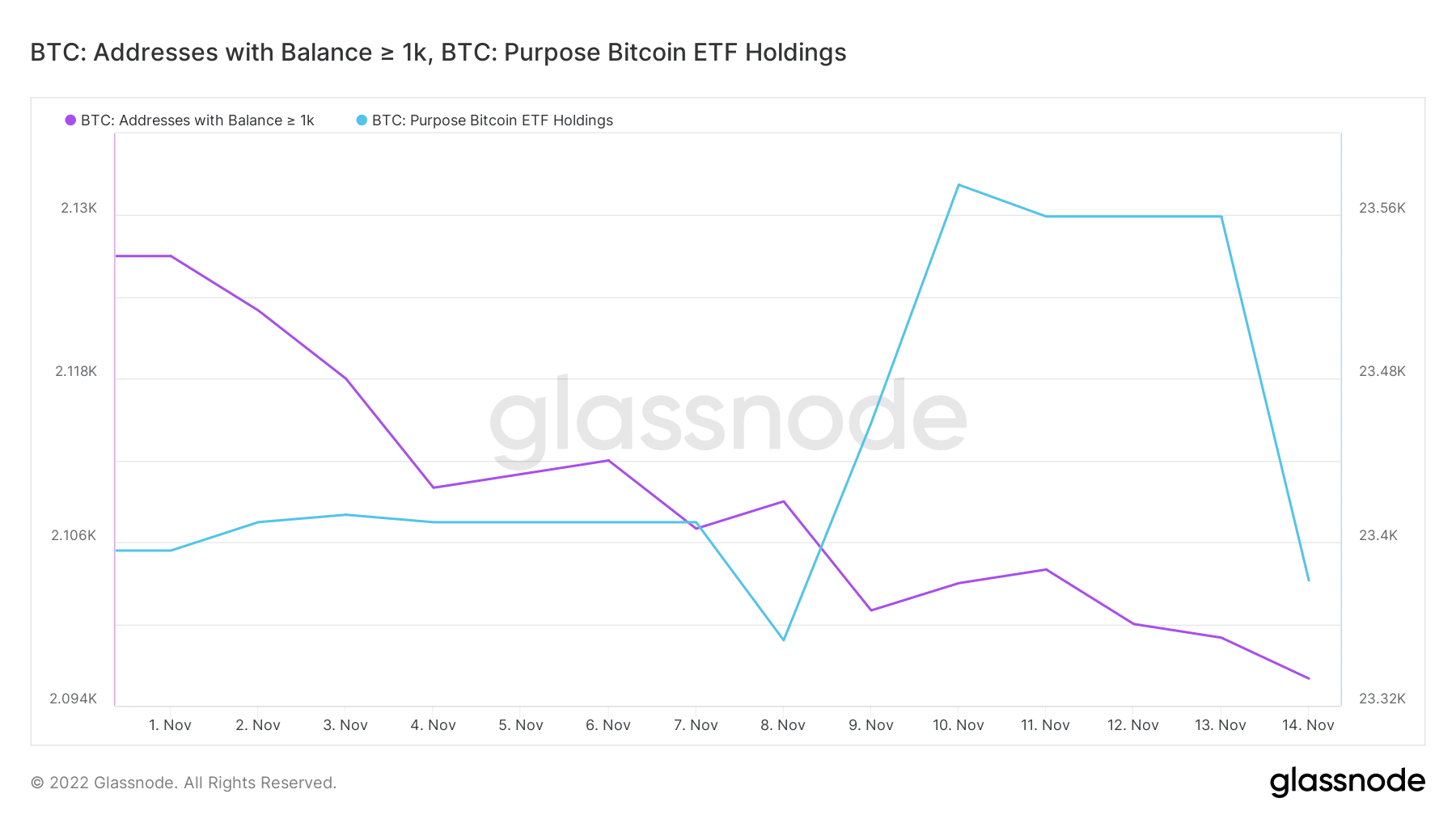

- BTC whales didn’t show much of an interest in purchasing the king coin at discounted prices

If you were hoping for crypto winter to end soon, then the latest market crash may have just dampened your mood. Fortunately, the latest Bitcoin [BTC] observations could be the silver lining to a dark cloud that is currently hovering over the crypto market.

Read Bitcoin’s [BTC] price prediction 2023-2024

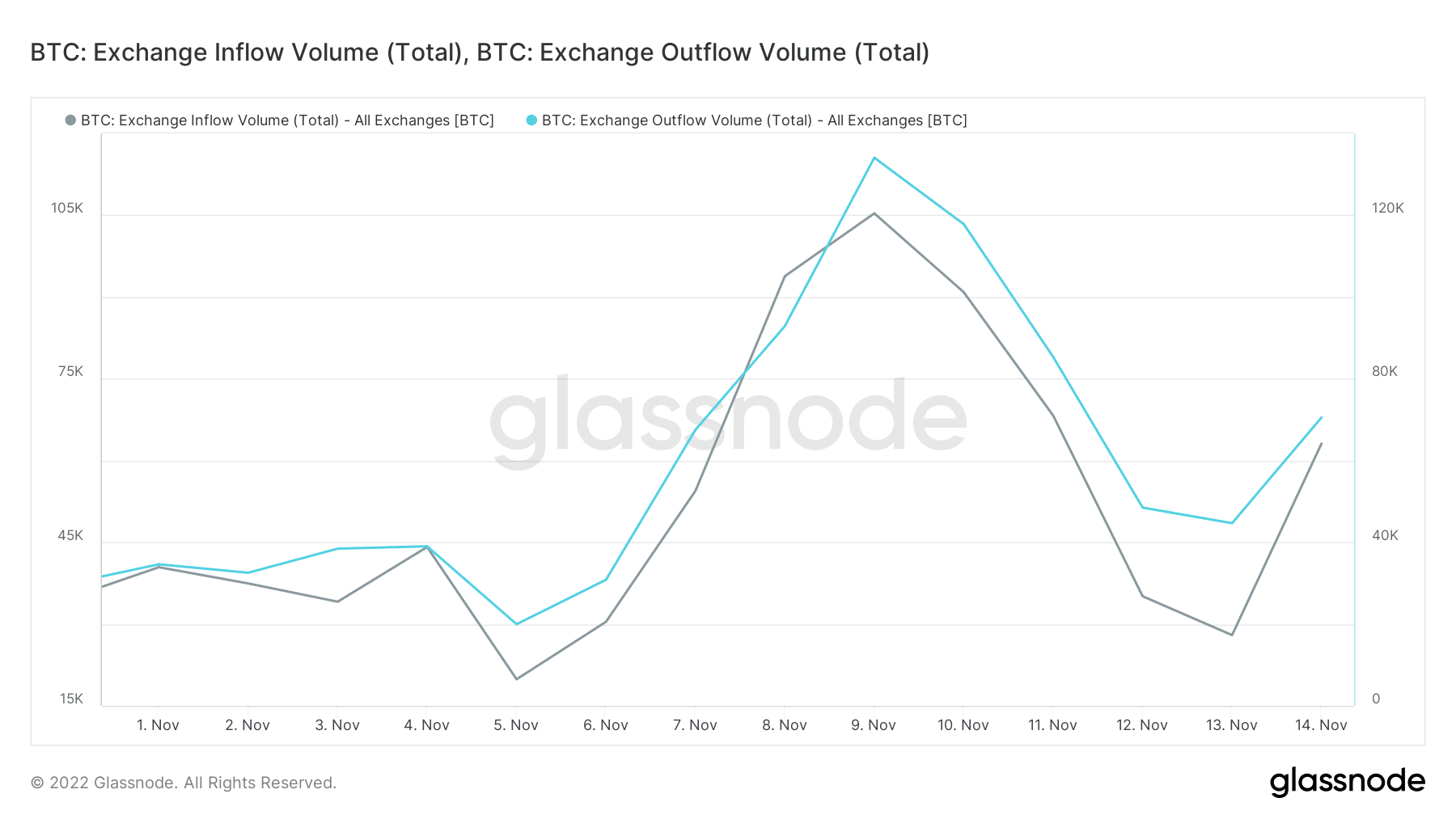

According to the latest Glassnode analysis, large amounts of Bitcoin have been flowing out of exchanges in the last few days. Such observations usually underscore strong accumulation and are considered a positive outcome especially as far as demand is concerned.

Investors are panic moving their Bitcoin into private wallets

This time the huge Bitcoin exchange outflows may not necessarily be tied to heavy accumulation. Last week’s market crash highlighted the risks of having cryptocurrencies on exchanges. As a result, many traders opted to move their Bitcoin from exchanges to private wallets.

Although the above observation didn’t necessarily reflect demand, the market showed some significant bullish signs. The amount of stablecoins on exchanges increased substantially in the last couple of months. This highlighted the strong purchasing power waiting for market conditions to recover.

Bitcoin demand sees some recovery

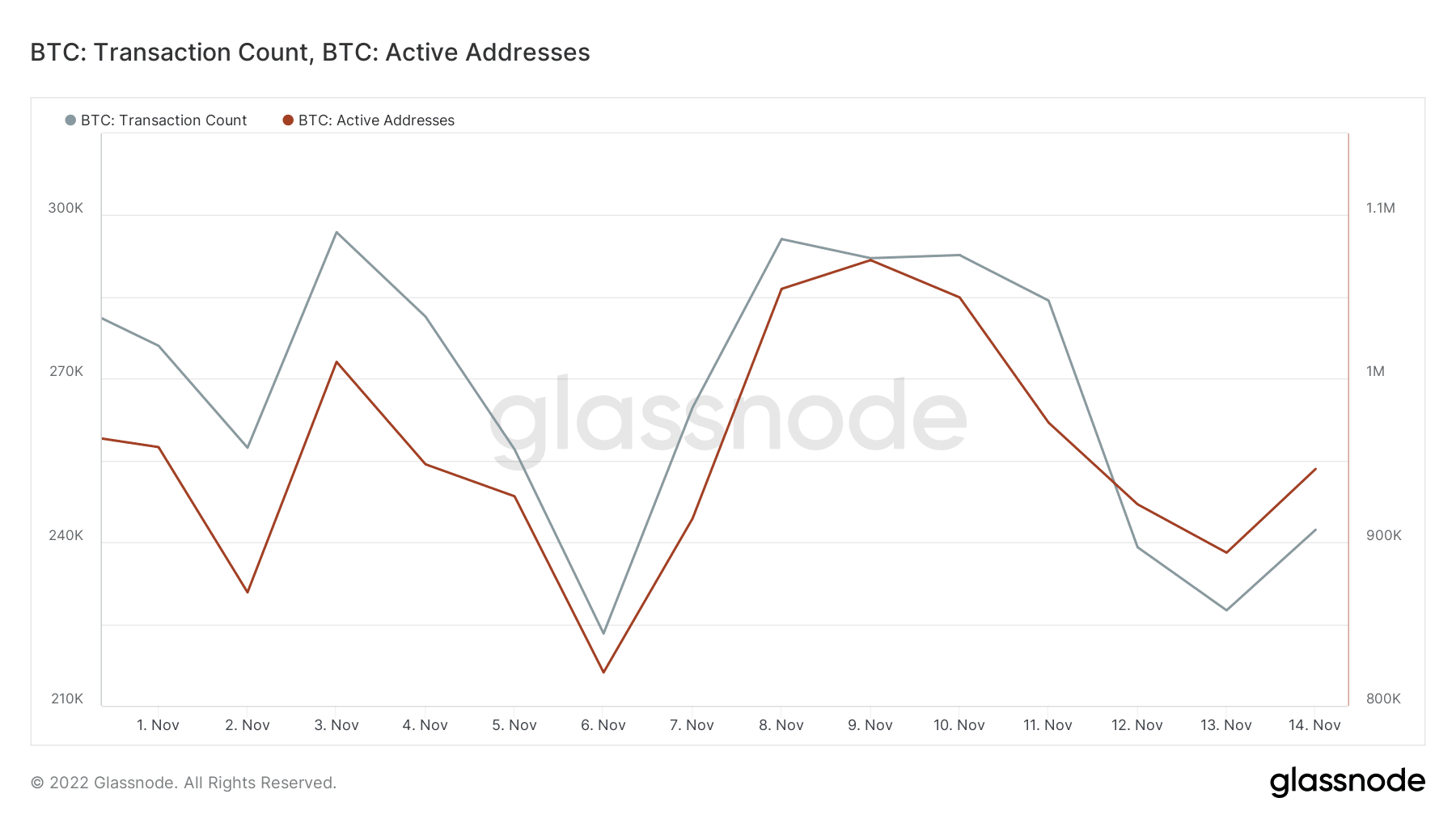

Bitcoin transactions were bound to see an increase especially considering investors moving their funds. This was observed in the number of active addresses which registered a spike in the last two days.

But did this necessarily reflect higher demand for BTC? A look at exchange flows may help provide a clearer picture. Bitcoin exchange outflows, at press time, outweighed exchange outflows. This was confirmation. However, it did indicate that there was still a significant amount of exchange inflows that indicated incoming sell pressure.

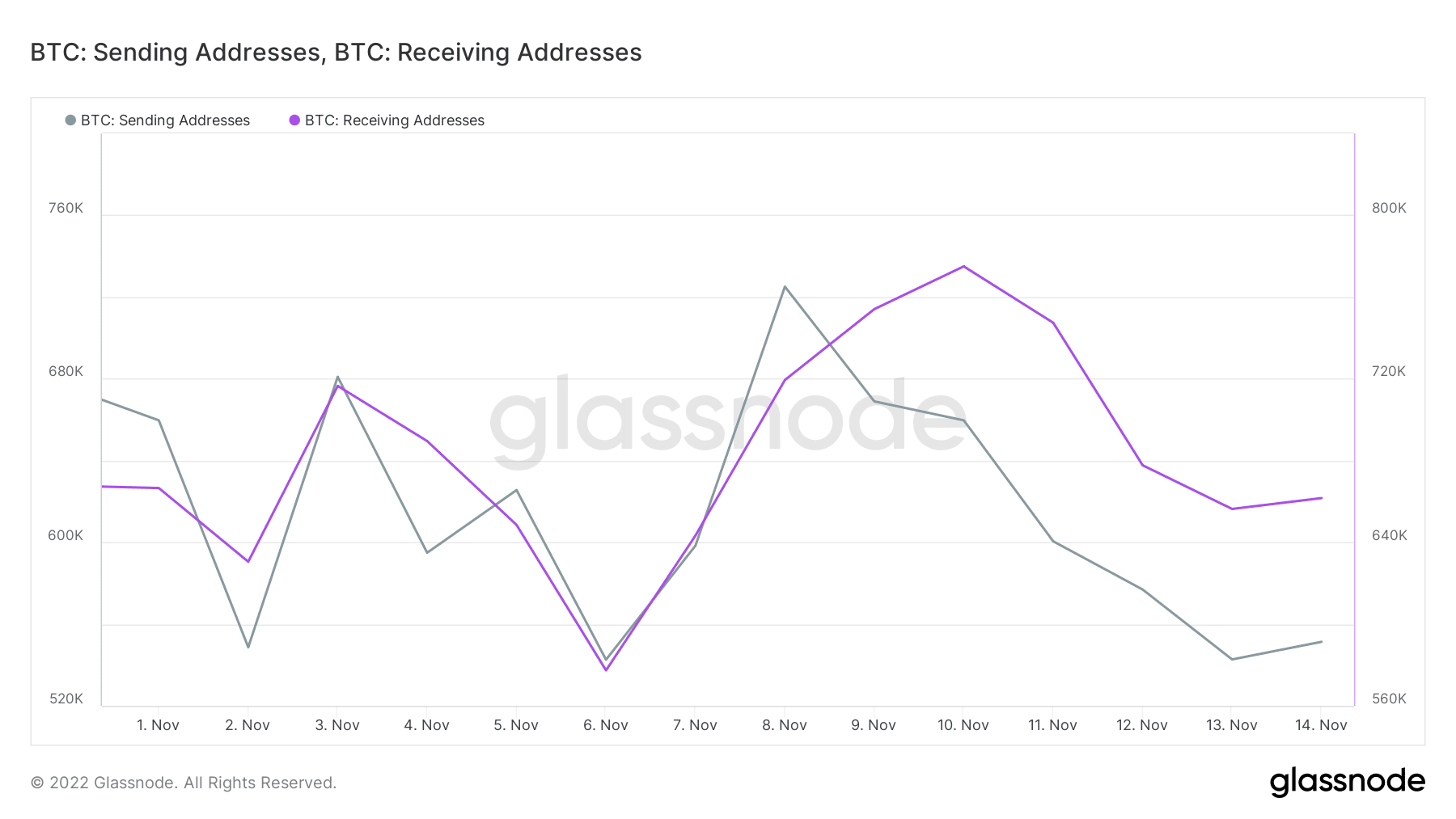

Bitcoin receiving addresses also outweighed the number of sending addresses. This confirmed that demand witnessed a significant increase especially in the last two days and stood in favor of the bulls.

While these observations may indicate a demand recovery, it was worth noting that the demand was relatively low. This was because it was largely associated with retail demand which often fails to have enough muscle to influence a substantial market move. It also suggested that whales were relatively absent. The addresses holding more than 1,000 BTC confirmed this expectation.

Summing up the BTC scenario…

One would expect that whales and institutions would be buying especially after the latest discounted prices. However, the above chart revealed that the market-moving financial muscle failed to contribute to the current demand.

Thus, all in all a major market move without buying pressure from Bitcoin whales and institutions could not be expected. Nevertheless, the retail market was taking advantage of the current discount to accumulate. Whales and institutions might do the same when the FUD cools down.