- St. Kitts and Nevis to adopted BCH as the legal tender in 2023

- BCH could see some upside in the days to come thanks to investor optimism

Bitcoin Cash [BCH] notably became less popular as the top cryptocurrencies segment became more crowded. This meant that it was at the risk of being sidelined as investors favored other top crypto projects.

Many investors might find themselves wondering whether they should still add it to their portfolio especially for 2023. Here are some observations that may help with that decision.

Read Bitcoin Cash’s [BCH] price prediction 2023-2024

Development was one of the yard sticks used to measure the health of a cryptocurrency and blockchain network. Bitcoin Cash previously announced plans for a network upgrade livestream. However, as per its latest announcement it was confirmed that the network would not proceed with it.

However, in other news, Bitcoin Cash, secured another win in terms of adoption. The St. Kitts and Nevis Prime Minister recently confirmed plans to adopt BCH as legal tender in his country in March 2023.

Can these events do good for BCH?

Legal tender status is a big step in the right direction for Bitcoin Cash. This move could reassure investors that BCH was still worth adding to their portfolio and may have better days ahead.

The news, however, did not have an impact on the BCH price action. Its $101.4 price of 13 November represented a significant bounce back from its new 2022 low of $87 last week. At press time, BCH exchanged hands at $98.70 after witnessing a drop of 4% in the last 24 hours.

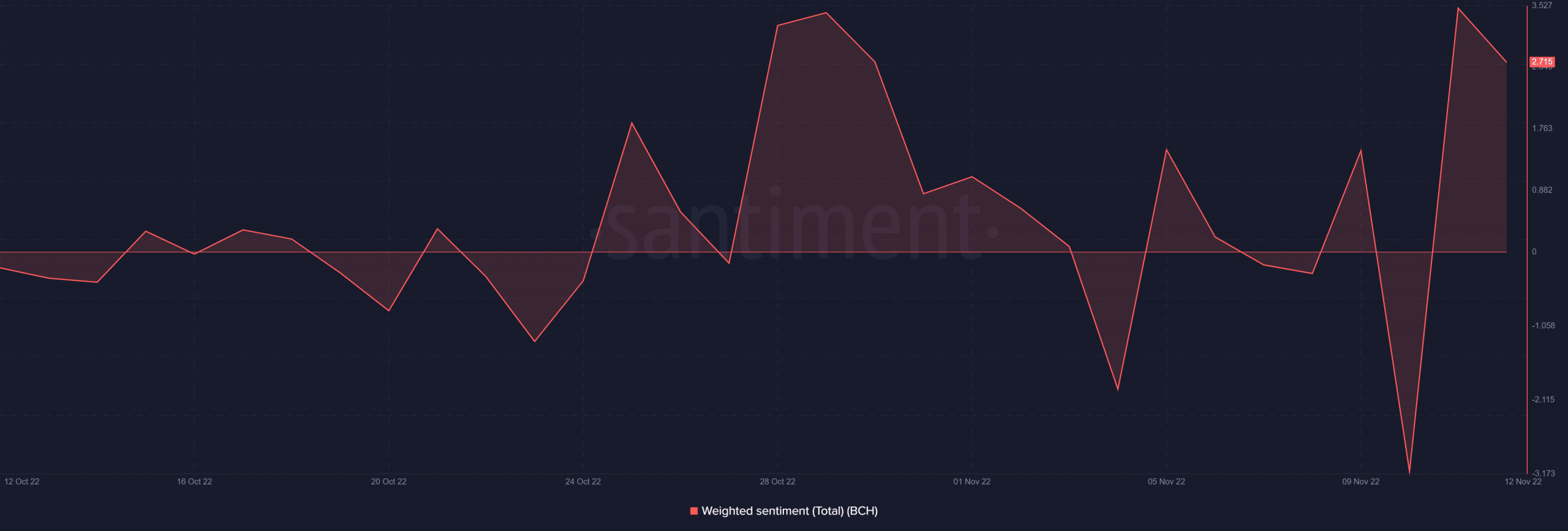

BCH’s performance in the last three days suggested that it was stuck in a price direction limbo. This suggested the lack of strong demand at the current price level. Investors also demonstrated optimism in the possibility of more upside even though the sentiment slid slightly in the last two days.

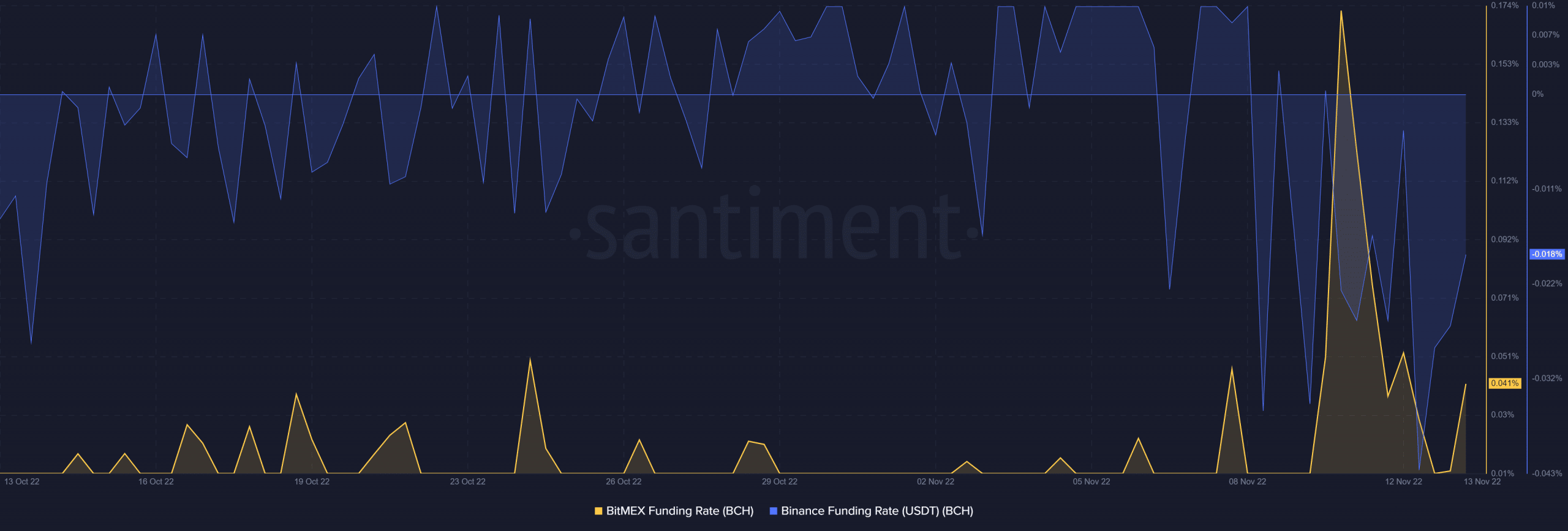

Furthermore, BCH’s weighted sentiment favored the bulls especially from its new 2022 low. BCH demand in the derivatives market also tanked significantly in the last five days as a result of the market crash. However, we did see a slight recovery in the last two days, indicating that demand was gradually gaining traction.

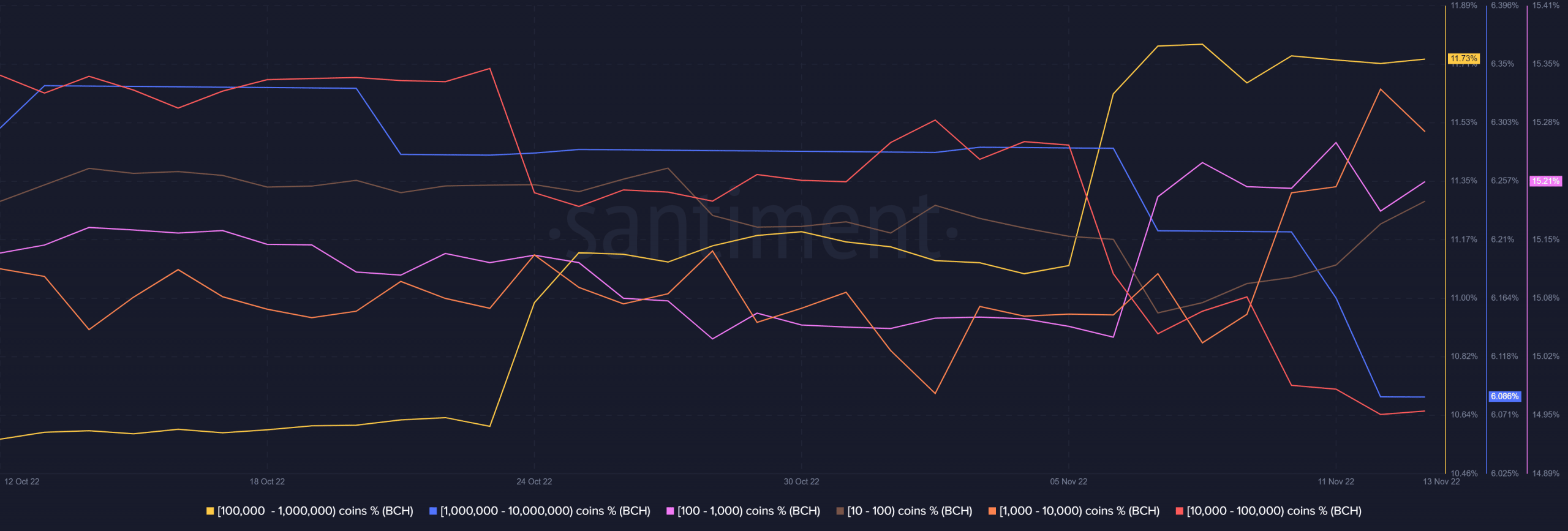

Bitcoin Cash’s supply distribution confirmed that whales trimmed their balances by a substantial margin last week. The largest whales holding over 1 million BCH had sharp outflows from their addresses in the last five days. Interestingly, the same whale category was yet to begin with their accumulation.

Addresses holding between 10,000 and 100,000 also sold off a significant chunk of their holdings. Meanwhile, addresses within the 10 to 10,000 BCH price bracket were buying the dip. The same was the case for addresses with 100,000 to 1 million coins. A slowdown in activity in the last two days also indicated uncertainty.