Bitcoin [BTC] traders closely watching its price action, especially over the last few days, may have noticed a slowdown in its sell pressure. Could this be a sign that it might be about to resume the upside or is this yet another recess before the bulls resume control?

Here’s AMBCrypto’s price prediction for Bitcoin (BTC) for 2022-23

Here’s a quick look at an analysis that may help provide some idea of what to expect this weekend.

Glassnode recently reported that Bitcoin’s seller exhaustion constant has retested its 2018 lows. According to the post, the metric retests its lower range when unrealized losses soar while volatility drops.

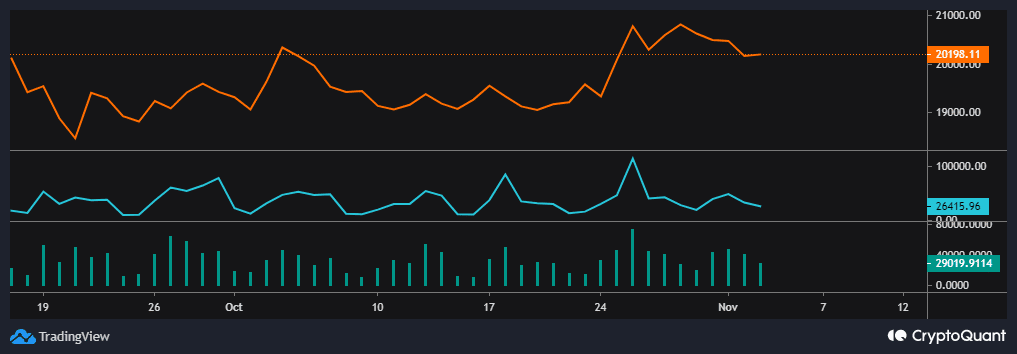

Seller exhaustion may indicate that Bitcoin might be about to switch gears in favor of the bulls. However, does this outcome align with the ongoing on-chain characteristics? Well, BTC exchange inflows have levelled out considerably since Wednesday after previously dropping over the last 3 days of October.

The pace of BTC exchange outflows have also seen a dip, especially since the start of November. This confirms the state of relative dormancy in the market as volatility dies down. This observation underscores the reduced incoming sell pressure, as well as buy pressure.

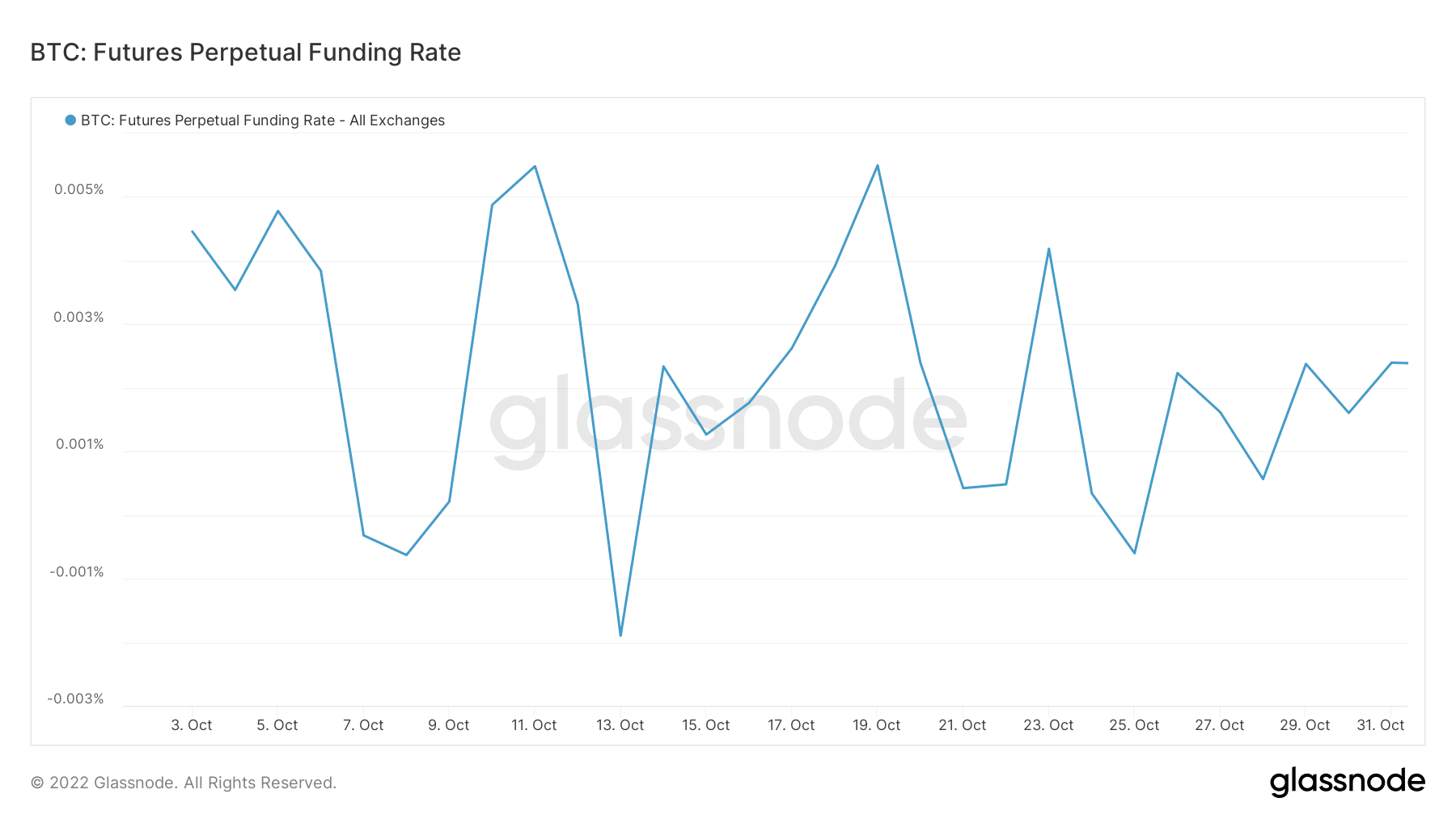

A similar outcome was seen in the derivatives market. Bitcoin Futures perpetual funding rate has been oscillating within a tighter range, with smaller movements. This seemed to confirm a drop in demand within the derivatives market.

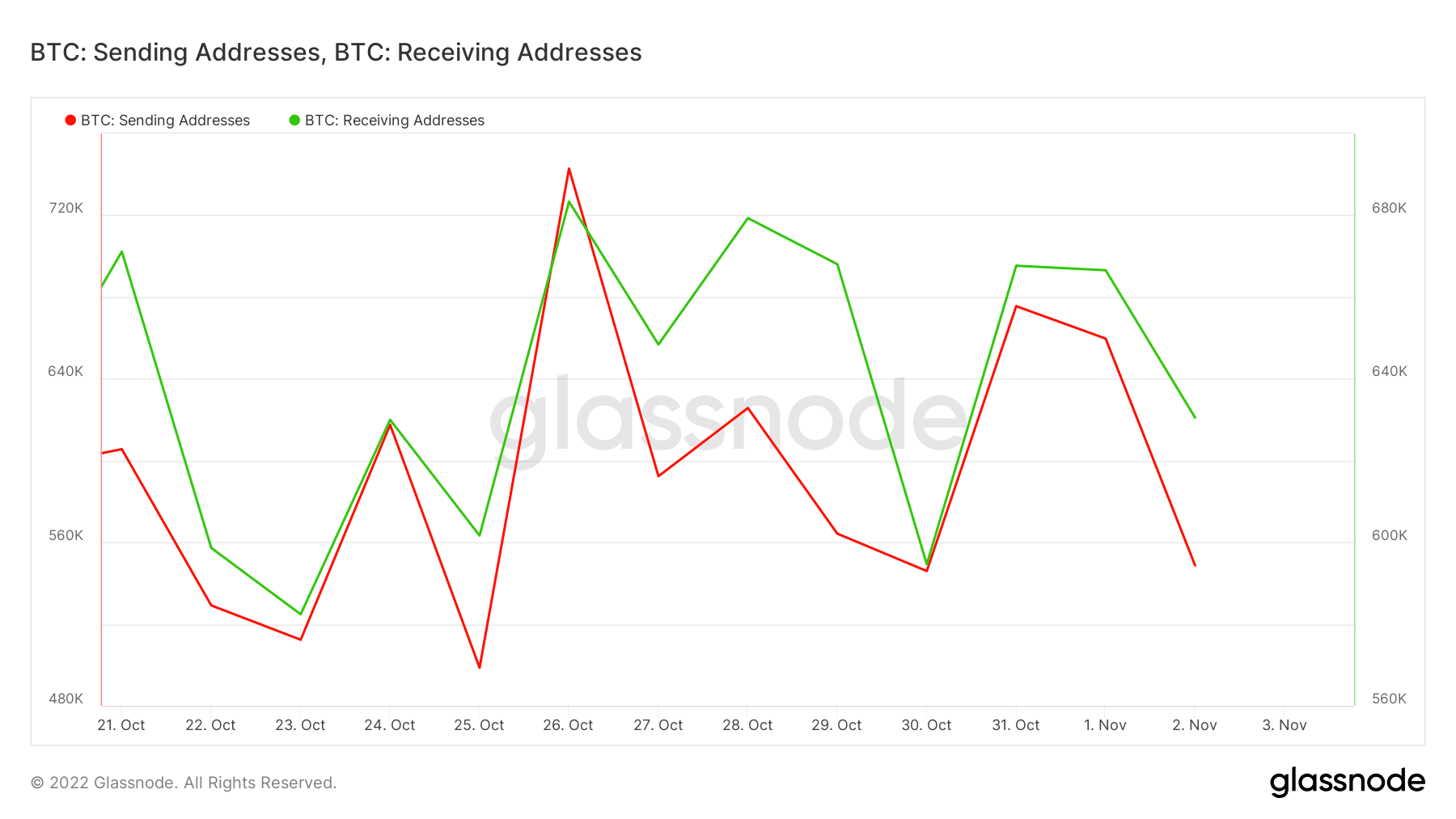

Bitcoin [BTC] has managed to sustain a significant level of trading activity over the last 3 days, despite an observed dormancy. Nonetheless, trading activity did take a hit and this is evident by the drop in both sending and receiving addresses.

Receiving addresses did outperform sending addresses, resulting in net address inflows in mid-week. This may explain why the bears allowed the bulls to dominate over the last 24 hours, at the time of writing.

How is the price actually doing?

BTC managed to stay above the $20,000-level, despite its bearish retracement over the last few days. In fact, its $20,247-press time price tag represented a 0.49% upside over the last 24 hours.

What BTC investors should prepare for

If the seller exhaustion observation is accurate, then healthy bulls might sustain price levels above $20,000, at least for some time. We might see some more upside if there is noteworthy bullish pressure as the weekend approaches.

On the other hand, Bitcoin investors should also watch out for another potential bearish wave. Investors should thus be on the look out for factors that may sway the price in either direction, given the uncertain nature of its position. If neither of these occur, then its prevailing performance might be the start of another crab market.