Bitcoin [BTC] just concluded a very exciting week observed in a while now. This was because the cryptocurrency’s downside in October continued to build on the bearish performance since mid-August. As A result, the recent rally relieved the tension in the market downturn, hence excitement during last week’s rally.

But can the bulls maintain this upside for a while longer? Let’s find out.

Here’s AMBCrypto’s price prediction for Bitcoin (BTC) for 2022-2023

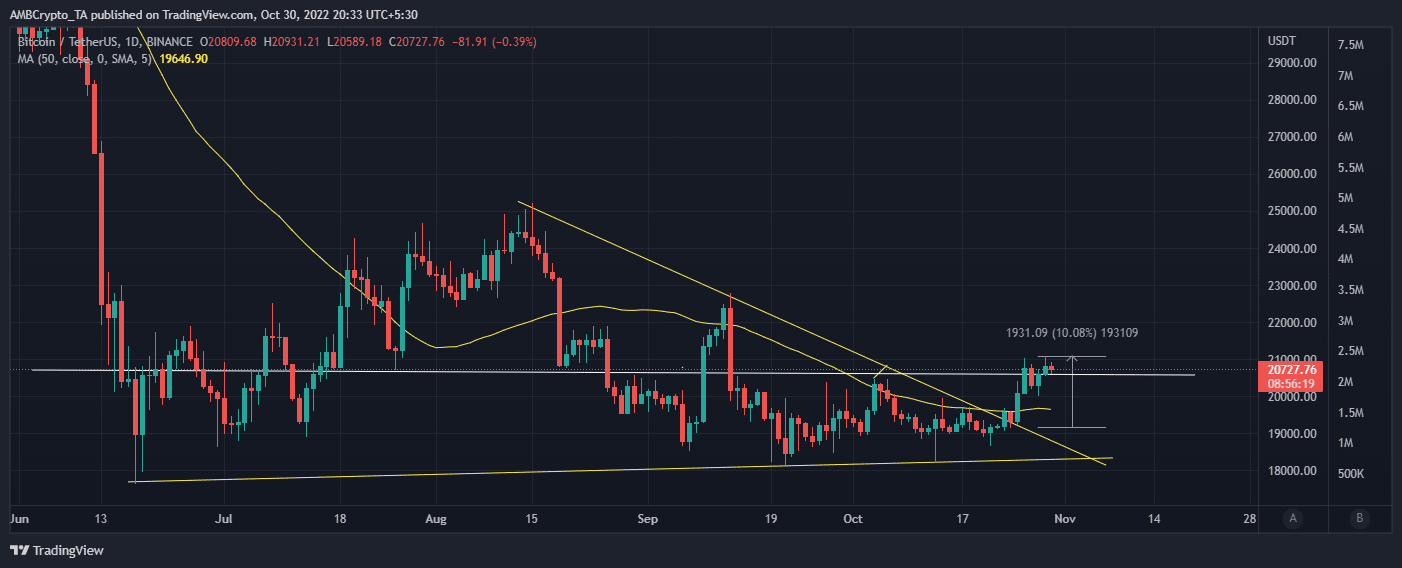

Yes, Bitcoin did witness a bullish recovery by over 10% last week, but its volatility notably dropped especially in the last three days. But can it resume the upside momentum or will we see the return of sell pressure? Well, here are some observations that may help provides eagle-eye view of where the market could be headed considering the current range.

According to a CryptoQuant analysis by TariqDabil (Pseudonym), the recent rally was fueled by retail buy pressure. In other words, the analysts suggested that whales and institutional investor participation was notably low.

Confirming low Bitcoin whale and institution participation

This analysis might hold true because the latest upside was not characterized by long daily candles to indicate strong big buys. This didn’t necessarily mean whale activity was absent. In fact, some bullish pressure from addresses holding between 10,000 and 100,000 BTC through-out the month was witnessed. Last week’s performance saw surge in buying pressure from addresses in the 100 to 100,000 bracket.

Addresses holding between 100 and 1,000 coins also saw net outflows during the week. This indicated profit taking by whales as prices went up. Addresses holding between 100,000 and 1 million registered a sharp outflow on 25 October. This whale category likely represents exchange addresses.

The above analysis also showed that the accumulation by top addresses levelled out. In addition, an increase in exchange reserves in the last seven days was also observed. This indicated that many traders were holding their BTC on exchanges. Furthermore, this also suggested that traders may not be confident enough in the bulls.

Bitcoin’s long-term holder SOPR had a 0.69 value at press time. This meant that long-term hodlers were still on the realized loss side of things.

All the above information pointed heavily on the expectations of another bearish retracement. This meant that Bitcoin might be doomed to extend its stay in the lower range. A look at its price action revealed that it was already experiencing resistance within the $20800 range. The same range previously acted as support and resistance in the last few months.

Are you doing okay BTC?

It will hard for Bitcoin to maintain the short-term upside without whale and institutional demand. After which an increase in sell pressure will likely push for another bearish outcome. On the other hand, investors should keep an eye out for the return of bullish demand from whales and institutions. This would ensure a continuation of the bullish momentum.