The usage restrictions of Bitcoin (BTC), which are largely due to its architecture, have been continuously questioned. The king coin had previously mostly been used as a store of value, but thanks to recent improvements, it is now being used in other ways and through different channels. Recently, Cash App announced that users could now transfer and receive Bitcoin utilizing the Lightning network. Bitcoin Product Lead for Cash App Michael Rihani tweeted the news, and the platform’s help page corroborated it.

Here’s AMBCrypto’s Price Prediction for Bitcoin(BTC) for 2022-2023

The new BTC utility on Cash App

Cash App had already provided Lightning Network compatibility for Bitcoin transactions, but only to the extent that customers could pay invoices by scanning Lightning QR codes. Now, unless otherwise stated, all Cash App transactions using QR codes would default through Lightning. Users would also be able to receive Bitcoin, instead of only sending it. There is a weekly cap of $999 on this new service, and it is still restricted in certain countries.

Source: Coinstats

As a “second-layer solution,” the Lightning Network helps Bitcoin transactions go through more quickly, allowing the cryptocurrency to be utilized for more frequent, smaller purchases.

How far has BTC come?

Twelve years ago, when Bitcoin’s value was much lower, one early adopter spent 10,000 BTC on two pizzas, starting a tradition that has become known as Bitcoin Pizza Day. How far BTC utility has progressed and a glimpse into what else it may give can be seen in recent advancements, such as the Cash App announcement.

In fact, while recent months haven’t been happy for BTC’s price action, the cryptocurrency is still trading close to $20,000 on the charts.

Hurray to 20k, but for how long?

Bitcoin finally broke the $20,000 barrier recently after much prevarication, much to the delight of BTC owners. Inspecting the price action over a 6-hour time frame confirmed that the uptrend is still in effect. One could see that the coin has been trading between $18,000 and $19,000 prior to its ongoing burst. As a result of repeated testing, a support area between $19,066 and $18,617 can be identified too.

Below the price movement, the short moving average (yellow line) could also be seen to be functioning as support. Additionally, a possible cross above the long MA (blue line) on the 6-hour timeframe was indicated by inflection. The blue line which initially acted as resistance could be seen acting as support for the new price pattern that was forming.

However, the price of BTC may decline to test the previous support level before the uptrend can be confirmed to sustain itself. If this level is successfully tested, the asset will properly commence a bull trend.

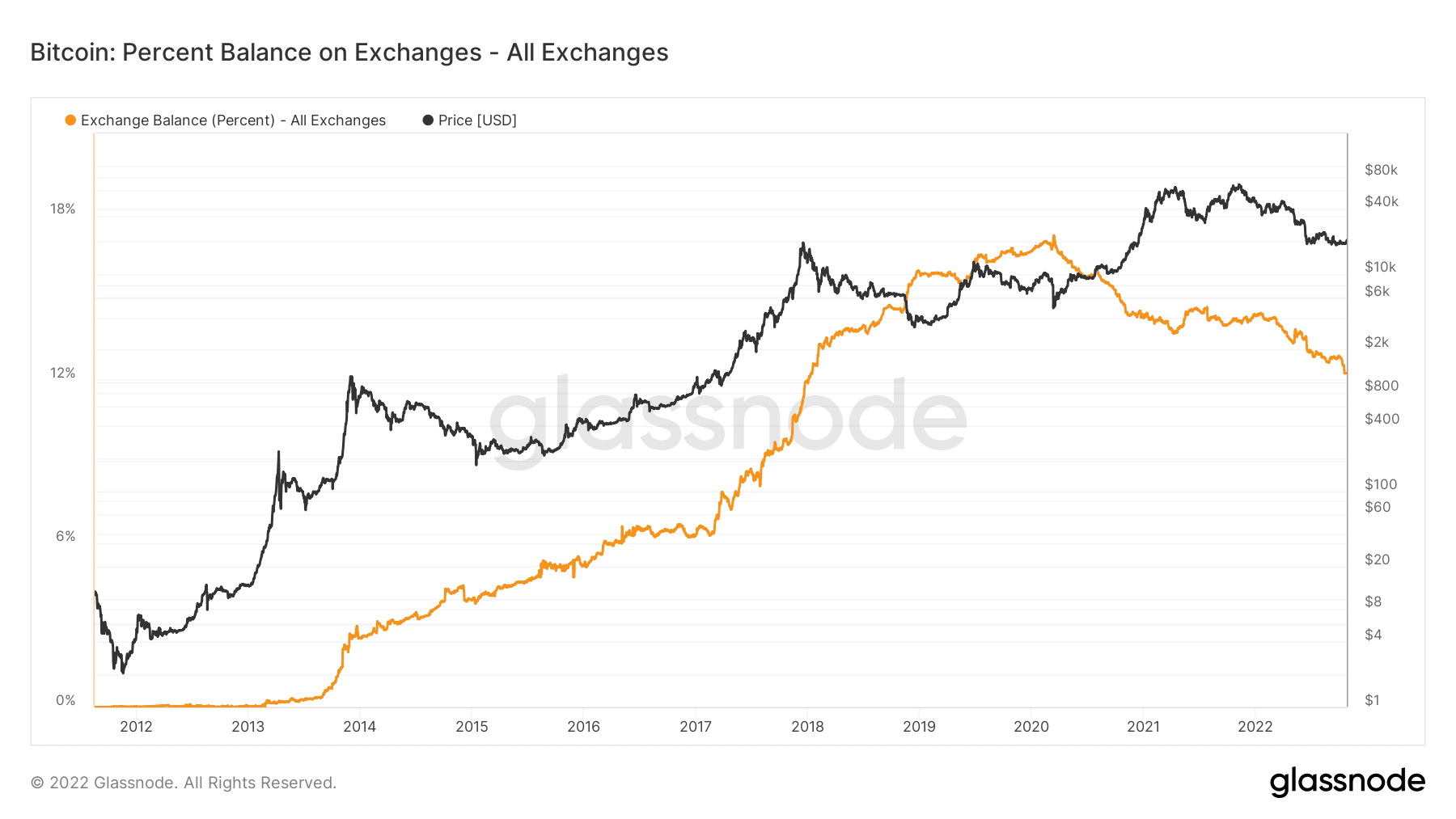

Are holders going off exchanges?

Based on Glassnode’s data, it is also possible to argue that the percentage of BTC held on exchanges has been declining since the year’s beginning. This implies that Bitcoin owners have been gradually removing their holdings from exchanges, a sign that they are hesitant to sell.