Bitcoin mining operations’ censure over its ESG concerns never ceases to exist. To make things worse, the mining industry suffered a major decline in 2022 amid the ongoing cryptocurrency winter. Following this, many big crypto-miners opted to sell their BTC holdings.

However, both of these factors could see a change in the scenario given the insights discussed below…

Spitting facts

Crypto-research and analytics firm Arcane Research, on 2 September, released a report estimating Bitcoin’s energy usage and its potential to transform the energy industry. The report asserted that the mining industry could transform worldwide energy production for the better. Contrary to its frequent narrative as a social and environmental harm. The report added,

“Most people disregard bitcoin mining as just yet another energy-intensive industry, but there is one big difference: bitcoin miners are uniquely flexible concerning when and where they consume energy.”

I.e. BTC could have a net-positive effect on energy and the environment. But, is this actually true?

As per the graph below, BTC miners consumed electricity at a rate of around 100 TWh per year, accounting for about 0.06% of the world’s total energy demands.

Source: Arcane Research

Compared to other sources, the said value represents an insignificant amount.

For instance, look at the video gaming and gold mining industry. The former consumed about 105 TWh per year, whereas the latter registered around 240 TWh – ~2.5x BTC mining consumption. Finally, the paper production operation’s consumption spoke for itself.

In addition to this, BTC mining systems reduce carbon emissions as the world increasingly transitions away from flexible fossil fuels to non-flexible renewables. The report opined,

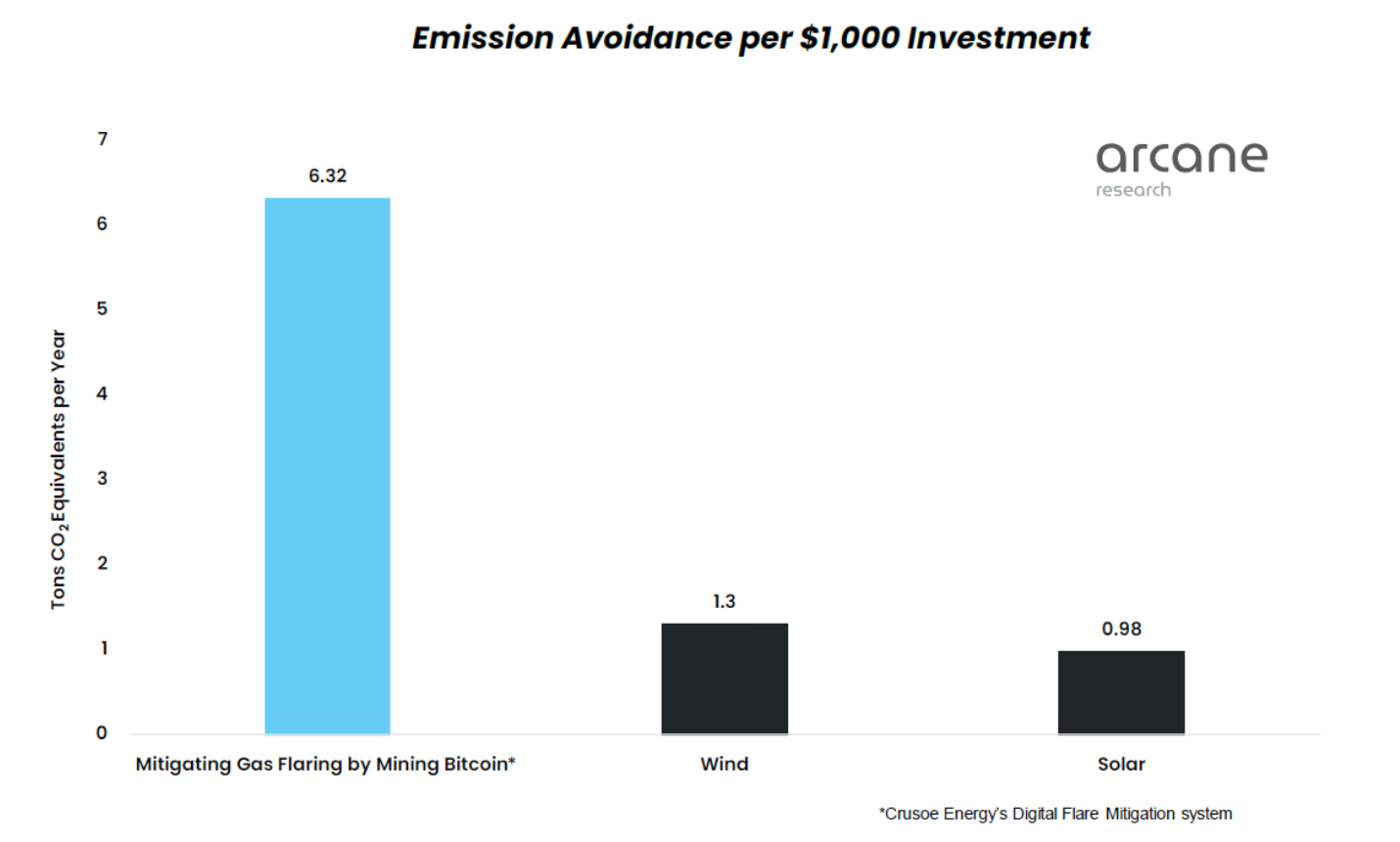

“Per $1,000 investment, a Bitcoin mining system reduces emissions of 6.32 tons of CO2 equivalents per year, compared to 1.3 for wind and 0.98 for solar.”

The graph below shed more light to support this narrative,

Source: Arcane Research

Did the miners (in exodus state or not) sense this sustainable change to mining operations? Well, YES. This is evident by the fact that Bitcoin Mining Difficulty saw its highest jump since January recently.

As per the previous report, BTC ushered in a mining difficulty adjustment at block height 751,968. Also, the mining difficulty increased significantly by 9.26% to 30.98T.

The question remains…

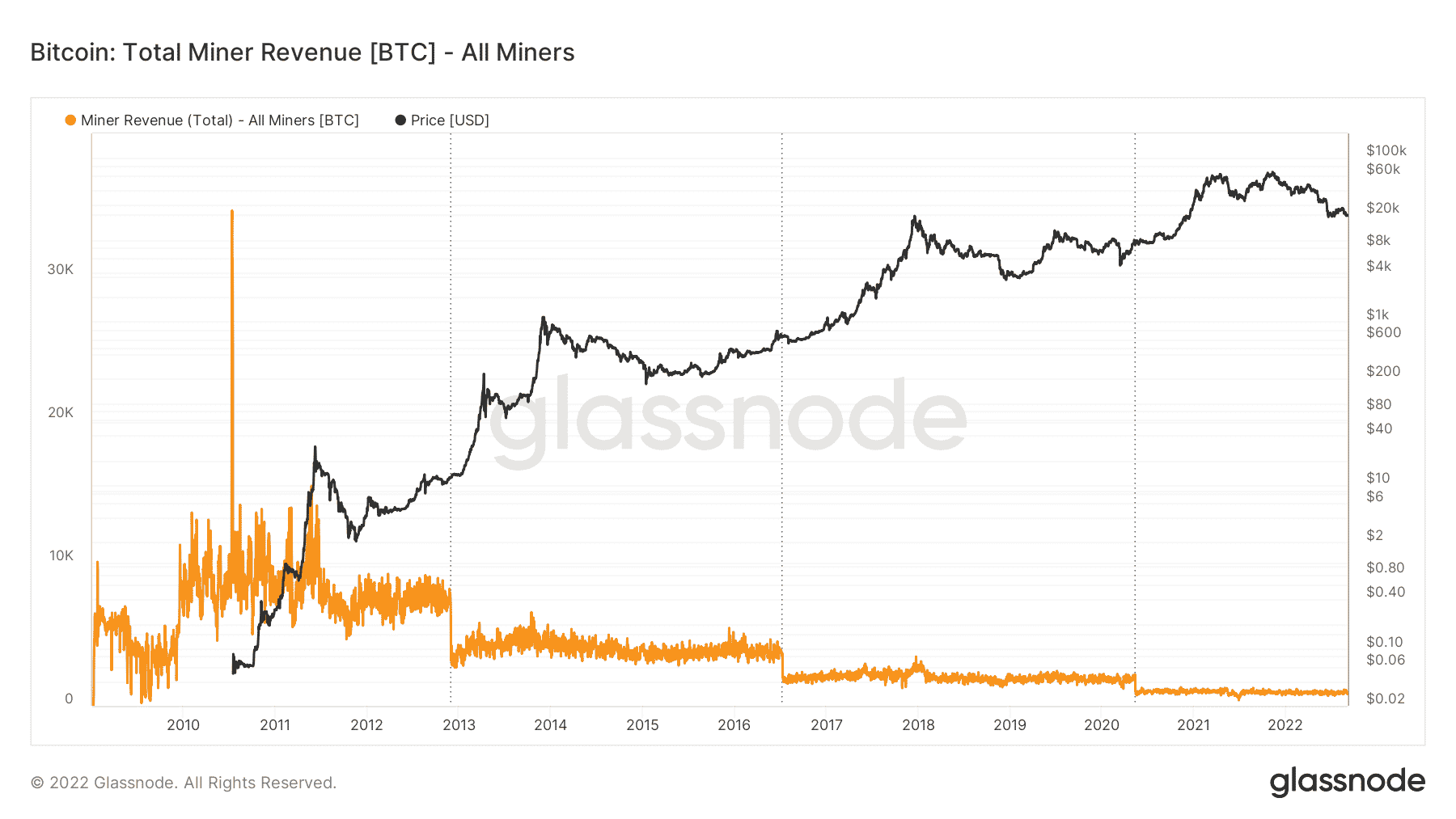

No doubt that the aforementioned insights reflect conviction among miners, despite the bearish sentiment(s). However, miners’ profit still highlighted a concerning scenario, with the same being the case for a while now.

Source: GlassnodeAt the time of writing, the total miner revenue was continuing to trade downhill.