Bitcoin, the largest cryptocurrency has had a lot of support from the community over the years. These holders have maintained an undeterred positive narrative despite challenging market conditions. However, BTC’s price didn’t quite show the same enthusiasm.

Holders assemble

Bitcoin has been extremely choppy of late, the king coin lost 7% over the last week. This marked the worst quarter for Bitcoin as the coin shed close to 50% in the second quarter of this year. At press time, BTC traded under the $20k mark despite holders buying the dip.

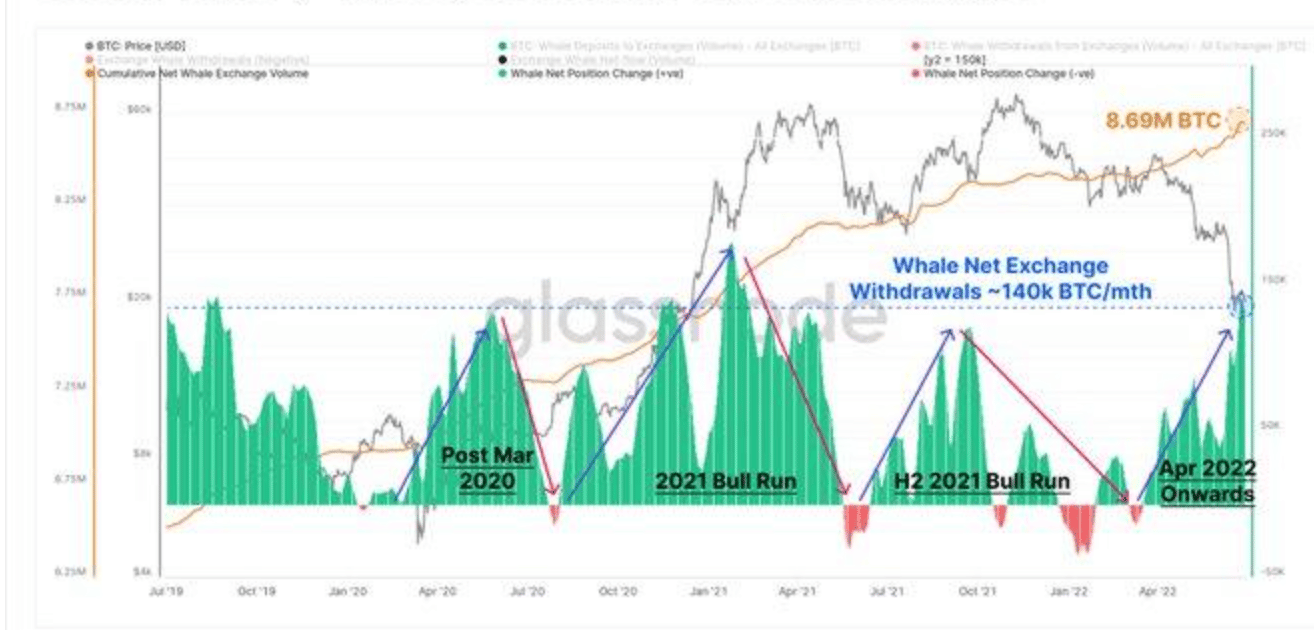

Whales (wallets with over 1k BTC) have been stacking BTC at a good pace. At present, the group bought 140k BTC per month from crypto exchanges and now owns 8.69 million BTC which is about 45.6% of the circulating supply.

Source: Glassnode

However, the accumulation has been very slow. This is one of the reasons why the price didn’t appreciate much. Moreover, shrimps as well (wallets with one or less than one BTC) have capitalized on the dip.

Source: Glassnode

Needless to say, although the second group acquired more BTC relative to the first, it didn’t quite affect BTC’s price. Santiment, an analytical platform shed more light on this situation. Consider the graph below. BTC’s largest whale transaction spikes happened on minor rallies. Ergo, keeping the prices ‘dormant.’

Source: Santiment

The vast majority of the largest spikes in BTC’s whale transactions occurred after small $100 to $200 $BTC price gains. However, ‘prices have subsequently fallen after each of these temporary increases in $100k+ or $1M+ transactions.’

Opportunity arises

Dominant buyers or long-term holders are scared to lose more portions of their portfolios. An analyst shared a solution for the aforementioned problem. Not to forget that Bitcoin is approaching a price zone that could offer a highly favorable risk-reward ratio for long-term BTC investors.

A crypto strategist Rekt Capital narrated this scenario to his 320,900 Twitter followers in a recent tweet.

Eventually, Bitcoin is expected to face seller exhaustion as it traded below the 200-week moving average at the press time. This could eventually put long-term investors in a position to pick up BTC at a price area that offers maximum rewards.