Recent developments in the market have reduced the pain tolerance of crypto investors that were already reeling from the May crash. What does the future of crypto assets look like now as global indexes begin to tremble further?

A living nightmare, maybe?

The crypto market has taken a huge hit since 11 June. Bitcoin [BTC] is currently down by 6% and below $27,500, Ethereum [ETH] is worse-off with a 12% hit and below $1,500. But that is not all as most of the major altcoins are also losing ground today.

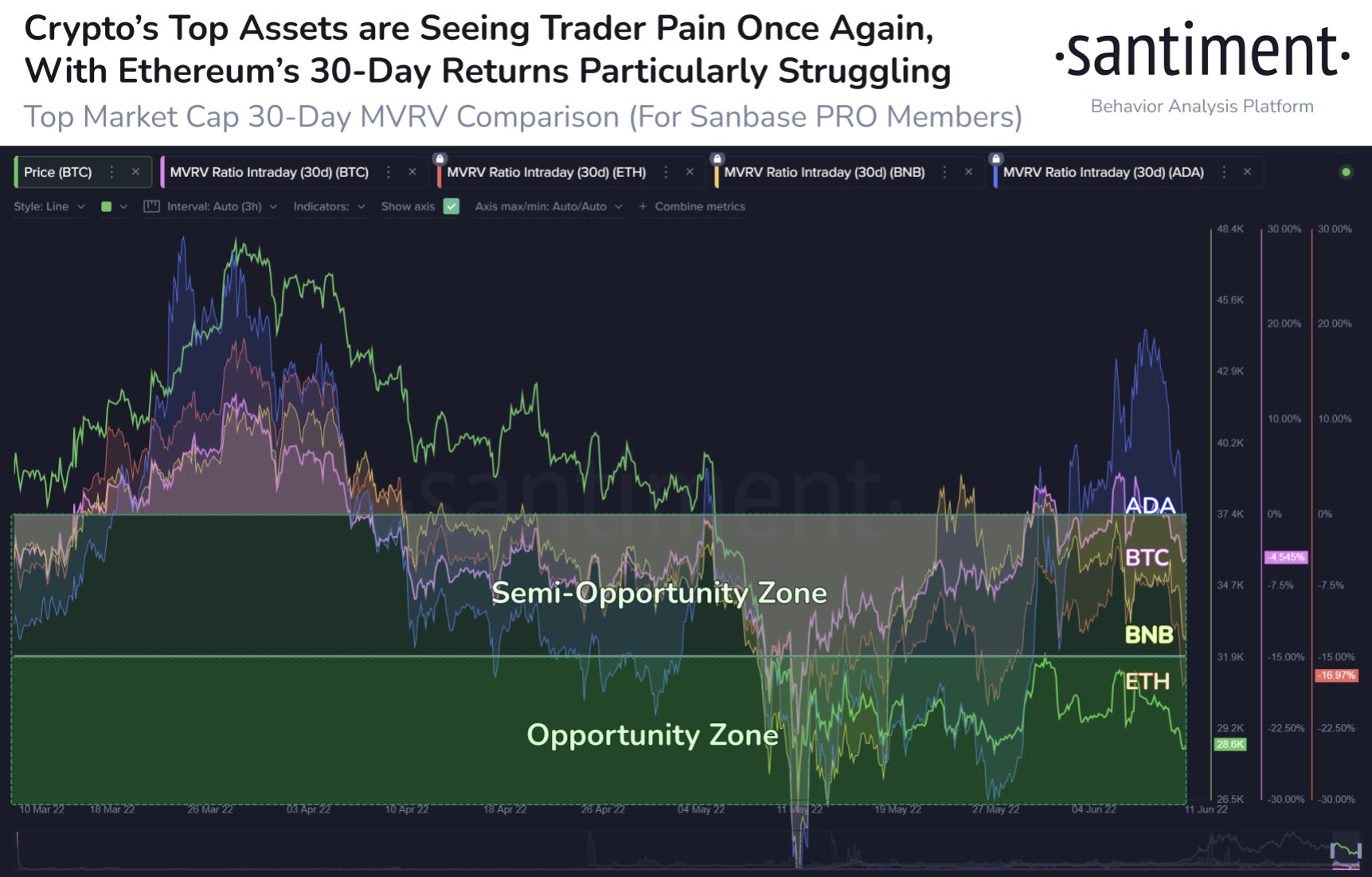

As per a recent Santiment study, the average returns of traders have fallen into negative territory again after the May debacle. Santiment used the MVRV-30 day metric on major cryptos and the results were terrifying with only ADA having neutral returns. Bitcoin and Binance Coin are negative and stuck in the semi-opportunity zone. Ethereum, on the other hand, is back in the opportunity zone again after dropping as low as its February 2021 price.

Source: Santiment

The recent slaughter in the equities market is being directed to a recent CPI data released by the US. According to data published by the U.S Bureau of Labour Statistics, the consumer price index increased by 1% in May. This puts the annual inflation rate in the United States at a 41-year high of 8.6%. According to a Wall Street Journal survey, economists had the May CPI forecasted at 8.3%, marking a significant misestimation of 30 basis points.

Source: Santiment

The token reactions

Bitcoin had recently recovered from the crypto crash during May to cross $32,000. But after the latest inflation update, it has chopped by more than 6.5% to fall below $27,500. The realised cap of Bitcoin just reached a seven-month low of $447.6 billion with the previous such low recently observed on 10 June. This is another worrying signal for the crypto community with the king coin struggling to maintain its position at the top.

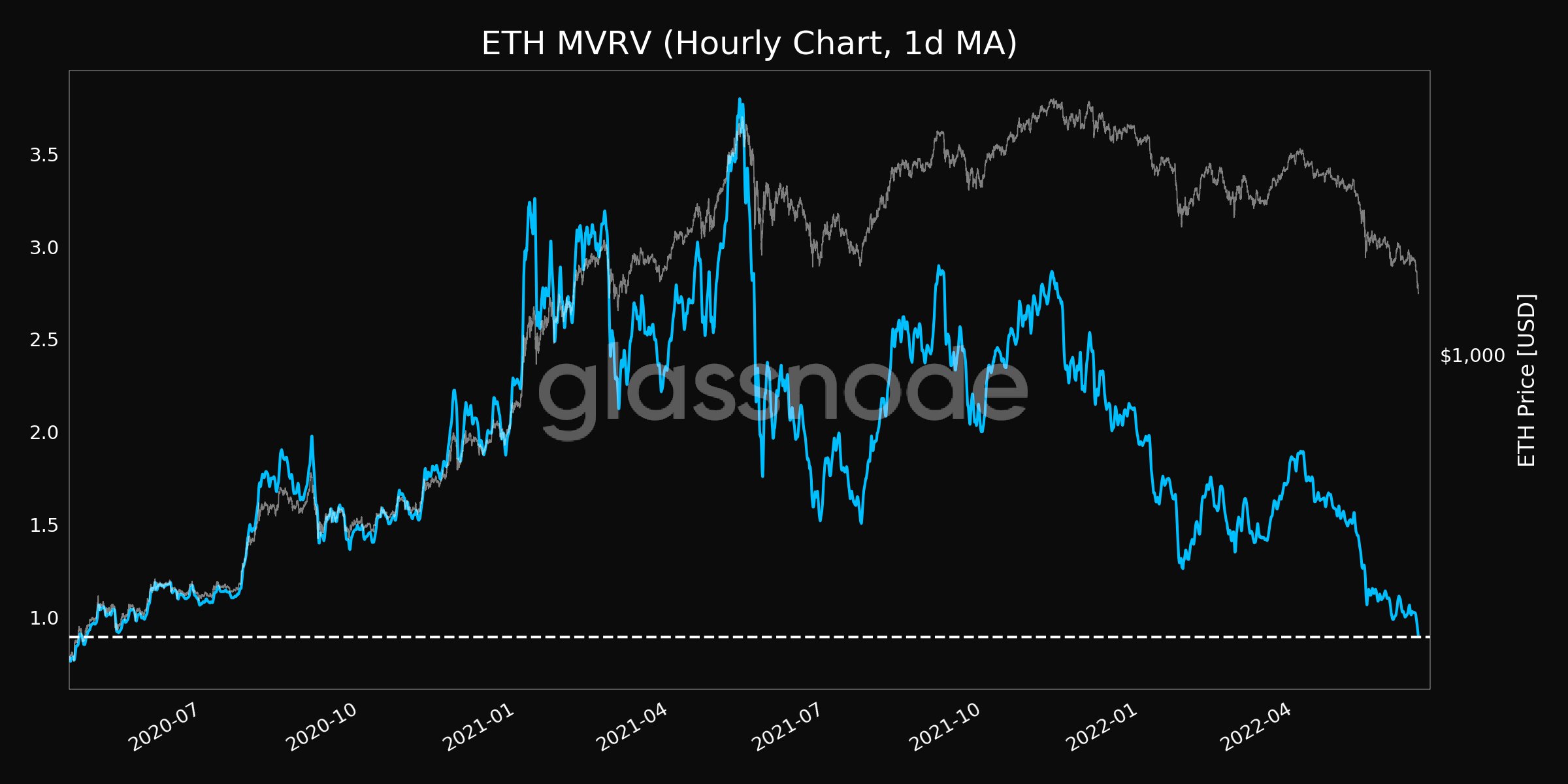

Source: Glassnode

The situation is far more critical for Ethereum despite the recent Ropsten merge with the beacon chain. The second largest cryptocurrency by market cap took a 12.8% dip to reach its lowest point since February 2021. ETH is currently trading at $1,451 and is down by around 19% during the week.

According to Glassnode’s tweet, the percent addresses in profit reached a 22-month low in Ethereum at 55.6%. The intraday MVRV is another metric showing the cracks in the network after reaching a two-year low of 0.894. This is a huge blow to the Ethereum community that already saw the ‘Difficulty Bomb’ pushed to August today.

Source: Glassnode

This sums up the state of the crypto market today which has crashed to $1.10 trillion and down by 8% in the past 24 hours. Experts believe the worst is yet to come with growing uncertainty among risk assets. Peter Schiff warned investors not to buy this dip as “Bitcoin looks poised to crash to $20K and Ethereum to $1K.”