The crypto market is facing a testing start to May. With the Feds announcement, the market has faced two major dips already with the latest being a 3.7% dip. Amidst this, there has been yet another statistic has come out that can cause a bit of worry and raise a lot of eyebrows.

Stablecoins, namely Binance USD (BUSD) and USD Coin (USDC), are showing tremendous volumes today. Interestingly, such levels have not been observed in months.

At the same time, Bitcoin has been taking since the start of May. Initially, it was ranging around $38,500 but the market sentiment has turned for the worse. The leading market cap cryptocurrency is now hovering around the $35,000 zone. Ethereum has also dropped to a sideways movement around the $2500 zone.

What does the data say?

Starting with USDC, it has really come about in the last 24 hours. As per Glassnode data, the number of active addresses on USDC has reached a new milestone. It stands at a 1-month high of 1,903.4 after crossing the previous high of 1896.7 on 6 May.

Source: Glassnode

The number of transfers of USDC also hit a new high today. The previous 1-month of 2,510.8 transfers was observed on 6 May which has since been overtaken at today.

Source: Glassnode

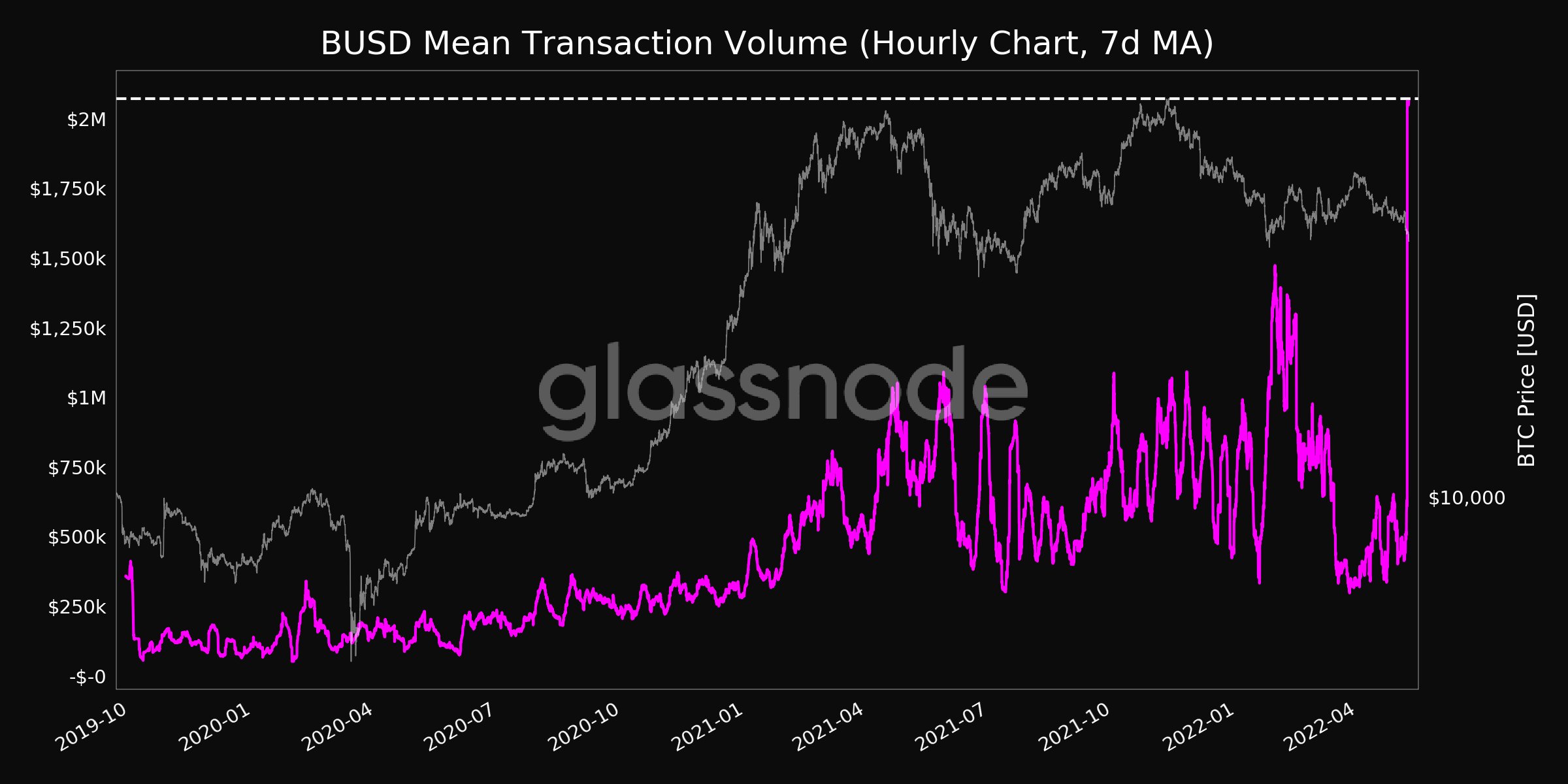

BUSD is another stablecoin that showed a massive surge in activity. BUSD’s “Mean transaction volume” reached an all-time high value today of $2,072, 063 eclipsing the previous all-time high.

Source: Glassnode

What about the “big-shots” of crypto?

Bitcoin and Ethereum both suffered losses in the last 24 hours. While BTC fell by 3.7%, and ETH by 4.5%, both major cryptocurrencies have suffered recently.

With bearish sentiment across the market, the BTC “Exchange inflow volume” reached a 3-month high of $57,349,095, as Glassnode reports. ETH, on the other hand, dropped to a new low with the number of addresses in loss reaching a 2-year high of 24,881,546.7.

So overall this increase in stablecoin activity amid poor market sentiments and falling prices of flagship tokens across the board doesn’t bode too well for the short term future of cryptos.