For the third time this year, the crypto market has managed to kill investors’ hopes by marking another rally followed by a quick drop leaving Bitcoin and other altcoins back at their lows.

But this time around, investors seem to be exhibiting a much different behavior than they did before, specifically a confident one.

Falling Bitcoin, rising interest

Bitcoin, trading at $39,369 currently, slipped below $40k once again in the last 24 hours, losing almost 4.54% at one point. Although BTC is actually in an ascending channel on a larger timeframe, gradually inclining to establish $40k as a much more reliable support.

Bitcoin price action | Source: TradingView – AMBCrypto

Regardless, fear has once again crept into the market after subsiding for a while thanks to the March-end rally.

But on a much more interesting note, this time around, investors are not actually worried about losses. The sentiment of buying the dip seems to be taking over BTC holders as they prepare for a recovery/rally soon.

This fall was, anyways, expected to be a cooldown after the two-week-long rally in March, albeit a drawdown this severe was not expected. It also caused about 16.5% of Bitcoin’s total circulating supply, about 3.135 million BTC worth $123.4 billion, to fall back into losses.

Bitcoin supply in profit | Source: Glassnode – AMBCrypto

Still, in the last week, investors bought out over 39,536 BTC worth $1.54 billion before selling 11k BTC ($429 million) back into the market.

Bitcoin exchanges indicate outflows | Source: Glassnode – AMBCrypto

Secondly, this is further evidence of the fact that BTC holders are HODLing for profit as profit-takers have been holding onto their supply since November 2021, right after Bitcoin hit its ATH of $66,945.

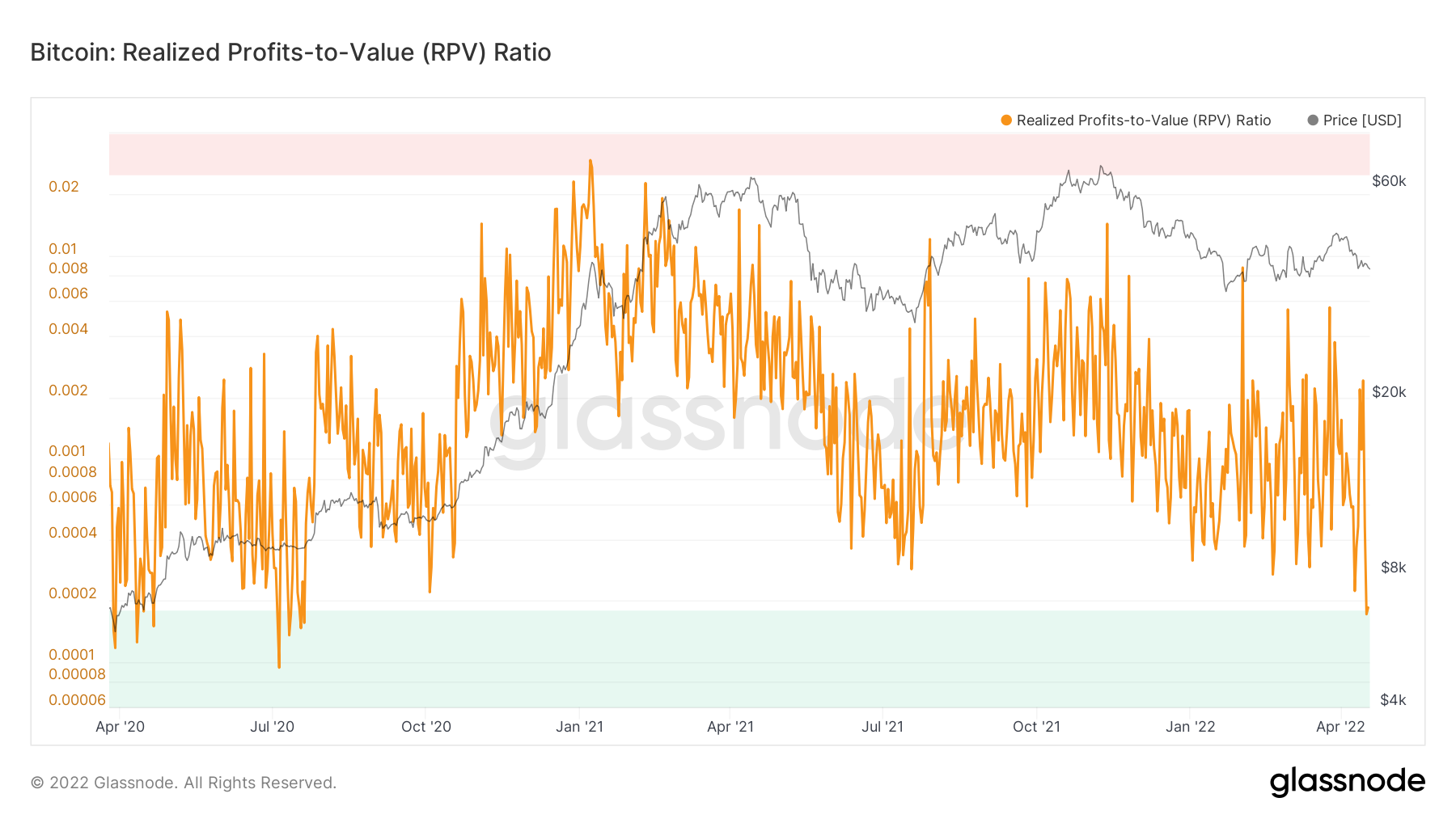

The RPV ratio is at the edge of bottoming, which it last did in July 2020, right after which Bitcoin shot up by 28% in the next ten days.

Bitcoin RPV ratio | Source: Glassnode – AMBCrypto

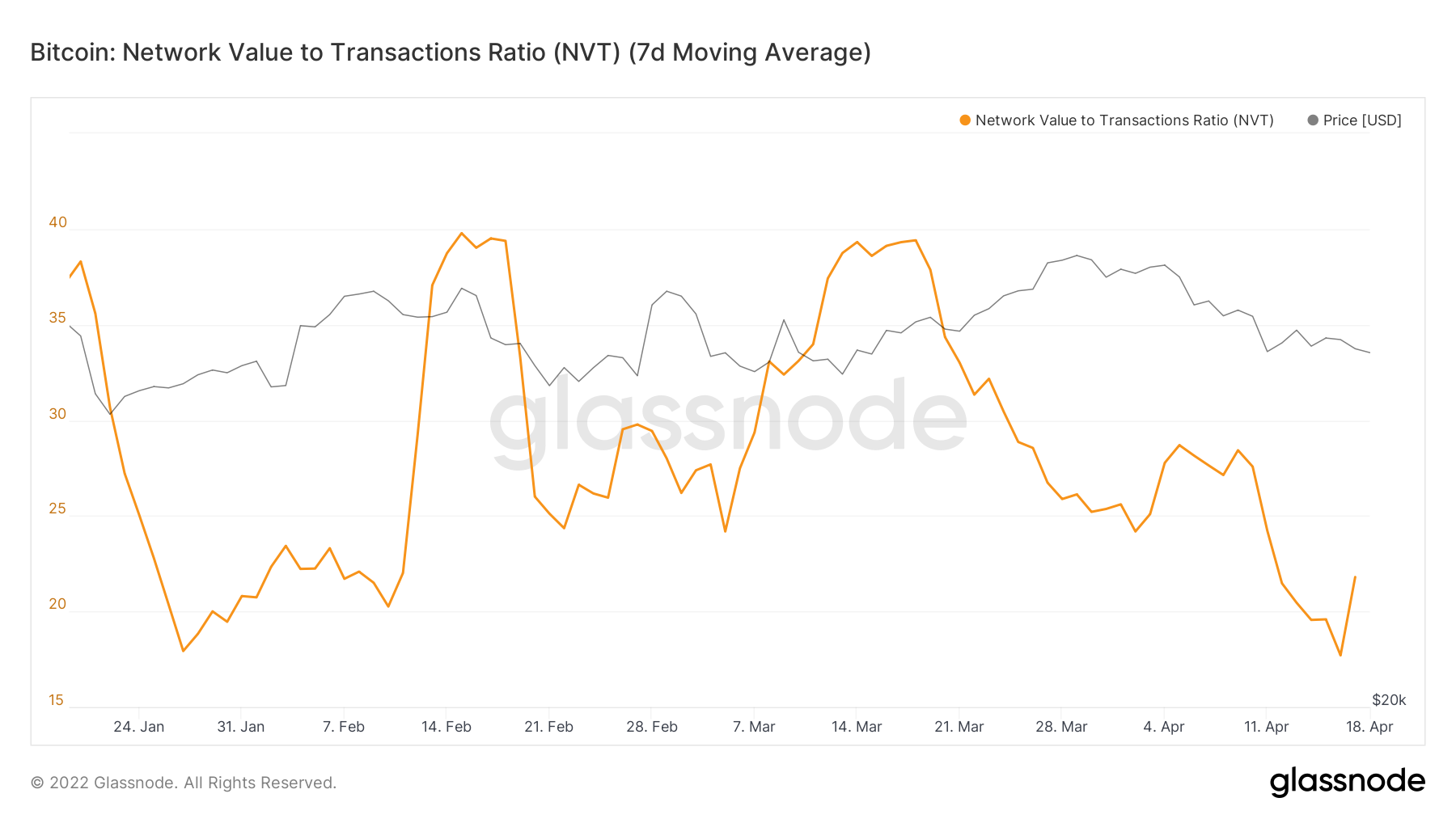

This could be an indication that Bitcoin might be heading towards a rally soon enough, and investors would thus make a profit out of their recent purchase. As it is, the king coin is severely undervalued at the moment, given the network value is at a two month low. This would further act as the fuel needed to reignite the fire.

Bitcoin NVT ratio | Source: Glassnode – AMBCrypto