This article was originally published in Bitcoin Magazine's "Orange Party" print edition with the headline "The Stage Is Now Set." Click here to subscribe now.

After many years of development and the successful routing of socialists, evil CIA proponents of “Democracy”, cowards and soft-skinned, fat, virtue-signaling infiltrators, Bitcoin is stronger than ever, growing in many surprising and encouraging ways and confounding people who can’t think.

The stage is now set for Bitcoin to totally replace fiat online and offline as the main way people spend. The infallible Bitcoin network and consumer-grade Bitcoin tools are spreading like wildfire in every direction as people wake up to what this new network can do for them and how fiat is inflating under their feet, just as people woke up to what the web could do, and that they didn’t need the post office any more.

The greatest explosion of Bitcoin users will be on mobile phone platforms where Wallet of Satoshi, Samourai Wallet, Breez, Muun, Phoenix, Pine, and BlueWallet are the vanguard of a new class of applications in the emerging “Consumer Bitcoin” sector.

Very few people understand the enormous impact Consumer Bitcoin is going to have on the way things are ordered in the world, and certainly, the list of selfish and ignorant bad actors listed above are either incapable of imagining it, and if not, are actively against it under orders to prop up the unethical, unsustainable, and evil fiat status quo.

Thankfully not all people are driven by fear of the new, or take their marching orders from violent psychopaths. This is manifestly clear in the case of El Salvador, the surprise market leader that is forging ahead fastest and most effectively to switch from the money of mass murder to the money of peace, “Bitcoin”. Not only are they embedding Bitcoin deeply into the economy there, they are actively educating other countries to help them remove the yoke of fiat and the murderous democracy boosters.

One of the countries attending the historic summit in San Salvador was the mighty Nigeria, which, should it heed the advice and learning accumulated there, could take its rightful place as the economic center of the continent of Africa. Rather than settling on the racist-inspired “Afro” currency, it could settle on bitcoin as the unifying, provably fair, and economically sound “lingua franca of money” for all citizens in African nations — bringing extraordinary economic benefits to all the people who live on that continent, as well as the long-overdue permanent removal of toxic Western influences.

Voting doesn’t make fiat ethical. Voting doesn’t trump math. Anyone who is for voting as the way to select how a monetary system should work is anti-Bitcoin, and certainly, no Nigerian should listen to a Washington wonk who desires all nations to be Cargo Cult copies of the West and its unethical, evil, unbalanced, and unworkable systems of control.

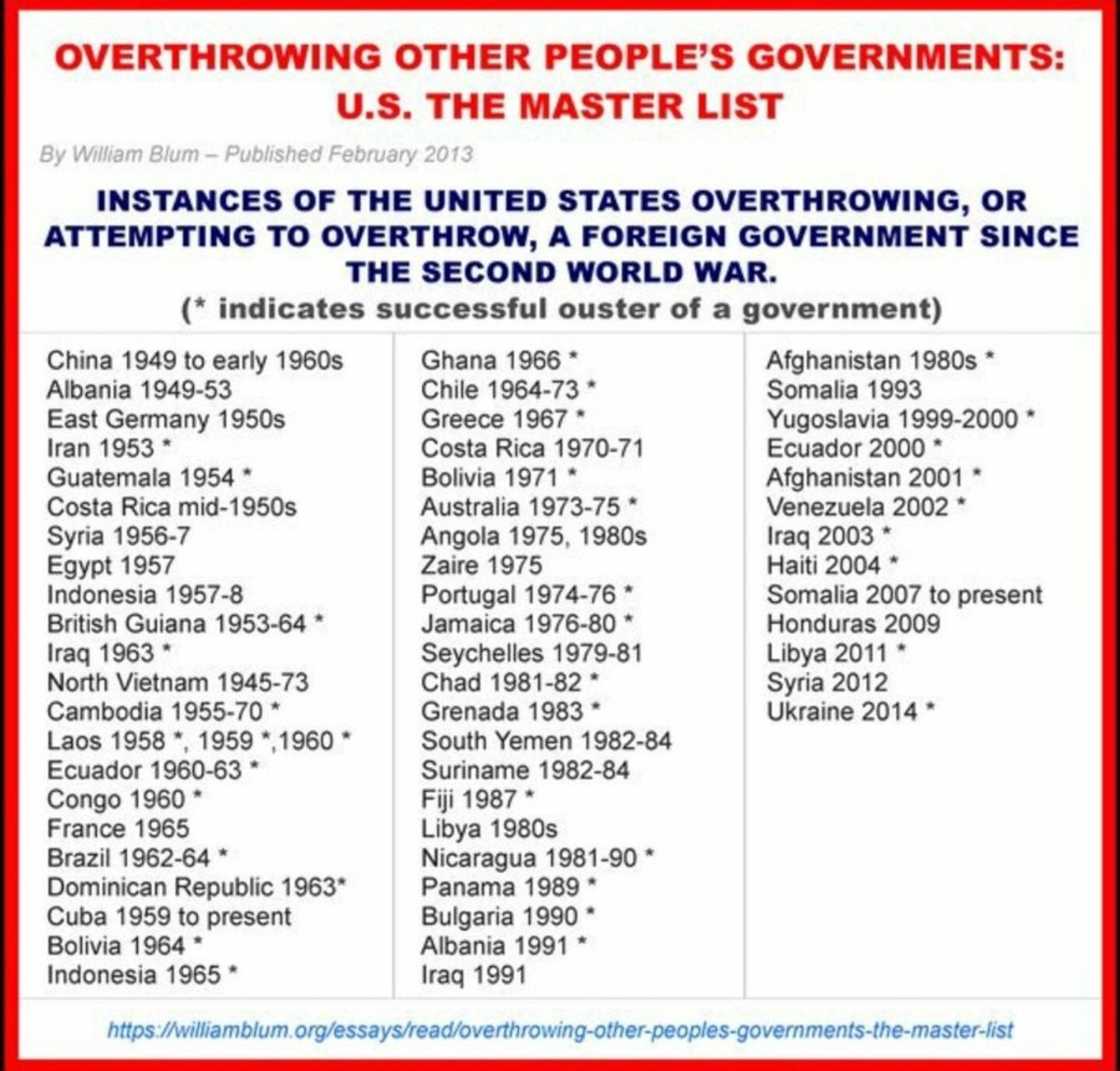

“Democratic” doesn’t equal fair, proper, or right. It doesn’t ensure just outcomes, or restrain the State from committing mass murder. Democratically overproduced fiat is the fuel that powered the mass murder “Military Industrial Complex” that ravaged the 20th century. Now, with bitcoin in place as the world’s money, outrages like this cannot happen again because there simply and literally is no money for it.

How and why is this so, and what is it about Bitcoin in particular that makes any of this predictable? Doesn’t the price of bitcoin and how it fluctuates refute these extravagant claims? Are they extravagant claims?

Bitcoin is a very new technology, even though the software and math concepts that it brings to life are decades old. The double-spending problem has been solved; this means that it is possible to use a digital “certificate” to stand in the place of money and be sure that as long as you hold it no one else can spend that “certificate” other than you. This is an unprecedented paradigm shift, the implications of which are not yet fully understood, and for which the tools do not yet exist to fully take advantage of this new idea.

This new technology requires some new thinking when it comes to developing businesses that are built upon it. In the same way that the pioneer providers of email did not correctly understand the service they were selling for many years, new and correct thinking about Bitcoin is needed, and will emerge, so that it reaches its full potential and becomes ubiquitous.

Hotmail used familiar technologies (the web browser and email) to create a better way of accessing and delivering email; the idea of using an email client like Outlook Express has been completely superseded by web interfaces and email “in the cloud” that provides many advantages over a dedicated client with your mail in your own local storage.

Bitcoin, which will transform the way you transfer money, needs to be understood on its own terms, and not just as an online form of money. Thinking about bitcoin as money is as absurd as thinking about email as another form of sending letters by post; one not only replaces the other but it profoundly changes the way people send and consume messages. It is not a simple substitution or one-dimensional improvement of an existing idea or service.

As I have explained previously, Bitcoin is not money. Bitcoin is a protocol. If you treat it in this way, with the correct assumptions, you can start the process of putting Bitcoin in a proper context, allowing you to make rational suggestions about the sort of services that might be profitable based on it.

Every part of Bitcoin is text. It is always text, and never at any point ceases to be text. This is a fact, and as text, it is protected under the free speech provisions of the constitutions of civilized nations with guaranteed, irrevocable rights.

If Bitcoin is a protocol and not money (it is), then setting up currency exchanges that mimic real-world money, stock and commodity exchanges to trade in it is not the sole means of discovering its price. You would not set up an email exchange to discover the value of email services, and the same thing applies to Bitcoin.

Staying with this train of thought, when you type in an email on your Gmail account, you are inputting your “letter”. You press send, it goes through your ISP, over the internet, into the ISP of your recipient and then it is outputted on your recipient’s machine. The same is true of Bitcoin; you input money on one end through a service and then send the bitcoin to your recipient, without an intermediary to handle the transfer. Once Bitcoin does its job of moving your value across the globe to its recipient it needs to be “read out”, i.e., turned back into money, in the same way that your letter is displayed to its recipient in an email.

In the email scenario, once the transfer happens and the email you have received conveys its information to you, it has no use other than to be a record of the information that was sent (accounting), and you archive that information. Bitcoin does this accounting on the blockchain for you, and a good service built on it will store extended transaction details for you locally, but what you need to have as the recipient of bitcoin is services or goods not bitcoin itself.

Bitcoin’s true nature is as an instant way to pay (despite not being money) anywhere in the world. It is not an investment, and holding on to it in the hopes that it will become valuable is like holding on to an email or a PDF in the hopes it will become valuable in the future without simultaneously investing in the companies that provide access to it for consumers doesn’t make any sense. Of course, you can hold on to bitcoin and watch its value go up, and its value will go up, but you need to have guts to weather the violent waves of selling and buying as the transition to an all-bitcoin economy gets under way.

Despite the fact that you can’t double spend them and each one is unique, bitcoin have no inherent value, unlike a book or any physical object. They cannot appreciate in value. Mistaken thinking about Bitcoin has spread because it behaves like money, due to the fact it cannot be double spent. Misrepresentation of Bitcoin’s true nature has masked its dual nature of being digital and not double-spendable.

Razzles. They start as a candy, and then end as a gum. Before you chew them, which are they? A candy, or a gum?

Bitcoin is digital, with all the qualities of information that make information non-scarce. It sits in a new place that oscillates between the goods of the physical world and the infinitely abundant digital world of information, belonging exclusively to the digital world but having the characteristics of both. This is why it has been widely misunderstood and why a new approach is needed to design businesses around it.

All of this goes some way to explain why the price of buying bitcoin at the exchanges doesn’t matter for the consumer. If the cost of buying bitcoin goes to 1¢, this doesn’t change the amount of money that comes out at the other end of a transfer. As long as you redeem your bitcoin immediately after the transfer into either goods or currency, the same value comes out at the other end no matter what you paid for the bitcoin when you started the process.

Think about it this way. Let us suppose that you want to send a long text file to another person. You can either send it as it is, or you can compress it with zip. The size of a document file when it is zipped can be up to 87% smaller than the original. When we transpose this idea to Bitcoin, the compression ratio is the price of bitcoin at an exchange. If bitcoin trades for $100, and you want to buy something from someone in India for $100 you need to buy 1 bitcoin to get that $100 to India. If the price of bitcoin is 1¢ then you need 10,000 bitcoin to send $100 dollars to India. These would be expressed as compression ratios of 1:1 and 10,000:1 respectively.

The same $100 value is sent to India, whether you use 10,000 or 1 bitcoin. The price of bitcoin is irrelevant to the value that is being transmitted, in the same way that zip files do not “care” what is inside them; Bitcoin and zip are dumb protocols that do a job. As long as the value of bitcoin does not go to zero, it will have the same utility as if the value were very “high”.

Bearing all of this in mind, it’s clear that new services to facilitate the rapid, frictionless conversion into and out of bitcoin are needed to allow it to function in a manner that is true to its nature.

The current business models of exchanges are not addressing Bitcoin’s nature correctly. They are using a twentieth-century model of stock, commodity, and currency exchanges and superimposing this onto Bitcoin. Interfacing with these exchanges is non-trivial, and for the ordinary user a daunting prospect. In some cases, you have to wait up to seven days to receive a transfer of your fiat currency after it has been cashed out of your account from bitcoin. While this is not a fault of the exchanges, it represents a very real impediment to Bitcoin acting in its nature and providing its complete value.

Imagine this; you receive an email from across the world, and you are notified of the fact by being displayed the subject line in your browser. You then apply to your ISP to have this email delivered to you and you have to wait seven days for it to arrive in your physical mailbox.

The very idea is completely absurd, and yet, this is exactly what is happening with bitcoin, for no technical reason whatsoever.

It is clear that there needs to be a rethink of the services that are growing around Bitcoin, along with a rethink of what the true nature of Bitcoin is. Rethinking services is a normal part of entrepreneurship and we should expect business models to fail and early entrants to fall by the wayside as the ceaseless iterations and pivoting progress, just as it was in the early days of the web.

Bearing all of this in mind, focusing on the price of bitcoin at exchanges using a business model that is inappropriate for this new software simply is not rational; it’s like putting a methane-breathing canary as a detector in a mine full of oxygen-breathing humans. The bird dies even though nothing is wrong with the air; the miners rush to evacuate, leaving the exposed gold seams behind, thinking that they are all about to be wiped out when all is actually fine.

Day traders speculating on bitcoin from home cause the price to oscillate. It’s an artificial signal that has nothing to do with demand for bitcoin and its circulation as an economic tool to facilitate commerce.

In the future. I imagine that very few people will speculate on the value of bitcoin, because even though that might be possible, and even profitable, there will be more money to be made in providing easy-to-use Bitcoin services that take full advantage of what Bitcoin is.

One thing is for sure; speed will be of the essence in any future Bitcoin business model. The start-ups that provide instant satisfaction on both ends of the transaction are the ones that are going to succeed. Even though the volatility of the price of bitcoin is bound to stabilize, since it has no use in and of itself, getting back to money or goods instantly will be a sought-after characteristic of any business built on Bitcoin.

The needs of Bitcoin businesses provide many challenges in terms of performance, security, and new thinking. Out of these challenges will come new practices and software that we can only just imagine as they come over the horizon.

Finally, when there is no more fiat, and the chaotic transition zone between fiat and Bitcoin has been abolished, then everything will be priced in bitcoin, and there will be no volatility, because no one uses anything other than bitcoin to buy or sell. If you know any chemistry, this will be like a reaction’s reagents reaching equilibrium; you can shake it and stir it all you like; the reaction is over and you’re left with the inert product.

Right now, compared to the amount of fiat in the world, bitcoin can expand and contract very rapidly over a large range, because it is small in volume. It can expand to what for many is an unimaginably high price, and then shrink down again. As it gets bigger and accumulates more mass (its price expressed in fiat), these fluctuations will become smaller and smaller. Through all of this, bitcoin remains exactly the same; it is its users that are publishing numbers as a signal to react upon that are changing.

In its essence, this is a struggle between Bitcoiners and liars. The liars who promote democracy and who believe that morality and even rights can come out of a vote.

The ideas of socialism and democracy are diametrically opposed to the core philosophy of a voluntary peer-to-peer system like Bitcoin. Peer-to-peer systems disintermediate the transfer of information and eliminate the need for an arbitrary governing authority or service provider. Bitcoin, like math, has no philosophy and is neutral.

Socialism’s basic premise is that “property is theft”, and that all property, goods, and services should be collectively owned for the benefit of all people in a coercive State with no opt-out. Under a socialist system of forced organization, individuals do not have free use of their inherent rights, which are violently suppressed.

This is an inherently immoral proposition, where one group of people inevitably coalesce into an illegitimate ruling class to control and administer other people “for their own good” — the good of the collective. Even if this aggregation of power were not the case, no man or group of men has the right to force another man to relinquish his property.

Libertarians understand that there is no such thing as “the rights of the collective” and that only a living individual human has rights. Chief among these rights, the “root right”, is the right of property. Anyone who contends that Bitcoin is a socialist idea is fundamentally mistaken about how Bitcoin works and its true nature, or is trying to redefine socialism so that it can fit in with and be the standard-bearer of the inevitable rise of Bitcoin. You can detect this when you read the phrase, “my idea of socialism is”, which means that the speaker wants to abandon the bad smell of socialism and rebrand the word to mean something that it is not, so that he can remain “a committed socialist” and be a part the real world at the same time.

Bitcoin is a strict peer-to-peer protocol, and not a centralized system under the control of arbitrary rules or fallacious economic ideas like Keynesianism. In its essence, Bitcoin acts like a law of nature (powered by cryptography) and it does not and cannot care about your philosophy or ideology. By dint of this alone, Bitcoin cannot be called socialist or have a political philosophy attributed to it any more than an inanimate object or a fundamental force of nature can. It is designed to do one thing, it does that one thing, and that one thing is not inherently political; only Bitcoin’s users have political ideas that they try, and fail, to superimpose upon it. Bitcoin is neutral, like a hammer or a neutron or a handgun.

Bitcoin is a stateless tool that is purely voluntary. You may or may not use bitcoin at your own discretion. No one forces you to be a part of the Bitcoin ecosystem or to abide by its rules. How much bitcoin you accumulate in exchange for goods and services is entirely up to you and your trading partners, and what you spend your bitcoin on is entirely up to you.

The users of Bitcoin do not “have a say” in what you can or cannot do with them. There is no State, statist, or socialist that can tell you that you may not collect as many bitcoin as you can, or that your bitcoin belong to the collective, or that you must hand over a percentage of them to the State “for the good of the people”.

Users of Bitcoin, by default, are freely associating people, choosing freely to accept the rules of the Bitcoin system. This is the complete opposite of socialism, which is the negation of individual liberty, the abolition of free choice, and the elimination of property rights.

Anyone who claims to be a socialist while advocating for the widespread adoption of bitcoin is de facto acting against their socialist principles and desire to create a world where collective property ownership and centralized direction of capital is enforced by violence.

In a world where money transfers are made entirely through bitcoin, a socialist state will at the very least have a huge amount of trouble compelling people to hand over their money to the State by force. As usual, the socialist collectivists will resort to threats, violence, imprisonment, confiscation of real property, and any other immoral and disgusting means they can come up with to steal money from people. This prompts the question, “how can an avowed socialist advocate the adoption of bitcoin when it has the potential to destroy his violent Statist utopia from the inside out?”.

The internet has brought the entire body of human knowledge to everyone who uses it, at a cost that is near zero. It has also rendered practically redundant the state monopoly over telephone systems and postal systems. Anyone who still believes that “we” need the State in the face of these revelations is completely insane, or is on the road to abandoning socialism, or is sticking his fingers in his ears, unable to face the facts of this matter.

Mankind is better off in every way without the State. The paradigm shifts brought about by the internet in publishing, music distribution, postal mail, telephony, and the new, unprecedented services created by the connectivity of the internet are proof of this. Each of these industries has been regulated by the State in the offline world, and now that they are running in the online world without State regulation they are more efficient and beneficial by orders of magnitude. The only people who are against this are the vested interests, the buggy whip makers and the socialists, and every time they try and exert their influence they inconvenience and damage people and cause them to expend time and money where they would otherwise not have to.

The next great shift on the internet is going to be the complete disruption of the sclerotic bank-mediated money transfer systems in favor of internet-facilitated money transfers that remove banks entirely from the process flow. This event will cause a great acceleration in the transaction rate of commerce worldwide, will defund the socialist states and be of great benefit to everyone, everywhere.

All the attempts the banks are making now to embrace the internet and peer-to-peer payments systems will eventually fail, as long as people are free to develop software, release it, and freely interface with money at will. This is why PayPal had banned transfers that touch bitcoin in any way; they knew that Bitcoin is completely superior to PayPal, and that it constituted an existential threat to their business. PayPal allowing its system to be used to make payments in exchange for bitcoin is allowing blood vessels to feed a cancerous tumor. Bitcoin is cancer to PayPal and they must kill it at any cost.

The PayPal response to the inevitable peer-to-peer payment ecosystem in the form of their “Blue Dorito” suffers from the fatal elixir of powdered friction, arbitrary rules, suppression, and regulation by the State, all made soluble with a profound lack of imagination — none of which Bitcoin suffers from… but that is beyond the scope of this post. PayPal (and Coinbase) will eventually become the MySpace of moving money because they’re both wedded to a pre-internet mode of thinking when it comes to payments, and they are in an abusive shotgun wedding with the State.

Bitcoin is going to be the vehicle for services that make this disruption come to pass. Once critical mass is reached, Bitcoin will be completely unstoppable. We need only look at the French restrictions on 128bit SSL and the way they dropped them when it became the standard protection for e-commerce transactions. The first sign of this shift will be the adoption of Bitcoin as an accessory service on one of the major money transfer service providers, offering bitcoin transfers to the computer illiterate.

Bitcoin is not socialist. It is not collectivist. It is voluntarist. It is a system of voluntary, entirely non-violent, free association.

There are many misconceptions about what Bitcoin is. That’s not at all surprising. Some of these misunderstandings are quite natural; Bitcoin is something radically new and different, and so coming to terms with what it is can be a daunting task for the computer illiterate that does not know what money is. That combination — computer illiteracy and economic ignorance — are the toxic cocktail that makes it impossible to understand Bitcoin.

Some of the misconceptions however, have nothing to do with misunderstanding monetary theory. They are simply wrong, as it is wrong to say, “liquid water is dry”.

There. I said it in a way that is unambiguous. Bitcoin is not democratic. It has never been democratic. It will never be democratic.

It is important to understand this, so that you can know exactly what you are dealing with when you use and think about Bitcoin.

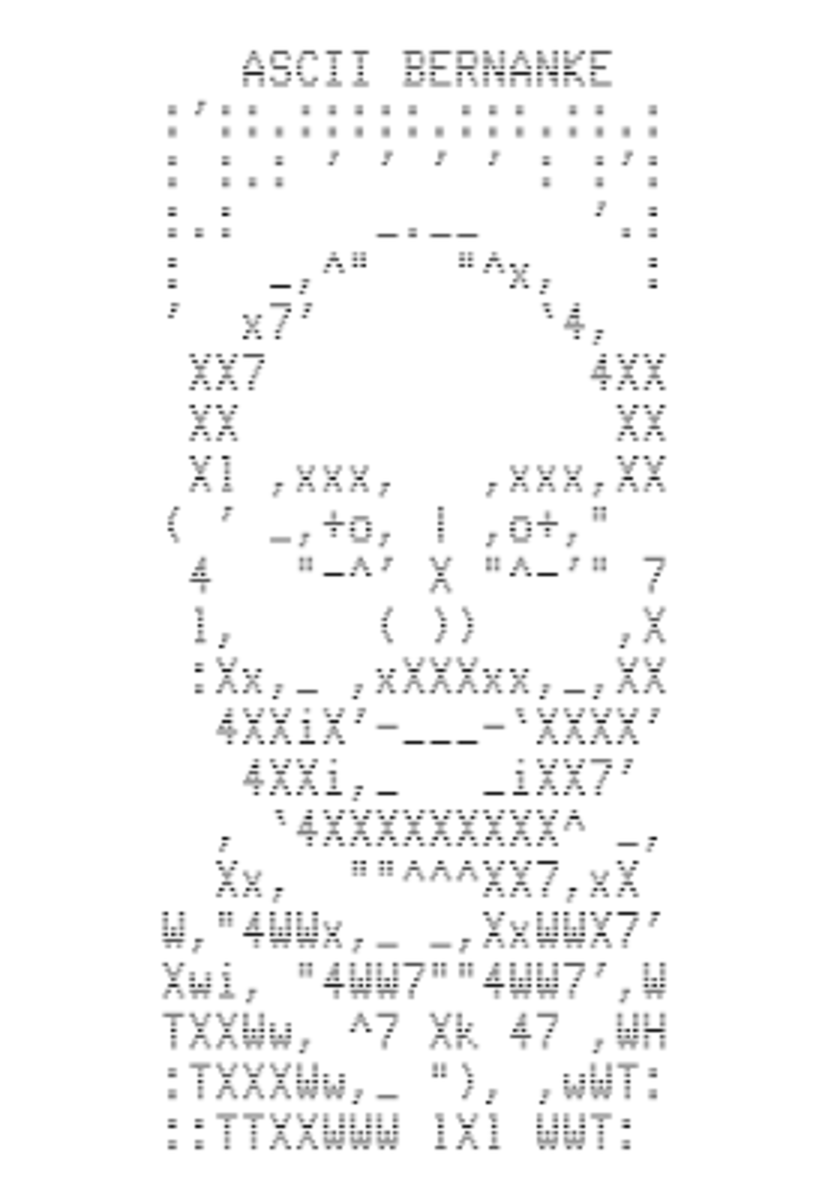

“ASCII Bernanke.” Bitcoin’s creator knows what money is and what needs to be done about the inherent problems associated with fiat currency — destroy the Federal Reserve irrevocably and return the control of money production to individuals voluntarily acting in concert. This is the only way the problem of inflation is going to be solved. That is what Bitcoin does. The portrait on the right is embedded in the Bitcoin blockchain as a tribute to Fed Chairman Ben Bernanke, who destroyed the dollar in a Keynesian frenzy of money printing, defrauding millions of people.

Bitcoin, by design, is not democratic. No matter how many times you try and assert that it is, it is not, and it never will be. And it is also not socialist, as I just clearly explained.

Removing all of the fascinating, revolutionary technical details, the core of Bitcoin is that it is voluntary and the transactions and ledger entries made with it are mediated by a computer program. You choose, as a free human being, to download the required software, use Bitcoin and be bound by the network’s fixed rules.

There is no voting involved, no coercion, no obligation, social or otherwise to use it. You are not even required to donate your CPU and bandwidth to the Bitcoin network in exchange for using it. When you use Bitcoin, you volunteer to use it on its terms. It is as simple as that.

What is “democracy”? Democracy is a coercive political system where people in a geographic area are “enfranchised”. This means that they all have a “vote”, allocated one vote per man, that they can cast in “elections”, where the accumulator of the most votes wins, and then that person takes “office”. No matter what the winner thinks or his plans are, he gets extraordinary, unconstrained, extra-judicial, extra-ethical powers over the “electorate” and near total immunity from the law.

That is all that democracy is.

I shall leave out that once in power, these people steal, murder, lie, corrupt, and poison to their black heart’s content, with almost absolute certainty that they will get away with whatever evil they do, no matter what the scale. In fact, the bigger the scale of their crimes, the less likely they are to face any justice of any kind, and the more likely they are to be rewarded. And of course, the sole monopoly on the dispensing of justice belongs to the same “democracy” which in effect, polices itself. In civil litigation the guiding principle is that no one may be a judge in his own cause, but in democracy, this is the default. It is an open scandal.

Now back to Bitcoin. At no point in the Bitcoin process do you have a vote over any aspect of how Bitcoin works, who owns what bitcoin, how they are distributed, transferred, their value, or anything whatsoever to do with its operation. If you don’t like it, you’re free to decline to use it.

The fact that you can choose one good over another does not mean you are participating in democracy or acting “democratic”. You cannot say that, “Ice cream is democratic”, because you can choose whatever flavor you like in Baskin Robbins or Carvel. Or choose Baskin Robbins over Carvel. You cannot say that choosing a Volkswagen over a Ford Fiesta is, “a democratic choice”. Democracy means only the hermetically sealed one-man-one-vote inherently corrupt and unethical political system. That is it. That is all.

Because millions of people have been brainwashed in government schools to believe that the system of government that educated them is the best, they have been encouraged to misuse the word “democracy” as a synonym for everything good or anything that is beneficial. I have even heard people saying, “that’s very democratic of you” when someone does another person a good turn. This is how distorted the meaning of the word “democracy” has become.

Bitcoin is a beneficial technology, so quite naturally, these uneducated and dangerous people will use the word “democracy” in association with it, despite it having no relation of any kind, way, shape, or form to democracy. Thinking about it, it is rather good that these people think Bitcoin is democratic. If they understood its true nature, they would hysterically rail against its mass adoption, as they have been trained like dogs to do against any threat to the violent system that has them in a hypnotic spell.

And these people are very well trained. And totally hypnotized. It should come as no surprise then, that Bitcoin, the software that is going to be of benefit to billions of people on Earth, is being called “democratic”. Sorry to shatter your mesmeric delusions, democracy lovers; Bitcoin is not democratic, and using it has nothing to do with majority rule, force, voting, or anything that touches democracy in any way. Bitcoin is without your greasy taint or fetid stink.

The nonsense that a choice in the market is “democratic” stems from the fallacious idea that consumers spending money is somehow a “vote”. It is not. It is an economic choice, that does not impose any rule over others, has nothing to do with achieving a majority, etc. Note also how some deranged thinkers misuse the word “voice”. This is the only way that the delusional democracy booster can make an argument — by distorting English until words lose all their meaning. People spending money do not “have a voice” (or as they say in the U.K., “have their say”); they have a choice. Even if they are using fraudulent central-bank-printed paper money, their voice, opinion, or sentiment is irrelevant at the moment of choice and exchange.

Even if you were to repurpose “the Blockchain” to act as a voter registration and voting system (ironically, it would then truly become a chain; a Chain of Fools that holds people as slaves to morally repugnant, violent, and unethical mob rule). This would not make Bitcoin the money-transport system democratic, it would simply be another “creative” use of the blockchain software — this time for an antisocial and completely evil purpose: enforcing the hold, coercion, and violence of democracy.

In this nightmare scenario, the miners would become de facto gaolers. Stealing bitcoin would mean that the political system could be bought — literally — for bitcoin. The idea is as nauseating as it is wrong.

All of this absurd posturing and conflating of Bitcoin with democracy (or socialism), however, is now nothing more than faintly amusing noise. The people who are doing it are as irrelevant as dead men.

The people who love democracy are going to find out first-hand what democracy really means and what it did to them, by virtue of its abrupt absence and the contrast of life before and after democracy. Bitcoin is going to defund the State by absorbing and extinguishing all the fiat currency in the world, so that eventually the the deluded slaves of democracy can vote all day and all night without the votes cast having any effect whatsoever. The libertarian society, protected and powered by Bitcoin, will not allow the violent, deluded, and sick devotees of democracy to wage war, steal money, or interfere with voluntary contracts and exchange.

Bitcoin is not democratic; it is voluntarist. No matter what you say or believe, the nature of Bitcoin does not change. You can call it a fruit cake, a leprechaun, cotton candy, a joke, Koosalagoopagoop, or anything else that you fancy. As it is with the ocean, if you dive into it, you will get wet. What you want does not come into it. If it is your desire to stay dry, don’t jump in, but you cannot expect to stay dry and go swimming at the same time. Calling Bitcoin democratic when it is not is utterly absurd, and insulting. The world has had quite enough of it and its virus-like variants.

Finally, Bitcoin doesn’t care what you think. It can’t care about anything. What you think doesn’t matter; that is the ultimate power of Bitcoin. Bitcoin is like a force of nature. You must conform to ethical standards of behavior in the Bitcoin-mediated world, or starve, since the option of violence is taken off of the table. The implications of all of this will only become clear once it is too late for the democracy lovers to stop it, who will be left scratching their heads wondering what happened, why democracy died, and crucially, why everything has not fallen apart…

…but is now infinitely better.

No government on Earth can change Bitcoin. They can either fail or adapt to Bitcoin. By allowing themselves to be transformed by Bitcoin, in a counter-intuitive and astonishing result, they will become more powerful than they ever have been. The benefits Bitcoin will bring to every economy will give unprecedented new tools to governments, not to oppress and destroy, but to do right by the explicit permission of the populace.

As people adopt Bitcoin, they will be “voting with their money” and moving to a space where the thin-skinned, lying boosters of democracy have no power over anything.

Bitcoin will eventually absorb all fiat currency in the world as consumer Bitcoin clients like Pine are installed globally. The jurisdictions that allow companies that facilitate this transformation to work unencumbered are going to be the new financial centers of the 21st century. And if they don’t, the absorption is going to happen in any case.

Whether or not your aim is to dominate in Bitcoin services as a nation, there is no other rational way to approach this other than abandoning KYC/AML, and Conway’s “Game of Life” provides a neat illustration of why this is so.

The Game of Life, also known simply as Life, is a cellular automaton devised by the British mathematician John Horton Conway in 1970.

The world in the Game of Life is a two-dimensional grid of square cells, each of which is in one of two possible states, alive or dead. Every cell interacts with its eight neighbors, which are the cells that are horizontally, vertically, or diagonally adjacent. At each step in time, the following transitions occur:

- Any live cell with fewer than two live neighbors dies, as if caused by underpopulation.

- Any live cell with two or three live neighbors lives on to the next generation.

- Any live cell with more than three live neighbors dies, as if by overpopulation.

- Any dead cell with exactly three live neighbors becomes a live cell, as if by reproduction.

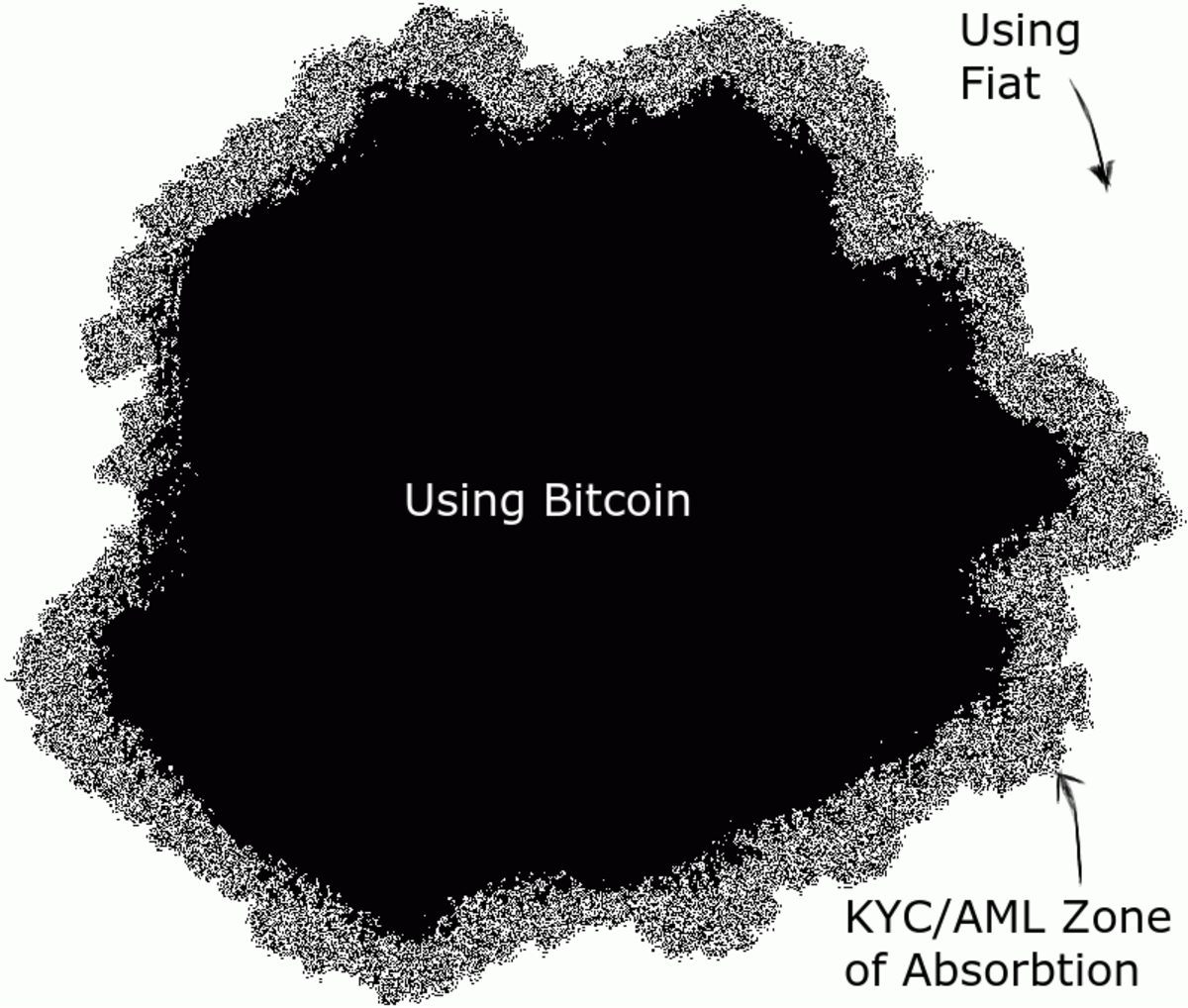

Let us now superimpose this simple idea on Bitcoin adoption. Imagine a world where there is total KYC/AML, and it has been running for years, with steady growth in Bitcoin adoption. The illustration below is a picture of this world; it is a grid with one billion cells in it. Each cell is a human being who uses money or bitcoin. If the cell is black, they use bitcoin as money. If the cell is white, they use fiat currency as money.

For a cell to turn from white to black (a person starting to use bitcoin), fiat must be converted into bitcoin at a KYC/AML entry point. This happens in a thin line at the edge of the fuzzy gray mass, via compliant companies that provide this conversion service.

Everyone outside in the white zone is either unbanked or using only fiat currency and banks. Everyone inside the mass in the black zone uses bitcoin. Those in the black zone do not ever engage with KYC/AML, because they already have bitcoin, and regularly send it anywhere, to any person, globally without further permission of any kind.

The central mass increases in size as it absorbs fiat currency. It will keep growing until either it absorbs all fiat currency, or a lower-than-total absorption equilibrium point is reached. A lower-than-total absorption equilibrium could be caused by the Bitcoin network reaching a technical upper limit (like the transaction rate limit, which is now impossible on a practical level thanks to Elizabeth Stark’s Lightning Labs “Layer-2” network) or a psychological or political distortion (banning, taxation, FUD, usability, or some other artificial pressure).

We can see from this illustration and thought experiment that eventually, there will be a huge number of users who will never again need to be KYC-/AML-verified, because their money exists and circulates freely only as bitcoin. This means that inside the Bitcoin ecosystem, KYC/AML is worthless after the first conversion. It also becomes immediately clear that any bitcoin leaving the mass on a peer-to-peer basis when new bitcoin users are brought in, creates more mass without KYC/AML, and this amount will be very large once the central mass is large.

This simple illustration shows what will happen as bitcoin absorbs fiat currency. KYC/AML will have a short life, after which it will be worthless as a tool to track people, since a large number of users are in bitcoin and never touch fiat.

Rather than go through this completely pointless stage of KYC/AML, a nation with competent leaders will understand the inevitable, and race to attract companies into their jurisdictions by eschewing the regulation of Bitcoin services.

The benefits of the virtuous circle of Bitcoin firms all incorporating and working in the same small area of the same city cannot be overstated. As a long-term strategy, abandoning KYC/AML is the only logical path.

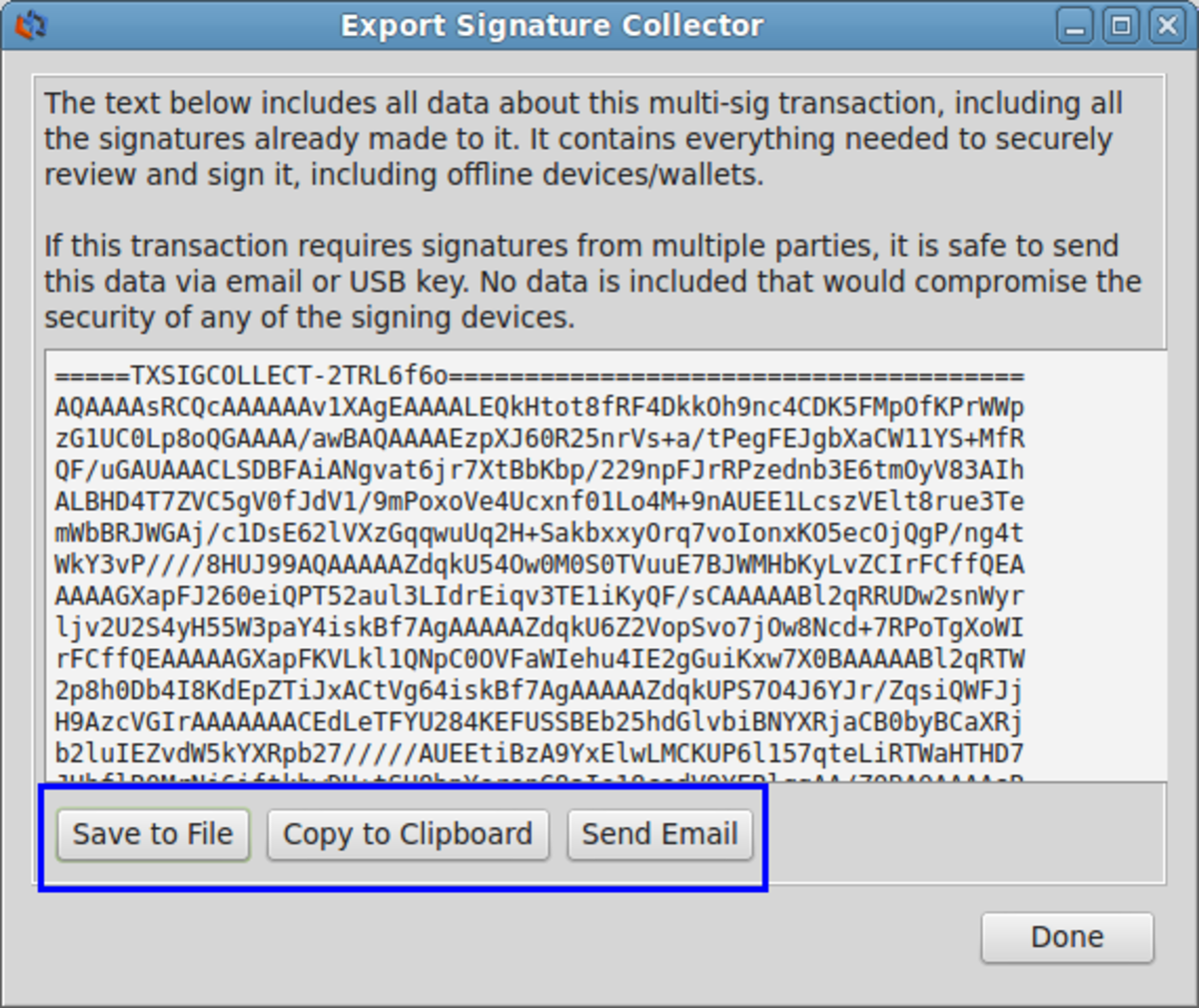

Inside the absorption zone is where all the businesses touching Bitcoin will operate. That is where Bitcoin “pure play” businesses will flourish, and that means software companies, providing the very important wallet and merchant services, new classes of services built on multisig and the other tools in Bitcoin; powered escrow services, time-triggered conditional payments, and many other things.

All people, institutions, and governments in the future will be equal peers on the Bitcoin network where no person or entity has any more control over Bitcoin than any other, and everyone has access on the same, provably fair, equal basis.

Bitcoin is the pure, level playing field where no one can cheat and everyone is guaranteeing the network for the benefit of everyone else. This is not “democratic” as some very stupid people might want to convince you; this is voluntarism in motion.

All corruption comes from the law produced by crony capitalism and democracy and unethical companies using it to distort economics. Under a Bitcoin regime, it will not be possible to print money for any reason whatsoever. That former privilege of the State is permanently revoked in Bitcoin. Now money is allocated by merit alone; you cannot accumulate money if you don’t serve other people. That is true on an individual level, the business level, and the governmental level also. Everyone will have the absolute power to refuse to pay for anything they would rather not pay for. This will become a universal law under Bitcoin.

In Bitcoin, everyone will have a free choice to be a slave or not, but not with other people’s money. You can voluntarily choose to subordinate yourself to liars, democracy boosters, and warmongers, but you can’t forcibly enlist other people and their money. Since most people are not interested in “Spreading Democracy”, demonizing and murdering brown-skinned strangers and other vile, disgusting things, you can be sure that the ills of the 20th century spread by democracy and its evil boosters will come to a sharp, abrupt, permanent, and most welcome end.

Naturally the question that follows is, “Which of the current nation-states has the best chance of dominating in this Bitcoin-mediated world?”. Oddly enough, the country whose government behaved the worst in the 20th century has the best chance of turning itself around and becoming a beacon of light again. The United States of America.

The Founding Fathers of the greatest country in the history of the world, the United States of America, gifted that nation a system borne of genius, ethics, and subtlety. That astonishing system, when combined with and constrained by Bitcoin, will create a nation that will last longer than the Roman Empire and be more prosperous. All that is required is that it follows the law as laid down by the Founders.

Hearings on Bitcoin and its derivatives are being held in the USA on a regular basis, and invariably the expert witnesses fail to properly describe the actual processes going on. If they used the correct language and excluded all analogies, the only possible conclusion would be that America cannot regulate Bitcoin under its current legal system. The Constitution guarantees the inalienable rights of American citizens, and therefore Bitcoin is a protected act or practice by virtue of it being a form of published text. The only way Bitcoin can be made regulable is if the Constitution is changed; and that does not mean adding a new Amendment — it means removing the First Amendment entirely.

Inevitably the anti-Bitcoin “protagonists” will face a robust and ultimately successful legal challenge that will remove the possibility of any sort of “BitLicense” or interference from the CTFC, FinCEN, or any other agency. It will also remove any possibility of interference at the State level. The consequence of adhering to the basic law of the United States will cause America to become the center of all Bitcoin business for the entire world, and will cause trillions of dollars worth of e-commerce to flow through the USA.

Let me explain why this is the case.

Some say that Bitcoin is money. Others say that it is not money. It doesn’t matter. What does matter are three things: that Bitcoin is, that the Bitcoin network does what it is meant to do completely reliably, and what the true nature of the Bitcoin network and the messages in it are.

Bitcoin is a database, maintained by a network of peers that monitors and regulates which entries are allocated to what Bitcoin addresses. This is done entirely by transmitting messages that are text, between the computers in the network (known as “nodes”), where cryptographic procedures are executed on these messages in text to verify their authenticity and the identity of the sender and recipient of the message and their position in the public ledger. The messages sent between nodes in the Bitcoin network are human readable, and printable. There is no point in any Bitcoin transaction at which Bitcoin ceases to be text. It is all text, all the time.

Bitcoin can be printed out onto sheets of paper. This output can take different forms, like machine-readable QR codes, or it can be printed out in the letters A to Z, a to z, and 0 to 9. This means they can be read by a human being, just like “Huckleberry Finn”.

At the time of the creation of the United States of America, the Founding Fathers of that new country in their deep wisdom and distaste for tyranny, haunted by the memory of the absence of a free press in the countries from which they escaped, wrote into the basic law of that then-young federation of free states, an explicit and unambiguous freedom, the “Freedom of the Press”. This amendment was first because of its central importance to a free society. The First Amendment guarantees that all Americans have the power to exercise their right to publish and distribute anything they like, without restriction or prior restraint.

Congress shall make no law respecting an establishment of religion, or prohibiting the free exercise thereof; or abridging the freedom of speech, or of the press; or the right of the people peaceably to assemble, and to petition the Government for a redress of grievances.

This single line, forever precludes any law that restricts Bitcoin in any way.

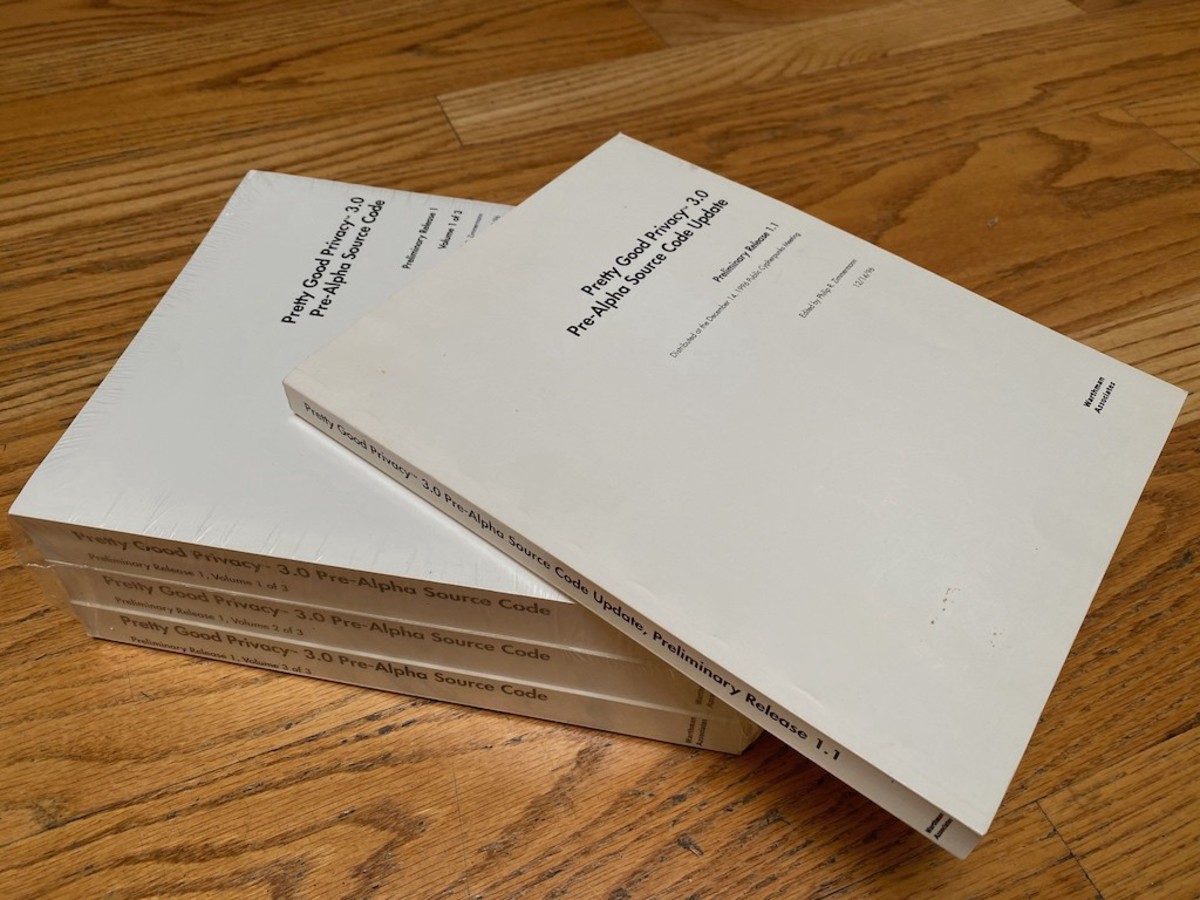

In 1995, the U.S. Government had on the statute books laws that restricted the export of encryption software products from America without a license. These goods are classified as “munitions”. The first versions of the breakthrough Public Key Encryption software “Pretty Good Privacy”, or “PGP”, written by Philip Zimmerman had already escaped the USA via bulletin board systems from the moment it was first distributed, but all copies of PGP outside of the United States were “illegal”. In order to fix the problem of all copies of PGP outside of America being encumbered by this perception, an ingenious plan was put into motion, using the First Amendment as the means of legally making it happen.

The source code for PGP was printed out.

It’s as simple as that. Once the source code for PGP was printed in book form, it instantly and more importantly, unambiguously, fell under the protection of the First Amendment. As a binary, the U.S. government ridiculously tried to assert that immaterial software is a device, and not text (software or “binaries” is text that can be run on devices). Clearly the idea that software is a device is patently absurd, but rather than waste money arguing this point in court, printing out PGP removed all doubt that a First Amendment act was taking place.

The printed source code was shipped to another country, perfectly legally and beyond challenge, and then transferred to a machine by OCR (Optical Character Recognition, a software tool that can turn a printed page into a text file, removing the need for a person to manually type out a printed page), resulting in a PGP executable that was legally exported from the United States.

The direct analogy to Bitcoin should be vividly clear to you now. PGP and Bitcoin are both:

- Pieces of software that can be rendered as printed text on paper.

- Software that generates unique blocks of human readable text.

- Designed to generate text that is 100% covered by the First Amendment.

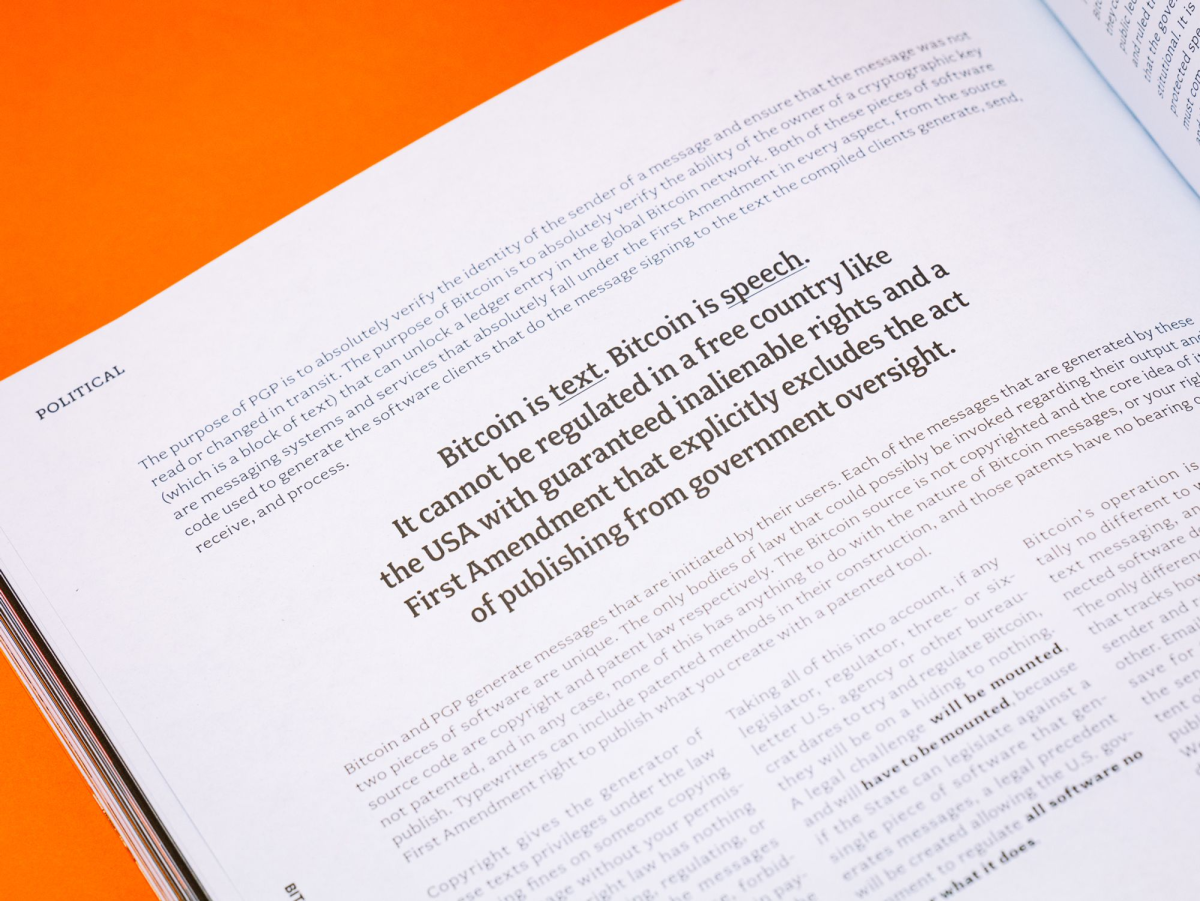

The purpose of PGP is to absolutely verify the identity of the sender of a message and ensure that the message was not read or changed in transit. The purpose of Bitcoin is to absolutely verify the ability of the owner of a cryptographic key (which is a block of text) that can unlock a ledger entry in the global Bitcoin network. Both of these pieces of software are messaging systems and services that absolutely fall under the First Amendment in every aspect, from the source code used to generate the software clients that do the message signing to the text the compiled clients generate, send, receive, and process.

Bitcoin is text. Bitcoin is speech. It cannot be regulated in a free country like the USA with guaranteed inalienable rights and a First Amendment that explicitly excludes the act of publishing from government oversight.

Bitcoin and PGP generate messages that are initiated by their users. Each of the messages that are generated by these two pieces of software are unique. The only bodies of law that could possibly be invoked regarding their output and source code are copyright and patent law respectively. The Bitcoin source is not copyrighted and the core idea of it is not patented, and in any case, none of this has anything to do with the nature of Bitcoin messages, or your right to publish. Typewriters can include patented methods in their construction, and those patents have no bearing on your First Amendment right to publish what you create with a patented tool.

Copyright gives the generator of these texts privileges under the law imposing fines on someone copying your message without your permission, but copyright law has nothing to do with exporting, regulating, or imposing a tax on the messages themselves, and of course, forbidding the copying of your Bitcoin payment message rather negates the purpose of using Bitcoin.

Taking all of this into account, if any legislator, regulator, three- or six-letter U.S. agency or other bureaucrat dares to try and regulate Bitcoin, they will be on a hiding to nothing. A legal challenge will be mounted, and will have to be mounted, because if the State can legislate against a single piece of software that generates messages, a legal precedent will be created allowing the U.S. government to regulate all software no matter what it does.

Bitcoin’s operation is fundamentally no different to what all email, text messaging, and internet-connected software do: relay messages. The only difference is in the software that tracks how the messages of the sender and recipient relate to each other. Email is no different to Bitcoin, save for the fact that a record of the sender and recipient and content of your email is not stored in a public ledger one against the other. We know it’s stored in a private database, but that’s another story. Wink wink.

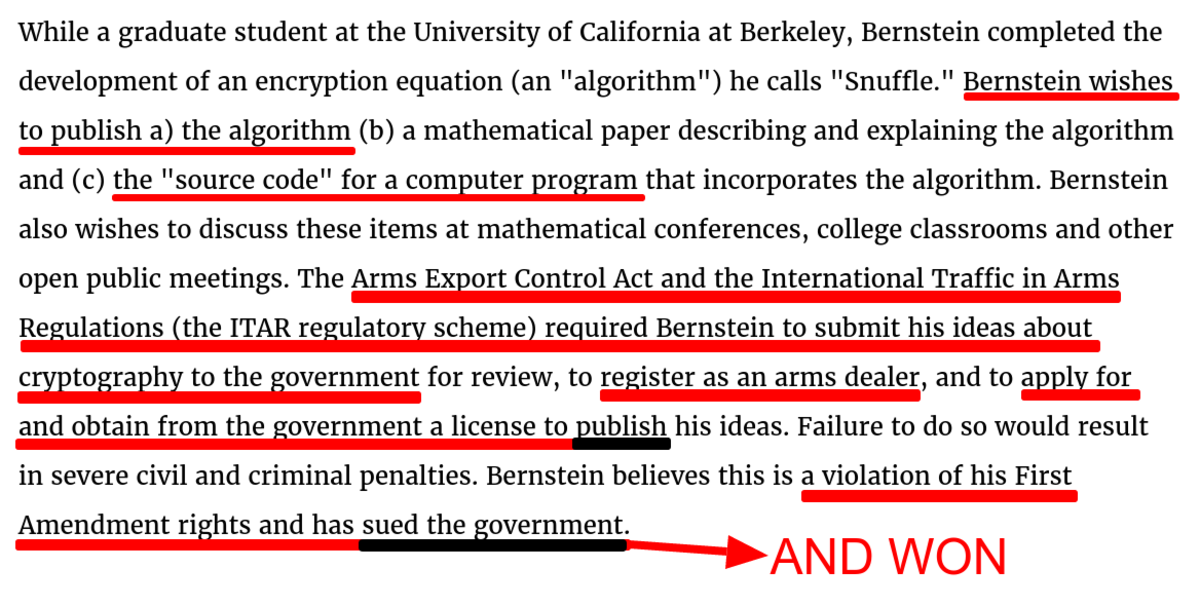

Here is another example of case law proving that this reasoning is correct.

In Bernstein v. U.S. Department of Justice, it was established that code is speech and is protected by the First Amendment. This absolutely and unambiguously applies to Bitcoin, with eerie parallels to KYC/AML in Bitcoin. The unconstitutional ITAR requirements are exactly the same as asking Bitcoin traders to register as “Money Transmitters” and seek licenses before they can be paid to transmit text to the Bitcoin network for publication on the public ledger. The Ninth Circuit Court of Appeals found in Bernstein’s favor, and ruled that software was speech protected by the First Amendment and that the government’s regulations preventing its publication were unconstitutional. It is clear to see that Bitcoin falls squarely into the category of protected speech, there is no way around any of this, and the U.S. courts must come to the same conclusion for Bitcoin. Bitcoin is protected speech, and the case law says so explicitly.

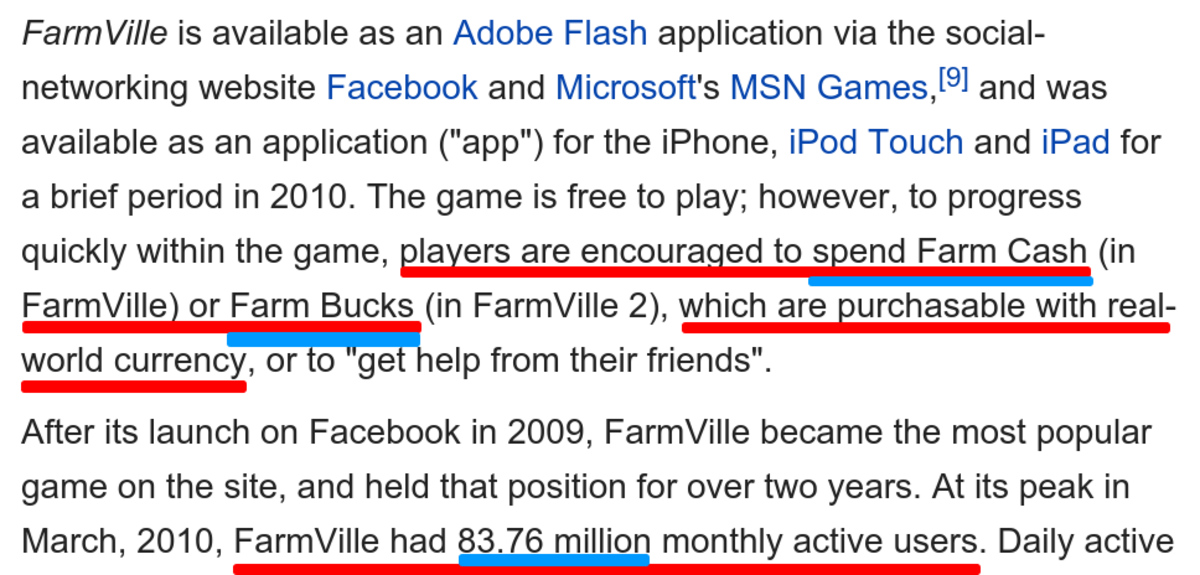

The position that Bitcoin is money is fundamentally wrong, and systems like it have existed for many years without gaining the attention of any three-letter agencies. Take for example FarmVille, the massively popular farm simulation game on Facebook.

This hugely popular game is no different to Bitcoin in nature. FarmBucks exist in a closed system, just as bitcoin does. The only difference is the size of the space where the messages are being sent, and in the case of FarmBucks, the number of users and transactions (messages sent) was large. FarmVille had 83,760,000 monthly active users and not a single one was subjected to KYC/AML to exchange fiat for FarmBucks or FarmCash. Why not? What happened to that money? Why weren’t FinCEN or SEC all over that game as they are on ICOs? No one can explain this adequately. This example is very useful as a tool to pull back the curtain on the people who assert that bitcoin is a money and is fundamentally different to a money kept in a game. All the rationales they use (mostly in the form of run-on sentences) to explain that the differences are inaccurate, and never address the fundamental processes; if they did, they would have no choice but to conclude that Bitcoin is no more subject to regulation than FarmBucks or PGP are.

Clearly, allowing legislation to touch Bitcoin means that any software of any kind will suddenly be liable to arbitrary and unconstitutional restriction. It will set a precedent that will be devastating to all software development in the USA, and software is the means by which everything is run, communicated, exchanged, and ordered in modern society. In fact, it is impossible to run a modern society without software.

Twitter for example, could find itself being regulated; it transmits messages that are no different in nature to the messages that Bitcoin transmits; the only difference being the publicly maintained ledger and application of the messages. In fact, Twitter could turn itself into a Bitcoin company quite easily by adding a few fields to its message JSON schema to include a Bitcoin address for each of its users, adding a page to its client, and running its own Bitcoin server pool. Would that extra text suddenly transform Twitter into a bank? Would that suddenly change the nature of each Tweet that is sent on their network, and cause them to be “Money Transmitters”? How is having a Bitcoin address integrated into your Twitter account different to making a promise by hand on Twitter to your followers or in a direct message?

Essentially, Bitcoin allows you to make written contracts with people without knowing them or signing paper; the network and software takes care of identifying and fulfilling the promise, all with cryptographically signed pieces of text. What the people calling for “BitLicenses” and the absurd, insulting, and totally anti-American “Lummis-Gillibrand Responsible Financial Innovation Act”, are asserting is that because Bitcoin right now has a particular use, it should be exempted from the basic law of the United States of America. That is completely insane, and will have unintended consequences that would be absolutely disastrous for the American economy since almost everything today is mediated by or touches software.

On the other hand, if Bitcoin is left to flourish and the market allowed to define its services, means of setting the value and resolving disputes, Bitcoin as an ecosystem will be extremely robust and widespread, just like the internet is today, after having grown for decades without any regulation or oversight from the State.

Furthermore, as I have said previously, the country that does not enact Bitcoin legislation will become the starting point and end points of all Bitcoin transactions globally by first-mover advantage. All other jurisdictions will see Bitcoin passing through them untaxed, and there will be nothing they can do about it, as Bitcoin is an unassailable peer-to-peer network.

We have seen a similar phenomenon with the legal position of encryption in France. SSL was regulated in France until Dominique Strauss-Khan, former managing director of the International Monetary Fund, removed the restrictions. They knew that “French e-commerce” would take place inside “le pays Roosbeef” if it were not possible to secure French websites with SSL on demand without friction. American Bitcoin businesses (since the end points will be in their jurisdiction) will be taxed on their profits, and this will be a percentage of the trillions of global transactions made on the network for every conceivable and inconceivable purpose.

The same is true for any other country. The United States looks set to cripple itself by enacting “BitLicenses” and declaring by fiat that bitcoin is a currency, or a commodity, or legal tender. As I describe above, Bitcoin is none of those things by nature, and the myriad number of applications it can be put to is only just being discovered. Our project Azteco is but one of them, with the potential to reach the billions of unbanked people in the world, and provide them with an easy way to access internet e-commerce, worldwide, with a system that makes payment fraud impossible. The potential benefit to the unbanked and the websites that sell goods online and the jurisdictions where those websites operate is without precedent. Only a fool would do something that could harm the advent of this transformation, or shun this new technology and the business building on it.

No legislature will be able to keep up with the advances in software that are taking place; there are too many developers and efficient tools in the wild all over the world, all with equal access to the market. The best the State can possibly hope for is to tax new businesses that use the new tools as they emerge, and encourage entrepreneurs to incorporate in their jurisdictions. If America wants to drive away Bitcoin developers, exchanges, and new businesses, by all means, do so and take the consequences. There are many other places in the world where fast internet pipes have been laid and where the government is not so backward. Skype was founded in Estonia, not Silicon Valley, and this is for a reason. All the big bitcoin exchanges are outside the USA. There is a reason for that. No one wanting to start a Bitcoin business is planning to move to New York from anywhere, because they know that their business models will immediately come under attack.

For those of you who are frightened of a free market in Bitcoin, rest assured, all the laws that currently exist to do with fraud, theft, misrepresentation, and everything else, continue to apply to all people and corporations who use bitcoin. Bitcoin does not make laws or your personal or corporate obligations moot. When you deal with a company, you retain access to the law and recourse to it. When someone makes a promise to sell you goods with bitcoin, that promise is not nullified because you are paying with bitcoin. Good Bitcoin businesses will build dispute resolution systems the way that eBay and Amazon have, so that you never have to go to court to obtain justice if there is a problem. Online, reputation is everything, and bad reputations can destroy your credibility and customer base overnight. This is a far more powerful incentive to behave correctly and fulfill promises, which most people do by default in any case, rather than some arbitrary and absurd “BitLicense”.

All the “BitLicenses” and “Lummis-Gillibrand Responsible Financial Innovation Acts” in the world could not stop Mt. Gox from having a software problem, and no law can bring back the money lost either directly or through the disruption caused by the software error. Once again, it is entrepreneurs powered by the internet that make life easier and better, not laws and regulations. Regulation does not make software correct; developers do.

I have one recommendation for anyone advocating that there should be a “BitLicense” or that the reprehensible “Lummis-Gillibrand Responsible Financial Innovation Act” should become law. Don’t waste everyone’s time, money, and resources proposing this anti-American idea. The EFF has better things to do with their time than teach the PGP “Munitions Case” lesson all over again. If it goes to court, your side will lose, and as a consequence, America will lose its head start as all Bitcoin entrepreneurs flee the USA for environments that will allow them to innovate, grow, and prosper.

And what can the business people who want a “BitLicense” forced on the software industry say? That they don’t trust themselves? That’s patently absurd. That they do not trust their competitors? If it’s the case that their competitors are not good actors, then the good actors have a market advantage. Remember, a license cannot protect the public from fraud or provide any guarantee of any kind; it can only distort the market.

What these “BitLicense” and Lummis-Gillibrand advocates actually want is a guaranteed market advantage. They are anti-American crony capitalists. They want to prevent the emergence of a “Golden BB” entrepreneur that might destroy their business, they want to slow down and stifle innovation, so that they can become the entrenched and unassailable gatekeepers. They want to bar new entrants to the market. It simply will not work. And it’s un-American.

The American legislature must let the American dream flourish and extend its power to Bitcoin, or it will be compelled to obey the law, and this has started to happen. Two judges in the USA have now found that bitcoin is not money, and have thrown out “Money Laundering” charges against two men:

U.S. Magistrate Judge Hugh B. Scott ruled in a money laundering case in Buffalo, N.Y., that bitcoin is more like a commodity and is not a form of currency, according to a local news report.

He recommended the money laundering charge be dropped against the defendant since bitcoin isn’t money.

In another money laundering case last year, Miami-Dade Circuit Judge Teresa Mary Pooler stated it is very clear, even to someone with limited knowledge in the area, that bitcoin has a long way to go before it is the equivalent of money.

–Archive: https://archive.is/pKQJ2

Bitcoin is not money. KYC/AML should not apply to it at all. The Hugh B. Scott ruling is highly significant, because it directly contradicts the idea of BitLicence and Lummis-Gillibrand. And lest there be any doubt, all of this, including legal remedies for breach of promise, applies to “ICOs” and “NFT”s (so called, “Digital Collectibles”), which are also nothing more than text stored in a database. The fact that they are called, “Initial Coin Offerings” or “Digital Collectibles” is irrelevant to the underlying processes, and it is not illegal to parrot the language and terms of finance, which are not trademarked or copyrighted. The Hollywood Stock Exchange wasn’t deceptive because it called itself a “Stock Exchange”. Opponents of Bitcoin and ICOs have no good arguments, and the threadbare pretexts for regulation they’re able to synthesize are as flimsy as fiat.

The longer-term effects of bitcoin becoming the only money will be a total collapse in the public’s belief in the Political Class, who, having had the power to steal and redistribute money revoked from them, will have literally nothing to offer anyone anymore. If a ceremonial class of apratchicks (entirely at their own personal cost of course) should remain, it will attract only the most hard-core and mentally ill participants and spectators.

And these evil people will not have stormtroopers on tap to raid citizen’s houses and steal from them with “Civil Asset Forfeiture” and other measures. All security will be provided by the free market, where the only rule enforced is Natural Law.

This is, of course, anathema to democracy addicts, who will be forced to go cold turkey.

Incompetence will also be permanently deprecated and suppressed by the market, because all money is accounted for in a fine-grained way, and people will only pay for services and goods that actually serve them correctly.

All of this may sound like the most “out there” fantasy, but so did Bitcoin before Bitcoin. And now Bitcoin is, and the effects it will have are what we, the people who predicted it will be, not what some idiotic democracy booster believes or wants it to be. The evil people never saw the need for Bitcoin in the first place; why should anyone believe that they have the crystal ball? We do, they don’t.

And as for the imbeciles that believe that only the State can keep people safe, the facts are against this also. The story of the incandescent light bulb is a perfect example of a scenario that will be absolutely forbidden in the Bitcoin-mediated world.