Polygon [MATIC] recently revealed the latest developments regarding its much-talked-about zkEVM. According to the latest update, a rigorous, comprehensive security audit for the zkEVM was underway.

Read Polygon’s [MATIC] Price Prediction 2023-24

These are the new updates

This audit represents an interesting challenge since it is intended to assess the security of a new type of technology, especially one designed to conceal information in a trustless manner.

The official announcement mentioned, “this audit is meant to verify the claim that Polygon zkEVM can only generate valid state transitions and that it does so in a zero-knowledge, non-interactive environment.”

The primary focus of the audits will be to validate this assertion across two sectors: correctness and soundness. Jordi Baylina, a developer of the zkEVM, tweeted that they are also in the final steps before the launch of what should be the last testnet before the mainnet.

Interestingly, MATIC also managed to remain quite popular in the crypto community as it was on the list of the cryptos that were trending on Coingecko.

Though these developments looked optimistic for MATIC, nothing was reflected in its price action as it registered negative growth. As per CoinMarketCap, MATIC’s price was down by more than 2% in the last 24 hours, and at press time it was trading at $0.8965 with a market capitalization of more than $7.8 billion.

Any signs of recovery?

Surprisingly, despite the recent downtrend, a few of the on-chain metrics were supportive of MATIC and gave investors reasons to relax.

Source: Santiment

For instance, positive sentiments regarding MATIC went up in the last few days, reflecting the crypto community’s trust and faith in the token.

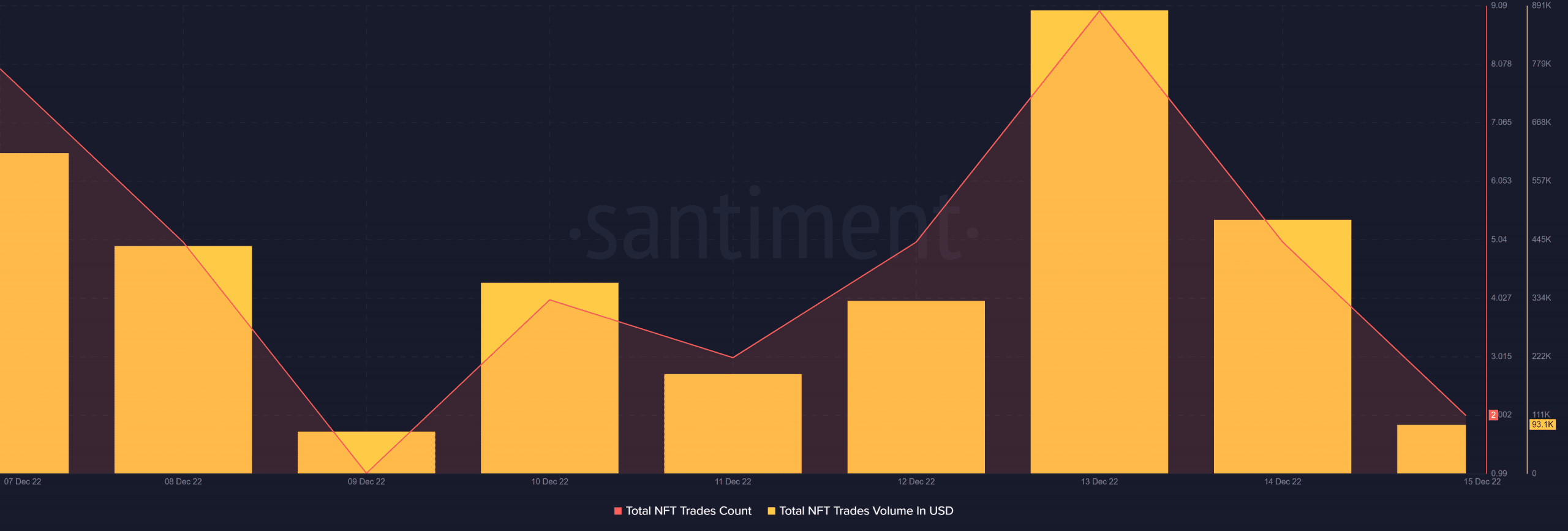

Polygon’s exchange reserve was also decreasing, suggesting less selling pressure. In fact, Polygon’s NFT space also witnessed growth last week. The total NFT trade count and total NFT trade volume in USD registered a spike, indicating higher demand for MATIC’s NFT ecosystem.

Source: Santiment

However, the rest of the metrics were bearish and revealed the possibility of a continued price decline. MATIC’s MVRV Ratio continued to stay low, which was a signal aligned with the sellers’ interest. The number of active addresses and total transactions also went down, further painting a bearish picture for Polygon.