Shiba Inu’s [SHIB] weak market could give sellers leverage to push the price lower. At the time of publication, the meme coin was trading at $0.00000888, down 2% in the past 24 hours.

In addition, trading volume was down 20%, indicating that buying pressure had likely eased. This would give sellers more leverage in the market and push the price of Shiba Inu to $0.00000874 or lower.

An upcoming bearish MACD crossover: will sellers gain more influence?

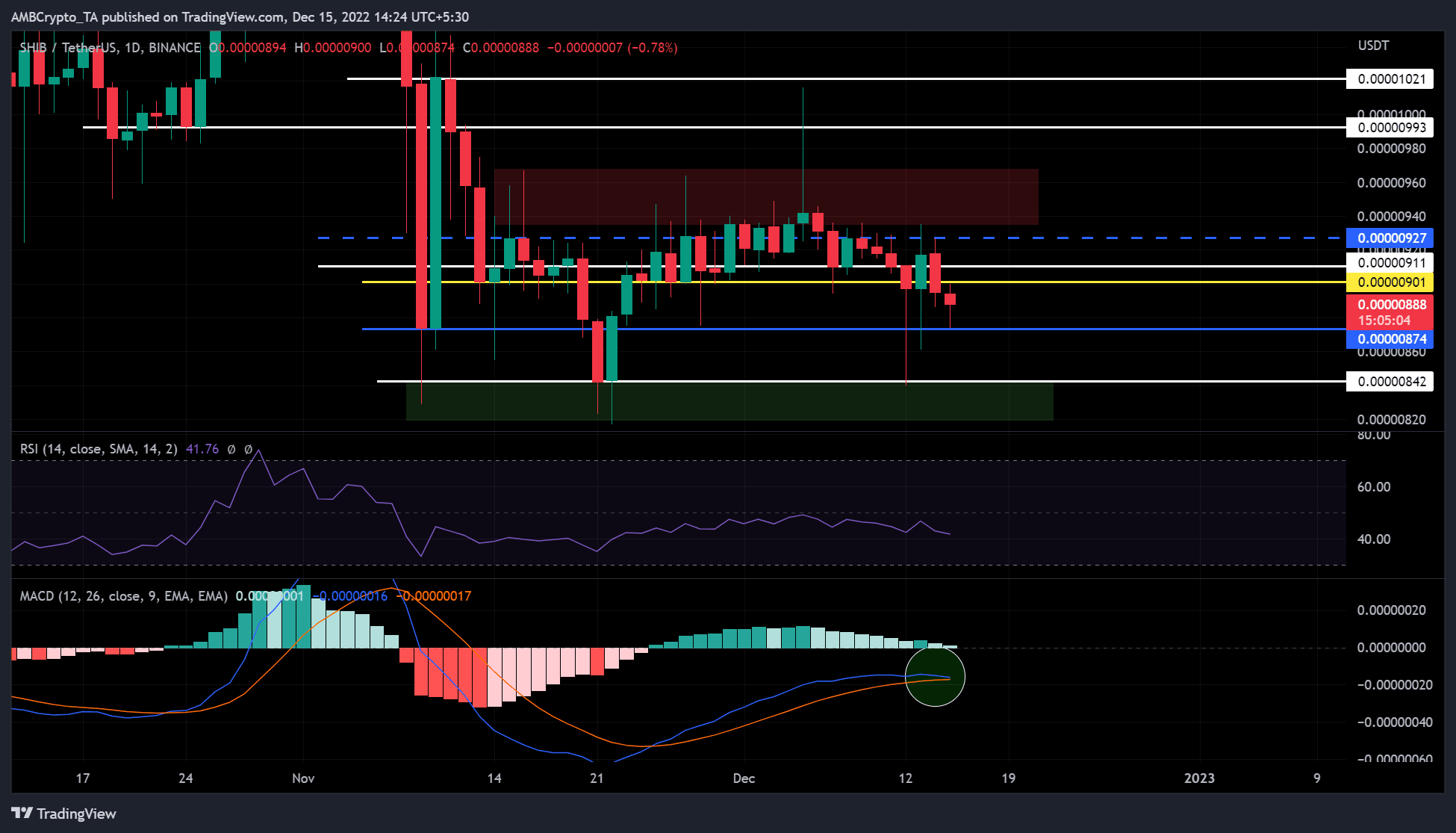

Source: SHIB/USDT on TradingView

The technical indicators on the daily chart suggest that memecoin could fall lower. For example, the Relative Strength Index (RSI) was below the neutral level of 50, at 42, and pointed lower. This shows that buying pressure decreased steadily and provided sellers with more opportunities.

In addition, the upcoming bearish MACD (Moving Average Convergence Divergence) crossover was a sell signal. It showed that the market momentum had developed in favor of the sellers.

As a result, SHIB could break below $0.00000874 or reach the previous support at $0.00000842. In such a case, investors can sell high and buy back when the price falls to these targets, pocketing the difference.

However, a breakout above $0.00000901 would render the above forecast invalid. Such an upward move will force SHIB to confront some resistances, including the immediate resistance at $0.00000927.

Shiba Inu saw improved sentiment, but stagnant active addresses

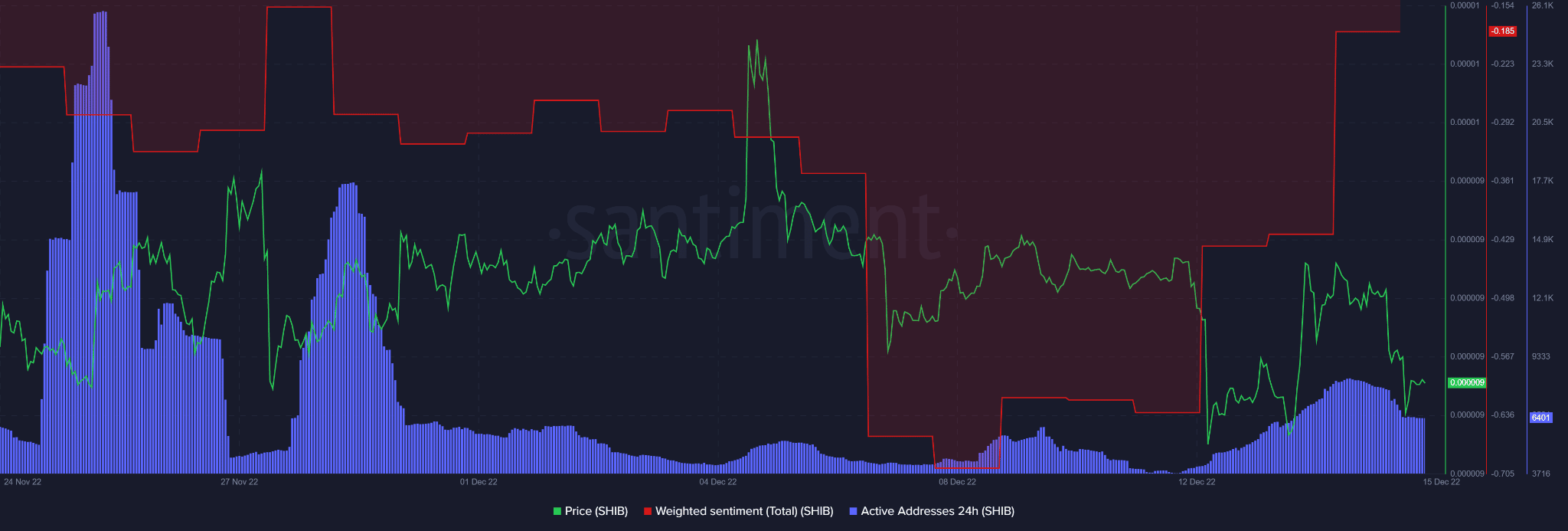

Source: Santiment

Santiment data showed that overall weighted sentiment remained negative but incredibly pulled back from deeper negative territory. This shows that investors’ outlook for memecoin improved.

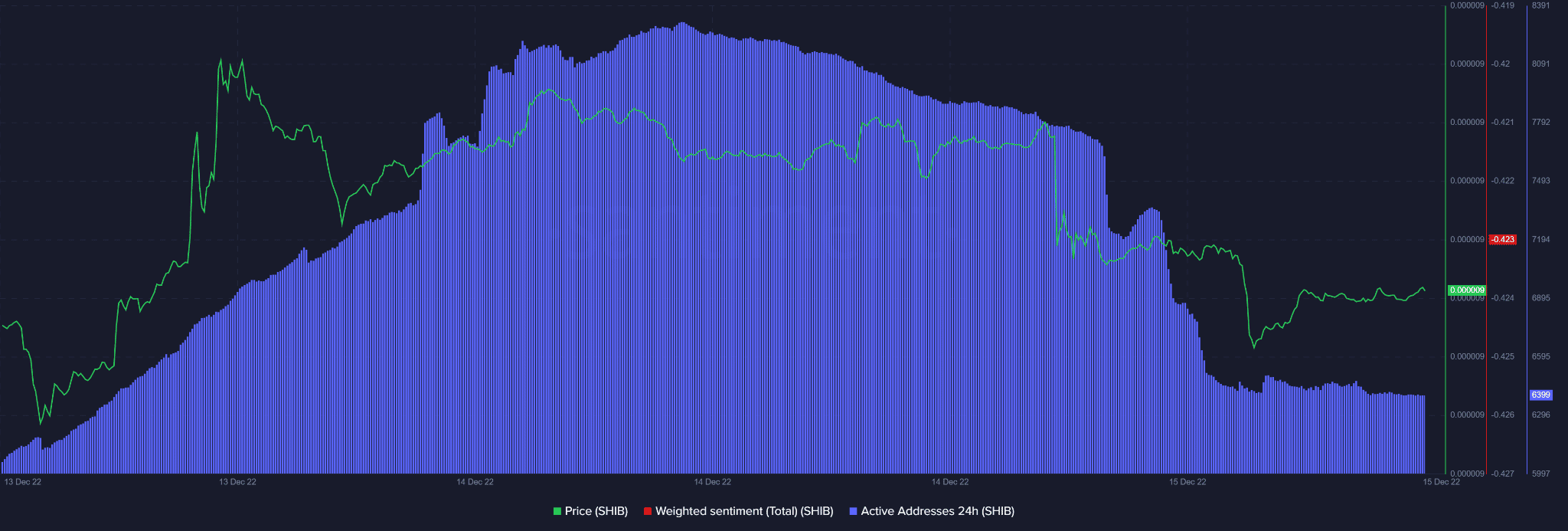

However, the number of accounts trading SHIB remained constant, as shown by the stagnant active addresses (see chart below).

Source: Santiment

So buying pressure on SHIB could be massively undermined, giving sellers a boost.

However, a bullish BTC and a rise above $18,000 would likely boost SHIB bulls. That could push SHIB’s price past resistance in its path and invalidate the above forecast.