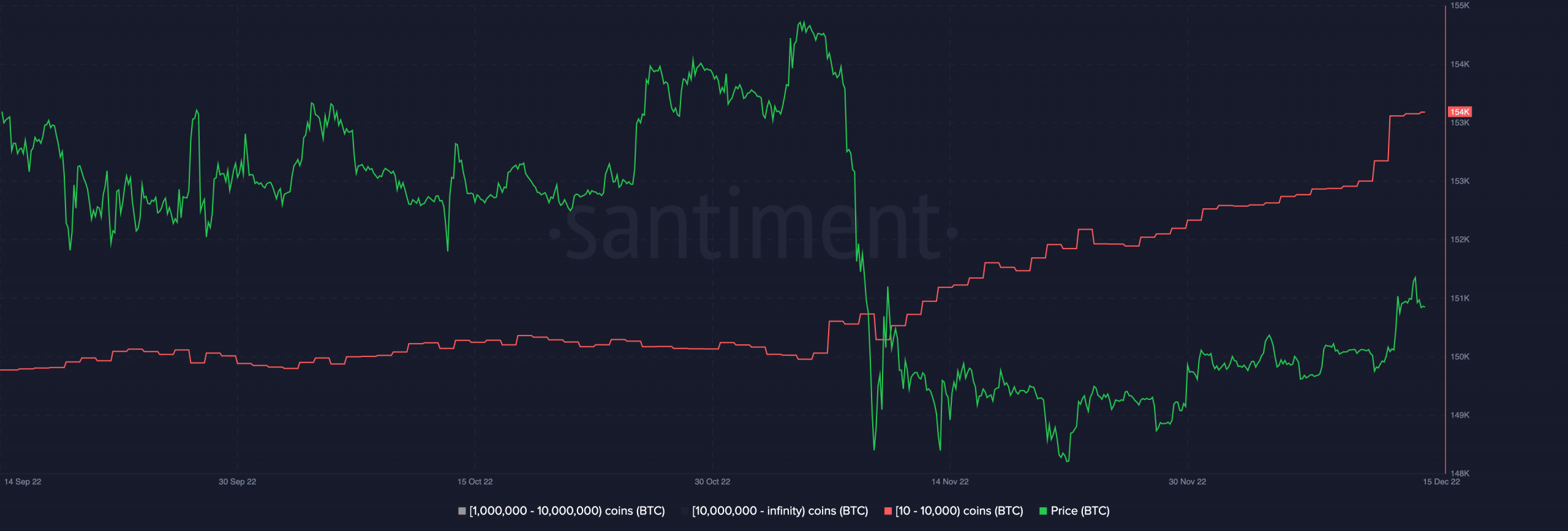

However, a change in sentiment amongst BTC whales has been spotted as this cohort of holders intensified accumulation in the past few months, data from Santiment revealed.

According to the on-chain analytics platform, in the past 10 days, BTC addresses holding between 100 to 10,000 BTC scooped up 40,747BTC worth over $726 million.

Additionally, the number of new addresses holding between 100 to 10,000 BTC has increased rapidly over the past three weeks (159 new addresses). This represents the fastest growth in this category of addresses in 10 months, which coincides with increased uncertainty and fear (FUD) following the announcement of the Russia-Ukraine war.

Source: Santiment

Is relief coming?

CryptoQuant analyst MAC_D assessed BTC’s Spent Output Value Bands and found that coin distribution momentum was declining.

MAC_D found that the series of events in the last month, like the collapse of FTX and miners’ capitulation, all of which should have led to a prolonged decline in BTC’s price, only impacted the king coin’s price momentarily, after which it rebounded. MAC_D noted,

“There have been several crises in the Crypto market this year, but the amount of whale deposits on the exchange is decreasing. The FTX crisis was much more serious than the LUNA crisis, but the decline was a short time and a small drop. Miner Crisis, which could be the next, could lower BTC prices, but it is not expected to cause major panic sells,”

While agreeing that FUD still lingered in the market, MAC_D stated,

“Because the number of long-term holders has increased, it is likely to be a boring and long decline rather than a strong panic sell.”

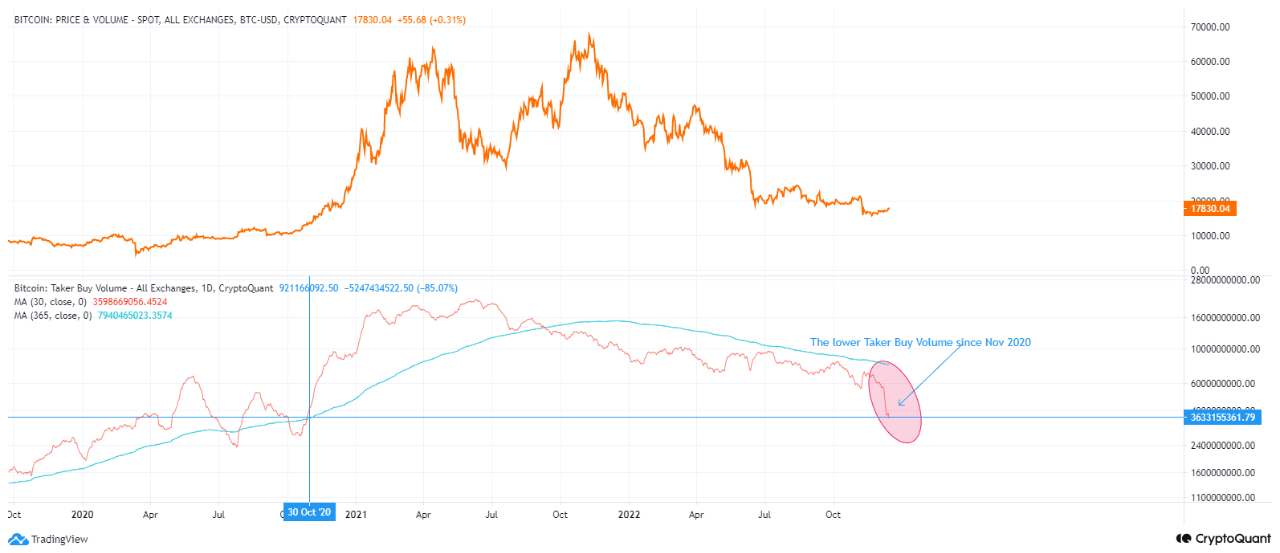

While selling pressure might have dropped and whale accumulation intensifying, BTC’s Buy Volume recently clinched its lowest level since November 2020. The growth in BTC’s Buy Volume momentum usually precedes an eventual uptrend in its price.

However, per CryptoQuant analyst, Ghoddusifar BTC’s “buy volume is still downward. and has reached its lowest level since November 2020.”

Projecting a further decline in BTC’s price, Ghoddusifar concluded that “we still cannot see a sign of a change in the trend.”

Source: CryptoQuant